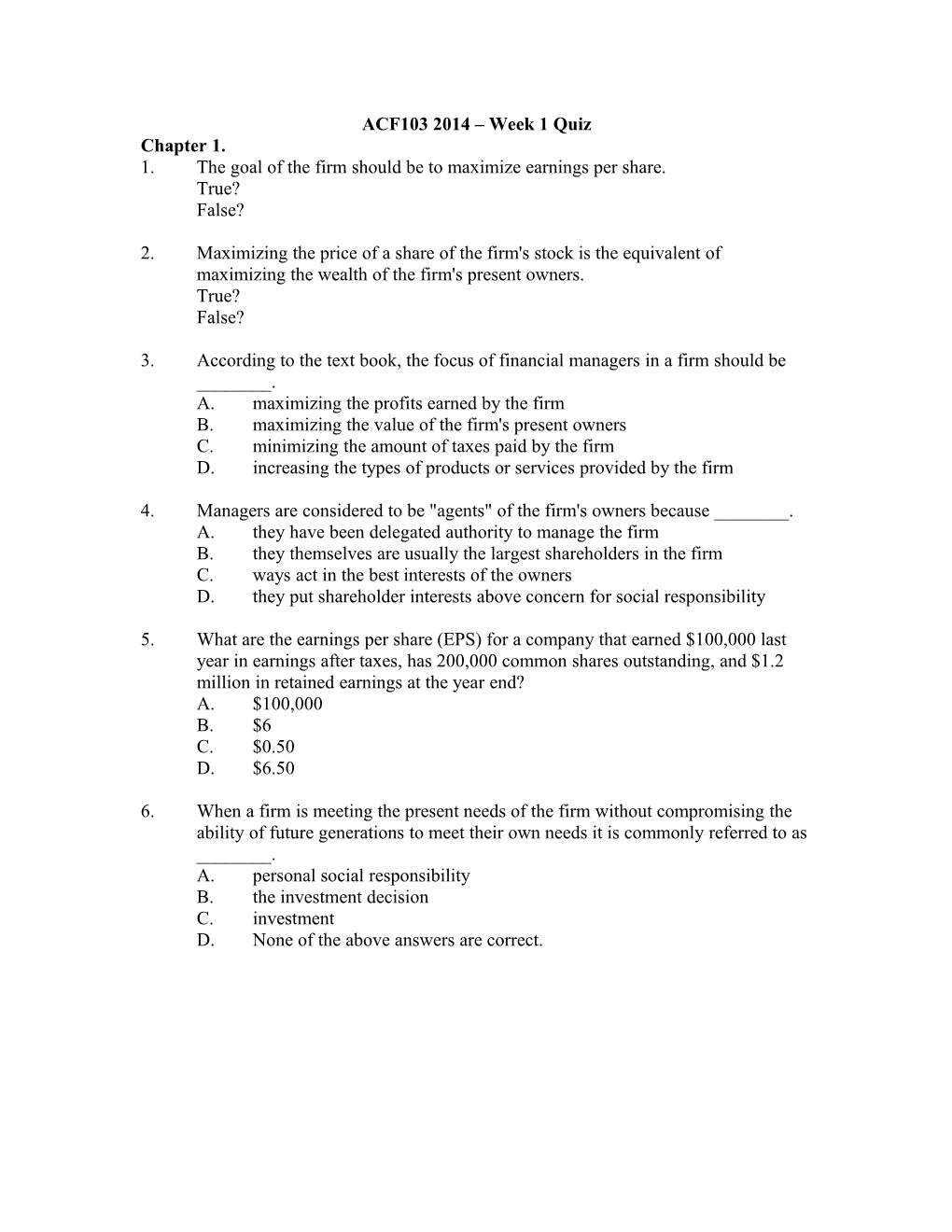

ACF103 2014 – Week 1 Quiz Chapter 1. 1. The goal of the firm should be to maximize earnings per share. True? False?

2. Maximizing the price of a share of the firm's stock is the equivalent of maximizing the wealth of the firm's present owners. True? False?

3. According to the text book, the focus of financial managers in a firm should be ______. A. maximizing the profits earned by the firm B. maximizing the value of the firm's present owners C. minimizing the amount of taxes paid by the firm D. increasing the types of products or services provided by the firm

4. Managers are considered to be "agents" of the firm's owners because ______. A. they have been delegated authority to manage the firm B. they themselves are usually the largest shareholders in the firm C. ways act in the best interests of the owners D. they put shareholder interests above concern for social responsibility

5. What are the earnings per share (EPS) for a company that earned $100,000 last year in earnings after taxes, has 200,000 common shares outstanding, and $1.2 million in retained earnings at the year end? A. $100,000 B. $6 C. $0.50 D. $6.50

6. When a firm is meeting the present needs of the firm without compromising the ability of future generations to meet their own needs it is commonly referred to as ______. A. personal social responsibility B. the investment decision C. investment D. None of the above answers are correct. Chapter 2 1. The ownership of a corporation can be transferred more easily than can the ownership of an individual proprietorship or partnership. True? False?

2. A capital gain is the amount by which the proceeds from the sale of a capital asset exceeds its depreciated (tax) book value. True? False?

3. Financial intermediaries make the financial markets more convenient but less efficient. True? False?

4. Which of the following is correct with regard to a sole proprietorship? A. Fringe benefits are legitimate business expenses and therefore deductible for tax purposes. B. The owner is personally liable for all business obligations, including any lawsuits brought against the business. C. Transfer of ownership is considerably easier than with any other form of business organization. D. Double taxation is imposed, meaning that the owner pays income taxes first on the income of the business, then again as personal income.

5. Suppose an asset costs $20,000 and has a depreciable life of five years. If the firm used the straight-line method of depreciation, depreciation charges during the second year would be ______. A. $8,000 B. $6,400 C. $4,800 D. $4,000

6. A corporation purchases a depreciable asset for $100,000. The asset has a five- year class life and is depreciated using the MACRS method. If it is sold for $120,000 after two years, the capital gain on the sale is ______. A. $84,000 B. $56,000 C. $20,000 D. $0 7. The purpose of financial markets is to ______. A. control inflation B. allocate savings efficiently C. increase the price of common stocks D. lower the yield on bonds Chapter 3 1. Which of the following statements is not correct with respect to both future and present value tables? A. For all positive rates of interest, the values in each table will be less than one. B. One table is the reciprocal of the other. C. Both tables simplify computation by solving for and using the (1 + i)n calculation (where i is the interest rate and n is the number of periods) in either the denominator or numerator of the factor. D. The values in the present value table, for a given number of periods, will be inversely related to the size of the interest rate; the reverse is true for the future value table.

2. You invest $8,000 in a savings account paying 5% interest a year, compounded annually. At the end of four years, your account will contain approximately ______. A. $10,880 B. $10,208 C. $9,728 D. $9,624

3. The present value of $5,000 received at the end of 5 years, discounted at 10%, is closest to ______. A. $620 B. $823 C. $3,105 D. $3,403

4. You plan to deposit $400 at the end of each year for 16 years in an account that pays 9% compounded annually. The terminal value at the end of the 16 year period is closest to ______. A. $13,201 B. $19,329 C. $9,634 D. $17,667

5. Suppose you wish to set aside $2,000 at the beginning of each of the next 10 years (the first $2,000 deposit would be made now) in an account paying 12% compounded annually. Approximately how much will you accumulate at the end of 10 years? A. $22,863 B. $25,151 C. $35,097 D. $39,310 6. You wish to accumulate $20,000 at the end of 10 years to pay for your child's first year in college. To accomplish this, you have decided to set aside a fixed amount at the end of each year for the next 10 years in a savings account that pays 6% interest compounded annually. How much do you have to set aside each year?

7. What is the total present value of the following series of cash flows, discounted at 10%? End of year Cash flow 1 $1,000 2 1,000 3 -2,000 4 3,000 Chapter 4 1. A bond sells at a discount from its face value when its coupon rate exceeds the rate of return required by the market. True? False?

2. Suppose you could buy a bond that paid $72 a year forever, and your required rate of return for this type of bond is 12%. The present value of this bond would be closest to ______. A. $60 B. $166.67 C. $600 D. $1666.67

3. An investor buying a share of 9%, $100 par preferred stock for $81 a share will receive a yield closest to ______. A. 9% B. 19% C. 8.1% D. 11.1%

4. The price of a 10-year bond with an 8% coupon rate is currently $681.76. If interest on the bond is paid semi-annually, the bond's yield to maturity is closest to ______. A. 7% B. 8% C 12% D. 14%

5. How much should you pay for a bond with $1,000 face value, a 14% coupon rate, and five years to maturity if your appropriate discount rate is 10% and interest is paid annually?

6. The CEO of Flying Carpet Transport, Inc. recently told financial analysts that he expects the company's dividends to grow at a compound rate of 12% for three years and a rate of 8% thereafter. The most recent annual dividend (twelve months ago) was $1 per share. a. Assuming a required rate of return of 10%, what is the present value of a share of Flying Carpet common stock? b. You have learned that Flying Carpet common stock is selling today for $64.50 per share. Given your answer in part a. above and assuming that you require a 10% rate of return for similar investments, would you buy stock in Flying Carpet? Chapters 6 & 7 1. Chuang Enterprises has current assets of $600,000, and total assets of $1,500,000. It also has current liabilities of $250,000, common equity of $500,000, and retained earnings of $170,000. How much long-term debt and fixed assets does the firm have?

2. The Tiananmen Company had revenues of $1,850,000 in 20X9. Its operating expenses (excluding depreciation) amounted to $650,000, depreciation charges were $250,000, and interest costs totaled $110,000. If the firm pays a marginal tax rate of 30%, calculate its net income after taxes.

3. D.K. Imports, Incorporated reported the following information at its last annual meeting: Cash and cash equivalents $122,500 Accounts payables $320,000 Inventory $625,000 Accounts receivables $350,000 Notes payables $120,000 Other current assets $12,500 Calculate the company’s net working capital.

4. The Wen Rong Corporation provided the following financial information for the quarter ending September 30, 20X9: Depreciation and amortization $150,000 Net Income $450,000 Increase in receivables $190,000 Increase in inventory $138,000 Increase in accounts payables $160,000 Decrease in marketable securities $68,000. What is the cash flow from operating activities generated during this quarter by the firm?