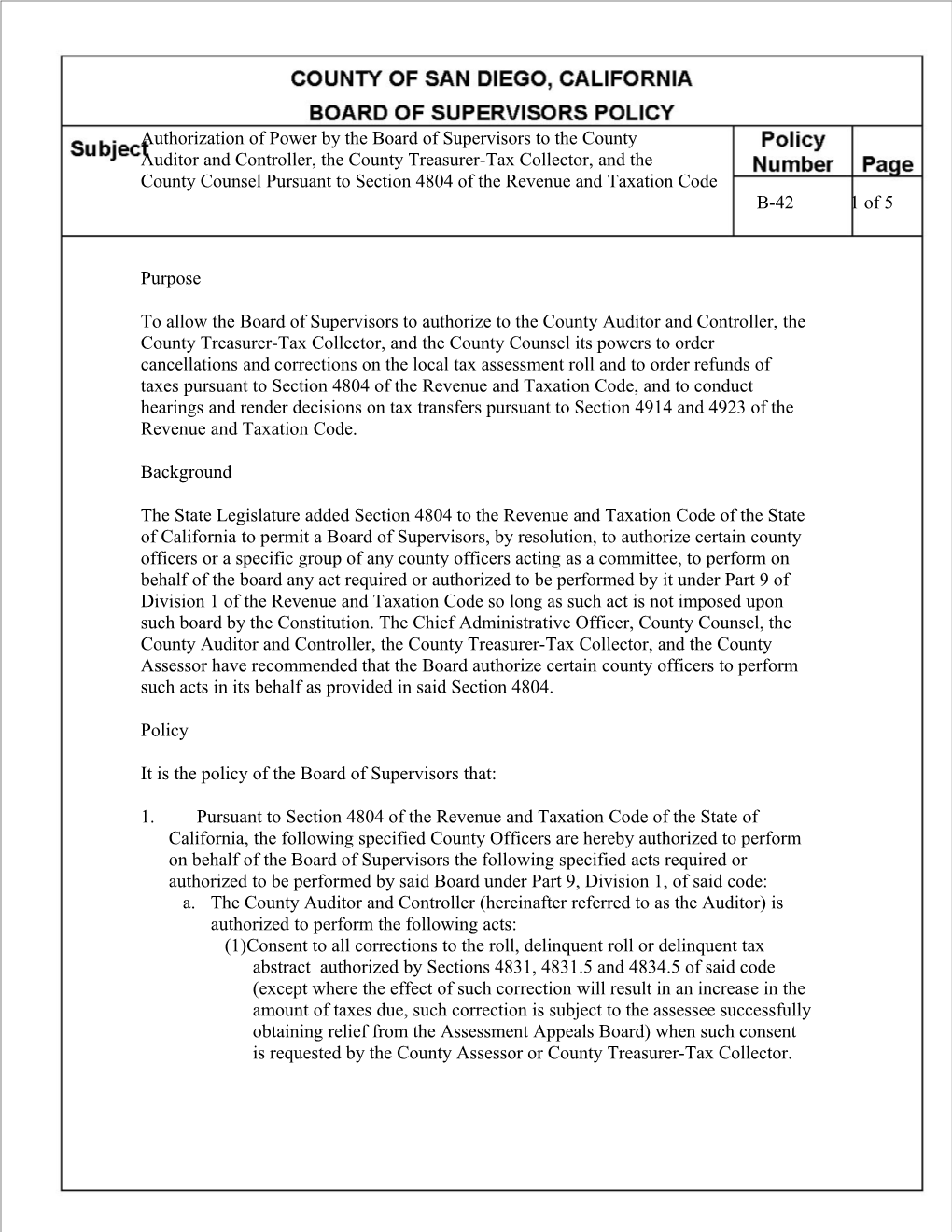

Authorization of Power by the Board of Supervisors to the County Auditor and Controller, the County Treasurer-Tax Collector, and the County Counsel Pursuant to Section 4804 of the Revenue and Taxation Code B-42 1 of 5

Purpose

To allow the Board of Supervisors to authorize to the County Auditor and Controller, the County Treasurer-Tax Collector, and the County Counsel its powers to order cancellations and corrections on the local tax assessment roll and to order refunds of taxes pursuant to Section 4804 of the Revenue and Taxation Code, and to conduct hearings and render decisions on tax transfers pursuant to Section 4914 and 4923 of the Revenue and Taxation Code.

Background

The State Legislature added Section 4804 to the Revenue and Taxation Code of the State of California to permit a Board of Supervisors, by resolution, to authorize certain county officers or a specific group of any county officers acting as a committee, to perform on behalf of the board any act required or authorized to be performed by it under Part 9 of Division 1 of the Revenue and Taxation Code so long as such act is not imposed upon such board by the Constitution. The Chief Administrative Officer, County Counsel, the County Auditor and Controller, the County Treasurer-Tax Collector, and the County Assessor have recommended that the Board authorize certain county officers to perform such acts in its behalf as provided in said Section 4804.

Policy

It is the policy of the Board of Supervisors that:

1. Pursuant to Section 4804 of the Revenue and Taxation Code of the State of California, the following specified County Officers are hereby authorized to perform on behalf of the Board of Supervisors the following specified acts required or authorized to be performed by said Board under Part 9, Division 1, of said code: a. The County Auditor and Controller (hereinafter referred to as the Auditor) is authorized to perform the following acts: (1)Consent to all corrections to the roll, delinquent roll or delinquent tax abstract authorized by Sections 4831, 4831.5 and 4834.5 of said code (except where the effect of such correction will result in an increase in the amount of taxes due, such correction is subject to the assessee successfully obtaining relief from the Assessment Appeals Board) when such consent is requested by the County Assessor or County Treasurer-Tax Collector. Authorization of Power by the Board of Supervisors to the County Auditor and Controller, the County Treasurer-Tax Collector, and the County Counsel Pursuant to Section 4804 of the Revenue and Taxation Code B-42 2 of 5

( (2) Order the cancellation of all or any portion of any assessment and all or any 3 portion of any uncollected tax, penalty or costs authorized by ) Sections4985.2, 4986, 4986.3, 4986.5, 4990 and 5062 of said code when the O County Assessor or County Treasurer-Tax Collector has requested or r approved such cancellation; provided the Auditor shall obtain the written d consent of any city officer required by said sections. Consent of County e Counsel shall be secured in any instance where specifically requested by the r Assessor, Treasurer-Tax Collector or Auditor and Controller.

t h e

c a n c e l l a t i o n

o f

a n y

u n c o l l e c t e d d e l i n q u e n t p e n a l t y , c o s t s , r e d e m p t i o n p e n a l t y , i n t e r e s t o r r e d e m p t i o n f e e a u t h o r i z e d b y

S e c t i o n

4 9 8 5 o f s a i d c o d e

( e x c e p t i n i n s t a n c e s w h e r e s u c h d e l i n q u e n t p e n a l t y , c o s t s , r e d e m p t i o n p e n a l t y , i n t e r e s t o r r e d e m p t i o n f e e h a s a t t a c h e d b e c a u s e o f a n e r r o r o f t h e

A u d i t o r o r b e c a u s e o f t h e

A u d i t o r ' s i n a b i l i t y t o c o m p l e t e v a l i d p r o c e d u r e s i n i t i a t e d p r i o r t o t h e d e l i n q u e n c y d a t e ) w h e n s u c h c a n c e l l a t i o n i s r e q u e s t e d o r a p p r o v e d b y t h e

A s s e s s o r o r

T r e a s u r e r - Authorization of Power by the Board of Supervisors to the County Authorization of PowerAuditor by andthe BoardController, of Supervisors the County to Treasurer-Tax the County Collector, and the Auditor and Controller,County the Counsel County PursuantTreasurer-Tax to Section Collector, 4804 ofand the the Revenue and Taxation Code County Counsel Pursuant to Section 4804 of the Revenue and Taxation Code B-42 3 of 5 B-42 5 of 5

T a x

C o l l e c t o r . (4) Order the cancellation of an entry of any tax on personal property or possessory interest as a lien on real property and order the re-entry of such tax as authorized by Section 4840 of said code when requested by the County Assessor.

b. The County Counsel is hereby authorized to perform the following acts: (1) Consent to the correction of any clerical error of the Auditor on the roll authorized by Section 4832 of said code (except where the effect of such correction will result in an increase in the amount of taxes due, such correction is subject to the assessee successfully obtaining relief from the Assessment Appeals Board) when such consent has been requested by the Auditor. (2) Order the cancellation of any uncollected delinquent penalty, costs, redemption penalty, interest or redemption fee authorized by Section 4985 of said code where such penalty, cost, interest or fee was attached because of an error of the Auditor or because of the Auditor's inability to complete valid procedures initiated prior to the delinquency date, and when such cancellation has been approved or requested by the Auditor. (3) Order the cancellation of the portion of any tax or special assessment understated on the roll by $5.00 or less due to clerical error of the Auditor, authorized by Section 4832.1 of said code, when such cancellation is requested by the Auditor. c. The County Treasurer-Tax Collector is hereby authorized to perform the following acts: (1) Order the refund of any paid taxes as authorized by the following sections of the Revenue and Taxation Code, provided he first obtains the written Authorization of Power by the Board of Supervisors to the County Auditor and Controller, the County Treasurer-Tax Collector, and the County Counsel Pursuant to Section 4804 of the Revenue and Taxation Code B-42 4 of 5

consent specified:

Code Section County Officer's Consent Required 5096(a)...... None 5096(b)...... County Counsel 5096(c)...... County Counsel 5096(d)...... County Assessor 5096(e)...... County Assessor 5096(f)...... None 5096(g)...... County Assessor 5096.5...... County Assessor 5096.7...... None (2) Reject claims for refund, or any portions thereof, filed with the Board of Supervisors either: (a) after a hearing by the Assessment Appeals Board or State Board of Equalization, (b) where the Assessment Appeals Board or State Board of Equalization would have had jurisdiction of the subject matter of the claim for refund but for the failure of the taxpayer to timely file an application for equalization except where a refund, or a portion thereof, must be granted pursuant to Revenue and Taxation Code Section 5096, or (c) where the claim for refund involves legal issues as to the validity of the tax or accrued penalties outside the jurisdiction of the Assessment Appeals Board and a determination has been made that the tax is valid. (3) Accept demands for hearings pursuant to Revenue and Taxation Code Sections 4914 and 4923 concerning the application of tax payments, schedule and conduct the hearings, and render decisions on the transfer.

2. Tax rate applicable. Whenever a correction authorized by the Auditor or the County Counsel results in an increase in an assessment the Auditor shall, pursuant to Section 4836.5 of said code, apply whatever tax rate was in existence in the year in which the error was made. 3. Auditor to keep records. The written authority for each correction shall be filed and preserved by the Auditor as a public record as required by Section 4837 of the Revenue and Taxation Code and the Auditor shall record each act performed pursuant to the authority of this policy, whether performed by the Auditor, County Counsel, County Authorization of Power by the Board of Supervisors to the County Auditor and Controller, the County Treasurer-Tax Collector, and the County Counsel Pursuant to Section 4804 of the Revenue and Taxation Code B-42 5 of 5

Assessor or County Treasurer-Tax Collector as required by Section 4804 of said code. 4. County Counsel consent. Pursuant to the request of County Counsel and the provisions of Section4804 of the Revenue and Taxation Code, the requirement that the County Counsel consent in writing to any act performed by County officers pursuant to delegation of authority of the Board of Supervisors under the provisions of this policy is hereby waived except acts for which the consent of County Counsel is expressly required by this policy. 5. Cancellations requested by special districts. Notwithstanding the fore-going, where the governing body of a special district requests the correction of the roll, delinquent roll or delinquent tax abstract (except where the effect of such correction will result in an increase in the amount of taxes due, such correction is subject to the assessee successfully obtaining relief from the Assessment Appeals Board) or requests the cancellation of all or a portion of a tax imposed by said special district, the Auditor is authorized to perform on behalf of the Board of Supervisors any act required or authorized to be performed by the Board of Supervisors under Part 9 of Division 1 of the Revenue and Taxation Code so long as such act is not imposed upon the Board of Supervisors by the Constitution. 6. Taxes defined. For the purpose of this policy the term tax or taxes includes special assessments, fees and charges carried on the roll, delinquent roll or delinquent tax abstract.

Sunset Date

This policy will be reviewed for continuance by 12-31-16.

Board Action

3-20-70 (68)

3-30-71 (56)

9-18-79 (40)

11-12-80 (8)

6-29-82 (12)

11-6-84 (16)

3-1-88 (92) 4-4-95 (28)

6-15-04 (25)

12-9-08 (33)

09-15-09 (16)

CAO Reference

1. Treasurer-Tax Collector