PROJECT EXECUTIVE SUMMARY GEF COUNCIL INTERSESSIONAL WORK PROGRAM SUBMISSION

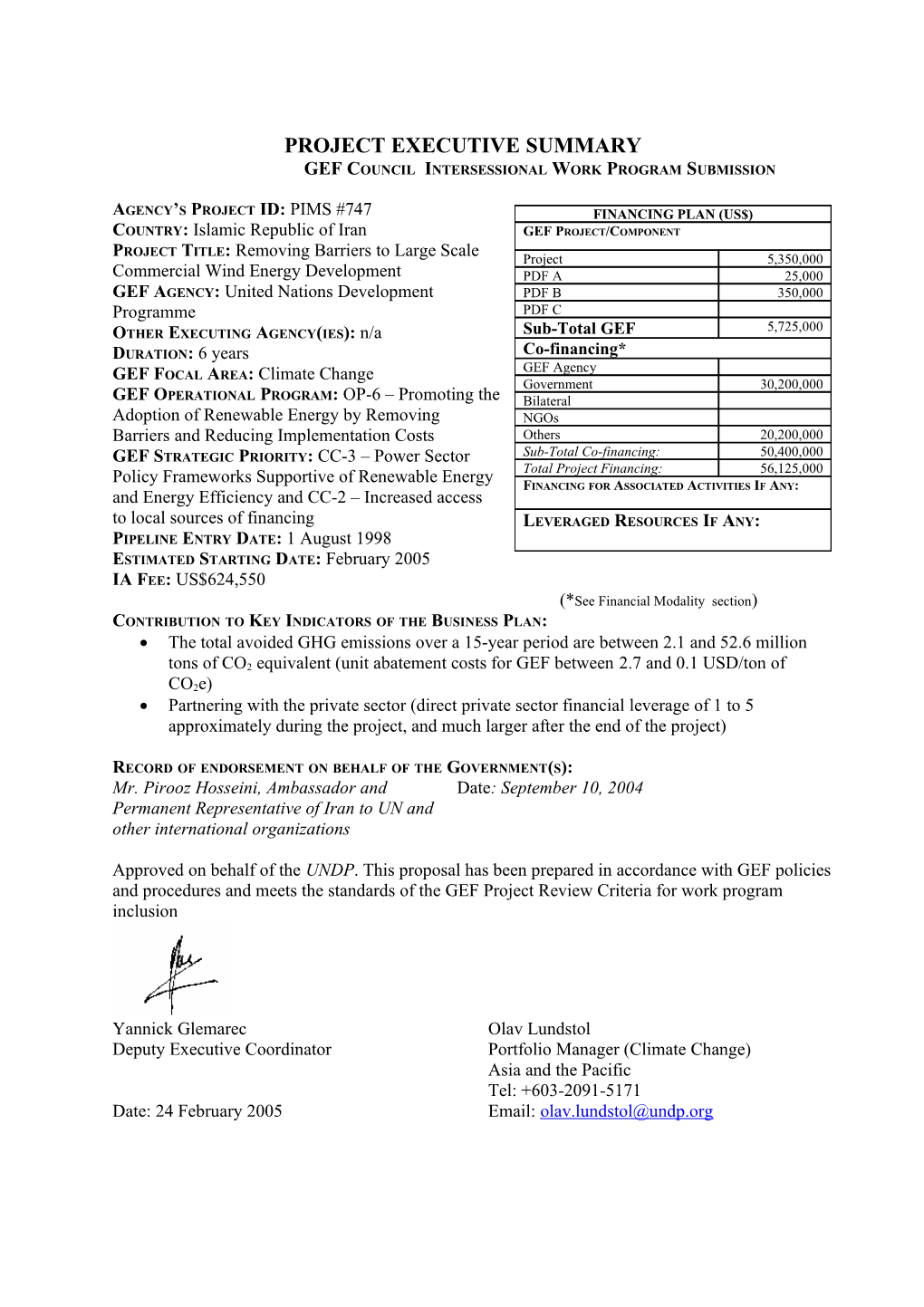

AGENCY’S PROJECT ID: PIMS #747 FINANCING PLAN (US$) COUNTRY: Islamic Republic of Iran GEF PROJECT/COMPONENT ROJECT ITLE P T : Removing Barriers to Large Scale Project 5,350,000 Commercial Wind Energy Development PDF A 25,000 GEF AGENCY: United Nations Development PDF B 350,000 Programme PDF C 5,725,000 OTHER EXECUTING AGENCY(IES): n/a Sub-Total GEF DURATION: 6 years Co-financing* GEF Agency GEF FOCAL AREA: Climate Change Government 30,200,000 GEF OPERATIONAL PROGRAM: OP-6 – Promoting the Bilateral Adoption of Renewable Energy by Removing NGOs Barriers and Reducing Implementation Costs Others 20,200,000 GEF STRATEGIC PRIORITY: CC-3 – Power Sector Sub-Total Co-financing: 50,400,000 Policy Frameworks Supportive of Renewable Energy Total Project Financing: 56,125,000 FINANCING FOR ASSOCIATED ACTIVITIES IF ANY: and Energy Efficiency and CC-2 – Increased access to local sources of financing LEVERAGED RESOURCES IF ANY: PIPELINE ENTRY DATE: 1 August 1998 ESTIMATED STARTING DATE: February 2005 IA FEE: US$624,550 (*See Financial Modality section) CONTRIBUTION TO KEY INDICATORS OF THE BUSINESS PLAN: The total avoided GHG emissions over a 15-year period are between 2.1 and 52.6 million

tons of CO2 equivalent (unit abatement costs for GEF between 2.7 and 0.1 USD/ton of CO2e) Partnering with the private sector (direct private sector financial leverage of 1 to 5 approximately during the project, and much larger after the end of the project)

RECORD OF ENDORSEMENT ON BEHALF OF THE GOVERNMENT(S): Mr. Pirooz Hosseini, Ambassador and Date: September 10, 2004 Permanent Representative of Iran to UN and other international organizations

Approved on behalf of the UNDP. This proposal has been prepared in accordance with GEF policies and procedures and meets the standards of the GEF Project Review Criteria for work program inclusion

Yannick Glemarec Olav Lundstol Deputy Executive Coordinator Portfolio Manager (Climate Change) Asia and the Pacific Tel: +603-2091-5171 Date: 24 February 2005 Email: [email protected] PROJECT SUMMARY

A) PROJECT RATIONALE, OBJECTIVES, OUTPUTS, AND ACTIVITIES

About 93% of Iran’s installed power generation capacity is thermal (natural gas and oil), while about 7% is hydroelectric. As is widely known there is an abundance of cheap fossil fuels in Iran (9% and 17% of the worlds reserves of oil and natural gas are Iranian), and this fact combined with the current electrification and pricing policies that has prioritised thermal generation options, have not contributed favourably to the development of renewable energy as an on grid option. Under such circumstances it is clear that fossil fuel and their associated electricity generation options will still continue to dominate the expansion and coverage in the electricity sector over the next 10-20 years.

Notwithstanding the above, there are still important niches and justifications to be found for promoting different sources of renewable energy in Iran such as wind, solar, geothermal and biomass. In the area of wind energy there is a conservatively estimated potential of 6500 MW and early research and experience have shown potential economic feasibility, manufacturing and employment opportunities if developed on a significant commercial scale, potential benefits for grid integrity and stability (e.g. when mixed with hydro generation in the regional and central grids), substantial CO2 reduction potential (when compared to the business as usual alternative).

Renewable energy policy is supported at the highest level: the decrees from Iran’s Head of State stating as a policy goal to “create a basket of energy from the many energy sources in the country, use this energy in accordance with the environmental problems, and attempt to increase the share of renewable energy in this basket” and “work to gain knowledge and know-how on renewable energy, and establish wind and solar power plants, fuel cells, and geothermal power systems.”

So far Iran has made some initial progress towards promoting wind energy. These include the establishment of a dedicated renewable energy organization (SUNA) that is placed under the national utility TAVANIR and the Ministry of Energy. They have promoted studies, resource assessments and pilot wind farms to test mainly the technical feasibility. Pilot plants include a 9.4MW wind farm in Manjil built using funds from the World Bank ‘Iran Earthquake Rehabilitation Project’, 2.1MW wind farm in Roodbar, 900kW in Harzavil, and recent construction of a 13MW wind farm in Manjil using locally produced wind turbines under licence from Vestas A.S. All these plants are grid connected but supply electricity into the grid independently of any form of power purchase agreement or even monitoring of system performance.

A rather extensive list of potential projects that could be developed in Iran has been developed (in the regions of Binalood, Khaff, Zabol, and Manjil) but because of remaining barriers to commercial developments and a weak enabling policy and regulatory framework, only a limited number of additional state funded developments are expected to materialize and with limited associated barrier removal efforts.

The global environment objective of this project is to reduce the greenhouse gas emissions of Iran by removing the barriers to the establishment of a sustainable wind energy market. The project objective is to integrate wind energy generation into the energy mix through the operation of the first commercial wind farms in Iran.

The main policy tool to support involvement of the commercial sector will be a production based tariff support mechanism. While legislation guaranteeing high feed-in tariffs for renewable energy generation (over 5.2 US cents, well above the base tariff) were introduced some years ago

2 (described in Budget Law 2002, article 62), inadequate attention has been given to the practical implementation of this policy. This has resulted in the non-functioning of the law, since funds or mechanisms were not allocated to cover the difference between the base and renewable energy tariffs - ie. the law was enacted without any attention given to how it would be supported. Two primary needs exist to rectify this problem: 1) determination of the most economic level of the tariff support sufficient to interest private investors, and 2) identification and commitment of resources to fund the mechanism - and these two needs will be tackled direct by this project. The existing law however is an excellent basis and illustrates the government’s overall intentions. The project strategy, through its focus on activities in the areas of information, capacity building and strengthening of the enabling institutional framework has the overarching aim of tackling these two issues.

These activities are closely linked to the establishment and operation by SUNA of a 28.4 MW wind farm in the Binalood area. Early lessons learned from this project and the associated activities would then enable the preparations for the estimated 20 MW commercial wind project to be competitively selected and put into effective operation under the envisioned conditions for market development support, including the tariff support mechanism. The project will address the principal barriers to the implementation of commercial wind energy through a process of barrier removal involving information and awareness building, activities focused on sound policy development, tackling of economic and financial barriers, and capacity building to overcome human resource barriers. The project will dedicate specific attention to identifying appropriate ways to optimise the production based incentive scheme and/or any other incentive scheme that is shown to be competitive, as well as the optimal way to secure continued funding for these mechanisms. These activities will be implemented in such as way as to ensure that benefits continue after the close of the project. The project adopts a comprehensive and systematic approach to barrier removal focused fully on commercial development of wind power in Iran. This is fully in line with the Government’s policy to restructure and privatise electricity generation.

Key outputs, and the related activities envisioned are:

1. Commercial wind energy resource data for the five areas with greatest potential widely available to commercial developers – measurements in 5 key regions, ongoing monitoring and updating of dataset, and publishing of wind atlas 2. Available, relevant wind development information and an extensive dissemination system operational – review of international experiences, assessment of local impacts / benefits, technical analysis of role and compatibility of wind energy in the Iranian energy mix, publications, workshops, seminars, wind energy exhibitions 3. Enhanced policy framework (national strategy) on wind energy including effective market stimulation measures – review current legal and regulatory frameworks, strengthening of policy approaches based on best practice Established Market Facilitation Organisation – a public-private entity supporting the commercial growth of wind energy, providing institutional support necessary for entry of commercial players into the Iranian wind energy market 4. Financial support mechanisms for wind energy developed – analysis of relevant approaches, local funding source potential and sustainability, building of capacity of financial sector, facilitate access to local and international financing 5. Demonstration of commercial opportunities of wind energy power generation for the private sector – implementation of demonstration projects including a 28 MW wind farm under public ownership with information available to policy and commercial development through process and performance monitoring and evaluation, and a 20 MW commercial wind farm with long-term PPA and production based tariff bonus

3 6. Strengthened national capacities for supporting wind as a commercial energy source – capacity needs assessment, training of trainers, training of key stakeholders including mid- level professionals who will implement, monitor, and report on the project, training course delivery 7. Enhanced private sector capacities and pipeline of commercial projects – prepare background studies for investment in key wind energy regions, provide technical assistance to the private sector in feasibility assessment, product licensing and technical co-operation with international manufacturers, and development of a pipeline of potential commercial wind energy projects

B) KEY INDICATORS, ASSUMPTIONS, AND RISKS (FROM LOG FRAME)

End of project ‘objective-level’ indicators include: A 20 MW wind farm operating on a fully commercial basis in Iran. Reduced technical and operational risks for commercial wind energy developers through a documented implementation of a government owned 28.4MW wind park and wide dissemination of the results. Fully supported promotion of wind energy by Government officials at national, regional and municipal levels as a viable energy source Built capacity of the Government for quantifying the benefits of commercial wind energy applications in terms of global environment, local air quality, rural and manufacturing job creation, and the reduction of oil consumption from a growing wind energy sector; and for relevant policy formulation, development and implementation. An established national strategy on wind energy development and commercial wind energy application, including policy support plans and activities. An established sustainable local financial mechanism to support the commercial development of wind energy A developed pipeline of commercial wind energy projects endorsed for financing support and implementation.

Risks Type Likelihood Remedial actions 1. Lack of ongoing, long Exogenous Medium Ongoing consultations and term political and ownership of project development government support for and implementation, with key wind energy government stakeholders 2. Financially viable Exogenous Medium A viable price will be agreed wind energy price is during negotiations with private higher that that forecast sector investors. Ongoing dialogue during project will be held with the Ministry of preparation. Energy and Tavinir additional funding is likely to be made available if clearly necessary. 3. Continued low real Exogenous High Technical assistance and studies term fossil fuel prices supported by UNDP on the effects of this policy and options for policy reforms 4. Regional instability Exogenous High UN involvement in the region to promote stability and a neutral partner for peace and development 5. Poor in country Exogenous High Promotion of active private sector investment climate and civil society participation by

4 UNDP through its thematic interventions in Poverty, Governance and Environment 6. Poor cooperation Endogenous Medium Highly participatory project between stakeholders development and implementation strategy, with specific incentives to key institutions 7. Withdrawal of Endogenous Low GOI commitments in this area has baseline funding been confirmed on the highest level and they have been committed over some time towards promoting wind energy 8. Inadequate project Endogenous Medium Careful selection of project team implementation members and the M&E to be put in place 9. Cost overrun and time Endogenous Medium Negotiation of fixed price delays “turnkey” contracts with suppliers and experts and the selection of contractors 10. Use of inappropriate Endogenous Low Utilizing technologies with a technologies satisfactory track record and use of experienced contractors 11. Lack of available Endogenous Medium Demonstration projects will be wind resources sited at locations where wind resources are known, based on existing wind farms or long term monitoring in the region 12. Failure of Endogenous Medium Mitigated through use of investment project commercial approaches and return on investment from production based incentive

COUNTRY OWNERSHIP

C) COUNTRY ELIGIBILITY

The Islamic Republic of Iran ratified the UNFCCC on 16 July 1996.

D) COUNTRY DRIVENNESS

The Islamic Republic of Iran has made a commitment to increasing the use of renewable energy, with priorities in the energy sector including:

- diversifying the resources of energy supply - reducing the share of crude oil in the country’s total energy consumption, and maintaining Iran’s share of oil sales in the world markets through increasing the share of gas as well as solar, wind and other renewable energies in the domestic energy consumption, and - adjusting energy prices to reflect parameters such as social justice and environmental impact.

This approach has further been underlined through policy for the Energy Sector, handed down by Iran’s Head of State, which states as a policy goal to “create a basket of energy from the many

5 energy sources in the country, use this energy in accordance with the environmental problems, and attempt to increase the share of renewable energy in this basket” and “work to gain knowledge and know-how on renewable energy, and establish wind and solar power plants, fuel cells, and geothermal power systems.” Thus policy of the Government of Iran favours the use of wind energy for oil substitution to increase the country’s export potential, to improve the national environment. The increased development of grid connected wind energy technology applications would contribute to each of these policy objectives. At the recent Bonn Renewables 2004, the Government of Iran committed itself to 500 MW of renewable energy by 2010 (the end of the 4 th Plan), half of which is to come from wind energy.

The Government has established a Renewable Energy Organisation of Iran (SUNA) under Tavanir, the “Power Generation and Transmission Management Organization” (which itself comes under the Ministry of Energy). This organisation is undertaking studies on almost all renewable sources of energy, including solar, wind, geothermal, ocean, and biomass energy, and SUNA now incorporates all the work of the former Renewable Energy Centre, CRERA, under agreements of July 2004. Tavanir is legislated to act as purchaser of power and is the counterpart in Power Purchase Agreements (PPA) with private sector organisations. Under this legislation, PPAs for BOO and BOT for fossil fuel power projects totalling 4,000 MW are under construction or are in final stages of negotiation This illustrates the government’s commitment to involvement of the private sector in power generation. The government has also acknowledged the need to supporting commercial development of renewable energy, and legislation was established in order to provide the legal underpinnings needed to formulate and implement measures that promote on a sustainable basis renewable energy in Iran, such as a production based renewable energy generation tariff premium scheme for wind energy (Budget Law 2002, article 62). The Management and Planning Office (MPO) of the Government of Iran has confirmed that that it is considering different sources of funding for such a dedicated tariff premium mechanism to be put into operation1, and as such this project would also constitute an opportunity for the GOI to pilot the most effective premium mechanism together with viable sources of funding to continue beyond the initial project.

PROGRAM AND POLICY CONFORMITY

E) FIT TO GEF OPERATIONAL PROGRAM AND STRATEGIC PRIORITY

This project will address important barriers that are limiting the widespread adoption of wind energy in Iran. It is argued that wind energy should be developed utilizing commercial rules of development and operation, however with targeted market support schemes and a strengthened regulatory and policy enabling framework. This is necessary in order to compensate for the extensive positive external environmental benefits associated with wind energy generation and to leverage the playing field when compared to other fossil power generation options where real generation costs are not reflected in the internal prices and tariffs charged.

The project is fully consist with OP6 “Promoting the adoption of RE and removing barriers and reducing implementation costs”, and it will contribute in meeting the following strategic GEF climate change priorities, however with an emphasis on CC-3:

1 A comparison of policy approaches, including bidding, obligation (portfolio standards) and tariff approaches, was made during project preparation, see annex E in the prodoc for details on this. This showed that a tariff mechanism appeared to be most appropriate for Iran. A more refined analysis of this will however be carried out through specific project activities under output1, 2 and 3 and the final approach will be modified to reflect the outcomes of this.

6 CC-2, “Increased access to local sources of financing for RE and EE”. The project will explicitly involve for the first time in the case of wind energy, both local and international private sources of funding within a fully commercial wind development scheme. CC-3, “Power sector policy frameworks supportive of RE and EE”. Policy and regulatory frameworks will be enhanced and tested for wind and wider RE within this project.

The total avoided GHG emissions over a 15-year period are between 2.1 and 52.6 million tons of CO2 equivalent. The total GEF investment, including the PDFB phase is 5,700,000 USD; hence the unit abatement cost of the GEF intervention will therefore be between 2.7 and 0.1 USD/ton of CO2e.

F) SUSTAINABILITY (INCLUDING FINANCIAL SUSTAINABILITY)

Overall sustainability, of the project intervention towards removing existing barriers that hinder an efficient wind energy development in Iran, will be sought through a participatory project intervention process where both the public and private sector will be participating actively and provide both cash contributions towards the project and receive crucial technical assistance and training so as to become drivers of the wind sector development over the next 15-20 years. The barrier removal activities aim to launch a long-term market transformation process. An analysis of the available policy mix was carried out in preparation of this project. At present, the Iranian government has no experience in utilizing production-based policies in environmental and renewable energy spheres. The proposed initial combination of feed-in-tariffs and tax credits/breaks could graduate and be expanded in later years to a more finely tuned instrument (potentially quota-based portfolio standard system although international success with this instrument is mixed) in line with increasing sophistication in the policy-making arena, better compliance with rule of law and more familiarity with artificial market systems created by the government.

Financial sustainability, will be supported through the overall strengthening of the policy and regulatory framework, that should provide increased level of stability and investor confidence that promote longer term wind energy planning and investment decisions. With regards to the specific financial viability, the dedicated market based incentive scheme that will provide a tariff premium, will pilot the implementation of the provisions already established within the GOI Budget Law 2002 (article 62). Specifically, the current average real cost per kWh delivered to consumers in Iran (based on July 2004 figures provided by the national public utility Tavanir) has been estimated to 3.2 US cents. Preliminary estimates2 for wind energy generation costs per kWh are 5.2 US cents. Based upon this, an estimated premium of 2 US cents per kWh delivered from the wind farm would be required in order to make it commercially feasible in financial terms.

This premium will be covered over a 20 year period, with the GEF support contributing to the first 5-year period (30% overall for the 5 year pilot period. Over the 20-year lifetime of the power purchase agreement this represents 7.5 % of the total cost)3. The project will dedicate specific attention to identifying appropriate ways to optimise the production based incentive scheme and/or any other incentive scheme that turns out to be competitive, as well as the optimal way to secure continued funding for these mechanisms. Local sources of funding will be identified and policies developed to make them available to support wind energy. One option, which was

2 Based upon the cost data collected during the PDFB project phase for an initially identified site in the Manjil region, utilizing various assumptions such as soft loan conditions, 8% discount rate and plant costs of 922.5 USD$/KWH. Similar cost estimate ranges have been observed in other prime wind regions like Binalood.

3 See the dedicated annex D in the prodoc with simplified NPV calculations and indications on the production based incentive scheme to be piloted through this project.

7 confirmed by MPO as currently being negotiated within the GOI, is to make available compensation from the Ministry of Petroleum for avoided fossil fuel use (related in part to the opportunity cost of oil on the international markets). Another option is to make available resources from the fuel cost subsidy given to Tavinir (which partially covers the consumer electricity prices) and making this available to wind energy projects. Use of fiscal and levy/duty mechanisms may also provide opportunities. The information and awareness raising activities will provide the foundation on which financial mechanisms may be justified. A possible partial long term funding source for replication projects (aiming at global GHG reduction) could be CDM (after the completion of this GEF project), and this could realistically provide between 0.35 and 0.7 US c/kWh (at a CO2 abatement cost of between 5 and 10 USD per tonne).

G) REPLICABILITY

According to international and local renewable energy experts Iran possesses wind and other renewable energy resources which may be characterised as “world class”, but the Iranian wind resource has not yet been mapped out in detail, and existing data is not easily available. During the project preparation the wind resources in the Manjil area were assessed based on existing data from a local meteorology station and found to be in line with Danish Class 1 / good European sites. A national wind energy map is yet to be developed, although the government has allocated 1,000,000 USD to the development of the base national wind resource map. Several sites have been initially identified for large-scale utilisation of wind energy and found promising in terms of both wind resources and infrastructure such as grid connection and road access. Estimates for the overall technical potential for wind farms range from 5,600 MW to 25,000 MW. A good conservative estimate for longer-term replication potential would be 6,500 MW.

H) STAKEHOLDER INVOLVEMENT

A wide range of project stakeholders has been consulted during project preparation and participated in the preparation of this project through PDF B activities. During the PDF B exercise, a multi-stakeholder seminar was held in which participants assisted in stakeholder analysis, problem/barrier identification, and strategy / objective setting, and were able to give comments and input into the project design. Numerous additional meetings were held with a wide range of stakeholders. These include the: Energy Efficiency Office, Ministry of Energy, Modelling and Coordination Group, Ministry of Energy, Energy Planning Department, Ministry of Energy, Renewable Energy Organisation of Iran (SUNA), Ministry of Energy, Deputy for Development and Economic Affairs, Ministry of Energy, Centre for Renewable Energy Research and Application (CRERA), TAVINIR, Ministry of Foreign Affairs, Department for International Economic Affairs, Electricité de France (EDF), Management and Planning Organisation, Energy Bureau, Commercial companies (including TAKBOD Consulting, MOSHANIR Power Engineering Consultants, SADID SABA NIROO, Vestas Wind Systems A/S (working with SADID), Lahmeyer International (working with MOSHANIR), PARS TECHNIC consultants and manufacturers), Scientific and educational institutes, UN Department of Economic and Social Affairs (UN-DESA) and World Bank.

Consultation with, and engagement of, these same stakeholders will be an important part of the proposed full-scale GEF project. Their involvement will be facilitated through information dissemination, contracts to fulfil some project outputs, and consultation within each project component.

I) MONITORING AND EVALUATION

8 The project will be monitored and evaluated in line with UNDP rules and procedures, and the GEF guidelines for monitoring and evaluation. The report formats to be used are those given in the UNDP/GEF Information Kit on Monitoring and Evaluation. The project indicators along with mid-term and final targets, as given in the Project Planning Matrix in Annex B are the benchmark against which Monitoring and Evaluation will take place and a number of specific Monitoring and Evaluation activities are also given below.

The planned Monitoring and Evaluation activities include preparation of an Annual Project Work Plan which will describe in detail the provision of inputs, activities, and expected results for the project in a given year or for the life of the project, indicating schedules and the persons or institutions responsible for providing the inputs and producing results. The work plan will be updated and revised each year by the Project Manager, the Annual Project Report (APR), a yearly tripartite review (TPR), which, although not mandatory is deemed to be useful for the implementation of this project, is the highest policy-level meeting of the parties directly involved in the implementation of a project and will include the Ministry of Energy, the Tehran Office of the UNDP, the project management unit, and the direct beneficiaries and other stakeholders. The reviews financial status, procurement data, impact achievement and progress in implementation will be reported in an annual Project Implementation Review (PIR). Independent consultants will carry out mid-term and final evaluations to assess effectiveness, efficiency and timeliness of project implementation and highlighting issues requiring decisions and actions. An annual project audit will be provided by the Government containing certified annual financial statements relating to the status of UNDP/GEF funds, including an independent annual audit of these financial statements, according to the procedures of the UNDP. The audit will be conducted by the legally recognised auditor of the Government, or by a commercial auditor engaged by the Government, and at the cost of the executing agency. During the course of the project there are five audits (in the second quarter of years 2, 3, 4, 5 and 6), and a sixth to be conducted after the close of the project.

FINANCIAL MODALITY AND COST EFFECTIVENESS

The total cost of the GEF alternative is estimated at US$56.070 million. The cost of the GEF alternative includes the cost of the 28.4 MW plant to be constructed and operated by the GOI in Binalood and the 20 MW plant to be competitively procured and operated as a private wind energy investment and operation. The total co financing amounts to US$ 50.4 million, with US$ 30.2 million from the GOI and US$ 20.2 million from the private IPP company.

The remainder of the cost for the GEF alternative US$ 5.350 million, will come from GEF and be utilized to cost share on a decreasing basis the production based tariff premium scheme (US$ 2.5 million) and to fund in part technical assistance and capacity building linked to the project components of policy and regulatory frameworks, economic and financial mechanisms and information and outreach.

The GEF contribution represents a leverage of 1 to 9.5, and it represents a balanced mix of GOI and anticipated private sector IPP funding (equity and loan capital), showing a solid commitment to promote wind energy in Iran through various modalities (e.g. smart subsidy schemes, fully owned and operated public wind farms).

9 Co-financing Sources Name of Co- Classification Type Amount financier (US$) Status* (source) Islamic Republic Government Grant 30,200,000 Written confirmation to of Iran be obtained from GOI Private sector Private sector Equity and 20,200,000 Letters of intent received investors Credit from three private sector investors, for projects totalling 120MW (~120 000 000 USD) Sub-Total Co-financing 50,400,000

INSTITUTIONAL COORDINATION AND SUPPORT

J) CORE COMMITMENTS AND LINKAGES

The project is fully consistent with the UNDP recently approved country programme for Iran and will form a core part of its energy and environment cluster and practice programme and contribute to the support of sustainable development, which encapsulates the UNDP mission. GHG reductions through energy conservation, energy efficiency and renewable energy development have been identified as key areas of support for UNDP in Iran over the programming period from 2005-2009.

K) CONSULTATION, COORDINATION AND COLLABORATION BETWEEN IAS, AND IAS AND EXAS, IF APPROPRIATE.

The UNDP, World Bank, and UN-DESA are all supporting environment and energy in Iran, although the WB currently has no office and is in the process of establishing an office in the near future. During project preparation consultations were held with both the World Bank and UN- DESA to ensure co-ordination of efforts. Because of this, and in order to ensure co-ordination with their activities, both these agencies may be appropriate as members of the project steering committee.

10 L) PROJECT IMPLEMENTATION ARRANGEMENT

Based on the extensive discussions with project stakeholders, a robust project implementation structure has been developed as given in the figure below.

Executing Agency Ministry of Energy PROJECT OVERSIGHT Project Steering Committee

Ministry of Energy, Management and Planning Office TAVANIR, UNDP, and others – eg. WB, UN-DESA, Private Sector Meetings every quarter, with the objective of monitoring project progress, co-ordinating institutional roles, and securing information and stakeholder commitment

Renewable Energy Organisation of Iran - SUNA Expert Groups (Part of Tavanir) International experts / advisors PROJECT Project Management Unit (PMU) ACTIVITY Full-time Project Director Local experts Administrative assistant Provides day-to-day project management and Implementation of ensures achievement of project outputs project tasks Reporting to PMU

P R O J E C T T A R G E T S T A K E H O L D E R S / B E N E F I C E R I E S Government decision- Technical institutes, Demonstration project makers, and other public universities, private sector stakeholders (enterprises and sector stakeholders NGOs, media government organisations)

The Executing Agency for this project will be the Ministry of Energy of the Islamic Republic of Iran. The Ministry heads a multi-level management system that encompasses TAVANIR and the Regional Electricity Companies. A special working group within the Ministry of Energy is envisaged as the basis for the Project Steering Committee. Other key participants of the Project Steering Committee will be representatives of the Management and Planning Office, TAVANIR, and the UNDP. UN-DESA and the World Bank, because of their earlier involvement in the Iranian (renewable) energy sector may be appropriate members of the project steering committee. The private sector is also considered an important stakeholder to be included in the steering committee. A Project Management Unit, will be established within the Renewable Energy Organization of Iran (SUNA). The UNDP, which worked in support of the PDF phases of this project, will play an important role in the implementation of the full-scale project, providing, where necessary technical backstopping for the project execution consisting of assistance to the Executing Agencies in Tehran and local implementation units including development of terms of reference, contracts of consultants on technical and project financing issues, consultant contract oversight, monitoring and reporting, dissemination of information and experience in the region and worldwide.

11 ANNEX IV- A: INCREMENTAL COST ANALYSIS

IC Matrix

The Baseline Without GEF participation, the proposed 28.4 MW government-owned wind energy project in Binalood would proceed, but it would do so without a focus on paving the way for private sector power producers. In the presence of barriers to private sector investment in wind energy, the private sector would invest in conventional power production, and the 20 MW plant would not be constructed with private capital. This baseline would be further characterised by:

Continued reliance on central fossil fuel generated energy, with new generation capacity provided by single cycle gas turbines.

Virtually no local capacity for wind and renewable energy project identification, design, and implementation - due to various market barriers, investment in wind and renewable energy projects will be rare, allowing little or no appreciable creation of local project development capacity. As a result, the scale and experience base of technology development will remain low, and will be driven by government investments.

CO2 emissions for the country will continue to grow, and (with the exception of growth in large scale hydro resources) will be driven by a primarily fossil fuel based energy path for the country.

A relatively minimal 500 MW RE-based power generation capacity in the country by 2020 is likely to be achieved.

The cost of the baseline includes the Government investment in the 28.4 MW wind farm, and private sector investment in a single cycle gas turbine (which at present natural gas costs is the most economical) equivalent to the envisioned 20 MW wind farm.

The results and input of the analysis has been used to set up a baseline with a 20 MW single cycle (Basic) gas turbine. The gas turbine input data from WASP has been used in the baseline, these data has been checked with data from a similar gas turbine plant from ALSTÖM. These gas turbines have typical electrical net efficiencies of 33%. The total investment for the plant is USD 6.6 million (20,000 kW x USD 330 / kW). Including fuel costs of USD 15 / MWh over a 15 year period, this makes, on simple terms, a base case cost of 19,700,000 USD.

The GEF Alternative The proposed GEF activities tackle the identified barriers to the widespread and commercial use of wind energy in Iran, through the implementation of the following outputs and activities:

Commercial wind energy resource data for the five areas with greatest potential widely available to commercial developers – measurements in 5 key regions, ongoing monitoring and updating of dataset, and publishing of wind atlas

Available, relevant wind development information and an extensive dissemination system operational – review of international experiences, assessment of local impacts / benefits, technical analysis of role and compatibility of wind energy in the Iranian energy mix, publications, workshops, seminars, wind energy exhibitions

12 Enhanced policy framework (national strategy) on wind energy including effective market stimulation measures – review current legal and regulatory frameworks, strengthening of policy approaches based on best practice Established Market Facilitation Organisation – a public- private entity supporting the commercial growth of wind energy, providing institutional support necessary for entry of commercial players into the Iranian wind energy market

Financial support mechanisms for wind energy developed – analysis of relevant approaches, local funding source potential and sustainability, building of capacity of financial sector, facilitate access to local and international financing

Demonstration of commercial opportunities of wind energy power generation for the private sector – implementation of demonstration projects including a 28 MW wind farm under public ownership with information available to policy and commercial development through process and performance monitoring and evaluation, and a 20 MW commercial wind farm with long- term PPA and production based tariff bonus

Strengthened national capacities for supporting wind as a commercial energy source – capacity needs assessment, training of trainers, training of key stakeholders, training course delivery

Enhanced private sector capacities and pipeline of commercial projects – prepare background studies for investment in key wind energy regions, provide technical assistance to the private sector in feasibility assessment, product licensing and technical co-operation with international manufacturers, and development of a pipeline of potential commercial wind energy projects

Resource assessments carried out in preparation for the project have indicated that Iran has a conservative minimum wind energy potential of 6,500 MW, covering wind speeds over 5 m/s at 40m. While the selection of wind energy potential / targets for 2020 is somewhat arbitrary, very rapid growth has been shown to be achievable in other countries with the right market stimulation mechanisms. A total wind energy generation capacity of 2,500 MW by 2020 has therefore been selected as a realistic target (overall electricity generation capacity is planned to be increased by 2,100 MW per year until 2020, and therefore wind energy would be a fairly modest component of the proposed growth). A thriving wind energy market will over time be a catalyst for growth in local economic and business regarding environmental friendly energy. The alternative will also open up for new institutional ideas in the fields of financing and expanding the power sector. The alternative will: Support and accelerate entry of private sector independent power producers, initially facilitating power purchase agreements between the main grid and IPPs, in the long run facilitating third-party transactions via wheeling through the main grid; Facilitating development of a local wind energy resource base; Support the deployment of the currently most competitive renewable energy source of electricity: wind energy4;

Future production inside Iran of a growing number of wind turbine components could reduce implementation costs and create local jobs.

System Boundary The geographical boundary of the proposed project is the national territory of Iran. Several geographical regions such as the Manjil and Binalood have been pre identified as having good wind regimes. As mentioned above a conservative preliminary estimate of 6,500 MW potential has been made based upon the available data. See also above section for estimates and assumptions made regarding the project scenarios underlying the project CO2 reduction potential. 4 This is based on studies carried out by the Ministry of Energy, and excludes large-scale hydropower

13 Additional benefits This project will bring many additional domestic benefits to Iran. Wind energy has been shown to help increase industrial capabilities, provide employment for local people in construction and operation, and bring a high level of local satisfaction (see “Evaluation of the socio-economic impacts of renewable energies: global survey to decision-makers”, European Commission 1999). Displacement of fossil fuel (natural gas in summer and fuel oil in Winter) will result in reduced emissions of sulphur and nitrogen oxide. Over a 15-year period (until 2020) reductions are

estimated at 24,000 tonnes of SO2 and 80,000 tonnes of NOx based on the current energy mix.

Costs The total cost of the GEF alternative is estimated to US$ 55.752 million, with a baseline cost of US$ 45.200 million and an incremental cost of US$ 10.552 million. The cost of the GEF alternative includes the cost of the 28.4 MW plant to be constructed and operated by the GOI in Binalood and the 20 MW plant to be competitively procured and operated as a private wind energy investment and operation. The total co financing amounts to US$ 49.400 million, with US$ 29.200 million from the GOI and US$ 20.200 million from the private IPP company.

The total GEF alternative project costs (in USD) will be divided as follows:

GEF GOI Private Total Sector Output 1.1 Wind energy 400,000 1,000,000 1,400,000 resource assessments Output 1.2 Available, relevant 600,000 500,000 1,100,000 wind development information and an extensive dissemination Output 2.1 Enhanced policy 350,000 100,000 450,000 framework on wind energy including market stimulation measures Output 2.2 Established Market 400,000 2,500 402,500 facilitation organization Output 3.1 Appropriate 500,000 500,000 financial support mechanisms for wind energy Output 3.2 Demonstration of 2,500,000 28,500,000 20,000,000 51,000,000 commercial opportunities of wind energy power generation for the private sector Output 4.1 Strengthened 200,000 100,000 300,000 national capacities for supporting wind as a commercial source Output 4.2 Enhanced private 400,000 200,000 600,000 sector capacities and pipeline of commercial projects 5,350,000 30,202,500 20,200,000 55,752,500

Global Benefits

14 The installation of 20 MW wind power results in an annual reduction of approximately 34,700 tons of CO2 equivalent. Thus up to 2020 (15 years) a total 15 x 34,700 = 520,000 tons of CO2e will be reduced as a direct result of this project. Indirect emission reductions, as a result of wind farm developments after this project have been estimated to lie between 1.6 and 52 million tons of CO2e. Thus the total anticipated emissions reductions are between 2.1 and 52.6 million tons of CO2e to 2020. The reader is referred to the detailed “baseline and emission calculations” which follows the incremental cost matrix below for more information.

15 Incremental Cost Matrix Component Baseline Alternative Increment Global Barriers limit growth of modern wind Information and awareness, policy and Significant GHG emission reductions Environ- energy beyond the baseline. In the baseline institutional, financial, and human resource are attained. mental wind energy increased from the present barriers are substantially reduced, resulting CO equivalent emission reductions Benefits 2 level of 10 MW to 500 MW by 2020. in increased deployment of wind energy and over a 15-year period as a result of this reduced GHG emissions associated with project are projected to be between 2.1 fossil fuel based generation. In the GEF and 52.6 million tons. alternative, 2 500 MW are installed replacing fossil fuel based generation. Domestic Under the baseline domestic benefits are In addition to increased employment and Increased local employment, added fuel Benefits likely to include modest growth in local added revenue through domestic fossil fuel security, improved industrial employment as a result of wind energy and savings, the modern wind energy systems capabilities, better local air quality added revenue through domestic fossil fuel introduced through this project will increase (including SO2 emissions reduced by 19 savings. SO2 emissions between 2005 and industrial capabilities and improve local air 200 tonnes between 2005 and 2020, and 2020 will be reduced by a sum total of quality. SO2 emissions between 2005 and NOx emissions by 64 000 tonnes) approximately 4 800 tonnes, and NOx 2020 will be reduced by a sum total of emissions by 15 900 tonnes. approximately 24 000 tonnes, and NOx emissions by 80 000 tonnes. Components: Information Wind energy resources for the whole Ongoing detailed wind energy assessments The perception of wind energy as a and outreach country are modelled and the 10 most are made in the 5 most promising regions- viable alternative to oil and gas for to increase promising sites are identified. sites, improving the quality of data and electricity generation is dramatically awareness reducing investor risk. The national wind improved. Decision-makers start to see Information is not widely disseminated map is refined each year. The wind resource wind energy as clean, modern, versatile, database is made available to potential and cost effective. developers and investors. Benefits of wind energy are locally well understood and knowledge widely disseminated Cost: USD 1,000,000 (Government) USD 2,000,000 USD 1,000,000 Policy and Policy for wind energy does not benefit Legal and regulatory frameworks are studied Policies are adapted to make optimal institutional from detailed cost-benefit analysis. Policy and recommendations made based on cost- use of wind energy resources. capacity and institutional barriers to commercial benefit analysis of the wind energy option. Availability of resources and expertise building developments remain National wind energy strategy developed. A leads to cost / risk reductions for new Market Facilitation Organisation for wind generation capacity. commercial sector is established. Cost: - USD 750,000 (GEF); 102 500 (Government) USD 852,500 Economic Funding of new generation capacity Appropriate and sustainable support Additional financial resources lead to and financial depends on government investment with mechanisms are put in place based on significantly higher investment in wind capacity no private risk. Favourable tariffs are detailed study of available options. Capacity energy, and greater deployment rates building abandoned as unworkable. Private sector of local financial institutions is increased, invests in non-renewable energy. and use of international funding sources facilitated Cost: USD 24,000,000 (Government) USD 24,000,000 (Government) USD 7,500,000 USD 20,000,000 (Base case USD 4,500,000 (Gvt., production bonus); investment and fuel costs) USD 3,000,000 (GEF, production bonus & other barrier removal activities) USD 20,000,000 (Private sector) Human National capacity to develop wind energy Government measures are enhanced through Replication of the demonstration resource projects remains limited. A portfolio of improved national capacities, and an project is ensured. The lessons learned capacity ‘bankable proposals’ is not developed, and investment pipeline is developed. A in the projects are applied, and wind building projects are selected in a loosely co- concrete set of future activities is identified energy use grows. Benefits continue ordinated fashion. No specific activities and activities and funding sources for post- after project concludes and wind energy are put in place to scale up activities. project continuation are secured. Capacity growth continues in a sustainable way. building continues after the end of the Barriers are permanently reduced. project as local educators have been trained. Cost: USD 200,000 (Private sector) USD 200,000 (Private sector) USD 700,000 USD 600,000 (GEF); 100,000 (Government) TOTAL Total baseline costs: Total project costs: Total Incremental costs: Cost USD 45,200,000 USD 55,752,500 USD 5,350,000 requested from GEF (11%) USD 5,202,500 from local sources

17 BASELINE AND EMISSION CALCULATIONS

Background This calculation is based on the project- level calculation formula provided by the GEF for direct, direct post-project, and indirect CO2 reductions. The field data was gathered during implementation of the PDF-B project.

Emission factors were determined by assuming baseline capacity to come from new investment in a combination of natural gas (for summer months) and gas-oil (for the winter). The planned new power generation in Iran over the next 10 years, according to Ministry of Energy planning, will be met with steam cycle power plants (approximately 3GW), gas combined cycle plants (approximately 7GW), and large hydropower plants (approximately 8GW). Since the steam cycle plants on fuel oil and diesel as seen as a vital security during cold seasons, and the hydropower plants represent relatively low-cost base load, it seems most likely that any substantial growth in wind energy will displace installation of combined cycle gas turbines. This can be seen as a conservative minimum from the point of view of emission reductions, since combined cycle gas turbines have low emissions compared to the steam cycle alternative. For the purposes of calculation this was determined for a combined cycle gas turbine. Using data from the “Wien

Automatic System Planning Package” the minimum CO2 reductions from the implementation of wind turbines have been estimated at 0.66 tCO2e/year/MWh.

Direct reductions As a result of direct investment in this project with the support of GEF an additional 20MW of wind energy will be installed. There are no Direct Post Project investments anticipated (no revolving fund or guarantee fund).

Indirect emission reductions – top down Starting from resources, and based on assessments carried out in preparation for the project a conservative minimum wind energy market potential of 6,500 MW can be identified, covering wind speeds over 5 m/s at 40m. While the selection of wind energy potential / targets for 2020 is somewhat arbitrary, very rapid growth has been shown to be achievable in other countries with the right market stimulation mechanisms. A total wind energy generation capacity of 2,500 MW by 2020 has therefore been selected as a realistic target (overall electricity generation capacity is planned to be increased by 2,100 MW per year until 2020, and therefore wind energy would be a fairly modest component of the proposed growth).

The GEF causality factor of 60% is taken since the project impact is considered to be “substantial but modest”: although the government clearly demonstrates interest in private sector involvement developing wind power, no adequate / comprehensive policy / institutional structure is being put in place to drive market transformation forward. This is specifically the work of the proposed GEF project.

Without the GEF project a total of 500MW of wind power is expected to be developed up to 2020.

Indirect emission reductions – bottom up Based on a replication factor of 3 and the direct impact of 20MW we expect an additional indirect reduction of 60MW. However, this appears to significantly underestimate the most likely situation: with the right policy framework, as will be developed/piloted within this project, the wind energy market in Iran could develop very rapidly, and thus simple replication factors are unlikely to hold. This is further underlined by government intentions to installation of 250MW by 2010.

19 Calculations The outcome of calculations are shown in the following table:

Total Sources Plant Annual Emission GEF Capacity CO2 Period Total of capacity Production ratio Contribution (MW) reduction (years) (tons CO2) reduction factor (MWh) (kgCO2/kWh) factor per year

Direct 20 0.30 52,560 0.66 1 34,700 15 520,000

Indirect – 2000 0.30 5256,000 0.66 0.6 3,470,000 15 52,000,000 top down Indirect – bottom 60 0.30 157,680 0.66 1 104,000 15 1,561,000 up 80 to 2.1 to 52.6 TOTAL 2020 million

Conclusion The total avoided emissions over a 15-year period are between 2.1 and 52.6 million tons of CO2 equivalent.

20 ANNEX IV-B: PROJECT LOGICAL FRAMEWORK

Project Strategy Objectively Verifiable Indicators Sources of Verification Assumptions

Goal

Greenhouse gas emissions are reduced CO2 emissions are reduced by an accumulated Yearly reports (giving reductions in tonnes The private sector continues to invest total of between 2.1 and 52.6 million tons of CO2e submitted to UNDP office prepared in wind energy after the end of the CO2e based on 2500 MW of wind farm by SUNA during project). Annual reporting project installations up to the year 2020 (using by SUNA after end of project. minimum 15 year system lifetimes). Policy support to wind energy is Data generated from the performance supported until at least 2020 reports from new wind facilities, plus data from Ministry of Energy on annual electricity production and fuel consumption.

Objective Domestic dependence on oil and GHG End-term target: 50MW of wind-turbines Yearly reports (giving reductions in tonnes World oil prices remain high, giving emissions sustainably reduced have been installed, with at least 20MW CO2e, and installed capacity) submitted to strong incentives to export oil products entirely with private ownership, 500MW under UNDP office. rather than use them locally negotiation. Annual reporting by project management Local investment climate in Iran Mid-term target: 28MW of wind-turbines unit. improves during project or at least installed and detailed data available. 20 MW remains constant. commercial wind farm operational. Available financing plans for pipeline of

Direct CO2 emissions are reduced by an commercial projects accumulated total of 520,000 tonnes (based on an installed capacity of 20 MW over the 15 year project lifetime)

A developed pipeline of commercial wind energy projects endorsed for financing support and implementation by the end of the project Outcomes 1. Information available and disseminated to By the end of the project wind energy is Results of project dissemination impact These assumptions apply to all four increase awareness of the benefits and promoted by Government officials at national, survey from year 3 and 5 outcomes: opportunities of wind energy in Iran regional and municipal levels as a viable energy source Project reports Ongoing support from Government and Reports from the Ministry of Energy the Ministry of Energy By the end of the project Government is in a position to quantify benefits in terms of global Political will to implement and sustain environment, local air quality, rural and tariff support mechanisms manufacturing job creation, and the reduction of oil consumption from a growing wind Fuel price distortions (subsidies for energy sector, and has developed supportive fossil fuels) continue to be reduced planning / policy (a national wind development strategy) There is an increasing willingness to recover energy costs from consumers Mid-term target: Impact survey shows that over 1000 stakeholders have significantly increased knowledge about the costs and benefits of wind energy.

2. Local capacity to develop effective and Market facilitation organisation established and Project reports sustainable policies and institutions supporting viable (self sustaining) by the end of the Reports from the Ministry of Energy wind energy strengthened project Government legislation and policies under Mid-term target: MFO officially established development and operating, serving 30 requests per year; 10 wind energy projects assisted per year; 95% of clients expressing satisfaction services.

22 3. Sustainable financing for private sector By the end of the project technical and Final project report, report on project investments in Iran’s wind energy sector from operational risks reduced for commercial wind pipeline, results from survey of project local sources facilitated through commercial energy developers through a documentation of impact and public sources a 28.4MW wind park and wide dissemination Project reports By the end of the project a 20 MW wind farm Reports from the Ministry of Energy will be operating on a fully commercial basis in Iran. Government legislation and policies under development By the end of the project a sustainable financial mechanism is in place to support the commercial development of wind energy

Mid-term target: Detailed reports (technical, financial / commercial) from 28.4MW wind farm available through training courses and publications of MFO (see outcome 2 for dissemination targets). 20MW wind farm (and production bonus system) operational.

4. Local capacity built, sufficient to support a By the end of the project, training will have Final project report, report on project thriving commercial wind energy market in been given to business and public sector pipeline, results from survey of project Iran stakeholders (>200 individuals), and skills built impact through on-the-job training.

By the end of the project a pipeline of follow- up projects will be under negotiation and technical assistance provided by the MFO and on competitive cost sharing basis with the private sector

Mid-term target: ~30 independent / private engineers and business professionals have had hands on experience in the 28.4 MW wind farm construction and operation. 50 other individuals will have participated in training courses per year.

23 24 Project Strategy Objectively Verifiable Indicators Sources of Verification Assumptions

Outputs Output 1.1: Wind energy resource By the end of the project, a copy of the wind Documented requests from developers These assumptions apply to all level 1 assessments resource map will have been requested / outputs: accessed by over 30 wind energy developers. Continued strong support from the By the end of year 5 the MOE will have Quarterly progress report Ministry of Energy allocated resources for annual wind resource Documented evidence of plans data updates Results from the detailed wind-energy assessments show benefits to Iran By the end of the project monitoring and Minutes from meetings of PMU and clearly outweigh the costs evaluation has been carried out according to twinned institute, reports from contractors plan and results have been used to provide for continual refinement of project activities

Mid-term targets: national wind resource Web or print based resource database database available to potential developers Quarterly progress reports through MFO. The wind energy maps have been accessed by ~15 wind energy developers. The national wind resource database is being updated and refined annually in the areas with most potential.

25 Output 1.2: Available, relevant wind By the end of month 9 a global review of Report development information and an extensive international experiences with wind energy dissemination system operational will be completed

By the end of year 1 a detailed report on the Report potential benefits of wind energy for Iran will be available

By the end of the project the benefits of wind Results of dissemination impact survey energy will be widely known by decision- makers

Mid-term targets: A detailed assessment of Report the potential share of wind energy in the Iranian energy mix is competed

A wind energy exhibition will have been held Results of dissemination impact survey raising the profile of wind energy and disseminating project interim results to more than 1000 local stakeholders

Output 2.1 Enhanced market-oriented policy By the end of year 5, the policy framework Documentation on the government policy These assumptions apply to all level 2 framework on wind energy developed will have been reviewed and updated / on wind energy applications. outputs: improved The Market Facilitation Organisation Mid-term targets: Policy recommendations Policy recommendations and reaction from continues to function after the end of the prepared to ensure consistent and supportive Government in national publications project policy, regulatory and legal frameworks for wind energy Continued strong support from the Ministry of Energy A clear policy and policy framework (a national strategy) for wind energy is established and enforced by the end of year 3.

Output 2.2: Established Market Facilitation By the end of month 6 the form and functions Progress report Organisation (wind energy association) of the MFO will have been agreed upon

By the end of month 9 the MFO will be Yearly project reports

26 functioning as a principal vehicle of training and information provision in wind energy development (i.e., involved in implementation of other activities)

By the end of the project the MFO will be able Annual reports of the MFO to function on a self-sustaining basis

There is a growing interest, indicated by Annual reports of the MFO increased requests to the MFO for information, from decision-makers targeted by the dissemination activities

By the end of the project 50 requests per year Leaflets, brochures and videos, records of will have been serviced by the MFO; 10 wind feedback (letters, phone calls, emails, energy projects assisted by the MFO each year evaluation questionnaire) from users starting 3; 95% of clients that expressed satisfaction in the services provided by the MFO.

Information leaflets and brochures and videos are published and distributed to target audiences (~1 new leaflet / brochure and 1 new video per year) each year.

Mid-term target: MFO officially established and operating, serving 30 requests per year; 10 wind energy projects assisted per year; 95% of clients expressing satisfaction services.

27 Output 3.1: Appropriate financial support By the end of year 1, the MoE will have Yearly project reports These assumptions apply to all level 3 mechanisms for wind energy completed a detailed analysis of financial outputs: support mechanisms and selected the most appropriate for the local context Economic analysis shows a net benefit from wind energy for Iran. By the end of year 5 the review will have been Yearly project reports, published reviews updated to include lessons learned from the World oil prices remain high, giving demonstration projects strong financial incentives to export oil products rather than use them locally By the end of year 2, broad agreement of local Yearly project reports funding arrangements will have been agreed.

3 banks/financial institutions are financing WE Yearly project reports projects by the end of the project.

At least 5 projects are applying for financing Yearly project reports each year starting year 6.

By the end of the project funding sources for a Yearly project reports pipeline of projects will have been identified and private sector investments underway for over 500 MW

Mid-term targets: training will have taken Yearly project reports place aimed at stimulating the involvement of Results from dissemination impact survey local financial institutions in financing wind on attitudes to wind energy in the financial energy, covering 50 individuals from 5 banks, sector (year 3 & 5) at least 2 of which are private

Guidelines for accessing international Yearly project reports financing are developed, and widely Availability of guidelines disseminated through the MFO Results from the dissemination impact survey

28 Output 3.2: Demonstration of commercial By the end of year 1, the case studies on Published case studies opportunities of wind energy power generation investment and construction phases of the Yearly project reports for the private sector Binalood 28.4 MW project will be complete

By the end of year 1, the call for bids for the Copies of tender documents commercial 20MW wind farm will be Reporting from selection panel complete, and the least cost applicant selected

By the end of year 3, the commercial wind Documented reports on demonstration farm will be in operation and initial data implementation and wind farm performance available on the performance of the production bonus and Power Purchase Agreements

By the end of the project case studies will be Published case studies available on the operation of the Binalood project and the commercial wind farm

By the end of the project detailed information Published lessons learned on the implementation process and wind farm performance of the demonstration projects will be available for future project developers

Mid-term target: Detailed reports (technical, financial / commercial) from 28.4MW wind farm available (see outcome 2 for dissemination targets). 20MW wind farm (and pilot production bonus system) operational.

Output 4.1 Strengthened national capacities By the end of year 1, the training needs of Yearly project report No external assumptions for supporting wind as a commercial energy stakeholders will have been assessed, and short Results of review source and medium length courses developed

There is a growing interest, indicated by Yearly project report increased requests to the MFO for information, MFO annual reports from decision-makers targeted by the Training evaluations dissemination activities (over 30 per year).

By the end of year 1, mid-level professionals

29 (more than 10) in Tavinir and in the project management unit who will implement, monitor, and report on the project will be efficiently carrying out tasks following receiving training

Mid-term target: ~30 engineers and business professionals in Tavinir and government organisations will have participated in training courses per year.

Output 4.2 Enhanced private sector capacities By the end of year 4, background studies have Yearly project report and pipeline of commercial projects been completed for wind energy development Availability of background studies regions coving environmental impact levels, wind energy potentials, land ownership, infrastructure availability, and local electricity uses Project proposals By the end of the project a pipeline of follow- up projects will be under negotiation and technical assistance provided by the MFO and on competitive cost sharing basis with the private sector

Mid-term target: ~30 independent / private engineers and business professionals have had hands on experience in the 28.4 MW wind farm construction and operation. 50 other individuals will have participated in training courses per year.

30 ANNEX IV- C: RESPONSE TO PROJECT REVIEWS

a) Review by expert from STAP Roster

Adjustments in the GEF Executive Summary and STAP reviewer UNDP Response to comment the UNDP Project Document A. Major comments

1. The project proposal is generally vague on During the project phase a market- The description of the project which market support strategies (e.g. on how oriented feed-in tariff will be strategy has been clarified in feed-in-tariffs and tax breaks) will be demonstrated - with GEF and the both executive summary (see developed during the project phase, and this government sharing costs equally over pages 2-3) and project will have major impacts on what options are the first 5 years. Thereafter the document (see pages 1-3). ultimately available. government will cover 100% of the production bonus costs. Discussion on page 45 (Annex C) on tariff This is now Annex E (page systems is useful but would be improved The long-term policy approach is 47-58) in the project with a greater degree of economic analysis. purposely flexible, with major project document, and it has been activities aimed at establishing efficient substantially updated with and effective approaches. more detailed economic analysis.

2. The key financial tool to be utilized in this In the event that 5.2 cents per kWh is The text has been clarified to proposal is a production premium to bring insufficient, indications are that the address these issues, see the cost of wind (est. at 5.2 cents/kWh) in Ministry of Energy will cover the pages 2-3 and 8 in the line with current electricity tariffs (3.2 difference. The production bonus will executive summary and cents/kWh). There are series of related be agreed for a 20-year period, with the pages 2-3 in the project concerns about the design of this program: government covering all costs after the document. 5 year GEF period. The government a) The wind costs are estimated, and could be has already demonstrated through higher due to wind resource issues, legislation their commitment to market interconnection issues, and unexpected oriented support to wind energy, and surprises. the Ministry of Energy is strongly committed to this first trial as a means How will higher costs impact the program? to demonstrate the potential of market Will added funds be available (unlikely), or approaches. will the 5 year period of GEF subsidies be reduced (very bad for investment decisions, While the power purchase agreement because of item (2), below. in the 20MW demonstration project will be for a period 20 years, and thus b) The financing mechanism to continue this provide the security needed by project beyond the initial five years is not commercial investors, the longer-term specified. scale-up strategy remains flexible and forms a major part of the work of the While the potential for CDM funds to be project (outputs 2.1 and 3.1). used in this area is promising on a $/ton of carbon basis, there is no clear revenue stream Local sources of funding will be to make this project attractive to private identified and policies developed to sector investors, and the operation of the make them available to support wind CDM itself can not yet be counted on for energy. project funding. One funding option is to make This makes the long-term strategy for this available compensation from the project one that could, and reasonably Ministry of Petroleum for avoided should, make investors and the GEF board fossil fuel use (related in part to the uneasy [However, the analysis of the opportunity cost of oil on the potential project cost on page 8 of the Project international markets). Executive Summary is both more compelling, and comes in at a realistic cost Another option is to make available

31 per ton of carbon. resources from the fuel cost subsidy given to Tavanir (which partially Two practical questions emerge: covers the consumer electricity prices) and making this available to wind i) What is the expected duration of subsidies energy projects. Use of fiscal and seen currently to be necessary to move this levy/duty mechanisms may also project to full commercial viability [even if provide opportunities. that market requires future government support, such as a production tax credit] The suggested members of the steering committee now include private sector ii) What are the contingency plans for this participants. project should this additional funding not materialize? iii) A related question is why the steering The suggested members of the steering See amendments on page 11 committee – while admittedly located within committee now include private sector in the executive summary the Ministry of Energy – does not have a participants. and page 4 in the project participant from a for-profit utility or document. business as member to help steer the operations to emphasize profitability at the earliest juncture.

3. There does not appear to be sufficient This type of training forms part of The text has been amended training of mid-level professionals who will output 4.1 and 4.2. to raise these points be asked to implement, monitor, and report explicitly, see page 26 in on the wind energy project. Annex B of the executive summary and page 32 in A series of training courses aimed at this Annex B of the project level would seem to make sense, including document. efforts focused on the basics of wind energy technologies and cost and price information for intermittent supply technologies in the context of a (largely dispatchable) current system.

4. Page 18 - Annex I: Why is the baseline a The government wind farm (28MW) is 20 MW gas turbine and not the government included in the baseline. For the developed 20 MW Binalood wind farm? purposes of emission reductions, the baseline for the 20MW wind farm is an equivalent capacity gas turbine since this additional capacity would be displaced. Planned growth in base load hydropower is not thought to be effected by the relatively modest growth in wind energy by 2020.

5. Page 19 – Annex I: Even if conservative, a Estimates based on the very rough 6,500 MW wind potential (of 5 m/sec winds) national wind energy data currently is exceedingly low for a country of Iran’s available indicate a technical potential size. Is this estimate somehow based on of between 5,600 MW and 25,000 current grid access? MW. We have chosen to be conservative so as not to raise If not, either a new assessment of wind expectations before harder data is resources is needed, or some other available. assurances may be needed that it makes sense to develop wind in Iran. With such a The government has committed 1 small potential, and such obstacles in place to million USD to carry out the first develop a commercial market, the ‘upside’ of national wind energy assessment, and this effort seems marginal. Further, with this effort will be supported by GEF 2,100 MW of new capacity expected to be through 5 more detailed studies in key added annually, 2,500 MW of wind by 2020 regions, specifically aimed at seems far less than a ‘modest’ component of answering questions raised by the

32 total new generation. reviewer.

Although at first sight 2,500 MW of wind energy by 2020 seems (very?) modest compared to 2,100 MW annual growth, it is important to bear in mind Iranian conditions and the baseline.

Even in the United States ‘only’ 2000MW of wind energy capacity was added over a 12-year period between 1990 and 2002 (IEA, 2004). Wind energy capacity in Denmark is likely to reach 2500MW by 2005 (since starting intense policy support in1979), further showing the scale of ambition. Over an 11 year period Spain has increased capacity from around 0 to ‘only’ 3.2 GW, with an acknowledge wind resources ‘third best in the world’.

Within approximately the same time period we are aiming for 2500MW starting from a base of less than 50 MW in a far less market oriented society than any of the examples given above. We believe this is ambitious but realistic.

6. Page 20 – 21, Annex A – The table can be The cost calculations for avoided CO2 made clearer and more useful. With a total emissions are standard within GEF and project cost of $55.7 million, and 7 million utilized by all climate change projects. tons of CO2 avoided (note, it is the carbon, As such this estimate is most useful not the CO2 that is of interest, so the true when comparing to other projects. figure of merit is (12/44)*(7 million tons) = 1.9 million tons of carbon). Thus, the carbon abatement value of this project is a very expensive $55.7 million/1.9 million tons = $29.3/tCarbon.

This high expense can be justified, however, if the wind industry and market is expected to grow significantly. This trivial, but important, calculation should appear as a new final row in the table.

Note, however, that even planning for optimistic wind market development (and unrealistically ascribing all of this growth to this project as the seed) one might then do a calculation based on the full 2,500 MW of potential wind development (as partially described in the table on page 22).

7. Page 28 – 30: Annex A – Somewhere The outputs listed in Annex A are not between Output 2.1 and 3.1 a phase of chronological. Business training is business training should be included, contained in output 4.2, and will presumably divided between academic and overlap with activities of output 2.1 industry-based experience. and 3.1. Much of this work will be implemented by the market facilitation organization described in output 2.2. 8. Page 38 – Annex C. Item A1. The lack of The government has committed

33 a wind resource map is clearly the items of approximately 1 million USD to carry highest importance, both at the large and the out this work, in addition to the micro-scale. A number of technologies exist estimated GEF contribution. The wind to provide very high-resolution wind resource map will be developed using mapping (Doppler radar, cheap wireless wind the latest technologies, under the sensors, etc…). Highest priority needs to be guidance of Lahmeyer. given to developing this database.

9. Page 38 – 39, Annex C: The barrier The annex has been adapted as See Annex C (pages 38-40) analysis is not presented in the standard (and suggested in the project document. useful) format where solutions are presented to each issue as well as a frank evaluation of the difficulty of overcoming the obstacle. This should be added.

10. There is an important and unexplained The 7 million is the CO2 reduction discrepancy between the PCA and the PES in baseline (over 15 years) without GEF that the PCA lists 7 million tons of CO2 intervention (500 MW). The 26 million offset, while the PES lists it at 26 million tons is the increment (2000 MW) as a tons of CO2. This analysis is based, as result of the GEF project. requested, on the numbers in the PCD.

B. Minor comments

1. Document needs page numbers Page numbers added See throughout documents 2. Section 1, page 1. The statement, ‘the The statement has been clarified to See page 7 (section on Iranian government has no expertise in make it clear that production based overall sustainability) in the utilizing quantity-oriented policies in …’. approaches in environmental or energy executive summary and page This statement is unclear as to what quantity- sectors. 1 in the project document. oriented policies are (presumably this is meant to be market transformation policies?).

Certainly the Government of Iran does have experience with quantity-oriented policies in some areas, such as agriculture. This comment should be modified.