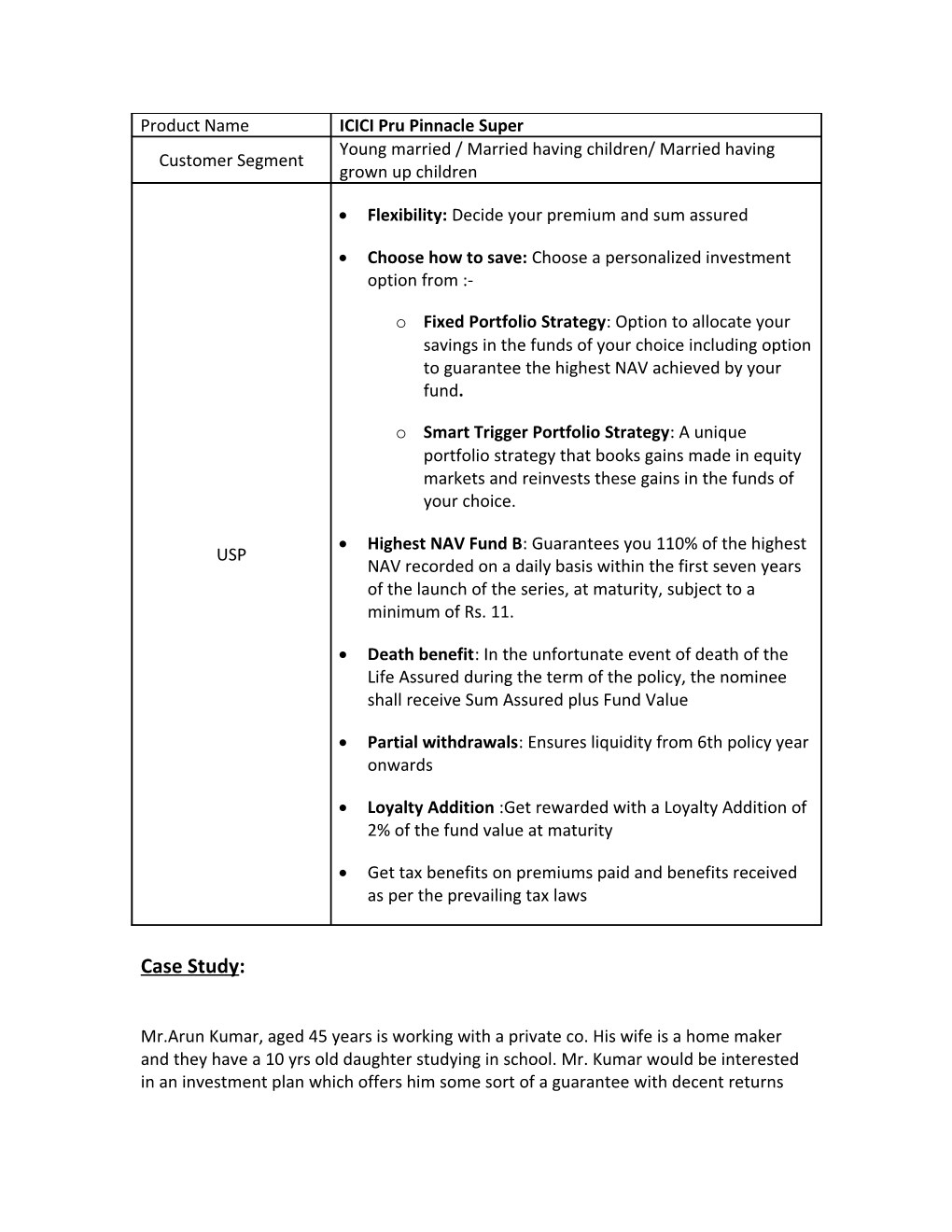

Product Name ICICI Pru Pinnacle Super Young married / Married having children/ Married having Customer Segment grown up children

Flexibility: Decide your premium and sum assured

Choose how to save: Choose a personalized investment option from :-

o Fixed Portfolio Strategy: Option to allocate your savings in the funds of your choice including option to guarantee the highest NAV achieved by your fund.

o Smart Trigger Portfolio Strategy: A unique portfolio strategy that books gains made in equity markets and reinvests these gains in the funds of your choice.

Highest NAV Fund B: Guarantees you 110% of the highest USP NAV recorded on a daily basis within the first seven years of the launch of the series, at maturity, subject to a minimum of Rs. 11.

Death benefit: In the unfortunate event of death of the Life Assured during the term of the policy, the nominee shall receive Sum Assured plus Fund Value

Partial withdrawals: Ensures liquidity from 6th policy year onwards

Loyalty Addition :Get rewarded with a Loyalty Addition of 2% of the fund value at maturity

Get tax benefits on premiums paid and benefits received as per the prevailing tax laws

Case Study:

Mr.Arun Kumar, aged 45 years is working with a private co. His wife is a home maker and they have a 10 yrs old daughter studying in school. Mr. Kumar would be interested in an investment plan which offers him some sort of a guarantee with decent returns which would help him build a kitty to take care of his daughter’s further education when she would be around 20 years of age.

Sales Executive : It gives me pleasure to introduce to you ICICI Pru Pinnacle Super, a unit linked insurance plan, which will not only help your investments grow but would also protect your hard earned money against any downside in the equity market. It also allows you to enjoy an insurance protection as well during the policy term.

Mr. Kumar: Safety in Ulip ! How is that possible?

Sales Executive: Yes Sir, this is possible through our Highest NAV Fund B option available with this plan

Mr. Kumar: Highest NAV fund B? What is that?

Sales Executive: Sir let me explain to you the same in detail. ‘Highest NAV Fund B’ is a mix of equity and debt. The NAV of which is recorded on a daily basis. It guarantees 110% of highest Net Asset Value of the first 7 years, at maturity. It provides protection against market losses while preserving the upward potential.

However you may opt for other funds options available in this plan apart from Highest NAV fund B

Mr. Kumar: OK…

Sales Executive : That is not all Sir, your investment also gets rewarded with a Loyalty Addition of 2% of the fund value at maturity to provide you a lump sum maturity benefit to meet your financial goals such as daughters education or marriage.

Mr. Kumar: That’s OK…but…markets…I am really not sure…

Sales Executive: I understand how you feel Sir. In fact, most of the people felt the same way but you have the unique option of Highest NAV fund B, which preserves your investment against falling markets.

Mr. Kumar: Sounds fine but how does the plan work?

Sales Executive: Under this plan, you have the flexibility to choose your premium amount as well as the sum assured looking to your protection needs. You would be required to pay premiums only for 5 years. You get the maturity benefit at the end of 10 years and enjoy the benefits of insurance protection for the entire term of 10 years.

Mr. Kumar: That means I will get my money only after 10 years… Sales Executive: Let me tell you Sir, this plan takes care of situations when at times you might need money for certain unplanned expenses and financial emergencies. This plan offers you with a flexibility to withdraw money from 6th year onwards every year to a maximum of 20% of the Fund Value.

Mr. Kumar: OK…you mentioned this has insurance too. How does that help?

Sales Executive: Sir in this plan, you can choose the Sum Assured in multiples of the annual premium. In case of unfortunate death, the nominee will receive Sum Assured plus Fund Value…

Mr. Kumar: OK…

Sales Executive: Sir, there’s more to it. You can avail tax benefit under sec 80C on the premiums paid and the maturity, death benefit & all withdrawals are tax free under Sec 10(10 D). So how does the plan sound to you?

Mr. Kumar: Well…seems good to me but I have heard unit linked plans come with very high charges…

Sales Executive: Mr. Kumar I can understand your concern. However, let me update you with the charges.

There would be a 6% premium allocation charge in the 1st year, reducing to 5% for year 2 and further to 3% for years 3 to 5. There is a policy admin charge of 0.25% for 1st five years and 0.10% from the 6th year onwards, of the annual premium.

Fund management charge for highest NAV fund B is 1.35%, and differs as per the fund chosen. Mortality charge would depend upon the sum assured opted.

For Highest NAV fund B, There will be an additional charge for the investment guarantee, made by adjustment to the NAV, which will be charged at 0.50% p.a.

Sir, this is the brochure which has the risk factor and terms and conditions of the plan, please have a look at it.

The policy document having detailed terms and conditions including charges will be sent across to you as part of welcome kit on issue of policy.

In fact, I would also give you the details of the charges while explaining you the benefit illustration. So can we go ahead with the documentation?

Mr. Kumar: OK…. Sales Executive: Mr. Kumar, you have to fill up a form with some basic documentation. The company could ask you to go for medicals…

Mr. Kumar: Medicals….what for?

Sales Executive: Sir this I can assure is in your best interest to get the medicals done. It just helps in avoiding any hassles later, at the time of receiving benefits.

Moreover, Mr. Kumar, the medicals can be done at your convenience

Mr. Kumar: So what documents would you require from me?

Sales Executive: Sir just few documents. Here is the list …

Mr. Kumar: OK….

Disclaimers Strictly for internal circulation only. Should not be further circulated/ used for presentation to a prospect /general public.