OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 1 of 31

Brief facts of the case

M/s. Nishta Mall Management Company Pvt. Ltd.(herein after referred to as ‘the said service provider’) is providing Renting of Immovable Property service as defined under Section 65(90a) of the Finance Act, 1994 (hereinafter referred to as “the Act”) and having Service Tax Registration No. AAECM0705HST001 with the Service Tax Commissionerate, Ahmedabad.

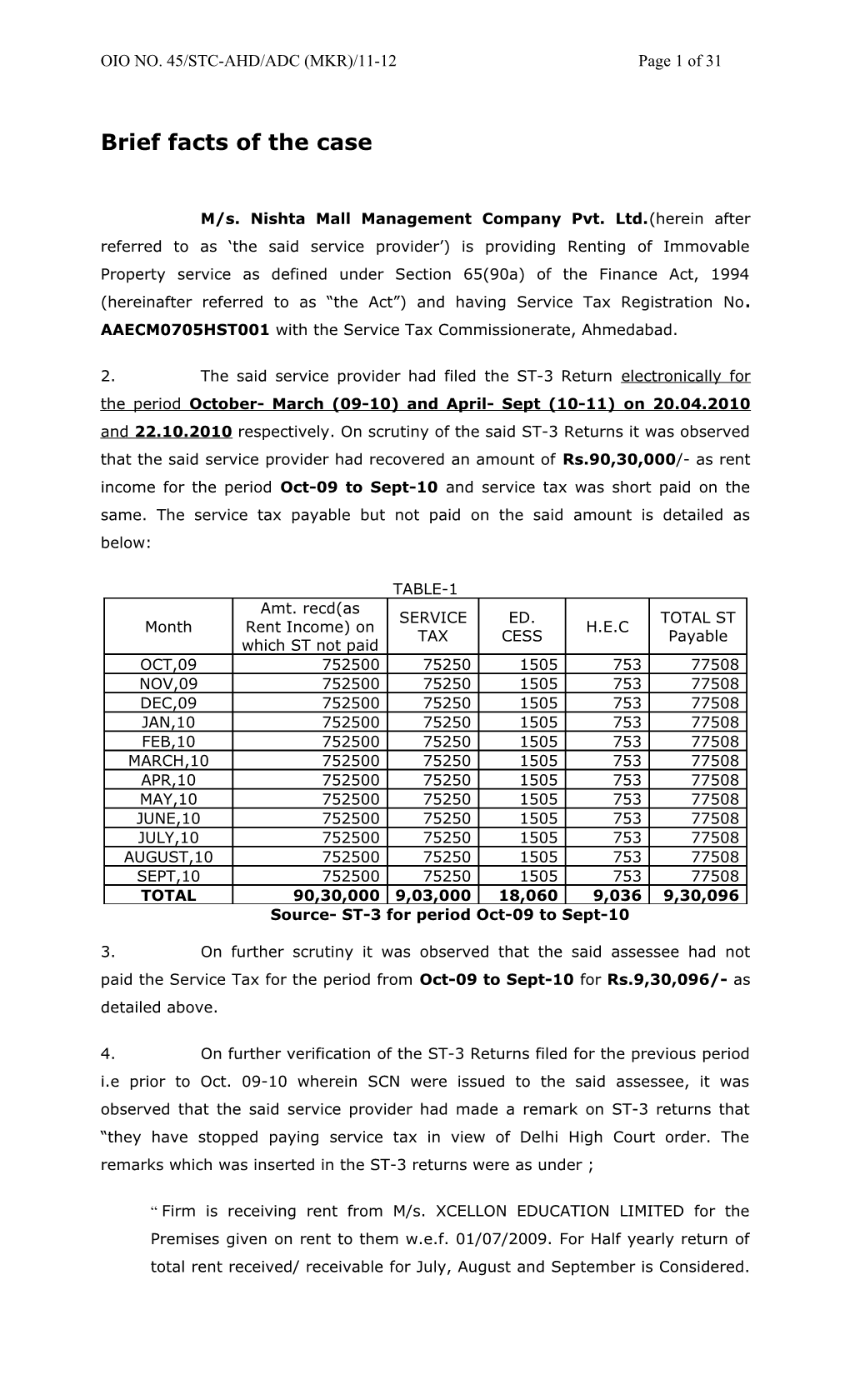

2. The said service provider had filed the ST-3 Return electronically for the period October- March (09-10) and April- Sept (10-11) on 20.04.2010 and 22.10.2010 respectively. On scrutiny of the said ST-3 Returns it was observed that the said service provider had recovered an amount of Rs.90,30,000/- as rent income for the period Oct-09 to Sept-10 and service tax was short paid on the same. The service tax payable but not paid on the said amount is detailed as below:

TABLE-1 Amt. recd(as SERVICE ED. TOTAL ST Month Rent Income) on H.E.C TAX CESS Payable which ST not paid OCT,09 752500 75250 1505 753 77508 NOV,09 752500 75250 1505 753 77508 DEC,09 752500 75250 1505 753 77508 JAN,10 752500 75250 1505 753 77508 FEB,10 752500 75250 1505 753 77508 MARCH,10 752500 75250 1505 753 77508 APR,10 752500 75250 1505 753 77508 MAY,10 752500 75250 1505 753 77508 JUNE,10 752500 75250 1505 753 77508 JULY,10 752500 75250 1505 753 77508 AUGUST,10 752500 75250 1505 753 77508 SEPT,10 752500 75250 1505 753 77508 TOTAL 90,30,000 9,03,000 18,060 9,036 9,30,096 Source- ST-3 for period Oct-09 to Sept-10

3. On further scrutiny it was observed that the said assessee had not paid the Service Tax for the period from Oct-09 to Sept-10 for Rs.9,30,096/- as detailed above.

4. On further verification of the ST-3 Returns filed for the previous period i.e prior to Oct. 09-10 wherein SCN were issued to the said assessee, it was observed that the said service provider had made a remark on ST-3 returns that “they have stopped paying service tax in view of Delhi High Court order. The remarks which was inserted in the ST-3 returns were as under ;

“ Firm is receiving rent from M/s. XCELLON EDUCATION LIMITED for the Premises given on rent to them w.e.f. 01/07/2009. For Half yearly return of total rent received/ receivable for July, August and September is Considered. OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 2 of 31

However in view of the Hon’ble Delhi High Court order in the matter of M/s. Home Solution Retails India Ltd., the tenant M/s. XCELLON EDUCATION LIMITED is not paying service tax alongwith monthly rent and therefore we have not deposited any Service Tax on rent received/ receivable from M/s. XCELLON EDUCATION LIMITED. We are enclosing herewith copy of letter dated 16/10/2009 issued by M/s. XCELLON EDUCATION LIMITED whereby they have conveyed that they will not pay us the Service Tax in view of the above referred Order of Hon’ble Delhi High Court.

It appeared that similar practice for non payment of service tax was continued by the assessee, in the period subsequent to Sept. 2009 onwards.

5. The stay granted by the hon’ble High Court in the case of M/s Home Solution Retails India Ltd., has been vacated by the Supreme Court vide order dated 10.01.2011 & 04.02.2011. Further, the Hon’ble Punjab and Haryana High Court has in CWP No. 11597 of 2010, in the case of M/s Shubh Timb Steels Ltd. v/s UOI passed an order dated 22/11/2010, upheld the validity of levy of service tax on Renting of Immoveable Property and upheld Parliament legislative competence to levy Service Tax on Renting with retrospective amendment.

6. Section 65 (90a) of the Finance Act, 1994 defines the services of Renting of immovable Property as under:-

“ Renting of immovable property” includes renting, letting, leasing, licensing or other similar arrangements of immovable property for use in the course or furtherance of business or commerce but does not include:-

(i) Renting of immovable property by a religious body or to a religious body; or

(ii) renting of immovable property to an educational body, imparting skill or knowledge or lessons on any subject or field, other than a commercial training or coaching centre;

Explanation 1.—For the purposes of this clause, “for use in the course or furtherance of business or commerce” includes use of immovable property as factories, office buildings, warehouses, theatres, exhibition halls and multiple-use buildings;]*

Explanation 2.— For the removal of doubts, it is hereby declared that for the purposes of this clause “renting of immovable property” includes allowing or permitting the use of space in an immovable property, irrespective of the transfer of possession or control of the said immovable property; OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 3 of 31

7. The service of “Renting of immovable Property” was taxable service under Section 65(105) (zzzz) of the Finance Act, 1994 as amended by the Finance Act 2010 with the retrospective effect from 1st June 2007, according to which, the “taxable service” means any service provided or to be provided-

“ to any person, by any other person, by renting of immovable property or any other service in relation to such renting, for use in the course of or, for furtherance of, business or commerce.”;

Explanation-1- for the purposes of this sub-clause, “immovable property” includes-

(i) Building and part of a building, and the land appurtenant thereto;

(ii) land incidental to the use of such building or part of a building;

(iii) the common or shared areas and facilities relating thereto; and

(iv) in case of a building located in a complex or an industrial estate, all common areas and facilities relating thereto, within such complex or estate, but does not include-

(a) vacant land solely used for agriculture, aquaculture, farming, forestry, animal husbandry, mining purposes;

(b) vacant land, whether or not having facilities clearly incidental to the use of such vacant land;

(c) land used for educational, sports, circus, entertainment and parking purposes; and

(d) building used solely for residential purposes and buildings used for the purposes of accommodation, including hotels, hostels, boarding houses, holiday accommodation, tents, camping facilities.

Explanation 2.—For the purposes of this sub-clause, an immovable property partly for use in the course or furtherance of business or commerce and partly for residential or any other purposes shall be deemed to be immovable property for use in the course or furtherance of business or commerce;

(v) Vacant land, given on lease or license for construction of building or temporary

Further, in the Finance Act, 2010, Validation of action taken under sub-clause (zzzz) of clause (105) of Section 65, is explained as under:-

Any action taken or anything done or omitted to be done or purported to have been taken or done or omitted to be done under sub-clause (zzzz) of clause OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 4 of 31

(105) of section 65 of the Finance Act, 1994, at any time during the period commencing on and from the 1st day of June, 2007 and ending with the day, the Finance Bill, 2010 receives the assent of the President, shall be deemed to be and deemed always to have been, for all purposes, as validly and effectively taken or done or omitted to be done as if the amendment made in sub-clause (zzzz) of clause (105) of section 65, by sub-item (i) of item (h) of sub-clause (5) of clause (A) of section 75 of the Finance Act, 2010 had been in force at all material times and, accordingly, notwithstanding anything contained in any judgment, decree or order of any court, tribunal or other authority,—

(a) any action taken or anything done or omitted to be taken or done in relation to the levy and collection of service tax during the said period on the taxable service of renting of immovable property, shall be deemed to be and deemed always to have been, as validly taken or done or omitted to be done as if the said amendment had been in force at all material times;

(b) no suit or other proceedings shall be maintained or continued in any court, tribunal or other authority for the levy and collection of such service tax and no enforcement shall be made by any court of any decree or order relating to such action taken or anything done or omitted to be done as if the said amendment had been in force at all material times;

(c) Recovery shall be made of all such amounts of service tax, interest or penalty or fine or other Charges which may not have been collected or, as the case may be, which have been refunded but which would have been collected or, as the case may be, would not have been refunded, as if the said amendment had been in force at all material times.

Explanation.—For the removal of doubts, it is hereby declared that no act or omission on the part of any person shall be punishable as an offence which would not have been so punishable had this amendment not come into force.

8. Thus, as per above stand taken by the said assessee for non-payment of service tax appears non-maintainable making the service provider liable for paying service tax on Renting of immovable property service.

9. It is provided under Section 68(1) of the act that ‘every person providing taxable service to any person shall pay service tax at the rate specified in section 66 in such manner and within such period as may be prescribed.’ The manner and period of payment prescribed under Rule 6 of the Service Tax Rules, 1994 permitting the use of space in an immovable property, irrespective of the transfer of possession or control of the said immovable property;

Further, in the Finance Act, 2010, Validation of action taken under sub-clause (zzzz) of clause (105) of Section 65, is explained as under:- OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 5 of 31

Taxable service to any person shall pay service tax at the rate specified in section 66 in such manner and within such period as may be prescribed.’ The manner and period of payment is prescribed under Rule 6 of the Service Tax Rules, 1994. Further, in their ST-3 returns self assessment memorandum para 7, they have given declaration that they have assessed and paid the service tax and/or availed and distributed Cenvat credit correctly as per the provisions of the Finance Act,1994 and the rules thereunder. However, it appeared that they had wrongly given certificate by not paying the appropriate service tax.

10. In the instant case it appeared that the said service provider had not paid service tax of Rs. 9,30,096/- and thereby appeared to violate the provisions of Section 68(1) read with Rule 6 of the Service Tax Rules, 1994.

11. It is provided under Section 70 of the act that ‘every person liable to pay the service tax shall himself assess the tax due on the service provided by them and shall furnish to the Superintendent of Central Excise, a return in such form and in such manner and as such frequency’. The form, manner and frequency are prescribed in Rule 7 of the Service Tax Rules, 1994.

12. In the instant case the said service provider had not assessed the tax due on the service provided by them and not paid the service tax of Rs. 9,30,096/- and thereby violated the provisions of Section 70 of the act and Rule 7 of the Service Tax Rules, 1994.

13. In view of the above, it appeared that the said assessee had contravened the provisions of Section 68 & 70 of the Act, and Rule 6 & 7 of the Service Tax Rules, 1994. All the contraventions and violations made by the said assessee appears to had rendered themselves liable to penalty under Section 76 & 77 of the act and the service tax of Rs. 9,30,096/- is recoverable under Section 73 of the act.

14. Therefore, M/s. Nishta Mall Management Company Pvt. Ltd. was directed to show cause to the Additional Commissioner of Service Tax vide SCN F.No. STC-53/O&A/SCN/NMM/ADC/10-11 dated 04.04.2011 as to why :

(i) amount of Service Tax of Rs.9,30,096/- (Incl. cess), not paid by the assessee, should not be demanded and recovered from them under the provisions of Section 73(1) of the Finance Act 1994; (ii) Interest, at appropriate rate, should not be charged upon them under section 75 of the Finance Act 1994; (iii) penalty should not be imposed upon them under Section 76 of the Finance Act 1994, for contravention of Section 68(1) of the Finance Act, 1994 read with Rule 6 of the Service Tax Rules, 1994; and (iv) penalty under section 77 of the Finance Act, 1994 should not be imposed upon them for the contravention of Section 67 of the Finance Act, OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 6 of 31

1994, for not computing the correct tax rate for computation of service tax payable.

15. Defence reply:- The service provider vide their letter dated 12.07.2011 and 29.11.2011 has submitted their defence reply wherein they, inter-alia,submitted that

15.1 They further submitted that the retailers Association of India had challenged the constitutional validity and the fact that providing the premises for using does not amount to rendering of services, that the Mumbai High Court and the other High Courts has granted the interim stay. The department had approached Hon’ble Supreme Court had requested the Supreme Court and requested them that the petitions shall be heard by one High Court, that as per the direction of the Supreme Court, all the matters in the various high court were transferred to Delhi High Court who has heard the matter, that thus, it is submitted that the matter is subjudice and therefore the decision on show cause notice may be kept pending till the Delhi High Court has decided the petition.

15.2 They further submitted that the Delhi High Court has held that licensing of the premises does not amount to rendering of services.

15.3 They further submitted that the amount shown in the show cause notice indicates the amount received by the company during the relevant period, that the company has not charged service tax to the service receiver as the company was under a bonafide belief that no service tax is payable by the company, that The explanation 2 to section 67 during the relevant time read as follows:-

Where the gross amount not charged by a service provider is inclusive of service tax payable, the value of taxable service shall be such amount as with the addition of tax payable, is equal to the gross amount charged.

15.4 They further submitted that the Hon, Supreme court has in the case of Maruti Udyog 2002 (141) ELD 003 (SC) has held that amount realized by the company towards the sale of goods should be considered as inclusive of duty & the assesable value should be recomputed, that the Hon, tribunal also in the case of Rampur Engineering 2006 (5) STT 386 has held that in the case of service tax also, if service tax is separately recovered from the customer, the value should be considered as inclusive of service tax and the value of taxable services shall be recomputed, that in those case, the service tax has not been separately recovered and therefore the value should be considered as inclusive of duty, that the value of taxable service should be recomputed.

15.5 They further submitted that under Section 80 of the service tax empowers the commissioner of central excise to waive the penalty if the assessee proves that there was a reasonable cause for non payment of service tax, that The words "reasonable cause" has been define as follows :- OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 7 of 31

Reasonable cause can be reasonably said to be a cause which prevents a man of average intelligence and ordinary prudence, acting under normal circumstances, without negligence or inaction or want of bonafides-Azadi BsachaoAndolan II. Union oflndia 2001 (116) Texman 249/252ITR471.

That , there was reasonable cause that the service tax is not payable by the company, that the fact that Mumbai High Court has granted the stay, itself Substantiate that it is possible to hold view that tax is not payable, that there is reasonable cause for non-payment of service tax.

15.6 They further submitted that the issue involved in the instant case relates to interpretation of the definition of the services given in the statute, that the Hon, Tribunal has consistently held that the penalty should not be imposed where the question of interpretation of any statutory provision are involved, that The appellants rely upon the following judgments for the above preposition.

(a) Sonar Wires Pvt. Ltd. Vs. CCEx.1996 (87) ELT 439 (T) (b) Synthetics & chemicals limited 1997 (89) ELT 793 (T) (c) Man Industries Corporatoin 1996 (88) ELT 178 (T) (d) Sports & Leisure apparel Ltd. CCE .. noida 2005 (180) ELT 429 (e) Aquamall water solutions Ltd. 2003 (153) ELT 428 (f) Blue cross laboratories Ltd. vide order no. Al1529/C-IV/SMB/2007 In this case, the issue is whether licensing/leasing of the premises is taxable service under section 65 (1 05)(zzzz). Thus, the issue relates to interpretation of statutory provisions.

16. They further submitted their reply on 30.11.2011 vide their letter dated 29.11.2011 wherein they deny the entirety of the allegations in the captioned SCN.

16.1 They further submitted that no Service tax can be levied under the taxing entry of Renting of Immovable Property Service as it existed prior to 2010, that vide Finance Act, 2007, w.e.f. 01.06.2007, there was a levy of Service tax on the renting of immovable property. The taxable service as defined under Section 65(105)(zzzz), as it existed prior to the enactment of Finance Act, 2010 is reproduced hereunder: “(zzzz) to any person, by any other person in relation to renting of immovable property for use in the course or furtherance of business or commerce. Explanation 1. – For the purposes of this sub-clause, “immovable property” includes- (i) building and part of a building, and the land appurtenant thereto; (ii) land incidental to the use of such building or part of a building; (iii) the common or shared areas and facilities relating thereto; and (iv) in case of a building located in a complex or an industrial estate, but does not include - OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 8 of 31

All common areas and facilities relating thereto, within such complex or estate, but does not include- (a) vacant land solely under for agriculture, aquaculture, farming, forestry, animal husbandry, mining purposes; (b) vacant land whether or not having facilities clearly incidental to the use of such vacant land; (c) land used for educational, sports, circus, entertainment and parking purposes; and (d) building used solely for residential purposes and buildings used for the purposes of accommodation, including hotels, hotels, boarding houses, holiday accommodation, tents, camping facilities. Explanation 2 – For the purposes of this sub-clause, an immovable property partly for use in the course or furtherance of business or commerce and partly for residential or any other purposes shall be deemed to be immovable property for use in the course or furtherance of business or commerce;”

The term “Renting of Immovable property” has been defined vide Section 65(90a) as under:

“65(90a) “renting of immovable property” includes renting, letting, leasing, licensing or other similar arrangements of immovable property for use in the course or furtherance of business or commerce but does not include --- (i) renting of immovable property by a religious body or to a religious body; or (ii) renting of immovable property to an educational body, imparting skill or knowledge or lessons on any subject or field, other than a commercial training or coaching centre; Explanation,--- For the purposes of this clause, “for use in the course or furtherance of business or commerce” includes use of immovable property as factories, office buildings, warehouses, theatres, exhibition halls and multiple-use buildings;” They further submitted that, in terms of the clear language of the taxing entry of Renting of Immovable Property Service, only service ‘in relation to’ Renting of Immovable Property is taxable and the taxing entry does not cover the renting out of immovable property by itself, that this position has been clearly laid down by the Hon’ble Delhi High Court in Home Solution Retail India Ltd. v. Union of India [2009 (237) E.L.T. 209 (Del.)], wherein the Hon’ble Court held as under:

“35. From this analysis, it is clear that we have to understand as to whether renting of immovable property for use in the course or furtherance of business or commerce by itself is a service. There is no dispute that any service connected with the renting of such immovable property would fall within the ambit of Section 65(105)(zzzz) and would be exigible to service tax. The question is whether renting of such immovable property by itself constitutes a service and, thereby, a taxable service. We have already seen that service tax is a value added tax. It is a tax on the value addition provided by some service OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 9 of 31

provider. Insofar as renting of immovable property for use in the course or furtherance of business or commerce is concerned, we are unable to discern any value addition. Consequently, the renting of immovable property for use in the course or furtherance of business of commerce by itself does not entail any value addition and, therefore, cannot be regarded as a service. Of course, if there is some other service, such as air conditioning service provided alongwith the renting of immovable property, then it would fall within Section 65(105)(zzzz). 36. In view of the foregoing discussion, we hold that Section 65(105)(zzzz) does not in terms entail that the renting out of immovable property for use in the course or furtherance of business of commerce would by itself constitute a taxable service and be exigible to service tax under the said Act. The obvious consequence of this finding is that the interpretation placed by the impugned notification and circular on the said provision is not correct. Consequently, the same are ultra vires the said Act and to the extent that they authorize the levy of service tax on renting of immovable property per se, they are set aside.” That , in view of the aforesaid decision, prior to amendment vide Finance Act, 2010, the incidence of the levy was on services ‘in relation to’ Renting of Immovable Property, not on renting per se, and no liability existed under the aforesaid taxing entry as “renting” was not a service per se.

16.2 They further submitted that Service tax cannot be retrospectively levied in pursuance of the 2010 Amendment , that vide Section 76(A)(6)(h) of the Finance Act, 2010, the Central Government amended the definition of the taxing entry under Section 65(105)(zzzz) as below:

“76. Amendment of Act 32In the Finance Act, 1994, - (A) in section 65, save as otherwise provided, with effect from such date as the Central Government 1994, may, by notification in the Official Gazette, appoint, - ... (6) in clause (105), - … (h) in sub-clause (zzzz), - (i) for the portion beginning with the words “to any person” and ending with the word “business or commerce”, the following shall be substituted and shall be deemed to have been substituted with effect from the 1st day of June, 2007, namely: - “to any person, by any other person, by renting of immovable property or any other service in relation to such renting, for use in the course of or, for furtherance of, business or commerce.”, (ii) in Explanation 1, after item (iv) the following items shall be inserted, namely:- “ (v) vacant land, given on lease or license for construction of building or temporary structure at a later stage to be used for furtherance of business or commerce;”; (Emphasis Supplied) OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 10 of 31

16.3 They submitted that the taxing entry was retrospectively amended in 2010 with effect from 01.06.2007, and in consequence of the aforesaid amendment, the Service tax was made leviable on ‘renting’ per se , that the retrospective amendment of Section 65(105)(zzzz) of the Finance Act is illegal and unsustainable in law. The amendment being substantive in nature cannot be made applicable to a period prior to the date of the amendment owing to the existence of an entirely different position in law , that the amendment to the definition of the taxable service was made under Section 76(A)(6)(h)(i) and Section 77, which sought to reintroduce Service tax on renting of immovable property from a retrospective date i.e. from 01.06.2007 and also validating all the actions taken or to be taken commencing on and from the 01.06.2007 and thereby provided the liberty to TRU to make all recoveries of Service tax with interest, penalty or fine along with other charges as though the amended provision stood incorporated from 01.06.2007, that it is settled law that a tax cannot operate retrospectively as it is a burden on the assessee. Reliance is placed on the following case laws:

(i) Suchitra Components Ltd. v. Commissioner of Central Excise, Guntur [2007 (208) E.L.T. 321 (S.C.)] (ii) Commissioner of Central Excise v. M/s. Mysore Electricals Industries Ltd. [2006 (204) E.L.T. 517 (S.C.)] (iii) V.K. Enterprises v. Commissioner of Central Excise [2010 (249) E.L.T. 462 (Tri. - Del.)]

16.4 They further submitted that an insight into Section 65(105)(zzzz) of the Finance Act as it was originally intended, would give one an inkling of what the Parliament actually intended, that it was originally supposed to only cover such services as would add value to the immovable property such as air-conditioning, water and power supply etc. and not to cover the renting of the immovable property itself, that it is clear that there is no resemblance whatsoever between the amendment in 2010 and the Section as it originally stood; they are two totally different creatures, that as such it cannot possibly be said that the amendment is a clarification of the existing law, that the issue with respect to the validity of the retrospective amendment is presently pending before the Hon’ble Supreme Court and consequently, in the interim, till the final disposal of the appeal, no demand of Service tax can be raised and collected.

16.5 They further submitted that no Service tax can be levied even post the amendment w.e.f. 01.06.2007 on the following grounds:

1. ‘ Renting’ per se is not a service. The grant of lease by whatever name called, amounts to transfer of rights, and does not amount to a service rendered by the lessor to the lessee. The lessor or the licensor is not a service provider but a transferor of rights in the immovable property.

2. The levy of Service tax on ‘Renting of Immovable Property’ is ultra vires the Constitution of India as the same is not within the legislative competency of the OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 11 of 31

Central Government in as much as these matters fall under Entry 49 of List II of the Seventh Schedule to the Constitution of India and the Central Government does not have the power to tax a state subject.

3. Since, the amendment has not and in fact, cannot cure the defect the validating provision is illegal and invalid. It is submitted that the lack of legislative competency of the Central Government to tax renting per se cannot be allowed to be cured by an artificial introduction of the words “by renting of immovable property” in the Finance Act. An act of renting of immovable property does not provide any value addition to the property or to the service seeker.

16.6 They further submitted the issue of whether or not renting itself is a service, is presently pending before the Hon’ble Supreme Court and consequently, in the interim, till the final disposal of the appeal, no demand of Service tax can be raised and collected.

16.7 They further submitted that CENVAT Credit of Service Tax Payable would be Available to the Noticee, that Noticee is liable to pay Service tax under the taxing entry of Renting of Immovable Property, the Noticee is entitled to take credit of inputs and input services used for providing such output services, that in terms of the provisions of the CENVAT Credit Rules, 2004 (‘Credit Rules’), credit of Excise duty and Service tax paid on inputs and inputs services respectively, used for the provision of output taxable service is available to an assessee, that in this regard, various inputs are used for the construction of the premises which is ultimately let out by the Noticee, that CENVAT credit of excise duty paid on such inputs is available to the Noticee , that the Noticee also avails certain input services which are used for the construction of the said premises, that the Noticee submits credit of such input services is also available to the Noticee.

16.8 They further submitted that additionally, Noticee that without prejudice to the above, the inclusive part of the definition of ‘input service’ specifically includes ‘services in relation to … activities relating to business such as’. This expression was interpreted in a catena of decisions to have a wide scope. Reliance in this regard, is placed on the following decisions:

(i) Coca Cola India Pvt. Ltd. v. Commissioner of C. Ex., Pune-III [2009 (242) ELT 168 (Bom)] (ii) ABB Ltd. v. Commissioner of C. Ex. &S.T., Bangalore [2009 (15) STR 23 (Tri-LB)] (iii) Semco Electrical Pvt. Ltd. v. Commissioner of C. Ex., Pune [2010 (18) STR 177 (Tri- Mumbai)] (iv) ITC Ltd. v. Commissioner of Central Excise, Hyderabad [2010 (17) STR 146 (Tri- Bang)] (v) Rashtriya Ispat Nigam Ltd. v. Commr. of C. Ex., Visakhapatnam [2010 (19) STR 389 (Tri - Bang)] OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 12 of 31

16.9 They further submitted that in the instant case, clearly Excise duty paid on the inputs and Service tax on the input services is available to the Noticee as credit, that consequently, the tax payable by the Noticee may by decreased by the value of credit taken on such inputs and inputs services.

16.10 They further submitted that Cum-Duty Benefit to be Given to the Noticee, that assuming without admitting that the Noticee is liable to pay Service tax, it is required to be calculated in an inclusive manner ; that the cum-tax benefit is available as a general principle in terms of Section 67(2) of the Finance Act. The relevant provision has been reproduced herein below:

“67. Valuation of taxable services for charging Service tax (1) … (2) Where the gross amount charged by a service provider, for the service provided or to be provided is inclusive of service tax payable, the value of such taxable service shall be such amount as, with the addition of tax payable, is equal to the gross amount charged.” Further, the cum-tax benefit is also a judicially established position. Reliance in this regard is placed on the following decisions:

(i) Commissioner of Service tax, Bangalore v. Prompt & Smart Security [2008 (9) S.T.R. 237 (Tri. - Bang.)] (ii) Commissioner of Central Excise, Delhi v. Maruti Udyog Ltd. [2002 (141) E.L.T. 3 (S.C.)] (iii) Rampur Engineering Co. Ltd. vs. Commissioner of Central Excise [2006 (3) S.T.R. 650 (Tri. - Del.)] (iv) Panther Detective services vs. Commissioner of Central Excise [2006 (4) S.T.R. 116 (Tri. - Del.)]

Reliance in this regard, is also placed on Trade Notice No.20/2002 dated 23.05.2002 of Delhi-II Commissionerate, which is reproduced as below supports our assertion:

“ The liability to pay the service tax remains with the service provider in the current scenario. Failure to realise or even charge the 5% service tax does not negate this statutory liability. In event of any such failure, the amounts realised from client in lieu of having rendered the service(s) will be taken to constitute amounts inclusive of service tax. Accordingly, the amount of service tax will be determined and required to be deposited to the credit of the Central Government.”

In view of the aforesaid, the amount is to be considered to be inclusive of all taxes and the cum-tax benefit would be available to the Noticee.

16.11 They further submitted that the Noticee was always under a genuine bona fide belief that they were not liable to discharge any Service tax liability on the basis of the position OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 13 of 31 in law as established in the decision of the Hon’ble Delhi high Court in the decision of Home Solutions Retail India Ltd (supra); that as aforementioned, the Hon’ble High Court held that the provisions imposing a levy of Service tax on Renting of Immovable Property is ultra vires the Constitution of India as the Union Legislature does not have the legislative competence therefore; that consequently, assessees were not required to pay Service tax; that Moreover, the demand of Service tax by the Department was not in line with the prevailing judicial position.

They further submitted that in such case, when there is a retrospective amendment, it cannot be alleged that the Noticee has suppressed any facts from the Department. Clearly, in terms of the taxing entry as it stood prior to the amendment, there was no liability to tax and the Noticee was not liable to disclose any information to the Department.

In this regard, reliance may be placed on Circular No. 588/25/2001-CX, dated 19- 9-2001 wherein the CBEC, in relation to a certain retrospective amendments under Central Excise laws, has clarified as below:

“1. My opinion is sought on the question of the scope and amplitude of the retrospective amendment to Section 11A of the Central Excise Act, specifically enacted to protect the Revenue’s interest after the judgment of the Hon’ble Supreme Court in the case of Collector of Central Excise v. M/s. Cotspun Ltd., 1999 (113) E.L.T. 353 (S.C.).… 2. Thus, it can be seen from Section 110 of the Finance Act, 2000 that the section seeks to grant legitimacy to all the actions taken for the recovery of the duty from the period 17- 11-1980 and that any action initiated in respect of any case after such date shall be deemed to have been validly taken and any judgment, decree or order of any court, tribunal or other authority shall not be an impediment to such an action.

They further submitted that the settled position as set out in the circular has been reiterated in a number of cases as set out below:

(i) J.K. Spinning and Weaving Mills Ltd. & Another [1987 (32) E.L.T. 234 (S.C.)] “31. Under Section 11A(1) the Excise authorities cannot recover duties not levied or not paid or short-levied or short-paid or erroneously refunded beyond the period of six months, the proviso to Section 11A not being applicable in the present case. Thus although Section 51 of the Finance Act, 1982 has given retrospective effect to the amendments of Rules 9 and 49, yet it must be subject to the provision of Section 11A of the Act. We are unable to accept the contention of the learned Attorney General that as Section 51 has made the amendments retrospective in operation since February 28, 1944, it should be held that it overrides the provision of Section 11A. If the intention of the Legislature was to nullify the effect of Section 11A, in that case, the Legislature would have specifically provided for the same. Section 51 does not contain any non-obstante clause, nor does it refer to the provision of Section 11A. In the circumstances, it is difficult to hold that Section 51 overrides the provision of Section 11A.” OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 14 of 31

(ii) Bajaj Auto Limited v. UOI [2003 (151) E.L.T. 23 (Bom.)] “ ...even when the Revenue is entitled to recover excise duty on account of retrospective amendment to the Excise Rules, recovery will be subject to the limitation prescribed under Section 11A of the Excise Act. In other words, even the amendment, which empowered the Revenue to recover excise duty with retrospective effect, in the absence of non obstante clause in the amendment, recovery will be governed by the limitation prescribed under Section 11A of the Excise Act.”

(iii) Rain Industries v. Commissioner of Central Excise, Thirupathi [2006 (4) S.T.R. 290 (Tri. - Bang.)] “The department has proceeded to levy Service Tax on the activity of carriage of goods by the Transport Operators. The said category was not covered by the sections 116 and 117 of the Finance Act, 2000. The Finance Act was retrospectively amended to bring this activity in the category of Service Tax. However, the Apex Court, in the case of CCE, Meerut-II v L.H. Sugar Factories Ltd. - 2006 (3) S.T.R. 115 (S.C.) = 2005 (187) E.L.T. 5 (S.C.) has held that Revenue should have issued Show Cause Notice prior to the retrospective amendment brought in the Finance Act to cover this activity for recovery of the tax. The view expressed by the tribunal in L.H. Sugar Factories Ltd. v. CCE, Meerut-II - 2006 (3) S.T.R. 230 (T) = 2004 (165) E.L.T. 161 (Tri.-Del.) in assessees’ favour has been upheld by the Apex Court. The learned Counsel submits that in the present case, the Show Cause Notice has been issued after the amendment to the Finance Act to bring the activity within the Service Tax net. Therefore, in terms of the cited judgment, demands are not enforceable… 3. On a careful consideration and perusal of the records, we notice that the Show Cause Notice has been issued in the present case after the amendment was brought to the Finance Act to bring the activity in the Service Tax net. Therefore, in terms of the cited judgments, the demands cannot be confirmed. The stay application and appeal are allowed following the ratio of the cited judgments with consequential relief, if any.”

16.12 They further submitted that in the present case, the Noticee has not been paying tax since the inception of the levy on the basis of the decision in the Home Solutions Retail case (supra); that The position in law having undergone a substantive change, the same cannot be enforced for the period prior to the amendment. They further submitted that in the light of the above, it is clear that there is absolutely no suppression of information on part of the Noticee in relation to the services rendered and therefore the allegation of suppression with the intent to evade is completely baseless; that consequently, the captioned SCN is liable to be struck down as time barred; that the SCN is liable to be dismissed on this ground alone. OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 15 of 31

16.13 They further submitted that no interest/ penalty applicable as demand itself unsustainable; that The captioned SCN proposes to levy interest under Section 75 and penalty under Section 76 and 77 of the Finance Act; that at the outset, in light of the legal and factual position set out herein above, the demand is itself unsustainable as against the Noticee and therefore, there can be no imposition of interest and penalty; that penalty cannot be imposed on the Noticee as there has been no infraction on the part of the Noticee nor has there been any intent to evade any duty, that In such circumstances, the levy of penalty is clearly unsustainable; that Penalty under Section 76 of the Act is attracted for failure to pay Service tax in accordance with the Service tax provisions; that as detailed in the preceding paragraphs, the activity in question is not liable to Service tax; that the Noticee cannot be said to have failed to pay the Service tax, and therefore, penalty under Section 76 of the Act is not imposable; that Penalty under Section 77 of the Act has been demanded from the Noticee for failing to file Service tax returns in accordance with the Service tax provisions; that the Noticee’s belief that it is not liable to make payment of Service tax, and the Noticee is also not liable to include the amounts received as Rent, in the returns; that penalty under Section 77 of the Act is not imposable.

16.14 They further submitted that where a genuine interpretational issue is involved, no penalty can be imposed, that reliance in this regard is placed on the following decisions, all of which condoned the imposition of penalty on the basis of the fact that a genuine issue of interpretation underlay the issues in question:

(i) Commissioner of Central Excise, Rajkot v Adishiv Forge P. Ltd. [2008 (9) STR 534 (Tri-Ahmd)] (ii) Fibre Foils Ltd. v Commissioner of Central Excise, Mumbai-IV [2005 (190) ELT 352 (Tri-Mumbai)] (iii) Wiptech Peripherals Pvt. Ltd. v Commissioner of C. Ex., Rajkot [2008 (232) ELT 621 (Tri-Ahmd) (iv) Sonar Wires Pvt. Ltd. v. Commissioner of Central Excise [1996 (87) ELT 439 (Trib.)] (v) Man Industries Corporation v. Commissioner of Central Excise, Jaipur [1996 (88) ELT 178 (Trib.)] (vi) Sports & Leisure Apparel Ltd. v. Commissioner of Central Excise, Noida [2005 (180) ELT 429] (vii) Aquamall Water Solutions Ltd. v. Commissioner of Central Excise, Bangalore [2003 (153) ELT 428]

16.15 They further submitted that given the facts of the instant case, and in light of the aforesaid submissions, it is evident beyond doubt that at no point of time could the Noticee be said to have intentionally sought to evade tax as it was under the bona fide belief that the activity of renting was not taxable as established in the case of Home Solutions (supra), and, further, the issue is clearly an interpretational one; that the attempt to impose penalty is OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 16 of 31 against the settled law of the Supreme Court that in case of an interpretational issue, penalty cannot be levied, owing to the absence of malafide, and hence is required to be set aside.

They further submitted that there was an industry-wide confusion as regards the taxability of renting services due to the view taken by the Delhi High Court in Home Solutions (Supra) with respect to the taxability of renting of immovable property; that it is been held in several cases that wherein confusion is prevailing in the industry as a whole with respect to the taxability or otherwise of an activity under a particular heading, intention to evade tax cannot be made out and no penalty is imposable. Reliance is placed by the Noticee on the following case laws:

(i) Alstom Projects (I) Ltd. v. CST 2009 [15] S.T.R. 63 (ii) Aparna Paper Processing Industry (P) Ltd. v. CCE 2009 [15] S.T.R. 53 (iii) Kamal Photo Studio etc. v.: CCE 2007 [7] S.T.R. 307 (Tri.-Mumbai) (iv) Miltech Industries Pvt. Ltd. v. CCE 2010 (175 )ECR 305 (Tri.-Mumbai) (v) Siddharth Tubes Limited v. CCE 2008 (228) ELT 193 (Tri.-Delhi)

They further submitted that the Supreme Court has consistently held that penalty can only be levied if an intentional act is committed and not otherwise. The following cases are relied upon in support of this submission:

(i) Tamil Nadu Housing Board v Collector of Central Excise, Madras [1994 (74) ELT 9 (SC)] (ii) DCW Ltd. v Asst. Collector of Central Excise [1996 (88) ELT 31 (Mad)]

They further submitted that there was lot of confusion regarding the taxability of the service of renting of immovable property; that in fact, the Hon'ble Delhi High Court in the case of Home Solutions (supra) held that renting out of immovable property by itself, for business or commercial use did not constitute taxable service and services in relation to renting of immovable property alone was taxable; that it is well settled when there was confusion in the industry and also a decision in favour of the assessees, and therefore, suppression and intention to evade payment cannot be alleged; that in view of the above submissions, no interest and no penalty can be imposed on the Noticee and the part of SCN imposing interest and penalties on the Noticee is liable to be set aside.

16.16 They further submitted that Section 80 applicable in the present case; that per Section 80 of the Act, no penalty is imposable if the assessee proves that there was reasonable cause. The said section is reproduced below:

“80. Penalty not to be imposed in certain cases. – OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 17 of 31

Notwithstanding anything contained in the provisions of section 76, section 77 or section 78, no penalty shall be imposable on the assessee for any failure referred to in said provisions if the assessee proves that there was reasonable cause for the said failure.”

They further submitted that reasonable cause warranting a condonation of penalty per Section 80 exists in the instant case as the Noticee was under the bona fide belief that no Service tax is payable by them on the activity of Renting of Immovable Property on the basis of the judicially established position in law in the case of Home Solutions Retail; that reliance in this regard is also placed on the following decisions in which penalty for delay in payment of Service tax due to bona fide error was condoned.

(i) Catalyst Capital Services Pvt. Ltd. v. Commissioner of C. Ex., Mumbai-IV [2005 (184) ELT 34 (Tri-Mumbai)] “It is contended on behalf of the appellants that there is no mala fide intention on the part of the appellants in making the late payment of Service Tax. There is also provision in the Finance Act for waiver of the penalty where sufficient cause is shown. As the appellants had already deposited the Service Tax and as there was no mala fide intention in making the delayed payment, the penalty imposed thereof i.e. Rs. 7,105/- is hereby set aside.” (ii) Hariala Depot Service v. Commissioner of C. Ex., Ahmedabad [2009 (15) STR 277 (Tri-Ahmd)] “As is clear from the above, the authorities below are not doubting the genuineness of the appellant or their bona fide intention. Tribunal in case of M/s. Catalyst Capital Services (P) Ltd. v. CCE - 2006 (3) S.T.R. 582 (Tribunal) = 2005 (184) E.L.T. 34 (Tribunal) = 2005 (1) STT-241 (Mum-CESTAT), has held that where there is no mala fide intention on the part of the appellant in making late payment of service tax, penalty has to be set aside in terms of provisions of Section 80 of the Finance Act. Inasmuch as there is a finding in the impugned order of the original adjudicating authority as regards absence of mala fide on the part of the appellant, we do not deem it proper to impose any penalty on the appellant.” 16.17 They finally submitted that , under the circumstances, they requested to drop the proceedings initiated by the captioned SCN under reply and submitted that they craves leave to add, alter, amend and/or modify all or any of the foregoing submissions, before any decision is taken or any Orders are passed in the above matter and prayed that a personal hearing be granted to him before any decision is taken in this matter and also craves leave to produce documents / records / case law at the personal hearing granted to them.

17. Personal Hearing OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 18 of 31

The personal hearing in this case was granted on 15.06.2011, 13.07.2011 and 03.08.2011. Nobody appeared on either of the dates. Hence, another date for personal hearing was granted on 30.11.2011. Shri Bishan Shah, Chartered Accountant and Shri Kinjal Jadav, Accounts Manager of M/s Nishta Mall Management Company Pvt. Ltd. appeared for hearing on 30.11.2011. They submitted the written submissions and requested to file another reply within seven days, but till date no additional reply has been received from them.

18. DISCUSSION & FINDINGS

18.1 I have gone through the defence reply dated 12.07.2011 & 30.11.2011, case records and content of the aforesaid Show Cause Notice. I find that the service provider have submitted their written submission on 30.11.2011 but did not bother to file further reply though promised to file within seven days. Finally, I proceed to decide the Show Cause Notice in public interest as I can not afford to keep pending the case for indefinite period.

18.2 I find that the entire show cause notice is based on non payment of service tax amounting to Rs. 9,30,096/- on the value of Rs. 90,30,000/- which the service provider had declared in the ST-3 returns filed by them for the period from OCT 2009 TO Sept 2010. The said amount of Rs. 90,30,000/- was received by the said service provider towards the “Renting of Immovable Property”. I find that the said service provider had not paid service tax on the said amount of rent Rs. 90,30,000/- in view of the remark passed on the ST-3 return for the period prior to Oct 2009-10, which reads as under;-

“ Following the injuction granted by the Hon’ble Gujarat High Court and Supreme Court, the Company has not taken Service Tax on rent a liability”.

18.3 In view of the aforesaid remark in ST-3 returns and pending decisions of aforesaid cases in various courts, the present proceedings appeared to have been initiated by the department vide impugned show cause notice No. STC-53/O&A/SCN/NMM/10-11 dated 04.04.2011.

18.4 I find that the Finance Act, 2007 has brought the services of renting of immovable property for use in the course or furtherance of business or commerce under the service tax net with effect from 1.06.2007. Taxable service of ‘Renting of immovable property’ has been defined under Section 65(105) (zzzz) of the Finance Act, 1994. OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 19 of 31

Renting included letting, leasing, licensing or other similar arrangement. For the purposes of this clause, “for use in the course or furtherance of business or commerce” includes use of immovable property as factories, office buildings, warehouses, theatres, exhibition halls and multiple-use buildings.

18.5 Further, by Finance Act, 2010, the Government amended the definition of “Renting of Immovable Property Services”, to provide that the activity of “renting” is itself a taxable service with retrospective effect from June 1, 2007. The Finance Act, 2010 has also inserted clause (v) in sub clause (zzzz) of clause 65(105) of the Finance Act,1994 so as to provide that service tax would be charged on rent of a vacant land if there is an agreement or contract between the lessor and lessee that a construction on such land is to be undertaken for furtherance of business or commerce.

18.6 Thus, in view of Section 65 (105) (zzzz) of Finance Act, 1994 the definition of taxable service of “Renting of Immovable property” means “any service provided or to be provided to any person, by any other person, by renting of immovable property or any other service in relation to such renting, for use in the course of or, for furtherance of, business or commerce.” Explanation 1. — For the purposes of this sub-clause, “immovable property” includes — (i) building and part of a building, and the land appurtenant thereto; (ii) land incidental to the use of such building or part of a building; (iii) the common or shared areas and facilities relating thereto; and (iv) in case of a building located in a complex or an industrial estate, all common areas and facilities relating thereto, within such complex or estate, [(v) vacant land, given on lease or license for construction of building or temporary structure at a later stage to be used for furtherance of business or commerce;] but does not include — (a) vacant land solely used for agriculture, aquaculture, farming, forestry, animal husbandry, mining purposes; (b) vacant land, whether or not having facilities clearly incidental to the use of such vacant land; (c) land used for educational, sports, circus, entertainment and parking purposes; and (d) building used solely for residential purposes and buildings used for the purposes of accommodation, including hotels, hostels, boarding houses, holiday accommodation, tents, camping facilities.

OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 20 of 31

Explanation 2. — For the purposes of this sub-clause, an immovable property partly for use in the course or furtherance of business or commerce and partly for residential or any other purposes shall be deemed to be immovable property for use in the course or furtherance of business or commerce;

18.7 Vide section 76 of the Finance Act, 2010, validation of action taken under sub-clause (zzzz) of clause (105) of Section 65, is explained as under:- Any action taken or anything done or omitted to be done or purported to have been taken or done or omitted to be done under sub-clause (zzzz) of clause (105) of section 65 of the Finance Act, 1994, at any time during the period commencing on and from the 1st day of June, 2007 and ending with the day, the Finance Bill, 2010 receives the assent of the President, shall be deemed to be and deemed always to have been, for all purposes, as validly and effectively taken or done or omitted to be done as if the amendment made in sub-clause (zzzz) of clause (105) of section 65, by sub-item (i) of item (h) of sub-clause (5) of clause (A) of section 75 of the Finance Act, 2010 had been in force at all material times and, accordingly, notwithstanding anything contained in any judgment, decree or order of any court, tribunal or other authority,— (a) any action taken or anything done or omitted to be taken or done in relation to the levy and collection of service tax during the said period on the taxable service of renting of immovable property, shall be deemed to be and deemed always to have been, as validly taken or done or omitted to be done as if the said amendment had been in force at all material times; (b) no suit or other proceedings shall be maintained or continued in any court, tribunal or other authority for the levy and collection of such service tax and no enforcement shall be made by any court of any decree or order relating to such action taken or anything done or omitted to be done as if the said amendment had been in force at all material times; (c) Recovery shall be made of all such amounts of service tax, interest or penalty or fine or other Charges which may not have been collected or, as the case may be, which have been refunded but which would have been collected or, as the case may be, would not have been refunded, as if the said amendment had been in force at all material times.

Explanation.—For the removal of doubts, it is hereby declared that no act or omission on the part of any person shall be punishable as an offence which would not have been so punishable had this amendment not come into force. OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 21 of 31

18.8 The Finance Bill received President’s Assent on 27.7. 2010 and thereby became a law. The new statue is known as the Finance (No.2) Act, 2010. Accordingly, as discussed in para supra, renting of building and part of a building, and the land appurtenant thereto for use in the course of or, for furtherance of, business or commerce became liable to service tax w.e.f 1.6.2007

18.9 I further find that the impugned show cause notice was issued prior to retrospective amendment effective from 1.06.2007, taken place vide Section 75 and 76 of the Finance Act., 2010. These retrospective amendment and its validations with effect from 01.06.2007, substantiated the content of the impugned show cause notice as, the period covered in the impugned show cause notice is Oct 2009 to Sept 2010. In this regard, I further find that M/s Home Solution Retail India Ltd had moved to Delhi High Court when the department have demanded service tax based on the earlier definition of taxable service i.e. prior to retrospective amendment have taken place. The Hon’ble Delhi High Court had given interim injunction to M/s Home Solution Retail India Ltd. [this decision is also cited by the noticee in the ST-3 return explaining why service tax is not paid by them]. However, against the said injunction order, the department had filed an appeal before the Apex Court against the judgment of Delhi High Court in the matter of Home Solution Retail India Ltd. and Ors. Vs. UOI (2009-PIOI- 196-HC- DEL-ST). The aforesaid appeal came up for hearing before the Hon’ble Supreme Court on 04.02.2011. The Hon’ble Supreme Court has passed an order to the effect that the High Court of Delhi will hear and dispose off all the writ petitions as expeditiously as possible. Before the aforesaid hearing, the Hon’ble Supreme Court while hearing the appeal on 10.01.2011 filed by the department the Supreme Court has ordered that “interim stay of the operation of the impugned judgment till the next date”. Therefore, the order which was passed by the Supreme Court on 10.01.2011 would continue to operate till the disposal of the writ petitions in the High Court (post amendments), staying the levy of service tax on renting of immovable property has been nullified.

18.10 Thus, I find that the basis of Stay granted in the case of M/s Home Solution Retail India Ltd. by the Hon’ble Delhi Court does not came to their rescue for non payment of service tax taken.

18.11 Further, Hon’ble Delhi High Court in light of Hon’ble Supreme Court’s direction, vide their order dated 23.09.2011 cited as 2011-TIOL-610-HC-DEL-ST-LB have OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 22 of 31 finally decided the pending appeal in the case of M/s Home Solution Retail India Ltd.[WP(C) No.3398/2010] , and others Vs Union of India and others as under

Service Tax – Renting of Immovable Property Service – Value of building gets accentuated because of scarcity of land or building, goodwill, accessibility and similar ancillary advantages which constitute value addition – When premises are taken for commercial purpose, it is basically to sub serve the cause of facilitating commerce, business and promoting the same – When a particular building or premises has the “effect potentiality” to be let out on rent for the said purpose, an element of service is involved in the immovable property and that tantamounts to value addition which would come within the component of service tax – An element of service arises because a person who intends to avail the property on rent wishes to use it for a specific purpose – Section 65(105)(zzzz) and section 66 of Finance Act, 1994 as amended by the Finance Act, 2010 intra vires the Constitution of India – Decision of Division Bench rendered in First Home Solution case - 2009-TIOL-196-HC-DEL-ST does not lay down correct law, overruled – Challenge to the retrospective amendment through Finance Act, 2010 held unsustainable – Retrospective amendments in Finance Act, 2010 declared constitutionally valid – On the question of penalty due to non-payment of tax, it is open to the government to examine whether any waiver or exemption can be granted

The relevant paras reflecting final decision of the said Hon’ble Delhi High Court’s order dated 23.09.2011 are reproduced as under:-

73. On the question of penalty due to non-payment of tax, it is open to the government to examine whether any waiver or exemption can be granted. It may be noted that the appeal against Home Solutions-I is pending before the Supreme Court but the operation of the said judgment has not been stayed.

74. Quite apart from the above, as we have overruled the first Home Solution case, we are disposed to think that the provisions would operate from 2007 and the amendment brought by the Parliament is by way of ex abundanti cautela.

75. In view of the aforesaid analysis, we proceed to enumerate our conclusions in seriatim as follows:

(a) The provisions, namely, Section 65(105)(zzzz) and Section 66 of the Finance Act, 1994 and as amended by the Finance Act, 2010, are intra vires the Constitution of India.

(b) The decision rendered in the first Home Solution case does not lay down the correct law as we have held that there is value addition when the premises is let out for use in the course of or furtherance of business or commerce and it is, accordingly overruled.

(c) The challenge to the amendment giving it retrospective effect is unsustainable and, accordingly, the same stands repelled and the retrospective amendment is declared as constitutionally valid.

76. Consequently, the writ petitions, being sans substratum, stand dismissed without any order as to costs.

18.12 Further, also I find that, the hon’ble Punjab and Haryana High Court has in CWP No.11597 of 2010, in the case of M/s Shubh Timb Steels Ltd. v/s UOI passed an order dated 22/11/2010 reported at 2010 (20) STR 737 (P&H), upheld the validity of levy of service tax on Renting of Immoveable Property and upheld Parliament legislative competence to levy Service Tax on Renting, with retrospective amendment. Hence, I find OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 23 of 31 that the Hon’ble High Court has upheld the demand with retrospective amendment. Thus, arguments of the assessee on limitation fail and does not survive as those are general in nature. Whereas in the present case the decision of Hon’ble High Court is specific to the impugned service. Accordingly, the case laws relied upon by the assessee on this count are misplaced and not applicable to the present case.

This view has been further followed by the hon’ble High Court of Orissa in the case of Utkal Builders Ltd., Vs UOI reported at 2011 (22) STR 257 (Ori.). The Hon’ble High Court of Orissa while dismissing the writ petition held that “….the nature of the transaction made by the petitioner with its tenant clearly amounts to renting of an immovable property for the purpose of business or commerce and is, therefore, clearly covered by Section 65(90-a) of the Finance Act, 1994 and “service tax” is clearly leviable thereon. Although challenge in the present case has been made to the Amendment Act of 2010 to Section 66(105)(zzzz), we find no justification to entertain the present writ application since we are also of the view that the amendment is clearly clarificatory in nature and Parliament certainly possesses the necessary legislative competence to declare the said amendment to be retrospective in operation and, therefore, we do not find any error or lack of competence in such legislation….” . 18.13 In view thereof, I find that service tax amounting to Rs. 9,30,096/- which the noticee have not paid on the taxable value of Rs. 90,30,000/- which they have collected as rent by Renting of Immovable Property is liable to be confirmed against them in view of the retrospective amendment in the sub-clause (zzzz) of clause (105) of Section 65 of the Finance Act. 1994 amended by the Finance Act, 2010 w.e.f. from 01.06.2007 supported by its validation. Accordingly, I hold that the aforesaid amount of Rs. 9,30,096/- which is proposed to be recovered under section 73(2) of the Finance Act.,1994 is required to be confirmed along with interest as provided under section 75 of the Finance Act.,1994.

18.14 Now, I look into Nishta Mall management’s contention that , the issue with respect to the validity of the retrospective amendment is presently pending before the Hon’ble Supreme Court and consequently, in the interim, till the final disposal of the appeal, no demand of Service tax can be raised and collected.

18.15 I find that after decision of Delhi High Court’s decision in light of Hon’ble Supreme Court’s direction, vide their order dated 23.09.2011 cited as 2011-TIOL-610- HC-DEL-ST-LB have finally decided the pending appeal in the case of M/s Home Solution OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 24 of 31

Retail India Ltd.[WP(C) No.3398/2010] , and others Vs Union of India and others, there is no dispute regarding service tax liability with effect from 01.06.2007.

This fact is further supported by recent judgment of Hon’ble Gujarat High Court dated 23.8.2011 in the case of Cinemax India Ltd., reported at 2011 (24) STR 3 (Gujarat). The Hon’ble High Court of Gujarat has in para 44 of the judgement held as follows:

“44. For the reasons aforesaid, while upholding Sec. 65(105)(zzzz) of Finance Act, 1994 as amended by Sec. 75(5)(h) and Sec. 76 of the Finance Act, 2010, we hold that the provision of Sec. 65(105)(zzzz) introducing service tax is not attracted if (i) the vacant land is used solely for agriculture, acquaculture, farming, forestry, animal husbandry, mining purposes; (ii) it is a vacant land, whether or not having facilities clearly incidental to the use of such vacant land; (iii) land is used for educational, sports, circus, entertainment and parking purposes and; (iv) building is used solely for residential purposes and buildings are used for the purposes of accommodation, including hotels, hostels, boarding houses, holiday accommodation, tents, camping facilities. The said provision levying service tax will be attracted if the immovable property is rented for the use in the course of or for furtherance of the business of commerce.”

Therefore, I find that argument made by the assessee and decisions quoted are not applicable to this case as these are prior to decision of Hon’ble Delhi High Court in the case of Home Solution Retail India Ltd.

18.16 Now, I look into M/s Nishta Mall management’s contention that in case service tax is to be levied, it should be levied on the basis of cum tax value of the services and not on the entire value. In this regard they placed reliance on the following judgments:- (i) Commissioner of Service tax, Bangalore v. Prompt & Smart Security [2008 (9) S.T.R. 237 (Tri. - Bang.)] (ii) Commissioner of Central Excise, Delhi v. Maruti Udyog Ltd. [2002 (141) E.L.T. 3 (S.C.)] (iii) Rampur Engineering Co. Ltd. vs. Commissioner of Central Excise [2006 (3) S.T.R. 650 (Tri. - Del.)] (iv) Panther Detective services vs. Commissioner of Central Excise [2006 (4) S.T.R. 116 (Tri. - Del.)]

18.17 I observe that there is no evidence on record to show that the invoices specifically indicated that the gross amount charged included the amount of service tax. Moreover, it was M/s Nishta Mall Management’s belief that no service tax was leviable on such receipts; therefore, they could not have included the service tax in the gross OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 25 of 31 amount shown in the invoice. There is no evidence on record to show that Service tax charged or not in the invoices raised for rent to their client. Also there is no evidence on records that invoices issued were inclusive of service tax. Therefore, it transpires that the amount of Rs. 90,30,000/- which is alleged to have been realized by them during the period Oct-09 to Sept-2010 does not include Service tax. The amount of service tax of Rs. 9,30,096/- demanded under present proceedings is correctly calculated and arrived at based on the receipts excluding the service tax as the service provider fails to explain that invoice does specifically say that the gross amount charged includes service tax, it cannot be treated as cum-service tax price. Therefore, in the absence of any evidence to show that invoices had indeed been prepared in this manner, cun-tax value benefit cannot be extended.”

18.18 Further, they were informed vide impugned Show Cause Notice at para 5 that Hon’ble Punjab & Haryana High Court while deciding CWP No. 11597 of 2010, in the case of M/s Shubh Timb Steels Ltd. Vs UOI has upheld the validity of levy of service tax on Renting of Immovable Property and upheld parliament legislative competence to levy of service tax on Renting with retrospective amendment. Even though they did not bother to deposit service tax.

18.19 In view thereof, I find that M/s Nishta Mall Management is not entitled to cum tax benefit. Hence , the ratio of case laws relied upon by them can not be applied in the case before me. I place reliance on the judgment of M/s Shakti Motors reported at 2008(12) STR 710(Tri. Ahmd.) which is more relevant here, wherein it has been observed as under:

“3……..I am unable to agree with the advocate that the amount realized has to be treated as cum-tax value in view of the provision of Section 67(2) of Finance Act, 1994, which is reproduced below for ready reference:-

“Section 67(2). Where the gross amount charged by a service provider, for the service provided or to be provided is inclusive of service tax payable, the value of such taxable service shall be such amount as, with the addition of tax payable, is equal to the gross amount charged”.

In terms of the above provision if the invoice does not specifically say that the gross amount charged includes service tax, it cannot be treated as cum-service tax price. Therefore, in the absence of any evidence to show that invoices had indeed been prepared in this manner, cun-tax value benefit cannot be extended………….”

My above view also finds support from the decision of Hon’ble Supreme Court in the case of Amrit Agro Industries Ltd. Vs CCE, Ghaziabad reported at 2007 (210) ELT 183 (S.C.). The Hon’ble supreme court, while applying in principle the facts and circumstance of the case of Asstt. Collector of Central Excise v. Bata India Ltd. reported in 1996 (84) E.L.T. 164 observed that unless it is shown by the manufacturer that the OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 26 of 31 price of the goods includes excise duty payable by him, no question of exclusion of duty element from the price for determination of value under section 4(4)(d)(ii) will arise. Hon’ble Supreme court at para 15 of the said judgment observed as:

“ In our view, in the facts and circumstance of the case the judgment of this court in the case of Bata India Ltd.(supra) on principle would apply. Therefore, in the present case, the assessee will have to show as to how he has determined the value. What the applicant has really done in the instant case has to be examined. Whether the price charged by him to his customers contains profit element or duty element will have to be examined. As stated above, this examination is warranted because, in the present case, one cannot go by general implication that the wholesale price would always mean cum-duty price, particularly when the assessee had cleared the goods during the relevant years on the basis of above exemption notification dated 1-3-1997.”

Accordingly, I find that claim made by the said noticee in this regard is not correct and hold that benefit of Cum-Tax value is not allowable to the noticee.

18.20 Therefore, in view of the above discussion, I conclude that Service tax of Rs. 9,30,096/- is recoverable from the said assessee under Section 73(2) of the Finance Act, 1994 along with interest as applicable under Section 75 ibid.

18.21 As regards, M/s Nishta Mall Management’s request for allowing the benefit of Cenvat credit in respect of duties paid on inputs and service tax paid on input services, I observe that since immovable property is neither subjected to central excise duty nor to service tax input, credit is not admissible on the output service of ‘Renting of immovable property service’ provided by M/s Nishta Mall Management . I also find that M/s Nishta Mall Management has not produced any documentary evidence in this regard and moreover, admissibility or otherwise of Cenvat credit is not an issue in this show cause notice and can only be dealt by the concerned officer with whom the returns are filed by the noticee. In view of this it would be premature to observe on the applicability of the relied upon judgments.

19. With regard to penalty :-

19.1 They submitted that given the facts of the instant case, and in light of the submissions, it is evident beyond doubt that at no point of time could the Noticee be said to have intentionally sought to evade tax as it was under the bona fide belief that the activity of renting was not taxable as established in the case of Home Solutions (supra), and, further, the issue OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 27 of 31 is clearly an interpretational one; that the attempt to impose penalty is against the settled law of the Supreme Court that in case of an interpretational issue, penalty cannot be levied, owing to the absence of malafide, and hence is required to be set aside.

19.2 I hold that there was no dispute regarding service tax liability wef 01.06.2007 on Renting of immovable property on the part of department. The service provider has created the dispute against constitutional decision. Also noticee has also stopped to pay service tax only on the belief that service receiver has not paid service tax to them. Further , they were informed vide impugned Show Cause Notice at para 5 that Hon’ble Punjab & Haryana High Court while deciding CWP No. 11597 of 2010, in the case of M/s Shubh Timb Steels Ltd. Vs UOI has upheld the validity of levy of service tax on Renting of Immovable Property and upheld parliament legislative competence to levy of service tax on Renting with retrospective amendment. Even though they did not bother to deposit service tax.

19.3 Since the said service provider had not discharged service tax liability at the material time on the amount of taxable value received as income, demanded under the show cause notice and therefore, they have contravened the provisions of Section 67, 68, of the Finance Act, 1994 and thereby rendered themselves liable to penal action under Sections 76 & 77 of Finance Act 1994.

19.4 In view thereof, I find that service tax amounting to Rs. 9,30,096/- which the noticee have not paid on the taxable value of Rs. 90,30,000/- which they have collected as rent by Renting of Immovable Property is liable to be confirmed from them in view of the retrospective amendment in the sub-clause (zzzz) of clause (105) of Section 65 of the Finance Act. 1994 amended by the Finance Act, 2010 w.e.f. from 01.06.2007 supported by its validation. Accordingly, I hold that the aforesaid amount of Rs. 9,30,096/-which is proposed to be recovered under section 73(2) of the Finance Act.,1994 is required to be confirmed along with interest as provided under section 75 of the Finance Act.,1994.

20. Penalty under Section 76 : OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 28 of 31

20.1 Further, as regards the penalty proposed to be imposed under Section 76 of the Finance Act, 1994, I observe that during the relevant period M/s Nishta Mall Management had defaulted in payment of service tax which has been established as not paid, in accordance with the provisions of Section 68 of the Finance Act, 1994 read with Rule 6 of the Service Tax Rules, 1994, and thereby rendered liable to pay mandatory penalty under the provisions of Section 76 of the Finance Act, 1994 for default in payment of service tax on time till the final payment. It has come to my notice that till date M/s Nishta Mall Management had not paid the service tax, hence imposition of mandatory penalty under Section 76 is once again justified.

20.2 Accordingly, I hold that M/s Nishta Mall Management is liable to imposition of penalty under Section 76 of the Finance Act, 1944. My conclusion is also based on various decisions of Hon’ble High Courts & Tribunals as mentioned below ; CCE & ST Vs First Flight Couriers Ltd reported at 2007(8) STR 225 (Kar.) UOI Vs Aakar Advertising, reported at 2008 (11) STR.5 (Raj.) UOI Vs Shiv Ratan Advertisers reported at 2008 (12) STR 690 (Raj.) Shiv Network Vs CCE, Daman reported at 2009 (14) STR 680 (Tri-Ahmd) CCE, Vapi Vs Ajay Sales Agencies reported at 2009 (13) STR 40 (Tri–Ahmd) Siddhi Motors Vs CCE, Rajkot reported at 2009 (15) STR 422 (Tri-Ahmd)

20.3 I further observe that the Hon’ble CESTAT in a recent judgment in the case of M/s Gujarat Industrial Security Force Society Vs CST, Ahmedabad, vide order No. A/1110/WZB/AHD/2010 dated 05.08.2010, has held that no lenient view can be taken under section 76 of the Finance Act, 1994. The relevant paras are reproduced below ;

“2. After hearing both the sides, I find that in this case, the assessee was registered more than 6 years back and no explanation has been given by them for delayed filing of return and delayed payment of service tax. Under these circumstances, I am not finding fault in stand taken by the lower authority that penalty is imposable under section 76 and once it is held that penalty is imposable under section 76, the amount fixed as per the provision of section 76 is required to be imposed. Under these circumstances, even though the Ld. Advocate submitted that the appellant is a non profit organization, no lenient view can be taken in view of the provisions of law. 3. Accordingly, the appeal is rejected.”

20.4 Hon’ble High Court of Gujarat in the case of CCE & Cus. Vs Port Officer, reported at 2010 (19) STR 641 (Guj) has now settled the issue of penalty under Section 76. The relevant para is reproduced below ;

“10. A plain reading of Section 76 of the Act indicates that a person who is liable to pay service tax and who has failed to pay such tax is under an obligation to pay, in addition to the tax so payable and interest on such tax, a penalty for such failure. The quantum of penalty has been specified in the provision by laying down the minimum and the maximum limits with a further cap in so far as the maximum limit is concerned. The OIO NO. 45/STC-AHD/ADC (MKR)/11-12 Page 29 of 31

provision stipulates that the person, who has failed to pay service tax, shall pay, in addition to the tax and interest, a penalty which shall not be less than one hundred rupees per day but which may extend to two hundred rupees for everyday during which the failure continues, subject to the maximum penalty not exceeding the amount of service tax which was not paid. So far as Section 76 of the Act is concerned, it is not possible to read any further discretion, further than the discretion provided by the legislature when legislature has prescribed the minimum and the maximum limits. The discretion vested in the authority is to levy minimum penalty commencing from one hundred rupees per day on default, which is extendable to two hundred rupees per day, subject to a cap of not exceeding the amount of service tax payable. From this discretion it is not possible to read a further discretion being vested in the authority so as to entitle the authority to levy a penalty below the stipulated limit of one hundred rupees per day. The moment one reads such further discretion in the provision it would amount to re- writing the provision which, as per settled canon of interpretation, is not permissible. It is not as if the provision is couched in a manner so as to lead to absurdity if it is read in a plain manner. Nor is it possible to state that the provision does not further the object of the Statute or violates the legislative intent when read as it stands. Hence, Section 76 of the Act as it stands does not give any discretion to the authority to reduce the penalty below the minimum prescribed.”

20.5 The Hon’ble High Court of Gujarat has further confirmed the above view in the case of CCE Vs S J Mehta & Co., reported at 2011 (21) STR 105 (Guj.) and CCE Vs Bhavani Enterprises reported at 2011 (21) STR 107 (Guj.).

20.6 Under the circumstances, their claim under section 80 of the Finance Act, 1994 does not survive and I am unable to accept the same.

21. Penalty under Section 77

I further find that the assessee has failed to file the correct return for the period covered under the impugned show cause notice & hence, they are liable for penalty under Section 77 of the Finance Act, 1994 for contravention of Section 70 (1) read with Rule 7 of the Service Tax Rules, 1994.

22. In view of the above discussions & findings, I pass following order.

-: O R D E R :-