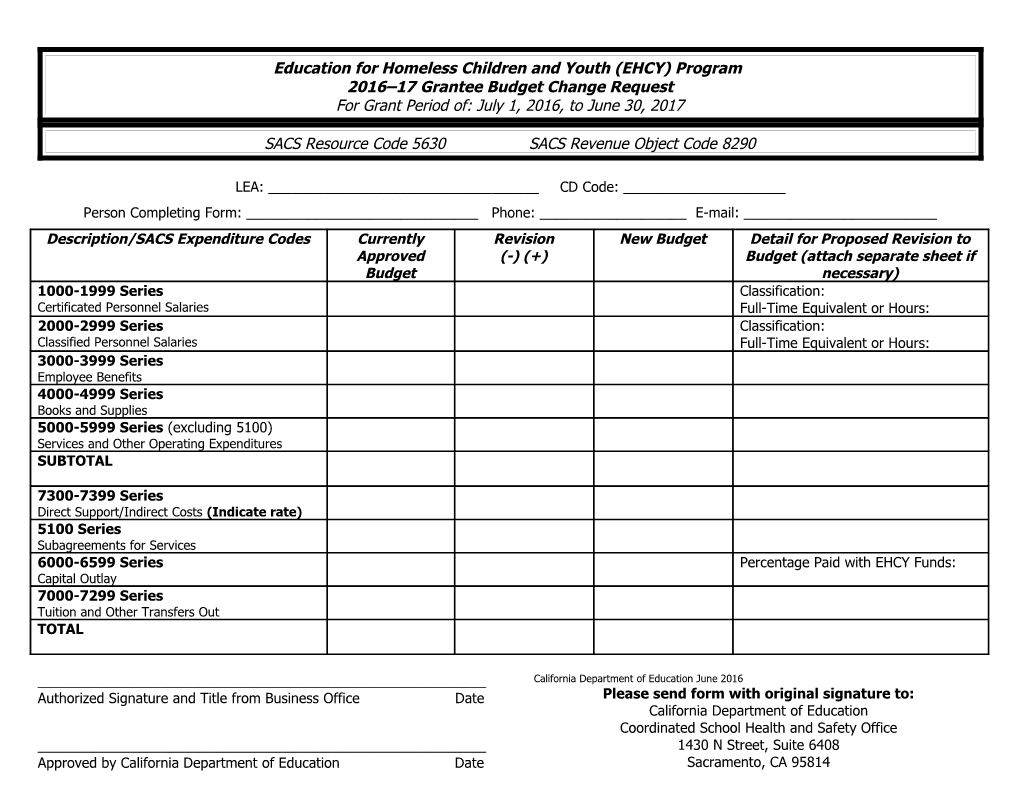

Education for Homeless Children and Youth (EHCY) Program 2016–17 Grantee Budget Change Request For Grant Period of: July 1, 2016, to June 30, 2017

SACS Resource Code 5630 SACS Revenue Object Code 8290

LEA: ______CD Code: ______Person Completing Form: ______Phone: ______E-mail: ______Description/SACS Expenditure Codes Currently Revision New Budget Detail for Proposed Revision to Approved (-) (+) Budget (attach separate sheet if Budget necessary) 1000-1999 Series Classification: Certificated Personnel Salaries Full-Time Equivalent or Hours: 2000-2999 Series Classification: Classified Personnel Salaries Full-Time Equivalent or Hours: 3000-3999 Series Employee Benefits 4000-4999 Series Books and Supplies 5000-5999 Series (excluding 5100) Services and Other Operating Expenditures SUBTOTAL

7300-7399 Series Direct Support/Indirect Costs (Indicate rate) 5100 Series Subagreements for Services 6000-6599 Series Percentage Paid with EHCY Funds: Capital Outlay 7000-7299 Series Tuition and Other Transfers Out TOTAL

______California Department of Education June 2016 Authorized Signature and Title from Business Office Date Please send form with original signature to: California Department of Education Coordinated School Health and Safety Office ______1430 N Street, Suite 6408 Approved by California Department of Education Date Sacramento, CA 95814 Attention: Pat Boncella, Associate Governmental Program Analyst Phone: 916-319-0384 Brief Explanation of Object Codes

The following explanations are very brief. Please consult the most recent version of the California School Accounting Manual (CSAM) for more detailed explanations. The manual can be viewed at: http://www.cde.ca.gov/fg/ac/sa/documents/csam2016complete.pdf.

1000-1999 Certificated Personnel Salaries Record expenditures for salaries for services that require a credential or permit issued by the Commission on Teacher Credentialing. Typical categories are the salaries for teachers, teacher substitutes, school administrators, librarians, counselors, or school nurses.

2000-2999 Classified Personnel Salaries Record expenditures for salaries for services that do not require a credential or permit issued by the Commission on Teacher Credentialing. Typical categories of classified personnel are teacher assistants, business managers, clerical staff, administrators such as board members or assistant superintendents who do not have credentials, custodians, cooks, bus drivers, or maintenance workers.

3000.3999Employee Benefits Record expenditures for the costs of benefits contributed by the employer as a part of the compensation package. Benefits include retirement (Public Employees Retirement System or State Teachers Retirement System), Social Security and Medicare, health and welfare benefits, unemployment insurance, workers compensation insurance, and other benefits that may be offered.

4000-4999 Books and Supplies Record expenditures for books and supplies including the costs of sales tax, freight, and inventory costs. Examples are textbooks, instructional materials, office supplies, custodial supplies, food service supplies, and gas and oil for buses.

5000.5999Services and Other Operating Expenditures Record expenditures for services, rents, operating leases, maintenance contracts, dues, travel, insurance, utilities, attorney fees, audit fees, and other operating expenses. Expenditures may be authorized by contracts, agreements, purchase orders, etc.

6000.6999Capital Outlay Record expenditures for equipment and intangible capital assets, such as computer software, including items acquired through leases with option to purchase.

7000.7999Tuition and Other Transfers Out Record expenditures for tuition payments to other entities, transfers of money to other funds or other programs such as Special Education or Regional Occupational Centers and Programs, and transfers to other districts or joint powers agencies.

7300.7399Direct Support/Indirect Costs Record expenditures for direct support costs and indirect costs. Please indicate your indirect cost rate within the parenthesis provided.