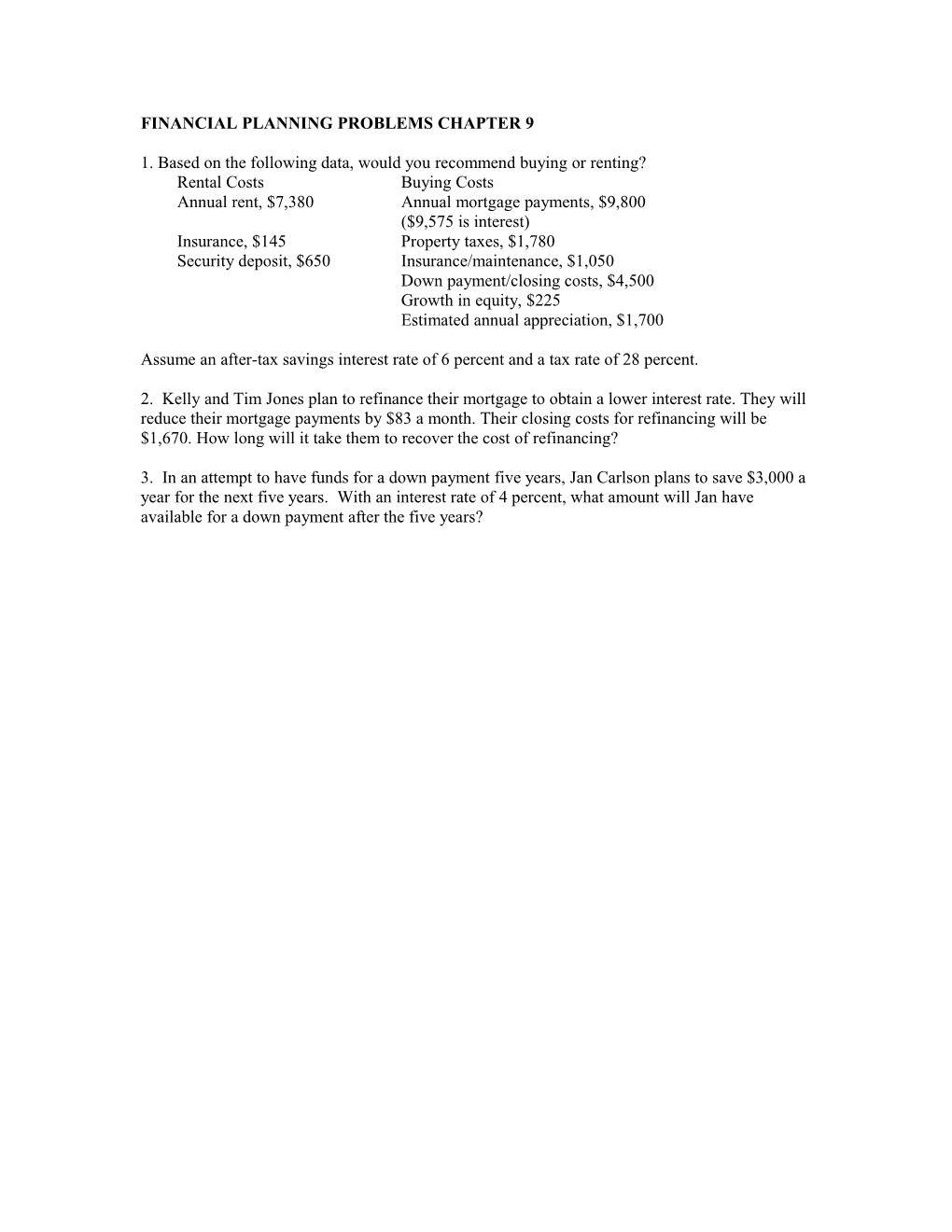

FINANCIAL PLANNING PROBLEMS CHAPTER 9

1. Based on the following data, would you recommend buying or renting? Rental Costs Buying Costs Annual rent, $7,380 Annual mortgage payments, $9,800 ($9,575 is interest) Insurance, $145 Property taxes, $1,780 Security deposit, $650 Insurance/maintenance, $1,050 Down payment/closing costs, $4,500 Growth in equity, $225 Estimated annual appreciation, $1,700

Assume an after-tax savings interest rate of 6 percent and a tax rate of 28 percent.

2. Kelly and Tim Jones plan to refinance their mortgage to obtain a lower interest rate. They will reduce their mortgage payments by $83 a month. Their closing costs for refinancing will be $1,670. How long will it take them to recover the cost of refinancing?

3. In an attempt to have funds for a down payment five years, Jan Carlson plans to save $3,000 a year for the next five years. With an interest rate of 4 percent, what amount will Jan have available for a down payment after the five years?