POB Unit 4.01 – Introduction to Taxes Competency 4.0 Explain the effect and importance of taxes Objective 4.01 Explain taxes on income Part 1: Why Pay Taxes????

The Government • The government provides ______for the community as a whole • The government regulated business activities and ______(so that it is “more fair” • To pay for these things, the government charges everyone ______. Vocabulary • ______ Benefits that cannot be withheld from those who don’t pay for them and benefits that may be consumed by one person without reducing the amount of the product available for others • ______ Shift resources from private individuals and businesses to the government in order to pay for public goods and services, regulate the economy, and redistribute income Where it Comes From • ______% of the government’s money comes from personal income taxes. • ______% comes from social security, Medicare, and retirement taxes • ______% from corporate income taxes • ______% from excise, customers, estate, gift, and miscellaneous taxes Where it Goes • ______% of the federal government finds goes to Social Security, Medicare, and retirement • ______% to national deference • ______% on Social Programs • ______% to pay interest on debt • ______% on physical, human, and community development • ______% to pay down the debt • ______% law enforcement, and general government

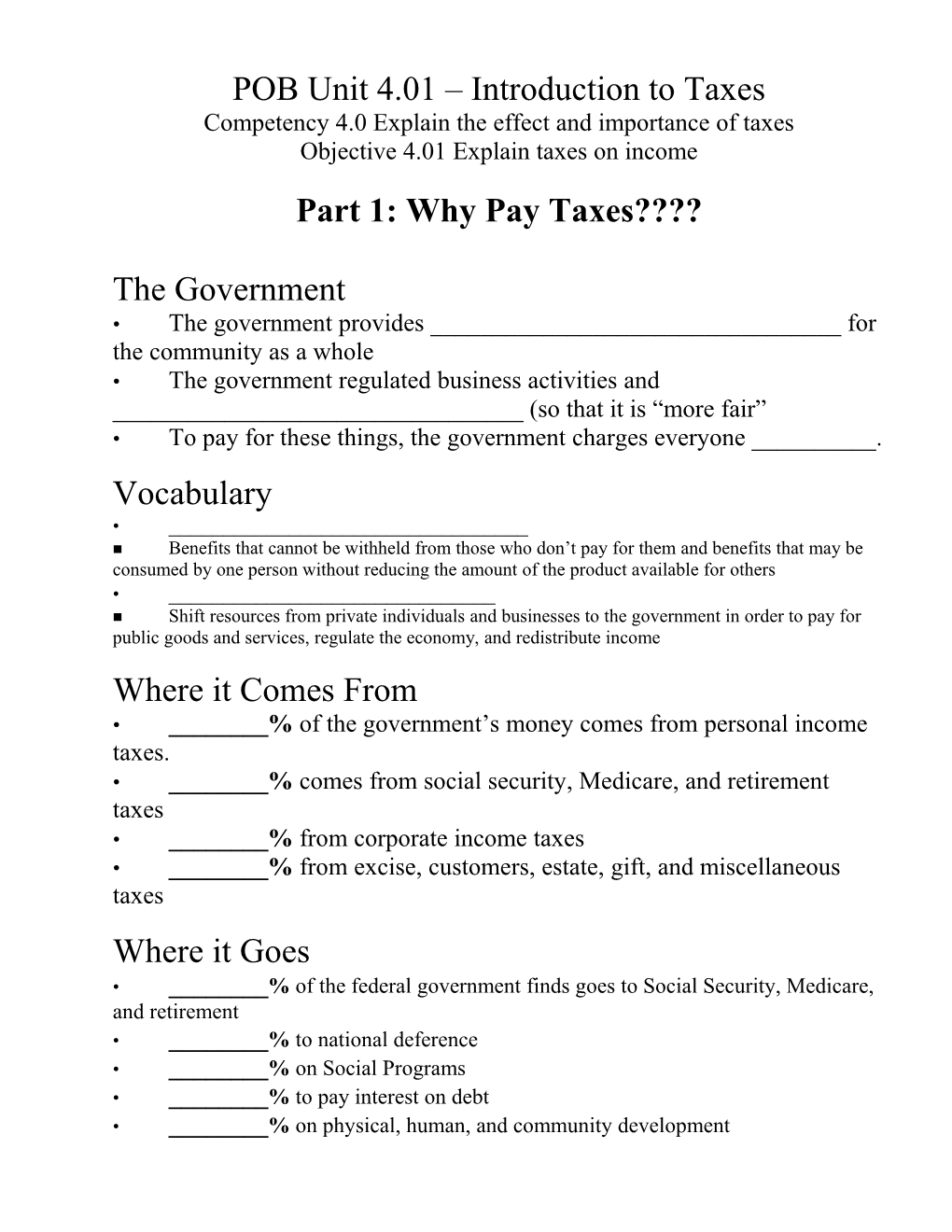

Activity: Answer the following questions from the chart below Year Revenue Spending 1950 $39 billion $43 billion 1960 $93.5 billion $92 billion 1970 193 billion $196 billion 1980 517.1 billion $591 billion 1990 1,032 billion $1,252 billion 2000 2,025 billion $1,789 billion

• Which years did the government spend more than it collected? • How many times larger was revenue in 2000 than in 1950? • How many times greater was spending in 2000 than in 1950? • Which grew more – revenue or spending? • How do you think revenue and spending will change in the future?

Part 2: Calculating Gross Earnings Payroll Records • Payroll is a ______for most companies and all records must be accurately maintained • ______is a list of employees and the payments due to each one for a specific pay period • A ______is the amount of time over which an employee is paid Weekly ______ Semi-monthly ______• The ______is a person who is responsible for preparing the payroll. • The payroll clerk: Makes sure employees are paid on time Makes sure each employee is paid the correct amount Completes payroll records Pays payroll taxes • Mistakes by the clerk can cost a business ______! • A ______is the way in which the payroll is paid • All payroll systems have certain tasks in common: Calculates earnings ______ Prepares payroll checks Reports payroll information to government Records earnings and deductions in payroll and accounting records Calculating Gross Earnings • ______is the total amount of money an employee earns in a pay period. • The calculation of gross earnings depends on the basis an employee is paid • An employee’s pay can be based on: ______ Hourly Wage ______ Salary + commission or bonus ______Calculating Gross Earnings • ______is a fixed amount of money paid to an employee for each pay period Mr. Doe is paid a salary of $2,000 a month • ______is an amount of money paid to an employee at a specified rate per hour worked. The number of hours worked multiplied by the hourly wage equals the gross earnings for the pay period Example: Sally is paid $6.25 per hour. Last week, she worked 36 hours. Sally’s gross earnings are 36 x $6.25 = $245.00 • An ______is an identification badge with a magnetic strip that contains employee information used to record starting and ending work hours. Used to keep wage employees honest about their hours worked. • ______is an amount paid to an employee based on a percentage of the employee’s sales Sue is paid a 5% commission on all her sales. Last week, Sue’s total sales were $8,254. Sue’s gross earnings were $8,245 x .05 = 412.70. • ______, set by the Fair Labor Standards of 1938, is 1.5 times the employee’s regular hourly rate John worked 43 hours last week. His hourly rate is $6.60. Regular 40 x $6.60= $264.00 Overtime 3 x $9.90= 29.70 Total $293.70

Activity: Calculate the gross earnings for the following employees Employee Total Pay Rate Regular Overtime Gross Hours Earnings Earnings Earnings James 33.5 $6.95 Betty 38 $7.80 Bobby 44.25 $8.30 Jean 43 $7.25 John 39.5 $8.30 Kelly 40 $7.50 Nelson 42.5 $9.75

Part 3: Payroll Deductions Deductions • ______is an amount that is subtracted from gross earnings • Deductions required by law: Federal income tax Social Security tax ______• Some deductions are ______Deductions • ______ Most people pay the federal government a tax based on their annual income Employers are required to withhold a certain amount of money from each paycheck • ______is an employee’s withholding allowance certificate that shows the number of allowances claimed for federal and state income taxes. • The amount withheld for federal taxes depends on three factors ______ Number of allowances ______Deductions • An employee who does not pay federal income tax can be “______” from withholding if he: Did not have a federal income tax liability in the previous year Expects no tax liability this year Has income of $700 or less including interest Cannot be claimed as a dependant on someone else’s tax return Deductions • If an employee writes “EXEMPT” on form W-4, the employer will not ______. • ______reduces the amount of income tax to be withheld. The greater the number of allowances claimed by the tax payer, the lower the amount of income tax withheld from earnings. • ______shows the amount to be withheld from the employees each pay period based on their filing status. Deductions • ______ Employers also collect social security taxes for the federal government The Federal Insurance Contributions Act (FICA) established the present social security program in 1935. The FICA taxes finance programs that provide income to certain individuals: The ______programs provide income to retired and disabled persons and their dependent children The survivor’s ______provides income to the spouse and dependent children of a deceased worker The ______provides health benefits for the elderly

• There are two FICA taxes: social security and Medicare. • Each tax is separately recorded on payroll documents. Tax rates are as follows: • Social Security = 6.20 % • Medicare = 1.45 % • Total FICA = 7.65 %

• The social security tax is deducted from each employee’s earnings until the maximum taxable earnings amount for the year is reached • The amount increases each year • For 1998, the max taxable earnings amount is $68,400. • Calculate FICA for Lisa who earns $75,000 in 1998. Social Security $68,000 x .062 = $4,240.80 Medicare $75,000 x .0145 = $1,087.50 Total FICA $5,328.30 Deductions • ______ Most states (including NC) and cities tax the earnings of the people who live or work within their boundaries. In some states and cities, the tax rates are set as a percentage of gross earnings, like social security taxes • ______ Most Employers agree to deduct other amounts from their employees’ payroll check to accommodate the wishes of the employee. Union dues Health insurance payments Life insurance payments Pension and retirement contributions Credit union deposits and payments US savings bonds Charitable contributions

Activity: Complete Tutorials and Simulations for Modules 1 and 2 on http://www.irs.gov/app/understandingTaxes/jsp/teach er_lessons.jsp Part 4: Payroll Records

• ______is a form that summarizes information about employees’ earnings for each pay period • Why is a payroll register important? To comply with federal and state lows, payroll records must be kept accurately. • ______is the amount left after total deductions are subtracted from gross earnings • ______is when the employer deposits the employee’s check into his or her personal banking account. ______ The employee receives a printed record Made through electronic funds transfer • ______is a record containing all of the payroll information related to an employee. • ______are the employee’s year-to-date gross earnings, or the employee’s gross earnings from the beginning of the year through the end of each pay period

• Businesses keep employee earnings records on a ______. This makes it easier to complete government reports that are required each quarter At the end of the quarter, the amount columns on each employee earnings records are ______. The final amount in the accumulated earnings column is ______to the top of the employee earnings record for the next quarter. • Most large companies perform payroll functions with a computer. The computer: ______ Prepares and prints the payroll register Prints the payroll checks and stubs Maintains the employee earnings records Activity: A Matter of Ethics #1 • During lunch, one of your co-workers, Donald, tells you that one of the company’s most valued customers has overpaid his bill by $30. Instead of returning the cash, Donald kept it. What if he’s offering to pay for your lunch with part of that money. What is your reaction? What are you going to say to Donald? Should you tell his supervisor? Do you think Donald should be fired? A Matter of Ethics #2 • As a payroll clerk at a small company, Donna knows the salaries of all the employees. While Donna was at a party lat week, she told several friends what two company’s administrators earn. Do you think Donna should have revealed this information? What would you do if you were her supervisor and found out about this? A Matter of Ethics #3 • Imagine that you’re the payroll clerk for The Gap. Your friend, Amber, who also worked there is interested in one of the sales clerks and she wants to find out how much money he makes and if he’s married. What are the ethical issues here? What are the alternatives? Who are the affected parties? How to the alternatives affect the parties? What would you do? (decision making process) Part 5: Employer’s Payroll Taxes Here we will talk about the taxes that the employer has to pay both for the business and on your behalf Employer’s Payroll Taxes • ______ Under the Federal Insurance Contribution Act, both the employee and the employer pay FICA taxes Employer’s Payroll Taxes • ______(FUTA) and the ______(SUTA) Require employers to pay unemployment taxes Based on a percentage of the employee’s gross earnings. Collected to provide funds for workers who are temporarily unemployed Somewhere around 8% of gross earnings Part 6: Tax liabilities payments and tax reports Payroll Tax Liabilities • At regular intervals, payroll taxes and amounts withheld from employees are paid by the employer to ______• These items include: FICA and employees’ federal income taxes Employees’ ______ Federal and state unemployment taxes • ______– one payment is made for: Social security and Medicare taxes (employer + employee) Employee’s federal income tax withheld Payroll Tax Liabilities • ______ At regular intervals, businesses pay the amounts withheld for state income taxes. Each state determines how and when the payments are made and what repots are filed • ______ Most businesses pay the federal unemployment or FUTA tax quarterly If a business has accumulated federal unemployment taxes of less than $100 for the year, only one annual payment is necessary • ______ The requirements for paying state unemployment taxes vary from state to state Usually state unemployment taxes are also paid on a quarterly basis • ______(Form 8109) is a form prepared by the employer to send in FICA and federal income taxes to the federal government • ______(EFTPS) is a means of transferring federal taxes electronically to the US government • ______is used to report the employer’s unemployment (state and federal taxes) • ______is a form used by the employer to report quarterly taxes consisting of both FICA and federal

Payroll Tax Liabilities • ______is a form given to each employee at the end of the year and contains a summary of the income you earned for the year and all amounts the employer withheld for taxes Federal, state, and local income taxes and social security ______ The employer will also send a copy of the W2 to the IRS and that determines if you own more or get $$ back