CHAPTER 9 LECTURE (PART II)

Net Present Value

The net present value (NPV) of a project is simply the present value of all the project cash flows including the initial investment. As with the profitability index, the discount rate used to find the present value of the cash flows is the required return on the project which, in turn, is based on the project’s risk. A formulaic representation of NPV is given below:

NPV = -I + CF1 + CF2 + CF3 + . . . + CFN 1 2 3 N (1 + K) (1 + K) (1 + K) (1 + K)

Where –I represents the project’s initial investment at time zero and K is the required return on the project. The NPV of a project represents an estimate of the change in shareholder wealth if the project is adopted. When the NPV is > 0 (i.e., when the present value of the cash inflows is greater than I), the project should be wealth-increasing for shareholders. When the NPV < 0, the project will likely reduce shareholder wealth. Clearly, only projects with NPV > 0 should be undertaken.

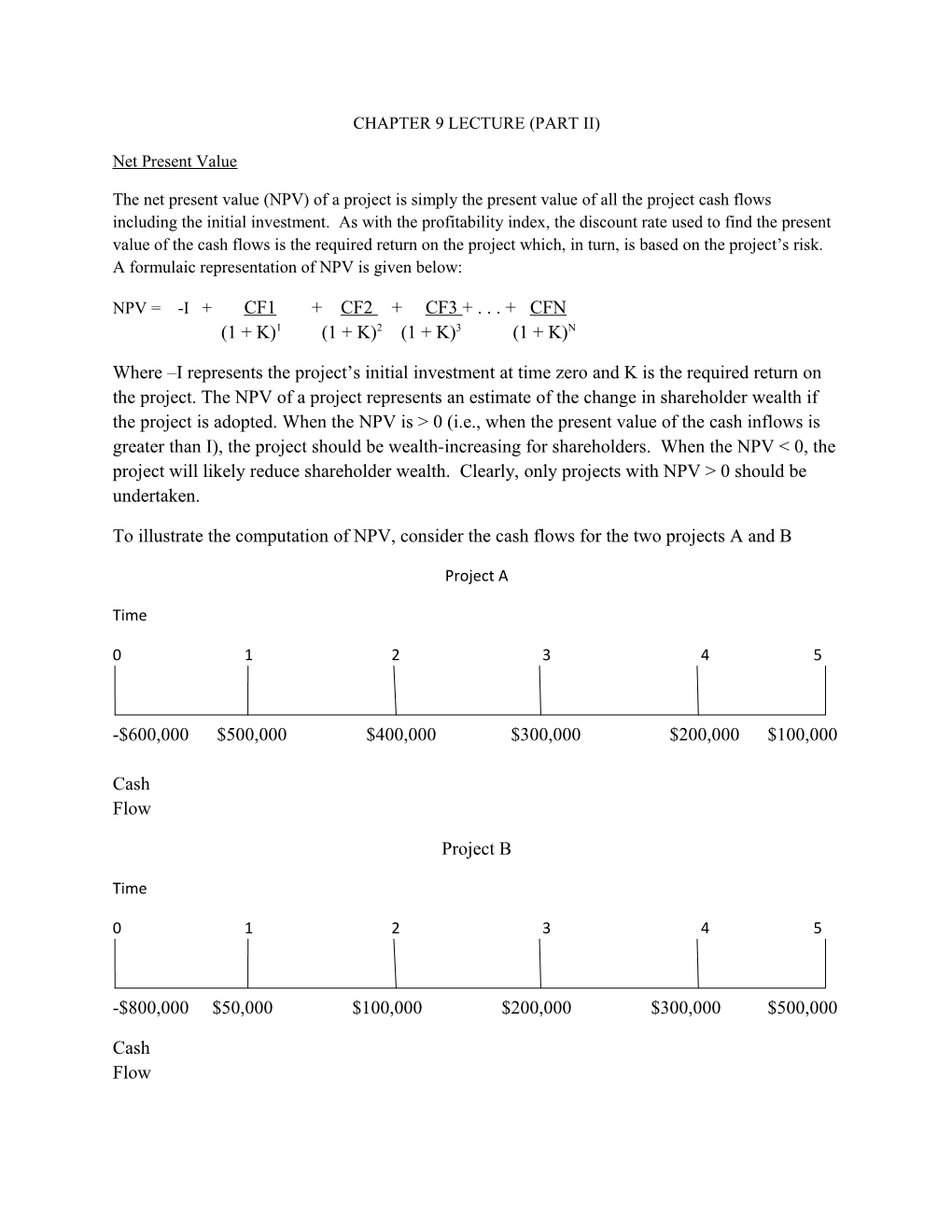

To illustrate the computation of NPV, consider the cash flows for the two projects A and B

Project A

Time

0 1 2 3 4 5

-$600,000 $500,000 $400,000 $300,000 $200,000 $100,000

Cash Flow

Project B

Time

0 1 2 3 4 5

-$800,000 $50,000 $100,000 $200,000 $300,000 $500,000

Cash Flow As with the computation of the profitability index, you can find the NPV using the cash flow work sheet on your calculator. For example, to find the present value of all of project A’s cash flows (again assuming a required return of 10%) hit the following buttons on the calculator:

CF

2ND CLR WRK

CF0 = 600,000 +/- ENTER

C01 = 500,000 ENTER

C02 = 400,000 ENTER

C03 = 300,000 ENTER

C04 = 200,000 ENTER

C05 = 100,000 ENTER NPV

I = 10 ENTER

CPT

NPVA = $609,213.23

The NPVA means that if the project cash flow and required return estimates are correct, adopting project A should increase shareholder wealth by $609,213.23.

See if you can find the NPV for project B on your own.

NPVB = -$6,273.17

The NPVB means that if the project cash flow and required return estimates are correct, adopting project B should decrease shareholder wealth by $6,273.17.

Take a minute to review the formula for NPV:

NPV = -I + CF1 + CF2 + CF3 + . . . + CFN 1 2 3 N (1 + K) (1 + K) (1 + K) (1 + K)

Notice what happens to the NPV of a project when the discount rate changes. If K rises, NPV falls. If K falls, NPV rises. What might cause K to change? A change in the risk of the project. If project risk rises, K rises (to compensate shareholders for the increased risk) and NPV falls. The reverse is also true. Clearly an increase in project risk can cause projects with slightly positive NPVs to become negative NPV projects. My personal bias is to build in a margin for error by accepting only projects with decisively positive NPVs.

The NPV decision rule is:

Accept all independent projects with positive NPVs. If the projects are mutually exclusive, accept the project with the highest NPV if it is positive.

Internal Rate of Return

The Internal Rate of Return (IRR) of a project, also known as the project’s yield, is simply the discount rate causing the NPV of a project to equal 0. In formula notation:

NPV = 0 = -I + CF1 + CF2 + CF3 + . . . + CFN 1 2 3 N (1 + IRR) (1 + IRR) (1 + IRR) (1 + IRR)

Notice the higher the cash inflows, the higher the IRR has to be to force the NPV to become zero. Finding the discount rate causing the NPV to equal zero is a guessing game. When your calculator finds the IRR for you, it actually tries a variety of guesses until it finds a discount rate that “works”.

Using the cash flows from project A once again, the sequence of buttons to hit on your calculator is :

CF

2ND CLR WRK

CF0 = 600,000 +/- ENTER

C01 = 500,000 ENTER

C02 = 400,000 ENTER

C03 = 300,000 ENTER

C04 = 200,000 ENTER C05 = 100,000 ENTER

IRR

CPT

IRRA = 57.25%

This means that if the project is adopted, the project’s estimated return to shareholders should be 57.25%.

Notice the calculator did not ask you for project A’s discount rate. That’s because the discount rate is not used to find a project’s IRR.

See if you can find the IRR of project B on your own.

IRRB = 9.77%

The decision rule for IRR is:

Accept all independent projects with IRRs greater than the required return on the project. If the projects are mutually exclusive, accept the project with the highest IRR if it is greater than the project’s required return. Under either circumstance, only project A would be accepted since it is the only project with an IRR greater than the project’s required return of 10%.

Problems with IRR

IRR has some significant drawbacks as a capital budgeting technique. For one thing, IRR cannot be used if there is more than one change on the signs of the project’s cash flows. Both projects A and B had only one change in sign on the cash flows: the sign on the cash flows started out negative with the initial investment then turned positive when the cash inflows began. However, what if the project cash flows looked like this?:

Time

0 1 2 3 4 5

-$600,000 $500,000 -$400,000 $300,000 $200,000 $100,000

Cash Flow

Notice there are now three changes in signs on the cash flows. The cash flow starts out with the negative sign on the $600,000 at time 0, then turns positive with the cash inflow of $500,000 at time 1, then turns negative with the cash outflow of $400,000 at time 2, then turns positive with the cash inflow of $300,000 at time 3. If we tried to find the IRR of this project, we would find more than one discount rate causing the NPV of the project to equal zero. This would happen whenever there is more than one change in sign on the cash flow stream. Which one is “correct”? We have no way of knowing. Therefore, IRR cannot be used under these circumstances.

Another problem with IRR is that it can sometimes lead you to select the wrong project among mutually exclusive projects. To show why this is true, I need to introduce you to something called the NPV profile.

An NPV profile is a graph that plots the NPV of a project at different discount rates. To illustrate this concept, I am going to use the data given in problem 9-19 on page 402 of your text to create a schedule showing the NPVs of mutually exclusive projects A and B at various discount rates.

Discount Rate (%) NPVA NPVB 0 $45,000 $25,000 2 36,903 20,702 4 29,551 16,777 6 22,858 13,185 8 16,753 9,891 10 11,171 6,862 12 6,057 4,072 14 1,362 1,496 16 -2,957 -886 18 -6,936 -3,092 20 -10,610 -5,141

IRRA = 14.61% (i.e., project A’s NPV will = 0 when the discount rate is 14.61%)

IRRB = 15.23% (i.e., project B’s NPV will = 0 when the discount rate is 15.23%)

A graph showing how the net present values of projects A and B fall as the discount rate rises is shown below. The red and green lines are the NPV profiles for projects A (red line) and B (green line). Notice the IRRs of A (red line) and B (green line) appear where the lines intersect the X (horizontal) axis. These points represent the discount rates (14.61% for A and 15.23% for B) where the NPVs of the projects = zero. Notice the lines appear to cross one another at a rate of about 14% (the exact cross rate is 13.87%). When discounted at this rate, the NPVs of both projects are exactly the same. Suppose the relevant discount rate for both projects is 10%. At this discount rate, NPV would tell us to select the project with the highest NPV. If you point with your finger at .10 on the X axis, then look to see which line is highest above that point, you will see the red line (project A) is highest. This means that at a discount rate of 10%, project A’s NPV is higher than project B’s.

Now let’s examine which project IRR is telling us to take. Again, looking at the X axis, we want to find the project with the highest IRR. Since each project’s IRR appears where its NPV profile crosses the X axis, and since the green line (project B) crosses to the right of (i.e. at a higher rate than) the red line (project A), IRR tells us to take B.

So at a discount rate of 10% NPV tells us to select project A. IRR tells us to select project B. So we have a conflict between NPV and IRR.

I selected a discount rate of 10% on purpose. Notice 10% is to the left of the crossover rate of 14%. As it turns out, there will always be a conflict between NPV and IRR for mutually exclusive projects when the discount rate is less than the cross rate. All discount rates less than 14% will result in a conflict between NPV and IRR.

In the event of a conflict, which capital budgeting technique should you use? The answer is NPV because:

1. NPV considers the timing, magnitude and risk of all the projects cash flows

2. NPV discounts the cash flows using required return on the project. IRR does not.

Item 2 does not occur to most students. Notice, the required return on the project is not used to compute IRR. This is a critical flaw.