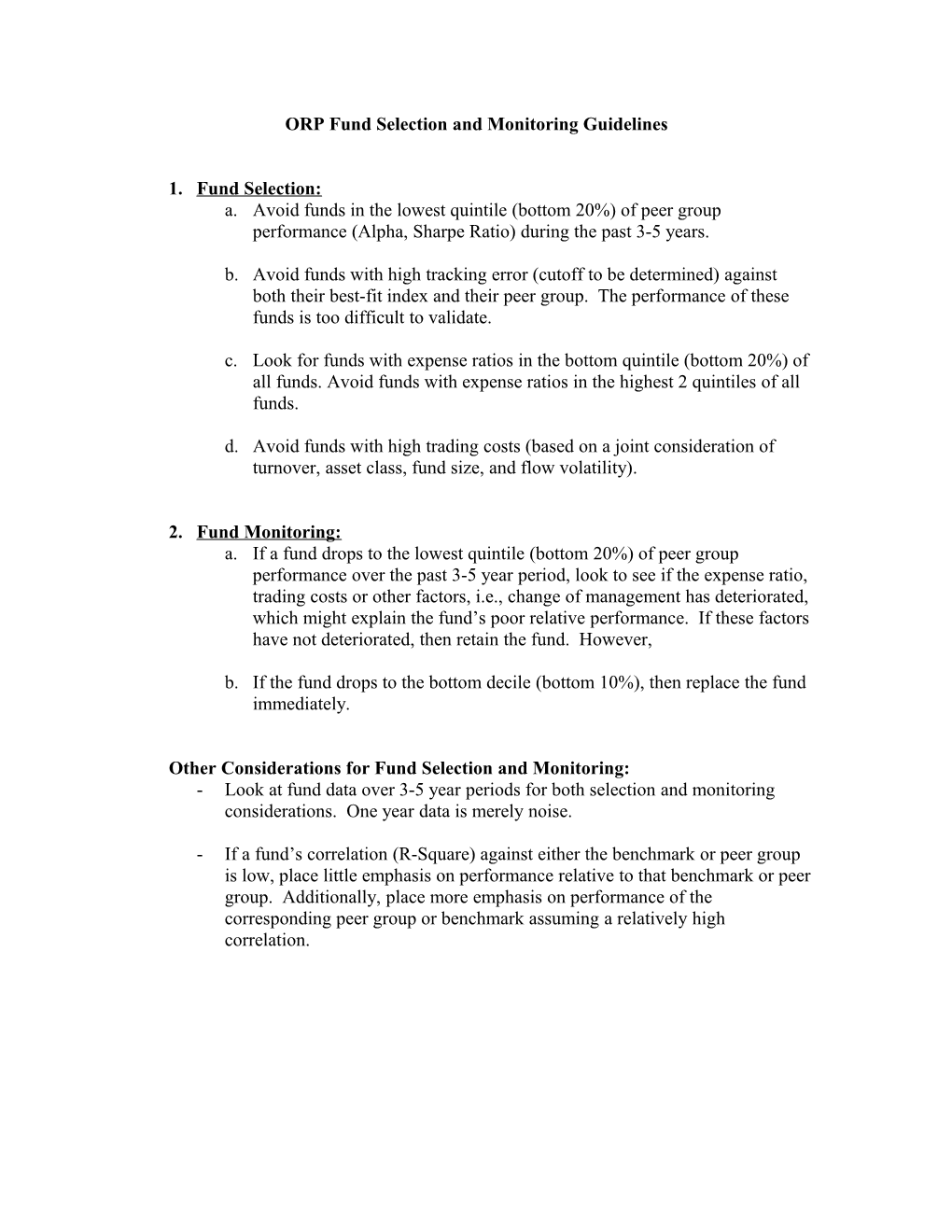

ORP Fund Selection and Monitoring Guidelines

1. Fund Selection: a. Avoid funds in the lowest quintile (bottom 20%) of peer group performance (Alpha, Sharpe Ratio) during the past 3-5 years.

b. Avoid funds with high tracking error (cutoff to be determined) against both their best-fit index and their peer group. The performance of these funds is too difficult to validate.

c. Look for funds with expense ratios in the bottom quintile (bottom 20%) of all funds. Avoid funds with expense ratios in the highest 2 quintiles of all funds.

d. Avoid funds with high trading costs (based on a joint consideration of turnover, asset class, fund size, and flow volatility).

2. Fund Monitoring: a. If a fund drops to the lowest quintile (bottom 20%) of peer group performance over the past 3-5 year period, look to see if the expense ratio, trading costs or other factors, i.e., change of management has deteriorated, which might explain the fund’s poor relative performance. If these factors have not deteriorated, then retain the fund. However,

b. If the fund drops to the bottom decile (bottom 10%), then replace the fund immediately.

Other Considerations for Fund Selection and Monitoring: - Look at fund data over 3-5 year periods for both selection and monitoring considerations. One year data is merely noise.

- If a fund’s correlation (R-Square) against either the benchmark or peer group is low, place little emphasis on performance relative to that benchmark or peer group. Additionally, place more emphasis on performance of the corresponding peer group or benchmark assuming a relatively high correlation. Decision Factors When Selecting Funds:

1. Make sure the correlation (R-Squared) error is high enough to be certain that we have good comparative information against the benchmark and peer group. 90% and higher is preferred, but higher than 85% is acceptable. If a fund has high performance but a low correlation to the benchmark, they are taking bets outside of the benchmark to enhance the returns. This may not be repeatable.

2. Start with looking at expenses. Look for low expenses because high expenses correlate to poor performance.

3. Next look at turnover ratio. Low is better.

4. Next look at net assets. Big is bad if the fund trades a lot. If the fund has a low turnover ratio, then size is less of an issue. Sometimes, big is better because big funds tend to have less flow volatility. Low flow volatility is a good thing.

5. Performance should be looked at last, and only as a tie breaker. Remember: past good performance is not indicative of future performance.