ChangeWave Research: Consumer Tablets and eReaders March 4, 2011

Consumer Tablets and eReaders – 90 Day Outlook iPad Momentum Continues Even As Competition Intensifies

Andy Golub and Paul Carton

Overview: Since its release, the Apple iPad has remained the de facto standard by which competing tablets are measured. With the bar set high and the release of the new iPad 2 right around the corner, can new tablets from Motorola, Research in Motion and a host of others successfully launch and compete?

To find out, ChangeWave surveyed 3,091 consumers on tablet demand and buying trends – including customer satisfaction, tablet cannibalization of other electronic devices, and consumer preference for wireless tablet services.

The Jan. 31 – Feb. 9 survey, completed prior to this week's iPad 2 announcement, also looked at the Kindle vs. iPad vs. the Nook in the eReader market.

Tablet Wars – The iPad vs. the Competition

ChangeWave’s February consumer spending report showed electronics purchases trending down in the aftermath of a huge holiday season (see February Consumer Spending Report).

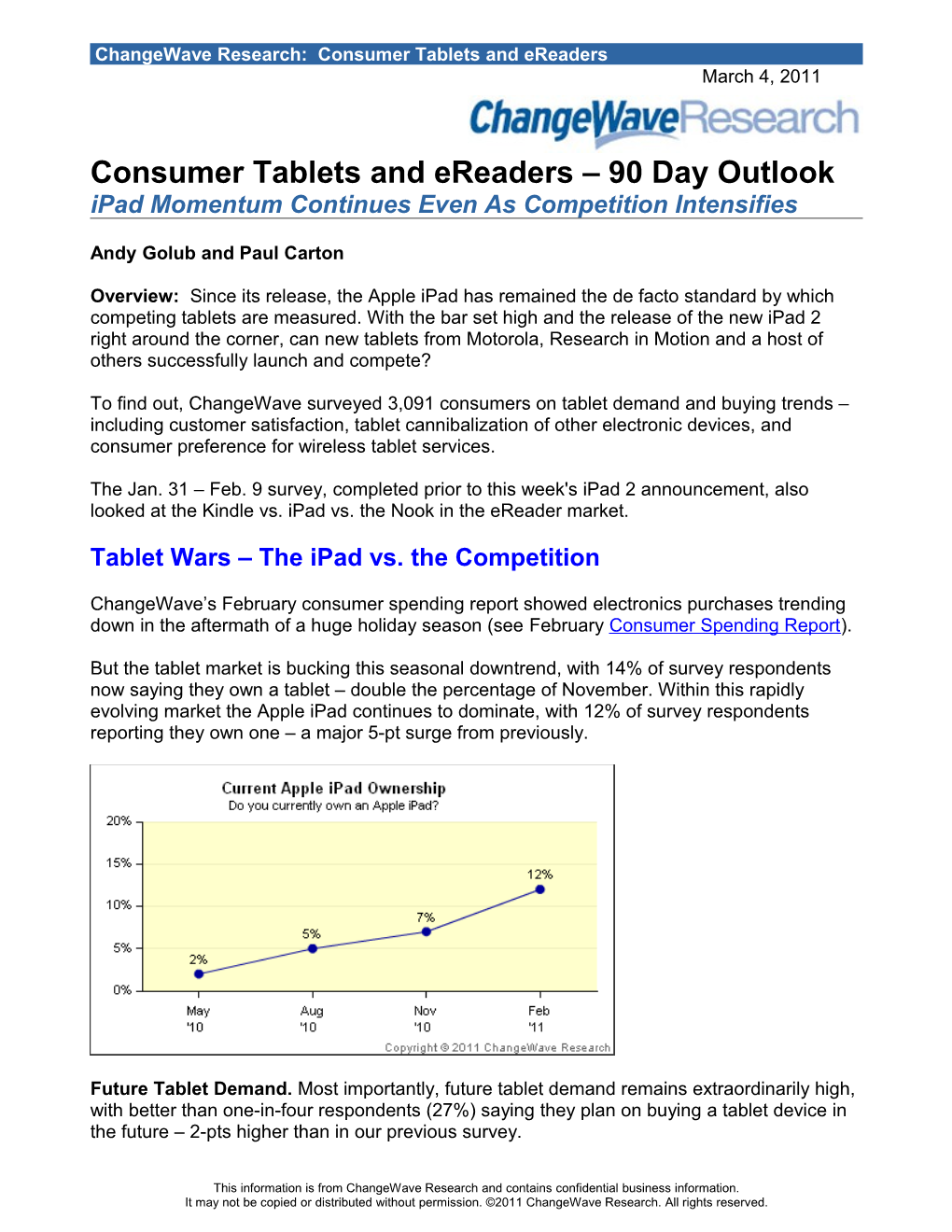

But the tablet market is bucking this seasonal downtrend, with 14% of survey respondents now saying they own a tablet – double the percentage of November. Within this rapidly evolving market the Apple iPad continues to dominate, with 12% of survey respondents reporting they own one – a major 5-pt surge from previously.

Future Tablet Demand. Most importantly, future tablet demand remains extraordinarily high, with better than one-in-four respondents (27%) saying they plan on buying a tablet device in the future – 2-pts higher than in our previous survey.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. ChangeWave Research: Consumer Tablets and eReaders

Looking ahead, are you planning on buying a tablet device in the future?

Focusing on just the next 90 days, 5% of respondents say they’ll be purchasing a tablet within this time frame.

Once again Apple remains the overwhelming winner among planned buyers, with 82% of future tablet buyers saying they’ll be purchasing an iPad.

Neither the Motorola Xoom (4%) – which hadn’t yet been released at the time of the survey – nor the soon-to-be-released RIM/BlackBerry PlayBook (3%) have had a significant impact so far on iPad demand. Similarly, the Samsung Galaxy Tab (3%) has done little to date to slow the iPad’s momentum.

It remains to be seen which of these tablet devices or other new entries in the market will be able to successfully compete.

The survey results provide a glimpse at what they’re up against. First and foremost, the iPad’s satisfaction rating remains outstanding among owners – with 70% saying they’re Very Satisfied and 25% Somewhat Satisfied with the Apple tablet device.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 2 ChangeWave Research: Consumer Tablets and eReaders

*Note: 2% of iPad owners selected Don’t Know/NA

Cannibalization. To better understand the threat tablets pose to other electronic devices, we asked Tablet owners whether there were any other products that they had originally planned on buying but had put on hold or canceled in order to purchase a tablet. Looking at the following list of products, are there any that you had previously planned on buying but have put on hold or canceled because you purchased a new tablet device? (Check All That Apply) Current Previous Survey Survey Feb ‘11 Nov ‘10 Kindle eReader (Amazon) 17% 12% Sony Reader (Sony) 3% 3% Nook eReader (Barns & Noble) 3% 1% Other eReading Device 3% 1% Laptop (non-Netbook) Computer 11% 9% Netbook Computer 10% 8% Desktop Computer 3% 2% As can be seen, the two product lines most vulnerable to the tablet onslaught are eReaders and Laptops.

A total of 17% of tablet owners say they’ve put off buying an Amazon Kindle because they purchased a tablet. Another 9% have put off buying some other eReading device. The second most affected category is Laptops (11%), followed by Netbooks (10%). For more on the overall impact of tablets on the computer market see ChangeWave’s February PC Buying Report.

Wireless Services and the iPad Now that Verizon and AT&T are both offering wireless services for the iPad, where do future buyers plan to purchase the Apple tablet and which service will they be using?

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 3 ChangeWave Research: Consumer Tablets and eReaders In a major finding, 17% of planned buyers say they’ll purchase their iPad and get their wireless service directly from Verizon – 2-pts higher than in our November survey. That’s a significant achievement, considering Verizon has only been selling the iPad for 4 months.

Which best describes where you’ll buy your iPad and what wireless service you plan on using?

In comparison, while 24% of iPad purchasers say they’ll use AT&T as their wireless service provider, that includes 16% who will buy their iPad directly from Apple, 4% from Best Buy/ Wal-Mart/Target, and only 4% who will be buying it directly from AT&T.

All told, these findings represent a 3-pt decline for AT&T since our November survey.

The iPad vs. the Kindle vs. the Nook eReader

Tablets and eReaders are categorized as different devices, but tablets also perform as eReaders and previous ChangeWave surveys have shown the iPad is having an extraordinary impact on the eReader market.

Our latest survey shows important gains have been made in the past 90 days by the Amazon Kindle and the Barnes and Noble Nook, but the iPad remains a giant and unprecedented threat in the eReader market.

Here are our latest findings on this ongoing battle:

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 4 ChangeWave Research: Consumer Tablets and eReaders In terms of current market share, the Kindle (50%) remains number one among eReader owners followed by the iPad (30%) and the Nook (9%).

Which of the following eBook Readers do you currently own?

*Includes only iPad owners who consider their device to be an eReader.

A closer look at the market trends for each manufacturer shows the Kindle up 3-pts and the iPad down 2-pts since our November survey, while the Nook has jumped a full 5-pts.

Of course, Amazon slashed the Kindle’s price in the run-up to last Fall and that clearly ended up having a dramatic impact on the Holiday shopping season. After having lost share to the iPad for much of 2010 – dropping from 68% last February to 47% in November – Amazon has actually picked up 3-pts in the past 3 months.

Bottom line, the Kindle’s new low $139 price tag had a lot to do with its recent success. With no monthly fees and at gift item prices, the survey shows the Amazon Kindle proved to be an extremely popular purchase over the holidays – as was the Barnes and Noble Nook.

Importantly, the average iPad sells for more than four times the cost of the Amazon eReader and charges a considerable monthly wireless service fee to its 3G owners. Nonetheless the iPad continues to provide ferocious competition against the Kindle in the eReader market

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 5 ChangeWave Research: Consumer Tablets and eReaders In terms of owner satisfaction, the ratings for the iPad (70% Very Satisfied) and Kindle (68% Very Satisfied) are nearly identical – representing a significant improvement for Amazon since our previous survey (they had a 54% Very Satisfied rating in November).

*Note: 2% of iPad owners, 3% of Kindle owners, and 5% of Nook owners selected Don’t Know/NA.

Much of the jump in Kindle owner satisfaction can also be attributed to the lower price tag – which has clearly helped realign consumer expectations and improve satisfaction ratings for the Amazon eReader.

Most Important Features. What is it about eReaders that users find most satisfying? To find out, we asked respondents which features are most important to them in an eReading device:

Battery Life (56%) remains the top feature according to more than half of all eReader owners, followed by Screen Clarity/No Glare (44%), the Cost (37%) and Screen Size (34%).

We note that the Amazon eReader is widely recognized as having superior battery life. And it’s no accident that recent Kindle commercials have aggressively zeroed in on screen clarity and glare in an attempt to contrast the Kindle vs. the iPad.

But long term Amazon can’t afford to sell the Kindle at giveaway prices unless it’s making its money elsewhere in the eReader market. Which brings us to the epicenter of the fight – the battle over content.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 6 ChangeWave Research: Consumer Tablets and eReaders What’s Being Read? We asked eReader owners about the types of content they read on their devices, and continue to find significant differences between iPad and Kindle owners.

Which of the following types of content do you currently read with your eBook Reader? (Check All That Apply)

Virtually all Amazon Kindle owners (94%) say they read eBooks on their device. But among iPad owners who consider their device to be an eReader, only 71% read eBooks.

At the same time, iPad owners are nearly four times more likely to read Newspapers, Magazines and Blogs/News Feeds than their Kindle counterparts.

Based on these findings it’s not surprising that News Corp. launched The Daily in February, an iPad-only newspaper featuring original content for $0.99 per week.

To gauge demand for this new offering, we asked iPad owners how interested they were in subscribing. In an encouraging finding for Apple and News Corp, one-in-four iPad owners said they were interested in signing up (9% Very Interested/17% Somewhat Interested).

As respondent MRK09357 puts it, "Love the concept. Wish to be rid of all printed publications." SKI9571 adds, "While cost is a factor, I think the paperless option is a big draw." Other owners are waiting to see the product first. MAR07554 writes, "Curious to see if it’s worth getting," and GST15549 wants to know “If the content layout is easy and concise, and if it’s any different than free news out there.”

(A sample of the responses can be found in Appendix A on pages 23-24).

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 7 ChangeWave Research: Consumer Tablets and eReaders Battle Between Online Bookstores We asked eReader owners where they purchase their eBooks, Newspapers, and Magazines, and not surprisingly it’s the Amazon Kindle Bookstore (65%) that holds the clear lead among online bookstores – far ahead of the Apple iBookstore (24%) and Barnes and Noble (14%). But in a direct comparison of Kindle owners vs. iPad owners, important differences emerge. Among Kindle owners, 95% report they use the Kindle Bookstore and only 5% the iBookstore. In comparison, while two-in-three iPad owners (67%) use the iBookstore, nearly half (45%) also say they use the Kindle Bookstore.

In short, the Amazon Kindle Bookstore is currently far stickier than the Apple iBookstore -- retaining the loyalty of the vast majority of Kindle owners and also being frequented by nearly half of iPad eBook readers. On the other hand, the Apple iBookstore has built up a very strong following among iPad owners in a far shorter period of time. A Look at eReader Demand – Next 90 Days. Among those respondents who plan on buying an eReader in the next 90 days, half (50%) say they’ll purchase an iPad and one-in- four (25%) a Kindle.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 8 ChangeWave Research: Consumer Tablets and eReaders Bottom Line: With the holiday gift season over and an iPad refresh imminent, it appears Apple is once again grabbing the momentum from Amazon going forward in the see-saw eReader market.

That’s great news for Apple. But it’s far from bad news for Amazon. For even as they continue to experience intense eReader competition from Apple and other manufacturers, Amazon’s industry leading Kindle Bookstore insures it will remain excellently positioned no matter which eReader consumers purchase.

Summary of Key Findings Tablet Wars: The iPad iPad: Overwhelming eReader Market: iPad vs. the Competition Winner Going Forward vs. Kindle vs. Nook Current Market 82% of planned tablet buyers Current eReader Market 14% of respondents say they say they’ll purchase an iPad Kindle (50%; up 3-pts) own a tablet overall – double 4% Motorola Xoom iPad (30%; down 2-pts) previous survey in November 3% RIM/BlackBerry PlayBook Nook (9%; up 5-pts) The iPad dominates – 12% 3% Samsung Galaxy Tab eReader Satisfaction Ratings report they own one, a big iPad (70% Very Satisfied) 5-pt surge from previously iPad Dominates Customer Satisfaction Ratings Kindle (68%) – a significant Demand for Tablets Remains improvement for Amazon Extraordinarily High 70% of iPad owners say they’re Very Satisfied Nook (61%) 27% say they plan on buying a tablet in future – 2-pts 25% Somewhat Satisfied Most Important Features Battery Life (56%) higher than previously Wireless Service 5% say they’ll purchase one Screen Clarity/ Glare (44%) in next 90 days Providers and the iPad Cost (37%) Verizon vs. AT&T Screen Size (34%) Cannibalization Issue 17% of planned iPad buyers Top Online Bookstores eReaders, Laptops and say they’ll get wireless 65% use Kindle Bookstore Netbooks Remain Most service from Verizon – 2-pts 24% use iBookstore (Apple) Vulnerable to Tablet Growth higher than our Nov. survey 14% use Barnes and Noble eReaders 24% of iPad purchasers say eReader Demand: Next 90 -- 17% of tablet owners say they’ll use AT&T – but that’s Days they’ve put off buying an down 3-pts from previously iPad (50%; up 8-pts) Amazon Kindle because they 28% report they’ll buy Wi-Fi Kindle (25%; down 8-pts) purchased a tablet only versions -- 9% have put off buying Nook (6%; up 2-pts) another eReading device Laptops (11%) Netbooks (10%) The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals – as well as early adopter consumers – who work in leading companies of select industries. They are credentialed professionals who spend their everyday lives on the frontline of technological change. ChangeWave surveys its Network members weekly on a range of business and consumer topics, and converts the information into a series of proprietary quantitative and qualitative reports.

Helping You Profit From A Rapidly Changing World ™ www.ChangeWaveResearch.com

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 9 ChangeWave Research: Consumer Tablets and eReaders Table of Contents

Summary of Key Findings...... 9

The Findings...... 11

Tablet Wars – The iPad vs. the Competition...... 11

Wireless Services and the iPad...... 15

The iPad vs. the Kindle vs. the Nook eReader...... 16

ChangeWave Research Methodology...... 22

About ChangeWave Research...... 22

Appendix A...... 23

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 10 ChangeWave Research: Consumer Tablets and eReaders The Findings

Introduction: Since its release, the Apple iPad has remained the de facto standard by which competing tablets are measured. With the bar set high and the release of the new iPad 2 right around the corner, can new tablets from Motorola, Research in Motion and a host of others successfully launch and compete?

To find out, ChangeWave surveyed 3,091 consumers on tablet demand and buying trends – including customer satisfaction, tablet cannibalization of other electronic devices, and consumer preference for wireless tablet services.

The Jan. 31 – Feb. 9 survey, completed prior to this week's iPad 2 announcement, also looked at the Kindle vs. iPad vs. the Nook in the eReader market.

Tablet Wars – The iPad vs. the Competition

ChangeWave’s February consumer spending report showed electronics purchases trending down in the aftermath of a huge holiday season (see February Consumer Spending Report).

But the tablet market is bucking this seasonal downtrend, with 14% of survey respondents now saying they own a tablet – double the percentage of November.

Do you currently own a tablet device?

Current Current Survey Survey Feb ‘11 Nov ‘10 Yes 14% 7% No 86% 92%

Within this rapidly evolving market the Apple iPad continues to dominate, with 12% of survey respondents reporting they own one – a major 5-pt surge from previously.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 11 ChangeWave Research: Consumer Tablets and eReaders Do you currently own an Apple iPad?

Future Tablet Demand. Most importantly, future tablet demand remains extraordinarily high, with better than one-in-four respondents (27%) saying they plan on buying a tablet device in the future – 2-pts higher than in our previous survey.

Looking ahead, are you planning on buying a tablet device in the future?

Current Previous Survey Survey Feb ‘11 Nov ‘10 Yes 27% 25% No 73% 75%

Focusing on just the next 90 days, 5% of respondents say they’ll be purchasing a tablet within this time frame.

Once again Apple remains the overwhelming winner among planned buyers, with 82% of future tablet buyers saying they’ll be purchasing an iPad.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 12 ChangeWave Research: Consumer Tablets and eReaders (FOR THOSE BUYING A TABLET DEVICE IN THE FUTURE) Who is the manufacturer and what tablet device are you planning on buying?

Current Previous Survey Survey Feb ‘11 Nov ‘10 Apple iPad 82% 89% Motorola Xoom 4% NA RIM/BlackBerry PlayBook 3% 3% Samsung Galaxy Tab 3% 2% Archos Tablet 1% 0% Dell Streak 1% 1% H-P Slate 1% 1% Toshiba Tablet 1% NA Don't Know / Other 3% 2%

Neither the Motorola Xoom (4%) – which hadn’t yet been released at the time of the survey – nor the soon-to-be-released RIM/BlackBerry PlayBook (3%) have had a significant impact so far on iPad demand. Similarly, the Samsung Galaxy Tab (3%) has done little to date to slow the iPad’s momentum.

It remains to be seen which of these tablet devices or other new entries in the market will be able to successfully compete.

The survey results provide a glimpse at what they’re up against. First and foremost, the iPad’s satisfaction rating remains outstanding among owners – with 70% saying they’re Very Satisfied and 25% Somewhat Satisfied with the Apple tablet device.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 13 ChangeWave Research: Consumer Tablets and eReaders Overall, how satisfied are you with your Apple iPad tablet?

*Note: 2% of iPad owners selected Don’t Know/NA

Cannibalization. To better understand the threat tablets pose to other electronic devices, we asked Tablet owners whether there were any other products that they had originally planned on buying but had put on hold or canceled in order to purchase a tablet.

Looking at the following list of products, are there any that you had previously planned on buying but have put on hold or canceled because you purchased a new tablet device? (Check All That Apply)

Current Previous Survey Survey Feb ‘11 Nov ‘10 Kindle eReader (Amazon) 17% 12% Sony Reader (Sony) 3% 3% Nook eReader (Barns & Noble) 3% 1% Other eReading Device 3% 1% Laptop (non-Netbook) Computer 11% 9% Netbook Computer 10% 8% Desktop Computer 3% 2% Smart Phone 4% NA iPod/iPod Touch (Apple) 4% 4% Other MP3/Digital Music Player 2% 0%

As can be seen, the two product lines most vulnerable to the tablet onslaught are eReaders and Laptops.

A total of 17% of tablet owners say they’ve put off buying an Amazon Kindle because they purchased a tablet. Another 9% have put off buying some other eReading device. The second most affected category is Laptops (11%), followed by Netbooks (10%). For more on the overall impact of tablets on the computer market see ChangeWave’s February PC Buying Report. This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 14 ChangeWave Research: Consumer Tablets and eReaders Wireless Services and the iPad Now that Verizon and AT&T are both offering wireless services for the iPad, where do future buyers plan to purchase the Apple tablet and which service will they be using?

In a major finding, 17% of planned buyers say they’ll purchase their iPad and get their wireless service directly from Verizon – 2-pts higher than in our November survey. That’s a significant achievement, considering Verizon has only been selling the iPad for 4 months. Which best describes where you’ll buy your iPad and what wireless service you plan on using?

Current Previous Survey Survey Feb ‘11 Nov ‘10 AT&T Wireless Service Buy From Apple 16% 17% Buy From Best Buy, Wal-Mart or Target 4% 6% Buy From AT&T 4% 4%

Verizon Wireless Service Buy From Verizon - MiFi Wireless Service From Verizon 17% 15%

No Wireless Service Buy From Apple 19% 24% Buy From Best Buy, Wal-Mart or Target 9% 9%

Don't Know / Other / NA 30% 25%

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 15 ChangeWave Research: Consumer Tablets and eReaders In comparison, while 24% of iPad purchasers say they’ll use AT&T as their wireless service provider, that includes 16% who will buy their iPad directly from Apple, 4% from Best Buy/ Wal-Mart/Target, and only 4% who will be buying it directly from AT&T.

All told, these findings represent a 3-pt decline for AT&T since our November survey.

The iPad vs. the Kindle vs. the Nook eReader

Tablets and eReaders are categorized as different devices, but tablets also perform as eReaders and previous ChangeWave surveys have shown the iPad is having an extraordinary impact on the eReader market.

Our latest survey shows important gains have been made in the past 90 days by the Amazon Kindle and the Barnes and Noble Nook, but the iPad remains a giant and unprecedented threat in the eReader market.

Here are our latest findings on this ongoing battle:

In terms of current market share, the Kindle (50%) remains number one among eReader owners followed by the iPad (30%) and the Nook (9%).

Which of the following eBook Readers do you currently own?

*Includes only iPad owners who consider their device to be an eReader.

Current Previous Previous Previous Survey Survey Survey Survey Feb ‘11 Nov ‘11 May ‘10 Feb ‘10 Kindle (Amazon) 50% 47% 62% 68% iPad (Apple) 30% 32% 16% NA Nook (Barnes & Noble) 9% 4% 3% 2% Sony Reader (Sony) 3% 5% 7% 10% Galaxy Tab (Samsung) 1% NA NA NA A Smart Phone with eBook Capability 4% 6% 7% 15% Other / NA 3% 5% 7% 6%

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 16 ChangeWave Research: Consumer Tablets and eReaders A closer look at the market trends for each manufacturer shows the Kindle up 3-pts and the iPad down 2-pts since our November survey, while the Nook has jumped a full 5-pts.

Of course, Amazon slashed the Kindle’s price in the run-up to last Fall and that clearly ended up having a dramatic impact on the Holiday shopping season. After having lost share to the iPad for much of 2010 – dropping from 68% last February to 47% in November – Amazon has actually picked up 3-pts in the past 3 months. Bottom line, the Kindle’s new low $139 price tag had a lot to do with its recent success. With no monthly fees and at gift item prices, the survey shows the Amazon Kindle proved to be an extremely popular purchase over the holidays – as was the Barnes and Noble Nook. Importantly, the average iPad sells for more than four times the cost of the Amazon eReader and charges a considerable monthly wireless service fee to its 3G owners. Nonetheless the iPad continues to provide ferocious competition against the Kindle in the eReader market In terms of owner satisfaction, the ratings for the iPad (70% Very Satisfied) and Kindle (68% Very Satisfied) are nearly identical – representing a significant improvement for Amazon since our previous survey (they had a 54% Very Satisfied rating in November). Overall, how satisfied are you with your eBook Reader?

*Note: 2% of iPad owners, 3% of Kindle owners, and 5% of Nook owners selected Don’t Know/NA. This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 17 ChangeWave Research: Consumer Tablets and eReaders Much of the jump in Kindle owner satisfaction can also be attributed to the lower price tag – which has clearly helped realign consumer expectations and improve satisfaction ratings for the Amazon eReader.

Most Important Features. What is it about eReaders that users find most satisfying? To find out, we asked respondents which features are most important to them in an eReading device:

(FOR THOSE WHO CURRENTLY OWN OR PLAN ON BUYING AN eBOOK READER) Which of the following are most important to you in an eBook Reader? (Choose No More Than Five)

Current Survey Feb ‘11 Battery Life 56% Screen Clarity/No Glare 44% Cost of Device 37% Screen Size 34% Internet Browser 31% Selection of Books 28% Color Screen 25% Touch Screen 21% Purchase Price of Books 21% Access to Email 20% Brand/Manufacturer 16% Access to Magazines and Newspapers 16% PDF Compatibility 16% 3G Wireless Service 15% Flash Memory (i.e., number of books device can store) 9% Ability to Read Downloaded Books on Other Devices (e.g., smart phone, PC) 9% Speed of Turning Pages 2% Text-to-Speech Functionality 2% Other 2%

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 18 ChangeWave Research: Consumer Tablets and eReaders Battery Life (56%) remains the top feature according to more than half of all eReader owners, followed by Screen Clarity/No Glare (44%), the Cost (37%) and Screen Size (34%).

We note that the Amazon eReader is widely recognized as having superior battery life. And it’s no accident that recent Kindle commercials have aggressively zeroed in on screen clarity and glare in an attempt to contrast the Kindle vs. the iPad.

But long term Amazon can’t afford to sell the Kindle at giveaway prices unless it’s making its money elsewhere in the eReader market. Which brings us to the epicenter of the fight – the battle over content.

What’s Being Read? We asked eReader owners about the types of content they read on their devices, and continue to find significant differences between iPad and Kindle owners.

Which of the following types of content do you currently read with your eBook Reader? (Check All That Apply)

Virtually all Amazon Kindle owners (94%) say they read eBooks on their device. But among iPad owners who consider their device to be an eReader, only 71% read eBooks.

At the same time, iPad owners are nearly four times more likely to read Newspapers, Magazines and Blogs/News Feeds than their Kindle counterparts.

Based on these findings it’s not surprising that News Corp. launched The Daily in February, an iPad-only newspaper featuring original content for $0.99 per week.

To gauge demand for this new offering, we asked iPad owners how interested they were in subscribing. In an encouraging finding for Apple and News Corp, one-in-four iPad owners said they were interested in signing up (9% Very Interested/17% Somewhat Interested).

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 19 ChangeWave Research: Consumer Tablets and eReaders How interested are you in subscribing to The Daily newspaper on the iPad?

Current Survey Feb ‘11 Very Interested 9% Somewhat Interested 17% Not Interested 64% Don't Know 10%

As respondent MRK09357 puts it, "Love the concept. Wish to be rid of all printed publications." SKI9571 adds, "While cost is a factor, I think the paperless option is a big draw." Other owners are waiting to see the product first. MAR07554 writes, "Curious to see if it’s worth getting," and GST15549 wants to know “If the content layout is easy and concise, and if it’s any different than free news out there.”

(A sample of the responses can be found in Appendix A on pages 23-24).

Battle Between Online Bookstores

Which online bookstore(s) - if any - do you use to purchase eBooks, Newspapers, Magazines, etc.? (Check All That Apply)

Current Survey Feb ‘11 Kindle Bookstore (Amazon) 65% iBookstore (Apple) 24% Barnes & Noble 14% Stanza 1% Don't Know 2% Don't Use Any Online Bookstores 8% Other 6%

We asked eReader owners where they purchase their eBooks, Newspapers, and Magazines, and not surprisingly it’s the Amazon Kindle Bookstore (65%) that holds the clear lead among online bookstores – far ahead of the Apple iBookstore (24%) and Barnes and Noble (14%). But in a direct comparison of Kindle owners vs. iPad owners, important differences emerge. Among Kindle owners, 95% report they use the Kindle Bookstore and only 5% the iBookstore. In comparison, while two-in-three iPad owners (67%) use the iBookstore, nearly half (45%) also say they use the Kindle Bookstore.

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 20 ChangeWave Research: Consumer Tablets and eReaders

In short, the Amazon Kindle Bookstore is currently far stickier than the Apple iBookstore -- retaining the loyalty of the vast majority of Kindle owners and also being frequented by nearly half of iPad eBook readers. On the other hand, the Apple iBookstore has built up a very strong following among iPad owners in a far shorter period of time. A Look at eReader Demand – Next 90 Days. Among those respondents who plan on buying an eReader in the next 90 days, half (50%) say they’ll purchase an iPad and one-in- four (25%) a Kindle. Which of the following eBook Readers do you plan on buying?

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 21 ChangeWave Research: Consumer Tablets and eReaders ChangeWave Research Methodology

This report presents the findings of a recent ChangeWave survey on consumer electronics spending patterns. The survey was conducted between January 31 – February 9, 2011. A total of 3,091 respondents participated in the survey.

ChangeWave's proprietary research and business intelligence gathering system is based upon the systematic gathering of valuable business and investment information directly over the Internet from accredited members.

The Research Network is assembled from senior technology and business executives in leading companies of select industries. More than half of members (53%) have advanced degrees (e.g., Master's or Ph.D.) and 91% have at least a four-year bachelor's degree.

The business and investment intelligence provided by ChangeWave provides a real-time view of companies, technologies and business trends in key market sectors, along with an in-depth perspective of the macro economy – well in advance of other available sources.

About ChangeWave Research

ChangeWave Research, a subsidiary of InvestorPlace Media, LLC, identifies and quantifies "change" in industries and companies through surveying a network of thousands of business executives and professionals working in more than 20 industries.

The ChangeWave Research Network is a group of 25,000 highly qualified business, technology, and medical professionals – as well as early adopter consumers – who work in leading companies of select industries. They are credentialed professionals who spend their everyday lives on the frontline of technological change. ChangeWave surveys its Network members weekly on a range of business and consumer topics, and converts the information into a series of proprietary quantitative and qualitative reports.

ChangeWave delivers its products and services on the Web at www.ChangeWaveResearch.com.

ChangeWave Research does not make any warranties, express or implied, as to results to be obtained from using the information in this report. Investors should obtain individual financial advice based on their own particular circumstances before making any investment decisions based upon information in this report.

For More Information:

ChangeWave Research Telephone: 301-250-2200 9201 Corporate Blvd. Fax: 301-926-8413 Rockville, MD 20850 www.ChangeWaveResearch.com USA [email protected]

Helping You Profit From A Rapidly Changing World ™ This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 22 ChangeWave Research: Consumer Tablets and eReaders

www.ChangeWaveResearch.com

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 23 ChangeWave Research: Consumer Tablets and eReaders Appendix A

How interested are you in subscribing to The Daily newspaper on the iPad?

Current Survey Feb ‘11 Very Interested 9% Somewhat Interested 17% Not Interested 64% Don't Know 10%

And for those of you interested in subscribing, what is the most important reason why? (open-ended)

Paperless

RLT18245 writes, "To support the concept....save a tree."

JMO20007 writes, "Moving all reading to non-paper products"

SKI9571 writes, " While cost is a factor, I think the paperless option is a big draw."

MRK09357 writes, " Love the concept. Wish to be rid of all printed publications."

CHR03589 writes, "Prefer a digital newspaper to a printed one."

Curious

MAR07554 writes, " Curious to see if it’s worth getting."

WSP14501 writes, "More curious than interested."

CCG15461 writes, "Curiosity - want to try a newspaper on the iPad."

GST15549 writes, " If the content layout is easy and concise, and if it’s any different than free news out there."

HUG06752 writes, "Looks very good. This may be the future of all news."

Quality of Content

MEC94506 writes, "Quality news organization"

SIN07760 writes, "I am hoping that the content will include the best of the WSJ and USA Today."

K2S26397 writes, "News from a trusted source, with journalistic credibility" This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 24 ChangeWave Research: Consumer Tablets and eReaders

WRG99383 writes, "If content is good and presented well, I might actually read the paper"

Convenience and “On-the-Go” Capability

ROG17805 writes, "Excellent access in one place for news delivered in the best possible format."

MIR15452 writes, "Timely news I can rely on"

OLD09362 writes, "To get the news when I'm on the go."

Ease of Use

tom16070 writes, "Ease of use; love the iPad; a really well done Daily newspaper sounds good."

NEW06507 writes, "The iPad interface is great for news/magazine reading"

MAR04119 writes, "I like the Wall Street Journal and USA today, but have difficulty reading them on the iPad"

Price

WOO99920 writes, "price & content"

HJW01274 writes, "Costs less than hardcopy newspaper, contains multimedia, and timely. I am on the free trial now and like it a lot... " iPad Specific

MBU08301 writes, "iPad specific news app. See what they have to offer."

MIC9787 writes, "Designed for iPad, but I wish the content were more designed toward the highly educated – more science, less sports, TV culture, etc.."

Interactive Features

MIK19803 writes, "Will try the Daily. Currently get the free version of USA Today. But I understand the Daily will have video also, definitely worth a look."

NPR2659 writes, "it appears to be a more interactive way to read newspapers

This information is from ChangeWave Research and contains confidential business information. It may not be copied or distributed without permission. ©2011 ChangeWave Research. All rights reserved. 25