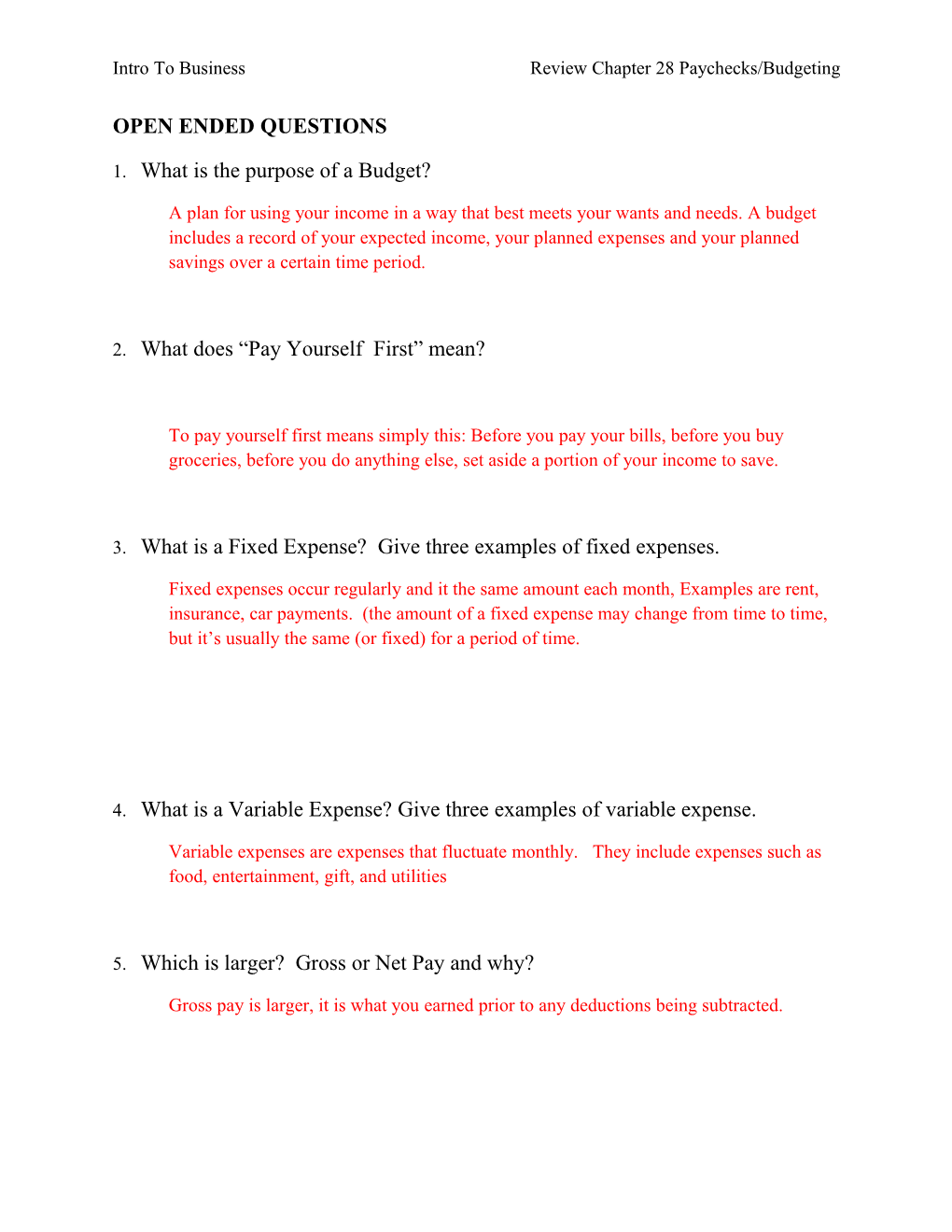

Intro To Business Review Chapter 28 Paychecks/Budgeting

OPEN ENDED QUESTIONS

1. What is the purpose of a Budget?

A plan for using your income in a way that best meets your wants and needs. A budget includes a record of your expected income, your planned expenses and your planned savings over a certain time period.

2. What does “Pay Yourself First” mean?

To pay yourself first means simply this: Before you pay your bills, before you buy groceries, before you do anything else, set aside a portion of your income to save.

3. What is a Fixed Expense? Give three examples of fixed expenses.

Fixed expenses occur regularly and it the same amount each month, Examples are rent, insurance, car payments. (the amount of a fixed expense may change from time to time, but it’s usually the same (or fixed) for a period of time.

4. What is a Variable Expense? Give three examples of variable expense.

Variable expenses are expenses that fluctuate monthly. They include expenses such as food, entertainment, gift, and utilities

5. Which is larger? Gross or Net Pay and why?

Gross pay is larger, it is what you earned prior to any deductions being subtracted. Intro To Business Review Chapter 28 Paychecks/Budgeting

6. What does FICA stand for and what are the 2 parts of the FICA tax.

Federal Insurance Contribution Act (Social Security – retiree’s pension plan, and Medicare – retiree’s medical plan)

7. What are the FICA tax rates?

Social Security -6.2% of Gross Income, taxed on first $118,000 of earnings each year

Medicare- 1.45% on all Gross Income earned in a year.

8. What type of tax is the Federal Income Taxes. Progressive or Flat? Explain the difference between a progressive tax and a flat tax.

U.S. Federal Income tax is a progressive tax, which means the tax rate increases as your income increases. The federal tax rates range from 10-35% . A flat tax is one tax rate that is applied to all income regardless of how much you make

9. What department of the government is responsible for collecting federal taxes, issuing regulations, and enforcing tax laws written by the United States Congress? IRS (Internal Revenue Service)

10. Where do your tax dollars go? What does the federal government do with the money?

Tax dollars are used to fund and operate the federal government. The dollars are spent on National Defense, welfare programs, running the departments of the government Intro To Business Review Chapter 28 Paychecks/Budgeting

11. What are the different ways States assess State Income tax? (Name 3)

Progressive

Flat

No State Income Tax

12. How does your employer know at what rate to withhold federal income tax ?

You are responsible for filling out a Form W-4 (employee allowance withholding certificate) before you start a new job. This form helps your employer determine the percentage of gross pay which will be withheld for your taxes.

13. What is the name of the form that new employees must adhere to that shows proof of identity and the ability to work in the U.S.

I-9 Employment Eligibility Verification

14. How many month’s living expenses should you have in the bank in case of emergency?

3 to 6 months Intro To Business Review Chapter 28 Paychecks/Budgeting

15. Name at least 4 items that would be considered as a deduction from your Gross Pay.

Federal Income Tax

State Income Tax

FICA Tax

Medical Plan contributions

401k plan

Union Dues

16. Name two different forms of Income. What is the most common form of Income for people?

Wages

Dividends/Interest

Gains from Sale of Investments

Rental Income.

Wages are the most common form of income for most people

17. Name two benefits of participating in your Company’s 401k plan.

Contributions to plan are made with pre-taxed dollars

Your employer may match your contribution

Forced Savings for retirement (pay yourself first) Intro To Business Review Chapter 28 Paychecks/Budgeting

18. If your expenses exceed your income, what must you do to balance your budget?

You must adjust your budget. You will either need to reduce expenses (variable) or earned more income if possible.

19. What are the three category of items that should be included in a budget?

Income, Expenses and Savings

20. In planning a budget, why is it important that the figure for take-home pay (not gross pay) be used for income?

“Take home pay” or net pay is the amount that is deposited into your checking account and is the amount that you have access to in order to pay your bills

21. What is a good way to estimate your expenses from month to month when you are preparing a budget?

For Variable (changing) expenses, look at your past spending patterns and a use as a basis to predict your future expenses

22. What are the 5 steps in planning a budget?

1. Set Goals 2. Estimate Income Intro To Business Review Chapter 28 Paychecks/Budgeting

3. Estimate Expenses 4. Plan for Savings 5. Balance and Adjust

23. How do you define your Net Worth?

Assets – Liabilies = Net Worth

24. What is another name for items you own that have value?

Assets

25. What is another name for debts you owe to others?

Liabilities

26. What is a Budget variance?

The difference between planned or budgeted spending and actual spending

27. What is the definition of Money Management? Intro To Business Review Chapter 28 Paychecks/Budgeting

The process of planning how to get the most from your money

True or False

A Budget will help you plan how to afford all of your goals, no matter what your goals are .

True False

A budget should help you decide which goals you can meet with the amount of money you have

Once you create a budget, it is not a good idea to change it in any way

True False

Budgets should change to accommodate changes in expenses or income

A good way to estimate expenses is to look at how much you paid for similar items in the past

True False

The first step in developing a spending plan is setting goals

True False

Gross pay is the same thing as “take-home” pay”

True False

Net pay is the same thing as “take-home” pay

When creating a budget, it’s important to limit your spending to your gross income. Intro To Business Review Chapter 28 Paychecks/Budgeting

True False

When creating a budget, its important to limit your spending to your net income

Savings protect you against expenses that you didn’t expect.

True False