W-2 Facts / Explanation

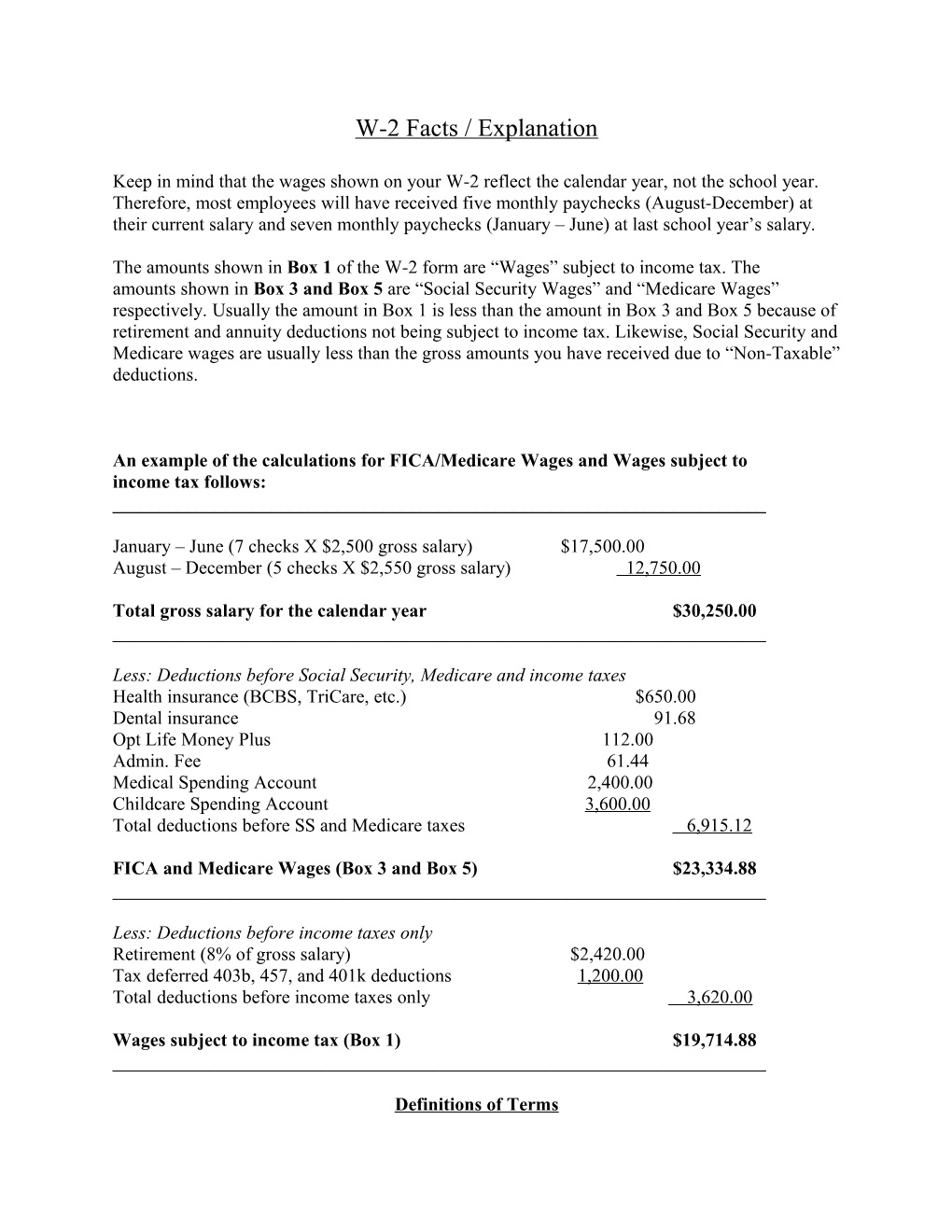

Keep in mind that the wages shown on your W-2 reflect the calendar year, not the school year. Therefore, most employees will have received five monthly paychecks (August-December) at their current salary and seven monthly paychecks (January – June) at last school year’s salary.

The amounts shown in Box 1 of the W-2 form are “Wages” subject to income tax. The amounts shown in Box 3 and Box 5 are “Social Security Wages” and “Medicare Wages” respectively. Usually the amount in Box 1 is less than the amount in Box 3 and Box 5 because of retirement and annuity deductions not being subject to income tax. Likewise, Social Security and Medicare wages are usually less than the gross amounts you have received due to “Non-Taxable” deductions.

An example of the calculations for FICA/Medicare Wages and Wages subject to income tax follows: ______

January – June (7 checks X $2,500 gross salary) $17,500.00 August – December (5 checks X $2,550 gross salary) 12,750.00

Total gross salary for the calendar year $30,250.00 ______

Less: Deductions before Social Security, Medicare and income taxes Health insurance (BCBS, TriCare, etc.) $650.00 Dental insurance 91.68 Opt Life Money Plus 112.00 Admin. Fee 61.44 Medical Spending Account 2,400.00 Childcare Spending Account 3,600.00 Total deductions before SS and Medicare taxes 6,915.12

FICA and Medicare Wages (Box 3 and Box 5) $23,334.88 ______

Less: Deductions before income taxes only Retirement (8% of gross salary) $2,420.00 Tax deferred 403b, 457, and 401k deductions 1,200.00 Total deductions before income taxes only 3,620.00

Wages subject to income tax (Box 1) $19,714.88 ______

Definitions of Terms Gross Wages: Actual wages received during the calendar year before any deductions are withheld. This amount does not appear on your W-2.

Taxable Wages: That portion of your pay that is subject to taxes. Some “Non-Taxable” deductions are taken out of your wages before payroll taxes are applied.

Non-Taxable Deductions: Below is a list of non-taxable deductions. Health, dental and vision insurance premiums Retirement contributions 401k, 457, 403b and other annunity contributions Dependent care, medical spending and health savings accounts Optional Life Money Plus Tobacco Surcharge Admin. Fee

Calendar Year: January 1 through December 31.

School Year (or Fiscal Year): July 1 through June 30.

If you have any other questions or have lost your W-2 and need a replacement, please Email Cindy Smith or David Hayes.

Revised: 1/23/2015