A Short Primer on Florida Receivership Law and the Answers to Some Frequently Asked Questions about Receiverships in General by Joseph E. ("Ed") Foster ©September 25, 2012

This Primer is divided into two parts. The first part is a discussion of Florida receivership law, particularly as it relates to mortgage foreclosures. The second part consists of the answers to some frequently asked questions about receivership law.

PART I – A DISCUSSION OF FLORIDA RECEIVERSHIP LAW

A general overview

Perhaps the most important thing to understand about Florida receivership law is that a creditor has NO absolute right to the appointment of a receiver, NO right to select the receiver in the event the court determines that a receiver should be appointed, and NO right to determine the powers and duties of the receiver once appointed. The appointment of a receiver, the selection of the receiver, and the powers and duties of the receiver are all within the sound discretion of the court.

To further illustrate this point, two grounds for appointment of a receiver often used in other states - (a) the contract / loan / mortgage contains a clause giving the creditor an absolute, unconditional right to appointment of a receiver, and (b) the loan is in default - carry little or no weight with Florida courts. Instead, the focus in Florida is usually on whether the appointment of the receiver will prevent the subject property from being wasted or subjected to a serious risk of loss.1 1 However, a showing of "waste" is not an absolute requirement for the appointment of a receiver. For example, in MB Plaza, LLC v. Wells Fargo Bank, National Association, 72 So. 3d 205 (Fla. 2d DCA 2011), the Court approved the appointment of a receiver for a shopping center without a showing of waste. In that case, the Court found the appointment of the receiver to be within the trial court's discretion where the mortgagor had been collecting rents for several months, the property had fallen in value so that the loan was upside down, and the borrower did not have the funds to pay the outstanding property taxes. To the same effect is Alafaya Square Association, Ltd. v. Great Western Bank, 700 So. 2d 38 (Fla. 5th DCA 1997), fn. 2.

{20021290;1}1 Procedure for appointment of a receiver in Florida

Receivership in Florida is an ancillary remedy, meaning that there is not an independent cause of action for appointment of a receiver in Florida. Instead, the appointment of a receiver is a form of ancillary relief afforded a plaintiff who is asserting an underlying cause of action – typically for foreclosure, accounting, corporate dissolution or the like. In Florida, the party seeking appointment of a receiver files a motion in an already-pending action asking the court for entry of an order appointing the receiver. The motion typically suggests a receiver-candidate, and states with particularity the grounds upon which the appointment is sought. The motion is scheduled for hearing on the court's calendar.

Florida Rule of Civil Procedure 1.620 is the Rule governing the appointment of receivers in Florida. That rule provides:

(a) Notice. The provisions of rule 1.610 as to notice shall apply to applications for the appointment of receivers.

(b) Report. Every receiver shall file in the clerk’s office a true and complete inventory under oath of the property coming under the receiver’s control or possession under the receiver’s appointment within 20 days after appointment. Every 3 months unless the court otherwise orders, the receiver shall file in the same office an inventory and account under oath of any additional property or effects which the receiver has discovered or which shall have come to the receiver’s hands since appointment, and of the amount remaining in the hands of or invested by the receiver, and of the manner in which the same is secured or invested, stating the balance due from or to the receiver at the time of rendering the last account and the receipts and expenditures since that time. When a receiver neglects to file the inventory and account, the court shall enter an order requiring the receiver to file such inventory and account and to pay out of the receiver’s own funds the expenses of the order and the proceedings thereon within not more than 20 days after being served with a copy of such order.

(c) Bond. The court may grant leave to put the bond of the receiver in suit against the sureties without notice to the sureties of the application for such leave.

Rule 1.620, Fla. R. Civ. P.

{20021290;1}2 Note the reference in Rule 1.620(a) to the notice provisions of Rule 1.610. Rule 1.610 is

Florida's temporary injunction rule. Applying the notice provisions of Rule 1.610 in a receiver context, a hearing for appointment of a receiver without notice to the defendants is allowed only if the movant can show by sworn affidavit or verified pleading2 that immediate and irreparable injury, loss or damage WILL – not might - result to movant before the adverse party can be heard in opposition, and the movant's attorney certifies in writing any efforts that have been made to give notice, and why notice should not be required. In a non-noticed hearing, no live testimony is allowed, with the movant permitted to proffer only affidavits or verified pleadings.

The bottom line is that ex parte hearings to appoint receiver are not favored in Florida, and often result in motions being denied without prejudice until notice can be given, higher bonds when the motions are granted ex parte, and prompt follow-up hearings to reconsider appointments.

Thus, the timeline for obtaining a hearing on the motion for appointment of a receiver can vary widely from court to court, from judge to judge, and from week to week. In a genuine "the property is on fire" emergency, the court can often find time for the hearing immediately, or within 24 to 72 hours of the filing of the motion, but absent a true emergency3, the timeline for obtaining the hearing may vary from a few days to a few weeks, or even longer.

The receivership hearing

The conduct of the hearing itself varies from case to case, court to court, and judge to judge. If the hearing has been properly noticed, the court may well wish to consider live testimony, although in some instances the court will be content to consider the motion based on

2 In Florida, a "verified" pleading usually means one that is signed under penalty of perjury, and generally excludes verifications based on information and belief or knowledge and belief. §92.525, FLA. STAT. (2012). 3 It is NEVER a good idea to claim an emergency in a non-emergency situation in order to obtain a speedy hearing. The court will probably not be pleased with the misrepresentation, and the deception may well lead the court to question the veracity of the movant and its counsel on other matters raised in the suit, and in subsequent suits.

{20021290;1}3 supporting affidavits, verified pleadings, and argument of counsel. The hearing is one at which a wise party "hopes for the best and prepares for the worst." A court which has routinely not taken live testimony in support of prior receivership motions may well decide to take live testimony at your particular hearing, just as a court which has routinely required live testimony in past receivership hearings may decide at your hearing to rule based solely on affidavits and argument of counsel.

Grounds for appointment of a receiver in Florida

Carolina Portland Cement Co. v. Baumgartner, 99 Fla. 987, 128 So. 241 (1930), is the seminal case on receiverships in Florida. While recognizing that the trial court has great discretion over whether to appoint a receiver, the case holds that if the mortgagee can demonstrate a likelihood that he will prevail upon the merits, that the mortgagor specifically pledged the rents and profits from the property as security for the debt, and that the rents and profits are not being applied to the debt, the appointment of a receiver should probably be granted. Id.

A provision in a mortgage providing for the appointment of a receiver upon default will be given great weight. Carolina Portland Cement Co., supra; McEwen v. Growers Loan &

Guar. Co., 104 Fla. 176, 139 So. 805 (1932).

However, ultimately the decision to grant or deny an application for appointment of a receiver is within the sound discretion of the court. E.g. Wilkins v. Wilkins, 144 Fla. 590, 198 So.

335 (1940); Welch v. Gray Moss Bondholders Corporation, 128 Fla. 722, 175 So. 529 (1937);

Prudence Co. v. Garvin, 118 Fla. 96, 160 So. 7 (1935); Singleton v. Knott, 101 Fla. 1077, 133

So. 71 (1931); Mirror Lake Co. v. Kirk Securities Corporation, 98 Fla. 946, 124 So. 719 (1929);

{20021290;1}4 Armour Fertilizer Works v. First Nat. Bank, 87 Fla. 436, 100 So. 362 (1924); Frisbee v.

Timanus, 12 Fla. 300 (1869).

In We’re Assoc. VI, L.L.P. v. Curzon Dev. Corp., 738 So. 2d 440 (Fla. 4th DCA 1999), the Court decided the question of whether a contract that permitted the appointment of a receiver in the event of a default gives the trial court discretion to impose less restrictive conditions on the mortgagor's use of operating funds in lieu of a receivership. In that case, the trial court refused to appoint a receiver, but restricted the mortgagor’s right to use its operating funds. The Fourth

District found that the lower court’s actions amounted to the imposition of a temporary injunction, but that the plaintiff’s motion had not complied with the Florida Rule of Civil

Procedure 1.610. Therefore, the Court reversed the lower court. In addition, because the mortgagor had presented unrefuted evidence that there was sufficient equity in the property to more than cover the balance of the mortgage, plus interest and penalties, the reversal of the lower court’s decision was without leave for the mortgagee to seek an injunction.

In Alafaya Square Ass’n, Ltd. v. Great Western Bank, 700 So. 2d 38 (Fla. 5th DCA

1997), the Court refused to appoint a receiver in a mortgage foreclosure action, despite a contractual provision stipulating to the appointment of a receiver, in the absence of specific evidence showing that the subject real property was being wasted or otherwise subjected to serious risk of loss. The Court noted that the appointment of a receiver in a foreclosure action was not a matter of right, and that the trial court’s discretion to appoint a receiver would be abused unless there had been a showing that the secured property was being wasted or subjected to a serious risk of loss. In this case, the plaintiff’s testimony had been that the exterior of the shopping center needed some painting, some exterior structural repairs, and parking lot repairs.

In addition, plaintiff testified that the overall appearance of the property was poor, and that

{20021290;1}5 landscaping was not being kept up. The Fifth District expressly noted in its decision that the defendant had taken reasonable and timely action in pursuing necessary repairs. The Fifth

District also noted that the lender had refused to authorize payment from an escrow account for repairs and taxes. The Fifth District Court was not impressed with the lender's refusal. "[The lender] asserts that [the borrower's] failure to make the necessary repairs constitutes waste. We reject this argument as spurious since such failure was a direct result of [the lender's] failure to authorize use of the sequestered rent." Further, "…the only impediment to the payment of the taxes was [the lender's] refusal to consent [to the use of the escrowed funds to make the payment.]"

In MB Plaza, LLC v. Wells Fargo Bank, National Association, 72 So. 3d 205 (Fla. 2d

DCA 2011), the Florida Second District Court of Appeal allowed the appointment of a receiver for a shopping center in a mortgage foreclosure without a showing of waste. The Court found that the appointment of the receiver was within the lower Court's discretion where the mortgagor had been collecting the rents for several months, the property had fallen in value so that the loan was upside down, and the borrower did not have the funds to pay the property taxes.

Qualifications for serving as receiver

First and foremost, a receiver should not favor the interests of one party over any other party. Beach v. Williamson, 78 Fla. 611, 83 So. 860, (Fla. 1920); Lehman v. Trust Co. of Am., 57

Fla. 473, 49 So. 502 (Fla. 1909); State v. Jacksonville, Pensacola & Mobile R.R., 15 Fla. 201

(Fla. 1875). See also Fugazy Travel Bureau, Inc. v. State by Dickinson, 188 So. 2d 842 (Fla. 4th

DCA 1966). In other words, the receiver is required to be neutral and impartial. This neutrality and impartiality requirement is not surprising given the fact that, in Florida, the receiver serves

{20021290;1}6 as an officer of the court4, effectively working for the judge who appoints him / her. Since the court is supposed to be neutral and impartial, the receiver must also be neutral and impartial.

Lehman, supra at 503.

Violation of this neutrality and impartiality requirement may subject the receiver to claims for breach of his / her duty, and can, although rare, subject the movant to sanctions by the court, and claims for damages by the other parties to the action. Note that a receiver acting within the course and scope of his duties enjoys a form of judicial immunity as an officer of the court. Property Management & Investments, Inc. v. Lewis, 752 F.2d 599 (11th Cir. 1985);

Murtha v. Steijskal, 232 So. 2d 53 (Fla. 4th DCA 1970). Thus, the receiver cannot be sued without the permission of the court appointing him.5

Section 660.41, FLORIDA STATUTES (2012) provides in part:

All corporations are prohibited from exercising any of the powers or duties and from acting in any of the capacities, within this state, as follows:

(2) As receiver or trustee under appointment of any court in this state.

…………….

This section does not apply to banks or associations and trust companies incorporated under the laws of this state and having trust powers, banks or associations and trust companies resulting from an interstate merger transaction with a Florida bank pursuant to s. 658.2953 and having trust powers, or national banking associations or federal associations authorized and qualified to exercise trust powers in Florida.

§660.41(2) and (4), FLA. STAT. (2012). (Emphasis added.)

4Just as confessions of judgment are absolutely null and void in Florida – Section 55.05, FLORIDA STATUTES (2012) – a court may well consider itself not bound by a provision in a contract to which it is not a party requiring it to appoint an officer of the court to perform receivership duties. 5 There is a waiver exception to this general rule however. In Moss v. Ten Associates, 524 So. 2d 480 (Fla. 3d DCA 1988), a receiver had been sued by a plaintiff in a personal injury action without the plaintiff first having sought permission from the court that had appointed the receiver. But the receiver moved to dismiss the personal injury action, apparently on the merits and not asserting his judicial immunity, and so the court in the personal injury action ruled that the receiver had waived his privilege and had given the court personal jurisdiction over him.

{20021290;1}7 See also, Brickell Station Towers, Inc. v. JDC (America) Corp., 564 So. 2d 132 (Fla. 3d

DCA 1990). However, Florida's LLC (limited liability company), LP (limited partnership), and general partnership statutes do not contain similar injunctions, meaning that some business entities other than corporations can be appointed as receivers. While this does happen, courts in

Florida often choose to appoint individual human beings as receivers as opposed to property management companies, although the orders appointing receivers often provide that the receiver may hire a management company to assist in the performance of the receiver's duties.

The author typically recommends that the receiver not subsequently be given the listing for a foreclosed property, since granting such a listing could be viewed as evidence of a lack of neutrality and impartiality by the receiver.

The receiver's powers and duties

Property held by a receiver is deemed held by the court, for the benefit of all lawful claimants. Columbia Bank for Coop. v. Okeelanta Sugar Coop., 52 So. 2d 670 (Fla. 1951);

Johnson v. Metzinger, 116 Fla. 262, 156 So. 681 (1934). Anyone who willfully disturbs the receiver’s possession of the property may be guilty of contempt. Southeastern Pipe Line Co. v.

Powell, 113 F. 2d 434 (5th Cir. 1940).

A receiver cannot acquire any rights or powers over the property greater than those belonging to the owner and mortgagee. See Hamilton v. Flowers, 134 Fla. 328, 183 So. 811

(1938). The general powers of the receiver are not spelled out under any Florida statute, rule or case law. MB Plaza, LLC v. Wells Fargo Bank, National Association, 72 So. 3d 205 (Fla. 2d

DCA 2011) at fn. 2 – ("We are not aware of any Florida statute, rule, or case law that establish a receiver's 'usual powers and duties' in cases 'similar' to this case.")

{20021290;1}8 Except for the reporting and inventory requirements specified in Rule 1.620 of the

Florida Rules of Civil Procedure6, there is no generally accepted generic list of the general powers and duties of a Florida receiver. Nor can the receiver's powers and duties be reliably specified in an underlying contract. MB Plaza, LLC v. Wells Fargo Bank, National Association,

72 So. 3d 205 (Fla. 2d DCA 2011) at fn. 2 – ("The mortgage agreement contains a section that purports to describe the rights and authorities of a receiver or the lender in the event of a default.

It is unlikely to be binding upon the trial court when the court exercises its discretion to appoint a receiver, especially to the extent that several of the powers described therein might contravene

Florida law if afforded to a receiver and the section creates few, if any, duties.").

In the absence of a statute, rule, or common law delineation thereof, the powers and duties of a particular receiver are determined by the order appointing the receiver. Thus, a typical order appointing a receiver in Florida should be fairly lengthy, and detail the receiver's powers and duties as they relate to the particular case and the particular property involved.

However, if the order affords the receiver with powers and duties unjustified by the facts at hand, the overly broad grant of power to the receiver may be viewed as an abuse of the court's discretion, and the order be subject to reversal on appeal. MB Plaza, LLC, supra, 72 So. 3d at

206 – ("The powers and duties actually provided [by the order appointing receiver] are not justified by the record. We conclude that it was an abuse of discretion to enter an order with these extensive provisions in the context of this case and this hearing.")

At a minimum, the following items should be considered in connection with the preparation of an order appointing a receiver:

a. Appoint the individual7 as receiver.

6 Rule 1.620 is reproduced on page 2 supra. 7 As noted above, the receiver is typically an individual person, should never be a corporation, but can be an LLC, LP, or partnership.

{20021290;1}9 b. Provide for a receiver bond, as well as a mortgagee bond if appropriate.

c. Provide for the surrender of the property8 to the receiver.

d. Provide for the surrender of all books, leases, licenses, insurance information, utility information, utility and security deposits, and rent records to the receiver.

e. Provide for the transfer of all licenses to the receiver.

f. Provide for authorization for the receiver to apply for replacement liquor licenses.

g. Provide for the inventory and receiver reports as specified in Rule 1.620.

h. Authorize the receiver to incur and pay necessary operating expenses.

i. Authorize the receiver to apply any profits from the property to the mortgage debt.

j. Set the receiver’s fee and authorize payment of it.

k. Authorize the receiver to accept or reject executory contracts.

l. Provide for the issuance of receiver certificates if needed.

m. Authorize the receiver to hire an attorney, an accountant, and / or a property management company.9

n. Authorize the receiver to evict tenants, bring suit against tenants, and the like.

o. Authorize the receiver to pay attorney fees, accountant fees, property management company fees, and usual and customary trade payables. (The order may also include appropriate constraints and review provisions governing these payments. The order may provide that the money to pay those professionals comes either from revenue generated by the property, or from loans from the plaintiff, or from the sale of receiver certificates.)

p. Enjoin interference with the receiver in the performance of his duties.

8 The "property" may simply be the real estate, but often also includes associated personalty. For example, in a receivership for a hotel, office building or shopping center, the "property" might well be defined to include the real estate, as well as all of the personalty associated with the particular development. The lender's UCC filings, and the boilerplate in the mortgage itself, often provide a detailed list of the lender's collateral, which in turn may well be a detailed list of the "property" covered by the receivership. 9 If the receiver hires a management company, attorney, accountant, etc., they are employed by the receiver, not by the lender.

{20021290;1}10 q. Authorize the receiver to hire any of the mortgagor’s employees necessary to operate the property.

r. Provide for the receiver to obtain his / her own liability insurance.

s. Allow the receiver to conduct repairs of the property and to complete any necessary construction.

t. Provide for the discharge of the bond, the discharge of the receiver, and the discharge of any surety at the appropriate time.

u. Allow the receiver to negotiate leases with tenants.

v. Allow the receiver to obtain appropriate environmental studies, surveys and inspections of the property.

w. Allow the receiver to negotiate with any necessary governmental entities.

x. Provide for powers as appropriate to preserve evidence, including electronic evidence.

y. Provide for the handling / forwarding of mail and packages addressed to individuals or entities other than the debtor. Allow the Receiver to open the debtor's mail, or provide a protocol for dealing with mail addressed to the debtor.

z. Additional items arising from the facts of the case.

Prior to the determination of the litigation on its merits, the receiver may not ordinarily apply profits from the property to pay the mortgage indebtedness. Turtle Lake Assoc., Ltd. v.

Third Fin. Serv., Inc., 518 So. 2d 959 (Fla. 1st DCA 1988). But see Westminster Found., Inc. v.

AmeriFirst Fed. Sav. & Loan Ass’n, 383 So. 2d 1147 (Fla. 4th DCA 1980).

The receiver’s costs are generally charged against the mortgaged property as an expense of foreclosure to be included in the final judgment. As such, those costs must be paid in order to redeem the property. Flagler Ctr. Bldg. Loan Corp. v. Chem. Realty Corp., 363 So. 2d 344 (Fla.

3d DCA 1978), rev. denied, 372 So. 2d 467 (Fla. 1979).

The bonds

{20021290;1}11 Although the trial court has some discretion in determining the size of the receiver's bond to be posted in connection with the appointment of a Receiver, the bond generally must be of a sufficiently high amount to protect the opposing party from loss should it ultimately be determined that the receivership was improvident. Comprop Inv. Properties, Ltd. v. First Tex.

Sav. Ass’n, 534 So. 2d 418 (Fla. 2d DCA 1988). In determining the amount of the receiver's bond, the court apparently must consider the fair market value of the property being placed in the receivership. Where the bond amount is substantially less than the fair market value of the real estate, the appointment of the Receiver may be attackable on appeal. Rescom Inv., Inc. v.

Strategic Consulting and Managing, Inc., 635 So. 2d 1061 (Fla. 2d DCA 1994); Cohen v. Rubin,

554 So. 2d 4 (Fla. 3d DCA 1989).

Although there is no reported case law approving the practice, in many instances the court appointing a receiver for an income-producing property will set the receiver's bond at some multiple (for example 1, 2 or 3 times) of the monthly gross cash-flow passing through the receivership. A bond of this size, coupled with a monthly reporting requirement, may provide the court with some comfort that any theft by a receiver will be detected before it exceeds the size of the bond.

Although it doesn't happen very often, a court has the authority to require the moving plaintiff to post a bond conditioned to pay damages if the appointment of the receiver proves to be wrongfully obtained.

It is also possible for the court to require the defendant to post a bond to prevent the immediate appointment of a receiver.

{20021290;1}12 It is error to discharge the receiver and to discharge the receiver's bond if there is pending litigation against the receiver at the time of the discharge. Dina’s Discount, Inc. v. U.S. Dev.

Corp., 658 So. 2d 564 (Fla. 3d DCA 1995).

Sales of property by receivers free and clear of liens

In Florida, it is often extremely difficult to obtain a court's permission to allow a receiver to sell real property free and clear of liens in lieu of a traditional mortgage foreclosure. And in those cases in which the court is willing to enter such an order, Florida's title companies are often unwilling to insure the title transferred by such a receiver sale.

The nature of foreclosures in Florida mitigates against sales by receivers free and clear of liens

Florida is what is sometimes referred to as a "lien theory" state with regard to mortgage law. In Florida, a lender has only a lien on the mortgaged property, with the owner / mortgagor / borrower holding genuine fee simple title to the property, subject only to the mortgagee's lien.

This "lien theory" of mortgage law contrasts with the "title theory" of mortgage law predominant in approximately 35 other states. In those states, the lender mortgagee has a genuine ownership interest of sorts in the real property.

In a "title theory" state, since the lender already has an ownership interest of sorts in the real property, our constitutional due process of law concepts are not ordinarily implicated in the foreclosure process. After all, the lender is simply taking something in which it already has an ownership interest.

By contrast, in a "lien theory" state, constitutional concepts of due process are very much in play in the foreclosure proceeding since the enforcement of the lender's mortgage necessarily results in the mortgagor's loss of his or her very real ownership rights in real property.

{20021290;1}13 Thus, in "title theory" states, Georgia and Texas for example, foreclosure proceedings are often non-judicial in nature – no need to have a court oversee a foreclosure if the lender isn't really taking anything that it doesn't already own after a fashion. But in "lien theory" states, like

Florida, foreclosure is often an entirely different story.

Florida law does not provide for any form of non-judicial foreclosure procedure. All mortgage foreclosures in Florida must be filed and prosecuted as civil law suits, usually in

Florida's Circuit Courts, which are the state trial courts with general jurisdiction in disputes where the amount in controversy exceeds $15,000.00. In general, a mortgage foreclosure suit is treated no differently than any other type of civil suit, and is subject to the same rules governing discovery, including depositions, motion practice, affirmative defenses, counterclaims, trial, and rights of appeal as any other civil action.

Thus, the primary problem with a Florida state court receiver sale free and clear of liens is that the concept begins to butt heads with the entire "lien theory" concept of Florida mortgage law, and begins to look more like a non-judicial foreclosure in a "title theory" state. This makes many Florida judges, and all of the Florida title insurance companies who have opined on the issue, very nervous.

The case law on sales by receiver free and clear of liens

Although there is much discussion among commentators in Florida suggesting that sales by state court receivers free and clear of liens is entirely permissible in Florida – e.g., Dervishi and Seward, Using Receiverships to Maximize the Value of Distressed Assets, THE FLORIDA BAR

JOURNAL, December 2009, at 9 – the case law cited in support of allowing the receiver to sell property free and clear of liens is generally in the context of a receivership of an business entity undergoing a judicial dissolution, as opposed to a receivership of land, or in the context of a

{20021290;1}14 bankruptcy, where Section 363 of the Bankruptcy Code specifically allows sales free and clear of liens, trumping state law to the contrary.

Those rare cases in which a sale of property by a receiver is specifically authorized,

Fugazy Travel Bureau, Inc. v. State, 188 So. 2d 842 (Fla. 4th DCA 1966) for example, typically recognize that a sale by a receiver is "ordinarily improper" – Fugazy at 844 - usually deal with sales of property by a receiver of an entity, as opposed to sales of property by a receiver of a piece of property, usually occur in the context of a business dissolution or dispute among partners in a partnership, are not approved if the sale price is for less than the property should be reasonably expected to sell for, and are usually allowed only "where the character of the property or the surrounding circumstances are such as to render a sale [by a receiver] necessary for the adequate protection of the rights of the parties." Fugazy at 844. Note that the court in Fugazy is speaking of the rights of all of the parties, not just those of the lender.

In Turk v. Barns, 264 So. 2d 875 (Fla. 3d DCA 1972), the court allowed a sale of real property by a receiver appointed with the consent of all parties. BUT, the receiver was appointed as receiver of a corporation in a corporate dissolution pursuant to Section 608.28, which was later subsumed into Sections 607.1430, 607.1431, and 607.1432, FLORIDA STATUTES (2012). A receiver in a statutory corporate dissolution is specifically permitted to sell corporate assets as part of the corporate dissolution process. §607.1432(3), FLA. STAT. (2012).

In Bailey v. Treasure, 462 So. 2d 537 (Fla. 4th DCA 1985), the court granted a petition for certiorari and quashed the lower court's orders permitting a sale of real property by a receiver. In that case, the receiver had been appointed as receiver of a partnership in a dispute among the partners. The Fourth District quashed the sale order because it found that the lower court had not had sufficient evidence of the reasonableness of the sale price. While the Fourth District's

{20021290;1}15 decision implicitly recognizes that the receiver sale in a partnership dispute context might have been appropriate had the requisite evidence been presented to the lower court, the decision did not arise in a foreclosure context, and did not in any way indicate that the receiver's sale would have been free and clear of liens.

In a mortgage foreclosure context, there is no reported Florida case law allowing a challenged receiver sale free and clear of liens to stand. For example, in Interdevco, Inc. v.

Brickellbanc Sav. Ass'n, 524 So. 2d 1087 (Fla. 3d DCA 1988), the Third District Court of Appeal refused to allow the receiver in a foreclosure action to sell the subject commercial-residential building, although the court did permit the receiver to complete the construction of the property during the pendency of the foreclosure.

In Shubh Hotels Boca, LLC v. Federal Deposit Insurance Corporation, 46 So. 3d 163,

(Fla. 4th DCA 2010). In that case, the lower court in a mortgage foreclosure action had entered an order permitting a receiver to sell the subject real property, a hotel. The owner objected, and appealed. The Fourth District Court of Appeal reversed the trial court's order permitting the receiver to sell the property.

In making its ruling, the Fourth District expressly noted that, "… the general Florida rule is that the mere appointment of a receiver does not itself confer any of the owner's power or authority to sell such property." - citing Epps v. Dade Development Inc. of Miami, 170 So. 875

(Fla. 1936) – and further noted, "Also, the general Florida rule is that the role of a receiver in a foreclosure action is only to preserve the property's value." – citing Cone-Otwell-Wilson Corp. v.

Commodore's Point Term. Co., 114 So. 232 (Fla. 1927) and Alafaya Square Ass'n Ltd. v. Great

Western Bank, 700 So. 2d 38 (Fla. 5th DCA 1997).

{20021290;1}16 The Fourth District did, however, leave some sliver of hope for mortgage lenders.

Specifically, the appellate court implied that had the mortgage itself contained language, which it did not, giving a receiver a power to sell the property before entry of the foreclosure judgment, that might have been properly considered by the lower court.10 However, having dangled this fruit before the hungry mortgage lenders of the world, the Fourth District then went on note that every mortgagor in Florida has a statutory right of redemption.11 Having noted this right of redemption, the Fourth District concluded its holding by noting that, "Recognizing a general interim power of a receiver to sell mortgaged property in a foreclosure sale would contravene these statutory rights and principles."

In MB Plaza, LLC v. Wells Fargo Bank, National Association, 72 So. 3d 205 (Fla. 2d

DCA 2011), the Court addressed in its footnote 1 a provision in the lower court order authorizing a sale of the mortgaged property by the receiver, cited Shubh, and noted, "Although there may be instances in which the parties to a foreclosure could agree that a sale by receiver would be appropriate, a sale by a receiver is ordinarily improper and, even if authorized, should be carefully watched by the court." (Emphasis added.)

This latter language would appear to provide little comfort to a foreclosing lender in

Florida looking to convey insurable title through a receiver sale free and clear of liens. The reason for this lack of comfort is that even if a lender's counsel is able, as is sometimes the case, to obtain an order from a trial court allowing a sale of real property via a receiver, in lieu of a

10 However, even here, the Fourth District did not address whether a sale of property by such a contractually authorized receiver would be free and clear of liens. 11 In Florida, pursuant to common law and pursuant to Section 45.0315, FLORIDA STATUTES (2012), a mortgagor, and any other defendant to the foreclosure action, including junior lienholders and tenants, has the absolute right to pay the lender 100% of what the lender is owed, and thereby be subrogated to the lender's position in the foreclosure, even if the property is worth far more than the lender is owed. See Morris v. Osteen, 948 So. 2d 821 (Fla. 5th DCA 2007). By statute, the right of redemption typically expires upon the Clerk of Court's issuance of a Certificate of Sale, which is a document typically issued by the Clerk shortly after the judicial foreclosure sale, sometimes within an hour or so of the sale.

{20021290;1}17 judicial foreclosure sale, Florida's title insurance industry has exhibited a remarkable

unwillingness to insure titles obtained via any such receiver sales.

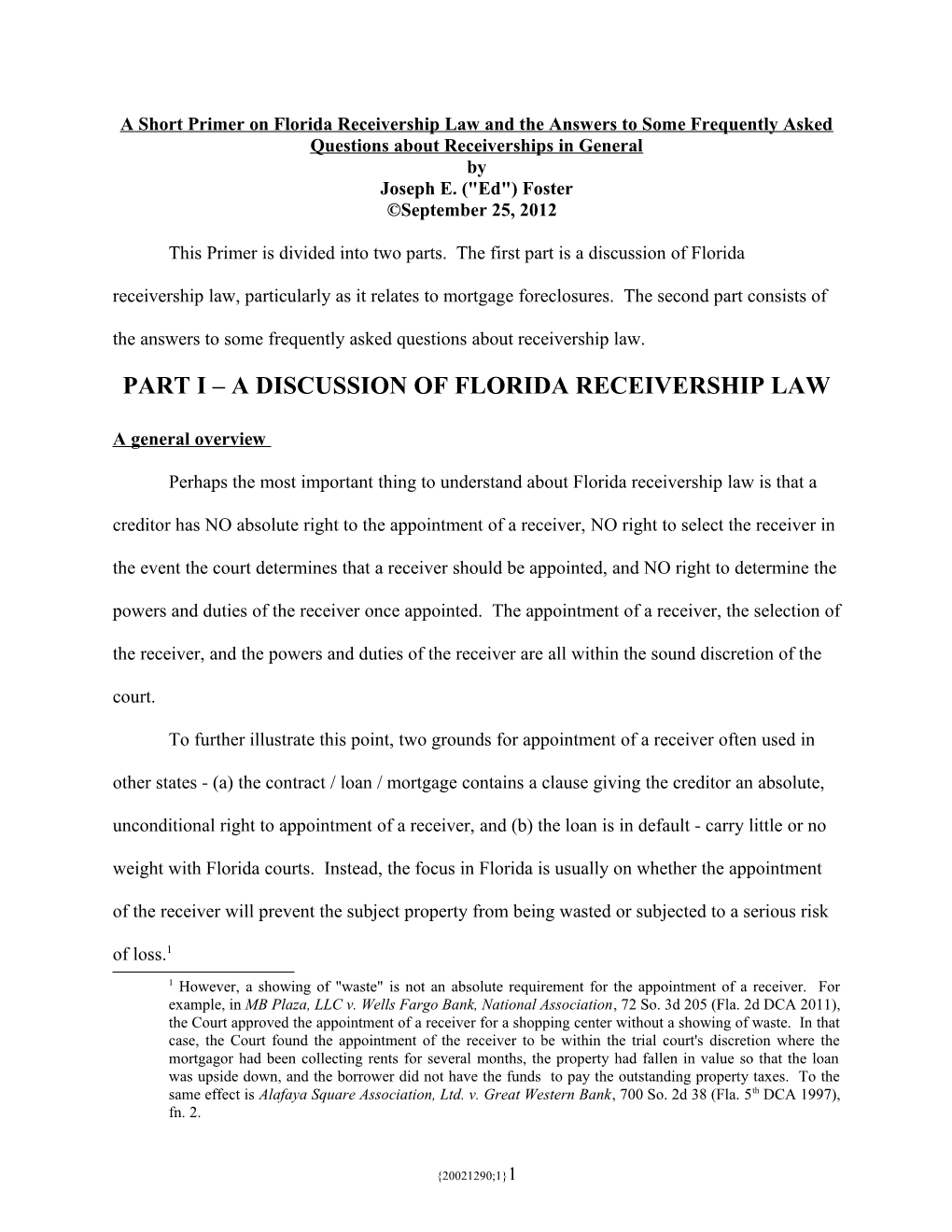

As of this writing, below is a synopsis of the positions of the various title insurance

companies noted with regard to their requirements for insuring a sale of real property by a

receiver in lieu of a foreclosure.

TITLE COMPANY POSITION ON INSURING TITLE OBTAINED VIA RECEIVER SALES Attorneys' Title Fund Services, LLC No bulletins issued since before November 12, 2010, but private communication as of that date indicates that The Fund will take the same position as Commonwealth and Lawyers Title, whose positions are stated below. Further, in private communication, The Fund takes the position as of November 12, 2010 that the Fourth District's decision in Shubh Hotels Boca, LLC v. Federal Deposit Insurance Corporation, 46 So. 3d 163, (Fla. 4th DCA 2010), affirmatively stands for the proposition that a receiver appointed in a foreclosure cannot sell real property and deny the owner and lienholders their rights of redemption. Chicago Title Insurance Company Excerpts from Title Bulletin No. 2009-33, dated December 30, 2009: - "After reviewing Florida law, the Company has not been able to find any legal authority that would authorize the Circuit Court to vest title to real property in a Receiver in a mortgage foreclosure action. In addition, the Company could not find law that would support the authority of the Circuit Court to order a sale by the Receiver free of junior liens, if any, that would be extinguished or foreclosed in the mortgage foreclosure had the action been completed through the issuance of the Certificate of Title."12 - "… the position of the Company is that, to insure title conveyed by a court-appointed Receiver in a mortgage foreclosure action, the Company will require either a deed of conveyance (e.g., a quit claim deed) from the Owner of property to the court-appointed Receiver, or an Agreed Order approving the sale and conveyance by

12 In Florida, the Clerk of the Court issues to the winning bidder at a judicial foreclosure sale, or its assignee, a Certificate of Title, which is the operative deed instrument conveying title to the purchaser at the foreclosure sale, or its assignee.

{20021290;1}18 the court-appointed Receiver signed by the owner with the formalities of a deed (witnessed by two witnesses and acknowledged). The Agreed Order must contain words of conveyance in favor of the Receiver, so that we could rely on the Order as the title transfer to the Receiver. As an alternative to the above, the Company would consider relying on a Power of Attorney from the Owner of the property authorizing the court-appointed Receiver to convey the property to the Insured as attorney in fact. The Power of Attorney would have to be witnessed by two subscribing witnesses and acknowledged. The form of the Power of Attorney must be approved by the underwriter."

The subject Bulletin also states that Chicago Title will require satisfaction of the Mortgage, the dismissal of the foreclosure action with prejudice, the discharge of any notice of lis pendens filed against the property in the foreclosure action, and a payoff letter from the lender – in a form similar to the one obtained for a short sale.

Note that the Bulletin does NOT say that the title conveyed pursuant to the Agreed Order would be free and clear of junior liens – especially if the junior lienholders are objecting to the entry of the Agreed Order. Commonwealth Land Title Excerpts from Bulletin No. FL 146, dated January 14, Insurance Company 2010: - "After reviewing Florida law, the Company has not found any legal authority that would authorize the Circuit Court to vest title to real property in a Receiver. In addition, the Company could not find any law that would support the authority of the Circuit Court to order a sale by the Receiver free of the junior liens, if any, that would be extinguished or foreclosed in the mortgage foreclosure had the action been completed through the issuance of a Certificate of Title." - "For the Company to insure title conveyed by a Receiver, regardless of whether the appointment occurs within a mortgage foreclosure action or a separate action, the Company will require either: 1. a deed of conveyance from the owner of property to the Receiver, or 2. an Order agreed to by all parties to the foreclosure approving the sale and conveyance by the Receiver (“Agreed Order”).

{20021290;1}19 For the Company to rely on an Agreed Order to transfer title to the Receiver, the Agreed Order will need to be signed by the owner with the formalities of a deed (executed by two witnesses and acknowledged) and must contain words of conveyance in favor of the Receiver.

Use of Power of Attorney

As an alternative to the above, the Company would consider relying on a power of attorney from the owner of the property authorizing the Receiver to convey the property to the insured as an attorney-in-fact. The power of attorney would have to be executed with the same formalities as a deed, namely: witnessed by two subscribing witnesses and acknowledged. The form of the power of attorney must also be approved by the Company."

The subject Bulletin also states that Commonwealth will require satisfaction of the Mortgage, the dismissal of the foreclosure action with prejudice, the discharge of any notice of lis pendens filed against the property in the foreclosure action, and a payoff letter from the lender – in a form similar to the one obtained for a short sale.

Commonwealth's Bulletin further says that they will also require that any and all junior lienholders will need to be released or satisfied of record. Fidelity National Title Insurance Excerpts from Underwriting Bulletin No. 01/01/2010.1, Company dated January 6, 2010: - "After reviewing Florida law, the Company has not been able to find any legal authority that would authorize the Circuit Court to vest title to real property in a Receiver in a mortgage foreclosure action. In addition, the Company could not find law that would support the authority of the Circuit Court to order a sale by the Receiver free of the junior liens, if any, that would be extinguished or foreclosed in the mortgage foreclosure had the action been completed through the issuance of a Certificate of Title." - "Please be advised that the position of the Company is that, to insure title conveyed by a court- appointed Receiver in a mortgage foreclosure action, the Company will require either a deed of conveyance (e.g., a quit claim deed) from the Owner of property to the court-

{20021290;1}20 appointed Receiver, or an Agreed Order approving the sale and conveyance by the court-appointed Receiver signed by the owner with the formalities of a deed (witnessed by two witnesses and acknowledged). The Agreed Order must contain words of conveyance in favor of the Receiver, so that we could rely on the Order as the title transfer to the Receiver. As an alternative to the above, the Company would consider relying on a Power of Attorney from the Owner of the property authorizing the court-appointed Receiver to convey the property to the Insured as attorney in fact. The Power of Attorney would have to be witnessed by two subscribing witnesses and acknowledged. The form of the Power of Attorney must be approved by an underwriter. In order to rely on the Power of Attorney and a deed of conveyance from the Receiver as attorney in fact, the Company would also require the satisfaction of the Mortgage that is the subject matter of the foreclosure suit (or the Final Judgment if the action has proceeded through Final Judgment), the dismissal of the foreclosure case (or, at a minimum, the foreclosure count in the Complaint) with prejudice and the discharge of any notice of lis pendens that may have been filed against the property in the foreclosure suit. A pay-off letter must be obtained from the foreclosing lender. Since it is likely the sales price of the property will be less than the amount of indebtedness owed to the foreclosing lender, the pay-off letter should be in a form similar to one obtained for a short sale."

As with the Chicago Title Bulletin above, Fidelity National Title's Bulletin does NOT say that the title conveyed pursuant to the Agreed Order would be free and clear of junior liens – especially if the junior lienholders are objecting to the entry of the Agreed Order. First American Title Insurance As of December 2010, First American has issued a Company written protocol. It is not Florida-specific. It states:

"We ask that the court apply a two-step process: 1) a final Court order appointing a receiver to evaluate whether a private sale, as opposed to a public sale pursuant to the ordinary foreclosure process, is in the best interest of the parties and, if so, authorizing the marketing of the property in a commercially reasonable manner, and 2) the Court’s final order confirming a sale pursuant to a

{20021290;1}21 contract executed by the receiver. The following elements of both the motions for the orders and the orders that we require are listed below.

Jurisdiction

The receiver must be appointed in a judicial action to foreclose the lender’s mortgage. In a state where the usual method of foreclosure is non-judicial, a judicial action to foreclose will still have to be filed.

The Court must have jurisdiction over the borrower/mortgagor/owner and the holders of all subordinate liens and interests (tenants need not be joined, if an exception for their rights will appear in the policy), unless it is the intent of the plaintiff to pay off and discharge the subordinate liens and interests

Motion for Order Appointing the Receiver:

Regardless of whether a defendant is in default in the action, notice of this Motion, consistent with the otherwise applicable procedural rules, should be given.

The Motion for the Order Appointing the Receiver must ask the Court to authorize the Receiver to:

investigate and evaluate whether the best interests of the parties are served through a public sale pursuant to the applicable foreclosure statutes and rules or through a private sale.

engage appraisers, real estate brokers, professional property management companies, and other support professionals in order to conduct the investigation and make the evaluation and to manage and operate the property on a day-to-day basis.

if the Receiver determines that the best interests of the parties are served though private sale, market the property in a commercially reasonable manner and negotiate and execute a

{20021290;1}22 contract to sell the property; subject to further Order of the Court confirming the sale and authorizing delivery of a conveyance deed.

The Motion must also

request that the Court rule that the mortgagor is in default of the mortgagor’s obligations under the note and/or loan agreement and the mortgage and that the plaintiff is entitled to a judgment of foreclosure (without actually ordering a sale).

set forth the amount of principal, interest, costs and fees due, and further interest to accrue. This must be supported by evidence in the form of an affidavit from an appropriate officer of the plaintiff.

request that the Court provide for a redemption period for the borrower which must be no less than the time for a redemption under the usual foreclosure process and request that the Court state the amount necessary to redeem.

If there are subordinate liens and the property is to be sold free and clear of those liens without payment and discharge, the Court must provide for a redemption period for the holders of such liens, which must be no less than the time for a redemption under the usual foreclosure process and the Order state the amount necessary to redeem.

Order Appointing Receiver

Must state that all defendants received notice of the Motion.

Must find that the borrower is in default of its obligations under the mortgage and the lender is entitled to a Final Judgment and Decree of Foreclosure.

Must specifically grant the relief requested in the Motion.

{20021290;1}23 Must state that the Receiver is not connected with the plaintiff, either through blood, marriage or any employment or ownership interest.

describe how the receiver is to be compensated.

establish receiver reporting responsibilities.

Set the amount of a bond that the Receiver must post.

Contain a description of the receivership property.

Motion for Order Confirming Sale by Receiver

Regardless of whether a defendant is in default in the action, notice of this Motion, consistent with the otherwise applicable procedural rules, should be given. The Motion must allege the following statements of fact and must be supported by an affidavit of the Receiver and, where applicable, an authorized representative of the mortgagee:

All defendants received notice of the Motion.

The sale is in the best interest of the parties.

The property was marketed in a commercially reasonable manner.

A private sale will realize more than a public sale.

The purchaser is not related to the plaintiff by blood, marriage, or any employment or ownership interest.

The borrower has consented to the sale, or the borrower has been provided an adequate redemptive period and the borrower’s right of redemption is foreclosed (or has been waived, if permissible under applicable state law).

The plaintiff will suffer irreparable harm by

{20021290;1}24 incurring the delay inherent in a public sale (e.g., loan is non-recourse, subject property is the sole asset of the borrower and the amount due exceeds the value of the property).

Whether the sale is to be subject to the plaintiff’s mortgage.

If there are contested liens, provide that the property is to be sold free and clear of such liens, which will attach to the sale proceeds. The proceeds will be held in escrow by a specifically designated person or entity and the priority of such liens will be determined by further order of the Court.

Order Confirming Sale by Receiver

The statements of fact in the Motion must be included in the Order as findings of the Court. If the Order provides that the sale will be subject to the foreclosing lender’s mortgage, the borrower must be released from its obligation or his obligation must be reduced by the net proceeds of the sale.

The Order Authorizing the Receiver to Sell must direct the Receiver to convey pursuant to a specific contract with all material terms of sale, including parties, sale price, disposition of liens (including the foreclosing lender’s lien) and closing date. It must state that, upon delivery of the deed, the sale will stand as final and confirmed.

The Order must state that it is a final order and shall not be stayed unless (a) a timely motion for rehearing or a timely appeal as of right is filed and (b) the Court issues a stay within such period upon the posting of a bond in the amount of the purchase price and upon such other conditions as are deemed appropriate by the Court.

Any objection must be heard and overruled and there must be no stay. The appeal period must expire without a

{20021290;1}25 Notice of Appeal having been filed."

Despite this written protocol, First American's Florida underwriting counsel continued to advise as recently as January 14, 2011 that it would not abide by the protocol in some respects, and that it preferred to underwrite on a case by case basis. At a minimum it wanted the owner to consent or stipulate to the order appointing the receiver which order should confer the express power to convey the property. Any conditions set out in the order should be examined and satisfaction of those conditions proven. First American further indicated privately that it was "pretty adamant" that the court had no authority to order a receiver sale free and clear of liens, and that it would not abide by any provision in the protocol to the contrary. Thus, First American would require releases from or payment to the junior lienholders. Lawyers Title Insurance Same position as Commonwealth Land Title above. The Corporation two companies are affiliated.

Excerpts from Bulletin No. FL 146, dated January 14, 2010: - "After reviewing Florida law, the Company has not found any legal authority that would authorize the Circuit Court to vest title to real property in a Receiver. In addition, the Company could not find any law that would support the authority of the Circuit Court to order a sale by the Receiver free of the junior liens, if any, that would be extinguished or foreclosed in the mortgage foreclosure had the action been completed through the issuance of a Certificate of Title." - "For the Company to insure title conveyed by a Receiver, regardless of whether the appointment occurs within a mortgage foreclosure action or a separate action, the Company will require either: 1. a deed of conveyance from the owner of property to the Receiver, or 2. an Order agreed to by all parties to the foreclosure approving the sale and conveyance by the Receiver (“Agreed Order”).

For the Company to rely on an Agreed Order to transfer title to the Receiver, the Agreed Order will need to be signed by the owner with the formalities of a deed (executed by two witnesses and acknowledged) and must

{20021290;1}26 contain words of conveyance in favor of the Receiver.

Use of Power of Attorney

As an alternative to the above, the Company would consider relying on a power of attorney from the owner of the property authorizing the Receiver to convey the property to the insured as an attorney-in-fact. The power of attorney would have to be executed with the same formalities as a deed, namely: witnessed by two subscribing witnesses and acknowledged. The form of the power of attorney must also be approved by the Company."

The subject Bulletin also states that Commonwealth / Lawyer's Title will require satisfaction of the Mortgage, the dismissal of the foreclosure action with prejudice, the discharge of any notice of lis pendens filed against the property in the foreclosure action, and a payoff letter from the lender – in a form similar to the one obtained for a short sale.

Commonwealth's / Lawyers Title's Bulletin further says that they will also require that any and all junior lienholders will need to be released or satisfied of record. Old Republic Title Insurance From private communication with Old Republic Title Company dated January 22, 2010:

Old Republic will insure title out of the receiver provided the following requirements are met (in addition to any and all other requirements in the commitment):

The property must be included in the Order Appointing Receiver Every owner, and if the property is to be sold free and clear of liens, every lien holder, must be properly served or noticed with the motion to approve the sale of the properties. If the property is not going to be sold free and clear of liens, certificates transferring the liens to other security must be recorded by the clerk prior to closing The Order authorizing the sale of the property by the Receiver must include the following:

1. That all of the necessary parties have been

{20021290;1}27 properly served or noticed. 2. That the sales of the property are necessary to prevent waste and to protect the interests of the parties. 3. If the property is to be sold free and clear of liens, that the liens attach to the proceeds. 4. That the court has determined that the prices for which the properties are being sold are reasonable and that they are being sold in an arms' length transaction. 5. That the Receiver has the authority to convey the property and execute deeds. 6. That the proceeds are to be disbursed to the Receiver or to the court.

Note that the appeal period will not be waived.

Also, you will need to update as close to the closing as possible to insure that no suggestion of bankruptcy has been recorded.

The author has been successful in obtaining title insurance in a receiver sale / foreclosure context on the following facts:

1) The foreclosure suit was prosecuted through entry of a final judgment of foreclosure.

2) An order was entered by the Court authorizing the receiver to conduct the foreclosure sale instead of the Clerk of the Court.13 The order allowed the receiver to sell the subject real property, free and clear of liens, by either public or private sale. The borrower agreed to the entry of the receiver sale order, probably rightly anticipating that a private sale by receiver, perhaps negotiated over a period of a few months, might well maximize the selling price for the property.

13 Section 45.031, FLORIDA STATUTES (2012) is Florida's judicial sale statute, pursuant to which the vast majority of foreclosure sales are conducted in Florida. The statute provides a judicial sale procedure, including advertising requirements, sale deposit and bidding requirements, provisions for certification of the sale, for issuance of a certificate of title, for filing and hearing objections to the sale, and for automatic sale confirmation. The statute has been in existence for more than forty (40) years, and is well-known and liked by Florida's judiciary and by the title insurance industry. However, the statute itself provides in its opening sentence, "In any sale of real or personal property under an order or judgment, the procedures provided in this section and ss.45.0315-45.035 may be followed as an alternative to any other sale procedure if so ordered by the court." Since Section 45.0315 deals with rights of redemption, and Sections 45.032-45.035 deal with the Clerk's fees and the handling of surplus foreclosure sale proceeds, the bolded language above provides a court with the discretion to craft an alternative procedure for the sale of real or personal property pursuant to an order or judgment.

{20021290;1}28 3) The sale order provided for advertising of any public sale, advance notice of any private sale, bidding on credit by the plaintiff at any public sale, rights of first refusal by the lender and defendants in connection with any private sale, the exercise of rights of redemption by all defendants, the making and disposition of objections to the sale, the confirmation of the sale, the handling of excess sale proceeds, the payment of a sale fee – in short all of the things that are normally dealt with automatically by Sections 45.031 through 45.035.

The borrower had not objected to the alternative sale procedure, but even had the borrower objected, plaintiff would have argued to the title insurer, hopefully successfully, that the sale procedure in the order was authorized by Florida law in that it was an alternative sale procedure as contemplated by Section 45.031.

The possibility of a quasi-receiver

I have had some success here in Florida in having courts appoint what I call a "receiver- light." A "receiver-light" is a property management company, sometimes the very one already employed by the borrower, ordered by the Court to manage and maintain the property, collect the revenue, provide regular accountings to the Court and the parties, pay the bills, etc.

The idea behind a "receiver-light" is that it gives the lender many of the same protections and advantages as a receiver, and subjects the property management company to the control and contempt power of the Court, while at the same time being more palatable to the borrower since the "receiver-light" may well be the same property management company already employed by the borrower. Further, a "receiver-light" appointment probably entitles the borrower to truthfully represent to third parties that the property is not in receivership, which may aid the borrower in finding buyers or alternative lenders.

{20021290;1}29 There is no Florida case law specifically recognizing the right of a court to appoint a

"receiver-light." Despite the lack of authority, I've argued successfully to a number of courts that the appointment should be within the court's inherent power, especially since the court has the discretion to take much more draconian action, the appointment of a receiver – with the concomitant loss of possession by the borrower. (I.e. if the court can take away possession of the property from the borrower via appointment of a receiver, why can't the court take a much less invasive step and allow the borrower's own property management company to remain in place, but subject to the court's order?) Faced with a motion for appointment of a receiver, a court and a borrower offered this less drastic alternative often seize on it, even absent case law authority for the concept.

And now, I've found an old case that, while not specifically addressing the court's power to appoint a "receiver-light," does appear to recognize the concept to some extent.

In Orlando Hyatt Associates, Ltd. v. FDIC, 629 So. 2d 975 (Fla. 5th DCA 1993), the Court notes that the borrower's stipulation that the management company deposit hotel revenues into an escrow account, use some money to manage the hotel property, and disburse the remainder to the lender, "indicates that the court intended to use the management company as a quasi-receiver."

[Emphasis added.]

This case should provide support for the proposition that a court can indeed appoint a quasi-receiver, such as a management company, in lieu of a formal receivership.

PART II – FREQUENTLY ASKED QUESTIONS ABOUT RECEIVERSHIPS IN GENERAL

The following are the answers to some frequently asked questions about

receiverships. The discussion below is not specific to any one state, but explains the

{20021290;1}30 typical practice of appointment, qualification, and operation of receiverships by the

courts.

I. How is a receiver appointed?

In general, a receiver is appointed by the court, either in response to an application for a receivership by a party with an interest in property or, in rarer cases, by the court's own motion.

A receiver may be appointed at any time during the litigation, even while a plea or trial is pending or after a judgment has been entered. Receivers can also be appointed by a government official who possesses the right of appointment, or they can be provided for by a contract in the event of certain circumstances occurring. The authority to appoint a receiver is granted by statute in some jurisdictions.

Some states, such as Florida, require that a party who moves for appointment of a receiver must show that they have title to or a lien on the property in question, and that a receiver is necessary to preserve the property. It can also be required that the defendant be permitted to be heard by the court before the appointment is made, unless the necessity is very stringent.

Many states require that notice be given to all parties prior to the appointment of a receiver, although the court usually has discretion to waive notice if extraordinary or emergency circumstances exist.

A receiver will generally not be appointed, however, where every purpose of the receivership can be effectively accomplished—namely the maintenance and protection of the property in question

—and the rights of the parties protected, by a bond furnished by the adverse party.

The party applying for the appointment of a receiver carries a burden of proof: the party must show by clear and convincing evidence the "necessity and propriety" of appointing a receiver, including a showing of some danger that the property in question will be lost or injured in some fashion without a receiver.

{20021290;1}31 II. What are a receiver's qualifications?

A receiver should be "impartial and disinterested," so that his or her personal interests do not conflict with unbiased judgment and duties as a receiver. Ordinarily, therefore, the receiver will not be a party to the case. Some states have statutes that control the prerequisite qualifications of a receiver, or in other instances, list specific disqualifications of certain individuals from appointment as receivers.

A receiver is considered an officer of the court, and although he or she "stands in the position of a representative and protector of the interests of creditors, shareholders, and depositors in the property in receivership," he or she is not an agent or fiduciary exclusive to either party. He or she must be a neutral, acting in good faith to and for the benefit of all parties interested in the property.

As a practical matter, this requirement of receiver neutrality should militate against the receiver later being retained as a broker or agent for the sale or management of the property after the lender acquires the property through foreclosure. Such action might subject both the lender and the receiver to claims arising from the receiver's violation of the neutrality requirement.

III. What type of bond must be posted by the receiver?

Generally, a receiver's bond is required, and in some states it is a condition precedent on the receiver's appointment. The purpose of the bond is generally understood to be to insure the receiver's obligations and to secure payment of any costs or damages that might result from the appointment. The amount of the bond is required to be sufficient to protect an opposing party from any losses sustained if the appointment of the receiver is ultimately shown to have been detrimental to the property.

In Florida, the moving party may be required to furnish a bond in favor of the party whose property is placed in receivership, conditioned to pay all costs and damages that might be

{20021290;1}32 sustained if the receiver's appointment proves wrongful. The receiver must furnish a bond himself, conditioned for faithful performance of his duties, in favor of the State.

IV. What are the receiver's powers and duties?

In some states, the receiver's powers exist pursuant to that state's rules of civil procedure, while other states have specific statutes on receivers' rights and obligations. In still other states, the receiver and his or her duties are entirely creatures of the court.

Generally, the powers of a receiver are not fixed solely by law. The court's "order of appointment" for the receiver often sets out the majority of the receiver's powers, although in some states the court may give other orders that further define the powers' scope. Also, although the receiver's powers do not extend beyond the authority granted to the receiver by the court, it is often implied that the receiver possesses the implied authority necessary to implement the court's orders.

The "basic purpose" of a receivership is the conservation of property pending a decision by the court regarding that property (usually an ultimate disposition). The receiver must exercise

"ordinary care and prudence" in handling the property or assets in his or her custody—the same care and diligence that an ordinary prudent person would exercise in managing their own property or assets. If the receiver is uncertain how to preserve the property, he or she should petition the court for instructions.

The receiver of real property "stands in the shoes of the owner," and must keep the property in the same manner of repair that he or she received it. This includes incurring reasonable expenses to maintain the property, and a receiver may be liable in his or her official capacity for failing to exercise ordinary care. Ordinary care must be exercised by a receiver in depositing assets in a bank as well.

{20021290;1}33 A receiver generally has no authority to borrow or lend money unless specifically authorized by the court who appointed him or her. The court has the power to authorize the receiver to pledge the assets or property as collateral for the loan, conditioned on precedents such as notice to the parties with an interest in the property, depending on the state. A petition to the court is also required for the receiver to abandon title of a worthless asset, in which case the asset's title reverts back to the debtor. The receiver can, however, usually incur essential expenses without specific direction from the court.

Duties of a receiver also include collecting and receiving assets or rents of the property, and in some cases, maintaining legal collection proceedings. Some state statutes dealing with receiverships specifically authorize the receiver to collect and sell debts or claims, although he or she is generally not required by law to sue tenants if the condition of the property when it came into his or her hands was not habitable or substantially violated codes. A receiver may be directed by the court to institute suit on an existing claim, and some states will allow the receiver to compromise claims of the debtor against third persons. Other state courts have specifically found that the receiver has no power to make a binding compromise of a claim without approval of the court in advance.

The receiver may be appointed to operate an ongoing business or complete the affairs of a going corporation. Generally, courts are more cautious about appointing this "operating receivership" than a receivership that merely takes charge of property and collects rents, as the receiver operating a business must necessarily have broader powers. In these cases, all possession and control of the business is transferred from the owner of the business to the receiver, who becomes responsible for its continued management. If the business is insolvent and/or at a continuing loss, the general rule is that the receiver should discontinue it, unless the expenses of

{20021290;1}34 the business are guaranteed. In this instance, the receiver should report the continuing loss or insolvency to the court for instructions.

On the whole, the general rule is that the receiver may take any actions necessary for the preservation or benefit of the property, and whether the action requires prior court approval depends upon the extent or long-term impact of the action upon the property.

V. Does a receiver have the power to liquidate the property?

In some states, a court can order its receiver to make a sale or disposition

of the property, for the purpose of paying creditors, liquidation, or ending a long-

term receivership whose principal asset is real estate. But in Florida, state courts

are often reluctant to allow receivers to liquidate property free and clear of liens.

In those states which allow receivers to sell property free and clear of

liens, there must be a petition stating a case to the court. A judgment is not

necessary before the receiver's sale can be decreed, but an order or some other

action from the court authorizing the sale is required, preferably stating the time

and place for bids.

The sale may be of real and personal property, but the receiver has no authority to sell real estate except upon the court's order, and then only as the court directs. The receiver of an insolvent corporation may be authorized by the court to sell the corporation's right to redeem, or the receiver of a leasehold may be directed to sell the option to purchase the property, even notwithstanding a lease provision which prohibits assignment.

A receiver's sale is a judicial sale, since the receiver is acting as an agent of the court, and the property in his or her hands is actually under the control and supervision of the court. The statutory provisions governing mortgage disclosures or sales on execution do not apply to a receiver's sale.

{20021290;1}35 The court has a number of options in directing the receiver to sell the property: publicly, at a private sale, by accepting an offer made directly to the court, or by ratifying a sale already made.

The manner of sale depends on what the court deems expedient for the welfare of the parties and the property. A mortgagor is not deprived of his or her rights under laws relating to judicial sales if the receiver is authorized by the court to dispose of the property at a private sale after advertising and filing of bids, so long as full consideration is given by the court to questions of necessity and the time, place, and manner of the sale, if the mortgagor cannot show that an injustice has been done.

If the state has no statute governing what type of notice will be given for the sale, the court may direct the receiver as to what notice to give. Failure to give the notice required by the court or the law will ordinarily render the sale invalid.

A receiver has an affirmative duty to obtain the largest amount possible from the sale, as does the court in confirming a proposed sale. The trial judge has discretion on whether to hold a hearing to set a minimum price, as well as discretion whether to order the sale for cash or for credit (or for a combination of cash and credit).

Because a receiver's sale of property is effectively made by the court, the court's confirmation is required for the sale to be valid, and the creditor acquires no rights until the sale is confirmed.

The court has discretion to confirm or refuse to confirm, or to set an additional condition that the prospective purchaser must meet before the sale can be confirmed, including an increased bid.

The court may exercise independent judgment in these decisions, and is not confined to weighing evidence produced by the interested parties.

If a protest is filed against the sale, the court must generally grant a hearing before confirming the sale. Mere inadequacy of the price is usually not a ground for objection to the sale's

{20021290;1}36 confirmation, unless the price is so inadequate as to "shock the conscience." After confirmation, a sale will rarely be set aside except for grounds such as fraud or mistake.

If the purchaser fails to make payment in complete accordance with the terms of the sale, the receiver normally has the right to demand or accept payment later, if the rights of other parties are not injured by the delay.

Proceeds of the sale are subject to disposition as decreed by the court. If the property is sold free of liens, any liens attach to the proceeds. The trial court may direct the payment of proceeds to the mortgagee who holds the first lien. A landlord's lien for rent on a tenant's merchandise or fixtures does not attach to the proceeds of a receiver's sale, even though the purchaser removed the merchandise or fixtures from the premises.

If the purchaser refuses to pay the agreed-upon price, the receiver must report the default to the court, who in turn may order the purchaser to complete payment, hold him or her in contempt, or order a resale, charging the original purchaser with any deficiency in the original sale price that arises. A bidder in a receiver's sale submits to the jurisdiction of the court for enforcement, and specific performance may be ordered even if the notice of the sale provides for liquidated damages.

The fees and expenses of the receiver in administering the property may be charged against the owner of the property or the proceeds of the sale. The court in granting leave for the receiver to sell can fix their compensation at the amount allowed by law for a master in a foreclosure sale.

In Florida, a party seeking to obtain leave of court for a receiver to sell property

free and clear of liens should consult with a title insurance company regarding

the terms and logistics of any such sale to insure that the title obtained through the

sale procedure will be insurable.

{20021290;1}37 {20021290;1}38