Tax Preparer USA LLC Gopi Krishna Neelam, MBA (Tax, Accounting) Phone: 586-201-9012 e-mail: [email protected] www.taxpreparerusa.com

Tax preparation required documentation

Hello: Greetings. Mainly I need your W2s (or) 1099-Misc forms & your previous filed tax returns (If available). You can scan them and e-mail me/ fax them to me.

If you worked in 1 state then my tax preparation fees is $60 for federal + one state tax preparation for filing 1040 form. I will let you know the exact fees amount once I receive your documents. If you worked more than one state, and need to file additional state tax returns, I will charge $30 extra/state.

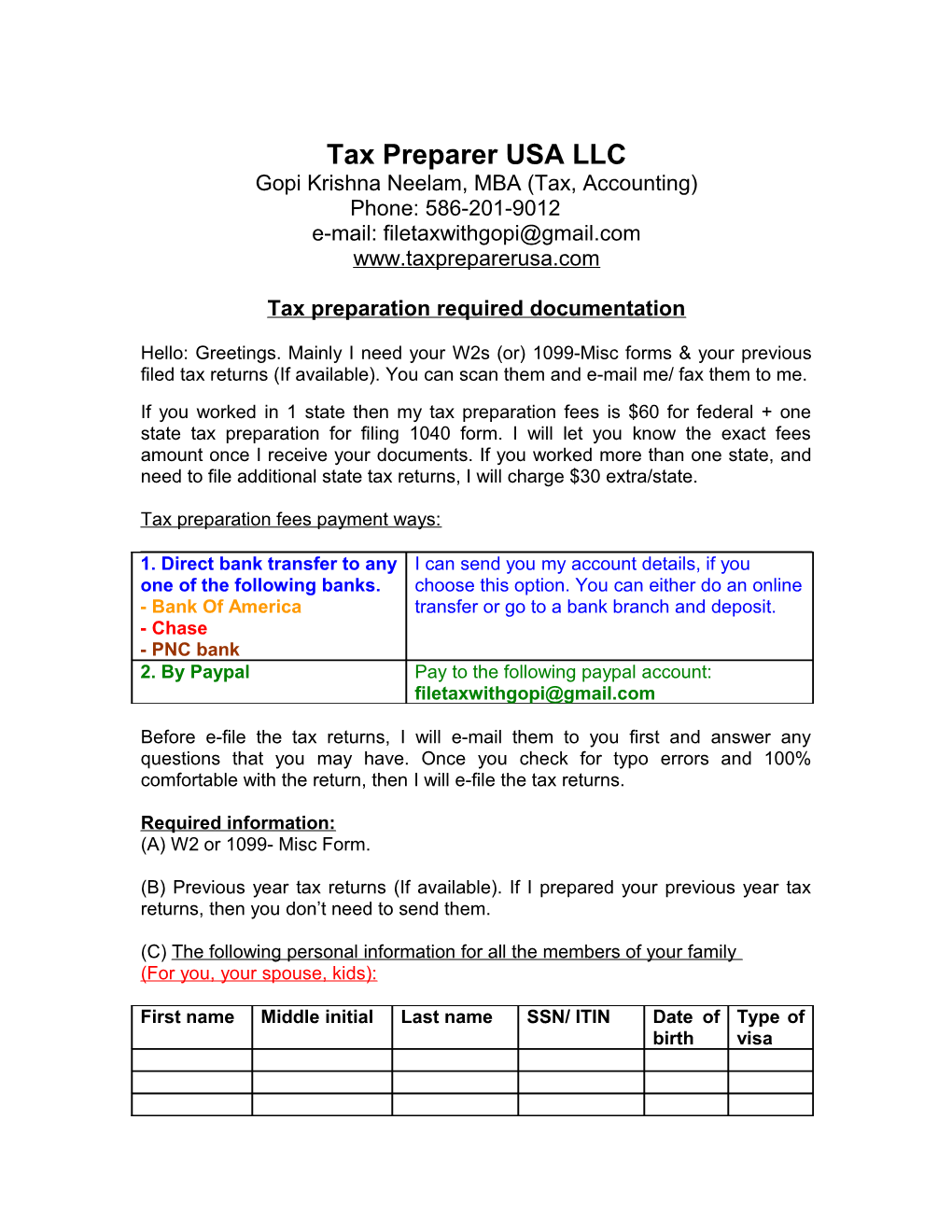

Tax preparation fees payment ways:

1. Direct bank transfer to any I can send you my account details, if you one of the following banks. choose this option. You can either do an online - Bank Of America transfer or go to a bank branch and deposit. - Chase - PNC bank 2. By Paypal Pay to the following paypal account: [email protected]

Before e-file the tax returns, I will e-mail them to you first and answer any questions that you may have. Once you check for typo errors and 100% comfortable with the return, then I will e-file the tax returns.

Required information: (A) W2 or 1099- Misc Form.

(B) Previous year tax returns (If available). If I prepared your previous year tax returns, then you don’t need to send them.

(C) The following personal information for all the members of your family (For you, your spouse, kids):

First name Middle initial Last name SSN/ ITIN Date of Type of birth visa (D) Address

Dates of residency in current year From To Current address

If moved, Previous address

(E) Your bank Information for direct deposit / with drawl of refunds:

Type of account: Checking account or Savings account? Routing number: Account number:

(F) Please verify if you received any of the following documents for the current year. If you did, please send me the information: (The following list is a long one which may not be applicable for you, but my aim is to make sure you are not missing any credit.)

Income: - Interest from a bank: Forms 1099-INT. - Dividends or capital gain distributions : Forms 1099-DIV - Forms 1099-B: Did you Buy/Sell stocks? Any of your stocks are worthless? (Please provide the xxx.csv file with stock transactions) - 1099-G for prior year state tax refund - 1099-R retirement plan distributions - Social security - Scholarships and fellowships - Information on any other income received: Child's income on your return, hobby income, Health Savings Accounts, Foreign earned income - Miscellaneous income including rent/royalties - Schedule K1 from Partnership/ S-Corporation/Trust Income - Prizes and awards, Gambling and Lottery winnings, Jury duty pay - Self-employment income / Unemployment benefit info - Alimony received/pay

Adjustments and deductions - Forms 1098-E and statements for student loan interest you paid - Individual retirement account (IRA) contributions - Records of charitable donations - Receipts for job-related moving expenses (If you moved due to job away from principal residence more than 50 miles) - Medical expenses - For a home owner: Home mortgage interest, property taxes, insurance, closing statements of buyer and seller in case of a new home purchase, Sale of home info 1099-S - For an apartment renter: Apartment rent amount. - Health Savings account documents 5498SA, 1099SA - Records of unreimbursed job expenses - Miscellaneous expenses such as tax prep fees, safe deposit box fees

Credits: - Child and dependent care information, including: Care expenses you paid Care provider's name, address and SSN or employer ID number -Tuition receipts and expenses: Any family member attended the college in current year? - Form 1098-T issued by college or university. - Expenses related to books and college lodging. - 529 Plan contribution details - Alimony paid/ received in case of divorced tax payer, SSN of payee

(G) Previous Year Amended returns: At no cost to you, I can check your previous year tax returns and see if you can get some more tax refund by amending your already filed returns. If you decide to amend the returns if you need my help in filing then I may charge nominal fees.

(H) Additional Services (For extra charge):

F1 Visa/ OPT/ CPT/ Practical training: If you are on F1 visa/ OPT/CPT and want to file 1040NR form, I charge $85. Also, you don’t need to pay your social security & medicare taxes. But some times employer deducts them and I can get them back for you for $45.

Individual Tax Identification Numbers (ITIN): I can also help you in getting the ITIN numbers for you (or) your dependents. You can claim them in your tax returns and get significant tax benefits. My fees are $25.

Foreign tax credit: Foreign tax credit requires filing the form 1116 on the tax return. The letter provided by the employer explaining the foreign income and foreign tax paid on US declared in the w-2 will help. Form 16, Gross earnings or IT projection sheet, your Last (typically December 31st) onsite pay stub also will help.

Regards, Gopi Krishna Neelam, Tax consultant Ph: 586-201-9012