Provide detailed step by step solution explaining in words on how you get to the answers. The answers are provided to you and highlighted, however you have to explain step by step on how you get to the answers:

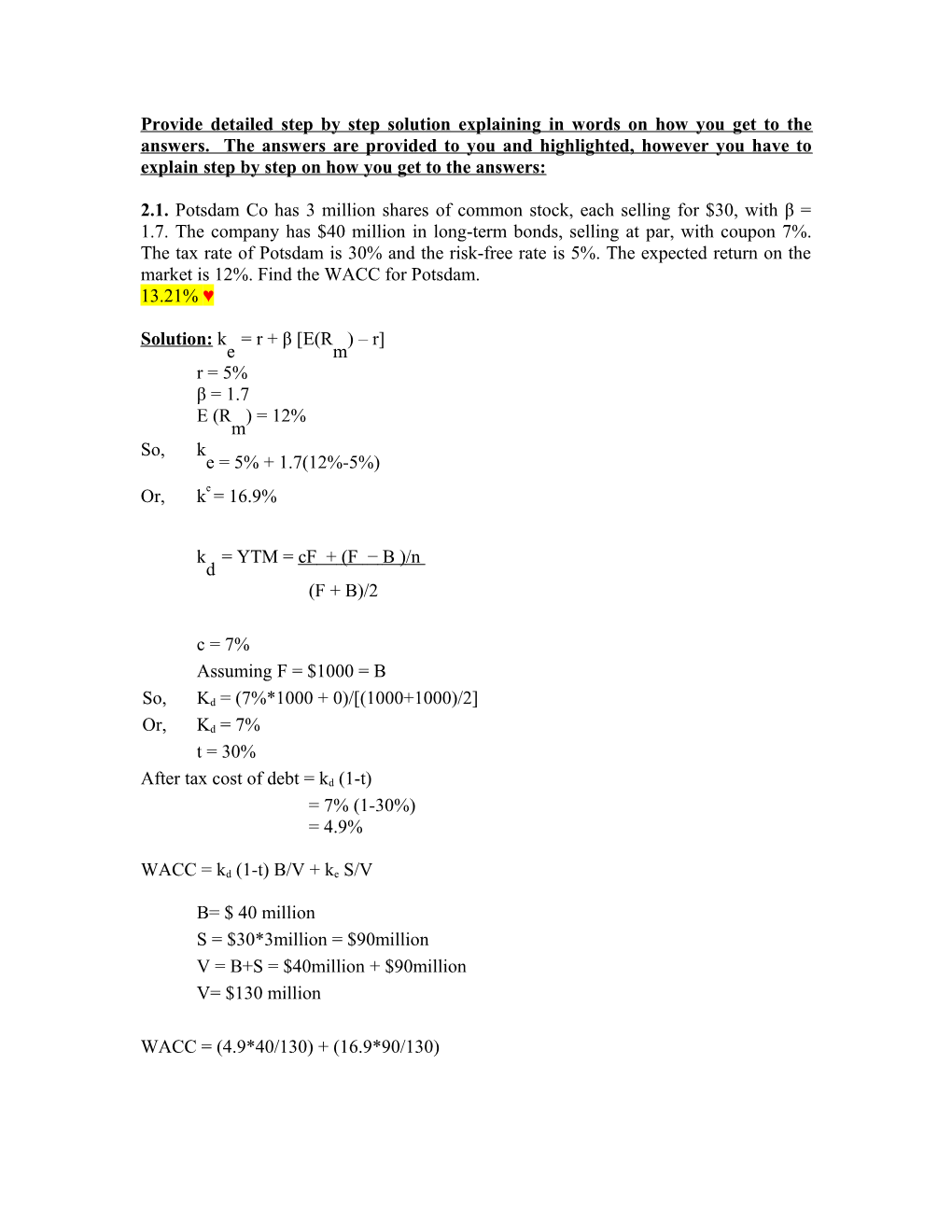

2.1. Potsdam Co has 3 million shares of common stock, each selling for $30, with β = 1.7. The company has $40 million in long-term bonds, selling at par, with coupon 7%. The tax rate of Potsdam is 30% and the risk-free rate is 5%. The expected return on the market is 12%. Find the WACC for Potsdam. 13.21% ♥

Solution: k = r + β [E(R ) – r] e m r = 5% β = 1.7 E (R ) = 12% m So, k e = 5% + 1.7(12%-5%) Or, ke = 16.9%

k = YTM = cF + ( F − B ) /n d (F + B)/2

c = 7% Assuming F = $1000 = B

So, Kd = (7%*1000 + 0)/[(1000+1000)/2]

Or, Kd = 7% t = 30%

After tax cost of debt = kd (1-t) = 7% (1-30%) = 4.9%

WACC = kd (1-t) B/V + ke S/V

B= $ 40 million S = $30*3million = $90million V = B+S = $40million + $90million V= $130 million

WACC = (4.9*40/130) + (16.9*90/130) Or, WACC = 13.21%2.2. Ohio Corporation has 6 million shares of common stock priced at $25 per share, which has just paid its annual dividend of $1.75. The dividends have grown steadily at the rate of 5% per year and the investors expect the growth to continue in the future. The 6% coupon bonds of the corporation have a face value of $60 million. The bonds will mature in 10 years and currently they sell at $857.14 each. The tax rate of Ohio is 25%. Calculate its WACC. 10.73% ♥

Solution: calculating cost of equity

ke = (D1/P0) + g

P0 = $25 g = 5%

D0 = $1.75

D1 = D0(1+g)

D1 = $1.75(1+5%)

Or, D1 = $1.8375

Therefore, ke = 1.8375/25 + 5%

Or, ke = 12.35%

Calculating cost of debt: k = YTM = cF + ( F − B ) /n d (F + B)/2

c = 6% Let F = $1000 B = $857.14 n = 10 years kd = [6%*1000 + (1000-857.14)/10]/[(1000+857.14)/2] kd = 8% After tax kd = 8%(1-25%) Or, after tax cost of debt = 6% Calculating WACC:

WACC = kd (1-t) B/V + ke S/V

Number of bonds = $60 million/$1000 per bond Or, number of bonds = 60000 B = 60000*857.14 Or, B = $51428400 S = 6 million shares * $25 per share Or, S = $150,000,000 V = $51,428,400 + $150,000,000 Or, V = $201,428,400 So, WACC = 6%*$51,428,400/$201,428,400 + 12.35%*$150,000,000/$201,428,400 Or, WACC = 10.73% 2.3. Erlangen Corporation needs a new machine that will cost $50,000. It will run for 5 years and the firm will depreciate it on a straight line basis, with no resale value. The machine will add $14,000 annually to Erlangen's earnings before taxes. The proper discount rate is 12% and the tax rate is 32%. Should Erlangen install the machine? NPV = −$4147, no ♥

Solution: The amount of annual depreciation will be $50,000/5 = $10000, because the machine does not have any residual value. The after-tax cash flow, C, is given by

C = 14000(1 − 0.32) + 0.32(10000) = $12,720

NPV = -$50,000 + $12,720*PVFA12%,5years

Where, PVFA is the present value factor for an annuity.

So, NPV = -50000 + 12720*3.6048

Or, NPV = -$4147

Since NPV is negative, hence Erlangen Corporation should not install the machine. 2.4. Freiburg Company wants to buy a machine that has expected life of 6 years. It costs $30,000, and increases the income of the company by $7,000 annually. It has a salvage value of $5,000. The proper discount rate is 12%, and the company pays no taxes at present. Should Freiburg purchase this machine? NPV = $1,313, yes. ♥

Solution: In this case, there is no tax hence we need not consider depreciation also.

NPV = -initial investment + present value of inflows

So, NPV = -$30,000 + $7,000*PVFA12%,6years + $5,000*PVF12%,6years

Where, PVF is the present value factor

Or, NPV = -$30,000 + $7,000*4.111 + $5,000*0.507

Or, NPV = $1,313

Since NPV is positive, hence Freiburg Company should purchase the machine.