Appendix A – 2015- 50 Chart of Corrections

ASU 2014-06: Technical Corrections and Improvements Related to Glossary Terms

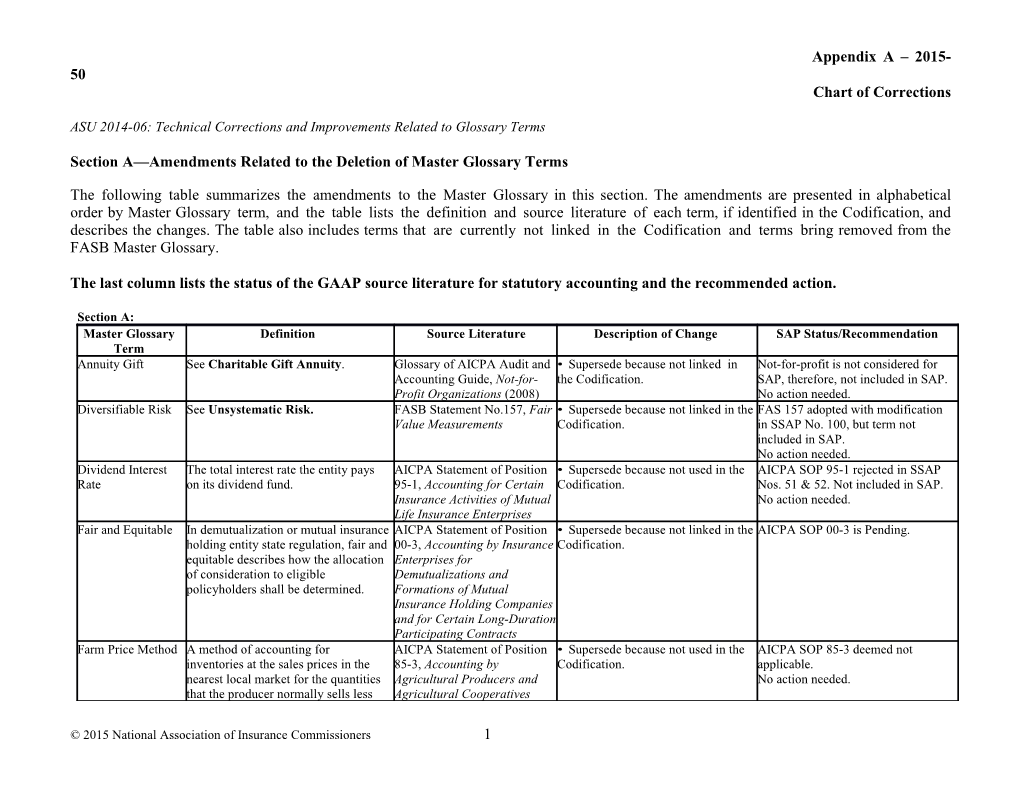

Section A—Amendments Related to the Deletion of Master Glossary Terms

The following table summarizes the amendments to the Master Glossary in this section. The amendments are presented in alphabetical order by Master Glossary term, and the table lists the definition and source literature of each term, if identified in the Codification, and describes the changes. The table also includes terms that are currently not linked in the Codification and terms bring removed from the FASB Master Glossary.

The last column lists the status of the GAAP source literature for statutory accounting and the recommended action.

Section A: Master Glossary Definition Source Literature Description of Change SAP Status/Recommendation Term Annuity Gift See Charitable Gift Annuity. Glossary of AICPA Audit and • Supersede because not linked in Not-for-profit is not considered for Accounting Guide, Not-for- the Codification. SAP, therefore, not included in SAP. Profit Organizations (2008) No action needed. Diversifiable Risk See Unsystematic Risk. FASB Statement No.157, Fair • Supersede because not linked in the FAS 157 adopted with modification Value Measurements Codification. in SSAP No. 100, but term not included in SAP. No action needed. Dividend Interest The total interest rate the entity pays AICPA Statement of Position • Supersede because not used in the AICPA SOP 95-1 rejected in SSAP Rate on its dividend fund. 95-1, Accounting for Certain Codification. Nos. 51 & 52. Not included in SAP. Insurance Activities of Mutual No action needed. Life Insurance Enterprises Fair and Equitable In demutualization or mutual insurance AICPA Statement of Position • Supersede because not linked in the AICPA SOP 00-3 is Pending. holding entity state regulation, fair and 00-3, Accounting by Insurance Codification. equitable describes how the allocation Enterprises for of consideration to eligible Demutualizations and policyholders shall be determined. Formations of Mutual Insurance Holding Companies and for Certain Long-Duration Participating Contracts Farm Price Method A method of accounting for AICPA Statement of Position • Supersede because not used in the AICPA SOP 85-3 deemed not inventories at the sales prices in the 85-3, Accounting by Codification. applicable. nearest local market for the quantities Agricultural Producers and No action needed. that the producer normally sells less Agricultural Cooperatives

© 2015 National Association of Insurance Commissioners 1 Section A: Master Glossary Definition Source Literature Description of Change SAP Status/Recommendation Term the estimated costs of disposition. Financial Position Financial position of an investee AICPA Accounting Principles • Supersede because not used in the AICPA APB 18 rejected in SSAP No. of an Investee determined in accordance with U.S. Board Opinion No. 18, The Codification. 97. generally accepted accounting Equity Method of Accounting No action needed. principles (GAAP). for Investments in Common Stock Funds Held in Resources held and administered, at Glossary of AICPA Audit and • Supersede because not used in the Not-for-profit is not considered for Trust by Others the direction of the resource provider, Accounting Guide, Not-for- Codification. SAP, therefore, not included in SAP. by an outside trustee for the benefit of Profit Organizations (2008) No action needed. a not-for-profit entity (NFP), frequently in connection with a split- interest agreement or permanent endowment. Involuntary See Termination. FASB Statement No. 60, • Supersede because only linked in FAS 60 rejected in various SSAPs. Termination Accounting and Reporting by the definition of Master Glossary Term not used. Insurance Enterprises term Termination. No action needed. Joint Venturers See Corporate Joint Venture. No source listed in • Supersede because not used in the Term included in SSAP No. 48. Codification Codification. No action needed. LDC Loan See Less-Developed Country Loan. No source listed in • Supersede because not used in the Term not used. Codification Codification. No action needed. Lease and Well See Wells and Related Equipment FASB Statement No. 19, • Supersede because not used in the FAS 19 not applicable to SAP. Equipment and Facilities. Financial Accounting and Codification. No action needed. Reporting by Oil and Gas Producing Companies Less-Developed A loan to a financially troubled No source literature listed in • Supersede because not linked in the Not used in SAP. Country Loan country, in regulatory terminology a the Codification Codification. No action needed. less-developed-country. Life Income A form of split-interest agreement in Glossary of AICPA Audit and • Supersede because not used in the Not-for-profit is not considered for Agreement which a not-for-profit entity (NFP) is Accounting Guide, Not-for- Codification. SAP, therefore, not included in SAP. obligated to make payments to the Profit Organizations (2008) No action needed. donor or a third- party beneficiary for that beneficiary’s life. See Charitable Gift Annuity and Charitable Remainder Trust. Matched Repos Matched repos are situations in which AICPA Audit and Accounting • Supersede because not used in the Brokers/dealers guide is not the broker-dealer has entered into Guide, Brokers and Dealers in Codification. considered for SAP, therefore, not repos and reverse repos using the same Securities (2008) included in SAP. securities. No action needed. Nondiversifiable See Systematic Risk. FASB Statement No.157, Fair • Supersede because not linked in the FAS 157 adopted with modification Risk Value Measurements Codification. in SSAP No. 100, but term not Appendix A – 2015- 50 Chart of Corrections

Section A: Master Glossary Definition Source Literature Description of Change SAP Status/Recommendation Term included in SAP. No action needed. Objective Covenants that require the financial Statement 133 Implementation • Supersede because not used in the Implementation Issues not reviewed Covenants institution to determine the borrower’s Issue No. C13 Codification. for SAP, so term not included. compliance objectively; that is, they No action needed. typically refer to financial ratios and other data. Raised Animals Animals produced and raised from an AICPA Statement of Position • Supersede because not used in the AICPA SOP 85-3 deemed not owned herd, as opposed to purchased 85-3, Accounting by Codification. applicable. animals. Agricultural Producers and No action needed. Agricultural Cooperatives Recurring Land Costs that do not result in permanent AICPA Statement of Position • Supersede because not used in the AICPA SOP 85-3 deemed not Development Costs or long-term improvements to land; for 85-3, Accounting by Codification. applicable. example, maintenance costs that occur Agricultural Producers and No action needed. annually or periodically. Agricultural Cooperatives Remainder Trust See Charitable Remainder Trust. AICPA Audit and Accounting • Supersede because not linked in the Not-for-profit is not considered for Guide, Not- for-Profit Codification. SAP, therefore, not included in SAP. Organizations (2008) No action needed. Retrospective Accounting methods that measure the FASB Statement No. 97, • Supersede because not used in the FAS 97 rejected for SAP. Term not Deposit Methods liability for policy benefits based on Accounting and Reporting by Codification. used. policyholder balances. Insurance Enterprises for No action needed. Certain Long-Duration Contracts and for Realized Gains and Losses from the Sale of Investments Revolving-Debt See Line-of-Credit Arrangement. No source listed in • Supersede because not used in the Term in SSAP No. 15. Agreement Codification Codification. No action needed. Risk Load See Risk of Adverse Deviation. FASB Statement No. 60, • Supersede because not used in the FAS 60 rejected for SAP. “Risk load” Accounting and Reporting by Codification. is not included in SAP. “Risk of Insurance Enterprises adverse deviation” is in Preamble, paragraph 10. No action needed. SDR See Special Drawing Rights. No source listed in • Supersede because not used in the Term not included in SAP. Codification Codification. No action needed. Subjective Covenants that permit the lender to Statement 133 Implementation • Supersede because not used in the Implementation Issues not reviewed Covenants determine the borrower’s compliance Issue No. C13 Codification. for SAP, so term not included.

© 2015 National Association of Insurance Commissioners 3 Section A: Master Glossary Definition Source Literature Description of Change SAP Status/Recommendation Term subjectively; that is, they contain No action needed. provisions that can be evaluated differently by the parties to the agreement, such as a provision referring to a material adverse change. Unit Livestock Accounting for livestock by using an AICPA Statement of Position • Supersede because not used in the AICPA SOP 85-3 deemed not Method arbitrary fixed periodic charge. For 85-3, Accounting by Codification. applicable. raised animals the amount is Agricultural Producers and No action needed. accumulated by periodic increments Agricultural Cooperatives from birth to maturity or disposition. For purchased animals the arbitrary fixed periodic amount is added to the acquisition cost until maturity or disposition of the animal. Voluntary See Termination. FASB Statement No. 60, • Supersede because only linked in FAS 60 rejected for SAP. Phrase Termination Accounting and Reporting by the definition of the Master Glossary included in SSAP No. 102. Insurance Enterprises term Termination. No action needed. Appendix A – 2015- 50 Chart of Corrections

Section B—Amendments Related to the Addition of Master Glossary Term Links

The following tables summarize the amendments to the Master Glossary in this section. The amendments in each table are presented in alphabetical order by the Master Glossary term to which they relate, and the table lists the definition and source literature of each term, if identified in the Codification, and describes the changes. The table includes terms that are currently not linked in the Codification and describes to which Subtopics or Master Glossary terms this ASU links these terms.

This section comprises two subsections. Each subsection has a table to reflect the amendments within that subsection. The first subsection table identifies new links between a Master Glossary term and the use of the term in a Codification paragraph (or another Master Glossary term) that originate from the same source literature. The second subsection table identifies new links between a Master Glossary term and the use of the term in a Codification paragraph (or another Master Glossary term) that do not originate from the same source literature, but have the same meaning.

The last column lists the status of the GAAP source literature for statutory accounting and the recommended action.

Section B–Same Source Literature: Master Glossary Term Master Glossary Definition Source Literature of Description of Related Paragraphs in Update SAP Status/ Term Changes Recommendation Contract Value of a Fully The contract value of a fully benefit- AICPA Statement of • Add 10 SOP 92-6 Benefit- Responsive responsive investment contract held by Position 92-6, glossary link to deemed not Investment Contract a defined contribution health and Accounting and Subtopic 965- applicable. welfare benefit plan is the amount a Reporting by Health 325, Plan No action participant would receive if he or she and Welfare Benefit Accounting— needed. were to initiate transactions under the Plans Health and terms of the ongoing plan. Welfare Benefits Plans — Investments —Other. Cooperatives The Agricultural Marketing Act of AICPA Statement of • Rename the 11–38 SOP 85-3 1929 defines a cooperative association Position 85-3, term deemed not as any association in which farmers act Accounting by Agricultural applicable. together in processing, preparing for Agricultural Producers Cooperatives. No action market, handling, and/or marketing the and Agricultural • Amend and needed. farm products of persons so engaged, Cooperatives add glossary and also means any association in links to the which farmers act together in definitions of Appendix A – 2015- 50 Chart of Corrections

Section B–Same Source Literature: Master Glossary Term Master Glossary Definition Source Literature of Description of Related Paragraphs in Update SAP Status/ Term Changes Recommendation purchasing, testing, grading, Member of an processing, distributing, and/or Agricultural furnishing farm supplies and/or farm Cooperative, business services. Provided, however, Nonmember of that such associations are operated for an Agricultural producers or purchasers and conform Cooperative, to one or both of the following and Patrons. requirements: • Add a. No member of the association glossary links is allowed more than one vote because to: of the amount of stock or membership o Subtopic capital he may own therein. 905-10, b. The association does not pay Agriculture— dividends on stock or membership Overall capital in excess of 8 percent per year. o Subtopic In addition to meeting either of the 905-205, requirements in this paragraph, the Agriculture— association shall not deal in farm Presentation business products, farm supplies, and of Financial farm services with or for nonmembers Statements in an amount greater in value than the o Subtopic total amount of such business 905-310, transacted by it with or for members. Agriculture— All business transacted by any Receivables cooperative association for or on o Subtopic behalf of the United States or any 905-325, agency or instrumentality thereof shall Agriculture— be disregarded in determining the Investments— volume of member and nonmember Other business transacted by such o Subtopic association. 905-330, Agriculture— Inventory o Subtopic 905-405, Agriculture— Appendix A – 2015- 50 Chart of Corrections

Section B–Same Source Literature: Master Glossary Term Master Glossary Definition Source Literature of Description of Related Paragraphs in Update SAP Status/ Term Changes Recommendation Liabilities o Subtopic 905-505, Agriculture— Equity o Subtopic 905-605, Agriculture— Revenue Recognition o Subtopic 905-705, Agriculture— Cost of Sales and Services. Designated Net Assets Unrestricted net assets subject to self- AICPA Audit and • Add 39 Not-for-profit is imposed limits by action of the Accounting Guide, Not- glossary link to not considered for governing board. Designated net assets for-Profit Organizations Subtopic 958- SAP, therefore, may be earmarked for future programs, (2008) 210, Not-for- not included in investment, contingencies, purchase or Profit Entities SAP. construction of fixed assets, or other —Balance No action uses. Sheet. needed. Direct Guarantee of An agreement in which a guarantor FASB Interpretation • Amend the 40 FIN 45 adopted Indebtedness states that if the debtor fails to make No. 45, Guarantor’s Master with payment to the creditor when due, the Accounting and Glossary term modification in guarantor will pay the creditor. If the Disclosure Indirect SSAP 5R. debtor defaults, the creditor has a Requirements for Guarantee of Definition not direct claim on the guarantor. Guarantees, Including Indebtedness included. No Indirect Guarantees of and link Direct change needed. Indebtedness of Others Guarantee of Indebtedness to the definition of this term. Dividend to Policyholders Nonguaranteed amounts distributable AICPA Statement of • Add 41–44 SOP 95-1 to policyholders of participating life Position 95-1, glossary links rejected in insurance contracts and based on Accounting for Certain to: SSAPs 51 & 52. Appendix A – 2015- 50 Chart of Corrections

Section B–Same Source Literature: Master Glossary Term Master Glossary Definition Source Literature of Description of Related Paragraphs in Update SAP Status/ Term Changes Recommendation actual performance of the insurance Insurance Activities of o Subtopic Links only. No entity as determined by the insurer. Mutual Life Insurance 944-20, change needed. Under various state insurance laws, Enterprises and FASB Financial dividends are apportioned to Statement No. 60, Services— policyholders on an equitable basis. Accounting and Insurance— The dividend allotted to any contract Reporting by Insurance Insurance often is based on the amount that the Enterprises Activities contract, as one of a class of similar o Subtopic contracts, has contributed to the 944-60, income available for distribution as Financial dividends. Dividends to policyholders Services— include annual policyholder dividends Insurance— and terminal dividends. Premium Deficiency and Loss Recognition o Subtopic 944-405, Financial Services— Insurance— Liabilities. Fractional Interest A partial ownership interest in real AICPA Statement of • Add 45 SOP 04-2 estate that typically includes larger Position 04-2, glossary link to deemed not blocks of time on an annual basis (for Accounting for Real Subtopic 978- applicable. No example, three weeks or more). Estate Time-Sharing 10, Real Estate action needed. Transactions —Time- Sharing Activities— Overall. Member of a Cooperative A member of a cooperative is an AICPA Statement of • Add 11–38 SOP 85-3 owner-patron who is entitled to vote at Position 85-3, glossary link to deemed not corporate meetings of a cooperative. Accounting by the definition applicable. Agricultural Producers of the Master No action and Agricultural Glossary term needed. Cooperatives Agricultural Appendix A – 2015- 50 Chart of Corrections

Section B–Same Source Literature: Master Glossary Term Master Glossary Definition Source Literature of Description of Related Paragraphs in Update SAP Status/ Term Changes Recommendation Cooperatives. • Rename the term Member of an Agricultural Cooperative, and update links throughout the Codification. Nonmember of a A nonmember patron is not entitled to AICPA Statement of • Add 11–38 SOP 85-3 Cooperative voting privileges. A nonmember Position 85-3, glossary link to deemed not patron may or may not be entitled to Accounting by the definition applicable. share in patronage distributions, Agricultural Producers of the Master No action depending on the articles and bylaws and Agricultural Glossary term needed. of the cooperative or on other Cooperatives Agricultural agreements. Cooperatives. • Rename the term Nonmember of an Agricultural Cooperative, and update links throughout the Codification. Orphan Share Potentially An identified potentially responsible AICPA Statement of • Add 46 and 47 SOP 96-1 Responsible Party party that cannot be located or that is Position 96-1, glossary link to adopted SSAP insolvent. Some of these parties may Environmental Subtopic 410- 67, As this is a be identified by the Environmental Remediation Liabilities 30, Asset Glossary link Protection Agency; others may be Retirement and only, no action identified as the site is investigated or Environmental needed. as the remediation is performed. Obligations— However, no contributions will ever be Environmental made by these parties. Obligations. Patrons Any individual, trust, estate, AICPA Statement of • Add 11–38 SOP 85-3 Appendix A – 2015- 50 Chart of Corrections

Section B–Same Source Literature: Master Glossary Term Master Glossary Definition Source Literature of Description of Related Paragraphs in Update SAP Status/ Term Changes Recommendation partnership, corporation, or Position 85-3, glossary link to deemed not cooperative with or for whom a Accounting by the definitions applicable. cooperative does business on a Agricultural Producers of Agricultural No action cooperative basis, whether a member and Agricultural Cooperative needed. or nonmember of the cooperative. Cooperatives and Nonmember of an Agricultural Cooperative. Participating Potentially A party to a Superfund site that has AICPA Statement of • Add 46 and 47 SOP 96-1 Responsible Party acknowledged potential involvement Position 96-1, glossary link to adopted SSAP 67 with respect to the site. Active Environmental Subtopic 410- Superfund is potentially responsible parties may Remediation Liabilities 30, Asset included in SSAP participate in the various Retirement and No. 65 as it administrative, negotiation, Environmental relates to monitoring, and remediation activities Obligations— asbestos and related to the site. Others may adopt a Environmental environmental passive stance and simply monitor the Obligations. exposures. activities and decisions of the more • Add As this is a involved potentially responsible glossary link to Glossary link parties. This passive stance could the definition only, no action result from a variety of factors such as of the Master needed. the entity’s lack of experience, limited Glossary term internal resources, or relative Potentially involvement at a site. This category of Responsible potentially responsible parties (both Party. active and passive) is also referred to as players. Potentially Responsible Any individual, legal entity, or AICPA Statement of • Add 46 and 47 SOP 96-1 Party government—including owners, Position 96-1, glossary link to adopted SSAP operators, transporters, or generators— Environmental Subtopic 410- 67. potentially responsible for, or Remediation Liabilities 30, Asset Superfund is contributing to, the environmental Retirement and included in SSAP impacts at a Superfund site. The Environmental No. 65 as it Environmental Protection Agency has Obligations— relates to the authority to require potentially Environmental asbestos and responsible parties, through Obligations. environmental Appendix A – 2015- 50 Chart of Corrections

Section B–Same Source Literature: Master Glossary Term Master Glossary Definition Source Literature of Description of Related Paragraphs in Update SAP Status/ Term Changes Recommendation administrative and legal actions, to • Add exposures. remediate such sites. At early stages of glossary link to As this is a the remediation process, the list of the definitions Glossary link potentially responsible parties may be of the Master only, no action limited to a handful of entities that Glossary terms: needed. either were significant contributors of o Orphan waste to the site or were easy to Share identify, for example, because of their Potentially proximity to the site or because of Responsible labeled material found at the site. As Party further investigation of the site occurs o and as remediation activities take place, additional potentially Participating responsible parties may be identified. Potentially Once identified, the additional Responsible potentially responsible parties would Party be reclassified from this category to o either the participating potentially responsible party or recalcitrant Recalcitrant potentially responsible party category. Potentially The total number of parties in this Responsible category and their aggregate allocable Party share of the remediation liability varies o Unknown by site and cannot be reliably Potentially determined before the specific Responsible identification of individual potentially Party. responsible parties. For example, some ultimately may be dropped from the potentially responsible party list because no substantive evidence is found to link them to the site. For others, substantive evidence eventually may be found that points to their liability. The presentation of that evidence to the entity would result in a reclassification of the party from this Appendix A – 2015- 50 Chart of Corrections

Section B–Same Source Literature: Master Glossary Term Master Glossary Definition Source Literature of Description of Related Paragraphs in Update SAP Status/ Term Changes Recommendation category of potentially responsible parties (sometimes referred to as hiding in the weeds) to either the participating potentially responsible party or recalcitrant potentially responsible party category. Reacquisition Price of The amount paid on extinguishment, AICPA Accounting • Add glossary 48 APB 26 adopted Debt including a call premium and Principles Board link to Subtopic with miscellaneous costs of reacquisition. If Opinion No. 26, Early 470-50, Debt— modification in extinguishment is achieved by a direct Extinguishment of Debt Modifications SSAP 15. As this exchange of new securities, the and is a Glossary link reacquisition price is the total present Extinguishments. only, no action value of the new securities. needed. Recalcitrant Potentially A party whose liability with respect to AICPA Statement of • Add glossary 46 and 47 SOP 96-1 Responsible Party a Superfund site is substantiated by Position 96-1, link to Subtopic adopted SSAP evidence, but that refuses to Environmental 410-30, Asset 67. Superfund is acknowledge potential involvement Remediation Liabilities Retirement and included in SSAP with respect to the site. Recalcitrant Environmental No. 65 as it potentially responsible parties adopt a Obligations— relates to recalcitrant attitude toward the entire Environmental asbestos and remediation effort even though Obligations. environmental evidence exists that points to their • Add glossary exposures. involvement at a site. Some may adopt link to the As this is a this attitude out of ignorance of the definition of the Glossary link law; others may do so in the hope that Master Glossary only, no action they will be considered a nuisance and term Potentially needed. therefore ignored. Typically, parties in Responsible this category must be sued in order to Party. collect their allocable share of the remediation liability; however, it may be that it is not economical to bring such suits because the parties’ assets are limited. This category of potentially responsible parties is also referred to as nonparticipating potentially responsible parties. Appendix A – 2015- 50 Chart of Corrections

Section B–Same Source Literature: Master Glossary Term Master Glossary Definition Source Literature of Description of Related Paragraphs in Update SAP Status/ Term Changes Recommendation Reload Transaction A reload transaction is a sale of a new AICPA Statement of • Add glossary 49 SOP 04-2 interval that should be treated as a Position 04-2, link to Subtopic deemed not separate transaction for accounting Accounting for Real 978-605, Real applicable. purposes. Estate Time-Sharing Estate—Time- As this is a Transactions Sharing Glossary link Activities— only, no action Revenue needed. Recognition. Stop-Loss Insurance A contract in which an entity agrees to AICPA Audit and • Add glossary 50–53 HCO Audit indemnify providers for certain health Accounting Guide, links to: Guide rejected in care costs incurred by members. Health Care o Subtopic SSAP 73. As this Organizations (2008) 954-450, is a Glossary link Health Care only, no action Entities— needed. Contingencies o Subtopic 954-720, Health Care Entities— Other Expenses. Unknown Potentially A party that has liability with respect AICPA Statement of • Add glossary 46 and 47 SOP 96-1 Responsible Party to a Superfund site, but that has not yet Position 96-1, link to Subtopic adopted in SSAP been identified as a potentially Environmental 410-30, Asset 67. Superfund is responsible party by the Environmental Remediation Liabilities Retirement and included in SSAP Protection Agency or by an analogous Environmental No. 65 as it state agency. Obligations— relates to Environmental asbestos and Obligations. environmental exposures. As this is a Glossary link only, no action needed. Unproven Potentially A party that has been identified as a AICPA Statement of Add glossary 46 and 47 SOP 96-1 Responsible Party potentially responsible party for a Position 96-1, link to Subtopic adopted in SSAP Appendix A – 2015- 50 Chart of Corrections

Section B–Same Source Literature: Master Glossary Term Master Glossary Definition Source Literature of Description of Related Paragraphs in Update SAP Status/ Term Changes Recommendation Superfund site by the U.S. Environmental 410-30, Asset 67. Superfund is Environmental Protection Agency or Remediation Liabilities Retirement and included in SSAP by an analogous state agency, but that Environmental No. 65 as it does not acknowledge potential Obligations— relates to involvement with respect to the site Environmental asbestos and because no evidence has been Obligations. environmental presented linking the party to the site. exposures. Also referred to as a hiding-in-the- As this is a weeds potentially responsible party. Glossary link only, no action needed. Appendix A – 2015- 50 Chart of Corrections

Section B–Different Source Literature: Master Glossary Term Master Glossary Source Literature of Description of Changes Related Paragraphs in Update SAP Status/ Definition Term Recommendation Cash Equivalents Cash equivalents are FASB Statement No. 95, • Add glossary links to: 54–57 FAS 95 rejected short-term, highly liquid Statement of Cash Flows o Subtopic 320-10, in SSAP 69. investments that have Investments—Debt and Cash equivalents both of the following Equity Securities— included in SSAP characteristics: Overall 2 with only o Subtopic 715-20, difference that a. Readily convertible Compensation— SSAP 2 does not to known amounts of Retirement Benefits— include list of cash Defined Benefit Plans— examples. b. So near their General As this is a maturity that they o Subtopic 830-230, Glossary link present insignificant risk Foreign Currency only, no action of changes in value Matters—Statement of needed. because of changes in Cash Flows. interest rates.

Generally, only investments with original maturities of three months or less qualify under that definition. Original maturity means original maturity to the entity holding the investment. For example, both a three-month U.S. Treasury bill and a three- year U.S. Treasury note purchased three months from maturity qualify as cash equivalents. However, a Treasury note purchased three years ago does not become a cash Appendix A – 2015- 50 Chart of Corrections

Section B–Different Source Literature: Master Glossary Term Master Glossary Source Literature of Description of Changes Related Paragraphs in Update SAP Status/ Definition Term Recommendation equivalent when its remaining maturity is three months. Examples of items commonly considered to be cash equivalents are Treasury bills, commercial paper, money market funds, and federal funds sold (for an entity with banking operations). Conduit Debt Securities Certain limited- FASB Statement No.126, • Add glossary link to 58 and 59 FAS 126 rejected obligation revenue Exemption from Certain Subtopic 855-10, in SSAP 100. bonds, certificates of Required Disclosures Subsequent Events— As this is a participation, or similar about Financial Overall. Glossary link debt instruments issued Instruments for Certain only, no action by a state or local Nonpublic Entities needed. governmental entity for the express purpose of providing financing for a specific third party (the conduit bond obligor) that is not a part of the state or local government’s financial reporting entity. Although conduit debt securities bear the name of the governmental entity that issues them, the governmental entity often has no obligation for such debt beyond the resources provided by a lease or loan agreement with the third party on Appendix A – 2015- 50 Chart of Corrections

Section B–Different Source Literature: Master Glossary Term Master Glossary Source Literature of Description of Changes Related Paragraphs in Update SAP Status/ Definition Term Recommendation whose behalf the securities are issued. Further, the conduit bond obligor is responsible for any future financial reporting requirements. Lump-Sum Contract See Fixed-Price AICPA Statement of • Add glossary link to 60 and 61 SOP 81-1 Contracts Position 81-1, Accounting Subtopic 910-10, deemed not for Performance of Contractors—Construction applicable. Construction-Type and —Overall. As this is a Certain Production-Type Glossary link Contracts only, no action needed. Natural Expense A method of grouping Glossary of AICPA Audit • Add glossary link to: 62–64 Not-for-profit is Classification expenses according to and Accounting Guide, o Subtopic 958-205, Not- not considered for the kinds of economic Not-for-Profit for-Profit Entities— SAP, therefore, benefits received in Organizations (2008) Presentation of Financial not included in incurring those expenses. Statements SAP. Examples of natural o Subtopic 958-720, Not- As this is a expense classifications for-Profit Entities—Other Glossary link include salaries and Expenses. only, no action wages, employee needed. benefits, supplies, rent, and utilities. Noncontribu-tory Plan A pension plan under FASB Statement No. 35, • Amend definition to refer 65–67 FAS 35 deemed which participants do not Accounting and to other postretirement not applicable. make contributions. Reporting by Defined benefits as well as pensions. SAP addresses Benefit Pension Plans • Add glossary link to other Subtopic 965-10, Plan postretirement Accounting—Health and benefits and Welfare Benefit Plans— pensions Overall. separately. No change needed. Pension Fund The assets of a pension FASB Statement No. 35, • Add glossary link to the 68 and 69 FAS 35 deemed plan held by a funding Accounting and definition of the Master not applicable. agency. Reporting by Defined Glossary term Vested Glossary link Appendix A – 2015- 50 Chart of Corrections

Section B–Different Source Literature: Master Glossary Term Master Glossary Source Literature of Description of Changes Related Paragraphs in Update SAP Status/ Definition Term Recommendation Benefit Pension Plans Benefits. only. No change needed. Plan Assets (Definition 1) Assets—usually stocks, FASB Statement No. 106, • Add glossary link to: 70–79 FAS 106 adopted bonds, and other Employers’ Accounting o Subtopic 965-20, Plan with modification investments (except for Postretirement Accounting—Health and in SSAP 92. As certain insurance Benefits Other Than Welfare Benefit Plans— this is a Glossary contracts as noted in Pensions Net Assets Available for link only, no paragraph 715-60-35- Plan Benefits action needed. 109)—that have been o Subtopic 965-30, Plan segregated and restricted Accounting—Health and (usually in a trust) to be Welfare Benefit Plans— used for postretirement Plan Benefit Obligations benefits. The amount of o Subtopic 965-205, Plan plan assets includes Accounting—Health and amounts contributed by Welfare Benefit Plans— the employer, and by Presentation of Financial plan participants for a Statements contributory plan, and o Subtopic 965-310, Plan amounts earned from Accounting—Health and investing the Welfare Benefit Plans— contributions, less Receivables benefits, income taxes, o Subtopic 965-325, Plan and other expenses Accounting—Health and incurred. Plan assets Welfare Benefit Plans— ordinarily cannot be Investments—Other withdrawn by the o Subtopic 965-360, Plan employer except under Accounting—Health and certain circumstances Welfare Benefit Plans— when a plan has assets in Property, Plant, and excess of obligations and Equipment. the employer has taken certain steps to satisfy existing obligations. Securities of the employer held by the plan are includable in Appendix A – 2015- 50 Chart of Corrections

Section B–Different Source Literature: Master Glossary Term Master Glossary Source Literature of Description of Changes Related Paragraphs in Update SAP Status/ Definition Term Recommendation plan assets provided they are transferable. Assets not segregated in a trust, or otherwise effectively restricted, so that they cannot be used by the employer for other purposes postretirement benefits. Those assets shall be accounted for in the same manner as other employer assets of a similar nature and with similar restrictions. If a plan has liabilities other than for benefits, those nonbenefit obligations are considered as reductions of plan assets. Amounts accrued by the employer but not yet paid to the plan are not plan assets. If a trust arrangement explicitly provides that segregated assets are available to satisfy claims of creditors in bankruptcy, such a provision would effectively permit those assets to be used for other purposes at the discretion of the employer. It is not necessary to determine Appendix A – 2015- 50 Chart of Corrections

Section B–Different Source Literature: Master Glossary Term Master Glossary Source Literature of Description of Changes Related Paragraphs in Update SAP Status/ Definition Term Recommendation that a trust is bankruptcy-proof for the assets of the trust to qualify as plan assets. However, assets held in a trust that explicitly provides that such assets are available to the general creditors of the employer in the event of the employer’s bankruptcy would not qualify as plan assets. Plan Assets (Definition 2) Assets—usually stocks, FASB Statement No.87, • Add glossary link to: 80–85 FAS 87 adopted bonds, and other Employers’ Accounting o Subtopic 715-30, with modification investments—that have for Pensions Compensation— in SSAPs 92 and been segregated and Retirement Benefits— 102. Glossary restricted, usually in a Defined Benefit Plans— links only. No trust, to provide for Pension action needed. pension benefits. The o Subtopic 960-20, Plan amount of plan assets Accounting—Defined includes amounts Benefit Pension Plans— contributed by the Accumulated Plan employer, and by Benefits employees for a o Subtopic 960-30, Plan contributory plan, and Accounting—Defined amounts earned from Benefit Pension Plans— investing the Net Assets Available for contributions, less Plan Benefits benefits paid. Plan assets o Subtopic 960-205, Plan ordinarily cannot be Accounting—Defined withdrawn by the Benefit Pension Plans— employer except under Presentation of Financial certain circumstances Statements. when a plan has assets in excess of obligations and Appendix A – 2015- 50 Chart of Corrections

Section B–Different Source Literature: Master Glossary Term Master Glossary Source Literature of Description of Changes Related Paragraphs in Update SAP Status/ Definition Term Recommendation the employer has taken certain steps to satisfy existing obligations. Assets not segregated in a trust or otherwise effectively restricted so that they cannot be used by the employer for other purposes are not plan assets even though it may be intended that such assets be used to provide pensions. If a plan has liabilities other than for benefits, those nonbenefit obligations may be considered as reductions of plan assets. Amounts accrued by the employer but not yet paid to the plan are not plan assets. Securities of the employer held by the plan are includable in plan assets provided they are transferable. Spending Rate The portion of total AICPA Audit and • Add glossary links to: 86–90 Not-for-profit is return on investments Accounting Guide, Not- o Subtopic 958-205, Not- not considered for used for fiscal needs of for-Profit Organizations for-Profit Entities— SAP, therefore, the current period, (2008) Presentation of Financial not included in usually used as a Statements SAP. budgetary method of o Subtopic 958-320, Not- No action needed. reporting returns of for-Profit Entities— investments. It is usually Investments—Debt and measured in terms of an Equity Securities. amount or a specified Appendix A – 2015- 50 Chart of Corrections

Section B–Different Source Literature: Master Glossary Term Master Glossary Source Literature of Description of Changes Related Paragraphs in Update SAP Status/ Definition Term Recommendation percentage of a moving average market value. Typically, the selection of a spending rate emphasizes the use of prudence and a systematic formula to determine the portion of cumulative investment return that can be used to support fiscal needs of the current period and the protection of endowment gifts from a loss of purchasing power as a consideration in determining the formula to be used. Spot Rate The exchange rate for FASB Statement No. 52, • Add glossary links to: 91–99 FAS 52 rejected immediate delivery of Foreign Currency o Subtopic 815-10, in SSAPs 23 and currencies exchanged. Translation Derivatives and Hedging 31. As this is a —Overall Glossary link o Subtopic 815-20, only, no action Derivatives and Hedging needed. —Hedging— General o Subtopic 815-25, Derivatives and Hedging —Fair Value Hedges o Subtopic 815-30, Derivatives and Hedging —Cash Flow Hedges o Subtopic 815-35, Derivatives and Hedging —Net Investment Hedges o Subtopic 926-20, Appendix A – 2015- 50 Chart of Corrections

Section B–Different Source Literature: Master Glossary Term Master Glossary Source Literature of Description of Changes Related Paragraphs in Update SAP Status/ Definition Term Recommendation Entertainment—Films— Other Assets—Film Costs o Subtopic 946-830, Financial Services— Investment Companies— Foreign Currency Matters. Written Notice of Any capital stock, AICPA Statement of • Add glossary links to: 100–102 SOP 85-3 Allocation revolving fund Position 85-3, Accounting o Subtopic 905-325, deemed not certificate, retain by Agricultural Producers Agriculture—Investments applicable. certificate, certificate of and Agricultural —Other As this is a indebtedness, letter of Cooperatives o Subtopic 905-505, Glossary link advice, or other written Agriculture—Equity. only, no action notice to the recipient needed. that states the dollar amount allocated to the patron by the cooperative and the portion that constitutes a patronage dividend. Appendix A – 2015- 50 Chart of Corrections

Section C: Amendments Related to Duplicate Master Glossary Terms

The following table summarizes the amendments to the Master Glossary in this section. The amendments are presented in alphabetical order by Master Glossary term, and the table lists the Subtopics in which the terms are used, describes the changes to the terms, and provides the definition for the terms. For ease of reference, duplicate terms are numbered by the order in which their definitions appear in the online version of the Codification.

The last column lists the status of the GAAP source literature for statutory accounting and the recommended action.

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update Actuarial The value, as of a specified 715-30 • Supersede The value, as of a specified date, of 105–109 Source docs FAS 87 Present Valuedate, of an amount or series of Definition 2; an amount or series of amounts and 88 adopted with (Definition 1) amounts payable or receivable replace all links payable or receivable thereafter, modification in thereafter, with each amount with links to with each amount adjusted to reflect SSAPs 8, 89, 92 and adjusted to reflect the time Definition 1. the time value of money (through 102. value of money (through discounts for interest) and the Term used in SSAPs discounts for interest) and the probability of payment (by means 92 and 102, but not probability of payment (by of decrements for events such as defined. means of decrements for death, disability, withdrawal, or events such as death, retirement) between the specified No action needed. disability, withdrawal, or date and the expected date of retirement) between the payment. specified date and the expected date of payment. Actuarial The value, as of a specified 715-60 Present Valuedate, of an amount or series of (Definition 2) amounts payable or receivable thereafter, with each amount adjusted to reflect the time value of money (through discounts for interest) and the probability of payment (for example, by means of decrements for events such as Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update death, disability, or withdrawal) between the specified date and the expected date of payment. Amortization The process of reducing a 715-60 • Amend Definition The process of reducing a 110–116 Source doc FSP FAS (Definition 1) recognized liability 1 to include recognized liability systematically 106-, adopted with systematically by recognizing pension by recognizing revenues gains or by modification in INT revenues or by reducing a information. reducing a recognized asset 04-17. No change in recognized asset • Supersede systematically by recognizing info, only definition in systematically by recognizing Definition 2; expe nses or costs lo s s es. In Master Glossary. expenses or costs. In replace all links accounting for p e nsion benefits or Definition not in SAP. accounting for postretirement with links to oth e r postretirement benefits, No changes needed. benefits, amortization also Definition 1. amortization also means the means the systematic systematic recognition in net recognition in net periodic periodic pension cost or other postretirement benefit cost postretirement benefit cost over over several periods of several periods of amounts amounts previously recognized previously recognized in other in other comprehensive comprehensive income, that is, income, that is, gains or losses, gains or losses, prior service cost or prior service cost or credits, credits, and any transition and any transition obligation obligation or asset. or asset. Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update Amortization The process of reducing a 715-30 (Definition 2) recognized liability systematically asset systematically by recognizing expenses or costs. In pension accounting, amortization is also used to refer to the systematic recognition in net pension cost over several periods of amounts previously recognized in other comprehensive income, that is, prior service costs or credits, gains or losses, and the by recognizing revenues or reducing a recognized transition asset or obligation existing at the date of initial application of Subtopic 715- 30. Assumptions Estimates of the occurrence of 715-60 • Amend Definition Estimates of the occurrence of 117–121 Source docs FAS 87 (Definition 1) future events affecting 1 to include future events affecting pension costs and FAS 106 adopted postretirement benefit costs, pension and other postretirement benefit with modification in such as turnover, retirement information. costs (as applic a ble), such as SSAPs 8, 89, 92, and age, mortality, dependency • Supersede turnover, retirement age, mortality, 102. Definition not status, per capita claims costs Definition 2; w i th d r a w a l , disablement, included in SAP. by age, health care cost trend replace all links dependency status, per capita claims No change needed. rates, levels of Medicare and with links to costs by age, health care cost trend other health care providers’ Definition 1. rates, levels of Medicare and other reimbursements, and discount health care providers’ rates to reflect the time value reimbursements, changes in of money. compensation and national pension Assumptions Estimates of the occurrence of 715-30 benefits, and discount rates to (Definition 2) future events affecting pension reflect the time value of money. costs, such as mortality, Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update withdrawal, disablement and retirement, changes in compensation and national pension benefits, and discount rates to reflect the time value of money. Attribution The process of assigning 715-60 • Amend The process of assigning pension or 122–127 Source docs FAS 87 (Definition 1) postretirement benefit cost to Definition 1 to oth e r postretirement b enefit benefits and FAS 106 adopted periods of employee service. include pension or costs cost to periods of employee with modification in Attribution The process of assigning 715-30 information. service. SSAPs 8, 89, 92, and (Definition 2) pension benefits or cost to • Supersede 102. SAP has pension periods of employee service. Definition 2; and postretirement replace all links separate, therefore, no with links to change needed. Definition 1. Benefits Payments to which 960-10, 960-20, 960-30, • Amend The monetary or in-kind benefits or 128–174 Source docs FAS 87, (Definition 1) participants may be entitled 960-205, 960-325, 960- Definition 3 to benefit coverage to which 88 and FAS 106 under a pension plan, 360 include participants may be entitled under a adopted with including pension benefits, information pension plan or oth e r postretirement modification in SSAPs disability benefits, death specific to benefit plan, including health care 8, 89, 92, and 102. benefits, and benefits due on health and benefits, life insurance, not Source dco FSP FAS termination of employment. welfare plans pr ovided through a pension plan, 106-2 adopted with Benefits Payments to which 715-30 and pension and legal, educational, and advisory modification in INT (Definition 2) participants may be entitled plans. services, pension benefits, disability 04-17. Source doc under a pension plan, benefits, death benefits, and be n efits EITF 06-04 adopted in including pension benefits, • Supersede due to terminati o n of empl o y ment. SSAP 92. EITF 06-10 death benefits, and benefits Definitions 1 rejected in SSAP 21. due on termination of and 2; replace SAP has pension and employment. all links with postretirement Benefits The monetary or in-kind 715-60 links to separate, therefore, no (Definition 3) benefits or benefit coverage to Definition 3. change needed. which participants may be entitled under a postretirement • Add glossary benefit plan, including health links to Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update care benefits, life insurance Subtopics: not provided through a pension • 962-10, Plan plan, and legal, educational, Accounting— and advisory services. Defined Contribution Pension Plans — Overall • 962-40, Plan Accounting— Defined Contribution Pension Plans — Terminating Plans • 962-205, Plan Accounting— Defined Contribution Pension Plans — Presentation of Financial Statements • 962-325, Plan Accounting— Defined Contribution Pension Plans — Investments — Other • 965-10, Plan Accounting— Health and Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update Welfare Benefit Plans —Overall • 965-20, Plan Accounting— Health and Welfare Benefit Plans —Net Assets Available for Plan Benefits • 965-30, Plan Accounting— Health and Welfare Benefit Plans —Plan Benefit Obligations • 965-40, Plan Accounting— Health and Welfare Benefit Plans — Terminating Plans • 965-205, Plan Accounting— Health and Welfare Benefit Plans — Presentation of Financial Statements Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update • 965-325, Plan Accounting— Health and Welfare Benefit Plans — Investments — Other. Contributory A pension plan under which 960-205 • Supersede A plan under which retirees or 175–180 Source docs FAS 35 Plan (Definitionparticipants bear part of the Definitions 1 active employees contribute part of deemed not 1) cost. and 3; replace the cost. In some contributory plans, applicable and FAS Contributory A plan under which retirees or 715-60 all links with retirees or active employees wishing 106 adopted with Plan (Definitionactive employees contribute links to to be covered must contribute; in modification in 2) part of the cost. In some Definition 2. other contributory plans, SSAPs 8, 89, 92, and contributory plans, retirees or • Add glossary participants’ contributions result in 102. SAP has pension active employees wishing to link to Subtopic increased benefits. and postretirement be covered must contribute; in 965-10, Plan separate, and other contributory plans, Accounting— definition not participants’ contributions Health and included. No change result in increased benefits. Welfare Benefit needed. Contributory A pension plan under which 715-30 Plans—Overall. Plan (Definitionemployees contribute part of 3) the cost. In some contributory plans, employees wishing to be covered must contribute; in other contributory plans, employee contributions result in increased benefits. Cost Approach A valuation technique that 820-10 • Supersede A valuation technique that reflects 181–184 Definition 1 from FAS (Definition 1) reflects the amount that would Definition 2. the amount that would be required 157 adopted with be required currently to • Definition 1 currently to replace the service modification in SSAP replace the service capacity of would remain capacity of an asset (often referred 100, para. 17c. SSAPs an asset (often referred to as unchanged. to as current replacement cost). 92 and 102 address current replacement cost). attribution Cost ApproachOne of the two groups of basic 715-30 individually. Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update (Definition 2) approaches to attributing ASU 2011-04 pending pension benefits or costs to SAP review. No periods of service. Approaches change needed. in this group assign net pension costs to periods as level amounts or constant percentages of compensation (that is, a cost-compensation approach). See Benefit Approach for the other group of basic approaches to attributing pension benefits. Defined Benefit Defined benefit health and 965-10, 965-30, 965- • Amend Defined A defined benefit plan provides 185–214 Source docs: Health and welfare plans specify a 205 Benefit Plan to participants with a determinable ASU 2012-04–Reject Welfare Plans determinable benefit, which incorporate benefit based on a formula provided FAS 35–N/A may be in the form of a elements specific for in the plan. FAS 87–Adopt/M reimbursement to the covered to defined benefit a. Defined benefit health and FAS 88–Adopt/M plan participant or a direct pension plans, w elfa r e plans—Defined benefit FAS 106–Adopt/M payment to providers or third- defined benefit health a n d w elf a re plans specify a SOP 92-6–N/A party insurers for the cost of postretirement determinable benefit, w hich m a y SOP 99-2–N/A specified services. Such plans plans, and defined be in the form of a reimbursement EITF 88-01–Adopt may also include benefits that benefit health and t o the covered plan participant or EITF 91-07–Adopt are payable as a lump sum, welfare plans. a direct p a y ment to providers or EITF 03-04–Adopt/M such as death benefits. The • Supersede Defined thir d - par t y insurers for the cost level of benefits may be Benefit Health and of specified services. Such plans Defined benefit plan defined or limited based on Welfare Plans, m a y also include benefits that are definition paraphrased factors such as age, years of Defined Benefit p a y able as a lu m p sum, such as in SSAP 92. No change service, and salary. Pension Plan death benefits. The level of needed. Contributions may be (Definitions 1 and benefits m a y be defined or determined by the plan’s 2), and Defined limited based on factors such as actuary or be based on Benefit age, y e a rs of service, and salar y . premiums, actual claims paid, Postretirement Contributions m a y be determined hours worked, or other factors Plan; replace all b y the plan’s actuary or be based determined by the plan links with links to o n premiums, actual claims paid, sponsor. Even when a plan is hours w o rked, or other factors Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update funded pursuant to agreements Defined Benefit determi n ed b y the plan sponsor. that specify a fixed rate of Plan. Even w h en a plan is funded employer contributions (for • Add Master p u rsuant to agreements th a t example, a collectively Glossary links to specify a f i xed r a te of empl o y e r bargained multiemployer Subtopics: contributions (for example, a plan), such a plan may o 965-325, Plan collect i v ely bargained nevertheless be a defined Accounting— multiemplo y e r plan), such a plan benefit health and welfare plan Health and Welfare m a y never t heless be a defined if its substance is to provide a Benefit Plans— benefit health a n d w elf a re plan if defined benefit. Investments— its substance is to provide a Defined BenefitA pension plan that specifies a 960-10, 960-20, 960-30, Other. defined benefit. Pension Plandeterminable pension benefit, 960-40, 960-205, 960- o 980-715, Regulated b. Defined benefit pension plan—A (Definition 1) usually based on factors such 310, 960-325, 960-360 Operations— pension plan that defines an as age, years of service, and Compensation— amo u nt of pension benef i t to be salary. This includes plans that Retirement provided, usually as a function of may be funded pursuant to Benefits. one o r more factors such as age, periodic agreements that y e a rs of service, or compensation. specify a fixed rate of A n y pension plan that is not a employer contributions (for defi n ed contr i b u ti o n pension example, a collectively plan is, for purposes of Subtopic bargained multiemployer 715-30, a defined benefit pension plan). For example, this plan. includes plans that prescribe a c. Defined benefit postretirement scale of benefits and plan—A plan that defines experience indicates or it is postretirement benefits in terms expected that employer of moneta r y amounts (for contributions are or will be example, $100,000 of life periodically adjusted to enable insurance) or benefit coverage to such stated benefits to be be provided (f or example, up maintained. Further, a plan t o$200 per d a y f or that is subject to the Employee hospitalization, o r80 percent of Retirement Income Security t he cost of specified surgical Act of 1974 and considered to procedures). A n y postretirement be a defined benefit pension benefit plan that i s not a defined plan under the Act is a defined contribution postretirement plan Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update benefit pension plan. is, for purposes of Subtopic 715- Defined BenefitA pension plan that defines an 715-30 60, a defined benefit Pension Planamount of pension benefit to postretirement plan. (Specified (Definition 2) be provided, usually as a moneta r y amou n ts and benefit function of one or more factors coverage are collect i v ely referred such as age, years of service, to as benefits.) or compensation. Any pension plan that is not a defined contribution pension plan is, for purposes of Subtopic 715- 30, a defined benefit pension plan. Defined BenefitA defined benefit plan N/A Plan provides participants with a determinable benefit based on a formula provided for in the plan. Defined BenefitA plan that defines 715-60 Postretirement postretirement benefits in Plan terms of monetary amounts (for example, $100,000 of life insurance) or benefit coverage to be provided (for example, up to $200 per day for hospitalization, or 80 percent of the cost of specified surgical procedures). Any postretirement benefit plan that is not a defined contribution postretirement plan is, for purposes of Subtopic 715-60, a defined benefit postretirement plan. (Specified monetary amounts and benefit coverage are Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update collectively referred to as benefits.) Defined Defined contribution health 965-10, 965-205 • Amend Defined A plan that provides an individual 215–224 Source docs: Contribution and welfare plans maintain an Contribution Plan account for each participant and ASU 2013-07–Reject Health and individual account for each to incorporate provides benefits that are based on FAS 106–Adopt/M Welfare Plans plan participant. They have elements specific all of the following: a. Amo unts FAS 132R–Adopt/M terms that specify the means of to defined amounts contributed to the SOP 92-6–N/A determining the contributions contribution participant’s account by the SOP 94-4–N/A to participants’ accounts, postretirement employer or emplo yee e m ployee; b. EITF 86-27–N/A rather than the amount of plans and defined Investment investment expe rience EITF 03-02–Reject benefits the participants are to contribution health exp eri ence; c. Any and a n y AAG and QA106 not receive. The benefits a plan and welfare plans. forfeitures allocated to the account, reviewed for SAP. participant will receive are • Supersede Defined less any administrative expenses limited to the amount Contribution charged to the plan. Paraphrased definitions contributed to the participant’s Health and a. Defined contribution health and in SSAPs 92 and 102. account, investment Welfare Plans and w elfare plans—Defined experience, expenses, and any Defined contribution health and w elfare forfeitures allocated to the Contribution pla n s maintain an individual participant’s account. These Postretirement account for each plan participant. plans also include flexible Plan; replace all Th e y have terms that specify the spending arrangements. links with links to m ea n s of determining t h e Defined A plan that provides an 715-30, 715-60, 715-70, Defined contributions to participants’ Contribution individual account for each 962-10, 962-40, 962- Contribution Plan. accounts, rather than the amo u nt of Plan participant and provides 205, 962-325, 965-325 • Add glossary link to benefits the participants are t o benefits that are based on all of Subtopic 965-325, receive. The benefits a plan the following: Plan Accounting— participant w ill receive are limited a. Amounts contributed to the Health and Welfare to the amount contributed to t h e participant’s account by the Benefit Plans— participant’s account, investment employer or employee Investments—Other. exp e rience, expenses, and an y b. Investment experience forfeitures allocated to the c. Any forfeitures allocated to participant’s account. These plans the account, less any also include flexible spending administrative expenses arran g ements. charged to the plan. b. Defined contribution Defined A plan that provides 715-70 postretirement plan—A plan that Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update Contribution postretirement benefits in provides postretirement benefits in Postretirement return for services rendered, return for s er v i c es rende r ed, Plan provides an individual account provi d es an individual account for for each plan participant, and each plan participant, and specifies specifies how contributions to how contributions to the the individual’s account are to individual’s account are to b e be determined rather than determined r ath e r than specifies specifies the amount of the amount of be n efits the benefits the individual is to individual is to receive. Under a receive. Under a defined defined contribution postretirement contribution postretirement plan, the benefits a plan participant plan, the benefits a plan w ill receive depend sole l y on the participant will receive depend amount contributed to t h e plan solely on the amount participant’s account, the returns contributed to the plan e a rned o n investments of those participant’s account, the contributions, and the forfeitu r es returns earned on investments of other plan participants’ benefits of those contributions, and the that m a y be allocated to that plan forfeitures of other plan participant’s account. participants’ benefits that may be allocated to that plan participant’s account. Discount Rate The interest rate used to adjust 715-30 • Amend Discount The rat es A rate or rates used to 225–231 Source docs: for the time value of money. Rate to include the reflect the time value of money. FAS 87–Adopt/M See Actuarial Present Value. definition of Discount rates are used in FAS 106–Adopt/M Discount Rates The rates used to reflect the 715-60 Discount Rates determining the present value as of QA 106 not reviewed time value of money. Discount and include the measurement date of future cash for SAP. rates are used in determining pension obligation. flows currently expected to be the present value as of the Supersede the required to satisfy the pension Term used in SSAPs measurement date of future original Discount obligation or other postretirement 92 and 102. No change cash flows currently expected Rates. benefit obligation. See Actuarial needed. to be required to satisfy the Present Value. postretirement benefit obligation. See Actuarial Present Value. Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update Enhanced- See Enhanced-Yield Bonus N/A • Retain glossary See Enha nced- Yield Bon us. A 232–237 Source docs: Crediting-Rate term Enhanced- sales inducement in which the SOP 03-1 rejected in Bonus Crediting-Rate insurance enti t y offers customers a SSAP 56. Enhanced-Yield A sales inducement in which 944-20, 944-30, 944-40 Bonus, but use cre d iting rate for a stated period in Bonus the insurance entity offers definition from excess of that current l y being customers a crediting rate for a Enhanced-Yield offered f or other similar contracts. stated period in excess of that Bonus. currently being offered for • Supersede the other similar contracts. term Enhanced- Yield Bonus; replace the term Enhanced-Yield Bonus with the term Enhanced- Crediting-Rate Bonus in the Master Glossary definition of the term Sales Inducements. • Replace all links to the term Enhanced-Yield Bonus with links to the term Enhanced- Crediting-Rate Bonus. Add glossary links to Subtopics: • 944-20, Financial Services— Insurance— Insurance Activities Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update • 944-40, Financial Services— Insurance— Claim Costs and Liabilities for Future Policy Benefits. Exchange An exchange (or exchange 845-10 • Supersede An exchange (or exchange 238–244 Source docs: (Definition 1) transaction) is a reciprocal Definition 2; transaction) is a reciprocal transfer ASU 2010-02–Pending transfer between two entities incorporate between two entities that results in ASU 2014-09–Pending that results in one of the Definition 2 into one of the entity’s acquiring assets APB 29–Adopt/M entity’s acquiring assets or Subtopic 978-10. or services or satisfying liabilities SOP 04-2–N/A services or satisfying liabilities • Definition 1 by surrendering other assets or EITF 93-11–Adopt by surrendering other assets or would remain services or incurring other EITF 01-02–Adopt/M services or incurring other unchanged. obligations. EITF 04-13–N/A obligations. Exchange The trading, by a purchaser of 978-10, 978-605 Definition 1 is included (Definition 2) a time- sharing interval, of that in SSAP 95, para. 3c. time-sharing interval for a Definition 2 is rejected given year for another time in SSAP 40. interval, another location, or No changes. another kind of privilege of ownership. Such trading is often effected through the buyer’s membership in an exchange entity. Many developers also offer an internal exchange program. Buyers typically pay a fee for exchange privileges. Expected Long- An assumption about the rate 715-60 • Supersede An assumption about the rate of 245–249 Source docs: Term Rate of of return on plan assets Definition 2; return on plan assets reflecting the FAS 87–Adopt/M Return on Plan reflecting the average rate of replace all links average rate of earnings expected FAS 106–Adopt/M Assets earnings expected on existing with links to on existing plan assets and expected QA 87 not reviewed (Definition 1) plan assets and expected contributions to the plan during the for SAP. Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update contributions to the plan Definition 1. period. during the period. Paraphrased definitions Expected Long-An assumption as to the rate of 715-30 in SSAPs 92 and 102. Term Rate ofreturn on plan assets reflecting No change needed. Return on Planthe average rate of earnings Assets expected on the funds invested (Definition 2) or to be invested to provide for the benefits included in the projected benefit obligation. Expected ReturnAn amount calculated as a 715-60 • Supersede An amount calculated as a basis for 250 Source docs: –255 on Plan Assetsbasis for determining the Definition 2; determining the extent of delayed FAS 106–Adopt/M (Definition 1) extent of delayed recognition replace all links recognition of the effects of changes QA 87 not reviewed of the effects of changes in the with links to in the fair value of plan assets. The for SAP. fair value of plan assets. The Definition 1. expected return on plan assets is expected return on plan assets determined based on the expected Term used in SSAPs is determined based on the long-term rate of return on plan 11, 92 and 102. No expected long-term rate of assets and the market-related value changes needed. return on plan assets and the of plan assets. market-related value of plan assets. Expected ReturnAn amount calculated as a 715-30 on Plan Assetsbasis for determining the (Definition 2) extent of delayed recognition of the effects of changes in the fair value of assets. The expected return on plan assets is determined based on the expected long-term rate of return on plan assets and the market-related value of plan assets. Explicit An approach under which each 715-60 • Supersede An approach under which each 256–259 Source docs: Approach to significant assumption used Definition 1; significant assumption used reflects FAS 87–Adopt/M Assumptions reflects the best estimate of the the best estimate of the plan’s future Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update (Definition 1) plan’s future experience solely replace all links experience solely with respect to Phrase/term used in with respect to that with links to that assumption. See Implicit SSAP 102. No change assumption. Definition 2. Approach to Assumptions. needed. Explicit An approach under which each 715-30 Approach to significant assumption used Assumptions reflects the best estimate of the (Definition 2) plan’s future experience solely with respect to that assumption. See Implicit Approach to Assumptions. Front-End SalesSee Front-End Sales Fee. N/A • Rename the term A sales commission or charge 260–265 Source docs: Load Front-End Sales payable at the time of purchase of EITF 85-24–N/A Front-End SalesA sales commission payable 946-605 Fee to Front-End mutual fund shares. Fee at the time of purchase of Load. Term not used. mutual fund shares. • Supersede the No change needed. term Front-End Sales Load. • Replace all links to the term Front- End Sales Fee with links to the term Front-End Load. Add glossary link to Subtopics: • 946-10, Financial Services— Investment Companies— Overall. • 946-20, Financial Services— Investment Companies— Investment Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update Company Activities. Funding Policy The program regarding the 960-205, 960-310 • Amend Definition 3 The program regarding the amounts 266–273 Source Docs: (Definition 1) amounts and timing of to include pension and timing of contributions by the FAS 35–N/A contributions by the plans. employers, plan participants, and employer(s), participants, and • Supersede any other sources (f o r example, Phrase not in SAP. No any other sources (for Definitions 1 and state, subsidies or federal grants) to change needed. example, state subsidies or 2; replace all links provide the benefits a pension plan federal grants) to provide the with links to or other postretirement benefit plan benefits a pension plan Definition 3. specifies. specifies. Funding Policy The program regarding the 715-30 (Definition 2) amounts and timing of contributions by the employer(s), participants, and any other sources (for example, state subsidies or federal grants) to provide the benefits a pension plan specifies. Funding Policy The program regarding the 715-60 (Definition 3) amounts and timing of contributions by the employers, plan participants, and any other sources to provide the benefits a postretirement benefit plan specifies. Gain or LossA change in the value of either 715-60 • Amend Definition A change in the value of either the 274–281 Source docs: (Definition 1) the accumulated 1 to include accum ulated postretirement benefit FAS 87–Adopt/M postretirement benefit pension obligation (projected benefit FAS 88–Adopt/M obligation or the plan assets information. obligation for pension plans or FAS 106–Adopt/M resulting from experience • Supersede accumulated postretirement b enefit QA 87 not reviewed different from that assumed or obligation for ot h er postretirement for SAP. Appendix A – 2015- 50 Chart of Corrections

Section C: Master Master Glossary Definition Codification Description of Definition Related SAP Status/ Glossary Term Subtopic(s) in Which Changes Paragrap Recommendation Term Is Linked hs in Update from a change in an actuarial Definition 2; b enefit plans) or the plan assets assumption, or the replace all links resulting from experience different Paraphrased in SSAP consequence of a decision to with links to from that assumed or from a change 92 para. 46 and SSAP temporarily deviate from the Definition 1. in an actuarial assumption, or the 102 para 19. substantive plan. Gains or consequence of a decision to No change needed. losses that are not recognized temporarily deviate from the other in net periodic postretirement postretirement b enefit substantive benefit cost when they arise plan. Gains or losses that are not are recognized in other recognized in net periodic pension comprehensive income. Those cost or net periodic postretirement gains or losses are benefit cost when they arise are subsequently recognized as a recognized in other comprehensive component of net periodic income. Those gains or losses are postretirement benefit cost subsequently recognized as a based on the recognition and component of n e t periodic pension amortization provisions of cost or net periodic postretirement Subtopic 715-60. benefit cost based on the Gain or LossA change in the value of either 715-30 recognition and amortization (Definition 2) the projected benefit provisions of Subtopic 715 - 30 or obligation or the plan assets Subtopic 715-60. resulting from experience different from that assumed or from a change in an actuarial assumption. Gains and losses that are not recognized in net periodic pension cost when they arise are recognized in other comprehensive income. Those gains or losses are subsequently recognized as a component of net periodic pension cost based on the amortization provisions of Subtopic 715-30. Appendix A – 2015- 50 Chart of Corrections