Evanston Housing 4 All A coalition supporting affordable housing through education and advocacy

Q

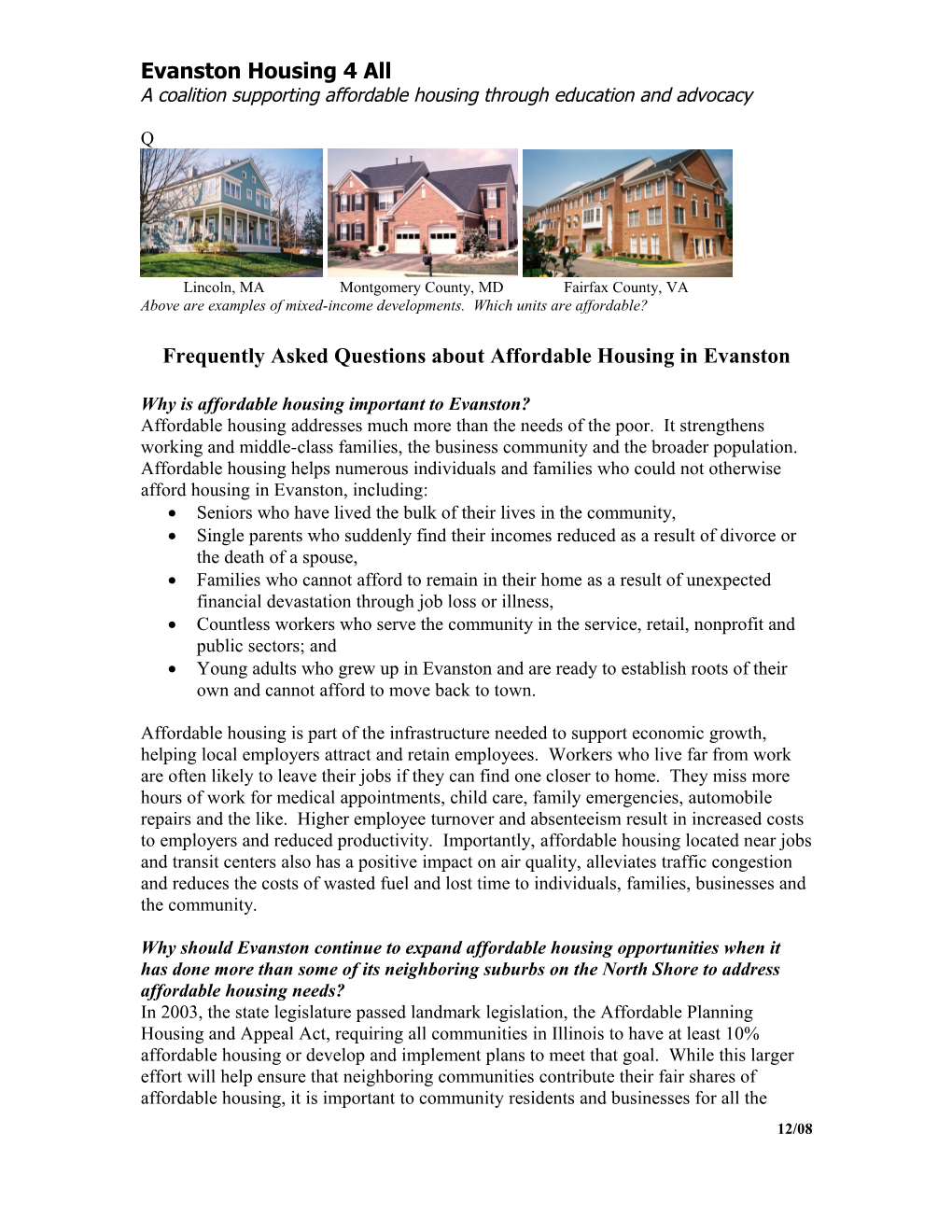

Lincoln, MA Montgomery County, MD Fairfax County, VA Above are examples of mixed-income developments. Which units are affordable?

Frequently Asked Questions about Affordable Housing in Evanston

Why is affordable housing important to Evanston? Affordable housing addresses much more than the needs of the poor. It strengthens working and middle-class families, the business community and the broader population. Affordable housing helps numerous individuals and families who could not otherwise afford housing in Evanston, including: Seniors who have lived the bulk of their lives in the community, Single parents who suddenly find their incomes reduced as a result of divorce or the death of a spouse, Families who cannot afford to remain in their home as a result of unexpected financial devastation through job loss or illness, Countless workers who serve the community in the service, retail, nonprofit and public sectors; and Young adults who grew up in Evanston and are ready to establish roots of their own and cannot afford to move back to town.

Affordable housing is part of the infrastructure needed to support economic growth, helping local employers attract and retain employees. Workers who live far from work are often likely to leave their jobs if they can find one closer to home. They miss more hours of work for medical appointments, child care, family emergencies, automobile repairs and the like. Higher employee turnover and absenteeism result in increased costs to employers and reduced productivity. Importantly, affordable housing located near jobs and transit centers also has a positive impact on air quality, alleviates traffic congestion and reduces the costs of wasted fuel and lost time to individuals, families, businesses and the community.

Why should Evanston continue to expand affordable housing opportunities when it has done more than some of its neighboring suburbs on the North Shore to address affordable housing needs? In 2003, the state legislature passed landmark legislation, the Affordable Planning Housing and Appeal Act, requiring all communities in Illinois to have at least 10% affordable housing or develop and implement plans to meet that goal. While this larger effort will help ensure that neighboring communities contribute their fair shares of affordable housing, it is important to community residents and businesses for all the 12/08 reasons noted above that Evanston continue its efforts to preserve and increase affordable housing.

Today, Evanston continues to need additional affordable housing. For example, nearly one of every two renter households and more than one out of every three homeowner households are burdened with excessive housing costs according to federal guidelines. Many who have lived in the community are being priced out, while many of those in the local workforce cannot afford to live in the community. Even dual wage earners are being priced out of the market (see the chart in the question below). More detailed information relating to Evanston’s affordable housing needs can be found in Evanston’s 2005-09 Consolidated Plan and in An Examination of Affordable Housing Needs in Evanston, a report prepared by Business and Professional People for the Public Interest in April 2008.

Are falling home prices good news for affordable housing? Falling home prices may mean more homes will be priced at levels affordable to households with modest incomes. However, other factors operating in the market today – increased unemployment and reduced credit availability – offset the beneficial impact of falling home prices. As a result, many low- and moderate-income households cannot take advantage of reduced prices.

In an expensive housing market like Evanston, there is still a gap between the cost of housing and what households with modest incomes can afford to pay. Indeed, even with a worsening market, the median home sales price in Evanston continued to increase in 2007 and the first half of 2008. Most significantly, home prices continue to grow much faster than incomes. Adjusting for inflation, the median home price in Evanston increased 26% between 2000 and 2007, while median personal income grew by only 2%. It is this divergence between growth in income and growth in home prices that results in such a large affordability gap. Even with the drop in home prices taking place, it is nowhere close to erasing the effects of the housing bubble on the reduced purchasing power of low- and moderate-income households.

The chart below illustrates the enormity of the affordability gap, even for dual earner households holding jobs in the service, retail, nonprofit and public sectors. Of course, the gap is even larger with only one wage earner.

The Combined Affordable 2007 Median Occupation Affordability Median Wage Home Price Sales Price Gap Firefighter and $90,948 272,844 $350,000 $77,156 preschool teacher Registered nurse and $82,528 247,584 $350,000 $102,416 retail sales clerk Clergy and $64,246 $192,738 $350,000 $157,262 receptionist Bookkeeping clerk and $54,924 $164,772 $350,000 $185,228 home health aide Illinois Department of Employment Security, Occupational Wages for Cook County as of 2007, 2nd Quarter. Affordable home price based on 3 x income.

2 How can there be a need for more affordable housing when there are vacant publicly subsidized units on the market that have not been sold? Even though the pricing of a unit may meet a government program’s definition of “affordable,” the price may not in fact be affordable to many the program is intended to serve. For example, a program may target households with incomes from 60% to 80% of the Chicago area median income, or roughly $45,000 to $75,000 for a family of four. However, due in part to limitations on the availability of funding to write down the cost of development, the housing produced under the program may be priced to be affordable to a household earning $75,000, leaving those earning less out of the market. Moreover, even if a family meets a program’s income eligibility requirements, the uncertainty created by the current economic crisis discourages some from considering a home purchase at this time, and the current credit crunch makes it more difficult for those who would like to buy now to obtain the mortgage financing needed.

Should financial assistance be provided to affordable housing developers so they can lower their sales prices or directly to households to help them purchase or rent housing? Both types of assistance can be effective in providing affordable housing, and both types of assistance are often combined. In determining the most appropriate type of assistance, the community needs to assess whether there is a need to increase the supply of affordable housing (in which case development would be a priority) or to make the cost of the current housing stock more affordable (in which case direct assistance to households would be a higher priority).

With the increasing cost of creating affordable home ownership opportunities, how can Evanston protect its public investment and ensure the greatest impact of limited public funds, while still providing working families with the asset building benefits of homeownership? There are several ways to structure public assistance to balance individual and community benefits. The most effective way to structure a homeownership program depends on the current and projected housing market, including the cost of housing, the nature and supply of the existing housing stock, the extent and nature of development opportunities, and the objectives of the community's homeownership program. An increasing number of communities faced, like Evanston, with home values that are increasing faster than incomes, have established programs that allow income-qualified buyers to purchase homes at significantly below market value in exchange for restrictions on the resale price that ensure that the homes will remain affordable for succeeding buyers without the need for additional public dollars. These programs use deed restrictions or a community land trust ground lease to restrict the resale price. A well- designed resale formula can provide an excellent rate of return for the homeowner while meeting the community's interest in maintaining permanent affordability.

How can Evanston ensure that affordable housing opportunities are dispersed throughout the community and not concentrated in any particular neighborhood? Location impacts land costs and housing values, making the costs of providing housing at affordable prices more expensive in some neighborhoods and less expensive in others. There are a variety of policy responses available to the City to support and promote the

3 location of affordable housing throughout the community, including by increasing the amount of financial assistance it provides in higher cost areas. In addition, modifications to existing policies, such as the Evanston’s inclusionary zoning ordinance, could help promote the availability of affordable housing in the city.

Does mixed-income housing work? There are thousands of examples of successful mixed income developments in communities throughout the country, including in the Chicago metropolitan area (e.g., Highland Park, Arlington Heights, Chicago). These developments include condominiums, town homes, single family subdivisions, and rental buildings. One of the keys to success in mixed-income housing is that all of the units – market rate and affordable – are built to the same design and building standards and use the same construction techniques and materials. In external appearance, they are virtually indistinguishable from one another (as the photos on the first page clearly illustrate). In addition, in well-run programs, families purchasing an affordable unit must meet the same (sometimes even higher) financial qualifications in terms of credit and mortgage readiness as their market rate counterparts.

Is single-family or multi-family housing more appropriate for families? Both are appropriate. Family needs and preferences vary. Healthy, vital communities offer diverse housing types and styles at a variety of prices in order to accommodate the needs and preferences of a diverse population. Families all over the country, including Evanston, enjoy living in multi-family housing, as well as in single-family detached homes.

Will affordable housing lower my property values? Extensive research has shown that affordable housing has no negative impact on the price or frequency of sales of neighboring homes. A Wisconsin study of housing constructed under the Low-Income Housing Tax Credit program concluded that property values surrounding these developments rose, even in relatively affluent areas. Numerous studies over time from around the country support the general notion that affordable housing has no negative impact on surrounding property values – especially when it is thoroughly integrated into the community.

4