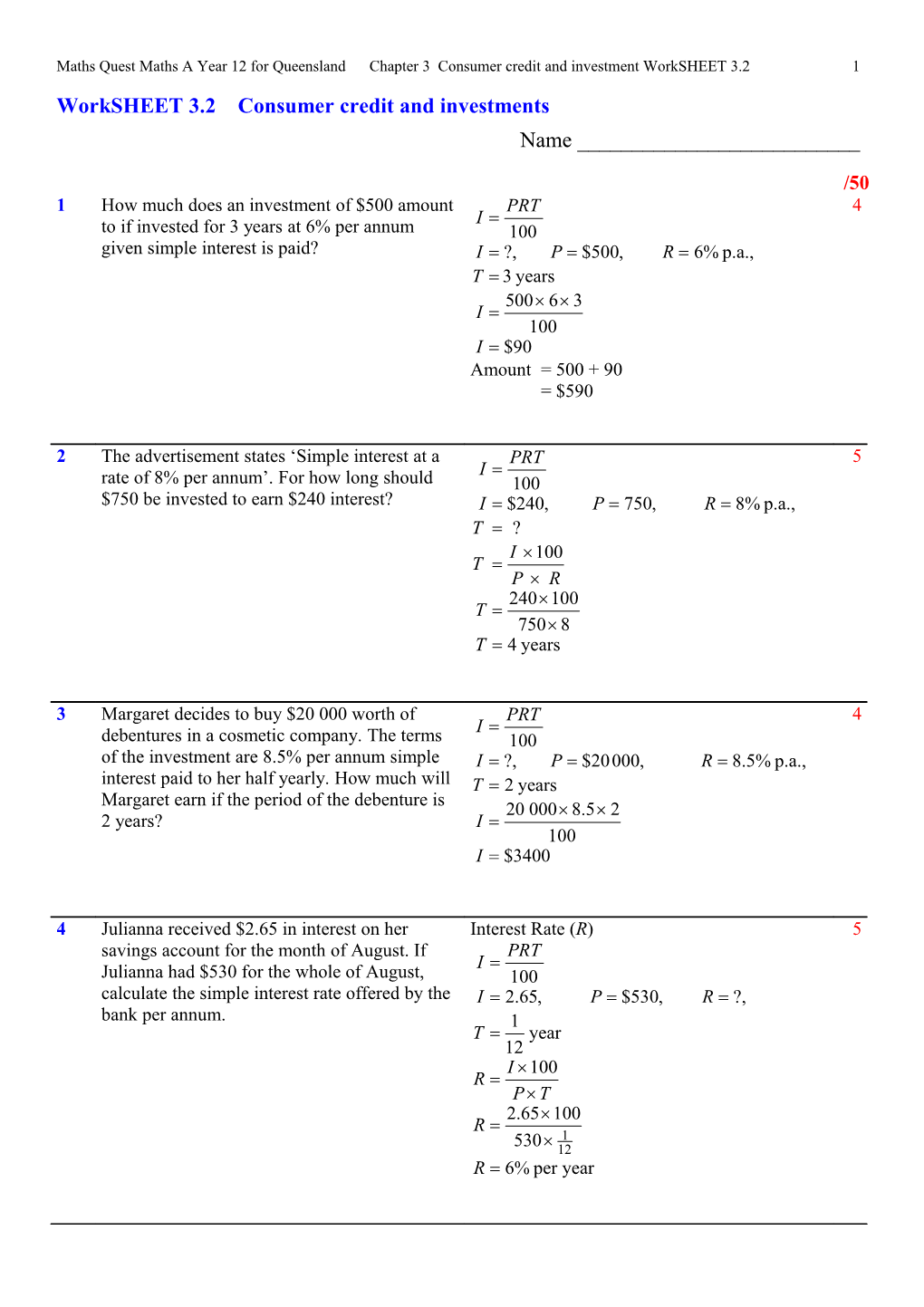

Maths Quest Maths A Year 12 for Queensland Chapter 3 Consumer credit and investment WorkSHEET 3.2 1 WorkSHEET 3.2 Consumer credit and investments Name ______

/50 1 How much does an investment of $500 amount PRT 4 I to if invested for 3 years at 6% per annum 100 given simple interest is paid? I ?, P $500, R 6% p.a., T 3 years 500 6 3 I 100 I $90 Amount = 500 + 90 = $590

2 The advertisement states ‘Simple interest at a PRT 5 I rate of 8% per annum’. For how long should 100 $750 be invested to earn $240 interest? I $240, P 750, R 8% p.a., T ? I 100 T P R 240100 T 7508 T 4 years

3 Margaret decides to buy $20 000 worth of PRT 4 I debentures in a cosmetic company. The terms 100 of the investment are 8.5% per annum simple I ?, P $20000, R 8.5% p.a., interest paid to her half yearly. How much will T 2 years Margaret earn if the period of the debenture is 20 0008.5 2 2 years? I 100 I $3400

4 Julianna received $2.65 in interest on her Interest Rate (R) 5 savings account for the month of August. If PRT I Julianna had $530 for the whole of August, 100 calculate the simple interest rate offered by the I 2.65, P $530, R ?, bank per annum. 1 T year 12 I 100 R P T 2.65100 R 1 530 12 R 6% per year Maths Quest Maths A Year 12 for Queensland Chapter 3 Consumer credit and investment WorkSHEET 3.2 2

5 At the start of May, Jack has $499 in his PRT 4 I passbook savings account. On his birthday, the 100 6th of May, his parents give him $50 which he I ? P $499 $50 $225 $324, deposits into his account. He buys a new bike 1 for $225 on the 20th of May. If the bank pays R 4% p.a., T years 4% p.a. simple interest paid monthly on the 2 324 4 1 minimum monthly balance, calculate the I 12 interest that Jack receives for May. 100 I $1.08

6 The Jones family sell their home for $195 000. (a) Commission 6 The commission on the sale is 5% of the first = 5% of $18 000 + 2.5% of $18 000 plus 2.5% of the remainder of the sale ($195 000 – $18 000) price. A 10% GST charge is then applied to the = 5% of $18 000 + 2.5% of $177 000 agent’s commission. = $900 + $4425 Calculate: = $5325 (a) the agent’s commission (b) the GST charged (b) GST = 10 % of $5325 (c) the money the Jones family will receive = $532.50 from the sale. (c) Money received from sale = $195 000 – $5325 – $532.50 = $189 142.50

7 The Stamp Duty due on the Jones’ house Sale price $195 000 5 transfer of ownership is payable at the rate of No. of lots of $100 $195 000 $100 $1 per $100 or part of $100, based on the purchase price. This money is paid by the 1950 purchaser. Stamp Duty $1 1950 What will the purchaser pay for the Jones’ $1950 house? Total payable $195 000 $1950 $196 950

8 Fran bought 500 shares at $3.75 each. (a) Cost of shares = $3.75 500 6 Brokerage on these shares is payable at the rate = $1875 of 2.5% of their value, or a minimum charge of $60. (b) Brokerage = 2.5% of $1875 Calculate: = $46.88 (a) the cost of the shares This is less than the minimum charge (b) the cost of brokerage of $60. (c) what the purchase of the shares will cost So brokerage payable is $60. Fran. (c) Cost to Fran = $1875 + $60 = $1935 Maths Quest Maths A Year 12 for Queensland Chapter 3 Consumer credit and investment WorkSHEET 3.2 3

9 Fran’s shares paid a yearly dividend of 2.5 (a) Total dividend = 2.5 500 6 cents per share. = $12.50 Calculate: (a) the total dividend received (b) Dividend yield (b) the dividend yield dividend per share 100% (c) the Price-Earnings Ratio. market price per share 2.5c 100% $3.75 2.5c 100% 375c 0.67%

market price per share (c) PE Ratio yearly dividend per share $3.75 2.5c 375c 2.5c 150

10 A company has an after-tax profit of Dividend = $8 000 000 85 000 000 5 $8 million. If the company decides to distribute = $0.094 all of this profit to its shareholders who collectively own 85 million shares, what So, the dividend per share is 9 cents. dividend per share will the shareholders receive?