Name: ______Date: ______

1. Money is: A) paper money and coins, but not checks.

B) currency and stocks.

C) anything that can easily be used to buy goods and services.

D) not represented by any of the above.

2. Which of the following combination of assets are considered to be money? A) currency in circulation, checkable bank deposits, and credit cards

B) currency in circulation, checkable bank deposits, and travelers' checks

C) currency in circulation and in bank vaults, checkable bank deposits, and travelers' checks

D) currency in circulation and in bank vaults, checkable bank deposits, and credit cards

3. Commodity-backed money is: A) a medium of exchange with no intrinsic value.

B) equivalent to commodity money.

C) a medium of exchange which has alternative economic uses.

D) gold and silver coins used for exchange.

4. When we keep part of our wealth in a savings account, money is playing the role of: A) medium of exchange. B) unit of account C) barter D) store of value

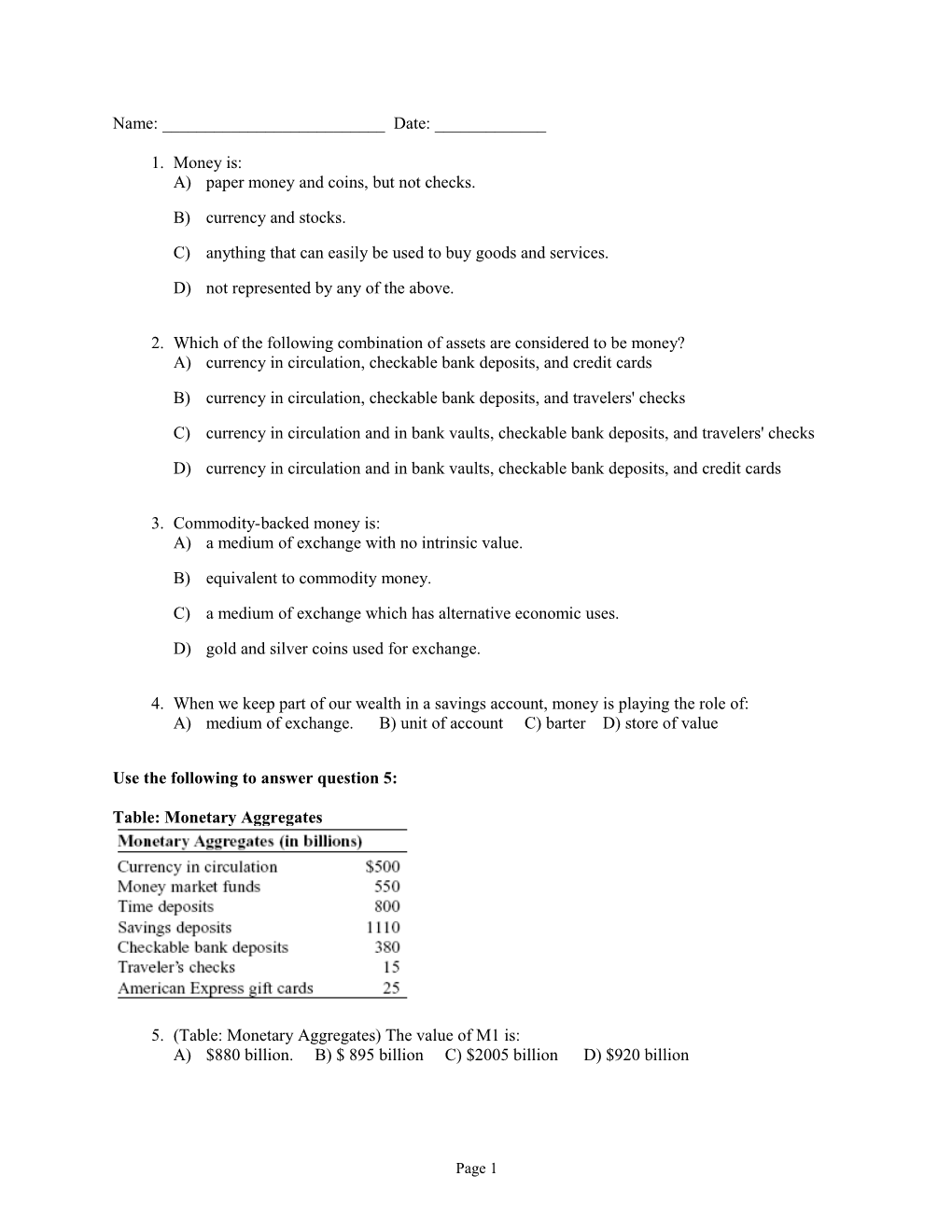

Use the following to answer question 5:

Table: Monetary Aggregates

5. (Table: Monetary Aggregates) The value of M1 is: A) $880 billion. B) $ 895 billion C) $2005 billion D) $920 billion

Page 1 6. The U.S. dollar is defined as: A) fiat money, because it was created by an act of law.

B) faith money, because we trust the government to defend its value.

C) commodity-backed money, because it is convertible into gold.

D) commodity money, because it is widely used to buy commodities.

7. If a bank has deposits of $100,000, loans of $75,000, cash on hand of $10,000, and $15,000 on deposit at the Federal Reserve, then its reserve ratio is: A) 5%.

B) 10%.

C) 12.5%.

D) 25%.

Use the following to answer questions 8-9:

Table: ABC Bank's Balance Sheet

8. (Table: ABC Bank's Balance Sheet) Refer to the balance sheet. If the minimum reserve ratio for ABC Bank is 10%, then the bank is required to maintain minimum reserves of: A) $10 million. B) $15 million C) $9.5 million D) $ 7.5 million

9. (Table: ABC Bank's Balance Sheet) Using the information in ABC Bank's Balance sheet, the bank is holding excess reserve of: A) $17 million. B) $15 million C) $5 million D) $25 million

10. A bank run can “break a bank” because: A) borrowers default on their loans, and the bank's assets become worthless.

B) banks can not convert quickly illiquid loans into liquid assets without facing a large financial loss. C) depositors' panic spreads to borrowers, who want to take additional loans from the bank.

D) the bank's reserves kept with the Federal Reserve are in the form of illiquid U.S. Treasury bonds.

Page 2 11. Which of the following is a component of BOTH the monetary base and the money supply? A) bank reserves at the Fed

B) currency in bank vaults

C) demand deposits

D) currency in circulation

12. The Federal Reserve Bank of the United States is: A) a purely private central bank.

B) a purely public central bank.

C) is part of the U.S. government.

D) is not exactly part of the U.S. government but not really a private institution either.

13. All of the following are responsibilities of the Fed EXCEPT: A) control the monetary base.

B) mint bills and coins.

C) oversee and regulate the banking system.

D) set the discount rate.

14. Which of the following is a tool used by the Fed in the conduct of monetary policy? A) changes in the prime rate

B) issuing new government bonds and retiring old ones

C) buying and selling corporate bonds

D) buying and selling federal government bonds

15. If the Fed increases the discount rate: A) the money supply is likely to decrease.

B) the money supply is likely to increase.

C) the money supply is not likely to change.

D) the federal funds rate must decrease.

16. To ______the money supply, the Fed could ______. A) increase; lower the reserve requirements

B) decrease; lower the discount rate

Page 3 C) increase; raise the federal funds rate

D) decrease; conduct open-market purchases

17. To ______the money supply, the Fed could ______. A) increase; decrease the money multiplier

B) decrease; lower the reserve requirements

C) increase; conduct open-market purchases

D) decrease; lower the discount rate

18. The money demand curve shows the relationship between the: A) the money supply and the quantity of money demanded.

B) aggregate price level and the nominal quantity of money demanded.

C) interest rate and the nominal quantity of money demanded.

D) real GDP and the nominal quantity of money demanded.

19. The demand curve for money will shift to the right because of a: A) fall in the interest rate.

B) rise in real GDP.

C) rise in the interest rate

D) fall in real GDP.

20. A 30% increase in the aggregate price level will: A) increase money demand by 30%.

B) increase money demand by the money multiplier.

C) decrease money demand by 30%.

D) not affect the demand for money.

21. Now that fast food places such as McDonald's are accepting credit card payments: A) the demand for money has increased.

B) the demand for money has decreased.

C) the demand for money has not been affected because credit cards are not considered to be money. D) the supply for money has increased as there is unused cash.

Page 4 Use the following to answer questions 22-25:A Money Market

22. The accompanying graph shows the money market. In this market, the equilibrium interest rate is:

A) r1.

B) r2.

C) r3.

D) M0.

23. The accompanying graph shows the money market. In this market, if the current interest rate is

r3, we would expect to see the interest rate _____ because there is a ______of money in the market. A) fall; surplus B) fall; shortage C) rise; surplus D) rise; shortage

24. The accompanying graph shows the money market. In this market, if the current interest rate is

r1, we would expect to see the interest rate _____ because there is a ______of money in the market. A) fall; surplus

B) fall; shortage

C) rise; surplus

D) rise; shortage

25. The accompanying graph shows the money market in equilibrium at an interest rate of r2. Holding money supply constant, which of the following might cause the interest rate in the

market to decrease to r1? A) The inflation rate falls to historically low levels.

B) Higher payroll taxes cause employers to pay workers cash “under the table.”

C) There is a recession that decreases real GDP.

Page 5 D) There is a significant increase in the stock market.

26. The money demand curve is ______because a lower interest rate ______. A) upward-slopping; increases the opportunity cost of holding money

B) downward-slopping; increases the opportunity cost of holding money

C) upward-slopping; decreases the opportunity cost of holding money

D) downward-slopping; decreases the opportunity cost of holding money

Page 6