CHAPTER REVIEW

Current Liabilities

1. (L.O. 1) A current liability is a debt that a company reasonably expects to pay (1) from its existing current assets or through the creation of other current liabilities, and (2) within one year or the operating cycle, whichever is longer. Current liabilities include notes payable, accounts payable, unearned revenues, and accrued liabilities.

Notes Payable

2. Notes payable are obligations in the form of written notes that usually require the borrower to pay interest. Notes due for payment within one year of the balance sheet date are usually classified as current liabilities.

3. When an interest-bearing note is issued, the assets received generally equal the face value of the note: a. During the term of the note, it is necessary to accrue interest expense. b. At maturity, Notes Payable is debited for the face value of the note and Interest Payable is debited for accrued interest.

Sales Taxes Payable

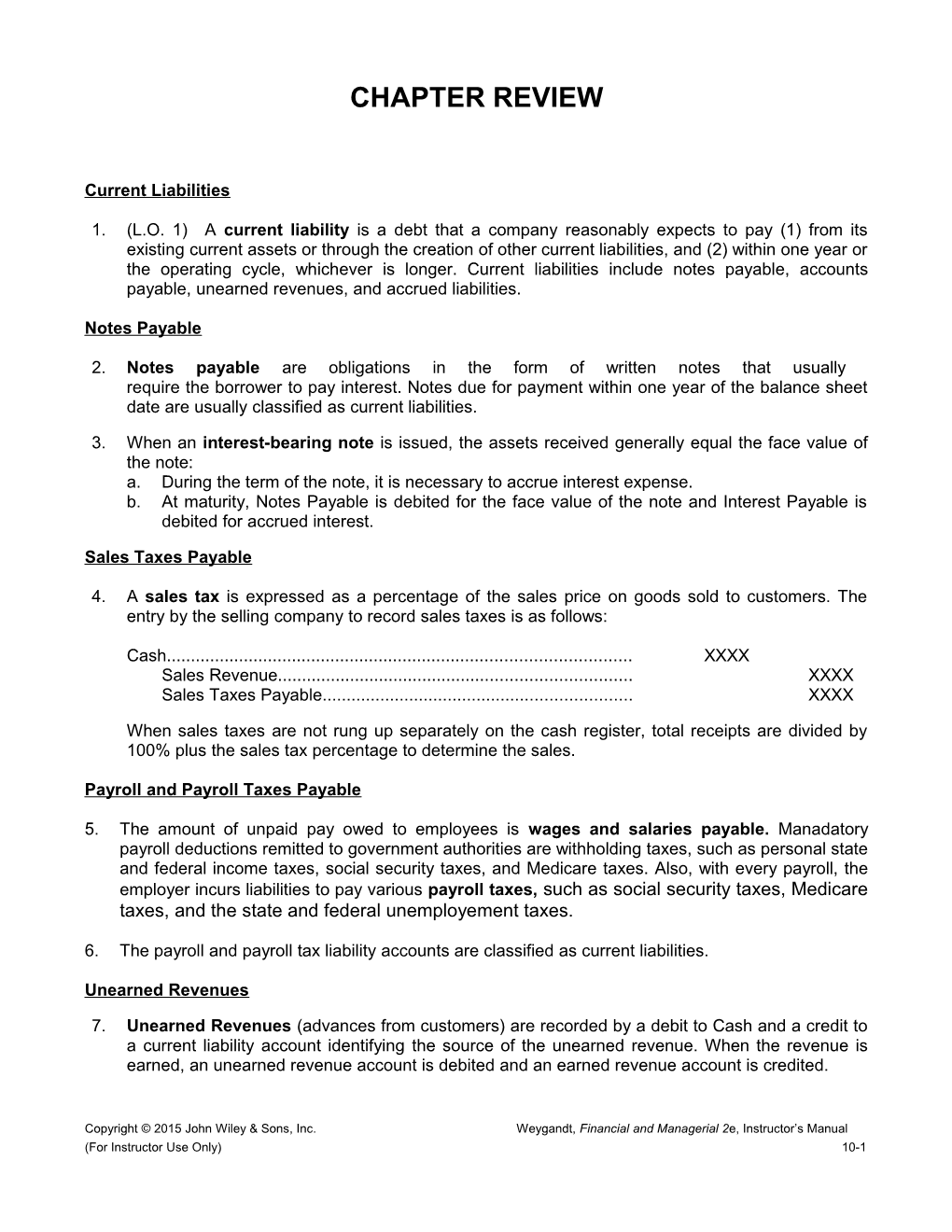

4. A sales tax is expressed as a percentage of the sales price on goods sold to customers. The entry by the selling company to record sales taxes is as follows:

Cash...... XXXX Sales Revenue...... XXXX Sales Taxes Payable...... XXXX

When sales taxes are not rung up separately on the cash register, total receipts are divided by 100% plus the sales tax percentage to determine the sales.

Payroll and Payroll Taxes Payable

5. The amount of unpaid pay owed to employees is wages and salaries payable. Manadatory payroll deductions remitted to government authorities are withholding taxes, such as personal state and federal income taxes, social security taxes, and Medicare taxes. Also, with every payroll, the employer incurs liabilities to pay various payroll taxes, such as social security taxes, Medicare taxes, and the state and federal unemployement taxes.

6. The payroll and payroll tax liability accounts are classified as current liabilities.

Unearned Revenues

7. Unearned Revenues (advances from customers) are recorded by a debit to Cash and a credit to a current liability account identifying the source of the unearned revenue. When the revenue is earned, an unearned revenue account is debited and an earned revenue account is credited.

Copyright © 2015 John Wiley & Sons, Inc. Weygandt, Financial and Managerial 2e, Instructor’s Manual (For Instructor Use Only) 10-1 Current Maturities of Long-Term Debt

8. Another item classified as a current liability is current maturities of long-term debt. Current maturities of long-term debt are often identified on the balance sheet as long-term debt due within one year.

Bonds 9. (L.O. 2) Long-term liabilities are obligations that are expected to be paid after one year. Long-term liabilities include bonds, long-term notes, and lease obligations. 10. Bonds offer the following advantages over common stock: a. Stockholder control is not affected. b. Tax savings result. c. Earnings per share of common stock may be higher. 11. The major disadvantages resulting from the use of bonds are that interest must be paid on a periodic basis, and the principal (face value) of the bonds must be paid at maturity.

Types of Bonds 12. Secured bonds have specific assets of the issuer pledged as collateral for the bonds. A mortgage bond is secured by real estate. 13. Unsecured bonds are issued against the general credit of the borrower; they are also called debenture bonds. 14. A bond secured by specific assets set aside to redeem (retire) the bonds is called a sinking fund bond. 15. Convertible bonds permit bondholders to convert the bonds into common stock at their option. Callable bonds are subject to call and retirement at a stated dollar amount prior to maturity at the option of the issuer. 16. State laws grant corporations the power to issue bonds. a. Within the corporation, formal approval by both the board of directors and stockholders is usually required before bonds can be issued. b. In authorizing a bond issue, the board of directors must stipulate the total number of bonds to be authorized, total face value, and the contractual interest rate (stated rate). c. The terms of the bond issue are set forth in a formal legal document called a bond indenture.

Market Value of Bonds 17. The market value (present value) of a bond is a function of three factors: (a) the dollar amounts to be received, (b) the length of time until the amounts are received, and (c) the market rate of interest. The process of finding the present value is referred to as discounting the future amounts.

Bond Transactions 18. (L.O. 3) The issuance of bonds at face value results in a debit to Cash and a credit to Bonds Payable. a. Over the term of the bonds, entries are required for bond interest. b. At the maturity date, it is necessary to record the final payment of interest and payment of the face value of the bonds.

Copyright © 2015 John Wiley & Sons, Inc. Weygandt, Financial and Managerial 2e, Instructor’s Manual (For Instructor Use Only) 10-2 19. Bonds may be issued below or above face value. a. If the market (effective) rate of interest is higher than the contractual (stated) rate, the bonds will sell at less than face value, or at a discount. b. If the market rate of interest is less than the contractual rate on the bonds, the bonds will sell above face value, or at a premium.

Bond Issues at Discount

20. When bonds are issued at a discount, a. The market rate of interest exceeds the stated rate. b. The discount is debited to a contra account, Discount on Bonds Payable, and it is deducted from Bonds Payable in the balance sheet to show the carrying (or book) value of the bonds. c. Bond discount is an additional cost of borrowing that should be recorded as interest expense over the life of the bonds.

Bond Issues at Premium

21. When bonds are issued at a premium, a. The market rate of interest is less than the stated rate. b. The premium is credited to the account, Premium on Bonds Payable, and it is added to Bonds Payable in the balance sheet. c. Bond premium is a reduction in the cost of borrowing that should be credited to Interest Expense over the life of the bonds.

Bond Redemption and Conversion

22. When bonds are redeemed at maturity and the last interest payment has been recorded, the Bonds Payable account debited and the Cash account credited for the face value of the bond.

23. When bonds are redeemed before maturity it is necessary to (a) eliminate the carrying value of the bonds at the redemption date, (b) record the cash paid, and (c) recognize the gain or loss on redemption.

24. In recording the conversion of bonds into common stock the current market prices of the bonds and the stock are ignored. Instead, the carrying value of the bonds is transferred to paid-in capital accounts and no gain or loss is recognized.

Long-term Notes Payable

25. (L.O. 4) A long-term note payable may be secured by a document called a mortgage that pledges title to specific assets as security for a loan. a. Typically, the terms require the borrower to make installment payments consisting of (1) interest on the unpaid balance of the loan and (2) a reduction of loan principal. b. Mortgage notes payable are recorded initially at face value; each installment payment results in a debit to Interest Expense, a debit to Mortgage Payable, and a credit to Cash.

Statement Presentation and Analysis

26. (L.O. 5) Current liabilities are the first category of liabilities on the balance sheet. a. Usually notes payable are listed first and then accounts payable. b. The other current liabilities are listed in order of magnitude.

Copyright © 2015 John Wiley & Sons, Inc. Weygandt, Financial and Managerial 2e, Instructor’s Manual (For Instructor Use Only) 10-3 27. Long-term liabilities are reported in a separate section of the balance sheet immediately following current liabilities.

28. Debt financing has these advantages over equity financing. a. Stockholder control is not affected. b. Interest expense is deductible, while dividends are not. c. Return on stockholders’ equity may be higher.

29. Liquidity can be measured by comparing current assets to current liabilities in two ways. a. Working capital = Current assets – Current liabilities b. Current ratio = Current assets ÷ Current liabilities

30. Two measures of a company’s debt-paying ability and long-term solvency are: a. Debt to assets ratio = Total liabilities ÷ Total assets b. Times interest earned = (Net income + Interest expense + Tax expense ) ÷ Interest expense

20 MINUTE QUIZ

Circle the correct answer. True/False

1. A liability is always classified as current if it is due in less than one year. True False

2. With an interest-bearing note, the amount of cash received upon issuance of the note will be less than the note’s face value. True False

3. An unearned revenue arises when payment is accepted in advance of the goods or services being provided. True False

4. If the market rate of interest is higher than the contractual rate, the bonds will sell at a premium. True False

5. The amount that must be invested today at current interest rates in order to receive a specified sum of money at a specified date is the present value. True False

6. When bonds are issued at face value, the debit to Cash is equal to the credit to Bonds Payable.

Copyright © 2015 John Wiley & Sons, Inc. Weygandt, Financial and Managerial 2e, Instructor’s Manual (For Instructor Use Only) 10-4 True False

7. Bonds with a higher contractual interest rate than the market rate for similar bonds will probably sell at a discount. True False

8. The sale of bonds above face value causes the total cost of borrowing to be more than the bond interest paid. True False

*9. Under the straight-line method of amortization, the amortization of a bond premium will increase each year over the life of the bond. True False

*10. Under the effective-interest method, the amortization of a bond discount will result in an increasing interest expense each year over the life of the bond. True False

Multiple Choice

1. The account Unearned Subscription Revenue a. is considered a miscellaneous revenue account. b. has a normal debit balance. c. is a contra account to Subscription Revenue. d. is a current liability.

2. The total cost of borrowing on a 10-year, 9%, $1,000 bond that sold for $960 is a. $960. b. $940. c. $860. d. $870.

3. If bonds payable are issued at a discount, the contractual interest rate is a. higher than the market rate of interest. b. lower than the market rate of interest. c. equal to the market rate of interest. d. changed to reflect the market rate of interest.

4. A $2,000,000 bond issue with a carrying value of $2,080,000 is called at 103 and retired. Which of the following is true? a. A gain of $80,000 is recorded. b. A loss of $20,000 is recorded. c. A gain of $20,000 is recorded. d. No gain or loss is recorded.

Copyright © 2015 John Wiley & Sons, Inc. Weygandt, Financial and Managerial 2e, Instructor’s Manual (For Instructor Use Only) 10-5 *5. When the effective-interest method is used, the interest expense for the period is calculated by multiplying the a. face value of the bonds at the beginning of the period by the contractual interest rate. b. carrying value of the bonds at the beginning of the period by the contractual interest rate. c. face value of the bonds at the beginning of the period by the effective-interest rate. d. carrying value of the bonds at the beginning of the period by the effective-interest rate.

ANSWERS TO QUIZ

True/False

1. False 6. True 2. False 7. False 3. True 8. False 4. False *9. False 5. True *10. True

Multiple Choice

1. d. 2. b. 3. b. 4. c. *5. d.

Copyright © 2015 John Wiley & Sons, Inc. Weygandt, Financial and Managerial 2e, Instructor’s Manual (For Instructor Use Only) 10-6