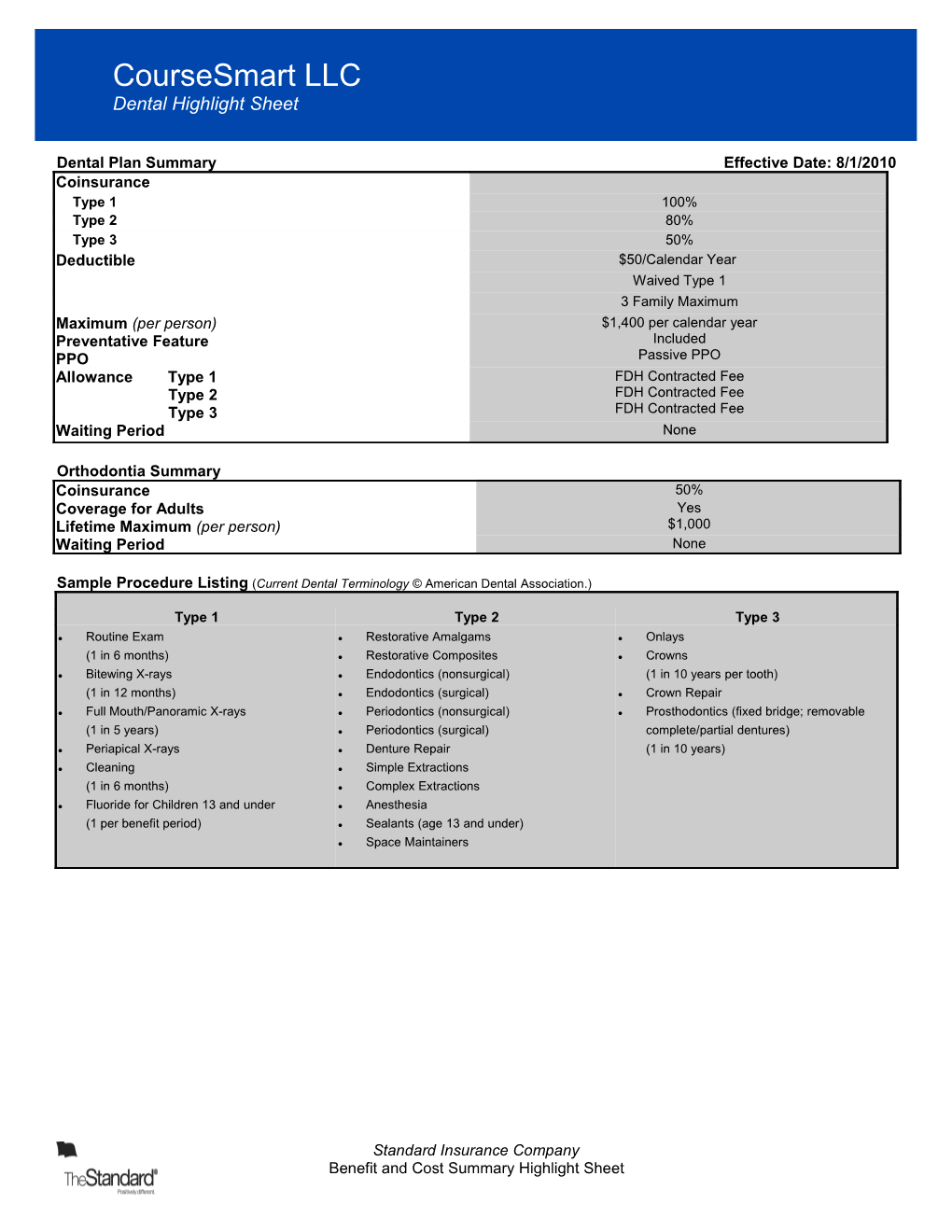

CourseSmart LLC Dental Highlight Sheet

Dental Plan Summary Effective Date: 8/1/2010 Coinsurance Type 1 100% Type 2 80% Type 3 50% Deductible $50/Calendar Year Waived Type 1 3 Family Maximum Maximum (per person) $1,400 per calendar year Preventative Feature Included PPO Passive PPO Allowance Type 1 FDH Contracted Fee Type 2 FDH Contracted Fee Type 3 FDH Contracted Fee Waiting Period None

Orthodontia Summary Coinsurance 50% Coverage for Adults Yes Lifetime Maximum (per person) $1,000 Waiting Period None

Sample Procedure Listing (Current Dental Terminology © American Dental Association.)

Type 1 Type 2 Type 3

l Routine Exam l Restorative Amalgams l Onlays

(1 in 6 months) l Restorative Composites l Crowns

l Bitewing X-rays l Endodontics (nonsurgical) (1 in 10 years per tooth)

(1 in 12 months) l Endodontics (surgical) l Crown Repair

l Full Mouth/Panoramic X-rays l Periodontics (nonsurgical) l Prosthodontics (fixed bridge; removable

(1 in 5 years) l Periodontics (surgical) complete/partial dentures)

l Periapical X-rays l Denture Repair (1 in 10 years)

l Cleaning l Simple Extractions

(1 in 6 months) l Complex Extractions

l Fluoride for Children 13 and under l Anesthesia

(1 per benefit period) l Sealants (age 13 and under)

l Space Maintainers

Standard Insurance Company Benefit and Cost Summary Highlight Sheet CourseSmart LLC Dental Highlight Sheet

A PPO Plan Using The FDH EPO Network l While the dental provider network available to plan participants is called the First Dental Health EPO network, the plan design for our FDH-related products is PPO. This design gives plan participants the freedom to choose any dental care provider, whether in or out of the network. l Plan participants who select one of more than 11,000 provider access points from the independent California-based FDH EPO Network can often save on dental costs. They are guaranteed their dental charges for covered procedures will be no more than the FDH contracted fees. l Non-FDH dentists can collect their normal charges for dental services. Plan participants who select a non-FDH dentist often pay more out-of-pocket because they are responsible for any amount charged by their dentist that exceeds the amount covered by the plan. l Prior to being accepted in the FDH EPO network, dentists must pass a credentialing process. FDH re-credentials its EPO providers every year. l Savings through discounts on non-covered procedures: By choosing an FDH EPO network provider, plan participants will receive a discount on all procedures performed. Important: Discounts on non-covered procedures are not part of the plan coverage. Instead, participants receive the discounts through a contractual arrangement between FDH and its EPO network providers. Participants are responsible for the cost of the procedure. l Here's how the discount arrangement works:

l For procedures listed on the FDH fee schedules, the FDH EPO provider will charge the participant according to the contracted fee amount.

l For procedures not listed on the FDH fee schedules, the FDH EPO provider will discount his or her normal charge by 25% and bill the participant accordingly.

Preventive Feature l With this plan option, benefits for Type 1/Preventive procedures are not deducted from the plan participant's annual maximum benefit. This saves the entire annual maximum for the Type 2/Basic and Type 3/Major procedures that are covered by your plan. l Each plan participant has a separate annual maximum benefit, which is the maximum amount the plan will pay toward Type 2 and Type 3 covered procedures in a benefit period. If your plan includes Type 4/Select procedures, they would be included. Plus, there are no lifetime maximums for Type 2 and Type 3 procedures. l Type 1 procedures include dental exams, cleanings and fluoride. Depending on the plan design, bitewings, panoramic X-rays, sealants and space maintainers also may be included. l Encourages preventive dental care, and gives plan participants more of their annual maximum benefit to spend on higher-priced covered dental procedures, which may include fillings, extractions, crowns and bridges. l Regular dental care is an integral part of maintaining overall health, and preventive care is key to long-term wellness. l Available with all annual maximum options, and works well with our money-saving PPO dental plans for both in- and out-of- network. l Add our Max Builder with PPO bonus and plan participants can carry over a portion of their annual maximum benefit and increase the amount available for future covered dental procedures. (Type 1 benefits would apply to the Max Builder threshold amount.) l Type 1 procedure limitations such as frequency and age apply. Applicable Type 1 deductible and coinsurance (if any) also would apply.

Pretreatment While we don't require a pretreatment authorization form for any procedure, we recommend them for any dental work you consider expensive. As a smart consumer, it's best for you to know your share of the cost up front. Simply ask your dentist to submit the information for a pretreatment estimate to our customer relations department. We'll inform both you and your dentist of the exact amount your insurance will cover and the amount that you will be responsible for. That way, there won't be any surprises once the work has been completed.

Late Entrant Provision We strongly encourage you to sign up for coverage when you are initially eligible. If you choose not to sign up during this initial enrollment period, you will become a late entrant. Late entrants will be eligible for only exams, cleanings, and fluoride applications for the first 12 months they are covered.

Domestic Partner California state law requires that coverage shall be provided to Registered Domestic Partners that is equal to, and subject to the same terms and conditions as, the coverage provided to a spouse. Registered Domestic Partner means a partner of the Insured as long as the partnership meets the requirements for such relationship as defined in Section 297 of the California Family Code or the functional equivalent registration of any other state or local jurisdiction.

This form is a benefit highlight, not a certificate of insurance. Standard Insurance Company Benefit and Cost Summary Highlight Sheet