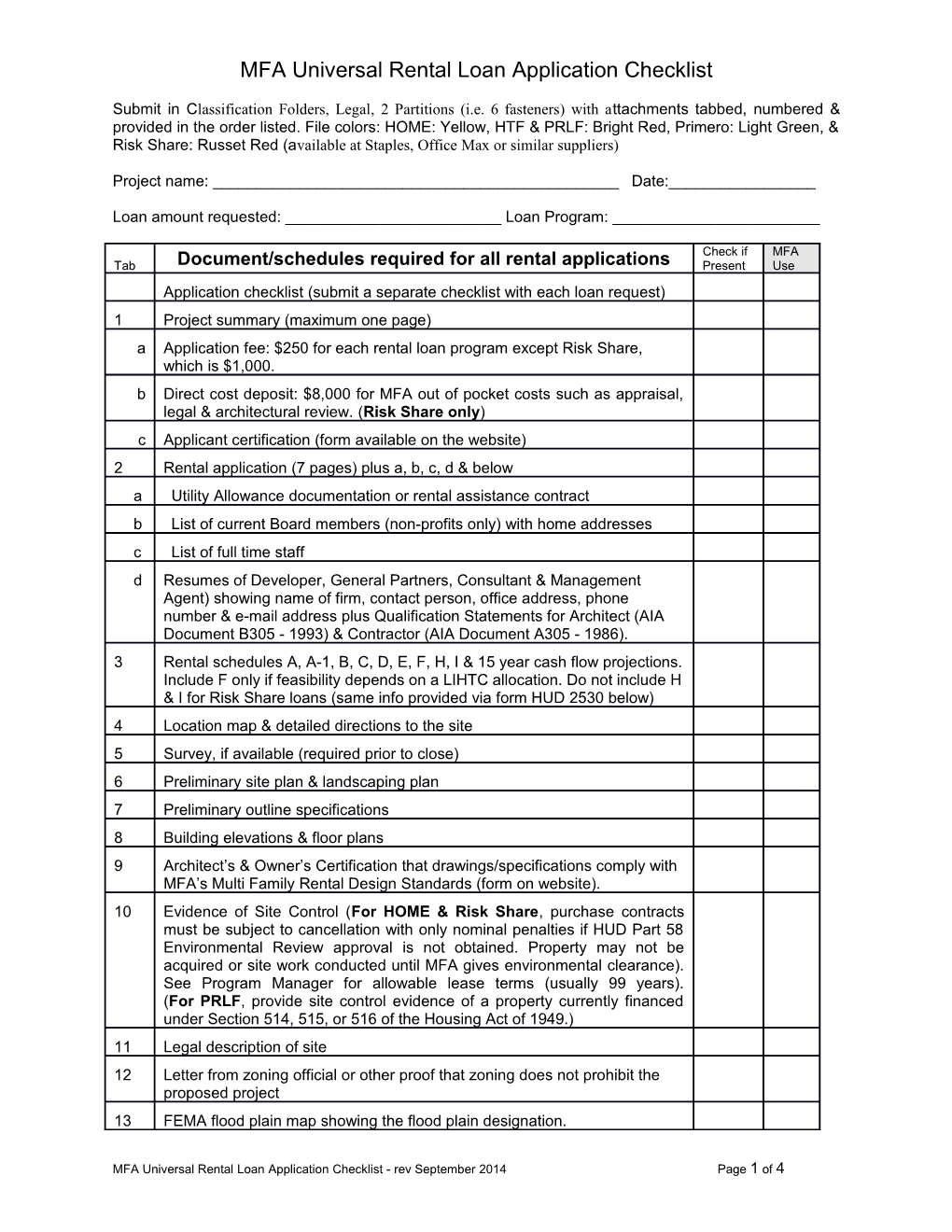

MFA Universal Rental Loan Application Checklist

Submit in Classification Folders, Legal, 2 Partitions (i.e. 6 fasteners) with attachments tabbed, numbered & provided in the order listed. File colors: HOME: Yellow, HTF & PRLF: Bright Red, Primero: Light Green, & Risk Share: Russet Red (available at Staples, Office Max or similar suppliers)

Project name: ______Date:______

Loan amount requested: ______Loan Program: ______

Check if MFA Tab Document/schedules required for all rental applications Present Use Application checklist (submit a separate checklist with each loan request) 1 Project summary (maximum one page) a Application fee: $250 for each rental loan program except Risk Share, which is $1,000. b Direct cost deposit: $8,000 for MFA out of pocket costs such as appraisal, legal & architectural review. (Risk Share only) c Applicant certification (form available on the website) 2 Rental application (7 pages) plus a, b, c, d & below a Utility Allowance documentation or rental assistance contract b List of current Board members (non-profits only) with home addresses c List of full time staff d Resumes of Developer, General Partners, Consultant & Management Agent) showing name of firm, contact person, office address, phone number & e-mail address plus Qualification Statements for Architect (AIA Document B305 - 1993) & Contractor (AIA Document A305 - 1986). 3 Rental schedules A, A-1, B, C, D, E, F, H, I & 15 year cash flow projections. Include F only if feasibility depends on a LIHTC allocation. Do not include H & I for Risk Share loans (same info provided via form HUD 2530 below) 4 Location map & detailed directions to the site 5 Survey, if available (required prior to close) 6 Preliminary site plan & landscaping plan 7 Preliminary outline specifications 8 Building elevations & floor plans 9 Architect’s & Owner’s Certification that drawings/specifications comply with MFA’s Multi Family Rental Design Standards (form on website). 10 Evidence of Site Control (For HOME & Risk Share, purchase contracts must be subject to cancellation with only nominal penalties if HUD Part 58 Environmental Review approval is not obtained. Property may not be acquired or site work conducted until MFA gives environmental clearance). See Program Manager for allowable lease terms (usually 99 years). (For PRLF, provide site control evidence of a property currently financed under Section 514, 515, or 516 of the Housing Act of 1949.) 11 Legal description of site 12 Letter from zoning official or other proof that zoning does not prohibit the proposed project 13 FEMA flood plain map showing the flood plain designation.

MFA Universal Rental Loan Application Checklist - rev September 2014 Page 1 of 4 MFA Universal Rental Loan Application Checklist

Check if MFA Tab Document/schedules required for all rental applications Present Use 14 Local Jurisdiction Support Letter signed by the Chief Elected Official (or local equivalent) of the jurisdiction where the project is located 15 Market study, if available at application, or other proof of demand as determined necessary by MFA (required prior to loan approval) 16 Phase I Environmental Site Assessment (ESA) (include Phase II, if there is one) updated if more than six months older than application date. For rehabilitation (rehab) projects built prior to 1978 the ESA must include a lead based paint (LBP) assessment by a certified LBP risk assessor or LBP technician (if LBP is found, additional requirements will apply). For rehab/demolition (regardless of the year built) an asbestos inspection by an inspector licensed under EPA AHERA or licensed by another state is required (if asbestos is found, additional requirements will apply) 17 Geotechnical/Soils Report, if available (new construction only) May be requested for loans where MFA is the primary construction lender. 18 General Contractor contract, if available (required prior to close) 19 Capital Needs Assessment (rehabs only) acceptable to MFA updated if more than six months older than application date. The assessment must include a 20 year replacement reserve analysis. Project scope must include all recommended rehab work. Projections must incorporate recommended annual replacement reserves. 20 Letters of interest (LOI) or Financing Commitments, if available (commitments required prior to close). For projects with 9% or 4% LIHTC, an LOI from an experienced LIHTC investor is required at application. 21 Financial Statements: Borrower: N/A if the proposed Borrower is a new entity with no history, however, for rehabs of existing projects, provide statements of the existing operating entity. Non-Profits & Housing Authorities (includes Tribally Designated Housing Entities (TDHE)): Audits for the previous two fiscal year ends (unaudited acceptable for the most recent fiscal year if the audit is not yet available) & current YTD financial statement dated within 3 months of the application. For-Profits Entities : Same as above except that CPA reviewed statements are acceptable if there are no audits. Owner: Defined as the ultimate owner with the financial capacity to own and manage affordable housing. Same requirements as above. N/A for newly formed or pass-through entities & limited partners/investor members. Guarantors: Guaranties acceptable to MFA are required if funds are to be used during construction (may be released after completion). Requirements are the same as for Borrower. If audits or CPA Reviewed statements are not available then MFA may allow individual guarantees. Submit the last 2 years of federal tax returns (include any filing extensions) with all schedules, attachments & K-1s, and Personal Financial Statement (HUD form 92417 or equivalent) signed & dated within 90 days of application date (show contingent liabilities) 22 Appraisal, if available.

Organizational Documents of Borrower/Owner/Guarantor

MFA Universal Rental Loan Application Checklist - rev September 2014 Page 2 of 4 MFA Universal Rental Loan Application Checklist

if available at application (required prior to close) 23 Certificate of Incorporation or similar document for LLCs, Partnerships or Tribally Designated Housing Entities 24 Articles of Incorporation or similar document for LLCs, Partnerships, or Tribally Designated Housing Entities 25 By Laws or similar document for LLCs, Partnerships, or Tribally Designated Housing Entities 26 Certificate of Good Standing from the NM Public Regulation Commission if a corporation or LLC 27 Certificate of Existence from the NM Secretary of State if a partnership 28 IRS Designation Letter Verifying 501(c)(3) or (4) Tax Exempt Status under Code Section 501(a), (if applicable) 29 Evidence of current registry with the New Mexico Attorney General’s Office’s Registry of Charitable Organizations (non-profits only) Program Specific Information 30 If applying for Green Building points per NOFA Exhibit A item #5 Ranking Criteria, applicant must provide a certification from the relevant provider (e.g. LEED, Enterprise, etc.) stating that the certification to which it is committing is attainable according to its preliminary plans and specifications. The LIHTC certification is acceptable. HTF only 31 Completed Exhibit A of NOFA with self-score and signed criterion #5 (if seeking Green Building points) HTF only 32 Relocation requirements (rehabs only): At the time of application (1) Copy of the General Information Notice (GIN) that was mailed to tenants, (2) A copy of the Rent Roll for the month the GIN was issued and (3) a copy of the Relocation Plan in accordance with the Uniform Relocation Act (URA). See http://www.housingnm.org/uniform-relocation-act. Prior to submitting an application call the MFA Program Specialist for guidance. HOME only 33 HUD Part 58 Environmental Review compliance documents as requested by MFA (may be submitted post application but must be approved prior to funding, land purchase, and/or site work). Complete MFA Environmental Checklist with attachments. HOME & Risk Share only See http://www.housingnm.org/environmental-review for guidance. 34 Form RD 1940-20 “Request for Environmental Information” completed and signed by the applicant. Attach a statement stipulating the age of the building to be rehabilitated and a completed and signed FEMA Form 81-93 “Standard Flood Hazard Determination”. If the building is over 50 years old, it is on the National Register of Historic Places, or it is within a 100 year flood plain MFA will contact RD to determine what additional steps are needed to determine environmental eligibility. PRLF only 35 If applicant has any USDA projects in non-compliance submit the agency approved workout plan. PRLF only Provide the below for 542(c) Risk Share loans only 36 Previous Participation Certification form HUD-2530 for all entities required on page 2 of the form. This generally means that general partners managing members, construction company & management agent. Most management agents file via HUD’s electronic system. If an entity plans to file electronically it is not necessary to submit a paper form 2530. For

MFA Universal Rental Loan Application Checklist - rev September 2014 Page 3 of 4 MFA Universal Rental Loan Application Checklist

passive investors or tax credit investors HUD will accept an LLCI letter instead of a 2530. See Program Manager for guidance. Fillable form 2530 available on website. Please include an ownership chart in the application. 37 Copy of proposed management agent contract allowing termination upon 30 days’ notice, without penalty and with or without cause, upon written request by Lender to Borrower (MFA must approve) 38 Written verification the proposed management agent is operating under the authority of a Qualified Broker licensed for the State of New Mexico (MFA must confirm) 39 Form HUD 9839-B Project Owner’s/Management Agent’s Certification signed by general partner(s)/managing member(s) and management agent (MFA must approve) 40 Form HUD 9832 Management Entity Profile (signed by management agent) 41 Form HUD 935.2A Affirmative Fair Housing Marketing Plan (AFHMP), signed by general partner(s)/managing member(s) and/or management agent; all required documentation, per AFHMP instructions must be attached (MFA must approve) 42 Form HUD 92010 Equal Opportunity Certification signed by general partner(s)/managing member(s) and management agent 43 Authorization for Inspection by MFA and HUD signed by the general partner(s)/managing member(s) (form available on the website) 44 Mortgagor Certification of Loan Guarantees signed by general partner(s)/managing member(s) (form available on the website) 45 For tax exempt bonds requested of MFA without Low Income Housing Tax Credits (LIHTC only: “Supplemental Information Fact Sheet for NM State Board of Finance Submission”. If applicable, contact the MFA Bond/LIHTC Program Manager for the form. 46 Prior to final close of permanent loan MFA will require As-Built plans drawings so that the MFA architect can perform a final inspection and confirm that the project was built to the specification of the Architect’s & Owner’s Certification (see #9) above. Standard Form of Agreement Between Owner & Architect AIA #B-141 or 47 B109 – 2010 for a multi-family residential or mixed use residential project. Letters of utility availability (new construction only) for water, sewer, gas 48 and electricity. Other Information Submitted

MFA Universal Rental Loan Application Checklist - rev September 2014 Page 4 of 4