Financial Accounting Question Database Fall 2011

1. Examples of notes are descriptions of the significant accounting policies and methods used in preparing the statements, explanations of contingencies, and various statistics.

2. Net income for the period is determined by subtracting total expenses and dividends from revenues.

3. If the assets owned by a business total $100,000 and liabilities total $65,000, stockholders' equity totals $25,000.

4. Owners of business firms are the only people who need accounting information.

5. Management of a business enterprise is the major external user of information.

6. In the annual report, where would a financial statement reader find out if the company's financial statements give a fair depiction of its financial position and operating results? A) Notes to the financial statements B) Management discussion and analysis section C) Balance sheet D) Auditor's report

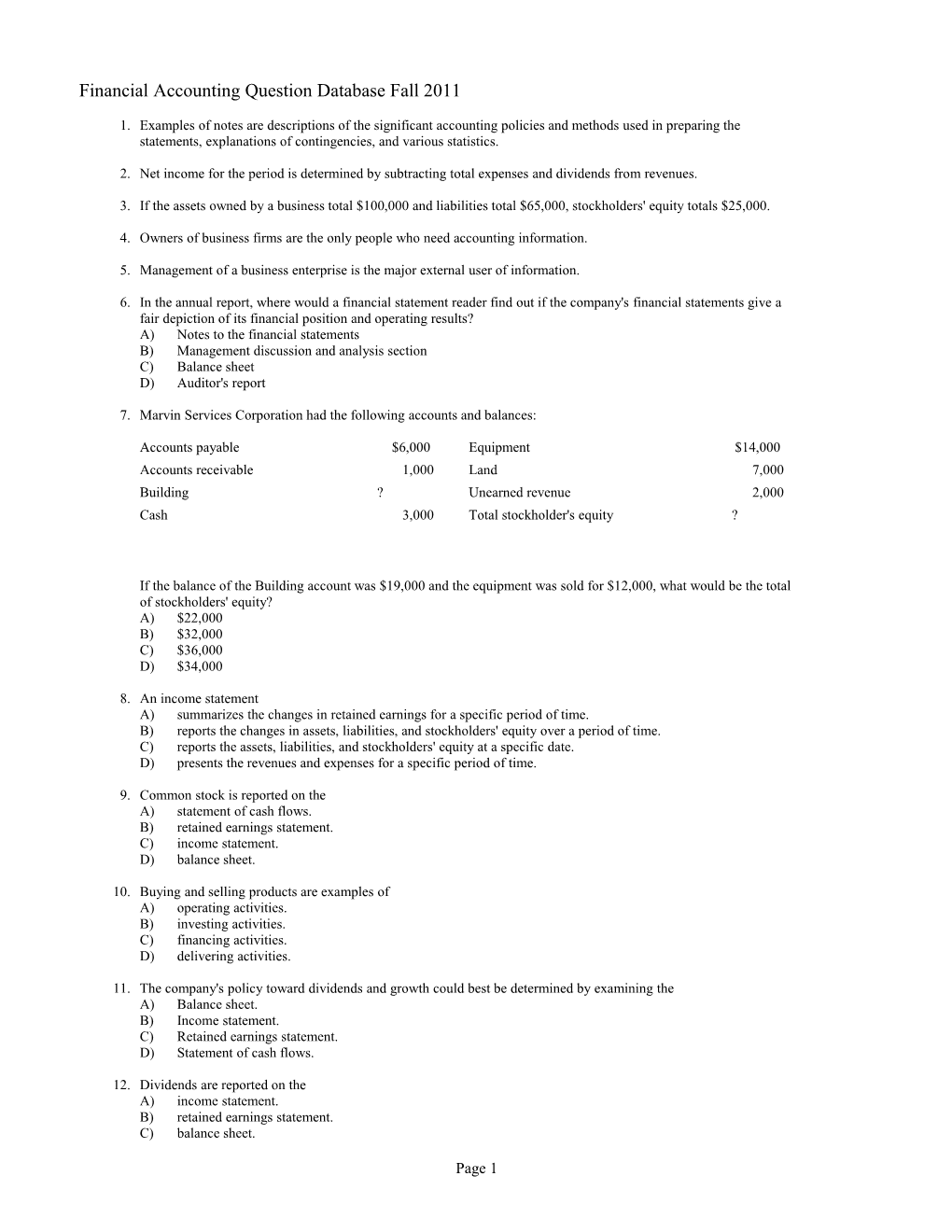

7. Marvin Services Corporation had the following accounts and balances:

Accounts payable $6,000 Equipment $14,000 Accounts receivable 1,000 Land 7,000 Building ? Unearned revenue 2,000 Cash 3,000 Total stockholder's equity ?

If the balance of the Building account was $19,000 and the equipment was sold for $12,000, what would be the total of stockholders' equity? A) $22,000 B) $32,000 C) $36,000 D) $34,000

8. An income statement A) summarizes the changes in retained earnings for a specific period of time. B) reports the changes in assets, liabilities, and stockholders' equity over a period of time. C) reports the assets, liabilities, and stockholders' equity at a specific date. D) presents the revenues and expenses for a specific period of time.

9. Common stock is reported on the A) statement of cash flows. B) retained earnings statement. C) income statement. D) balance sheet.

10. Buying and selling products are examples of A) operating activities. B) investing activities. C) financing activities. D) delivering activities.

11. The company's policy toward dividends and growth could best be determined by examining the A) Balance sheet. B) Income statement. C) Retained earnings statement. D) Statement of cash flows.

12. Dividends are reported on the A) income statement. B) retained earnings statement. C) balance sheet.

Page 1 D) income statement and balance sheet.

13. When expenses exceed revenues, which of the following is true? A) a net loss results B) a net income results C) assets equal liabilities D) assets are increased

14. Which type of corporate information is readily available to investors? A) financial comparison of operating alternatives B) marketing strategies for a product that will be introduced in eighteen months C) forecasts of cash needs for the upcoming year D) amount of net income retained in the business

15. If the retained earnings account increases from the beginning of the year to the end of the year, then A) net income is less than dividends. B) a net loss is less than dividends. C) additional investments are less than net losses. D) net income is greater than dividends.

16. To be reliable, accounting information should predict future events, confirm prior expectations, and be reported on a timely basis.

17. Stockholders' equity is divided into two parts: common stock and retained earnings.

18. The concept of materiality requires a large company to record the purchase of a $10 wastepaper basket as an asset and depreciate it over its useful life.

19. The going concern assumption is that the business will continue in operation long enough to carry out its existing objectives and commitments.

20. For accounting purposes, business transactions should be kept separate from the personal transactions of the stockholders of the business.

21. A general ledger should be arranged in financial statement order beginning with the balance sheet accounts.

22. Assets are decreased with a credit.

23. A trial balance does not prove that all transactions have been recorded or that the ledger is correct.

24. The dividends account is a subdivision of the retained earnings account and appears as an expense on the income statement.

25. A credit balance in a liability account indicates that an error in recording has occurred.

26. Closing entries result in the transfer of net income or net loss into the Retained Earnings account.

27. A liability—revenue account relationship exists with an unearned rent revenue adjusting entry.

28. The balances of the Depreciation Expense and the Accumulated Depreciation accounts should always be the same.

29. Revenue received before it is earned and expenses paid before being used or consumed are both initially recorded as liabilities.

30. Unearned revenue is a prepayment that requires an adjusting entry when services are performed.

31. If net sales are $600,000 and cost of goods sold is $480,000, the gross profit rate is 20%.

32. The multiple-step income statement is considered more useful than the single-step income statement because it highlights the components of net income.

33. The Sales Returns and Allowances account and the Sales Discount account are both classified as expense accounts.

34. Under the perpetual inventory system, purchases of merchandise for sale are recorded in the Merchandise Inventory account.

Page 2 35. The terms 2/10, net/30 mean that a 2 percent discount is allowed on payments made within the 10 days discount period.

36. If the unit price of inventory is increasing during a period, a company using the LIFO inventory method will show less gross profit for the period, than if it had used the FIFO inventory method.

37. A company may use more than one inventory cost flow method at the same time.

38. Under the periodic inventory system, both the sales amount and the cost of goods sold amount are recorded when each item of merchandise is sold.

39. Goods in transit shipped FOB shipping point should be included in the buyer's ending inventory.

40. Raw materials inventories are the goods that a manufacturing company has completed and are ready to be sold to customers.

41. Segregation of duties among employees eliminates the possibility of collusion.

42. To obtain maximum benefit from a bank reconciliation, the reconciliation should be prepared by the employee authorized to sign checks.

43. Only large companies need to be concerned with a system of internal control.

44. A basic principle of cash management is to increase the speed of paying liabilities.

45. The most important element of the fraud triangle is rationalization.

46. Accounts receivable are one of a company's least liquid assets.

47. The Allowance for Doubtful Accounts is a liability account.

48. Under the accounts receivable aging method, the balance in Allowance for Doubtful Accounts must be considered carefully prior to adjusting for estimated uncollectible accounts.

49. Under the direct write-off method, no attempt is made to match bad debt expense to sales revenues in the same accounting period.

50. In computing the maturity date of a note, the date the note is issued is included but the due date is omitted.

51. Once cost is established for a plant asset, it becomes the basis of accounting for the asset unless the asset appreciates in value, in which case, market value becomes the basis for accountability.

52. A characteristic of capital expenditures is that the expenditures occur frequently during the period of ownership.

53. Under the double-declining-balance method, the depreciation rate used each year remains constant.

54. The IRS does not require the taxpayer to use the same depreciation method on the tax return that is used in preparing financial statements.

55. The book value of a plant asset is always equal to its fair market value.

56. The carrying value of a bond is equal to the market price on the date of sale.

57. If bonds are issued at a premium, the carrying value of the bonds will be greater than the face value of the bonds for all periods prior to the bond maturity date.

58. Total interest cost for a bond issued at a premium equals the total of the periodic interest payments added to the premium.

59. If a corporation issued bonds at an amount less than face value, it indicates that the corporation has a weak credit rating.

60. An unsecured bond is one that is issued against the general credit of the borrower.

61. Treasury stock is reported as an asset on the balance sheet because treasury stock may later be resold.

Page 3 62. Return on common stockholders' equity is computed by dividing net income by ending stockholders' equity.

63. A stock dividend is a pro rata distribution of cash to a corporation's stockholders.

64. A corporation must be incorporated in each state in which it does business.

65. The issuance of common stock affects both paid-in capital and retained earnings.

66. For external reporting, a company must prepare either an income statement or a statement of cash flows, but not both.

67. A loss on sale of equipment is added to net income in determining cash provided by operations under the indirect method.

68. Under the indirect method, gains and losses from the sale of equipment used in operations would be included in the cash flows from operating activities section on the statement of cash flows.

69. The payment of interest on bonds payable is classified as a cash outflow from operating activities.

70. Using the indirect method, an increase in accounts payable during a period is deducted from net income in calculating cash provided by operations.

71. Using the following balance sheet and income statement data, what is the earnings per share? Current assets $ 7,000 Net income $ 12,000 Current liabilities 4,000 Stockholders' equity 27,000 Average assets 40,000 Total liabilities 9,000 Total assets 30,000 Average common shares outstanding was 10,000 A) $3.60 B) $4.00 C) $1.20 D) $0.83

72. At December 31, 2010 Keen Company had retained earnings of $1,242,600. During 2010 they issued stock for $33,000, and paid dividends of $16,000. Net income for 2010 was $175,600. The retained earnings balance at the beginning of 2010 was: A) $1,402,200 B) $1,083,000 C) $1,116,000 D) $1369200

73. Use the following data to calculate the current ratio. Eddy Auto Supplies Balance Sheet December 31, 2010

Cash $ 50,000 Accounts Payable $ 55,000 Prepaid Insurance 30,000 Salaries Payable 10,000 Accounts Receivable 40,000 Mortgage Payable 90,000 Inventory 70,000 Total Liabilities $155,000 Land held for investment 80,000 Land 75,000 Building $110,000 Common Stock $120,000 Less Accumulated Retained Earnings 250,000 Depreciation (20,000) 90,000 Total stockholders' equity $370,000 Trademark 70,000 Total Liabilities and Total Assets $525,000 Stockholders' Equity $525,000 A) 1.85 : 1. B) 2.92 : 1. C) 4.15 : 1. D) 1.07 : 1.

Page 4 74. Based on the following data, what is the amount of current assets? Accounts payable……………………………………………………….. $31,000 Accounts receivable…………………………………………………….. 50,000 Cash………………………………………………………………………. 15,000 Intangible assets………………………………………………………… 50,000 Inventory…………………………………………………………………. 69,000 Long-term investments…………………………………………………. 80,000 Long-term liabilities……………………………………………………………. 100,000 Marketable securities……………………………………………………. 40,000 Notes payable……………………………………………………………. 28,000 Plant assets……………………………………………………………… 670,000 Prepaid expenses……………………………………………………….. 1,000 A) $ 96,000 B) $175,000 C) $106,000 D) $105,000

75. Use the following data to determine the total dollar amount of assets to be classified as current assets. Carne Auto Supplies Balance Sheet December 31, 2010

Cash $ 82,000 Accounts Payable $ 71,000 Prepaid Insurance 40,000 Salaries Payable 10,000 Accounts Receivable 50,000 Mortgage Payable 90,000 Inventory 70,000 Total Liabilities $171,000 Land held for investment 65,000 Land 94,000 Building $100,000 Common Stock $120,000 Less Accumulated Retained Earnings 250,000 Depreciation (30,000) 70,000 Total stockholders' equity $370,000 Trademark 70,000 Total Liabilities and Total Assets $541,000 Stockholders' Equity $541,000 A) $242,000. B) $122,000. C) $307,000. D) $172,000.

76. An intangible asset A) derives its value from the rights and privileges it provides the owner. B) is worthless because it has no physical substance. C) is converted into a tangible asset during the operating cycle. D) cannot be classified on the balance sheet because it lacks physical substance.

77. Which of the following is not a qualitative characteristic associated with reliability? A) Verifiable B) Conservatism C) Neutral D) Faithful representation

78. Which of the following is not a current liability? A) Wages payable B) Accounts payable C) Taxes payable D) Bonds payable

79. A liquidity ratio measures the A) income or operating success of a company over a period of time. B) ability of a company to survive over a long period of time. C) short-term ability of a company to pay its maturing obligations and to meet unexpected needs for cash. D) percentage of total financing provided by creditors.

80. Which of the following organizations issues accounting standards for countries outside the United States? A) SEC B) GAAP Page 5 C) IASB D) FASB

81. Receiving payment of a portion of Accounts Receivable will A) not affect total assets. B) increase liabilities. C) increase stockholders' equity. D) decrease net income.

82. An accountant has debited an asset account for $1,500 and credited a liability account for $750. What can be done to complete the recording of the transaction? A) Nothing further must be done. B) Debit a stockholders' equity account for $750. C) Debit another asset account for $750. D) Credit a different asset account for $750.

83. Which one of the following is not a part of an account? A) Credit side B) Trial balance C) Debit side D) Title

84. If services are rendered for cash, then A) assets will increase. B) liabilities will increase. C) stockholders' equity will decrease. D) liabilities will decrease.

85. An investment by the stockholders in a business increases A) assets and stockholders' equity. B) assets and liabilities. C) liabilities and stockholders' equity. D) assets only.

86. The usual ordering of accounts in the general ledger is A) assets, liabilities, stockholders' equity, revenues, and expenses. B) assets, liabilities, stockholders' equity, expenses, and revenues. C) liabilities, assets, stockholders' equity, revenues, and expenses. D) stockholders' equity, assets, liabilities, expenses, and revenues.

87. An account consists of A) a title, a debit balance, and a credit balance. B) a title, a left side, and a debit balance. C) a title, a debit side, and a credit side. D) a title, a right side, and a debit balance.

88. An awareness of the normal balances of accounts would help you spot which of the following as an error in recording? A) A debit balance in the Dividends account B) A credit balance in an expense account C) A credit balance in a liabilities account D) A credit balance in a revenue account

89. An account will have a credit balance if the A) credits exceed the debits. B) first transaction entered was a credit. C) debits exceed the credits. D) last transaction entered was a credit.

90. Debits A) increase both assets and liabilities. B) decrease both assets and liabilities. C) increase assets and decrease liabilities. D) decrease assets and increase liabilities.

Page 6 91. Which of the following would be unethical? A) Recording advertising costs as an expense when the advertising takes place. B) Recognizing revenue at the time a gift card is sold. C) Deferring rent expense paid in advance. D) Deferring revenue recognition on monies received in advance of providing the service.

92. Which of the following accounts will reflect the account's beginning balance on the adjusted trial balance? A) Cash B) Retained earnings C) Prepaid insurance D) Unearned revenue

93. The primary difference between accrued revenues and unearned revenues is that accrued revenues have: A) not been earned and accrued revenues have been. B) been paid and unearned revenues have not. C) been recorded and unearned revenues have not. D) not been recorded and unearned revenues have.

94. If a company fails to make an adjusting entry to record supplies expense, then: A) stockholders' equity will be understated. B) expense will be understated. C) assets will be understated. D) net income will be understated.

95. A law firm received $2,000 cash for legal services to be rendered in the future. The full amount was credited to the liability account Unearned Service Revenue. If the legal services have been rendered at the end of the accounting period and no adjusting entry is made, this would cause: A) expenses to be overstated. B) net income to be overstated. C) liabilities to be understated. D) revenues to be understated.

96. Draxon Company borrowed $41,000 from the bank signing a 9%, 3-month note on September 1. Principal and interest are payable to the bank on December 1. If the company prepares monthly financial statements, the adjusting entry that the company should make for interest on September 30, would be: A) debit Interest Expense, $3,690; credit Interest Payable, $3,690. B) debit Interest Expense, $308; credit Interest Payable, $308. C) debit Note Payable, $3,690; credit Cash, $3,690. D) debit Cash, $923; credit Interest Payable, $923.

97. Nova Real Estate signed a four-month note payable in the amount of $6,000 on September 1. The note requires interest at an annual rate of 6%. The amount of interest to be accrued at the end of September is: A) $360. B) $90. C) $30. D) $60.

98. A post-closing trial balance will show: A) zero balances for all accounts. B) zero balances for balance sheet accounts. C) only balance sheet accounts. D) only income statement accounts.

99. The primary difference between prepaid and accrued expenses is that prepaid expenses have: A) been incurred and accrued expenses have not. B) not been paid and accrued expenses have. C) been recorded and accrued expenses have not. D) not been recorded and accrued expenses have.

Page 7 100. The trial balance for Greeley Corporation appears as follows:

Greeley Corporation Trial Balance December 31, 2010

Cash $ 300 Accounts Receivable 500 Prepaid Insurance 60 Supplies 140 Office Equipment 4,000 Accumulated Depreciation, Office $ 800 Equipment Accounts Payable 300 Common Stock 1,000 Retained Earnings 1,400 Service Revenue 3,000 Salaries Expense 1,000 Rent Expense 500 0 $6,500 $6,500 If service for $125 had been performed but not billed, the adjusting entry to record this would include a: A) debit to Service Revenue for $125. B) credit to Unearned Service Revenue for $125. C) credit for Service Revenue for $125. D) debit to Unearned Revenue for $125.

101. At the beginning of the year, Uptown Athletic had an inventory of $400,000. During the year, the company purchased goods costing $1,600,000. If Uptown Athletic reported ending inventory of $600,000 and sales of $2,000,000, their cost of goods sold and gross profit rate would be A) $1,000,000 and 50% B) $1,400,000 and 30% C) $1,000,000 and 30% D) $1,400,000 and 70%

102. Financial information is presented below: Operating Expenses $ 45,000 Sales Returns and Allowances 13,000 Sales Discount 6,000 Sales 160,000 Cost of Goods Sold 77,000 The gross profit rate would be A) .454. B) .546. C) .500. D) .538.

103. Income from operations is gross profit less 1. operating expenses and other expenses and losses. 2. operating expenses plus other revenues and gains. 3. operating expenses. . A) 1 B) 2 C) 3 D) both 1 and 2

104. A credit sale of $60,300 is made on July 15, terms 2/10, net/30, on which a return of $2,175 is granted on July 18. What amount is received as payment in full on July 24? A) $60,300 B) $56,963 C) $58,125 D) $59,094

Page 8 105. The credit terms offered to a customer by a business firm were 2/10, n/30, which means A) the customer must pay the bill within 10 days. B) the customer can deduct a 2% discount if the bill is paid between the 10th and 30th day from the invoice date. C) the customer can deduct a 2% discount if the bill is paid within 10 days of the invoice date. D) two sales returns can be made within 10 days of the invoice date and no returns thereafter.

106. Indicate which one of the following would appear on the income statement of both a merchandising company and a service company. A) Gross profit B) Operating expenses C) Sales revenues D) Cost of goods sold

107. The operating cycle of a merchandising company is A) always one year in length. B) ordinarily longer than that of a service company. C) about the same as that of a service company. D) ordinarily shorter than that of a service company.

108. When a seller records a return of goods, the account that is credited is A) Sales. B) Sales Returns and Allowances. C) Merchandise Inventory. D) Accounts Receivable.

109. As an incentive for customers to pay their accounts promptly, a business may offer its customers A) a sales discount. B) free delivery. C) a sales allowance. D) a sales return.

110. Which of the following items does not result in an adjustment in the merchandise inventory account under a perpetual system? A) A purchase of merchandise. B) A return of merchandise inventory to the supplier C) Payment of freight costs for goods shipped to a customer D) Payment of freight costs for goods received from a supplier

111. Use the following information regarding Black Company and Red Company to answer the question “Which amount is equal to Red Company's "days in inventory" for 2009 (to the closest decimal place)?”

Year Inventory Turnover Ratio Ending Inventory Black Company 2008 $26,340 2009 10.7 $29,890 2010 10.2 $30,100

Red Company 2008 $25,860 2009 8.8 $24,750 2010 9.5 $22,530 A) 67.8 days B) 38.4 days C) 28.1 days D) 41.5 days

112. The specific identification method of inventory costing A) always maximizes a company's net income. B) always minimizes a company's net income. C) has no effect on a company's net income. D) may enable management to manipulate net income.

113. Which inventory method generally results in costs allocated to ending inventory that will approximate their current cost? A) LIFO B) FIFO C) Average Cost Method D) Whichever method that produces the highest ending inventory figure Page 9 114. Classic Floors has the following inventory data: July 1 Beginning inventory 15 units at $4.00 5 Purchases 60 units at $4.40 14 Sale 40 units 21 Purchases 30 units at $4.80 30 Sale 28 units

Assuming that a perpetual inventory system is used, what is the value of ending inventory on a LIFO basis for July? A) $310.40 B) $468.00 C) $236.00 D) $157.60

115. All of the following statements are true regarding the LIFO reserve except: A) Companies using LIFO are required to report the LIFO reserve. B) The equation (LIFO inventory – LIFO reserve = FIFO inventory) adjusts the inventory balance from LIFO to FIFO. C) The financial statement differences of using LIFO normally increase the longer a company uses LIFO. D) Current ratios and the inventory turnover ratio can be significantly affected if a company has material LIFO reserves.

116. The term "FOB" denotes A) free on board. B) freight on board. C) free only (to) buyer. D) freight charge on buyer.

117. Pop-up Party Favors Inc has the following inventory data: July 1 Beginning inventory 20 units at $22 $ 440 7 Purchases 70 units at $23 1,610 22 Purchases 10 units at $25 250 $2,300 A physical count of merchandise inventory on July 30 reveals that there are 30 units on hand. Using the FIFO method, the value of ending inventory is A) $670. B) $710. C) $700. D) $690.

118. The managers of Hong Company receive performance bonuses based on the net income of the firm. Which inventory costing method are they likely to favor in periods of declining prices? A) LIFO B) Average Cost C) FIFO D) Physical inventory method

119. Apple-A-Day Company has the following inventory data: July 1 Beginning inventory 20 units at $15 $ 300 7 Purchases 70 units at $16 1,120 22 Purchases 10 units at $18 180 $1,600 A physical count of merchandise inventory on July 30 reveals that there are 35 units on hand. Using the LIFO cost method, the amount allocated to cost of goods sold is A) $1,060. B) $1,040. C) $1,020. D) $540.

120. Selection of an inventory costing method by management does not usually depend on A) the fiscal year end. B) income statement effects. C) balance sheet effects. D) tax effects.

Page 10 121. Which of the following bank reconciliation items would not result in an adjusting entry? A) Service charge. B) Outstanding checks. C) NSF check of customer. D) Collection of a note by the bank.

122. Which of the following is not a limitation of internal control? A) Cost of establishing control procedures should not exceed their benefit. B) The human element. C) Collusion. D) The size of the company.

123. A petty cash fund of $100 is replenished when the fund contains $5 in cash and receipts for $92. The entry to replenish the fund would A) credit Cash Over and Short for $3. B) credit Miscellaneous Revenue for $3. C) debit Cash Over and Short for $3. D) debit Miscellaneous Expense for $3.

124. A debit memorandum would not be issued by the bank for A) a bank service charge. B) the issuance of traveler's checks. C) the wiring of funds. D) the collection of a notes receivable.

125. Supervisors counting cash receipts daily is an example of A) human resource controls. B) independent internal verification. C) establishment of responsibility. D) segregation of duties.

126. Each of the following is a feature of internal control except A) an extensive marketing plan. B) bonding of employees. C) separation of duties. D) recording of all transactions.

127. Before a check authorization is issued, the following documents must be in agreement, except for the A) invoice. B) remittance advice. C) receiving report. D) purchase order.

128. A debit balance in Cash Over and Short is reported as a A) contra asset. B) miscellaneous asset. C) miscellaneous expense. D) miscellaneous revenue.

129. Which one of the following items would never appear on a cash budget? A) Office salaries expense. B) Interest expense. C) Depreciation expense. D) Travel expense.

130. Which of the following statements is true? A) Due to its liquid nature, cash is the easiest asset to steal. B) A good system of internal control will ensure that employees will not be able to steal cash. C) It takes two or more employees working together to be able to steal cash. D) All statements are true.

131. An aging of a company's accounts receivable indicates that $57,000 are estimated to be uncollectible. If Allowance for Doubtful Accounts has a $22,800 debit balance, the adjustment to record bad debts for the period will require a A) debit to Bad Debts Expense for $57,000. B) debit to Allowance for Doubtful Accounts for $79,800. C) debit to Bad Debts Expense for $79,800.

Page 11 D) credit to Allowance for Doubtful Accounts for $57,000.

132. If a company fails to record estimated bad debts expense, A) cash realizable value is understated. B) expenses are understated. C) revenues are understated. D) receivables are understated.

133. The maturity value of a $2,000, 6%, 60-day note receivable dated February 10th is A) $2,020. B) $2,010. C) $2,000. D) $2,120.

134. When the allowance method of accounting for uncollectible accounts is used, Bad Debt Expense is recorded A) in the year after the credit sale is made. B) in the same year as the credit sale. C) as each credit sale is made. D) when an account is written off as uncollectible.

135. Which of the following would probably be the most significant type of a claim held by a company? A) notes receivable B) non-trade receivables C) accounts receivable D) interest receivable

136. The financial statements of the Belfry Manufacturing Company reports net sales of $400,000 and accounts receivable of $80,000 and $40,000 at the beginning of the year and end of year, respectively. What is the average collection period for accounts receivable in days? A) 40 times B) 80 times C) 54.7 times D) 50 times

137. When using the balance sheet approach, the balance in Allowance for Doubtful Accounts must be considered prior to the end of period adjustment when using which of the following methods? A) Net realizable method B) Direct write-off method C) Accrual method D) Allowance method

138. The financial statements of the Phelps Manufacturing Company reports net sales of $400,000 and accounts receivable of $80,000 and $40,000 at the beginning of the year and end of year, respectively. What is the receivables turnover ratio for Phelps? A) 6.7 times B) 10 times C) 5 times D) 8 times

139. The interest rate for a three-month loan would normally be stated in terms of which of the following rates of interest? A) Daily B) Monthly C) Quarterly D) Annual

140. Bad Debts Expense is reported on the income statement as A) part of cost of goods sold. B) an expense subtracted from net sales to determine gross profit. C) an operating expense. D) a contra revenue account.

Page 12 141. The following information is provided for Nguyen Company and Northwest Corporation. (in $ millions) Nguyen Company Northwest Corporation Net income 2010 $275 $325 Net sales 2010 1,500 3,700 Total assets 12/31/08 1,000 2,400 Total assets 12/31/09 1,050 3,000 Total assets 12/31/10 1,150 4,000 What is Northwest's return on assets for 2010? A) 10.6% B) 9.5% C) 10.8% D) 9.3%

142. Which of the following is not considered an intangible asset? A) Goodwill. B) An oil well. C) A franchise. D) A patent.

143. During 2010, Ronald Corporation reported net sales of $2,000,000, net income of $1,200,000, and depreciation expense of $100,000. Ronald also reported beginning total assets of $1,000,000, ending total assets of $1,500,000, plant assets of $800,000, and accumulated depreciation of $500,000. Ronald's asset turnover ratio is A) 2 times. B) 1.6 times. C) 1.3 times. D) 0.96 times.

144. A machine with a cost of $160,000 has an estimated salvage value of $10,000 and an estimated useful life of 5 years or 15,000 hours. It is to be depreciated using the units-of-activity method of depreciation. What is the amount of depreciation for the second full year, during which the machine was used 5,000 hours? A) $50,000. B) $30,000. C) $43,333. D) $53,333.

145. When estimating the useful life of an asset, accountants do not consider A) the cost to replace the asset at the end of its useful life. B) vulnerability to obsolescence. C) expected repairs and maintenance. D) the intended use of the asset.

146. The Land account would include all of the following costs except A) drainage costs. B) the cost of building a fence. C) commissions paid to real estate agents. D) the cost of tearing down a building.

147. Arnold Company purchases a new delivery truck for $35,000. The sales taxes are $2,000. The logo of the company is painted on the side of the truck for $1,200. The truck's annual license is $120. The truck undergoes safety testing for $220. What does Arnold record as the cost of the new truck? A) $38,540. B) $38,420. C) $37,000. D) $36,420.

148. A company purchased factory equipment for $165,000. It is estimated that the equipment will have a $16,500 salvage value at the end of its estimated 5-year useful life. If the company uses the double-declining-balance method of depreciation, the amount of annual depreciation recorded for the second year after purchase would be A) $66,000. B) $39,600. C) $59,400. D) $35,640.

149. On January 1, a machine with a useful life of four years and a residual value of $3,000 was purchased for $19,000. What is the depreciation expense for year 2 under straight-line depreciation? A) $2,000.

Page 13 B) $4,000. C) $8,000. D) $4,750.

150. When an asset is sold, a gain occurs when the A) sale price exceeds the book value of the asset sold. B) sale price exceeds the original cost of the asset sold. C) book value exceeds the sale price of the asset sold. D) sale price exceeds the depreciable cost of the asset sold.

151. The following partial amortization schedule is available for Courtney Company who sold $200,000, five-year, 10% bonds on January 1, 2010 for $208,000 and uses annual straight-line amortization. BOND AMORTIZATION SCHEDULE Interest Periods Interest Interest expense Premium Unamortized Bond Carrying Value to be paid Amortization Premium January 1, 2010 $8,000 $208,000 January 1, 2011 (i) (ii) (iii) (iv) (v)

Which of the following amounts should be shown in cell (iii)? A) $4,000 B) $8,000 C) $1,600 D) $800

152. The amortization of a bond premium will result in reporting an amount of interest expense for an interest period that A) is less than the amount of cash to be paid for interest for the period. B) exceeds the amount of cash to be paid for interest for the period. C) equals the amount of cash to be paid for interest for the period. D) has no predictable relationship with the amount of cash to be paid for interest for the period.

153. When the straight-line method of amortization is used for a bond discount, the amount of interest expense for an interest period is calculated by A) adding the amount of discount amortized for that period to the amount of cash paid for interest during the period. B) subtracting the amount of discount amortized for that period from the amount of cash paid for interest during the period. C) multiplying the face value of the bonds by the stated interest rate. D) multiplying the face value of the bonds by the market interest rate.

154. Winrow Company received proceeds of $94,250 on 10-year, 8% bonds issued on January 1, 2009. The bonds had a face value of $100,000, pay interest annually on December 31st, and have a call price of 101. Winrow uses the straight-line method of amortization. Winrow Company decided to redeem the bonds on January 1, 2011. What amount of gain or loss would Winrow report on its 2010 income statement? A) $4,600 gain B) $5,600 gain C) $5,600 loss D) $4,600 loss

155. The following totals for the month of April were taken from the payroll register of Noll Company. Salaries $24,000 FICA taxes withheld 1,100 Income taxes withheld 5,000 Medical insurance deductions 900 Federal unemployment taxes 64 State unemployment taxes 432 The journal entry to record the monthly payroll on April 30 would include a A) debit to Salaries Expense for $24,000. B) credit to Salaries Payable for $24,000. C) debit to Salaries Payable for $24,000. D) debit to Salaries Expense for $17,000.

156. A bond with a face value of $100,000 and a quoted price of 104¼ has a selling price of A) $104,250 B) $104,025. C) $100,425. D) $104,000. Page 14 157. Wolford Company borrowed $750,000 from U.S. Bank on January 1, 2009 in order to expand its mining capabilities. The five-year note required annual payments of $195,327 and carried an annual interest rate of 9.5%. What is the balance in the notes payable account at December 31, 2010? A) $750,000 B) $490,059 C) $625,923 D) $607,500

158. Yanik Corporation issues 1,000, 10-year, 8%, $1,000 bonds dated January 1, 2010, at 97. The journal entry to record the issuance will show a A) debit to Cash of $1,000,000. B) debit to Discount on Bonds Payable for $30,000. C) credit to Bonds Payable for $970,000. D) credit to Cash for $970,000.

159. A $500,000 bond was retired at 98 when the carrying value of the bond was $515,000. The entry to record the retirement would include a A) gain on bond redemption of $15,000. B) loss on bond redemption of $15,000. C) loss on bond redemption of $25,000. D) gain on bond redemption of $25,000.

160. The following partial amortization schedule is available for Courtney Company who sold $200,000, five-year, 10% bonds on January 1, 2010 for $208,000 and uses annual straight-line amortization. BOND AMORTIZATION SCHEDULE Interest Periods Interest Interest expense Premium Unamortized Bond Carrying Value to be paid Amortization Premium January 1, 2010 $8,000 $208,000 January 1, 2011 (i) (ii) (iii) (iv) (v)

Which of the following amounts should be shown in cell (i)? A) $20,800 B) $21,600 C) $20,000 D) $ 4,000

161. The cash debt coverage ratio is computed by dividing net cash provided by operating activities by A) average current liabilities. B) net sales. C) average long-term liabilities. D) average total liabilities.

162. Harden Corporation engaged in the following transaction. Assume that the Harden Corporation uses the indirect method to depict cash flows. Indicate where, if at all, purchased land and building with a mortgage would be classified on the statement of cash flows. A) Operating activities section. B) Investing activities section. C) Financing activities section. D) Does not represent a cash flow.

163. In preparing a statement of cash flows, a conversion of bonds into common stock will be reported in A) the financing section. B) the "extraordinary" section. C) a separate schedule or note to the financial statements. D) the stockholders' equity section.

164. Which of the following is not typically a characteristic experienced by a company during the growth phase of the corporate life cycle? A) Cash from operations on the statements of cash flows will be less than net income on the income statement. B) Collections on accounts receivable will lag behind sales. C) Cash from investing is positive. D) Cash from financing is positive.

Page 15 165. Norris Company issued 10,500 shares of $1 par common stock for $30 per share during 2010. The company paid dividends of $18,000 and issued long-term notes payable of $230,000 during the year. What amount of cash flows from financing activities will be reported on the statement of cash flows? A) $18,000 net cash inflow. B) $222,500 net cash inflow. C) $545,000 net cash outflow. D) $527,000 net cash inflow.

166. Which of the following is not typically a characteristic experienced by a company during the introductory phase of the corporate life cycle? A) Cash used in operations will exceed cash generated by operations. B) Considerable cash will be used to purchase productive assets. C) Cash from investing is positive. D) Cash from financing is positive.

167. Geary Company had credit sales of $1,080,000. The beginning accounts receivable balance was $48,000 and the ending accounts receivable balance was $118,000. Using the direct method of reporting cash flows from operating activities, what were the cash collections from customers during the period? A) $1,150,000. B) $1,080,000. C) $1,010,000. D) $1,128,000.

168. The acquisition of land by issuing common stock is A) a noncash transaction that is not reported in the body of a statement of cash flows. B) a cash transaction and would be reported in the body of a statement of cash flows. C) a noncash transaction and would be reported in the body of a statement of cash flows. D) only reported if the statement of cash flows is prepared using the direct method.

169. Cash from operations and net income are approximately the same during the A) introductory phase. B) growth phase. C) maturity phase. D) decline phase.

170. Using the indirect method, patent amortization expense for the period A) is deducted from net income. B) causes cash to increase. C) causes cash to decrease. D) is added to net income.

171. Those most responsible for the major policy decisions of a corporation are the A) stockholders. B) board of directors. C) management. D) employees.

172. A disadvantage of the corporate form of organization is A) professional management. B) tax treatment. C) ease of transfer of ownership. D) lack of mutual agency.

173. XYZ Company has $20,000 of dividends in arrears. Based on this information, which of the following statements is false? A) Dividends in arrears are not considered to be liabilities. B) An obligation for dividends in arrears exists only after the board of directors declares payment. C) The investment community looks favorably on companies with dividends in arrears, since the money is redirected toward more important growth opportunities. D) The amount of dividends in arrears should be disclosed in the notes to the financial statements.

174. The date on which a cash dividend becomes a binding legal obligation is on the A) declaration date. B) date of record. C) payment date. D) last day of the fiscal year end.

Page 16 175. Indicate the respective effects of the declaration of a cash dividend on the following balance sheet sections: Total Stockholders' T Total Liabilities o Equity A) Increase Decrease No change

B) No change Increase Decrease C) Decrease Increase Decrease D) Decrease No change Increase

176. Alt Corp. issues 11,000 shares of $1 par value common stock at $6 per share. When the transaction is recorded, credits are made to: A) Common Stock $11,000 and Paid-in Capital in Excess of Stated Value $55,000. B) Common Stock $66,000. C) Common Stock $11,000 and Paid-in Capital in Excess of Par Value $55,000. D) Common Stock $11,000 and Retained Earnings $55,000.

177. Retro Company is authorized to issue 10,000 shares of 8%, $100 par value preferred stock and 500,000 shares of no- par common stock with a stated value of $1 per share. If Retro issues 5,000 shares of common stock to pay its recent attorney's bill of $20,000 for legal services on a land access dispute, which of the following would be the best journal entry for Retro to record? A) Legal Expense 5,000 Common Stock – Stated value 5,000 B) Legal Expense 20,000 Common Stock – Stated value 20,000 C) Legal Expense 20,000 Common Stock – Stated value 5,000 Paid-in Capital in Excess of Stated Value - Common 15,000 D) Legal Expense 20,000 Common Stock 5,000 Paid-in Capital in Excess of Par - Preferred 15,000

178. The following selected amounts are available for Thomas Company. Retained earnings (beginning) $19,000 Net loss 200 Cash dividends declared 100 Stock dividends declared 500 What is its ending Retained Earnings balance? A) $19,000. B) $18,800. C) $18,200. D) $18,700.

179. The effect of a stock dividend is to A) decrease total assets and stockholders' equity. B) change the composition of stockholders' equity. C) decrease total assets and total liabilities. D) increase the book value per share of common stock.

180. Paid-in capital in excess of stated value would appear on a balance sheet under the category A) capital stock. B) retained earnings. C) additional paid-in capital. D) contra to stockholders' equity.

Page 17