USCMarshall School of Business

FBE 506 Quantitative Methods in Finance Syllabus, Summer 2016

Class Lectures: MW 1:00 – 3:45 Professor: M. Safarzadeh Class Number: 667 Classroom: JKP212 Office Hours: MW 12:00-1:00 and by appointment Office : BRI 204G Email: [email protected]

Course Description: FBE-506 is an advanced finance elective that aims to develop mathematical and statistical models used in many practical problems of modern economics and finance.

Learning Objectives: Students successfully completing this course will be able to: 1. Summarize sample data in descriptive statistics for making inference from sample to population using proper distribution theories. 2. Build simple economic and financial models, collect data and apply statistical methods for estimating the model, hypothesis testing, and forecasting. 3. Compute different measures of risk to investment and learn about their use in practice. 4. Combine several stocks into a portfolio and optimize the risk and return relation of the portfolio by minimizing the risk for an expected return or by maximizing return for an assumed risk tolerance. 5. Use statistical techniques to measure the effects of the changes in economic conditions or the effects of the special events on risk and return to securities and portfolios. 6. Do pricing of complex securities such as American and European options.

Required Material: Required textbook for the course is, Quantitative Methods in Finance: Market Risk Analysis I, by Carol Alexander, John Wiley & Sons Ltd, 2010, ISBN: 978-0-470-99800. This textbook is to serve as the point of departure for lectures and some of the homework assignments and tests. Topics not covered by the textbook will be supplemented by handouts in the class or by the notes posted on Blackboard. For students who may need more detailed description of the statistical concepts, a recommended book is Statistics for Business and Economics, 12e, by Anderson, Sweeney and Williams, Cengage, ISBN: 978-1-133-27453-7. I have listed the relevant chapters or sections of the book in the course outline under ASW. As well, you have to have access to one of the following statistical software, E-Views by Quantitative Micro Software; http://www.eviews.com, or Stat; http://www.stata.com, or R (a free software). You should also make yourself familiar with the statistical package of MS Office, especially the Solver. You are required to be sufficiently familiar with the topics assigned for each class meeting prior to the class so that they can intelligently be discussed and practiced in the class.

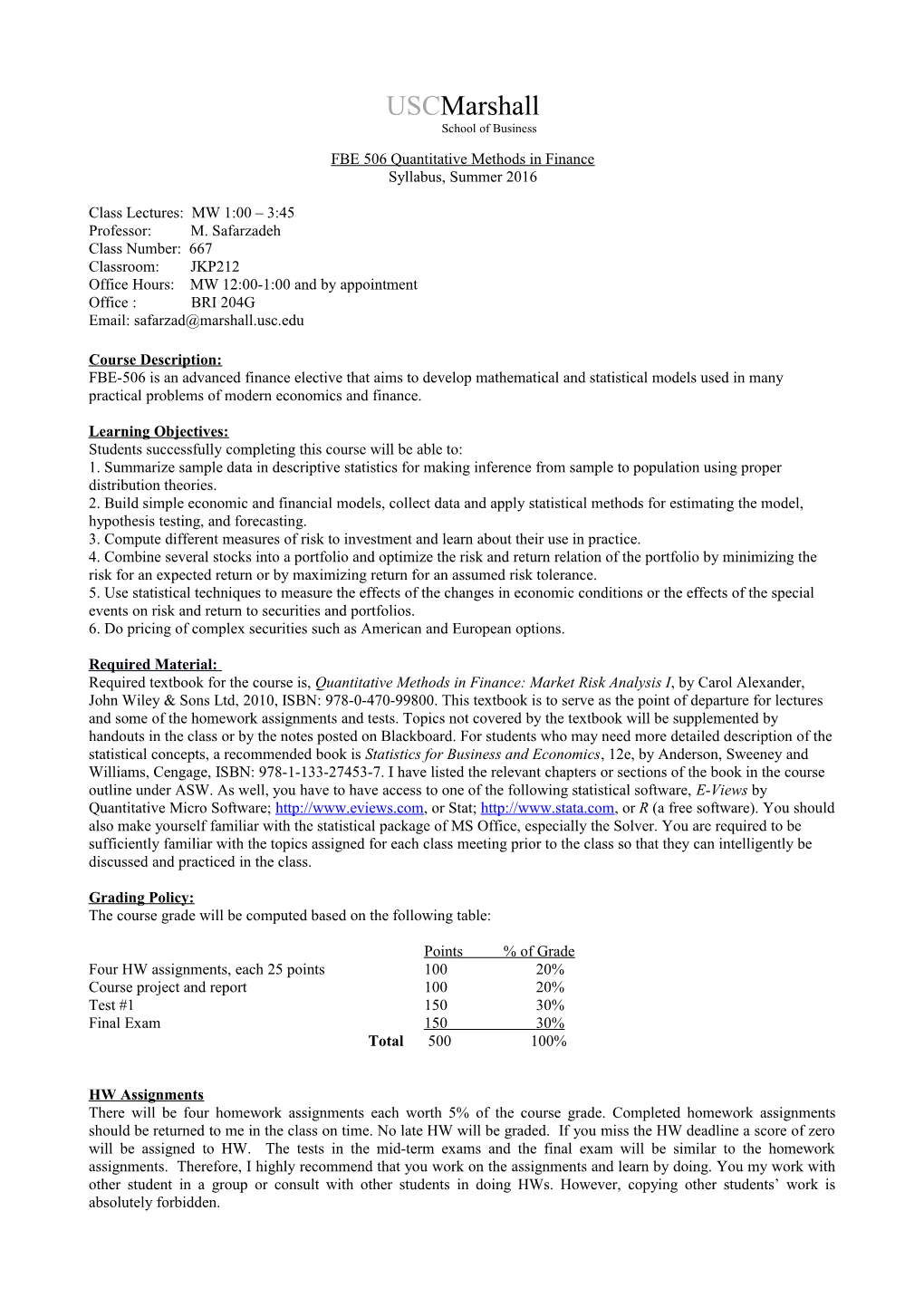

Grading Policy: The course grade will be computed based on the following table:

Points % of Grade Four HW assignments, each 25 points 100 20% Course project and report 100 20% Test #1 150 30% Final Exam 150 30% Total 500 100%

HW Assignments There will be four homework assignments each worth 5% of the course grade. Completed homework assignments should be returned to me in the class on time. No late HW will be graded. If you miss the HW deadline a score of zero will be assigned to HW. The tests in the mid-term exams and the final exam will be similar to the homework assignments. Therefore, I highly recommend that you work on the assignments and learn by doing. You my work with other student in a group or consult with other students in doing HWs. However, copying other students’ work is absolutely forbidden. Midterm Exams There will be one midterm exam during the course of the semester and a final exam. The midterm will be worth 30% of the course grade and will test all the material covered up to the exam. If you miss the exam for any reason other than medical emergency, a score of zero will be assigned to the exam. If you miss the exam on account of a proven medical emergency a makeup exam should be arranged as soon as the medical emergency is over.

Final Exam The final exam will be comprehensive but will emphasize the material covered after the first midterm. The final exam will be worth 30% of the course grade. If you miss the final exam for a medical emergency reason that can be documented and verified, there will be a makeup final to be arranged as soon as possible. Otherwise, a grade of zero will be assigned to the final exam. All the exams in this course are closed notes and closed book.

Course Project and Report You are required to work on one applied project. The project will concentrate on the application of the techniques taught during the semester to a portfolio that you will construct. The project will be an ongoing project and you will be asked to report the progress of the project from time to time. Select 5 stocks or more from five different industries (for the list of the firms in different industries see, https://biz.yahoo.com/p/sum_conameu.html). Using monthly closing prices of the stocks from January 2, 2013 to present allocate a hypothetical amount on the selected stocks. Apply the techniques learned in the class to your portfolio as the course proceeds. You are required to report a summary of your work and the results as they progress. The idea behind this assignment is to do a hands-on practice on quantitative techniques after reviewing the relevant theories. The project will be worth 100 points and will be graded as any test is graded. You have to show your knowledge of the subject matter as well as the skills in applying the quantitative methods in analyzing and explaining the statistical results. At the end of the semester, you may be required to present the results in the class. You are required to submit your names and the list of selected securities no later than the second week of the semester.

Academic Conduct:

Plagiarism – presenting someone else’s ideas as your own, either verbatim or recast in your own words – is a serious academic offense with serious consequences. Please familiarize yourself with the discussion of plagiarism in SCampus in Section 11, Behavior Violating University Standards https://scampus.usc.edu/1100-behavior-violating-university- standards-and-appropriate-sanctions/. Other forms of academic dishonesty are equally unacceptable. See additional information in SCampus and university policies on scientific misconduct, http://policy.usc.edu/scientific-misconduct/. Discrimination, sexual assault, and harassment are not tolerated by the university. You are encouraged to report any incidents to the Office of Equity and Diversity http://equity.usc.edu/ or to the Department of Public Safety http://capsnet.usc.edu/department/department-public-safety/online-forms/contact-us. This is important for the safety of the whole USC community. Another member of the university community – such as a friend, classmate, advisor, or faculty member – can help initiate the report or can initiate the report on behalf of another person. The Center for Women and Men http://www.usc.edu/student-affairs/cwm/ provides 24/7 confidential support, and the sexual assault resource center webpage https://sarc.usc.edu/reporting-options/ describes reporting options and other resources.

Academic Integrity: USC seeks to maintain an optimal learning environment. General principles of academic honesty include the concept of respect for the intellectual property of others, the expectation that individual work will be submitted unless otherwise allowed by an instructor, and the obligations both to protect one’s own academic work from misuse by others as well as to avoid using another’s work as one’s own (plagiarism). All students are expected to understand and abide by these principles. SCampus, the Student Guidebook, (www.usc.edu/scampus or http://scampus.usc.edu) contains the University Student Conduct Code (Section 11.00 and Appendix A).

Students will be referred to the Office of Student Judicial Affairs and Community Standards for further review, should there be any suspicion of academic dishonesty. The Review process can be found at: http://www.usc.edu/student- affairs/SJACS/ . Failure to adhere to the academic conduct standards set forth by these guidelines and our programs will not be tolerated by the USC Marshall community and can lead to dismissal.

Support System: Students whose primary language is not English should check with the American Language Institute http://dornsife.usc.edu/ali, which sponsors courses and workshops specifically for international graduate students. The Office of Disability Services and Programs (www.usc.edu/disability) provides certification for students with disabilities and helps arrange the relevant accommodations. If an officially declared emergency makes travel to campus infeasible, USC Emergency Information (http://emergency.usc.edu/) will provide safety and other updates, including ways in which instruction will be continued by means of blackboard, teleconferencing, and other technology.

Students with Disability:

The Office of Disability Services and Programs (www.usc.edu/disability) provides certification for students with disabilities and helps arrange the relevant accommodations. Any student requesting academic accommodations based on a disability is required to register with Disability Services and Programs (DSP) each semester. A letter of verification for approved accommodations can be obtained from DSP. Please be sure the letter is delivered to me (or to your TA) as early in the semester as possible. DSP is located in STU 301 and is open 8:30 a.m.–5:00 p.m., Monday through Friday. The phone number for DSP is (213) 740-0776. Emergency Preparedness/Course Continuity: In case of a declared emergency if travel to campus is not feasible, the USC Emergency Information web site (http://emergency.usc.edu/) will provide safety and other information, including electronic means by which instructors will conduct class using a combination of Blackboard, teleconferencing, and other technologies.

In case of a declared emergency if travel to campus is not feasible, the USC Emergency Information web site (http://emergency.usc.edu/) will provide safety and other information, including electronic means by which instructors will conduct class using a combination of Blackboard, teleconferencing, and other technologies.

Incomplete Grades: A mark of IN (incomplete) may be assigned when work is not completed because of a documented illness or other “emergency” that occurs after the 12th week of the semester (or the twelfth week equivalent for any course that is scheduled for less than 15 weeks).

An “emergency” is defined as a serious documented illness, or an unforeseen situation that is beyond the student’s control, that prevents a student from completing the semester. Prior to the 12th week, the student still has the option of dropping the class. Arrangements for completing an IN must be initiated by the student and agreed to by the instructor prior to the final examination. If an Incomplete is assigned as the student’s grade, the instructor is required to fill out an “Assignment of an Incomplete (IN) and Requirements for Completion” form (http://www.usc.edu/dept/ARR/grades/index.html) which specifies to the student and to the department the work remaining to be done, the procedures for its completion, the grade in the course to date, and the weight to be assigned to work remaining to be done when the final grade is computed. Both the instructor and student must sign the form with a copy of the form filed in the department. Class work to complete the course must be completed within one calendar year from the date the IN was assigned. The IN mark will be converted to an F grade should the course not be completed.

Course Outline: The following course outline will be followed in a lecture format, but with sufficient flexibility to alter allotted time and emphasis as questions arise. From time to time, class will be conducted on application and discussion format. Topics/Daily Activities Readings and Deliverables Homework & Due Dates

Review of Preliminary Concepts: I.1.2.1 – I.1.3.4 a. Introduction to Computer Software: Excel, E-Views, and Stata. ASW: Week 1 Chapter 1: 1.1- b. Types of Data, Data Sources, Data Collection, and Session 1 1.6 Data Analysis. Lag, Lead, Log and Lag Operators. June 1th Review of Math: a. Constrained and Unconstrained Optimization. b. Elements of Matrix Algebra.

Review of Stat: Project topic Week 2 a. Measures of Relative Location and Detecting Outliers. I.1.4.1- I.1.6.2 and abstract. Session 2 I.2.2.1- I.2.3.2 b. Measures of Association Between Variables. I.2.4.1- I.2.4.3 Mathematics of Expected Value: June 6th 1.3.2.1- I.3.3.8 a. Calculating expected return and risk to a portfolio using means and variances of its components, the case of two ASW: and n assets, envelope portfolios. Chapter 3: 3.1- 3.3 and 3.5 Application in Finance: See notes Week 2 a. Graphing financial and economic indices, trend analysis. posted on Due date for Session 3 b. Measuring risk and return to several assets. Blackboard. Assignment #1 June 8th c. Measuring Variance-Covariance matrix of several assets for use in Modern Portfolio Theory. d. Constructing efficient frontier, computing the global minimum variance portfolio (GMVP). Probability and Distribution Theory: I.3.3.1- I.3.3.8 Project a. Random Variable, experiments, counting rules, and progress assigning probabilities. ASW: report. Week 3 Chapter 4: 4.1- c. Some Basic Relationships of Probability Session 4 4.4 d. Discrete Probability Distributions (Binomial Chapter 5: 5.1- June 13th and Poisson distributions). 5.6 e. Continuous Probability Distributions (Uniform, Chapter 6: 6.2, exponential, Normal, t, F, and Chi-squared). 6.4 Applications in Finance: See notes Due date for Week 3 a. Measuring Value at Risk (VaR) for assets or portfolios, posted on Assignment #2 Session 5 Static VaR, Dynamic VaR, Scaling of VaR, Equity Blackboard. VaR, Downside Risk, Lower Partial Moments (LPM). June 15th b. Testing for distribution of stock returns, normal and lognormal property of stock prices. c. Measuring downside risk and semi-variance for computing coefficient of variations, Sharpe ratio, Sortino ratio, Treynor ratio, M2 measure (RAP) and others. Sampling and Sampling Distributions: I.3.5.1- I.3.5.4 Week 4 a. Sampling Distribution of a Random Variable, Point Session 6 ASW: Test Review Estimation. Chapter 7: 7.3-7.5 June 20th b. Properties of Point Estimators; Bias, Efficient Estimate, Chapter 8: 8.1-8.2 Consistent Estimate. c. Interval Estimation of a Population Mean and Variance. Hypothesis Testing: a. Developing Null and Alternative Hypothesis b. One and Two-Tailed Tests and Inference about Population mean. c. Hypothesis Testing about Population Variance. d. Hypothesis Testing and Decision Making.

Application in Finance: I.3.5.5 – I.3.5.8 Week 4 a. Making inference from sample statistics to population Test #1 Session 7 ASW: parameters using interval estimation. Chapter 9: 9.1-9.4 June 22nd b. Comparing the average return of an asset with the Chapter11: 11.1- average return of a risk-free asset. 11.2 c. Testing equality of the mean returns of two assets. See the notes on d. Testing equality of the risks of two assets. Blackboard.

Introduction to Regression Analysis: I.4.2.1 – I.4.3.5 Week 5 a. Simple Linear Regression Model. I.4.5.1 – I.4.5.5 Project Session 8 ASW: b. Assumptions of Classical Regression Models. progress Chapter 14:14.1- report. June 27th c. Multiple Regression Model 14.5 d. Qualitative Independent Variables Chapter 15: 15.1 Introduction to Forecasting: I.4.6.1 – I.4.6.5 Due date for Week 5 a. Smoothing Techniques (MA, WMA, ES, Kalman Filter, ASW: Assignment #3 Chapter14: 14.6 Session 9 Hodrick-Prescott Filter). b. Using Regression for Forecasting See also notes June 29th c. Using Smoothing Techniques for Forecasting posted on d. Measures of Forecasting Efficiency (MAD, MAPE, Blackboard. RMSE). Application in Business and Finance: I.6.3.1 – I.6.5.2 Week 6 a. Estimating Jensen and coefficients of the CAPM. Session 10 b. Using the Security Market Line (SML) to calculate cost of equity. th July 6

Decomposition Techniques I.4.4.1 - I.4.4.6 Due date for Week 7 a. Estimating trend, seasonal, cyclical, and autocorrelation Assignment #4 Session 11 components of a financial or economic data. ASW: b. Using smoothing techniques for forecasting return and Chapter 13: 13.1- July 11th volatility of an asset. 13.3 c. Using smoothing techniques for de-trending or de- seasonalizing data. d. Estimating equation of demand for a product and measuring the elasticities. Estimating optimum level of advertising for a product.

Experimental Design and Analysis of Variance: I.4.4.1 - I.4.4.6 Due date for Week 8 a. Introduction to experimental design and ANOVA. project Session 12 b. ANOVA and completely randomized design. ASW: Chapter 13: 13.1- Review for c. Two and three factors ANOVA July 18th 13.3 Final Test

Final Test July 20th

Data Sources: http://finance.yahoo.com and http://wrds.wharton.upenn.edu (for stock prices). https://biz.yahoo.com/p/sum_conameu.html (list of firms by industry). www.globalfindata.com (global financial data) www.economagic.com www.banx.com (banking, interest rate, …) www.bea.doc.gov (labor data, macroeconomic data) www.lib.umich.edu/libhome/documents.center/stats.html (surveys of consumers and consumer confidence) www.imf.org (international monetary fund) www.hussman.com (stock market, money supply, interest rate, …) www.federalreserve.gov (interest rate, foreign exchange rate, consumer credit, …)