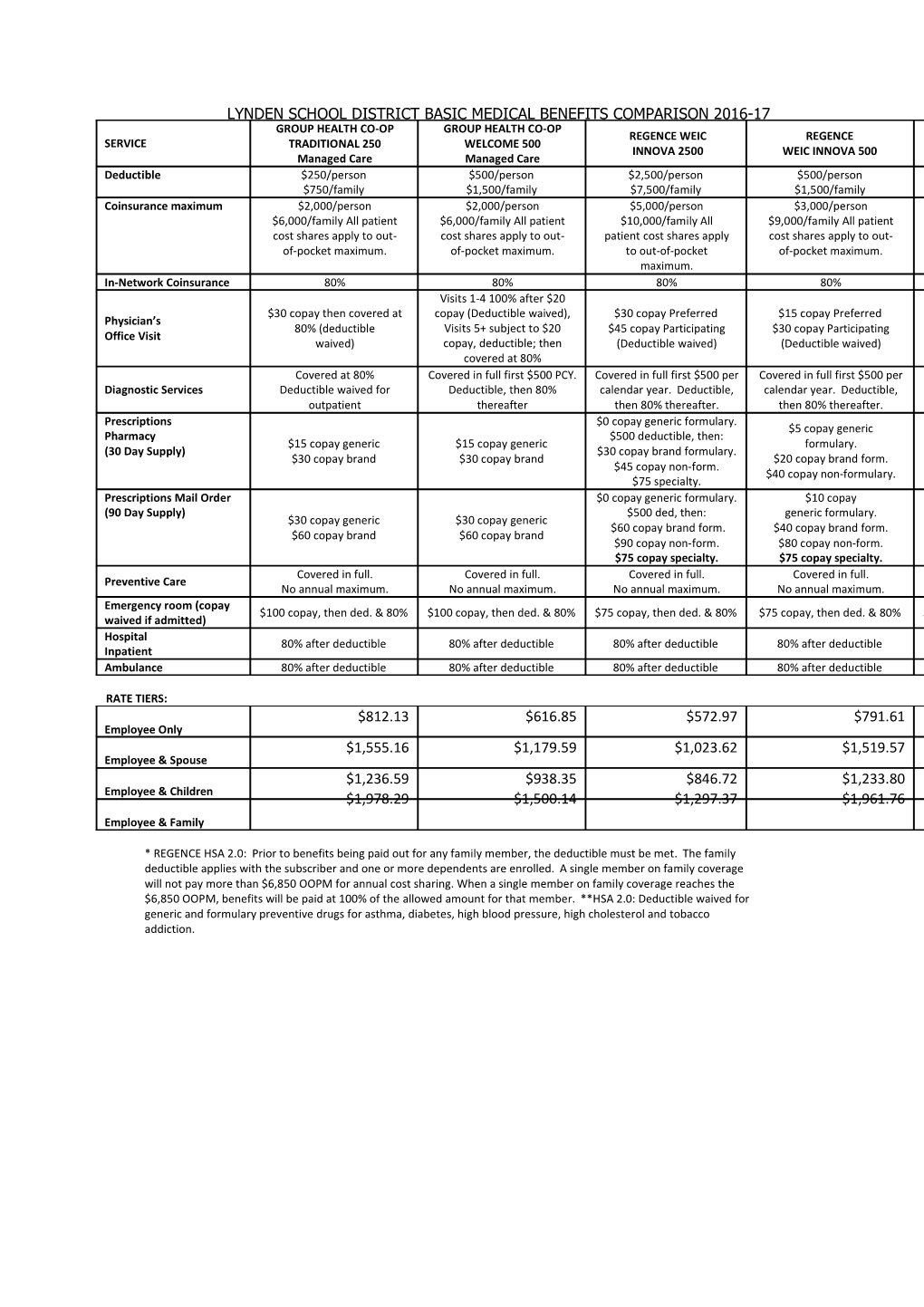

LYNDEN SCHOOL DISTRICT BASIC MEDICAL BENEFITS COMPARISON 2016-17 GROUP HEALTH CO‐OP GROUP HEALTH CO‐OP REGENCE WEIC REGENCE SERVICE TRADITIONAL 250 WELCOME 500 INNOVA 2500 WEIC INNOVA 500 Managed Care Managed Care Deductible $250/person $500/person $2,500/person $500/person $750/family $1,500/family $7,500/family $1,500/family Coinsurance maximum $2,000/person $2,000/person $5,000/person $3,000/person $6,000/family All patient $6,000/family All patient $10,000/family All $9,000/family All patient cost shares apply to out‐ cost shares apply to out‐ patient cost shares apply cost shares apply to out‐ of‐pocket maximum. of‐pocket maximum. to out‐of‐pocket of‐pocket maximum. maximum. In‐Network Coinsurance 80% 80% 80% 80% Visits 1‐4 100% after $20 $30 copay then covered at copay (Deductible waived), $30 copay Preferred $15 copay Preferred Physician’s 80% (deductible Visits 5+ subject to $20 $45 copay Participating $30 copay Participating Office Visit waived) copay, deductible; then (Deductible waived) (Deductible waived) covered at 80% Covered at 80% Covered in full first $500 PCY. Covered in full first $500 per Covered in full first $500 per 70%. Diagnostic Services Deductible waived for Deductible, then 80% calendar year. Deductible, calendar year. Deductible, outpatient thereafter then 80% thereafter. then 80% thereafter. Prescriptions $0 copay generic formulary. $5 copay generic Pharmacy $500 deductible, then: $5 $15 copay generic $15 copay generic formulary. (30 Day Supply) $30 copay brand formulary. $30 copay brand $30 copay brand $20 copay brand form. $45 copay non‐form. $40 copay non‐formulary. $75 specialty. Prescriptions Mail Order $0 copay generic formulary. $10 copay (90 Day Supply) $500 ded, then: generic formulary. $30 copay generic $30 copay generic $60 copay brand form. $40 copay brand form. $60 copay brand $60 copay brand $90 copay non‐form. $80 copay non‐form. $75 copay specialty. $75 copay specialty. Covered in full. Covered in full. Covered in full. Covered in full. Preventive Care No annual maximum. No annual maximum. No annual maximum. No annual maximum. Emergency room (copay $100 copay, then ded. & 80% $100 copay, then ded. & 80% $75 copay, then ded. & 80% $75 copay, then ded. & 80% $ waived if admitted) Hospital 80% after deductible 80% after deductible 80% after deductible 80% after deductible Inpatient Ambulance 80% after deductible 80% after deductible 80% after deductible 80% after deductible

RATE TIERS: $812.13 $616.85 $572.97 $791.61 Employee Only $1,555.16 $1,179.59 $1,023.62 $1,519.57 Employee & Spouse $1,236.59 $938.35 $846.72 $1,233.80 Employee & Children $1,978.29 $1,500.14 $1,297.37 $1,961.76 Employee & Family

* REGENCE HSA 2.0: Prior to benefits being paid out for any family member, the deductible must be met. The family deductible applies with the subscriber and one or more dependents are enrolled. A single member on family coverage will not pay more than $6,850 OOPM for annual cost sharing. When a single member on family coverage reaches the $6,850 OOPM, benefits will be paid at 100% of the allowed amount for that member. **HSA 2.0: Deductible waived for generic and formulary preventive drugs for asthma, diabetes, high blood pressure, high cholesterol and tobacco addiction.