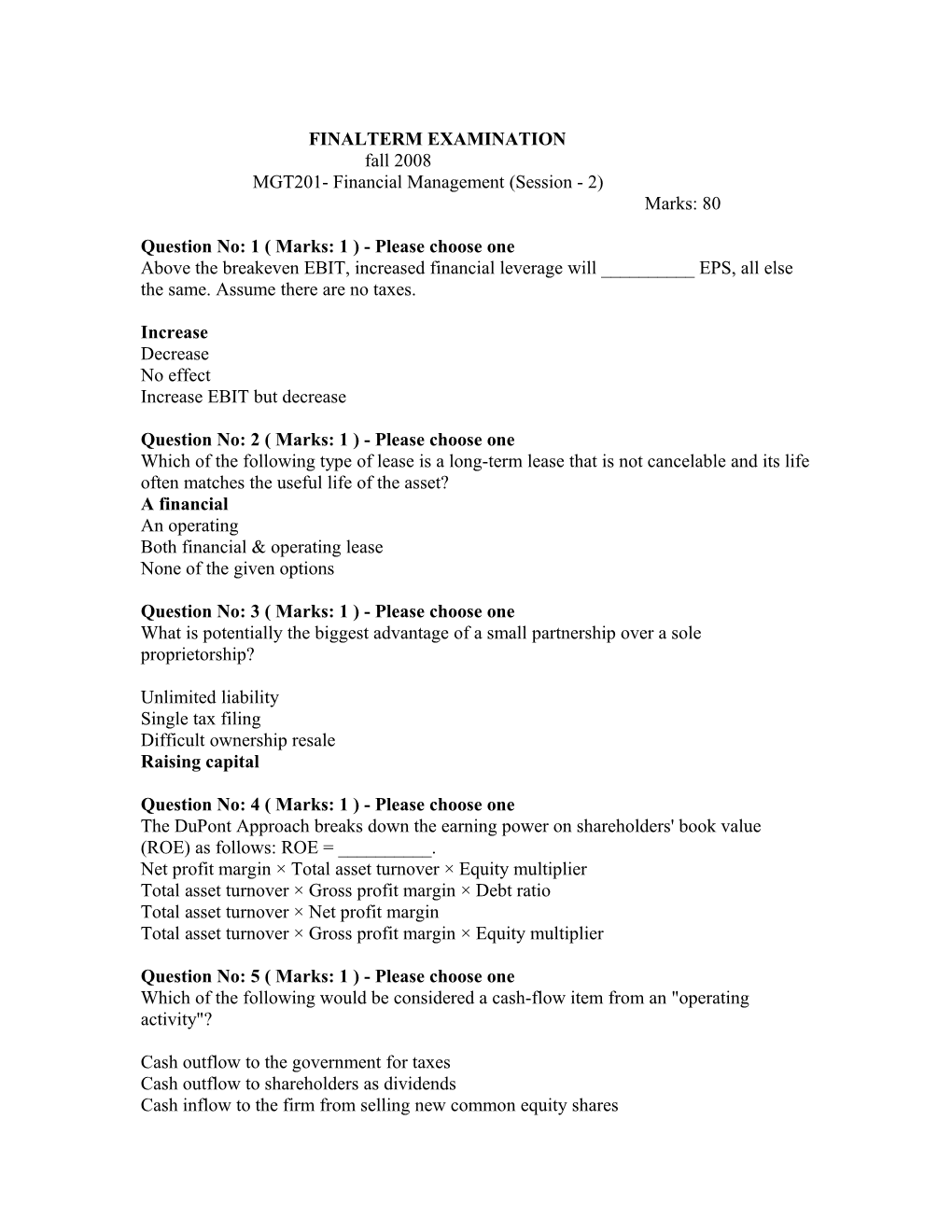

FINALTERM EXAMINATION fall 2008 MGT201- Financial Management (Session - 2) Marks: 80

Question No: 1 ( Marks: 1 ) - Please choose one Above the breakeven EBIT, increased financial leverage will ______EPS, all else the same. Assume there are no taxes.

Increase Decrease No effect Increase EBIT but decrease

Question No: 2 ( Marks: 1 ) - Please choose one Which of the following type of lease is a long-term lease that is not cancelable and its life often matches the useful life of the asset? A financial An operating Both financial & operating lease None of the given options

Question No: 3 ( Marks: 1 ) - Please choose one What is potentially the biggest advantage of a small partnership over a sole proprietorship?

Unlimited liability Single tax filing Difficult ownership resale Raising capital

Question No: 4 ( Marks: 1 ) - Please choose one The DuPont Approach breaks down the earning power on shareholders' book value (ROE) as follows: ROE = ______. Net profit margin × Total asset turnover × Equity multiplier Total asset turnover × Gross profit margin × Debt ratio Total asset turnover × Net profit margin Total asset turnover × Gross profit margin × Equity multiplier

Question No: 5 ( Marks: 1 ) - Please choose one Which of the following would be considered a cash-flow item from an "operating activity"?

Cash outflow to the government for taxes Cash outflow to shareholders as dividends Cash inflow to the firm from selling new common equity shares Cash outflow to purchase bonds issued by another company

Question No: 6 ( Marks: 1 ) - Please choose one What is the present value of an annuity that pays 100 per year for 10 years if the required rate of return is 7%?

Rs.1000 Rs.702.40 Rs.545.45 Rs.13,816

Question No: 7 ( Marks: 1 ) - Please choose one If we were to increase ABC company's cost of equity assumption, what would we expect to happen to the present value of all future cash flows?

An increase A decrease No change Incomplete information

Question No: 8 ( Marks: 1 ) - Please choose one Incidental cash flows that arise because of the effect of the new project on the running business are known as:

Externalities p-50 Cannibalization Opportunity cost Hidden cost

Question No: 9 ( Marks: 1 ) - Please choose one When market is offering lower rate of return than the bond, the bond becomes valuable, with respect to the given scenario which of the following is correct?

Market interest rate < coupon interest rate, market value of bond is > par value p68

Market interest rate > coupon interest rate, market value of bond is > par value Market interest rate < coupon interest rate, market value of bond is < par value Market interest rate = coupon interest rate, market value of bond is > par value

Question No: 10 ( Marks: 1 ) - Please choose one What is yield to maturity on a bond?

It is below the coupon rate when the bond sells at a discount, and equal to the coupon rate when the bond sells at a premium The discount rate that will set the present value of the payments equal to the bond price It is based on the assumption that any payments received are reinvested at the coupon rate None of the given options Question No: 11 ( Marks: 1 ) - Please choose one What is difference between shares and bonds?

Bonds represent ownership whereas shares do not Shares represent ownership whereas bonds do not Shares and bonds both represent equity Shares and bond both represent liabilities

Question No: 12 ( Marks: 1 ) - Please choose one You wish to earn a return of 11% on each of two stocks, C and D. Stock C is expected to pay a dividend of Rs. 3 in the upcoming year while Stock D is expected to pay a dividend of Rs. 4 in the upcoming year. The expected growth rate of dividends for both stocks is 7%. The intrinsic value of stock C:

Will be greater than the intrinsic value of stock D Will be the same as the intrinsic value of stock D Will be less than the intrinsic value of stock D Cannot be calculated without knowing the market rate of return

Question No: 13 ( Marks: 1 ) - Please choose one Music Doctors Company has an expected ROE of 14%. The dividend growth rate will be ______if the firm follows a policy of paying 60% of earnings in the form of dividends. 4.8% 5.6% 7.2% 6.0%

Question No: 14 ( Marks: 1 ) - Please choose one The logic behind ______is that instead of looking at net cash flows you look at cash inflows and outflows separately for each point in time. IRR MIRR PV NPV

Question No: 15 ( Marks: 1 ) - Please choose one What will happen to the expected return on a stock with a beta of 1.5 and a market risk premium of 9% if the Treasury bill yield increases from 3% to 5%?

The expected return will increase by 2.0% The expected return will remain unchanged The expected return will increase by 1.0% The expected return will increase by 3.0%

Question No: 16 ( Marks: 1 ) - Please choose one Which of the following is NOT correct regarding the relationship between the market risk of a security and the rate of return of that security? The CAPM states that the expected risk premium of an investment should be proportional to its beta The expected rate of return from all investments is equal to the risk-free interest rate The security market line does not relates the expected return investor s demand of a security to the beta All of the given options

Question No: 17 ( Marks: 1 ) - Please choose one Which of the following is correct regarding the opportunity cost of capital for a project?

The opportunity cost of capital is the return that investors give up by investing in the project rather than in securities of equivalent risk. Financial managers use the capital asset pricing model to estimate the opportunity cost of capital The company cost of capital is the expected rate of return demanded by investors in a company. All of the given options

Question No: 18 ( Marks: 1 ) - Please choose one Which of the following is equal to the market risk, beta, of a security?

The covariance between the security's return and the market return divided by the variance of the market's returns The covariance between the security and market returns divided by the standard deviation of the market's returns The variance of the security's returns divided by the covariance between the security and market returns The variance of the security's returns divided by the variance of the market's returns

Question No: 19 ( Marks: 1 ) - Please choose one Which of the following is the characteristic of a well diversified portfolio? Its market risk is negligible Its unsystematic risk is negligible 100% Its systematic risk is negligible All of the given options

Question No: 20 ( Marks: 1 ) - Please choose one Which of the following factor(s) do NOT affects the movements in the market index?

Macroeconomic factors Socio political factors Social factors All of the given options

Question No: 21 ( Marks: 1 ) - Please choose one A beta greater than 1 for a stock shows: Stock is relatively more risky than the market If the market moves up by 10% the stock will move up by 12%

As the market moves the stock will move in the same direction All of the given options

Question No: 22 ( Marks: 1 ) - Please choose one In efficient market the stock price depends upon the required return which depends upon ______. Market risk Total risk Diversified risk Non- Systematic risk

Question No: 23 ( Marks: 1 ) - Please choose one

Security market line gives the relationship between ______and ______. Market risk and the required return 113 Systematic risk and the required return Non-diversified risk and the required return All of the given options

Question No: 24 ( Marks: 1 ) - Please choose one Where the efficient stock combination of risk and return in efficient market should lie?

On the SML 114 Below the SML Above the SML It may lie anywhere for efficient combination

Question No: 25 ( Marks: 1 ) - Please choose one Find the Expected Return on the Market Portfolio given that the Expected Return on Stock is 17%, the Risk-Free Rate is 1.1%, and the Beta for Stock is 1.5. 11.7% 12.14% 13.23% 13.82%

Question No: 26 ( Marks: 1 ) - Please choose one Calculate the break-even point for sales revenues given the following information. The firm has Rs.1, 000,000 in fixed costs. The firm anticipates that variable costs will be Rs.1 for every Rs.5 in sales. Rs.1, 250,000 Rs.1, 000,000 Rs.250, 000 Rs.200, 000

Question No: 27 ( Marks: 1 ) - Please choose one Which of the following costs would be considered a fixed cost? Raw materials Depreciation Bad-debt losses Production labor Question No: 28 ( Marks: 1 ) - Please choose one

A firm's choice of capital structure belongs to which department in a firm? Finance Accounting Marketing Accounts Receivable

Question No: 29 ( Marks: 1 ) - Please choose one Which of the following expressed the proposition that the value of the firm is independent of its capital structure? The Capital Asset Pricing Model M&M Proposition I M&M Proposition II The Law of One Price

Question No: 30 ( Marks: 1 ) - Please choose one According to ______, the firm's cost of equity increases with greater debt financing, but the WACC remains unchanged. M&M Proposition I with taxes M&M Proposition I without taxes M&M Proposition II without taxes M&M Proposition II with taxes

Question No: 31 ( Marks: 1 ) - Please choose one According to ______, the firm's cost of equity increases with greater debt financing, while the WACC first decreases and then increases.

M&M Proposition I with taxes M&M Proposition I without taxes The static theory of capital structure M&M Proposition II without taxes

Question No: 32 ( Marks: 1 ) - Please choose one Which of the following is the common currency created by the group of European countries? The EU currency The European Union The EMU The Euro

Question No: 33 ( Marks: 1 ) - Please choose one Which of the following is a reason suggested by the authors for a divestiture, such as a sell-off or spin-off?

Synergy Reverse synergy Hubris Economies of scale

Question No: 34 ( Marks: 1 ) - Please choose one The average takeover premium a target firm has historically received is closest to which of the following percentages? 5% 12% 30% 80%

Question No: 35 ( Marks: 1 ) - Please choose one Which of the following is NOT a form of short-term, spontaneous credit? Accrued wages Trade credit Commercial paper Accrued taxes

Question No: 36 ( Marks: 1 ) - Please choose one The ______is the proportion of earnings that are paid to common shareholders in the form of a cash dividend. Retention rate 1 plus the retention rate Growth rate Dividend payout ratio

Question No: 37 ( Marks: 1 ) - Please choose one What is a dividend clientele effect assumes?

Investors prefer higher rather than lower dividends Shareholders are indifferent regarding dividends Investors have specific dividend preferences Investors are making "homemade" dividends

Question No: 38 ( Marks: 1 ) - Please choose one

Which of the following s existence on the balance sheet generates tax advantages that directly influence the capital structure of the firm? Long-term debt Retained earnings All of the given answers are correct A large proportion of fixed assets

Question No: 39 ( Marks: 1 ) - Please choose one In general, what would happen to the debt ratio of a firm if it always kept an optimal capital structure and if: 1) the government changed tax laws that allowed the deduction of dividend financing and 2) excluded the deduction of interest expense?

The debt ratio would fall The debt ratio would rise The debt ratio would not change Incomplete information

Question No: 40 ( Marks: 1 ) - Please choose one Which term would most likely be associated with the phrase "actions speak louder than words?" Incentive signaling Shareholder wealth maximization Financial signaling Optimal capital structure

Question No: 41 ( Marks: 5 ) Why may payout decisions be used by management to signal the prospects of the firm? Give answer in bulleted form.

Question No: 42 ( Marks: 5 ) Suppose a Firm ABC has Total Assets of Rs.1000 and is 100% Equity based (i.e. Unlevered). There were 10 equal Owners and 5 of them want to leave. So the Firm takes a Bank Loan of Rs.500 (at 10%pa Mark-up) and pays back the Equity Capital to the 5 Owners who are leaving. Now, half of the Equity Capital has been replaced with a Loan from a Bank (i.e. Debt). What impact does this have on ROE?

Question No: 43 ( Marks: 10 ) Stock X has a beta of 0.5, stock Y has a beta of 1.0, and stock Z has a beta of 1.25. The risk free rate is 10% and the expected market return is 18%. a. Find the expected return on stock X b. Find the expected return on stock Y c. Find the expected return on stock Z d. Suppose that you construct a portfolio consisting of 40% X, 20% Y and 40% Z. What is the beta of the portfolio?

Question No: 44 ( Marks: 10 ) David Company and Goliath Company are virtually identical firms (Rs. 50,000 NOI) except for the use of leverage. David has permanent debt of Rs. 200,000 with a 14% interest rate, while Goliath has no debt. The equity capitalization rate of Goliath (in the absence of borrowing) is 20 percent. The corporate tax rate for both firms is 40 percent. Assume that there are no personal taxes. a. What is the present value of the debt tax-shield benefit for David? b. Calculate the income available to all suppliers of capital (both debt holders and shareholders) for the firms. c. Calculate the total value of each firm. Question No: 45 ( Marks: 10 ) (A) Small-town Diners has a policy of treating dividends as a passive residual. It forecasts that net earnings after taxes in the coming year will beRs.500, 000. The firm has earned the same Rs.500, 000 for each of the last five years and has paid between Rs.200, 000 and Rs.350, 000 out in dividends in each of those years. The company is financed entirely with equity and its cost of equity capital is 12 percent. a. How much of the coming year' earnings should be paid out in dividends if the company has Rs.400, 000 in projects whose expected returns exceed 12 percent? b. How much should be paid out if the company has investment projects of Rs.5, 000,000 whose expected return is greater than 12 percent? (B) The K2 Company has Rs.1, 000,000 shares of Rs.4 par value stock outstanding (250,000 shares), Rs.800, 000 of additional paid-in capital, and 4,000,000 of retained earnings. The current market price of the stock is Rs.30 per share. What will happen to this account to the number of shares outstanding and the par value if the stock splits as follows: a. 2-for-1 b. 1-for-2 What stock price (assume 2-for-1 split) will firm sell at in the absence of any informational or signaling effects?