California Commissioning Collaborative Advisory Council Meeting Minutes December 6, 2005 9:30 am to 12:30 pm Pacific Energy Center, San Francisco

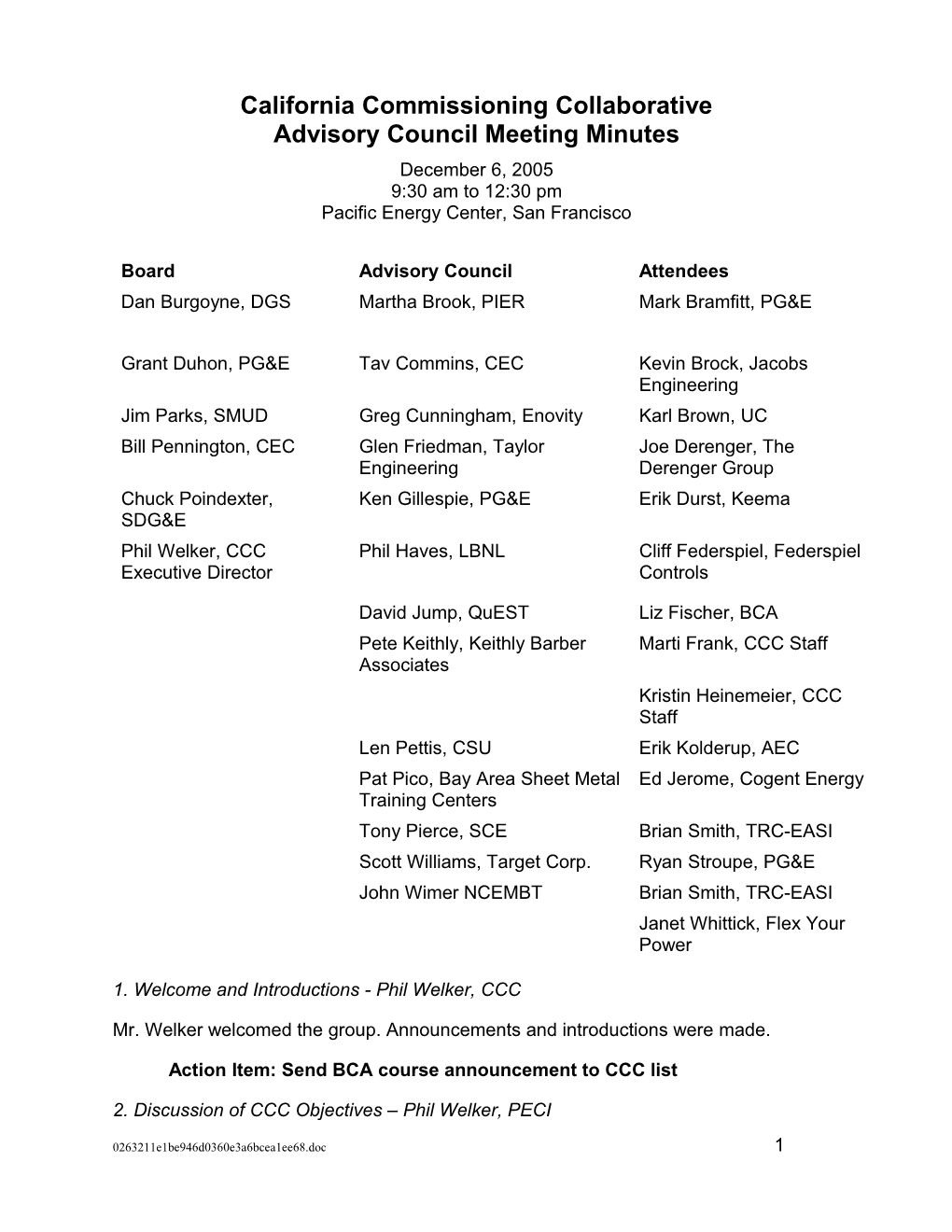

Board Advisory Council Attendees Dan Burgoyne, DGS Martha Brook, PIER Mark Bramfitt, PG&E

Grant Duhon, PG&E Tav Commins, CEC Kevin Brock, Jacobs Engineering Jim Parks, SMUD Greg Cunningham, Enovity Karl Brown, UC Bill Pennington, CEC Glen Friedman, Taylor Joe Derenger, The Engineering Derenger Group Chuck Poindexter, Ken Gillespie, PG&E Erik Durst, Keema SDG&E Phil Welker, CCC Phil Haves, LBNL Cliff Federspiel, Federspiel Executive Director Controls

David Jump, QuEST Liz Fischer, BCA Pete Keithly, Keithly Barber Marti Frank, CCC Staff Associates Kristin Heinemeier, CCC Staff Len Pettis, CSU Erik Kolderup, AEC Pat Pico, Bay Area Sheet Metal Ed Jerome, Cogent Energy Training Centers Tony Pierce, SCE Brian Smith, TRC-EASI Scott Williams, Target Corp. Ryan Stroupe, PG&E John Wimer NCEMBT Brian Smith, TRC-EASI Janet Whittick, Flex Your Power

1. Welcome and Introductions - Phil Welker, CCC

Mr. Welker welcomed the group. Announcements and introductions were made.

Action Item: Send BCA course announcement to CCC list

2. Discussion of CCC Objectives – Phil Welker, PECI

0263211e1be946d0360e3a6bcea1ee68.doc 1 CCC’s original mission was reviewed: to function as an organization that promoted Cx education, research, infrastructure, collaboration and tools. It was reiterated that CCC is not intended to fund specific implementation projects and programs.

The CCC’s objectives from its Strategic Plan (Dec, 2003) were reviewed: improving the perception of Cx, addressing market drivers, targeting specific market sectors, strengthening CA’s infrastructure, expanding market intelligence for the Cx industry.

Attendees commented that the CCC could target research/tools to specific market sectors, that the goals need to be normalized because they overlap, and that the East coast is struggling to define and sell Cx.

A lively discussion followed over the split between strengthening the Cx infrastructure versus changing perceptions of Cx. This was summarized as a supply versus demand issue. Opinions were offered on both sides, and the group concluded that the challenge is building both in sync.

Attendees who thought building demand was more important noted that engineering companies will move into Cx if the demand and profit margins are there – so if the CCC can help create demand and market will move to supply it. Also, utility programs have been driving demand so in the long term it will be important to build a business case demonstrating Cx’s value without incentives.

Attendees who thought building supply was more important noted that from an owner’s perspective, contractors have had good tactics selling Cx, but the people they sent out to do the work didn’t produce the desired results. This was noted by other attendees as a situation that would lead to a major setback for Cx, and the need to focus on skills building was reemphasized. It was further noted that bad experiences in one aspect of energy efficiency can sour a decision maker on other aspects – a carry over of perceptions. The example of T8 lighting in the early 1990s was given and the need for balance in demand and supply issues was reiterated.

It was noted that it takes longer to build infrastructure (skills) than demand (educating owners). It was commented that Nexant built infrastructure locally in Colorado in about 12 mos, and that they did it “from the ground up” building on small engineering offices.

It was noted that a major barrier is a lack of consensus about what the process is/should be, that it can’t just focus on comprehensive Cx and needs to be a more standardize approach. It was suggested that a standard concept be created for each market sector with demonstration projects to deliver consistency in expectations and results. A fundamental problem, it was noted, is that that owners can’t distinguish good from bad proposals.

0263211e1be946d0360e3a6bcea1ee68.doc 2 Action item: rewrite CCC objectives in light of upcoming activities

The group also discussed changes in the Cx industry since 2003:

LEED has spiked demand for Cx and continues to evolve in its requirements and their effects on the Cx process. LEED will be revised in coming years so there’s opportunity to influence it.

Acceptance of Cx/RCx as an energy efficiency measure, for funding by utilities means there is no longer a need to convince the CPUC of its effectiveness. There has been much success in having utilities buy into programs for Cx/RCx. But does that lead to a stay-the-course attitude in working to continue and expand utility involvement?

There is an increased emphasis on RCx, more now in CA than at any previous time. Perhaps this justifies more resources for RCx.

There is increased participation of contractors in Cx. Contractors have Cx requirements in their spec and look to Cx providers for assistance, sometimes employing a Cx Coordinator model.

Question about CCC’s funding from energy companies with mandate to produce savings, but need, for success of Cx, to include focus on other benefits

Action Item: The CCC should engage the building industry in attending CCC meetings

The group presented several thoughts on what direction the CCC should head:

The CCC been energy focused, but now that there is more involvement from the building trades the group may need to address other benefits of Cx.

Need to do whatever is necessary to support utility programs

Need to consolidate, document, discuss results, move existing work forward

Need to continue to capitalize on the ability of the CCC to bridge gaps between owners/practitioners/people in the field with practical experience, and policy makers in government/utilities.

Concern was expressed that the CCC’s focus on energy savings will prevent the long-term stability of market because Cx won’t be profitable/sustainable business without incentives

Suggested to put someone from CCC on the ASHRAE GL0 committee.

0263211e1be946d0360e3a6bcea1ee68.doc 3 3. Recap of CCC 2005 Activities – Kristin Heinemeier, PECI

Activities in 2005 were summarized.

Administrative activities were:

• Held 5 meetings

• Distribution list rose about 50% to 300 people

• Added 6 members to the Advisory Council

• Sent out 3 editions of CaCx News

• Added 84 documents to Library

• Redesigned website

• Added certification review, guidance, and sample documents to help owners select a provider

• Added paid provider listings to website

• Added over 50 Case Studies to website

• Developed pool of pre-qualified contractors

Program accomplishments were:

• Published “Support for Utility Cx Programs”

• Published “Commissioning Training Strategy Report”

• Drafted two federal building case studies

• Tested pilot Cx Seminar for Owners

• Completed drafts of Cx and RCx Guides

• Delivered CEC T24 training

4. Brainstorm New Activities – Phil Welker, PECI

Attendees brainstormed and prioritized potential project activities for 2006, as follows:

High Moderate Technical Research priority priority Verification of Savings 13 1 Quantifying non-energy benefits 7 -

0263211e1be946d0360e3a6bcea1ee68.doc 4 Benchmarking 2 1 Evaluate acceptance requirements 2 1 Document real world problems - 3 Building delivery – hand-off to occupancy - -

High Moderate Training priority priority Acceptance testing for code compliance (New Const) 5 1 Facilities staff – fundamentals and hands-on (In-house) 4 3 Controls Courses (New Const) 4 1 Comprehensive education analysis 3 4 Ongoing training – distance learning/on-the-job training (Long) 4 1 Guest lectures – slides, pool of presenters (Long) 3 3 Community Colleges – Laney support (Long) 3 3 Mentorship (RCx Prov) 2 4 Research existing extension programs and other opps (Long) 2 4 Curriculum guidelines (others provide actual training) - 6 Curriculum and train-the-trainer (licensed) 1 3 Workshop series – technical (RCx Prov) 1 3 LEED and Cx (New Const) 2 1 Industry Advisory Board (Long) 2 1 Owners/management – how to manage Cx activities (In- - 4 house) Owners – engineers – contractors – technicians (RCx Prov) 1 2 On-the-job training – guidelines for RFP (In-house) - 3 Advocate for accreditation (RCx Prov) - 3 LEED – EB (RCx Prov) - 2 UW Process Training (New Const) 1 - Extension program (RCx Prov) - -

High Moderate Marketing priority priority Training and toolkits for decision-makers by sector 5 4 Non-energy benefits by sector 5 2 Alliances with building owner groups (BOMA, IFMA, APPA) 4 1 Case studies – market specific 3 3 Demonstration projects – tied to mentoring, Cx Database, case 3 2 0263211e1be946d0360e3a6bcea1ee68.doc 5 studies Case studies – utility program “winners” 2 1 Present at owners’ events 1 2 Outreach to owners 1 1 New construction trends - 1 Awards - 1 Advertising - - Case studies – searchable - - Revisit case studies – persistence - -

High Moderate Infrastructure priority priority Mentoring toolkit – in-house toolkit 6 1 Career opportunities – scenarios for 12 year olds 1 10 Cx toolkits 1 4 Cx Assistant 1 1 Job site - - Email forum - -

There was the following discussion about the potential projects:

Technical Research

Verification of savings: research and recommendations

CA programs will have M&V run by the CPUC – utilities can tell them what the best methodologies are and how to judge persistence. The CPUC will be measuring, and we (the CCC) need to supply them with the best methods and help them understand what to measure – ie. recommend a protocol. There will be over $150m in M&V money (not all for Cx). It is a short time frame – the protocol would need to be ready within one year. General protocols are currently out for draft review. Specifics will have to wait until the programs are designed.

Need to be careful to make something useful outside the program context

Should this be a high level protocol that describes what do you look at and gives metrics for each building/system?

Need a process to compare programs – BTU v. MBCx – what’s the best approach? Need to get same information from each.

Persistence should be integrated with M&V.

0263211e1be946d0360e3a6bcea1ee68.doc 6 Benchmarking

Link between M&V and benchmarking – helps identify potential for savings through RCx. Need to integrate benchmarking in with all the projects that will be undertaken.

Evaluate acceptance requirements

Need to wait for market to deliver buildings with them. Then the CEC needs feedback on how they’re working, what’s too hard, fine tuning, new strategies.

Quantifying Non-Energy Benefits

Is it worthy research?

Construction industry can probably contribute to this

Encourage more owners in this aspect

Quantifying in financial terms, vs. qualitative terms – need to document them as drivers because they are more important, but face the challenge that they’re very difficult to document

Involve CA health care industry

Contractors and Hand-off process

Getting Cx as a part of the building delivery process – getting Cx written in to contract documents

Training – New Construction

Need for balance between long and short term projects; three audiences: owners, providers, technicians

Curriculum v. train-the-trainers v. accreditation are not contradictory, all part of portfolio

Educational programs for engineering students

Existing programs are design-oriented and limited to 10% HVAC to keep their accreditation

Internship program

First step is identifying mentors

BCA ran a similar program

Training - Topics

0263211e1be946d0360e3a6bcea1ee68.doc 7 Series of technical hands-on workshops (RCx)

Courses in fundamentals – in house

Hands on guidelines

Collaborate with other groups to reach larger audience - SMACNA

Controls Courses

LEED & Cx

Research on existing programs/extensions

See how applicable Cx is to them, then take action

Guest lecture program

Common pool of slides and people trained to give them

Integrate with “career ladder training”

Usually on the job training or distance learning, occurs every 3-4 years

Document real world problems for use in training

Research report on general training needs

Infrastructure Development

RCx Toolkits

Cx Toolkit

Job site on website (openings)

Career opportunities – case studies of individuals for young people to emulate

Cx Assistant (in process)

Marketing

Research

Decision maker research

Owners

Demonstration projects

0263211e1be946d0360e3a6bcea1ee68.doc 8 Merge with mentorship/internship with going through doing demonstration projects

Awards

Database

Case studies

Target market specific case studies

Need to have systems that are applicable to the building owner

Revisit previously studied buildings and write up persistence case study

Coming out of utility programs

Alliances with other building owner organizations – information delivery to them

Media/trade pubs/radio advertising

0263211e1be946d0360e3a6bcea1ee68.doc 9