Creditor's Rights - Spring 2001 Nonjudicial Collection Methods Provision for frivolous actions.

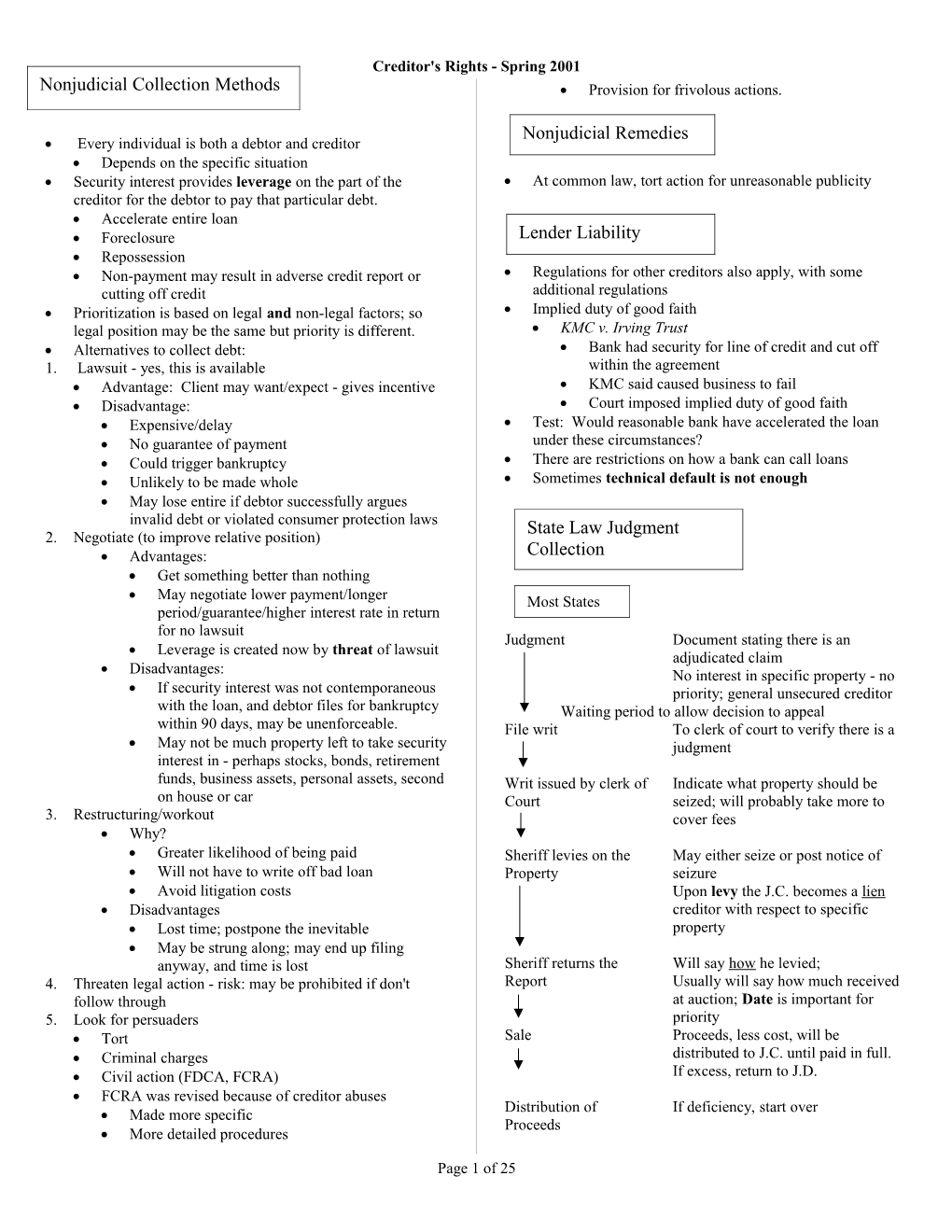

Nonjudicial Remedies Every individual is both a debtor and creditor Depends on the specific situation Security interest provides leverage on the part of the At common law, tort action for unreasonable publicity creditor for the debtor to pay that particular debt. Accelerate entire loan Foreclosure Lender Liability Repossession Non-payment may result in adverse credit report or Regulations for other creditors also apply, with some cutting off credit additional regulations Prioritization is based on legal and non-legal factors; so Implied duty of good faith legal position may be the same but priority is different. KMC v. Irving Trust Alternatives to collect debt: Bank had security for line of credit and cut off 1. Lawsuit - yes, this is available within the agreement Advantage: Client may want/expect - gives incentive KMC said caused business to fail Disadvantage: Court imposed implied duty of good faith Expensive/delay Test: Would reasonable bank have accelerated the loan No guarantee of payment under these circumstances? Could trigger bankruptcy There are restrictions on how a bank can call loans Unlikely to be made whole Sometimes technical default is not enough May lose entire if debtor successfully argues invalid debt or violated consumer protection laws State Law Judgment 2. Negotiate (to improve relative position) Advantages: Collection Get something better than nothing May negotiate lower payment/longer Most States period/guarantee/higher interest rate in return for no lawsuit Judgment Document stating there is an Leverage is created now by threat of lawsuit adjudicated claim Disadvantages: No interest in specific property - no If security interest was not contemporaneous priority; general unsecured creditor with the loan, and debtor files for bankruptcy Waiting period to allow decision to appeal within 90 days, may be unenforceable. File writ To clerk of court to verify there is a May not be much property left to take security judgment interest in - perhaps stocks, bonds, retirement funds, business assets, personal assets, second Writ issued by clerk of Indicate what property should be on house or car Court seized; will probably take more to 3. Restructuring/workout cover fees Why? Greater likelihood of being paid Sheriff levies on the May either seize or post notice of Will not have to write off bad loan Property seizure Avoid litigation costs Upon levy the J.C. becomes a lien Disadvantages creditor with respect to specific Lost time; postpone the inevitable property May be strung along; may end up filing anyway, and time is lost Sheriff returns the Will say how he levied; 4. Threaten legal action - risk: may be prohibited if don't Report Usually will say how much received follow through at auction; Date is important for 5. Look for persuaders priority Tort Sale Proceeds, less cost, will be Criminal charges distributed to J.C. until paid in full. Civil action (FDCA, FCRA) If excess, return to J.D. FCRA was revised because of creditor abuses Distribution of If deficiency, start over Made more specific Proceeds More detailed procedures

Page 1 of 25 Creditor's Rights - Spring 2001 Since atty has mechanisms (depos. Interrogatories) to find out what the debtor has, should let the sheriff know. Wyoming Statutes Ask for cash first Prior to 1999 Some States Automatic lien on real property in county where judgment was granted Judgment Record judgment, docket Meant - must search real estate records and clerk's Some states, when judgment is office and UCC records. docketed, get lien on real property; In 1999 sometimes personal property. Amended to require file with clerk (1-17-303). Docket date gives priority date No longer self-executing Recordation Certified judgment Take to real estate office to record Advantages Must find out all the property the person has. Quick, inexpensive Lien provides leverage to get paid Compare bankruptcy Can increase expenses for JC - waste of time Problem 4.1 Advantages of state law procedure To show position of creditors with various judgment dates, Cranky debtor execution dates; Isolated debt 1. No lien, therefore, general unsecured creditor Good to know how to get liens in place for priority in 2. Sheriff levied, so creditor has lien - paid from proceeds bankruptcy a. Encourage sheriff to look for other goods 3. Remainder to JD unless one of the other creditors takes If debtor is client, explain this to suggest bankruptcy as action option Debtor's argument Aging Judgments If waiting period violated, improper seizure Dormant - must be revived before can execute Priority with Competing Cannot revive after 21 years execution Liens - State Law 1-16-502 steps to revive 1. Some states - Relation back to delivery date of writ to To avoid dormancy, periodically try to execute sheriff (WY) Lose priority after one year § 1-17-336 a. Fairness - did all you could do - up to sheriff Statute of limitations to enforce judgment - 21 years 2. Some states - First to levy wins Execution writ - 60 days to execute 3. Some states - Based on issuance date of writ provided the writ hasn't lapsed Problem 4.2 4. If the statute says a judgment constitutes a lien, it does - Sheriff levied but forbore seizure otherwise it does not To show relative position of creditors; 5. Levy - some states say must physically seize; some just tag Distribution of proceeds a. Usually - first to levy wins Leverage b. Must wait until waiting period expires before levy Security interest in property c. May get stay of execution (put up bond) Get agreement they will not borrow or grant other 6. Wyoming security interest a. Lien attaches when certified judgment filed (uncertain 1. If no physical seizure required, lien can relate back to the interpretation) filed with clerk. issuance of the writ; can affect if writ expires b. In Albany Co. cross-reference to all real estate records 2. Can argue that leaving property with JD was waiver of lien i. If property in another county, take transcript 3. Lose priority by stopping of district court in judgment county to clerk of 4. Is there really a levy if the JD has the property? court and county clerk where property is and ensure recorded in real estate records What is the effect of halting the collection process? ii. Personal property - writ to sheriff Can have risks for JC iii. If property in another state, comply with law Documents could expire (refile or lose) of that state c. Personal property - dates from levy (seizure); deliver Left with JD for a long time, hard to assert that writ - sheriff seizes sheriff had dominion (levy could be challenged) d. 1-17-309 - first delivered to sheriff gets priority of Halt of execution constitutes a waiver proceeds. (Two delivered on same day - distributed in proportion to debt). Page 2 of 25 Creditor's Rights - Spring 2001 Think carefully before agree to forbear, because secured Low price alone not enough - may signal fraud, creditor with perfected security interest in specific property mistake, overreaching or failure to follow statutory may come in. procedures; If agree to workout -- condition it on agreement to protect Unfairness yourself (get leverage) If only asset was worth 64,400 and just have Security interest $2000 judgment, court may step in under fairness, Agreement from JD won't borrow more or without and say can't force to sell such large asset to satisfy your consent Sheriff's duty Don't grant security interest in any other property - if General rule - In most states, sheriff is agent of both JD refuses, ask to find out what other property may be out and JC and must protect both; must exercise care and there discretion If breach this, allows to accelerate and move in self- Must levy only o property sufficient to satisfy the debt. help under Art. 9. Dividing the property Some states allow (by statute) the JD to choose Sheriff then responsible to ensure sufficient property Why Reduce Technicalities? In real case, JD could get back the property if: Help creditors get their money Paid $20,000 for it to purchaser Sales more quickly $2000 to Creditor 1 Fewer challenges $17,000 to Creditor 2 Less cost The purchaser is the only one who loses Prices would rise Discourages buying at sheriff's sale If want to discourage judicial sales, use other means (make So, although this seems fair, may have economic effects other rules) More confident sale won't be overturned But there is no evidence that reducing technicalities would Garnishment result in more sales.

Why Have Technicalities? Procedure to reach property of JD held by a third party Wages Protect JD - minimize debtor's loss Bank account Protect JC - may get better price Proceeds of contract May help prevent fraud 1. To use garnishment procedure must be a JC Encourages negotiation and refinancing a. Must have judgment in hand Encourages money recovery rather than sale b. E.g. just because have Art. 9 rights doesn't mean can Discourages sale and seizure garnish But - no evidence 2. Essentially bringing another lawsuit If procedure was easier, not so many set aside 3. Must follow state's procedures Higher prices 4. Time of service of writ to answer (as hearing, of contested) Not so many technicalities, just deal with in requirements for the sale. Hypo Jason $500 loan Ryan Judicial Sales Garnishee Owes $550 over owes In most states, sale can be either public or private 4 months $1000 next Car In WY, if show cause can order private sale (usually get month more money) Sale procedures are very technical Garnishment Kelly Notice Action Garnisher Advertisement Waiting period Ryan unhappy with the car and refuses to pay Kelly. Redemption provisions Offers to return car - refuses Appraisal provisions (WY) What can Kelly do? 1. Lawsuit - judgment against Ryan Two Problem 4.3 2. Garnishment action against Jason Lawsuits Shows sale procedure How to set aside sale

Page 3 of 25 Creditor's Rights - Spring 2001 Raise defenses (usurious) How does Kelly know that Jason owes Ryan money? Claim right to setoff Discovery procedures - interrogatories, depo. Hearing after answer If Jason is in Colorado - use Colorado law Uniform Enforcement of Judgment Act Garnishee is Jason One-time v. Continuing Garnisher is Kelly Garnishment JD - Ryan JC - Kelly Restrictions General rule - any debt in possession that is garnished - must Don't want to take all of salary hold (keep in safekeeping) until finds out what to do. Incentive to keep working; social costs If wrongfully paid out, garnishee can become liable. States vary on how much can be taken Jason's defenses against Ryan (like interest rate too high) Federal restrictions Goes in answer Wyoming - 25% disposable income (after taxes, certain 1. No obligation is owed to JD, or exempt property) 2. Offset, or Threshold - If JD makes less than this amount, cannot 3. Counterclaim against Ryan garnish for anything other than child support. If ignores garnishment and pays Ryan, Kelly gets default judgment against Jason for full amount (Webb v. Erickson) Problem 5.2 Will look at evidence about what he owed Ryan, and how Shows timing of transactions, and which are subject to much he can pay on the garnishment. garnishment Lease (disputed date of execution) Problem 5.1- apply Wyoming statutes Equipment that was leased Wyoming garnishment statutes Pre-judgment remedies

1-15-425 - Wyoming net - when writ is served until writ is These measures are extraordinary discharged. Matter of state law 1-15-417 - In Wyoming, may get attachment, replevin, Bank can offset overdraft garnishment How do garnishers divide? States differ, but here Attachment - lien on certain property use delivery to sheriff Replevain - request delivery of the property - wrongful 1-15-504 - Wrongfully paid the check. JD entered a judgment retention Effect of answering 5 days early - varies by state. Pre-judgment garnishment - attaches to property in hands of 3rd party Answer 1. File complaint - claim recovery of money judgment 2. Written motion to get court order Answer form sent along with writ of garnishment a. Notice, opportunity for hearing State statutory procedures 3. Or - Affidavit claim irreparable harm before notice can be Garnish wages, amount, or stream of payments under given contract a. Dispose of property Cannot garnish unless you are a JC b. Concealed Separate lawsuit against garnishee, c. Value impaired Therefore, discovery procedures are available to find 4. Hearing at earliest possible date out what property has (if don't complete answer Very technical procedure correctly) Must post bond for costs and damages

1. Procedures are very technical Problem 6.1 2. Generally allow net around assets in hands of 3rd party at To show procedure for pre-judgment remedies, and some of time of writ the problems with it. 3. Net lasts until (differs) answered, discharged, object. Must show need for extraordinary measure

Procedural Protections Objection Fundamental rights, due process JD can claim property exempt Order must be issued by a judge Garnishee Must set forth facts Can say no obligation owed Page 4 of 25 Creditor's Rights - Spring 2001 Affidavit must be more than conclusory (cannot just say he c. Even if not in statute, courts generally protect the will conceal assets) homestead. Must have personal knowledge of facts d. Often use common law tenancy by the entirety - would Must have immediate hearing need other owner to sign. Writ will not continue unless requesting party puts on proof. Problem 8.1 Examples of going through possessions to determine what is Wrongful use of State Process exempt Tax judgment not exempted by any state law. 1. Secured creditor cannot breach the peace Can usually negotiate a. Unlawful seizure if breach Private Texas statute - arguments to be made to make some things b. Civil and criminal penalties Repossession exempt; car on blocks, wedding ring; law books c. Damages Recovery under pending claim - states differ d. May constitute a tort Bank account that contains wages and social security 2. Sheriff acting on repo is action of the State payment a. Misuse of process Argue that it keeps its exempt nature. b. § 1983 civil rights actions At what point is it no longer current wages? 3. Misuse of collection statutes Holmes, Williams cases a. Malicious prosecution Hard to prove. Debtor values the items, creditor can object b. Abuse of process Needs malice. Burden of proof depends on state law

Exemptions Problem 8.2 To show distribution of proceeds from sale of home (including homestead exemption) Every state has statutes 1. Expenses of sale - sheriff cost, fix-up, advertising Policy - don't want people to become destitute 2. Mortgage amount (consensual liens) Want people to have enough to make a fresh start. 3. Exemption amount - JD Not exempt from voluntary liens 4. First JC who executed involuntary PMSI Not protected 5. Other JC whose judgments have attached, liens Mortgage by exemption Or steps taken toward execution Installment contract statutes 6. JD Applies to voluntary liens Judgment The forced sale Levy Bidding in Garnishment Secured party may bid amount up to amount of debt Can only garnish non-exempt property and don't have to come up with the cash Execution - can only execute on non-exempt property Reduction of deficiency owed by debtor In addition to state statute, there are a number of other Discourages unrelated parties exemption statutes Most statutes say court must consider FMV Federal exemptions Bid-in price probably not a good indicator of FMV, because Social Security the secured party doesn't have to come up with cash, AFDC whereas unrelated party does, so unrelated parties are Veterans' benefits discouraged. Black lung However, even if at private sale Other state exemptions Will probably get less than full value If owner knows he will lose it - won't take care of it. 1. Classification - most fighting time here a. must make statutory construction arguments Why would JC want to force a sale even if he gets nothing? b. Legislative purpose, plain meaning, specificity or lack Force into bankruptcy c. Many items move from state exemptions to other Revenge classifications Bitterness 2. Changing form - does it stay exempt? Anger 3. Partially exempt 1. Could get leverage - try to get 2nd mortgage and improve a. Sell property position (currently 4th on the list b. Exemption attaches to part of proceeds 2. Might ask for reaffirmation of the debt. 4. Homestead exemption 3. Could try to buy the property himself. a. Especially multiple property owners b. Can one person waive the exemption? Page 5 of 25 Creditor's Rights - Spring 2001 Paternalism of the judiciary Valuation Downside - Judicial efficiency Inequity, unfairness Important issue in whether debtor gets to keep the property Based on limited experience; forget to list some things Differences Benefit Proceed value Gives direction to people who have made bad decisions Retention value Sometimes exemptions are absolute - like family bible Fraudulent Conveyances If there is a $ value on the exemption, Estimated value Themes -security interest Fear of fraudulent debtors If more, must be sold Fear that creditors will be misled But if property is less than exemption amount, sale will not Assist bona fide purchasers be ordered 1915 UFCA - Wyoming adopted and still has If represent debtor, many times wants to keep, not sell. Intent: Not free to give away own property/make Sentimental bad deal if serves to chat creditors Expensive to replace Restriction on basic freedom Little proceeds from sale 1984 UFTA - Adopted by many states - same basic principles, Usually won't recover debt. with a few technical changes Therefore, exempt property has high leverage/hostage value. UFTA Equity in property - don't know until actually sold Value from sale Section 5 -consensual lien 1. Transfer (§ 1(12) Debtor's equity 2. Claim arose before transfer made 3. Did not receive Reasonably Equivalent Value and Wyoming 1-17-316 4. Debtor insolvent or became insolvent (§ 2) Officer who levies must designate an appraiser a. 2(a) - Balance sheet testimony Appraisal to sheriff b. 2(b) - not paying as become due If appears 2/3 value is sufficient to satisfy execution with Reasonably Equivalent Value costs, don't go after more property Is there a market? Mean - will not sell if it will bring less than 2/3 of debt Discount for fast sale Must be prepared with arguments and paper trail How to structure order for the sale? If all elements of § 5 are met except REV, go to § 7 If JD - private Transaction is set aside even if good faith If JC, Buyer is the one who is hurt Give to long, may reduce value of property Defenses of buyer under § 5 May order cost of upkeep as cost of sale Not talking about § 8 because § 8(a) applies to § 4(a)(1) intent Determine what is the worst that can happen, and plan for to hinder that If have § 5 claim, good faith is not a defense. Only defense is that one of the other § elements is not met. Problem 8.3 Looks at sale of house and what must be done with the money § 4 that goes to JD as exemption amount (a) Claim arose before or after Intent of legislation - fresh start Transfer How long should exemption be protected? What if can't Creditor before or after find a house Actual intent to hinder, delay, or defraud If use the money to buy a Porsche? 4(a)(1) factors in determining actual intent (4(b)) How paternalistic do we allow the judiciary to be? 4(a)(2) or without receiving REV and Some states protect for specified period of time unless put Remaining assets unreasonably small or in same asset Incur debts beyond ability to pay Some states disregard proceeds. Only use 4(b) when talking about 4(a)(1) 4(a)(2) don't use facors Problem 8.4 Present creditors - better to make § argument because need Policy basis for exemptions not prove intent 1. Overall dollar limit - JD can keep whatever he wants 2. List the categories - JD can retain any amount **In Wyoming, UFCA has good faith defense because of §§3 3. List the categories and limit the value of each group and 4 together Page 6 of 25 Creditor's Rights - Spring 2001 Creditor may come back and say assisted in fraud More defenses under old act - more good faith stuff New - good faith not a defense Problem 10.3b Is this fair? Client asks for help in making a transfer - don't know for sure Creditor is unsecured whether it is fraudulent Restriction on all property transferred Document that you asked all the right questions Implies promise to pay means won't squander assets Malpractice - did you block something he was allowed to until pay. do? Statute says -- certain facts suggest cheating; When those facts are present presume fraud Bankruptcy Different, depending on future or present creditors.

Problem 9.2 How Bankruptcy Works Application of § 5 and § 4 to determine whether claims will be successful under either of these (apply elements) 1. Filing creates estate Problem 9.3 2. Automatic stay provides protection from further creditor Apply factors - no asset, so no transfer of asset. action 3. Divide property in estate Problem 9.4 a. Exempt - to debtor What can creditor recover from bona fide purchaser, if b. Non-exempt - sold and proceeds divided shown the conveyance was fraudulent? 4. Creditors take allowable secured claims 5. Priority of unsecured claims Concept of innocent buyer v. innocent creditor; 6. Discharge Amount given - probably buyer can get that back after sale From Creditor's Perspective Amount spent on improvements? Depends on State Law interpretation; lien for improvements the BFP made Has to compete against other creditors Enhanced value of property because of improvements? Pressure to move quickly Harder to BFP to claim Often get less because forced sale Expensive/time-consuming Other Ways to Hide Assets - Can you Plan for Must follow procedures - where is property? Bankruptcy? Bankruptcy Problem 10.1 Collective procedures - interest of all creditors What to do with cash, if bankruptcy looms All creditors work with debtor thinking will get Full spectrum among the states on what will be allowed more than with forced sale Will have problems with conversion, even if the law allows. Federal jurisdiction - improves ability to control Even if conversion is allowed under the relevant state Debtors have to file elaborate schedules. Creditors law, may deny discharge under bankruptcy. benefit from enforced candor

Coplan From Debtor's Perspection Planned carefully and moved to Florida to take advantage Bankruptcy of homestead exemption. Discharge - frees from obligations Court held it was a concerted effort to evade creditors, and Policy reasons: denied Florida exemptions a. Humanitarian Court has power to deny relief under the state law, if debtor b. State interests - safety net to avoid becoming has not acted in good faith public charges Fact specific c. Safety valve - mitigate harsh consequences of credit system. Reason for move d. Avoidance of debt has adverse effect on the economy Problem 10.2 Lawyer's advice on conversion Distinction between treat of businesses and individuals Pro Individual - focus on fresh start Legal right to convert; malpractice not to advise Business - more from a financial standpoint No one will challenge converting cash to necessities Con Two approaches in Code Bankruptcy laws may prohibit discharge later 1. Liquidation - sell-out Own feelings of ethics Page 7 of 25 Creditor's Rights - Spring 2001 a. Available to individual and to business What if employer promised to set up retirement b. Take everything; I'll try again. account c. Usually Chapter 7 No money in it now 2. Reorganization Promise is contract right a. Allows debtor to keep assets in exchange for promise Doesn't fall under ERISA. to pay with method to repay. If granted an interest in retirement account - this is b. Chapter 11 - Individual and business; a consensual lien.- becomes part of estate i. Lots of assets Policy for retirement plans - encourage to save for ii. Rich people more like a business the future and not be State wards in old age. c. Chapter 13 Abuses like OJ Simpson - assets protected i. Real people with relatiely modest debts from bankruptcy because in retirement plan. Elements Common to Consumer Bankruptcies Problem 12.2 Compare: Property right The estate Expectation The minute a petition is filed, there is an estate. Hope Everything previously owned by the person (Lottery ticket) § 541 (Promise to marry is not contract right) Includes Real property Problem 12.3 Tangible personal Contract is part of estate Intangible personal Value depends on crop when it is harvested 1. Is the item in question "property?" Farmer does not have to harvest, unless it is a personal 2. What is the debtor's interest in the property? services contract; if he does harvest, he is entitled to 3. Did the debtor have an interest as of the compensation for the value of his services commencement of the case? 4. Then, do any of the exemptions apply? § 522 Problem 12.4 541(a)(1) is very broad - want to bring all property into Trust, with non-assignable rights to future income and estate corpus; gets these when mom (who is sick) dies Exception Estate gets income already received (b)(1) - Power as trustee that can be exercised only for Whether estate gets corpus under 541(a)(5) depends on someone else's benefit definition of devise, bequest - so wait to file until she (c)(2) - restrictions on transferability of trust are dies enforceable (spendthrift; ERISA-qualified) 541(c)(2) Policy for including almost everything in estate. General rule - Invalidates restrictions on transfer of 1. Need to monitor the debtor's property. If the court debtor's property knows about everything, can consider exceptions Caveat/exception - A restriction on the transfer of a 2. Debtor gives up all non-exempt property beneficial interest of the debtor in a trust that is 3. Concern that debtor can construe a statute to not enforceable under non-bankruptcy law is enforceable include valuable property. in a case under this title. 541(a)(5) Problem 12.1 To go through list of items and determine whether each is part Includes property debtor acquires or "becomes entitled of the estate. Note: to acquire" within 180 days after petition by If have legal title and someone else has equitable Bequest, devise, or inheritance title (like you are the trustee and someone else the Property settlement or divorce beneficiary), the legal title comes into the estate, As beneficiary for life insurance but the beneficial interest does not Net comes out at date of filing and extends for 180 If there are profits from the estate (dividends from days stock that goes into estate), § 541(6) overrides (5) Interpretation question as to whether the corpus is an requirement of interest on date of filing, so goes to inheritance estate Policy: windfall; not expecting, not able to manipulate ERISA qualified retirement account - NO Therefore, does not impair fresh start Spendthrift trust - NO (§ 541 (c)(2)) Trust provided for benefit of another - What is interest in property? restrictions to protect from "wasting" assets No property of the debtor Must look to state law Contingent interests Page 8 of 25 Creditor's Rights - Spring 2001 May be included No time for calm cost/benefit of filing Certain Usually overwhelmed Determinable Shows different conditions, and effect of filing When matures, becomes part of estate (garnishment, check outstanding, May be enforceable Criminal prosecution for bad check - some wiggle room Expectancy Some courts have held that conditional dropped Marry rich charges (conditioned on paying back) is a collection Work for larger law firm device, and can enjoin DA from prosecuting Not part of estate Some courts order the debtor not to testify so drop. Doesn't stay criminal prosecution unless it's really a collection device Problem 12.5 Alimony, child support can go forward To show arguments for whether awards, bonuses are part of the 362(b)(11) doesn't prevent presentment of negotiable estate instrument Is the award for past services (estate) or contingent on an Present to estate, reject, this preserves claim against event that happens after filing (not estate) other parties. Something like research award, what will the estate do with Does not allow to enforce against debtor (preserved it? May have to abandon because restrictions prevent against secondary obligors on check) anyone from bidding on it. 362(a)(7) setoff Generally recognizes state law rights to setoff Problem 12.6 May not set off post petition against pre-petition unless Licenses get relief from stay 1. Whether become part of estate depends on whether can be Supreme Court has held that administrative freeze on transferred bank account does not violate the automatic stay 2. Interest involved in identity of license holder. (driver's because just preserves the status quo. license, liquor license) Factors to consider Problem 13.2 Some courts respect stated policy on transferability To show range of actions that cannot be done by creditors Some courts look at what really happens without violating the automatic stay If don't transfer, creditors will be hurt Some say, don't want to create a market in government Exemptions permits

Property itself is not exempt; exemption is debtor's equity that is Automatic Stay allowable under exemption. 522(d) - Federal exemptions Biggest benefit to petitioner 1. Only available to real person Self-executing 2. Be in state that has not opted out under 522(b)(2) Gives debtor some breathing room; relieves pressure from WY (1-20-109) opted out, so must use WY exemptions collection activities rather than 522(d) Very broad concept Can use other federal exemptions like Social Security, Automatically stays judicial, administrative actions disability… Prevents enforcement of pre-petition judgments 39 states have opted out Agreeing to settle for less - may be reaffirmation - check Some of the remaining 11 allow debtor to choose state with the court; very limited or federal (cannot mix and match; all one or the other) Taking payments after petition - no because upsets the Inflation adjustments to specific amounts status quo Important to know federal exemptions, because big flap about variations in state exemptions 362 (h) Violation of Stay New law may have federal limits or not allow states to opt Willful - Recover damages including costs and attorney's out fees 522(d)(5) - wild card Civil contempt; criminal charges; jail; injunction of activity Married, double the amount that is violation of the stay Ordinarily the action taken has no legal effect (will undo 522(f) the transaction) Overrides lots of case law; Certain judicial liens and non-PMSI non-possessory liens in Problem 13.1 certain types of property are not favored. Illustrates why people file for bankruptcy Page 9 of 25 Creditor's Rights - Spring 2001 Problem 14.2 List of assets; discussion of what can be kept under Federal Unsecured under § 502 exemptions Amount of debt + pre-petition interest (if agreement so provides) Some debtors doe better than others + pre-petition atty fees (by contract or state law) Homeowners do better + post-petition atty fees [maybe][probably] Car owners do better (Merchant case says yes if Alimony recipients get a break ((d)(10)) agreement or state law so Some types of benefits can be kept. provides) Caveat: commentators argue no, but no post-petition Married Couples interest If both are debtors, and file can stack exemptions Joint petition Choose: 2 fed. or Secured § 506 Two state (if state Only as good as the collateral that secures it. Gives choice Oversecured Effect: Exemptions apply to each debtor Collateral value greater than what is owed. 522(a)(1) defines "dependent" to include spouse; Amount of debt +pre-petition interest (at contract rate, if agreement so provides) Can exempt some of each other's assets +pre-petition attys fees (by contract or state law) If file separate petitions could take one state, one federal +post-petition attys fees (by contract or state law) set of exemptions +post-petition interest (allowable even if no agreement) Some courts, when they see this, join the petitions to not (contract rate, if none, legal rate of interest) allow it. Add these until value of collateral is exhausted 522 (f) Involuntary Lien To the extent a judicial lien "impairs an exemption" (makes Undersecured it less valuable to the debtor) Secured to value of collateral; remainder treated as May avoid the judicial lien - even if put on before filing. unsecured Applies to nonpossessory, non-PMSI (voluntary lien); Household items Unsecured Tools of the trade Get put in a pile Impairment defined in 522(f)(2) Take proceeds and distribute pro rata. Can only avoid the lien to the extent of the exemption Remainder will still be available to creditors Procedures for Creditors Creditors will usually get notice of bankruptcy and proof of Valuation claim form Ch 7 and Ch 13 Under Mitchell, Must file proof of claim within 90 days after first FMV is not limited to liquidation value meeting of creditors (§ 341 meeting) Should not look at foreclosure sales value Must file claim, even if your debt is on the schedule Realized; reasonable; diligent; interested buyer Ch 13 - not required to file claim if amount on Under ordinary selling conditions schedule is correct, but hardly ever correct. Under Walsh Ch 11 FMV is liquidation value If debt is scheduled, not required to file proof of claim Look at surrounding circumstances; foreclosure sales Proof of claim price How much is owed What is debt based on Problem 14.5 Copy of the agreement (writing) This is the Mitchell/Walsh analysis of whether to force a sale Calculates Cindy's "effective exemption" if Walsh valuation § 502(a) Allowance of claims is used and judge doesn't force sale. Claim allowed unless party in interest objects If Mitchell valuation theory is used, judge will force sale Court can decide Argue for appropriate valuation method depending on Often based on one party not coming up with proof which side representing Disputes Bookkeeping error Secured and Unsecured Debtor thinks it has been paid Creditors Pre-petition repo not commercially reasonable Page 10 of 25 Creditor's Rights - Spring 2001 Deposits Problem 15.1 Include downpayments Example of debt secured by stock; variance in selling price of Rentals stock causes the debt to be oversecured in one case and Rental equipment undersecured in another; distribution of proceeds in each case. Policy - protect innocent consumer Problem 15.2 No opportunity to spread the risk over a number of Another example of oversecured and undersecured; transactions Definition of allowable secured claim Income Tax - Three years Problem 15.3 507(a)(8)(A) Probably get the whole amount Allowable secured claim - value of collateral Include a tax year if it passes two tests: Allowable unsecured - remainder of principal and interest 1. Tax year ended before date of filing, and and possibly atty fees. 2. Return for the tax year must have been due before the Unsecured post-petition interest - not collectible date exactly 3 years prior to date of filing. Authors say don't collect post-petition anything. Generally can reach 3 years Case law Based on date due not taxable year Merchants says get post-petition costs Note: if filing date if before April 15, current year drops If meant to exclude would have specifically excluded out. Tax liabilities are not discharged, so priority is important to fresh start policy. Priorities - § 507 Trustee 507(a)(1) - costs of preserving the estate (503(b)(1)), and § 507 applies to all cases (ch 7, 13) except some Ch 11. compensation (503(b)(2)) Each priority class gets paid in full before unsecured Why an administrative priority? creditors in the next lower class Protects unsecured creditors If not enough to pay a class, they share pro rata then nothing goes to next level. Still on Problem 16.1 - lots of items to prioritize Sometimes there are arguments that can be made relative to Attorney's fees - classifications. For will - no priority - general unsecured credit Trustee makes classifications Bankruptcy filing - 507(a)(1) If client is lower on the list - challenge classification of Varies by district those who are higher. 503(b)(4) only if reasonable Some will not pay pre-filing costs Problem 16.1 If not, insist on cash up front Levels of priority for unsecured creditors Negotiable note to ex-wife Wages to $4300 (includes bounced checks) Alimony or child support - 507(a)(7) Policy - want to give higher priority to those who Property settlement - no priority (general unsecured cannot bear the loss credit) 90-day limit - time to be on notice SSI and withholding Discharge Employee part - 507(a)(3) just like wages Employer part - 507(a)(8)(D) employment taxes This is very important in consumer case Failure to pay - creates personal liability of Must turn over assets for sale, but don't really get principals; this priority gets them off the hook discharge from all debts Property taxes (507(a)(8)(B) - one year - to qualify for Lots of the litigation in Ch. 7 happens here priority: But discharge litigation is rare. 1. Must be a "property tax" Challenges may not show up because those threats of 2. Must be assessed prior to commencement of the challenge may be used as negotiations to get reaffirmation case of debt. 3. Must have been last payable without penalty after one year prior to commencement of the case. Challenges to discharge Note on taxes: Certain debtors from certain debts Many tax claims will actually be secured claims because they get a tax lien; 507(a)(8)D) only applies to unsecured Nondischargeable debt depends on the type of bankruptcy 1. Assessment Creation of Can leave bankruptcy still saddled with large debt 2. Notice and demand of amount due tax lien Can be challenged by trustee (acting on behalf of all 3. Failure to pay within 10 days creditors) or single creditor 523 - particular debts

Page 11 of 25 Creditor's Rights - Spring 2001 727 - global denial Can fairly easily make a credible threat of global 727(a)(3) - failed to preserve records (Harron) discharge and get reaffirmation 523(a)(2)(A) - fraud (Dorsey) 727(a)(2) - intent to hinder, delay, defraud Problem 17.3 727(a)(5) - failed to explain loss of assets (Reed) Can bank avoid discharge of the loan, based on the application, 523(a)(8) - student loans undue hardship (D'ettore) when there were some misstatements on the application 523(a)(3) - debts neither listed nor scheduled § 523 (a)(2)(B)no discharge from debts by statement: 727(a)(4) - made false oath, gave advantage, withheld info 1. In writing 523(a)(2) - written statement 2. Materially false a. materially false 3. Respecting financial condition b. respecting financial condition 4. On which creditor reasonably relied c. reasonably relied, and 5. Intent to deceive d. intent to deceive § 523 (a)(5) - exempt support payments from discharge 523(a)(6) - willful and malicious injury Non-support obligations may be dischargeable 1. 523 (a)(15)(A) - inability to pay In re Harron 2. 523(a)(15)(B) - balancing Denied discharge because no records at all. 523(c)(1) - failure to get determination of dischargeability Creditor objected under § 727 (a)(3) failure to preserve records 523(a)(5) General rule exempts support payments from Objector has burden of proof discharge Usually bad records, alone, not enough Support = alimony, maintenance or support Make sure debtor answers questions accurately Label is not determinative - must be "in nature of support" Dorsey Bankruptcy court must determine what is support and what is property settlement. Fraud Divorce is a major cause of bankruptcy, so be careful how In re Reed - global denial of discharge the settlement is structured Federal bankruptcy court Policies: Under § 727 (a)(2) intent to hinder delay, defraud Support payments are day-to-day expenses - don’t' want to force onto public assistance Under § 727 (a)(5) failed to explain loss of assets Spouse and children are not able to spread the risk. D'ettore § 507 - support payments are 7th priority (favored) Student loans Nonsupport may be dischargeable under: Non-dischargeable (523(a)(8)), except 1. 523(a)(15)(A) debtor lacks ability to pay 2. 523(a)(15)(B) balancing testimony Undue hardship If benefit of discharge to debtor outweighs Factors on p. 296 detriment to recipient, may discharge (Hill) Judges may vary. Six factors Problem 17.1 Court is inquiring into how much all the parties need to live on § 523(a)(3) - if not listed, will not be discharged. Personally intrusive Should advise her to list - may decide later don't want to pay and will blame atty Not just egregious cases; average people If creditor had notice or actual knowledge and she didn't Must determine what is alimony and what is list, it would be discharged not If didn't list, would be false oath What happened in divorce is not necessarily determinative §727 (a)(4) - withheld information and gave advantage 3. 523 (c)(1) - If spouse fails to request determination If creditor, claim that failed to list and met one of these, In this case, must file complaint (4007) can challenge under this When non-debtor spouse gets notice of Response to § 727 discharge: bankruptcy, should file right away Unduly harsh penalty If don't file, judge will probably look carefully to No prejudice to other creditors since she intended to ensure notice, atty competence. pay anyway Two determinations Reason for § 727 1. Is it support, and therefore, automatically exempt from Hammer - lose all discharge discharge? Puts bite in disclosure provisions 2. Should it be discharged anyway under one of the other Discourages side deals to skirt safeguard and exemptions.? reaffirmation.

Page 12 of 25 Creditor's Rights - Spring 2001 Problem 17.5 Can re-negotiate the terms Look at sections of divorce settlement to determine what can be Voluntary construed as support, and what is property settlement Safeguard for debtor is 3rd party review for reasonableness Problem 17.6 Look at willful and malicious injury - no discharge; negligence - Problem 19.1 may be discharged; drunk - not discharged Interrelationship between redemption provision and exemption provision Effect of Discharge Different example Bank loan - still owe $1000 Trustee has right to sell § 525(a) - cannot discriminate based on use of the bankruptcy FMV - $5000 property in excess of code. Exemption - $2000 exemption List in (a) is not exhaustive If trustee values the car at $5000 with $2000 exemption, estate Codifies Perez where driver's license renewal was denied will get $3000; then must pay off bank $1000 from that because of bankruptcy. If debtor wants to keep the car must pay $3000; pay trustee Discrimination frustrates fresh start. amount equal to excess equity and secured party the value of allowed secured claim. Problem 18.1 525 only applies to government units, employment and student Problem 19.2 loans. Points out that affidavit is only needed for reaffirmation, not redemption. Why? Problem 18.2 Policy to let him keep what he can pay for Cannot fire solely because of bankruptcy; very difficult to prove Really not encumbering a fresh start reason, much less solely because 525 (b) Freedom of choice Perhaps Ch. 13 would be better, if really wants to Problem 18.6 keep- could make periodic payments rather than License renewal lump sum Debtor's Post-Bankruptcy Position Problem 19.3 524(c)(1) not enforceable if made after discharge. Why? Debts are discharged, but liens are not discharged Reform measure - wanted someone to look over shoulder Unsecured debts vanish Impairs fresh start Liens remain attached to the related collateral Don't get anything in return May be coercion To keep collateral with a lien, debtor must either: 1. Put up cash to redeem May reaffirm for the wrong reasons 2. Get the creditor to agree to let him keep it by May not be in debtor's best interests reaffirming the debt Problem 19.4 To redeem - 722 Developing a procedure for a creditor to get reaffirmations from Must be consumer good (personal, family, household) customers Exemption abandoned Approach at § 341 meeting - may arrange before or after 341 meeting for reaffirmation Debtor has to pay an amount equal to the allowed secured claim (according to § 506) which is generally the value of the collateral, or amount owed on loan, whichever is less. Can do Cannot do After the value of the collateral has been paid - remainder See only for cash Withhold (or threaten) medical of debt is discharged (in the real world, this rarely happens - services need relative or friend to help) Creditor-initiated contact can Pay debt first, then treat happen at 341 meeting Reaffirmation - 524(c) Condition future credit on Agreement must be executed before discharge reaffirmation; this re- negotiation is actually act to Right to rescind within 60 days collect Must have affidavit from attorney Debtor is fully informed and voluntary There is some kind of line between what can and cannot be Agreement is not undue hardship done, although also some gray area Debtor is fully informed of effect of agreement and Letter to debtor's atty - Standard and have been viewed as consequences of default OK This is a new agreement between creditor and debtor

Page 13 of 25 Creditor's Rights - Spring 2001 Problem 19.5 Amount distributed must not be less than the amount of Tensions faced when trying to handle affidavits the claim Some atty say re-affirm everything or nothing Prepare the plan Problems with no-affirm decisions Terms of repayment Cannot save collateral Debtor remains under supervision of court until complete May jeopardize client's position (deprive of a benefit) the schedule Hard line may be a problem with relationship in the Debtor gets to keep control of the property community Trustee - object to improper creditor claims Problems with all-affirmation decision Jeopardize fresh start Problem 20.1 Unhappy clients Adequate protection - § 361 Can ruin credibility with court File motion for relief from stay under § 361, § 362(d) Grounds for relief: Problem 19.6 1. Cause - including lack of adequate protection What is the analysis to determine whether affidavit should be Policy: keep creditor in same position signed? Risks - If these risks § 524 (c)(3) - Decline in value are present, may get Fully informed Loss - fire, destruction relief from stay Voluntary 2. Debtor does not have equity in the property Undue hardship Remember valuation arguments Ability to pay 3. Property is not necessary for an effective Projected income reorganization Cost of living - how strict The facts are key Propensity to consume § 361 may award - Cost of alternatives lump sum Factors in addition to financial periodic payments What is the benefit of the item? additional or replacement lien Best interest test - are we making value judgments? grant other relief, so creditor gets indubitable When can refuse to sign? equivalent of its interest Atty must determine what best interest is Consider only debtor's assessment of ability to re-pay Problem 20.2 (they will lie)? Creditor is entitled to be paid to account for the time value of 524(c)(3) mandates an independent assessment - does money (value of collateral or debt at its present value) that require atty to make decision hostile to client's What interest rate will be used in the PV calculation? wishes? Collier's - T bill rate, adjusted for risk of subsequent Brown shows a way around - refuse to sign and let court default decide Courts often use combination - assume contract rate Explain consequences of reaffirmation to client and will reflects market and adjust for risk. usually change his mind. Courts may look at similar contracts Arguments re: valuation is more useful than arguments re: Chapter 13 interest rate Reorganization In this problem, to have a confirmable plan, must have PV of 21,000 and pro-rata share of unsecured. At this time, no involuntary Chapter 13 - choice of the debtor Problem 20.3 Arguments in valuation § 1325 Confirmation of Plan Cram down 1325(a)(4) - How much of each allowed unsecured claim must be paid Debtor may keep property over creditor's objection if creditor Must look at what would happen under Chapter 7. retains lien securing the claim and debtor makes payments that Creditors must get as least as much as would get total the PV of the allowed secured claim (i.e. PV of value of the under Chapter 7. collateral) 1325(a)(5)(ii) - How much of allowed secured claim must Rash - price a willing buyer in debtor's trade, business, or be paid situation would pay to obtain like property from willing seller. Don’t want Chapter 13 to deteriorate secured creditors Definitely applies to Ch. 13 - some courts have held applies to § 722 (Ch. 7) Page 14 of 25 Creditor's Rights - Spring 2001 Was supposed to resolve the most basic valuation -If no dispute about liability but dispute about question, but was no help - left to trier to fact amount - It will be liquidated to the extent of the In light of the purpose of the disposition § 506 - admitted amount valuation Modifications in response to perceived problems Therefore, Rash holding is that proper valuation is Concern about unfair treatment of unsecured creditors replacement value - what the debtor would have to pay by abusing Ch. 13 for comparable property (like age and condition) Payment plans well below ability to pay Not foreclosure - leave to court as trier of fact, on the So - read into Code a good faith requirement basis of evidence presented Require meaningful payments 5th Circuit had focused on creditor's interest - therefore Debtors must use best effort the foreclosure value. Court rejected this Abuse of process - debtor must not have entered into Stevens dissent says the "purpose" is to put the creditor debt without intent to pay) in same shoes as if he were able to exercise his lien and 1325(b) - Attempt to resolve foreclose. Plan may not be approved over objection of creditor or trustee unless Problem 20.4 Provides payment in full of objecting unsecured Contents of the plan; necessary provision in plan for mortgage creditor, or 1322(b)(2) - can modify rights of holder of secured claim Commits all debtor's disposable income over a period except real property that is principal residence of years 1322( b)(5) - Can provide for curing of default within reasonable time for mortgage Disposable Income Test If arrerage is paid over time, must account for time value of Not reasonably necessary to be expended for maintenance or money support of debtor or a dependent. Also necessary to cure - if oversecured, may have to pay Most courts have not abandoned good faith test, and have (under § 506) additional penalties and interest. also applied disposable income test Caveat - do not have to pay interest on interest No clear standard Current expenses? Problem 20.5 Reasonably necessary? File bankruptcy now to stop foreclosure proceedings; Future expenses? (Dentist) 1322(c)(1) codifies Taddeo - deaccelearated ; original schedule Standard of living? is reinstated Cushion? If last mortgage payment is due before last payment under § 1329 - modification is allowed after the plan, can modify payments (to reach the end of the confirmation, so argue that cushion is not plan) necessary § 109 (g) limits how often can file and dismiss (six months) Problem 21.1 Qualifications for Chapter 13 filing Look at current expenses and formulation of plan - what is reasonable? What is the test? 1. Individual 2. Regular income Problem 21.2 Do not have to be employee (available to self- Formulate a plan; employed) § 1325(a)(4) - unsecured cannot get less than would receive Do not have to be wage earner under Ch. 7 - here, OK because Ch. 7 would be nothing Sufficiently stable and regular to make payments under Nominal plan OK (Greer) as long as good faith the Chapter 13 plan (courts interpret this liberally) § 1325(b)(1) - reasonably necessary test (this case was Regularity is important (like alimony) luxury goods - IL says must give up) 3. Debts owed on the date of filing (bright line date) §1325(a)(3) - still must pass good faith test 4. Noncontingent, liquidated Unsecured debts less than $290,525 Problem 21.3 Secured debts less than $871,550 Time value of money - unsecured creditors would get that under Noncontingent - Ch. 7, so proposal of face value spread over 3 years is not Owes a legal duty as of the filing date equivalent. Liquidated -Determinable with some degree of precision Problem 21.4 -No dispute as to amount §1322(a)(2) - plan must provide for full payment of all claims Not liquidated if there is a dispute about liability entitled to priority under § 507 unless holder of claim agrees or amount otherwise.

Page 15 of 25 Creditor's Rights - Spring 2001 Note: Once priority claims are figured in - they are usually No leverage - probably only bad faith the only ones who get paid. Under Ch. 13 must delay write-offs of loss until plan is completed, whereas discharge is immediate with Ch. 7. Difficult to justify discriminating unless there is a real Exceptions to Discharge in difference. Chapter 13 - § 1328 Problem 22.2 After successful completion of plan - discharge except Discharge of debts following divorce (a)(1) - long term debts (1322(b)(5)) - stay current during Child support, alimony non-discharge under 1328. plan; continue after plan Can re-litigate the divorce agreement, but takes times and (a)(2) - alimony, maintenance, or support (523(a)(5)) expense to re-litigate in bankruptcy court. education (523(a)(8)) Joint debt - may be treated differently DWI death or PI (523(a)(9)) If he discharges, the creditor will come after Jessie (§ (a)(3) - restitution or fine in sentence for criminal 1301) - reclassify and discharge conviction Medical bills On grounds such as Kourtakis Past bills - argue this is support Bad faith Usually only in Future - depends on whether they are listed as debts on Abuse of process intentional tort schedule (contingent debts) No honesty of intention cases If listed, claim as child support; if not listed, not discharged Classification of Unsecured Debts A spouse in divorce is a potential creditor in bankruptcy.

§ 1322 (b)(1) Would settlement be dischargeable in Ch. 7? Debtor can classify unsecured claims if claims are 523 (a)(15) balancing test. Certain property settlements not substantially similar (references § 1122) dischargeable in Ch. 7 because doesn't meet the test - May not discriminate unfairly therefore, not dischargeable in Ch. 13. Can treat individual consumer debt differently if a co-debtor Dismissal or Conversion Courts have not been friendly to classification Groves test (p. 383) - Absent a showing that discriminatory treatment is necessary for the debtor to complete the plan, § 1307 - Debtor may convert to Ch. 7 or dismiss at any time separate classification not permitted. § 1307 - Court may convert to Ch. 7 or dismiss at request of party in interest or U.S. trustee, after notice and a hearing, for Problem 22.1 the reasons listed in this section Classification of unsecured debt Must be for cause - § 1307(c) In this case, debtor classified because he wanted to treat Default doesn't automatically lead to dismissal them differently § 1329 - Modification of plan after confirmation Arguments of creditors if debtor tries to classify their debts § 1328 (b) - Elements of harship discharge (Bond case) Would do better under Ch. 7 Circumstances beyond debtor's control Not best effort Creditors have been paid at least what they would Not good faith have been under Ch. 7. Abuse of process Modification would not be practicable. Tort judgment Doesn't discharge 1322 or 523 non-dischargeable Generally dischargeable under 1328, unless drunk or stuff. criminal fine Edgar's argument that should not be dischargeable Abuse of Ch. 13 process Problem 23.1 His leverage - threats to challenge plan Ch. 13 plan - Creditors will get 100% Strength of this argument - weak (p. 379 more Representing creditors: egregious - was dischargeable Meet all eligibility elements for Ch. 13? 109(e) And others will probably object because they will Creditors atty can move to dismiss for cause, (§ get less. 1307(c)), including Collins (credit union) No longer eligible under Ch. 13 Threaten to cut off credit Not in best interests of creditors Will say violates stay Failure to make timely payments May still feel some pressure to pay - so unofficial Representing Leona: leverage Advise of eligibility requirements Margo (consumer debt) Creditors will find out when she misses payments Page 16 of 25 Creditor's Rights - Spring 2001 § 1326 (a)(1) - commence payments within 30 days 1. Individual after plan filed unless authorized otherwise 2. Regular income (§ 101) Options Don't have to be employee Courts 1. If haven't heard about it - come up with cash to make Don't have to be wage earner interpret 1st payment. Sufficiently stable and regular to liberally 2. Ask court to authorize. Get company to say will be make payments called back. Irregularity (like alimony) is 3. Convert to Ch. 7 - wouldn't want to do this important 4. Move to dismiss - cannot file again for 180 days Income too low 5. Hardship - implies some payments have been made 3. That owe on the date of filing (bright line date) 6. Could request modification under § 1329, but will be 4. Noncontingent (owes legal duty as of filing date; not difficult to get dependent on occurrence of future event), liquidated (no dispute as to amount; not liquidated if there is a dispute Problem 23.2 about liability or amount; if no dispute about liability, but TIB duties and incentives dispute about amount - it will be liquidated to the extent of Court can monitor, but not much motivation to do so the admitted amount. Generally, TIB only will move for dismissal on his own if creditor hounds him. Problem 24.1 Why Ch. 13 rather than Ch. 7? Problem 23.3 Trying to get rid of a tort judgment Doris's life turns around and gets big salary Under § 523 (a)(6) not dischargeable in Ch. 7, but may be Then, holder of unsecured claim will move for modification discharged in Ch. 13 (§ 1328). Doris is essentially working for creditors Eligible? Sometimes courts will sympathize and allow her to Argue about regular income realize a benefit from her hard work. Then again, ll his debts may be discharged, so no If modify under § 1329, will be litigation costs. payments may be necessary. Creditors cannot call debtor - violation of stay which is in $250,000 tort judgment; effect during the plan. Noncontingent If don't plan an Call atty - negotiate, not threaten, may make arrangements Liquidated appeal outside the plan. Unsecured If plans to appeal - not liquidated - don't file. Problem 23.4 Can argue bad faith, because just doing it to avoid Ch. 7 Navy guy non discharge. Is it worth it to pursue modification to the plan if debtor receives If it were more than the allowed amount, ti's not a debt on regular pay increases? the date of filing. Remember, all creditors in a class (like unsecured) will receive pro rata share - probably not worth it (modification Problem 24.2 motions are not as quick as dismissal motions) Making the choice - Ch. 7 or Ch. 13; Debtor guaranteed a mortgage loan that missed some Problem 23.5 payments Are there grounds for creditor to attack the Ch. 13 filing? Analyze loan agreement, security agreement, and No nonexempt property guarantee Had Ch. 7 last year, so cannot do Language determines whether this debt is contingent Will probably use good faith standard Is the guarantee secured or unsecured ? Arguments Not good faith because should do Ch. 7. If secured, how much is secured? He is trying to do a Ch. 7 and avoid § 727 Can offer collateral to make debts secured to be eligible If Joe loses procedurally, could convert to Ch. 7 and invoke under Ch. 13. the stay in the short term - then he won't get discharge But, lenders may not agree to it, because rather have in because of § 727. Ch. 7. This is not unethical because could have been granted a Ch. 13. Problem 24.3 Restrictions on Ch. 7 discharge

§ 727 (a)(8) If discharge in Ch. 7 or 11 commenced in past 6 years - denied discharge § 727 (a)(9)

Page 17 of 25 Creditor's Rights - Spring 2001 If discharge under Ch. 13 or 12 commenced in past 6 1. Individual years, denied discharge unless 2. Primarily consumer debt (§ 101) (a) Paid 100% of allowed unsecured, or 3. If substantial abuse (b) Paid 70% of allowed unsecured and 4. Presumption in favor of granting relief i. in good faith ii. and best effort Substantial Abuse Test Ability to pay (Walton) Problem 24.4 Consumer debt includes all non-business debts one is Exercises in determining whether a person can file for Ch. 7, likely to incur in life - and it does include PI Ch. 13. Used ability to pay - pay debts as they become due - So if allowed Ch. 7, it would be abuse Consumer Bankruptcy System Last resort (Texas) 707 (b) very strict - Ch. 7 only used as last resort Done everything else More recent revisions have tried to make Ch. 13 more attractive. Not trying to pay Increased limits for eligibility No effort to live within budget § 348(f) encourage to attempt Ch. 13 - if later have to Totality of circumstances (4th Circuit) convert, get to keep property acquired since filing. Does he need Ch. 7, relief or is he just trying to beat Limit the access to discharge under Ch. 7. creditors? § 707 substantial abuse limits access to Ch. 7. Ability to repay out of future income Evidence of bad faith Problem 25.1 Failure to disclose Has potential tort judgment that would put over limit - what to Misrepresentation of income or debt do now? Eve of bankruptcy spending or debt File Ch. 13 just before pre-trial action (his debts qualify) Calamity beyond control (illness, unemployment) Tort action is contingent and unliquidated Creditors will move to life automatic stay. How should the lawyer bring up that there might be abuse? After litigation - even if judgment comes in higher than At the § 341 hearing, show limit Facts that show these things If stay lifted, then litigated, will amend his plan to include judgment Bring to court or trustee Then argue bad faith Cannot bring own motion of with personal trustee. His argument - amend to five years In re White - Debtor 19 year-old store clerk Court will say this is a ruse. Car wreck; judgment for PI Criminal fines/restitution will not be dischargeable Court held not a consumer debt, so 707(b) shouldn't apply Court will usually hearsay this If didn't allow Ch. 7, life would be ruined. Even if too much - was decided after Usually PI judgment would be included and called List it as a contingent debt. consumer debt Problem 25.2 Problem 25.5 To show clawhammer guy gets out from under debt in 3-5 Changing jobs, analysis to determine whether Ch. 7 would years, and student loan is forever. constitute abuse Old job - Ch. 7 would constitute abuse Problem 25.6 Atty fees are #1 priority in Ch. 7 (§ 507 (a)(1)) New job - Ch. 7 would be OK Still require fees up front because just first in line for nothing. § 303 Involuntary Ch. 7 or Ch. 11

§ 1328 has no limitation based on previous bankruptcy. Must be 3 creditors sign the motion All 3 must have non-contingent claims, not subject to bona Substantial Abuse § 707 Dismissal fide dispute As a group, claims must aggregate $11,625 unsecured Court can dismiss on its own motion or motion of U.S. contingent (more than the value of liens on the property) Trustee, but not on motion of a party in interest (can raise If there are fewer than 12 creditors, go to exception facts and court comes to its own decision), if substantial abuse of the provisions of the Code. Any time before case is dismissed, other creditors may Presumption for granting relief: come in.

Page 18 of 25 Creditor's Rights - Spring 2001 Cure defective petition In this problem, has regular income, so could probably file Avoid technically deficient petition. a Ch. 13 plan. To withstand motion to dismiss, must allege statutory grounds.: Chapter 11 1. § 303(h) - Generally not paying undisputed debts as they become due. People who do business with the debtor often don't notice a Important - in present tense; insolvency is not enough difference. Debts cannot be disputed DIP has power of trustee. Non-payment has to be in the normal course of File to give breathing room. business - not isolated incident But, the DIP is acting with fiduciary duty to creditors. Debtor's ability to pay is not a defense. § 1104(a) may appoint outside trustee - with grounds Usually, this is the death knell for business 2. Preceding 120 days - made general assignment or appointed a receiver under state law. May go around this with federal Automatic Stay - Adequate Protection bankruptcy. Secured creditors shouldn't be harmed by bankruptcy. If not adequate protection, can petition for relief from stay. Policy Most frequently litigated part of bankruptcy law. Debtors wait too long to file (gives creditor ability to jump § 361 gives non-exclusive list of some things that can show in) adequate protection Fear dissipation of assets or preferential treatment to other 1. Periodic payments creditors 2. Additional or replacement lien Some creditors want to stop the state law race. 3. Cathcall Most common way - collateral has value greater than claim. Problem 27.1 The excess amount can constitute adequate protection. "Generally not paying" - has been left to courts. This is equity cushion (complicated by valuation Focus on conduct - no balancing; no financial condition test issues) Totality of circumstances Make this argument if value of collateral is declining in value Involuntary petition not usually filed against consumer Cushion should cover decline in value, risk of loss, Not practical and penalties, atty's fees Consumers get better remedies under state law, so Policy creditors better off with state law. To what extent should we protect unsecured creditors/ secured creditors? Generally not paying undisputed debts as they come due If equity cushion not enough, not automatically lifting stay. 1. No paying % of debts May get higher payment agreement 2. Not paying % of amount due Debtor floats adequate protection 3. Not paying largest debts E.g. higher interest - longer 4. All debts late Sell some asset - increase cushion 5. Not making any effort to pay undisputed debts 6. Not paying some debts that are critical (rent, taxes, wages, Creditor just gets to protect his secured position - not supplies) improve it - e.g. if have 75% secured position, that is the Some state law discovery is allowed amount he gets to protect Not free Trade journals § 362 (d)(1) and (2) Grounds for lifting stay If file on best information, and turns out wrong -- costs, 1. For cause including lack of adequate protection, or attorney's fees, damages if bad faith. (303(i)) 2. Debtor does not have equity in property AND 3. Not necessary for effective reorganization Problem 27. 2 Debtor fears bankruptcy. Why? What else can he do? Court must decide within 30 days (362(e)); if no decision, Restrictions on transfer of transfer of partnership interests. stay is lifted. Why is "generally not paying" judged on financial Judge must balance: statements, but rather on conduct? 1. Protect creditor v. debtor interests Bad faith not relevant unless case is dismissed Unsecured creditors will be harmed if take assets 2. Equity cushions have divided courts. **If involuntary 7 is filed, can convert to 11 or 13 and file a Creditor argument plan.** 1. Insufficient cushion ($3,000 not enough) 2. Depreciation - wear and tear Page 19 of 25 Creditor's Rights - Spring 2001 3. Risk of loss 4. The bank is losing money under this plan - bailing the A. the 30-day limit protects creditors, whose position company out. deteriorates over time. B. But few creditors actually seek special writ (makes judge Policy arguments mad) Debtor - creditor is getting all that he was promised - the value Policy argument for debtor of his secured claim. 1. Benefits to community to keep business going (jobs, taxes) Creditor - 2. Lender partially responsible - knew about bankruptcy law; losing the time value of money. could have negotiated better loan In anything goes wrong with the collateral, the creditor Policy against debtor bears the risk. 1. Debtor entered freely into agreement General 2. Economic ramifications which will be passed on to other Debtor gets to get on his feet customers. Spreading the loss - redistributed Commentators disagree - unsecured creditors should bear Problem 28.3 the loss § 362(d)(2) - debtor does not have equity in property (lean exceeds collateral) Problem 29.2 Not likely to be effectively reorganized as slide rule To show valuation issues business. If bank wants stay lifted, argue: Court must quickly investigate plan. Value declining Creditor may ask for relief before plan is in place. No adequately protected If stay maintained, will argue for high value, because: Cartwright ***Value determined by court on adequate protection hearing is Creditors can argue that debtor is unlikely to propose an not binding on other issues (506(a)) effective plan But - credibility problem If I'm a creditor, argue not adequately protected because plan is implausible Problem 29.3 Concern - not moving toward reorganization plan - stalling Adequate Protection Payments (apartment building) If creditor, make these arguments for valuation: 1. Figure the payments needed - if higher than cash flow - stay 1. Stream of income (occupancy, here) is lifted, reorganization is over 2. Market estimate 2. What kind of payments are creditors supposed to get - how 3. Offer year before to meet them. 4. Historic price Must balance the fact that they may not have adequate Pendancy Interest protection so entitled to payments, with Debtor cannot make payments Interest Prepetition Pendancy Plan If creditor loses on 361 issue, do they have 362(d)(2)? Oversecured to To extent Get contract rate May demand on fully secured permitted by on pendancy entire claim - but Debtor has no equity and state law interest (506) court can adjust No necessary to effective reorganization to current rate Locked into an investment controlled by someone with no intead of contract rate (1129) equity, paying less than current interest, and completely Unsecured To extent No pendancy No entitled to speculative. permitted by interest (502) interest under If stay is not lifted, § 1121, creditor can propose its own state law plan plan. Partially secured To extent No pendancy Interest only on to undersecured permitted by interest (Timbers allowed secured Should file a liquidation plan state law case) claim to value of Force debtor to bring plan collateral No atty Only debtor may file in first 120 days fees or costs (1129) If less than $4,000,000 falls into 362(d)(3) then he has 90 days to get plan approval or start making monthly payments Problem 29.1 at market rate of interest To see application of Timber's case. 90 days starts when creditor petitions to lift stay Company's plan - Meet current expenses, and make monthly payment to bank to cover depreciation. Summary Bank wants more § 362 (d)(1) for cause, including lack of adequate protection 1. Secured creditor § 362 (d)(2) no equity and not necessary for effective 2. Undersecured reorganization. 3. Not entitled to pendancy interest - Timber's case § 362 (d)(3) single asset real estate Page 20 of 25 Creditor's Rights - Spring 2001

Cash Collateral Setoff

Section 363 Creditor has a claim and is also indebted to debtor May enter into transactions in the ordinary course of Common law says offset is OK; must have: business 1. Mutual claims (a) definition of "cash collateral" includes proceeds, 2. Both are valid and enforceable products, offspring, rent . . . in which entity other than 3. Arose before filing of petition estate has an interest. 4. Not part of same transaction. (c)(2) - trustee may not use . . . sell cash collateral unless This is basically preferential treatment for some creditors. A. Each entity with interest consents. Exceptions: (553) validates setoff in bankruptcy B. Court authorizes after notice and hearing. Not automatic Court must determine that have setoff rights Appointment of Trustee 1104(a) mandates appointment of trustee for cause Example - bank's right to setoff Cause = fraud, dishonesty, gross management, incompetence You You You You Creditors' Committee Deposit $100 Borrow § 1102 and 1103 - Creditors' committee formed Checking $100 Appointment by U.S. trustee Usually 7 largest creditors willing to serve Owes borrower Sends Usually only in larger cases $100 $100 Cash Often other committees as well, e.g. equity committee § 1103 - power and duties Bank Bank Bank Bank Negotiate plan Assist in running General deposit in a bank creates debtor/creditor Important right - access to information about the debtor relationship Right to be hearsay on virtually anything that comes If then file for bankruptcy then bank has setoff right before the court. (can't use to profit own business) Mutual Claims Information that affects business decisions. Valid Arose before filing Cash Not same transaction This restricts company's ability to use cash. § 363(c) - DIP can use cash in ordinary course of business 506(a) allowed claim of creditor has language "or subject to Also constraints in use of cash that is subject to a lien. setoff" under § 553 is a secured claim Equates to a lien to the extent of the setoff Limitations on Use of Cash 363 = lien = cash collateral 1. Cash collateral 2. Setoff right Supreme Court hs held that an "administrative freeze" does not violate the stay (only true for banks). § 363(a) - Definition of cash collateral For example, bank security interest in inventory and A/R. § 553 Feared abuses - specific circumstances where setoff is As inventory is sold, debtor gets cash prohibited Creditor's interest continues in the cash. (a)(2) - transferred to creditor by 3rd party 90 days prior to Bank's interest is protected in bankruptcy because filing. cash is treated as cash collateral. Claim was transferred by an entity other than the Debtor must have consent of creditors to use. debtor to such creditor After commencement of case, or Problem 30.1 1. After 90 days before the date of filing and To show what ordinary course of business is. 2. While debtor was insolvent. May set up arrangements with creditor to make partial (a)(3) - debt incurred to obtain setoff payments as cash is collected, but probably won't work within 90 days before petition Go to court to determine how to pay while debtor was insolvent, and for the purpose of obtaining a right of setoff against the debtor (c) - presume insolvent 90 days prior to filing.

Page 21 of 25 Creditor's Rights - Spring 2001 Says priority put in place by court won't be upset on appeal Problem 30.2 This alters the priority of payment This is thought to be a compensating balance that some Generally: need notice and hearing (but real world - go in banks require. This is asked for 2 months before filing. at time f filing to ask the court to authorize post-petition $4000 in account; $1500 was required; $2500 just in borrowing, court then finds exigent circumstances and they account will authorize limited borrowing for a period of time. So trustee can look to § 553 (a)(3) Here creditor = bank; debtor = Teddy; Debt owed = $1500 Problem 31.1 § 553 (c) - presumption that if within 90 days was insolvent First look at 364 (a) and (b) - so looks like meets all elements of 553 (a)(3) - it was 60 To get to 364 (c) must first show paper trail to show cannot days. get unsecured credit. Presumed insolvent and they did it to get a right to setoff If cannot get unsecured, move on to other types. So -- probably won't get right to setoff with respect to Offer Super Super priority, lien on unencumbered or $1500. junior lien on already encumbered. Loan will make it The other %2500 doesn't meet, so could get right to setoff more valuable. for it, but must go to court to get it (probably could get the So best deal possible administrative freeze). But estate cannot use it either because it is cash collateral.

Problem 30.3 552(a) prepetition security interests do not attach to Bank is trying to claim a right to setoff because they now property acquired after bankruptcy. own the $5000 claim - so then they would only owe 364 allows DIP to obtain credit or incur obligations after Funtime $12,000. petition is filed. 553(b) - Debtor = Funtime; Creditor = Bank 364(a) and (b) authorizes unsecured credit as administrative Entity other than Debtor, within 90 days (not after expense with priority over other unsecured. commencement but this an or) so no right to setoff for the 364 (c) if unable to obtain unsecured credit, court may Bank. authorize: Also, this means there is no lien so the account is not cash 1. Priority over administrative expense collateral; 2. Lien on unencumbered property, or Therefore, the estate can draw on it in the ordinary course 3. Junion lien on the encumbered property without the court's permission. Problem 31.2 Converted from Ch. 11 to Ch. 7 Post-Petition Financing $35,000 unencumbered assets After sell remaining inventory and A/R: The estate is a new entity, so old security agreements don't Debts: bind it with respect to new stuff Bank $25,000 - sought adequate protection 552(a) - prepetition security interests do NOT attach to Finance Co. - $10,000 post-petition loan property acquired after bankruptcy Debtor's lawyer - $15,000 May become cash collateral if sold Ch. 7 trustee & atty - $5,000 If creditor can show that new inventory was purchased Total - $55,000 with proceeds from old (secured) inventory - may 1. Ch. 7 trustee and atty - $5000 Paid 1st (726(b)) claim. 2. Bank - $25,000 (507(b)) lack of adequate protection This means secured creditors don't want to give any money 3. Hanratty unsecured treated as administrative expense as based on old loans and debtor needs cash, so we have § 364 post-petition financing

§ 364 (a) Chapter 7 Trustee Allows DIP to obtain credit or incur obligations after the and Lawyer petition is filed. 364(a) and (b) - allow unsecured credit as an Super priority under § 726 (b) - people who do conversion administrative expense work get paid first (otherwise no one will do Ch. 7s) 364(c) -if unable to obtain unsecured credit, court may Trumps everything else. authorize. Even if get great preference treatment under 364, still get 1. Priority over administrative expense trumped by conversion folks. 2. Lien on unencumbered property 3. Junior lien on encumbered property

§ 364 (e) Page 22 of 25 Creditor's Rights - Spring 2001 If Yankee drops out, and Murphy is only one left, and only Bank way to save the company, may allow.

Sought adequate protection, got inadequate protection Avoiding Powers of the (inventory and A/R) Trustee Court guessed wrong - assets not worth enough 507(b) Bank has super-priority in remaining assets over Strongarm Clause - § 544 other adminsitrative expenses, because of inadequate Preference Provision - § 547 protection Power to undo pre-bankruptcy transactions. Extends to new liens to give adequate protection to pre- Policy: petition liens. Bankruptcy to assure fair distribution. Treated as administrative expense. Keep level playing field prior to bankruptcy.