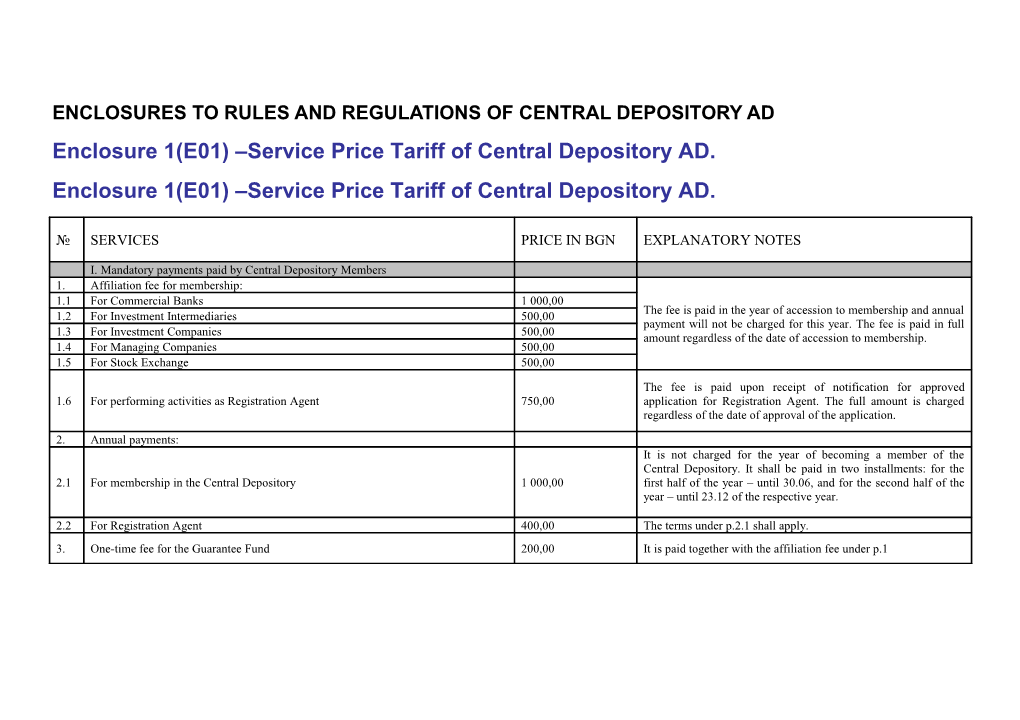

ENCLOSURES TO RULES AND REGULATIONS OF CENTRAL DEPOSITORY AD Enclosure 1(Е01) –Service Price Tariff of Central Depository AD. Enclosure 1(Е01) –Service Price Tariff of Central Depository AD.

№ SERVICES PRICE IN BGN EXPLANATORY NOTES

І. Mandatory payments paid by Central Depository Members 1. Affiliation fee for membership: 1.1 For Commercial Banks 1 000,00 The fee is paid in the year of accession to membership and annual 1.2 For Investment Intermediaries 500,00 payment will not be charged for this year. The fee is paid in full 1.3 For Investment Companies 500,00 amount regardless of the date of accession to membership. 1.4 For Managing Companies 500,00 1.5 For Stock Exchange 500,00

The fee is paid upon receipt of notification for approved 1.6 For performing activities as Registration Agent 750,00 application for Registration Agent. The full amount is charged regardless of the date of approval of the application.

2. Annual payments: It is not charged for the year of becoming a member of the Central Depository. It shall be paid in two installments: for the 2.1 For membership in the Central Depository 1 000,00 first half of the year – until 30.06, and for the second half of the year – until 23.12 of the respective year.

2.2 For Registration Agent 400,00 The terms under p.2.1 shall apply. 3. One-time fee for the Guarantee Fund 200,00 It is paid together with the affiliation fee under p.1 It is the minimum amount of the payment for crediting the account from which the Central Depository deducts ex-officio the fees and commissions, according to this Tariff, for the activities Maintenance fee from which the amounts due with regard to the activities of the 4. 300,00 performed by the Central Depository member. The balance of this Central Depository member are deducted ex-officio. account shall not be less than BGN 100 in the beginning of every business day.

II. Services for issuers: Monthly fee for maintenance of the actual status of the Register of Shareholders. The regular payment of the monthly fee covers the delivery of 5 print-outs of Registers of Shareholders as of 5. Monthly fee for maintenance of Register of Shareholders: dates, specified by the issuer, within one calendar year. Any additional request for preparing a Register of Shareholders is charged to the amount of 1 monthly fee under p. 5. The fee is calculated as a sum of the amounts under p. 5.1 and p. 5.2.

5.1 Amount on the basis of nominal value of the issue Nominal value of the issue Shareholders fee from to 1 50 BGN 25. 0 50 000 50 > BGN 30. 50 001 500 000 BGN 35. 500 001 1 000 000 BGN 37. 1 000 001 10 000 000 BGN 40. 10 000 001 > BGN 45.

For pension-security companies, insurance companies, investment 5.2 Amount on the basis of number of shareholders companies, managing companies, companies with special Numbers of Shareholders lower upper investment purpose, investment intermediaries and commercial fee banks,the monthly fee shall not be less than BGN 40. from to limit limit

1 50 0,01 0,25 BGN 0,25 per every 50 shareholders 51 1 000 0,15 3,00 BGN 0,30 per every100 shareholders 1 001 5 000 3,50 17,50 BGN 0,35 per every 100 shareholders 5 001 10 000 25,01 50,00 BGN 0,50 per every 100 shareholders 10 001 15 000 30,00 45,00 BGN 0,60 per every 200 shareholders 15 001 30 000 32,50 65,00 BGN 0,65 per every 300 shareholders 30 001 50 000 48,00 80,00 BGN 0,80 per every 500 shareholders 50 001 100 000 42,50 85,00 BGN0,85 per every1000 shareholders 100 001 > 63,33 BGN0,95 per every1500 shareholders Issuance of a certificate of the capital structure of companies which have concluded a 6. 12,00 contract with the Depository. Issuance of a certificate of capital structure of companies which have not concluded 7. 20,00 an agreement with the Depository. Issuance of Register of Shareholders out of the procedure established under the 8. Register Contract: 8.1 Up to 1000 shareholders 300,00 8.2 From 1000 to 10 000 shareholders 420,00 8.3 Over 10 000 shareholders 650,00 Issuance of a certificate of a company for registration on free market of the Bulgarian 9. 50,00 Stock Exchange – Sofia AD. 10. Deposit/withdrawal of securities:

Nominal value lower limit/ Fee in BGN from to upper limit 0 50 000 150 150,00 / 150,00 50 001 100 000 300 + 1,00/1000 300,00 / 350,00 100 001 200 000 400 + 0,90/1000 400,00 / 490,00 200 001 500 000 500 + 0,80/1000 500,00 / 740,00 500 001 1 000 000 750 + 0,70/1000 750,00 / 1100,00 1 000 001 5 000 000 1100 + 0,55/1000 1100,00 / 3300,00 5 000 000 10 000 000 3300 + 0,32/1000 3300,00 / 4900,00 10 000 001 20 000 000 4900 + 0,10/1000 4900,00 / 5900,00 20 000 001 100 000 000 5900 + 0,05/1000 5900,00 / 9900,00 100 000 000 > 9900 + 0,03/1000 9900,00 / =<50000,00 Initial offering of securities through the Bulgarian Stock Exchange – Sofia AD of 11. issues registered with the Central Depository – fee to the amount of the due one under p.10 p. 10. 12. Issuance of a depository receipt 0,30 13. Registration of the change of the nominal value of the shares 150,00 Closing of an account (lot) upon demand of a joint-stock company which register is 14. 1 000,00 maintained by the Depository The fee is 0,1% of the nominal value of the issue, but not less 15. Registration of a bond issue from 500,00 to 5000,00 than BGN 500 and not higher than BGN 5000.

Monthly fee for maintenance of the actual status of the Register of Bondholders. The regular payment of the monthly fee covers the delivery of 5 print-outs of Register of Bondholders as of dates, 16. Maintenance of Register of Bondholders 75,00 specified by the issuer, within one calendar year. For any additional request for preparing of a Register of Bondholders the fee is BGN 75.

17. Closing of a bond issue 500,00 Conversion of the specified (by the issuer) percentage of the capital of the joint-stock company into number of shares; preparing an excerpt of the shareholders which hold the so- Providing a report on the shareholders/bondholders which hold a certain percentage calculated number of shares and proving a print-out of the 18. of the company capital/the bond issue, specified by the issuer, as of a fixed date. 50,00 information where the shareholders are arranged by EGN/ BULSTAT. Upon explicit demand, the information may be provided on a disk (e-version).

19. Portfolio of an issuer 50,00 20. Issuance of a certificate of shareholders/bondholders, foreigners 50,00 21. Buy back of shares 500,00 Blocking and servicing of restricted securities upon demand of the issuer, in BGN, 22. 300,00 payable upon blocking, for every calendar year. Fee for temporary blocking of an issue, if needed by the issuer on account of the 23. 100,00 technological terms for registration in the court registry. 24. Report on issuers with state participation for public institutions 5,00 25. ISIN coding of an issue 56,00 26. Issuance of a certificate for exercised/not exercised RIGHTS 12,00 Issuance of a certificate for amounts received at the account of the Central Depository 27. 12,00 AD from sales of RIGHTS Report on the entities, exercised/not exercised RIGHTS upon capital increase of an 28. issuer. p.5 The issuer shall pay a monthly fee under p.5

The issuer shall pay a monthly fee under p.5. at the end of each 29. Dematerialization of securities p.5 quarter, upon a written notification from the Central Depository. Servicing of payments for a bond issue interests, principals as well as dividends – 30. 0.01% of the amount of the payments, but not less than BGN 500 and not more than 0,01% BGN 5 000. Calculation of dividends of a joint-stock company (issuers, holdings and investment 31. companies which have concluded a contract with the Depository) and print-out of a list for disbursement of the amounts: 31.1 up to 1000 shareholders 100,00 31.2 from 1000 to 10 000 shareholders 200,00 31.3 over 10 000 shareholders 300,00 Calculation of dividends of a joint-stock company which has not concluded a contract 32. with the Depository and print-out of a list for disbursement of the amounts: 32.1 up to 1000 shareholders 250,00 32.2 from 1000 to 10 000 shareholders 400,00 32.3 over 10 000 shareholders 600,00 33. Report on the general meetings of the public companies and the results from them. 5,00 The fee is paid for each one of the companies. 34. Registration of in-kind of securities 300,00 Registration of transformation (merger, acquisition, separation and division) of 35. 300,00 companies The fee is paid for every business day on which the report of the 36. Report on the number of the shares in circulation 2,50 Mutual fund and the Investment Company is prepared. ІII. Services for investment intermediaries: 37. Processing of a transfer 0,50 The fee is paid by the transfer parties for each one of the clients. The service includes: syntactic and logic checks and sending back respective messages with the results from them, comparison and establishment of the uniformity of the requisites (matching) of the transfer messages, processing of the messages for correction (if needed), blocking of securities in the account of the selling party, transfer of the securities (and the money, if the transfer includes payment) and sending back information for the completion of the process.

It includes: a syntactic check of the submitted message and sending back a message with the result from it, a logic check for correctness of the data submitted by the investment intermediary on the client and the type of the account to be open, sending back 38. Opening of an account 0,40 a message for the result from the logic check, processing of the messages for correction (if needed), opening of the account and sending back a message with the account number to the investment intermediary – applicant. Issuance of the form “Order for transfer of securities/compensatory instruments to a 39. 0,30 client account within an intermediary” Processing of the results from the centralized public tenders of the mass privatization 40. 0,60 The fee is paid for each one of the shareholders. for the investment intermediaries–members of Central Depository AD. The fee is paid for each one of the clients of the investment 41. Additional information services 0,30 intermediary. 42. Verification of a depository receipts through ISO message 0,20 43. Excerpt from the daily settlement of the transactions: 43.1 Print-out of the excerpts from the daily settlement of the transactions 20,00 Monthly fee Extraordinary generating and submitting of an excerpt from the daily settlement of 43.2 5,00 The fee is paid for each day for which the excerpt is prepared. the transactions 44. Issuance of a depository receipt 0,30 Fee for issuance of a depository receipt upon transfer of compensatory instruments 45. from personal account to client account in case the registration is on the grounds of a 1,00 decision for compensation (without issuance of a certificate for CI). Correction by Central Depository operator of incorrectly submitted data by a member 46. 50,00 in regard to a transaction not yet finalized. IV. Pledges The fee of BGN 40 covers only the first page of the application, whereas for every following page and for the document of 47. Registration of Special Pledges Agreement 40,00 consent, if attached separately, the fee of BGN 10 per each shall be paid. 48. Deletion of a pledge 25,00 49. Registration of additional circumstances under Pledges Agreement 25,00 50. Issuance of a certificate of lack/presence of registered circumstances 10,00 The fee is paid for each record in the certificate. 51. Registration of blocking/unblocking of securities 40,00

52. Issuance of a certificate of blocking upon demand of the parties under the agreement 10,00

V. Services for Registration Agents: The fee is paid by the transfer parties for each one of the clients. The service includes: syntactic and logic checks and sending back respective messages with the results from them, comparison and establishment of the uniformity of the requisites (matching) of the 53. Processing of a transfer 0,50 transfer messages, processing of the messages for correction (if needed), blocking of securities in the account of the selling party, transfer of the securities (and the money, if the transfer includes payment) and sending of information for completion of the process. It includes: a syntactic check of the submitted message and sending back a message with the result from it, a logic check for correctness of the data submitted by the investment intermediary for the client and the type of the account to be open, sending back 54. Opening of an account 0,40 a message with the result from the logic check, processing of the messages for correction (if needed), opening of the account and sending back a message with the account number to the investment intermediary – applicant. It includes: syntactic and logic checks of the submitted message and sending back the respective messages for the results from the 55. Duplicate of a depository receipt 3,00 checks, data generating and sorting in a format appropriate for printing on a pad (hard copy), print-out. 56. Report on securities or compensatory instruments holding (portfolio): The report includes: personal data of the person, name of the company (companies) from which issues the person holds securities, ISIN code of the issue (issues), nominal value, number of securities for each one of the issues and account type (personal 56.1 Standard portfolio of a physical person 5,00 or within an intermediary). The report shall be prepared as of the date of the application (report of the day). In case the portfolio is prepared with regard to inheritance procedure, when preparing it, the securities held by the deceased person shall be blocked. In addition to the data under p.54.1, the report includes the numbers of the investment intermediaries within which the client 56.2 Extended portfolio of a physical person 10,00 accounts are open, if any. The report shall be prepared as of the date of the application (report of the day). It is prepared usually in case of application for professional/ institutionary investor or in case the Commission of Financial Supervision requires such from investment intermediaries, 56.3 Portfolio as of a past date 12,00 registration agents, managing companies, etc. It includes the data under p.54.1 but shall be prepared as of a past date as indicated by the applicant. The report includes the entity data, the name of the company (companies) from which issues the entity holds securities, ISIN code of the issue (issues), the nominal value of the securities, the 56.4 Portfolio of a legal entity 50,00 number of securities for each one of the issues and the account type (personal or with an intermediary). The report shall be prepared as of the date of the application (report of the day). 57. Changing of personal data 3,00 58. Donation 5,00 VI. Internet services: Services for issuers which have entered into service agreement with the Central 59. Depository AD: 59.1 Report on Register of Shareholders – fee to the amount of the one due under p. 5 p.5 Report on registered transfers for a specified period – fee to the amount of the one 59.2 p.5 due under p. 5 59.3 Report on Register of Bondholders – fee to the amount of the one due under p.5 p.5 59.4 Official certificate of the capital structure 12,00 Services for issuers which have not entered into service agreement with the Central 60. Depository AD: 60.1 Report on Register of Shareholders – fee to the amount of the one due under p.8 p.8 Report on registered transfers for a specified period – fee to the amount of the one 60.2 p.8 due under p.8 60.3 Report on Register of Bondholders - fee to the amount of the one due under p. 8 p.8 Irregular reports for Register of Shareholders/Bondholders out of the procedure under The fee is to the amount of the half of the monthly fee due under 60.4 p.5 or p.8 1/2 * p.5(p.8) p.5 or p.8. 60.5 Portfolio of issuer 50,00 Check up from Special Pledge Register 60.6 5,00 VII. Services for payment by compensatory instruments (CI) under Art.13 of Law on 61. Transactions with Compensatory Instruments in favor of the local and central government authorities: 61.1 For payments by CI with nominal value up to BGN 4 999. 5,00 61.2 For payments by CI with nominal value from BGN 5 000 to BGN 49 999. 20,00 61.3 For payments by CI with nominal value from BGN 50 000 to BGN 499 999. 50,00 61.4 For payments by CI with nominal value over BGN 500 000. 100,00

VIII. Fees with regard to the procedure of registration of transactions with 62. compensatory instruments, concluded on OTC market:

Compensatory instrument nominal value 1 - 1 000 BGN. 20,00 1 001 – 5 000 BGN. 50,00 5 001 – 10 000 BGN. 100,00 10 001 – 50 000 BGN. 200,00 50 001 – 100 000 BGN. 500,00 Over 100 001 BGN. 1 000,00

63. IX. Irregular and informal reports

Report on a balance of the account of a securities holder for the States Receivables 63.1 10,00 Collection Agency, Territory Tax Offices and other empowered public authorities

Irregular report on changes in the registries (for the Depository members and their 63.2 50,00 clients) Informal report on registries, where the format of the report and the respective fee 63.3 By agreement shall be agreed in advance by the applicant and the Central Depository. Enclosure 2(E02) – Registration of securities issues and registration of changes in the register of the companies with dematerialized shares with Central Depository AD.

1. Company – issuer of securities shall be registered by : 1.1. The company – issuer, on the basis of the following documents: 1.1.1. Registration statement – Form 01/E02, where securities data, incl. their number and nominal value shall also be indicated.; 1.1.2. Copy of the certificate of actual legal status according to the Companies Register; 1.1.3. Copy of BULSTAT number certificate; 1.1.4. Copy of the actual Articles of Association of the company certified by the Companies Register/Register of the respective court; 1.1.5. Copy of the decision of the competent body of the issuer for issuing of the securities certified by the Companies Register/Register of the respective court; 1.1.6. Certificate of ISIN code of the issue; 1.1.7. List of the shareholders on hard copy and on a disk, containing the following data: 1.1.8. for local physical persons – full name of the shareholder, EGN, address according to identity document, number of shares; 1.1.9. for local legal entities – name of the company, seat and registered office, BULSTAT, number of shares; 1.1.10. for foreign physical persons – name, personal number „EGN”/social security number, permanent address and number of shares 1.1.11. For foreign legal entities - name, registration number of entering in the register of the respective country/BULSTAT (if available), registered office, address by registration and number of shares. 1.1.12. Agreement between Central Depository and the issuer for maintenance of actual register of dematerialized securities; 1.1.13. document for paid registration fee; 1.2. Investment intermediary – underwriter, member of Central Depository – the registration shall be performed based on the documents under p.p. 1.1.1 – 1.1.9, whereas a copy of the agreement between the issuer and the investment intermediary- underwriter for servicing the issue shall also be submitted. 1.3. The application for registration shall be signed by the representative of the issuer and the representative of the investment intermediary - underwriter. 1.4. Privatization Agency – registration shall be performed based on the documents under p.p. 1.1.1 – 1.1.9. 1.5. Information under p.1.1.7 on a disk shall be prepared in EXCEL format according to Form 02/E02. 1.6. Registration Documents on hard copy shall be signed by the representative of the company-issuer according to the court registration, and in case of p.1.3 – by the representative of Privatization Agency. 1.7. The submitted copies of documents shall be certified by the text “Confirming with the original”, signature of the person under p.1.5, date and seal of the companies. 2. Registration under p.1 shall be made within a 10-working day period following the submission of the full set of documents under p.1. in the Central Depository. 2.1. Following the registration, the Central Depository shall issue Act of registration of the issue which shall be submitted to the representative of the company – issuer, to a proxy explicitly authorized by him, or to the investment intermediary – underwriter. The act shall include information about the issue amount, list of the shareholders containing their names and the shares they hold. 2.2. Together with the Act under p. 2.1 depository receipts shall be provided to the shareholders for which personal accounts have been opened. The issuer and Central Depository can agree other procedure for submission of depository receipts. 2.3. In case of presence of encumbrances (distraints, pledges on the shares from the issue) Central Depository shall enter the encumbrances on basis of Statement - Form 01Б/E02. 3. Registration of changes. 3.1. Registration of capital increase by issuing of new shares – registration shall be performed based on: 3.1.1. Statement of registration of capital increase by issuing of new shares – Form 03/E02. 3.1.2. Copy of effective court order for the capital change certified by Companies Register/Register of the respective court; 3.1.3. Certificate for actual legal status by the Companies Register; 3.1.4. Copy of the decision of the competent body of the issuer for the capital change certified by Companies Register/Register of the respective court; 3.1.5. List of the shareholders, on hard copy and on a disk, who have acquired new shares from the capital increase, containing the following data: 3.1.5.1. for local physical persons – full name of the shareholder, EGN, address according to the identity documents, number of shares; 3.1.5.2. for local legal entities – name of the company, seat and registered office, BULSTAT, number of shares; 3.1.5.3. for foreign physical persons – name, personal number/social security number, permanent address and number of shares 3.1.5.4. For foreign legal entities - name, registration number of entering in the register of the respective country/BULSTAT (if available), registered office, address by registration and number of shares. 3.1.6. Annex to the Agreement under p. 1.1.8 in regard to the relationships between Central Depository and the issuer related to the capital increase provided they are not settled in this agreement. 3.1.7. Document for paid fee for registration of the change; 3.1.8. Certified copy of the agreement between the issuer and the investment intermediary provided the capital increase is registered through the investment intermediary. 3.1.9. Registered shares from the capital increase shall be blocked on the respective accounts of the shareholders until the capital increase is entered into the register under Art. 30 of the Law on Commission of Financial Supervision. Shares shall be unblocked based on a notification from the Commission of Financial Supervision, stating that the decision for registration of the capital increase is entered in the register in compliance with Art. 30 of the Law on Commission of Financial Supervision and it have entered into effect, within one working day following the receipt of the notification. During this period securities cannot be traded and encumbrances cannot be established thereon. 3.2. Registration of the capital increase through increasing the nominal value of the shares – shall be performed based on Application – Form 04/E02 and the documents under p.p. 3.1.2, 3.1.3, 3.1.4, 3.1.7. 3.3. After completion of the procedure of registration and payment of the shares from the capital increase pursuant to p.3.1 and p.3.2, the issuer shall notify the Central Depository about the completion of the procedure of capital increase. In case the shareholders have not paid the shares from the increase within the specified terms and they shall be cancelled therefore, in addition to the notification, the issuer shall enclose: 3.3.1. List of the shareholders whose shares should be cancelled. The list shall include the data under p. 1.1.7.1-1.1.7.4; 3.3.2. List of the shareholders acquired new shares from the increase. The list shall include the data under p.1.1.7.1-1.1.7.4; 3.3.3. Copy of the publication in State Gazette for advance notifying the shareholders with regard to registration and payment of additional contributions from the capital increase; 3.3.4. Statement of the representative of the company – issuer that the shareholders have not made contributions for paying the shares from the increase within the specified term. 3.4. Registration of the capital increase through rights issues and registration of rights entitling the holder to listed shares. 3.4.1. Registration of the rights issues and registration of rights entitling the holder to listed shares shall be performed according to Procedure 20 (E20). 3.4.2. Registration of the rights entitling the holder to listed shares shall be performed based on Statement – Form 03/E02 and the documents under p.p. 3.1.2, 3.1.3, 3.1.5. - 3.1.5.4, 3.1.6, 3.1.7. 3.4.3. Registered rights entitling the holder to listed shares shall be blocked on the respective accounts of the shareholders until the capital increase is entered into the register under Art. 30 of the Law on Commission of Financial Supervision. Shares shall be unblocked based on a notification from the Commission of Financial Supervision, stating that the decision for registration of the capital increase is entered in the register in compliance with Art. 30 of the Law on Commission of Financial Supervision and it has entered into effect. Unblocking shall be accomplished within one working day following the receipt of the notification. 3.5. Registration of the capital increase through initial offering of securities on Bulgarian Stock Exchange. 3.5.1. Central Depository registers temporary issue of securities which shall be subject of initial offering on the floor of Bulgarian Stock Exchange based on Statement Form 05/E02 and the following documents: 3.5.1.1. Decision of the competent body of the issuer for capital change through initial offering of securities on the floor of Bulgarian Stock Exchange; 3.5.1.2. Decision of the Commission of Financial Supervision for approval of Prospectus of the issuer for initial offering of securities; 3.5.1.3. Certified copy of the publication in State Gazette where the term of the subscription is specified; 3.5.1.4. Certificate from the service bank for opened and blocked account in compliance with Art.89 of LPOS. 3.5.1.5. Certificate of ISIN Code of the temporary issue 3.5.1.6. Document of paid fee for registration of temporary issue; 3.5.1.7. Agreement between the issuer and the investment intermediary, administrating the capital increase. 3.5.2. Securities from the issue under p.3.5.1 acquired during the subscription shall be registered on a client account with the investment intermediary through whom they have been acquired. 3.5.3. Following the completion of the subscription and the registration of the capital increase in Companies Register, Central Depository shall register the shares from the capital increase based on Statement Form 03/E02 and the documents under p.p. 3.1.2, 3.1.3, 3.1.6, 3.1.7. 3.5.4. Shares from the capital increase shall be registered on accounts of the shareholders with the investment intermediary, with which the accounts under p.3.5.2. have been opened. 3.5.5. Central Depository shall issue Act of registration of capital increase under this procedure, certifying the total amount of the issue / shares after the increase and data of the shareholders who have acquired shares from the increase. Registration of capital reduction Registration of capital reduction by reducing the nominal value of the shares – shall be performed based on Statement – Form 04/E02 and the documents under p.p. 3.1.2., 3.1.3, 3.1.4, 3.1.7. Upon explicit demand of the issuer /free style/ the Central Depository shall issue new depository receipts with changed nominal value of the shares. The receipts shall be submitted to the issuer for which the issuer shall pay a fee according to the Tariff of the Central Depository. The Central Depository shall issue Act of registration of the capital reduction under this procedure, certifying the total amount of the issue/ shares after reduction. Capital reduction through immobilization of shares. Immobilization of shares – shall be performed based on Statement – Form 06/П02; decision of the competent body of the issuer for reduction of the capital; list of the persons whose shares shall be immobilized including the data under p.p. 1.1.7.1 – 1.1.7.4; certified copy of the court order for registration of the capital reduction; annex to the Agreement under p.1.1.8 with regard to the relationships between the Central Depository and the issuer regarding reduction of the capital of the issuer; document for paid fee for registration of the change. In case of immobilizing of shares through buy back from the issuer, the investment intermediary servicing the buy-back shall notify the Central Depository for the beginning of the buy-back under this procedure and provide a certified copy of the court decision for registration in Companies Register the decision of the General Meeting of the issuer for the buy-back of shares intended their further immobilization. After completion of the buy-back of shares, the Central Depository shall issue a certificate of the amount of the shares bought back, registered on a client account in the name of the issuer with the investment intermediary, which have administrated the buy-back. The certificate shall be provided to the investment intermediary. Cancellation of the shares under p.3.6.2.2.1 shall be performed based on the following submitted documents: a certified copy of the decision of the General Meeting of the issuer for cancellation of the shares under p.p.3.6.2.2.1; a certified copy of the court order for reduction of the capital by the amount of the shares under p.3.6.2.2.1; Statement for cancellation of shares–Form 07/E02. Based on the documents under p. 3.6.2.2.2 the Central Depository shall transfer from the account under p. 3.6.2.2.1. to the issuer’s own account, and shall cancel/delete the shares from this account. The Central Depository shall issue Act for registration of the change. Registrations under p.3 shall be made within a 10 working day period after receiving of the full set of the documents unless other terms are specified by law. 4. Registration of apportation of securities. Registration shall be performed based on the following documents: Statement Form 08/E02 from the representative of the company for registration of the apportation through transfer of the shares from the account of the principal, holder of the securities to the company account. The statement shall be submitted together with the following documents: Copy of the decision of the competent body of the issuer/client certified by the Companies Register/Register of the respective court for participation in the company incorporation or in the increase of the capital through apportation of own securities. Copy of the decision for amendment of the contract of incorporation, respectively the Articles of Association certified by the Companies Register/Register of the respective court, including detailed description of the contribution and the contributor. Written consent of the contributor, certified in front of notary, with description of the contribution. Court order for incorporation of the company or increase of the capital – in original, transcript certified by court or copy certified in front of notary. Excerpt from the contract of incorporation, respectively Articles of Association certified in front of notary. Certified copy of the court order for acceptance of the expert assessment. Document for paid fee for registration of the apportation.

1. Registration of transformation of issuer/client (merger, consolidation, separation, division). Transformation of issuer/client shall be registered on the basis of: Statement for registration of transformation of issuer/client – Form 09/E02. Certified copy of a decision of the competent body of the issuer/client, taken the decision for transformation. It shall be submitted for both companies. Certified copy of court order for registration of the transformation in Companies Register. It shall be submitted for both companies. Certified copy of court order for deletion of issuer/client from the Companies Register (in case of merger, consolidation and division). Name, BULSTAT of the acquiring/newly established company shall be indicated in the application. Document for paid fee for registration of transformation. Each entry of transfer of shares in case of merger, consolidation, separation, division shall be charged separately for each registration. Transformation plan certified by the Companies Register/Register of the respective court, where the allocation of the shares after the transformation shall be indicated. List of the shareholders of the acquiring/newly established company with the shares they hold after the transformation. The list shall include the data specified under p.1.1.7.1 – 1.1.7.4. In case the shares of the transforming company are on a client account with an investment intermediary, the statement under p.5.1.1 and the documents under p.5.1.2-5.1.5 shall be submitted by the investment intermediary. In case the transforming company is an issuer, the statement and documents under p.5.1.2- 5.1.4 shall be submitted by the company – issuer. In cases under Art.262ч, para.5, of the Commercial Code, the statement shall be signed by the Board of Directors of the applicant, and in cases under p.5.2 – by the Board of Directors and Investment Intermediary in compliance with the requirements under Art.262 of the Commercial Code. Accounts of the shareholders opened after registration of the transformation shall remain client/personal as before the transformation. Before registration of transformation of issuer/client, the representative of the acquiring/newly established company shall submit a request to the Central Depository for issuance of a certificate of presence/lack of encumbrances on the shares that shall be acquired as a result of the transformation. In case of registration of transformation of an issuer/client, the Central Depository shall transfer the shares together with the encumbrances established thereon, if available, on the grounds of Art. 261d, para.2 of Commercial Code. In case of registration of transformation, for each entry the Central Depository shall issue Act of registration and depository receipts of the shareholders in the acquiring / newly established company in case the shares are on personal accounts. 2. Writing off a company-issuer by the Central Depository. Writing off a company-issuer by the Central Depository in case of changing the type of the shares from dematerialized into materialized shares shall be performed on the basis of: Application for writing off the issue - Form 10/E02 Court order certified by Companies Register/Register of the respective court for express registration in Companies Register of the change of the type of the shares from dematerialized into materialized shares. Copy of actual Articles of Association of the company, certified by Companies Register/Register of the respective court, which shall include the change of the types of the shares. Copy of the decision of the competent body of the issuer, certified by Companies Register/Register of the respective court, for change of the type of the shares from dematerialized into materialized shares. Document from the Commission of Financial Supervision for writing off the company from Public Companies Register and that the decision of the Commission of Financial Supervision has entered into effect. Document for paid fee for deletion of the issuer from the register of the Central Depository and fee for drawing out the securities. Writing off the company-issuer upon its deletion from Companies Register shall be made on the basis of: Notification in writing from the representative of the company-issuer. Certified copy of court order for registration of the deletion in Companies Register. Document for paid fee for deletion and drawing out the securities. In case the issue is encumbered (blocking, pledges or distraints on the shares) the Central Depository shall notify in writing the interest parties after receipt of the application for writing off the issue. In case the issue is encumbered (blocking, pledges or distraints on the shares) the issuer shall declare in writing that undertakes to enter in Register of Materialized Shares or on interim certificates, the encumbrances entered in the register of the Central Depository as of the moment of the writing off. Declaration – Form 11/E02. The company-issuer shall pay the amounts due under the agreement as per p.1.1.8 up to the moment of writing off the issue from the register of the Central Depository. The Central Depository shall issue Act for deletion of the issue from the register. The company shall issue materialized shares, interim certificates and a register of materialized shares on the grounds of the data specified in Deletion Act. 3. Bond issues shall be registered on the basis of: Registration Statement Form 12/E02, in which the bond issue data shall be specified: ISIN code of the issue; date of issuing; bond issue amount (in the respective currency); number of bonds; nominal value of one bond; bond type (ordinary debentures, mortgage backed securities); issue type (public/non-public); issue term; currency; interest; period of payment. Documents under p.p. 1.1.2 – 1.1.6 and list of bondholders which shall include the data specified under p.1.1.7.1 – 1.1.7.4. Copy of Memorandum for issuing the bond issue shall be submitted together with a copy of Articles of Association of the company under p.1.1.4. Agreement between the Central Depository and the issuer for maintenance of actual register of the bond issue, where the matters related to the writing off the issue from the registries of the Central Depository after its maturity can also be governed. Document for paid fee for registration of the bond issue. Registration shall be made within one working day. Central Depository shall issue Act of bond registration which shall be provided pursuant to p.2.1. 4. Writing off a bond issue from the register of the Central Depository. Bond issue shall be written off from the register of the Central Depository after expiration of its term, in compliance with the agreement under p. 7.3, and in case these issues are not governed in such agreement, the writing off shall be made on the grounds of application for writing off the issue from the register of the Central Depository submitted by the representative of the company, issuer of the bond issue and document for paid fee. The application shall include the date of maturity of the issue as well as the date on which the issue shall be written off from the register of the Central Depository. On the date specified by the issuer (under an agreement or respectively by application) the Central Depository shall delete the bond issue and shall issue Act of Deletion of the Issue therefore. 5. Disbursement of dividends and payments on bond issues. Disbursement of dividend on share issues. 9.1.1 Before disbursement of dividends the Central Depository shall allocate the amounts of the dividends among shareholders on the grounds of Statement which shall include: Issue identification - ISIN code, number of shares, nominal value per share. Dividend amount per share. The date at which the shareholders’ list shall be specified. Central Depository is not responsible in case the date specified in the statement is not in conformity with the requirements specified under Art.115b, para.1 of LPOS. Initial date of dividend disbursement Certified copy of the competent body for dividend disbursement shall be enclosed to the statement. Agreement for administration of the disbursement signed between the issuer and the Central Depository. Document for paid fee for the service provided shall be enclosed too. The issuer shall transfer the amount for disbursement of the dividends, after deduction of the tax due, to an account of the Central Depository whereas the amount shall be transferred within the terms as follows: For BGN payments – the amount should be deposited on an account of the Central Depository within 4 /four/ working days prior to the initial date of dividend disbursement, not including the date of disbursement; For FC payments – the amount should be deposited on an account of the Central Depository not later than 4 /four/ working days prior to the initial date of dividend disbursement, not including the date of disbursement; 9.1.6 In case of established encumbrances– distraints or pledges, the issuer shall provide consent on behalf of the creditors for dividend disbursement within the term as specified under Art.73 of Commercial Code. The amounts for the dividend shall be blocked on pledged or distrained shares by order of the issuer until consent of all the shareholders is provided. 9.1.7 The Central Depository shall prepare lists by investment intermediaries including allocation of the amounts for dividend disbursement to their clients, company shareholders. The lists shall be submitted to the respective investment intermediary together with the transfer of the amounts. 9.1.8 The Central Depository shall provide a list of the shareholders with personal accounts to the service bank according to the terms of an agreement signed between the bank, the company and the Central Depository. 9.1.9 In case the payments shall be made at issuer’s desk, the Central Depository shall provide the list for dividend disbursement by shareholders to an authorized representative of the issuer. 9.1.10 Dividend payment through the system of the Central Depository shall be made in compliance with Procedure №27. Disbursements on bond issues shall be made based on: Statement from the company-issuer of the issue which shall contain the data as follows: Issue identification – ISIN code, number of bonds, nominal value per bond. Amount of the payment due per bond. The date at which the bondholders’ list shall be specified. The Central Depository is not responsible in case the date specified in the statement is not in conformity with the requirement as specified by law or with the information announced in the issue prospectus. Maturity date of payment. Agreement for administration of the disbursement signed between the issuer and the Central Depository. Document for paid fee. The Central Depository shall notify the issuer about the total amount of payment after calculations and in round figures. The issuer shall transfer the amount for disbursement of the payments due under the bond issue to an account of the Central Depository after deduction of the tax due. The amount shall be deposited to the account of the Central Depository within the following terms: For BGN payments – the amount should be deposited to an account of the Central Depository within 4 /four/ business days prior to the initial date of payment, not including the payment date; For FC payments – the amount should be deposited on an account of the Central Depository not later than 4 /four/ business days prior to the initial date of payment, not including the date of payment; The Central Depository shall prepare lists by investment intermediaries with allocation of the payment amounts under the bond issue to their clients, company bondholders. The lists shall be submitted to the respective investment intermediaries along with the transfer of the amounts. Payments under bond issues through the system of the Central Depository shall be made in compliance with Procedure №27. 6. Preparing and receiving of check ups from the Central Depository Register. Preparing of Register of Shareholders – shall be made based on a written application submitted to the Central Depository /on spot, by post, by fax/- Form 13/E02. The application shall include the following data: Company name, BULSTAT number, seat and registered office. The date as of which Register of Shareholders shall be issued. The application for preparing the register of shareholders can be submitted via internet by filling in a electronic registration form: The issuer shall register initially in the web-site of the Central Depository in order to obtain an official access to menu “clients/conditions”, on the basis of a hard copy application containing the company name and post address, the company number with the Central Depository system; electronic address on which the check-ups requested shall be submitted; contact person’s full name and phone number. The application shall be signed by the representative of the company and shall be sent by post or by bearer. Menu “clients” shall be accessed following its initial registration in “REGISTRATION WEB.CDAD” on the grounds of username and password filled in. Based on the application under p.10.1.3.1 the Central Depository shall provide official access to menu “clients” to the person authorized by the issuer. The Central Depository shall prepare register of shareholders and other check-ups on the basis of the requests received electronically through menu “services for issuers” in the Central Depository web-site to the electronic address specified in the application. For changing the data under p.10.1.3.1 the issuer shall submit to the Central Depository new application on hard copy. Registers of shareholders on hard copy shall be provided to the representative of the company or a person explicitly authorized by him. Registers of shareholders shall be received in case the following documents are provided: Certificate of actual legal status of the company; Power of attorney, in case Register of Shareholders will be received by an authorized person; Identity card of the person receiving it Document for paid fee. Check ups upon demand of the Commission of Financial Supervision, bodies of judicial authorities and other public institutions. Check ups shall be prepared upon demand of the applicants and in conformity with the provisions of Art.133 of LPOS. Document for paid fee, if due, according to Central Depository Tariff, shall be submitted. Check-ups shall be provided to the applicant in the way of submission of the demand – respectively by post or by bearer. The Central Depository shall prepare/submit the following check-ups/pieces of information with regard to the registers of the joint-stock companies maintained by the Depository: Certificate of capital structure; Check-up for the movements registered in the account of the company – issuer; Portfolio of issuer/client; Check-up for a shareholder’s share in percentage; Check-ups for the capital amount and for encumbrances on the issue; Check-ups for paid dividends/interest and principals; others The check-ups shall be provided to the empowered persons in compliance with the provisions of Art. 133 of LPOS and Art.21 of Regulation №8 of the Commission of Financial Supervision on the Central Depository of securities. The check-ups shall be prepared after receiving a written statement/demand by the applicant and shall be received by the applicant in the Central Depository office or by a person authorized by him against a document of fee paid for preparing the check-up. 7. ISIN Coding. ISIN Coding shall be made based on Demand From 14/EП02 submitted in the Central Depository for obtaining an ISIN code, which shall be completed by: Copy of actual court certificate certified by the Commercial Register. Document for paid fee for issuing ISIN code. The Central Depository shall provide ISIN code and register this code in Public Electronic Register of ISIN code of dematerialized securities and shall issue certificate of the code obtained to the applicant. ISIN Code Certificate shall be received by a representative of the issuer. In case of ISIN coding of materialized securities, a copy of the decision of the Ministry of Finance for printing materialized securities shall be enclosed to the demand under p.11.1. 8. Change of personal data of issuers of securities: In case of change of personal data of a company - issuer, the company issuer shall notify the Central Depository in writing for the changes immediately after their registration in Companies Register for which it shall enclose a copy of the court order for registration of the change. The notification shall be signed by the representative of the company. Company-issuer personal data shall be as follows: Name of the company-issuer; BULSTAT number; Seat and registered office; Change of the persons representing the company; Legal status of the company /bankruptcy proceedings, liquidation proceedings/. 9. Registration of securities issue in special cases. In case of immobilization/dematerialization of securities, the issuers should register the securities issue with the Central Depository pursuant to p.1. After registration of the issue, the securities shall be immobilized/dematerialized by an investment intermediary, with which the company-issuer has concluded an agreement. For immobilization/dematerialization of securities the investment intermediary shall submit to the Central Depository the following documents: 13.2.1 Application for immobilization/dematerialization of securities signed by the representative of the investment intermediary. 13.2.2 Certified copy of the agreement between the issuer and the investment intermediary. 13.2.3 Written statement of receipt and transfer between the investment intermediary and the Central Depository – Form 15/E02 , which shall contain the following data: the shareholders’ data under p.1.1.7.1-1.1.7.4; type of securities; number of the denomination; denomination structure of the securities – number of securities, nominal value per share and total nominal value; subsequent numbers of the securities; Hand-over protocol shall be signed by the representative of the investment intermediary by court registration or by a person explicitly authorized by him; 13.2.4. Originals of securities; 13.2.5. Document for paid fee for immobilization/dematerialization of securities; 13.3. In case of registration of company-issuer if some personal data of the shareholders under p.1.1.7.1-1.1.7.4 are missing, the shares shall not be registered on the holders’ individual accounts. In this case the total amount of securities, of the shareholders with missing data, shall be registered in separate “deposit account of securities of shareholders with missing data”. When all required personal data for these shareholders are provided, the respective securities shall be transferred from the general deposit account to a holder’s own account. 14. The Central Depository may require other documents or information from the company if needed for registrations or changes in the register. Enclosure 4(E04) – Legitimation and Representation Procedure

LEGITIMATION 1. Applicant shall identify its type /legal entity or physical person/ for which it shall provide documents. The documents shall be verified and compared and their copies shall be kept with Registration Agent. The Registration Agent shall compare the data and signatures in all documents as well as the congruence of the person with the photo in the identity document. Bulgarian physical persons – Original and copy of Bulgarian identity document certified by the person /identity card or passport/. Foreign physical persons – Original international passport for entry in Bulgaria. The legalized original translation of the passport pages which shall contain the data specified below. This document shall be archived and shall be left at the desk. Full name; Passport number; Date of issue (if indicated in the passport); Date of expiry of the passport (if indicated in the passport); Nationality; Address (if indicated in the passport). Copy of the passport pages containing the information and the photo of the foreign physical person, which have been translated. Bulgarian legal entities /registered in Bulgaria/: Original certificate of actual legal status from Companies Register or a copy certified in front of notary /validity not more than 3 months/. Copy of identity code- BULSTAT number. Original Bulgarian identity document (documents) of the person (persons) representing the legal entity according to the court registration. Copy of the certificate of tax number of the company. The registration agent should advise the applicant that Central Depository AD is not responsible in any cases of illegal transfers of securities. Foreign legal entities/registered abroad/: Copy of the act of registration in the original language. Legalized translation (or legalized copy of the translation certified in front of notary) of the text of the registration act which shall contain the data specified below: Full name of the legal entity; Date of issue; Country of registration; Address of the legal entity; Name of the persons who are entitled to represent the legal entity. In case the legal entity is registered in Bulgaria, copy of the certificate of the company tax number should also be provided. REPRESENTATION 1. Representation can be established by court registration, by power of attorney certified in front of notary, by document for legal representative /parent, trustee, guardian/. The representative/authorized person shall provide documents proving the representation: Representation of Bulgarian legal entities by their representatives according to court registration: The representative should provide the whole personal information as a physical person according to legitimation procedures. The representative should be a person or one of the persons entered in the act of registration. In case the legal entity is represented by two or more persons together, the representation shall be jointly performed. Representation of foreign legal entities by their representatives according to the registration: The procedure under p. 1.4. and p.2.2. shall apply. Representation of Bulgarian legal entities by an authorized person: Express power of attorney by the representatives of the company certified in front of notary. In case of vagueness, inaccuracy or other doubts for improper representation the power of attorney shall not be accepted. The name of the person signed the power of attorney should correspond to one of the names according to the registration act. In case the legal entity is represented by two or more persons together, the power of attorney should be signed by all the representatives. The authorized person should provide the whole personal information as a physical person according to legitimation procedures and copy of the identity documents of the representative (representatives) of the legal entity certified by him. Representation of foreign legal entities by an authorized person: Express power of attorney by the representatives of the company certified in front of notary. In case of vagueness, inaccuracy or other doubts for improper representation the power of attorney shall not be accepted. In case the power of attorney is certified in front of notary abroad, it shall be provided together with its official legalized translation. The name of the person who has signed the power of attorney should correspond to one of the names according to the registration act. In case the legal entity is represented by two or more persons together, the power of attorney should be signed by all the representatives. The authorized person should provide the whole personal information as a physical person according to legitimation procedures and copy of the identity documents of the representative (representatives) of the legal entity certified by him. Representation of Bulgarian physical persons. Express power of attorney by the holder of the securities certified in front of notary. In case of vagueness, inaccuracy or other doubts for improper representation the power of attorney shall not be accepted. The representative should provide the whole personal information as a physical person according to legitimation procedures and copy of the identity documents of represented person /authorizing party/. Representation of foreign physical persons: Express power of attorney certified in front of notary. In case of vagueness, inaccuracy or other doubts for improper representation the power of attorney shall not be accepted. In case the power of attorney is certified I front of notary abroad, it shall be provided together with its official legalized translation. The representative should provide the whole personal information as a physical person according to legitimation procedures and copy of the identity documents of represented person /authorizing party/. Representation of infant physical persons (under 14 years): Original and copy of the permit by the regional court at the place of residence of the parent (parents) for administrating the securities of the infant person according to Art. 73, Para 2 of Family Code. Declaration certifying that the transfer is not a donation, waiver of rights, lending and guaranteeing the debts of third persons by pledge or endorsement which are considered null and void according to Art. 73, Para 3 of Family Code. The legal representative /parent or guardian/ should provide the whole personal information as a physical person according to legitimation procedures: Birth certificate, respectively a document proving the nomination of the person as a guardian – original and copy; Representation of physical persons under age /at age from 14 to 16 years/. Original and copy of the permit by the regional court at the place of residence of the parent (parents) for administrating the securities of the infant person according to Art. 73, Para 2 of Family Code. Declaration signed by the parents certifying that they agree with the transfer and registration of securities under the specified terms in benefit of the infant person. Certificate by the municipality council at the place of residence that the parents are not deprived of parent rights. All documents and forms should be filled in according to the general procedure and shall be signed by the infant person and the representatives /parent or guardian/ indicating “agree"; The representative should provide the whole personal information as a physical person according to legitimation procedures, as well as a copy, certified by him, of the identity document of the infant person. Declaration certifying that the transfer is not a donation, waiver of rights, lending and guaranteeing the debts of third persons by pledge or endorsement which are considered null and void according to Art. 73, Para 3 of Family Code. Birth Certificate, respectively a guardianship document – original and copy; Representation of physical persons under age /at age from 16 to 18 years/. The requirements under p.2.8 shall apply in case the person is not contracted a marriage. If the person under age is married: Marriage Certificate - original and copy. Identity document – original and certified copy; Declaration of the parents that they agree with transfer and registration of the securities under the specified terms. Notice: In case additional requirements for legislation and representation are envisaged by enactment, they should be observed by Registration Agent nevertheless they are not explicitly specified in these procedures. Enclosure 5(E05) – Registration Agent Activity

1. All documents in compliance to which/ on the grounds of which the Registration Agent shall conduct the service of its clients /respectively originals or certified copies/,are required and kept with Registration Agent. Registration Agent shall order in the Central Depository the respective activities electronically according to the established manner of communication with the Central Depository. Upon demand, Registration Agent is obliged to provide the respective documents within the term specified by the Central Depository. 2. Transfer of securities. All transfers – donation, inheritance, sale and other transfer against payment of securities of companies and compensatory instruments listed on the floor of Bulgarian Stock Exchange shall be registered by the Registration Agent at the relevant segment of the Bulgarian Stock Exchange. In any other cases the transfer is out of counter. Registration Agent shall order transfer of securities based on: Sale and purchase agreement between the parties of the transaction certified in front of notary. Original or a transcript of the agreement certified in front of notary shall be kept with the Registration Agent; Order for transfer of securities signed by transferor – Form 02/E05. Documents under Enclosure 4(E04) – Legitimation and Representation Procedure, of the transaction parties. Original document certifying the ownership on the securities, subject of the transaction / depository receipt, interim share certificate/. After verification of the documents under p.2.2, in case the transaction is admissible, the Registration Agent: shall register the persons – parties of the transaction as its clients with the Central Depository and shall open them client accounts / in case they have not been registered as such/– message МТ 599. In case the securities of the transferor are in personal account, the Registration Agent shall order their transfer to a client account of the transferor – messages МТ540 and МТ542. In the presence of the circumstances under p.2.3.1 and p.2.3.2 the Registration Agent shall order transfer of the securities – messages МТ540 and МТ542. 3. Donation Transfer of securities from donor’s account to the account of the person receiving the donation shall be performed on the basis of: Donation Agreement in writing, where the signatures shall be certified in front of notary. Original or a transcript of the agreement certified in front of notary shall be kept with the Registration Agent. Order for transferring the securities, subject of donation, signed by the donor – Form 02/П05. The order shall be filled in by the donor and shall be signed in front of an official of the Registration Agent; Documents under Enclosure 04(E04) – Legitimation and Representation Procedure, of the parties of donation. Original document certifying the ownership on the securities, subject of the donation / depository receipt, interim share certificate, electronic message by the Central Depository for availability of securities/. Certificate of paid tax, if due. /It is not required in cases under Art.31, para.2 and Art.44, para.5 of LLTF./ After verification of the documents under p.3.1 and in case the transfer is admissible, the Registration Agent shall order the transfer of the securities, subject of donation, under the procedure of p.2.3. 4. Transfer of securities in case of inheritance/except for inheritance by testament/legacy/ Securities from the account of legator to the accounts of the heirs shall be transferred on the basis of: Certificate of heirs. Request for a check-up for securities held by legator– Form 06/E05, signed by all heirs or persons authorized by them. Agreement for voluntary partition between all heirs according to Certificate of heirs, where the signatures shall be certified in front of notary. Based on the check-up under p.4.1.2 the agreement should cover all securities, subject of inheritance except those being subject of inheritance by succession of legacy. The order under p.4.1.4 shall be signed only by the heirs who shall be granted a share according to the agreement of voluntary partition. Order for transfer of the respective shares of securities from the account of the legator to the respective accounts of the heirs signed by all heirs or persons authorized by them Form 03/E05. Original document certifying the ownership on the securities, subject of inheritance /depository receipt, interim certificate/. In case the heirs do not possess such document, they shall provide a statement free style for this circumstance. The statement shall be signed by the persons under p.4.1.2. Certificate of tax paid, when due. In case an heir is represented by a person authorized by him, the power of attorney shall specify explicitly the actions that may be performed by the authorized person on behalf of the authorizing party. The power of attorney shall meet the requirements under Art.36 of Regulation №1 on requirements to the activities of the investment intermediaries. After verification of the documents under p.4.1 the Registration agent shall: submit to the Central Depository application for a check-up in respect of securities hold by legator and for their blocking – message МТ599. The Central Depository shall provide the check-up on hard copy and shall submit it to the Registration agent as well as shall block the securities, subject of inheritance. submit the check-up prepared by the Central Depository to the heirs. In compliance with the agreement of voluntary partition between the heirs, shall order transferring of the respective shares of securities from the legator’s account to the respective accounts of the heirs – messages МТ540 and МТ542. Transfer of securities to an account of each of the heirs shall be ordered by separate message. In case the legator is not a client of the Registration agent, upon receipt of message МТ599 under p.4.2.1, along with blocking the securities, being subject of inheritance, the Central Depository shall register the legator as a client of the Registration agent providing ex-officio a number to him. Registration agent should register the heirs who shall receive a share under the voluntary partition agreement as its clients and open them client accounts. Registration agent shall submit to the Central Depository message МТ545 and message МТ542 for transfer of the respective shares of securities, subject of inheritance, to the respective client accounts of the heirs. Upon receipt of these messages the Central Depository shall open client accounts of the legator with the Registration agent and shall credit them ex- officio from the respective accounts of the legator respectively opened in Register A or with other Investment intermediary. The official opening of accounts of the legator and transferring of securities to these accounts are at the expense of the Registration agent which shall be charged by the Central Depository with the respective fees. In case accounts with securities subject of inheritance have been opened with an investment intermediary and these securities have been ex-officio transferred under the procedure of p. 4.2.3.3, the intermediary shall be advised electronically that these transfers are in regard to the activities performed by the Registration agent. In case an heir is represented by a person authorized by him, the power of attorney shall specify explicitly and fully all the actions that may be performed by the authorized person on behalf of the authorizing party. The power of attorney shall meet the requirements under Art.36 of Regulation №1 on requirements to the activities of the investment intermediaries. 5. Transfer of securities in case of inheritance by testament/legacy. In case of inheritance by testament/legacy, the Registration agent shall require all the documents specified below to be provided to him: Certificate of heirs; Transcript, certified in front of notary, of an autographical or notaries testament prepared in style and containing all the requisites as required under Inheritance Act. Notary Protocol for announcement of testament; Certificate of paid inheritance tax if needed; Identity document. All documents except identity documents shall be provided in original or a transcript certified in front of notary. Documents shall be signed and certified at each page by the heir-applicant, the person received the documents and a person from the internal control department under the procedure established by Regulation № 1 on the requirements to the activities of the investment intermediaries. The person from the internal control department shall prepare a document for verification of the circumstances carried out under Art. 37 of the Regulation. The Registration agent shall submit to the Central Depository a request for a check-up and blocking of the securities – portfolio and order for transfer by form. All documents in regard to the transfer shall be kept with the Registration agent. The relationships between the persons, ordering transfer of the securities on the grounds of testament order/succession by legacy and the Registration agent shall be governed by agreement. In case of litigation of the inheritance, of caused material and intangible damages of the Central Depository, affecting the Depository reputation as well as any other claims related to the inheritance, the Registration agent and the heirs/testator shall bear responsibility in front of the Central Depository for its actions. In such cases, pursuant to a decision of the Board of Directors, the Central Depository can require collaterals and compensations, as well as the measures under Art. 17 of Rules and Regulations of the Central Depository to be applied, incl. termination of membership agreement and Registration Agent agreement. Registration agent shall be notified by the Central Depository on the legator’s portfolio – Form 06а/E05 and shall advise the heir-applicant only for the amount of the share he shall receive from the securities hold by the legator as specified in the testament/legacy. The Registration agent shall not advise the heir about the total availability on the legator’s accounts. According to the testament/legacy, the Registration Agent shall order transferring the respective shares of securities from the legator’s account to the respective accounts of the heirs – messages МТ540 and МТ542. Separate message shall be submitted for the transfer on an account of each one of the heirs based on Form 03а/E05. After receipt of the order, the Central Depository shall transfer the ordered securities, individualized by type, number, ISIN code. In case the availability on the legator’ account is below the requested one, the Central Depository shall transfer only the securities available in the register of the Central Depository. All transfers in case of inheritance by testament/legacy of shares of public companies, compensatory instruments and investment vouchers shall be registered by the Registration agent on the respective segment of the Bulgarian Stock Exchange. Registration agent shall perform its activities in regard to transfers in case of inheritance in conformity with all effective regulations and requirements while acting with professional care and in good faith. In cases of transfer of securities in case of inheritance by testament and succession by legacy subsidiary the general provisions under p.4 shall apply. 6. Change of personal data. Investors in dematerialized securities registered with the Central Depository can request changing of their personal data entered in the registers of the Central Depository through the Registration agent by providing the following documents: Application for change of personal data – Form 04/E05. In case the documents are provided by authorized person, a power of attorney in which the actions the authorized person may perform on behalf of the authorizing party shall be explicitly specified as well as the identity documents of the representative shall be submitted. The power of attorney shall meet the requirements under Art.36 of Regulation №1 on the requirements to the activity of the investment intermediaries. The documents under Enclosure 04(E04) – Legitimation and Representation Procedure. All original documents certifying the ownership on dematerialized securities /depository receipts/. In case of change of EGN data, a certificate of the names and EGN of the persons issued by ESGRAON office or Civil Status Department with the respective municipality. Court order or other act for changing the name /Marriage Certificate/ in case the personal data are changed by such acts/certificates. On the basis of the submitted documents, the Registration Agent shall perform the following actions: 6.2.1 Register the person under p.6.1. as his client by submitting to the Central Depository message МТ599, which shall include the data of the person as registered with the Central Depository /the wrong data of the person/. 6.2.2 After submission of the message under p.6.2.1 the Registration agent shall submit again to the Central Depository message МТ599, which shall include the identification number of the message under p.6.2.1, the correct data of the person, sub-identifactor for correction /”DUPL”/ and the respective code of changing the data. Separate message shall be submitted for each one of the changes. Codes for change of personal data: 101 – Change of NAME AND ADDRESS; 001 – Change of ADDRESS; 100 – Change of NAMES; 010 – Change of EGN or BULSTAT; 011 – Change of EGN and ADDRESS or BULSTAT and ADDRESS; 6.2.3. After successful registration of the data from the message under p.6.2.2 the Central Depository shall submit electronic message to the investment intermediaries having the person as its client and shall print depository receipts of the securities owned by the person in personal accounts. The depository receipts shall be provided to the Registration agent in order to be delivered to the person. 6.2.4. Personal data of clients holding compensatory instruments shall not be changed through Registration agent. Correction of data of such clients shall be carried out under procedure established under LTCI and Regulation on the activities of the Central Depository in respect of registration OF the issuance, transactions and payments by compensatory instruments – Chapter ІV. 6.2.4.1. In case one and the same person owns compensatory instruments and other types of securities, the change of the data in the registers of the Central Depository through Registration Agent shall be performed only in respect of the other types of securities. 7. Issuance of a duplicate of depository receipt. 7.1. Duplicate of a depository receipt shall be issued on the basis of the following documents: 7.1.1. Application for issuance of duplicate of depository receipt – Form 07/E05 7.1.2. Identity documents under Enclosure 04(E04) – Legitimation and Representation Procedure. 7.1.3. The documents for issuance of duplicate shall be handed in to the Registration agent personally by the securities owners; their handing in by an authorized person is not allowed in order the security and interests of the investors to be ensured. 7.2. Based on the documents under p.7.1 the Registration agent shall submit to the Central Depository message МТ59 for requesting issuance of duplicate of a depository receipt for the securities owned by the holder in a personal account from the respective issue. 7.3. The Central Depository shall submit electronic message to the Registration Agent with the result from the processing of the message under p.7.2, and in case the data in the message correspond to the data in the registers of the Central Depository, it shall print a duplicate of the depository receipt. 7.3.1. The depository receipt shall be provided against signature to an authorized official of the Registration agent. 8. Preparing of portfolio check-ups 8.1. Portfolio check-up shall be prepared on the basis of the following documents: 8.1.1. Application for check-up of portfolio status – Form 05/E05. 8.1.2. Identity documents under Enclosure 04(E04) – Legitimation and Representation Procedure. 8.2. Based on the documents under p.8.1 the Registration agent shall submit to the Central Depository message МТ599 for issuance of the respective portfolio type. 8.2.1. Codes for preparing check-ups for availabilities on accounts of clients 72-Check up for availabilities in accounts 73-Extended check-up for availabilities in accounts – includes also the numbers of the intermediaries where the accounts are opened/; 75-Check up for portfolio of candidates for professional investors; 81-Application for check up and blocking in regard to inheritance procedure; 85- Application for check up and blocking in regard to inheritance procedure by testament/legacy 8.2.2. For receiving of extended check-up for a portfolio including data of the investment intermediary with availabilities on client accounts of the holder, the holder should authorize one particular official of the Registration agent, by a power of attorney certified in front of notary containing notary certification of the signature, to receive the extended check-up from the Central Depository. Enclosure 6(E06) – Procedures of Ordering Transfer of Securities from Personal Account to Client Account with an Intermediary