REAL CLIENT MANAGED PORTFOLIO MEMORANDUM

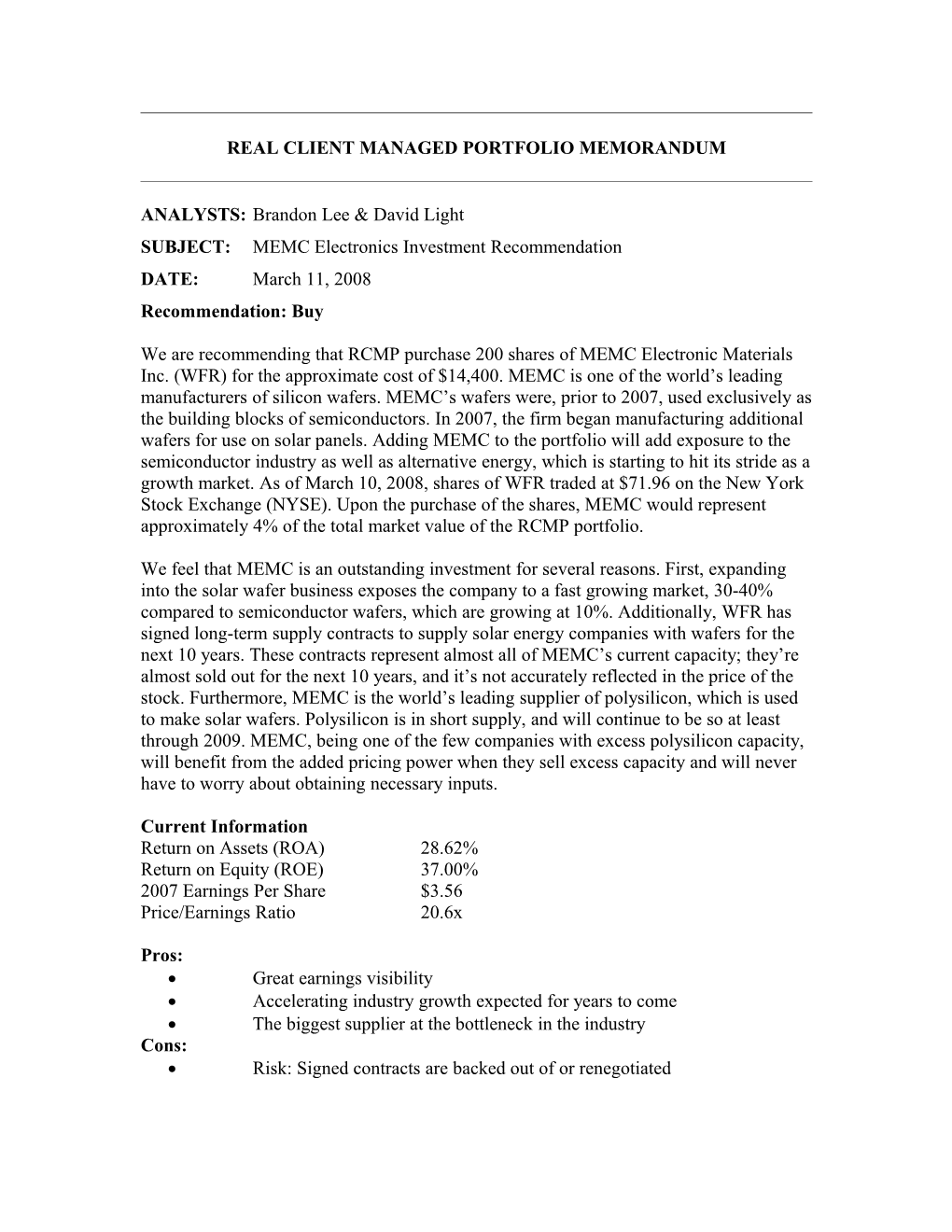

ANALYSTS: Brandon Lee & David Light SUBJECT: MEMC Electronics Investment Recommendation DATE: March 11, 2008 Recommendation: Buy

We are recommending that RCMP purchase 200 shares of MEMC Electronic Materials Inc. (WFR) for the approximate cost of $14,400. MEMC is one of the world’s leading manufacturers of silicon wafers. MEMC’s wafers were, prior to 2007, used exclusively as the building blocks of semiconductors. In 2007, the firm began manufacturing additional wafers for use on solar panels. Adding MEMC to the portfolio will add exposure to the semiconductor industry as well as alternative energy, which is starting to hit its stride as a growth market. As of March 10, 2008, shares of WFR traded at $71.96 on the New York Stock Exchange (NYSE). Upon the purchase of the shares, MEMC would represent approximately 4% of the total market value of the RCMP portfolio.

We feel that MEMC is an outstanding investment for several reasons. First, expanding into the solar wafer business exposes the company to a fast growing market, 30-40% compared to semiconductor wafers, which are growing at 10%. Additionally, WFR has signed long-term supply contracts to supply solar energy companies with wafers for the next 10 years. These contracts represent almost all of MEMC’s current capacity; they’re almost sold out for the next 10 years, and it’s not accurately reflected in the price of the stock. Furthermore, MEMC is the world’s leading supplier of polysilicon, which is used to make solar wafers. Polysilicon is in short supply, and will continue to be so at least through 2009. MEMC, being one of the few companies with excess polysilicon capacity, will benefit from the added pricing power when they sell excess capacity and will never have to worry about obtaining necessary inputs.

Current Information Return on Assets (ROA) 28.62% Return on Equity (ROE) 37.00% 2007 Earnings Per Share $3.56 Price/Earnings Ratio 20.6x

Pros: Great earnings visibility Accelerating industry growth expected for years to come The biggest supplier at the bottleneck in the industry Cons: Risk: Signed contracts are backed out of or renegotiated