DRAFT

OHIO STATE BAR ASSOCIATION CORPORATION LAW COMMITTEE

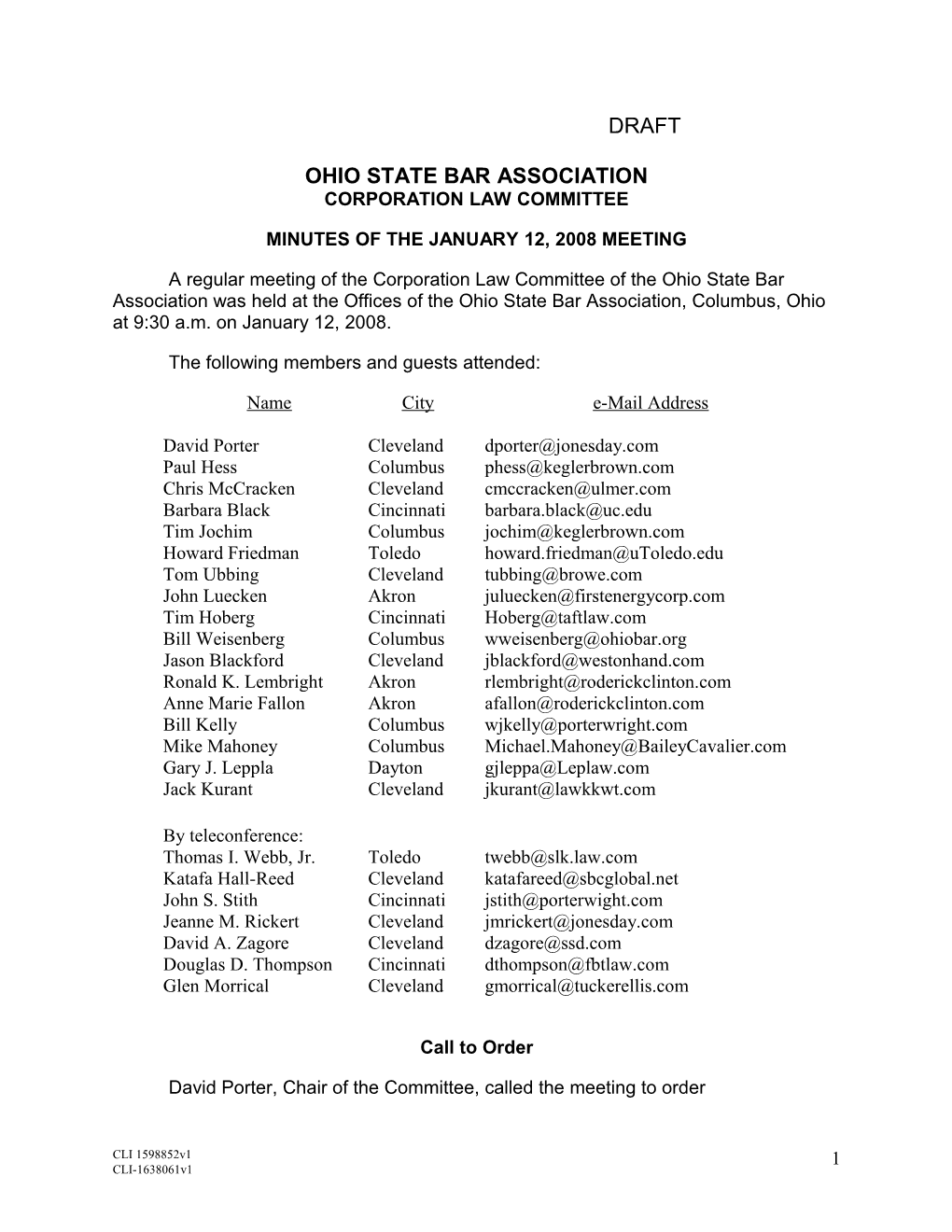

MINUTES OF THE JANUARY 12, 2008 MEETING

A regular meeting of the Corporation Law Committee of the Ohio State Bar Association was held at the Offices of the Ohio State Bar Association, Columbus, Ohio at 9:30 a.m. on January 12, 2008.

The following members and guests attended:

Name City e-Mail Address

David Porter Cleveland [email protected] Paul Hess Columbus [email protected] Chris McCracken Cleveland [email protected] Barbara Black Cincinnati [email protected] Tim Jochim Columbus [email protected] Howard Friedman Toledo [email protected] Tom Ubbing Cleveland [email protected] John Luecken Akron [email protected] Tim Hoberg Cincinnati [email protected] Bill Weisenberg Columbus [email protected] Jason Blackford Cleveland [email protected] Ronald K. Lembright Akron [email protected] Anne Marie Fallon Akron [email protected] Bill Kelly Columbus [email protected] Mike Mahoney Columbus [email protected] Gary J. Leppla Dayton [email protected] Jack Kurant Cleveland [email protected]

By teleconference: Thomas I. Webb, Jr. Toledo [email protected] Katafa Hall-Reed Cleveland [email protected] John S. Stith Cincinnati [email protected] Jeanne M. Rickert Cleveland [email protected] David A. Zagore Cleveland [email protected] Douglas D. Thompson Cincinnati [email protected] Glen Morrical Cleveland [email protected]

Call to Order

David Porter, Chair of the Committee, called the meeting to order

CLI 1598852v1 1 CLI-1638061v1 Chairman’s Announcements

Approval of Minutes

The Minutes of the meeting of the Committee held on September 8, 2007 were approved in the form distributed to the members of the Committee prior to the meeting.

Report of the Business Courts Subcommittee

In the absence of Harry Mercer, Jeanne Rickert reported that the Commercial Court Docket Task Force appointed by the Ohio Supreme Court is working actively and the Task Force hopes that the pilot project can be launched during 2008. The Task Force will submit a proposal for that purpose to the Ohio Supreme Court for the Court’s review. Actual implementation of the Commercial Docket will depend upon the Court’s response to that proposal.

Report of the Legislative Review Subcommittee

William Kelly, Chair of the Subcommittee, reported on the status of proposals presented to the Council of Delegates.

Two proposals approved by the Committee at its meeting on September 8, 2007 have been approved by the Council of Delegates and will be included in an appropriate bill presented to the legislature. Mr. Porter stated that he thought that they might be attached to House Bill 374. These proposals consisted of an amendment to Section 1701.24 to permit the articles or regulations to provide for uncertificated shares and an amendment to Section 1701.70 to expand the authority of directors to reduce the number of shares in any series following redemption, surrender or acquisition of those shares by the corporation. Mr. Porter stated that it was his understanding that these proposals would be attached as amendments to House Bill 374 and that an additional amendment would be included to Section 1701.591 to make clear that close corporations could not have uncertificated shares.

Mr. Kelly reported further that the Subcommittee continued to have a number of other matters under consideration, including possible modifications to the statutory provisions relating to corporate dissolutions, dissenter’s rights and conditional appointment of directors. He added that he hoped to be able to present proposals with respect to some of these at the September meeting of the Committee.

Mr. Porter encouraged members of the Committee to contact Mr. Kelly with any proposals they might have for changes in Chapter 1701.

Report of the Limited Liability Company Subcommittee

Jack Kurant, Chair of the Subcommittee, asked that William Weisenberg report on the status of the proposed amendment to Section 1705.02 which was approved by the Committee at its meeting on September 8, 2007. Mr. Weisenberg reminded the members of the Committee that the amendment was intended to clarify that not-for-

CLI-1638061v1 profit organizations can be formed as limited liability companies under Chapter 1705. He added that it had been assumed in the past that this could be done, but the Secretary of State had expressed doubts in this regard and the proposed amendment was attended to clarify the matter. Mr. Weisenberg added that substantial progress had been made and that the proposal has been incorporated into House Bill 160 which had originated from the Bar Association’s Probate Section. The proposed changes would operate retroactively so that any not-for-profit entity formed as a limited liability company in the past would be protected. Mr. Weisenberg added that he foresaw no difficulty in obtaining passage of the bill and hoped that this would be accomplished in the very near future. Mr. Weisenberg added that this favorable resolution reflected the excellent working relationships among the Committee, the Office of the Ohio Secretary of State and the Ohio Department of Taxation as well as the Bar Association’s Tax Committee.

Mr. Kurant added that the Subcommittee was looking at two other issues: the extent to which a limited liability company could expand upon or limit fiduciary duties of its members or managers; and the extent to which an assignee can exercise the rights associated with an assigned liability limited company interest. Howard Friedman stated that similar issues with respect to fiduciary duties arise in the context of close corporations and partnerships as well as limited liability companies and suggested that some sort of consistent approach should be considered. After discussion, Mr. Porter said that he believed that, since this issue crossed the jurisdictions of several of the subcommittees, it would be appropriate to set up a special subcommittee to look at these issues. Mr. Porter added that he would appoint such a special subcommittee which would include the chairs of the relevant standing subcommittees and invited members of the Committee to contact him by email if they wished to participate.

Report of the Non-Profit Corporation Subcommittee

Christopher McCracken, Chair of the Subcommittee, reported that the Ohio State Bar Association had asked that the Subcommittee review the state of Ohio law on unincorporated associations. Although there is no statistical data available, Mr. McCracken estimates that there are thousands of such entities in the State of Ohio. In fact, the Bar Association itself is an unincorporated association under Chapter 1745. The Subcommittee has been asked to review Ohio law and the model acts and recommend whether any changes are needed to add protection for individuals involved in these types of business organizations. Jack Stith reported that when he was President of the Bar Association he had appointed a constitutional review task force and had charged them to look at whether the Bar Association should switch to a different form of organization. The task force decided, on balance, that the Bar Association should stay as an incorporated association but suggested that the Committee should consider whether some statutory help was appropriate for protection. Mr. Friedman raised the question of whether there should be a simple way to convert from an incorporated association into another form of business organization. It was noted that Section 1702.08 does provide a process for conversion. However, this may be difficult for larger unincorporated associations. Mr. Stith added that the general counsel for the Bar Association, was familiar with issues involved in such conversions as a result of the review undertaken by the Bar Association’s task force and could provide information to

CLI-1638061v1 3 the Subcommittee. Mr. McCracken stated that the Subcommittee would look into these matters as requested by the Bar Association.

Report of the Partnership Law Subcommittee

Glen E. Morrical, Chair of the Subcommittee, reported on the status of the Committee’s proposal to adopt the revised Uniform Partnership Act in Ohio. House Bill 332, which is essentially the Committee’s bill with some style and numbering changes suggested by the Legislative Services Commission, passed the House during the previous week. The Subcommittee was involved heavily in discussions with the Legislative Services Commission and Mr. Morrical cited specifically the efforts of Ms. Rickert and Mr. Friedman in that regard. Concern was expressed by the Probate, Trust and Estate Section of the Bar Association concerning the effect of the language of House Bill 332 on the liability of trustees, but it was agreed that this would be addressed through a technical amendment to the Trust Code. Mr. Weisenberg expressed his view that the bill would be passed speedily by the Senate. Mr. Porter noted the importance of members of the Committee being willing to testify before legislative committees and expressed thanks to Messrs. Morrical and Friedman and Ms. Rickert for their willingness to do so in the case of this proposal.

Report of the Secretary of State Liaison Subcommittee

No report was provided by the Subcommittee.

Report of the Securities Regulations Subcommittee

No report was provided by the Subcommittee.

Report of the Tender Offer Subcommittee

David Zagore, Chair of the Subcommittee, reported that the Subcommittee has been meeting regularly, but had nothing to propose at this time. He noted that he has now become a member of the American Bar Association State Corporation Law Liaison Committee. In this capacity he is able to obtain electronically from the ABA, or bring to its attention, various types of information. If any Subcommittee desires information on the current status of laws in other jurisdictions, data on all 50 states can be accessed through this process. Messrs. Zagore and Porter encouraged other subcommittees to make use of this procedure by working through Mr. Zagore.

Mr. Porter noted that one recurring open issue was whether state laws could do anything to provide protection to corporations from being put “into play” by hedge funds. Mr. Zagore stated that he was aware of the issue, but that the only activity of which he had knowledge in this area was that the National Association of Securities Law Administrators has been considering actions with respect to vote lending and he understands that the Securities and Exchange Commission is also looking into this matter. Mr. Zagore said that the Subcommittee would consider the hedge fund situation. It was agreed that if a state law provision could assist corporations in regulating the voting of their shares, it would be very favorable to such corporations.

CLI-1638061v1 4 Report of the “Piercing the Veil” Special Subcommittee

Ms. Rickert, Chair of this ad hoc Subcommittee, reminded the members of the Committee that at their meeting on September 8, 2007, the Committee had approved proposed amendments to Section 1701.96 and a new section for Chapter 1705 dealing with shareholder liability in the “piercing the corporate veil” context. She added that the proposal was presented to the Steering Committee of the Council of Delegates subsequent to the September 8 meeting. This resulted a lively discussion, the conclusion of which was that the members of the Steering Committee felt that the proposal went a bit too far in limiting shareholder liability. Ms. Rickert added that, in light of this development, the original proposal was withdrawn. The ad hoc Subcommittee is now presenting a revised proposal to the Committee for consideration. Ms. Rickert added that the text of the revised proposal had been presented to the members of the Committee in December 2007. Ms. Rickert added that, if possible, the members of the Subcommittee wish to take the revised proposal back to the Steering Committee this Spring so that it would be considered by the same people who had considered the original proposal.

The members of the Committee then discussed the revised proposal. Discussion focused primarily on the distinction between in-state vs. out-of-state claimants as set forth in 1701.96(D)(2) and 1705.__(D)(2). After discussion it was agreed that these two sections would be deleted from the revised proposal. It was further agreed that the Committee comment to Section 1705.__ would be revised by including a reference to Section 1701.18(J) dealing with the limitation of shareholder liability at the end of the second sentence of the first paragraph and that the cross-reference following the second sentence of the second paragraph would be changed to “See also Committee Comment to Section 1701.96.”

It was moved and seconded that the proposed amendments to 1701.96 and a new section for Chapter 1705 dealing with shareholder liability, in the revised form presented to the Committee and with the further changes discussed above, be approved by the Committee and presented to the Council of Delegates. This motion was approved by unanimous vote of the members of the Committee present. Mr. Porter thanked the members of the ad hoc Subcommittee for their hard work on this matter.

Report of the Uniform State Law Subcommittee

No report was provided by the Subcommittee.

Legislative Update

Mr. Weisenberg and Mr. Porter reported on the current status of legislative proposals and active legislation incorporating previous Committee proposals.

The Committee’s proposal for majority voting of directors has been approved and became effective January 1, 2008. This allows corporations to require, through an amendment to their Articles of Incorporation, majority voting for election of directors.

CLI-1638061v1 5 House Bill 374 was previously discussed during the presentation of the Legislative Review Subcommittee. House Bill 374 at present includes provisions allowing a corporation to opt out of accumulative voting in its Articles without the 90 day waiting period and proposals to conform Section 1701 to language changes previously made in Chapter 1705 dealing with conversions. As discussed above, under the report of the Legislative Review Subcommittee, it is anticipated that additional provisions will be added to House Bill 374.

Mr. Porter added that one matter that was being referred to the Legislative Review Subcommittee deals with the required number of directors of an Ohio corporation. Section 1701.56 currently requires that the number of directors must be at least three unless the corporation has a fewer number of shareholders. The Uniform Laws and Delaware Law allow one director regardless of the number of shareholders. The Legislative Review Subcommittee has been asked to look at whether Ohio law should be changed to conform. Mr. Porter encouraged members of the Committee to express their views in this regard to the Legislative Review Subcommittee.

Old Business

Mr. Porter reminded the members of the Committee that at the September 8, 2007 meeting he had introduced materials previously distributed relating to a proposed “Statement on the Role of Customary Practice in the Preparation and Understanding of Third Party Legal Opinions.” The goal of the authors of this statement was to confirm in a short, simple statement that customary opinion practice is the starting place for evaluating the (i) sufficiency of an opinion giver’s diligence and (ii) the meaning of the words in the opinion. As approved by the Committee on September 8, 2007, Mr. Porter forwarded the materials to the chair of the Real Property Section, the Banking, Commercial and Bankruptcy Law Committee, the Corporate Counsel Section and the Real Property Section to explore the possible development of a statement of Ohio practice regarding legal opinions. No views have been volunteered by such other parties at present, but Mr. Porter will follow up on this seeking comments.

New Business

Mr. Porter reported on several matters of new business which he thought would be of interest to the Committee.

The first involved a proposal being made to the legislature for creating a new form of cooperatives. Mr. Porter added that cooperatives receive certain benefits under the tax, securities and antitrust laws. Ohio law currently provides for cooperatives, but the new proposal would allow investments in the cooperative by people who are not active members of the cooperative. Similar provisions have been adopted in other states. Mr. Porter has spoken with the chair of the Antitrust Law Committee of the Bar Association and feels that there are antitrust issues involved in such an approach. Mr. Porter added that this was provided to the Committee for information only since the Agriculture Committee of the Bar Association will respond to this proposal in a negative manner.

CLI-1638061v1 6 Mr. Porter had been contacted by the chair of the Corporate Counsel Section who has asked whether our Committee would be interested in combining with the Corporate Counsel Section. Mr. Porter expressed the view that the two bodies had different focuses for their activity. Our Committee is focused on legislative developments while the Corporate Counsel Section is primarily focused on continuing legal education for the corporate counsel community. Accordingly, Mr. Porter does not believe that there is any real interest in, or possible benefit from, such a combination.

While agreeing with Mr. Porter’s statement of the focus of the Committee, Ms. Rickert noted that the Committee has offered to provide education to judges involved in the Commercial Docket pilot project with respect to Ohio business law. Mr. Porter concurred, noting that the Committee has, in other ways, provided legal education with respect to legislative developments sponsored by the Committee and that this should continue to be a function of the Committee. For example, it was anticipated that the Committee would describe the new revised Uniform Partnership Act at future state CLE conferences.

Mr. Porter then noted that Timothy Hoberg had served as Secretary for the Committee for four years and had now developed a conflict with respect to the September 2008 meeting. Mr. Porter thanked Mr. Hoberg for his services and asked for volunteers to act as Secretary. Mr. Porter noted that the minutes of the meetings are important since they are sent to approximately 600 lawyers and paralegals throughout the State and serve to keep them up to date of the activities of the Committee. The members of the Committee then discussed ways in which the minutes could be made more easily accessible to members of the Bar Association, including posting them on the Association’s web page on a timely basis.

Mr. Weisenberg reported that the Ohio Department of Development is planning to hold a series of meetings around the state during 2009 where information would be provided with respect to tax incentives available in Ohio. The Bar Association will circulate a list of those dates to Ohio lawyers so that lawyers can become more familiar with tax incentives offered by the state. Mr. Weisenberg added that a link would be established and appropriate websites maintained by the Bar Association to facilitate the obtaining of such information.

Mr. Weisenberg added that he and Mr. Stith had attended a meeting sponsored by the Department of Development dealing with the establishment of a “Business Portal” which would make business and incentive information with respect to Ohio available in one convenient location. The Department is now looking at how best to put this together. Mr. Weisenberg promised to keep the members of the Committee up to date on developments in this regard.

CLI-1638061v1 7 Adjournment

There was no further business to come before the meeting and, therefore, Mr. Porter declared the meeting adjourned at 11:15 a.m.

Respectfully submitted,

Timothy E. Hoberg, Secretary

CLI-1638061v1 8