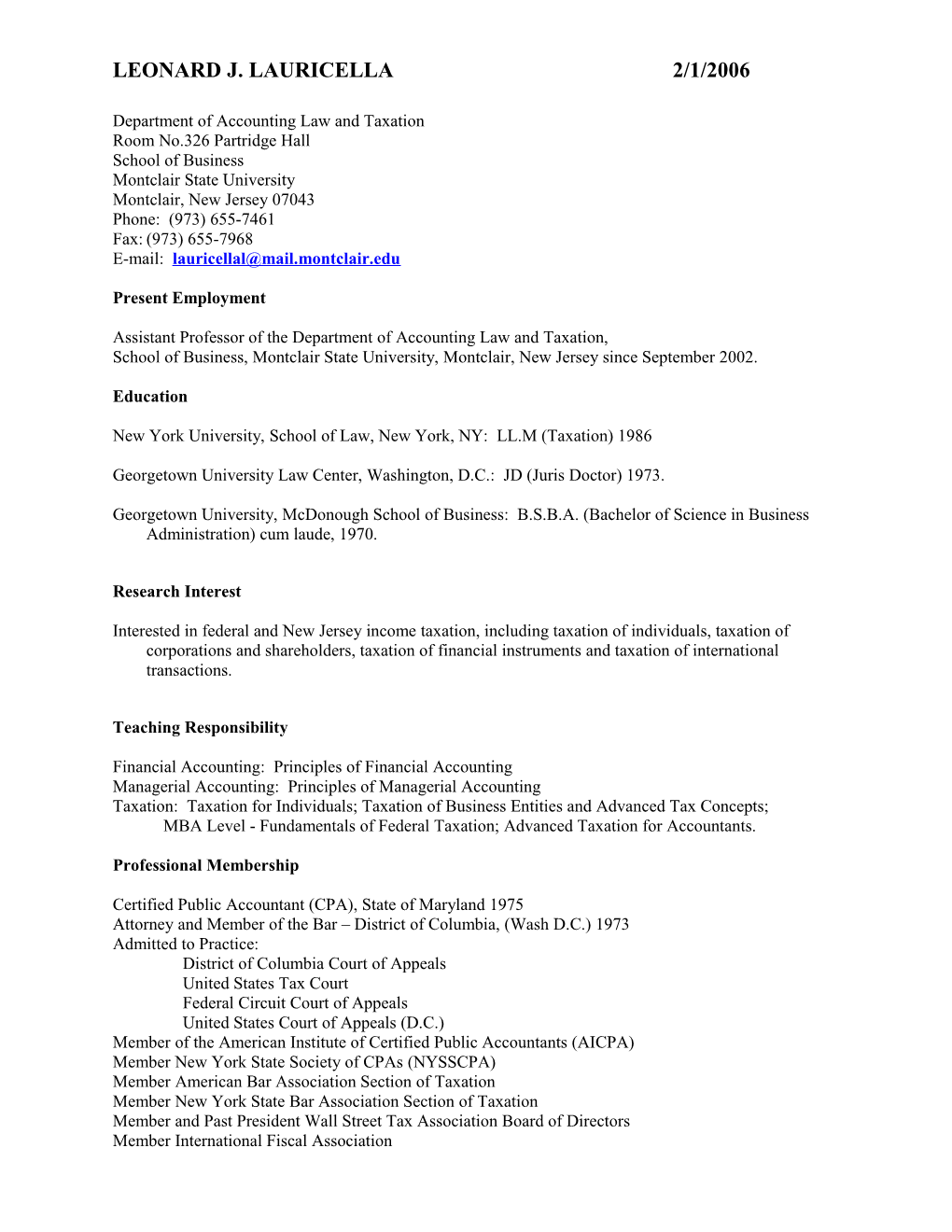

LEONARD J. LAURICELLA 2/1/2006

Department of Accounting Law and Taxation Room No.326 Partridge Hall School of Business Montclair State University Montclair, New Jersey 07043 Phone: (973) 655-7461 Fax: (973) 655-7968 E-mail: [email protected]

Present Employment

Assistant Professor of the Department of Accounting Law and Taxation, School of Business, Montclair State University, Montclair, New Jersey since September 2002.

Education

New York University, School of Law, New York, NY: LL.M (Taxation) 1986

Georgetown University Law Center, Washington, D.C.: JD (Juris Doctor) 1973.

Georgetown University, McDonough School of Business: B.S.B.A. (Bachelor of Science in Business Administration) cum laude, 1970.

Research Interest

Interested in federal and New Jersey income taxation, including taxation of individuals, taxation of corporations and shareholders, taxation of financial instruments and taxation of international transactions.

Teaching Responsibility

Financial Accounting: Principles of Financial Accounting Managerial Accounting: Principles of Managerial Accounting Taxation: Taxation for Individuals; Taxation of Business Entities and Advanced Tax Concepts; MBA Level - Fundamentals of Federal Taxation; Advanced Taxation for Accountants.

Professional Membership

Certified Public Accountant (CPA), State of Maryland 1975 Attorney and Member of the Bar – District of Columbia, (Wash D.C.) 1973 Admitted to Practice: District of Columbia Court of Appeals United States Tax Court Federal Circuit Court of Appeals United States Court of Appeals (D.C.) Member of the American Institute of Certified Public Accountants (AICPA) Member New York State Society of CPAs (NYSSCPA) Member American Bar Association Section of Taxation Member New York State Bar Association Section of Taxation Member and Past President Wall Street Tax Association Board of Directors Member International Fiscal Association Research Publications

“The ROTH 401(k) and Financial Planning Strategies” Sole-author CPA Journal, Vol. 76, No. 5, May 2000.

“Year-End Tax Planning: Wash Sales Aren’t Always Bad.” Sole-author. Tax Notes, Vol. 109, No. 13, December 26, 2005.

“How Far Does the Tax Benefit Rule Go in New Jersey?” Sole-author. State Tax Notes, Vol. 38, No. 3, October 10, 2005.

“Harvesting Capital Losses For New Jersey Individual Tax Savings.” Sole-author. State Tax Notes, Vol. 34, No. 4, October 25, 2004.

“Microsoft’s Huge Dividend May Be Extraordinary.” Sole-author. Journal of Taxation, Vol. 101, No. 3, September 2004.

“Foreign Withholding Tax and the 15% Rate on Dividends.” Sole-author. International Tax Journal, Vol. 30, No. 4, Fall 2004.

“Nonresident Aliens: Interplay Between the Net operating Loss and Taxable Income.” Sole-author. The Tax Advisor, Vol. 14, No. 9, September 1983.

“Optimizing Reduced Dividend Tax and Investment Interest Deduction.” Co-authored with James Yang, and Zu-Hsu Lee (Forthcoming in The National Accounting Journal)

Working Paper Under Review

“Tax And Investment Strategies Under Reduced Dividend Tax.” Co-authored with James G.S. Yang, Zu-Hsu Lee, and Beixin Lin. (Under review with Journal of Business and Economics)

Conference Proceedings and Discussions

Proceeding: “Jobs Growth Tax Relief and Reconciliation Act of 2003.” 30th Annual Conference Northeast Business & Economics Association 2003 held at Parsippany, New Jersey.

Academic and Teaching Experience

Assistant Professor Montclair State University School of Business, Department of Accounting Law and Taxation, Montclair, New Jersey.

Adjunct Assistant Professor, Baruch College, Zicklin School of Business, New York, New York, 2000- 2001

Adjunct Professor of Taxation, New York University Stern School of Business Graduate Division, New York, New York, 1982-1999

Instructor of Accounting, Georgetown University, McDonough School of Business, Washington, D.C. 1972. Prior Work Experience

Lehman Brothers Inc. (New York, NY) 1998 – 2002 Senior Vice President, Global Director of Taxes Global Tax Director responsible for tax consequences of all transactions affecting international investment bank. In charge of Tax Department comprised of 34 members in the United States and 14 members overseas.

1984 – 1998 Senior Vice President, Tax Research and Planning Managed both domestic and international tax research and planning. Issues included taxation of financial products, corporate taxation, consolidated returns, partnerships, foreign tax credit planning, international and domestic compensation plans and payroll tax. Analyzed new and proposed legislation, regulations and cases, and worked closely with congressional liaison. Represented Lehman Brothers at professional and industry association committee meetings. Managed staff of five Attorneys/CPAs and two MBA candidates. In charge of tax library.

KMG Main Hurdman (CPA Firm now part of KPMG), New York, NY 1981 – 1983 Tax Manager (New York, NY) Managed a full service tax planning, research, IRS audit and compliance function for clients from small closely held companies to multinational enterprises. Extensive experience in international tax, including inbound and outbound planning, and expatriate taxation and compensation. Duties included all technical tax aspects, plus recruiting, training, supervision and evaluation of staff. Public speaker at several client and outside tax conferences.

1976 – 1980 Tax Supervisor/Manager (London, England) In charge responsibility for U.S. personal and corporate tax, and coordination of foreign tax function involving clients in Europe.

1973 – 1976 Tax Staff/Senior (Washington D.C.) Tax research and compliance for Manager-In-Charge of National Tax Office, and corporate and individual local practice clients.