The University of North Carolina at Greensboro - Bryan School of Business and Economics Federal Tax Concepts (ACC 420) – Fall 2010

Dr. Bill Harden, Ph.D., CPA, ChFC Office Hours: Office: 384 Bryan Bldg. MW 1:00 – 2:00 Phone: 256-0188 T 5:00 – 6:00 e-mail: [email protected] or by appointment

REQUIRED TEXTS & SOFTWARE:

1 1. Prentice Hall’s Federal Taxation 2011 Comprehensive, by Pope, Anderson, and Kramer. 2 3 2. Federal Income Tax: Code and Regulations -- Selected Sections (2010-2011 edition) published by CCH, Martin Dickinson, editor. 4 5 3. Tax Preparation software for 2009 returns (optional) - any package such as Turbo Tax, H&R Block At Home, or Tax Act is sufficient - need Federal only and basic only package (not deluxe or business)

PREREQUISITE: ACC 318, Intermediate Accounting I, or equivalent with grade of C or better

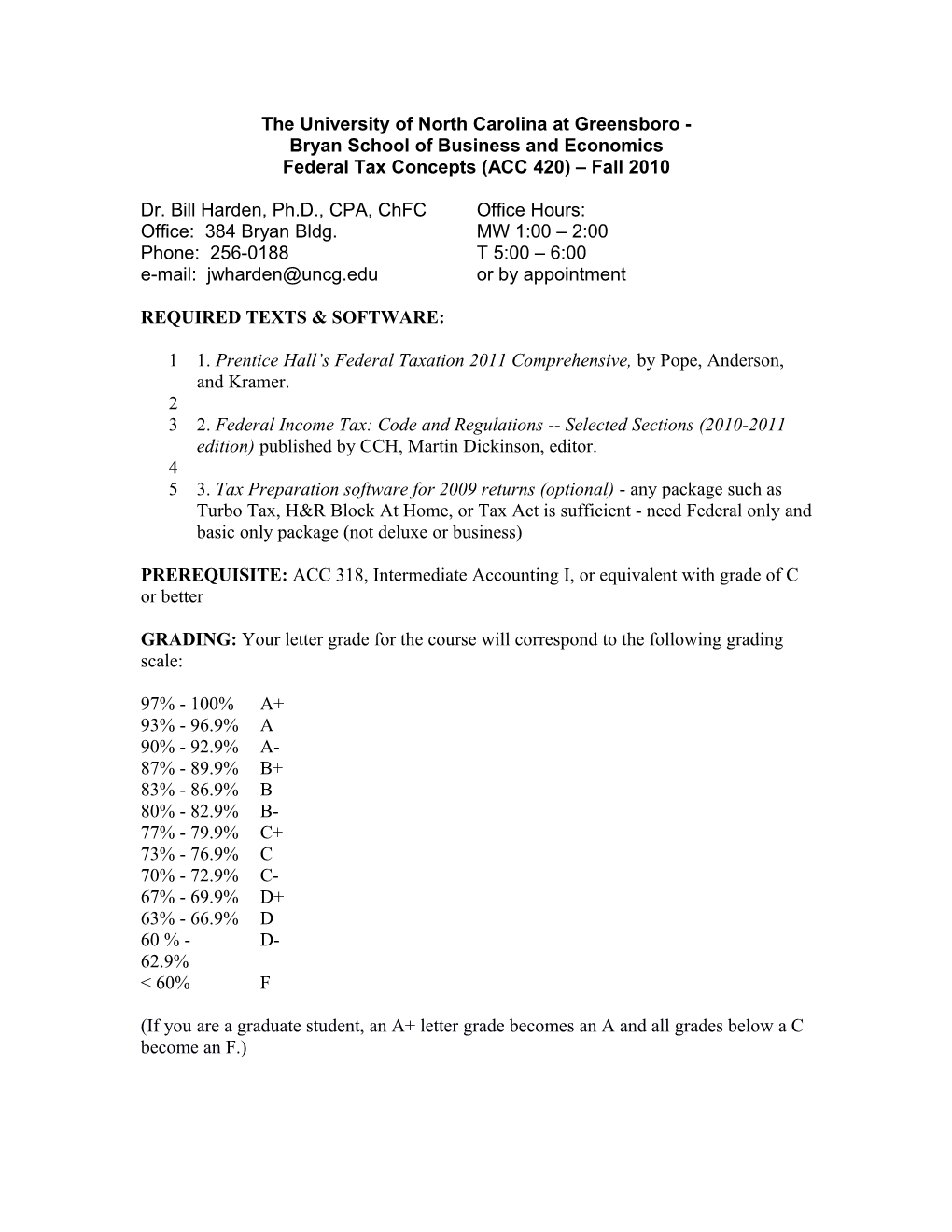

GRADING: Your letter grade for the course will correspond to the following grading scale:

97% - 100% A+ 93% - 96.9% A 90% - 92.9% A- 87% - 89.9% B+ 83% - 86.9% B 80% - 82.9% B- 77% - 79.9% C+ 73% - 76.9% C 70% - 72.9% C- 67% - 69.9% D+ 63% - 66.9% D 60 % - D- 62.9% < 60% F

(If you are a graduate student, an A+ letter grade becomes an A and all grades below a C become an F.) GRADING:

Three Examinations (20,20,30%) 70% Tax Return Problems 20% (see below) Homework and Class Part. 10% (see below) Total points 100%

COURSE OBJECTIVES: To provide students a basic knowledge of tax structure and the fundamental skills for decision making regarding tax compliance and planning at the individual taxpayer level.

ACADEMIC INTEGRITY: Students are expected to abide by the UNCG Academic Integrity Policy. All examinations are expected to be done honestly and by your own efforts. As much can be learned through discussions with each other, I encourage students to discuss graded projects and assignments with other students, but the final result for all of these should be each student's own work.

EXAMS: Exams are a combination of multiple choice and problems/essays. Students are allowed to bring code book and a summary sheet to the exams.

CLASS PARTICIPATION: Class discussion and exchange of ideas is greatly encouraged in this course. An explicit incentive is built into the course grading scheme for participation. Students are expected to be prepared and engage in class discussion by asking questions and responding to material presented. This places the responsibility on the student for his/her own learning. The results of these efforts should be reflected in better performance on the individual exams and the research assignments. HOMEWORK: Homework is essential to success and survival in this course. For each chapter there will be homework problems assigned. These assignments reflect the material covered in the chapter and will reinforce learning if students discipline themselves to work the problems prior to coming to class. Homework problems will be selectively taken up throughout the semester. Students are expected to be prepared with solutions by the date the problem is listed on the schedule. You may always check solutions to the assigned problems in my office during office hours. Also, I will be happy to talk with you about other matters during regularly scheduled office hours or by appointment. The result of successful completion of the homework assignments should result in better performance on the exams and other assignments. In order for the student to be successful in this course, one must view and use the textbook as but only one source among many to achieve the goals outlined above.

CLASS LECTURES: The format for class meetings will generally be used to present chapter material, answer student questions about subject matter, and go over homework assignments about which students have specific questions. This time should be viewed as an opportunity to interact with the instructor and others in the class to gain insight into tax matters covered in the text. There is a lot of material in the text and due to time constraints, not all of which will be specifically covered in class. The student must take responsibility for his/her own learning by reading the material in the chapter, preparing the homework assignments prior to coming to class, and by participating in class discussion on the relevant topics.

TAX RETURNS: You will be required to complete tax return problems. You may work in two-person groups to complete the assignment. If software is used, it is the responsibility of the student to be familiar with its use. Alternatively, you may complete the return on IRS Forms that can be obtained from the IRS web site or the IRS District Office located here in Greensboro. This assignment is intended to get you to put all the information that you have learned over the course together in an integrative fashion to enhance your overall understanding of important tax concepts and the applications of those concepts in a practical manner. Completion of the tax return will reinforce the material in the chapters and information gathered elsewhere (i.e., Internet, tax research, etc.). The tax return will be due on the date listed on the attached assignment schedule. Late assignments will not be accepted for any reason.

You may not seek advice or provide assistance from/to anyone else or from any other group member, the IRS, tax professionals, etc. Questions should be referred to the professor of the class. You are to attach a statement to this effect on the face of the completed return. You may self-select the group member you want to work with on the project. I suggest you do this soon after the semester begins so that you may collaborate with this person in other class matters that arise. The tax return will be graded on several dimensions including accuracy, completeness, neatness, and correctness.

USE OF COURSE WEB SITE: Materials for this course are available on the University's Blackboard site at: https://blackboard.uncg.edu You are responsible for checking this site for announcements, power point slides, and other materials relevant to the course. You are also expected to be checking your UNCG email regularly.

POLICIES:

1. This is a seminar class, therefore attendance is crucial. Late work will not be accepted. I reserve the right to drop students after two unexcused absences. Also, beginning with the second unexcused absence, any additional unexcused absences will result in your final average being reduced by 1 point for each unexcused absence. If you must miss a class, you may turn in the assignment early.

2. Students are expected to take the exams as scheduled. If you have an emergency, you must notify me before the exam, and only university excused absences will be accepted. You will be expected to provide verification of the emergency before a make-up will be scheduled.

3. Attendance will be taken at the beginning of each class and will count as part of your participation grade.

4. Homework will be taken up on an unannounced basis throughout the semester and will be graded for effort.

5. IF YOUR CELL PHONE GOES OFF DURING AN EXAM YOUR PAPER WILL BE COLLECTED AT THAT POINT AND YOU WILL NOT BE ALLOWED ADDITIONAL TIME TO COMPLETE YOUR EXAM.

6. Late work will not be accepted.

7. The complete Bryan School faculty and student guidelines can be references at: http://www.uncg.edu/bae/faculty_student_guidelines.pdf

TENTATIVE SCHEDULE

DATE TOPIC ASSIGNMENT

Aug. 24 Intro, Ch. I1-Introduction to Taxation

31 Ch. C1--Tax Research

Sept. 7 Ch. I2—Determination of Tax 3,4,5,7,21,22,29,30,33,35,43,44,52

14 Ch. I3—Gross Income: Inclusions 12,24,25,34,35,44,45 21 EXAMINATION #1

28 Ch. I4—Gross Income: Exclusions 6,9,10,13,15,16,33,35,39,40,44,47

Oct. 5 Ch. I6—Deductions and Losses 1,2,3,4,6,8,9,10,11,13,15,27,33,34,35,53, 55

12 Fall Break

19 Ch. I7—Itemized Deductions 1,11,14,18,19,21,38,40,45,47,50,53

26 Ch. I10—Depreciation, Cost Recovery 1,4,6,16,28,29,31,32,35,39

Nov. 2 EXAMINATION #2

9 Ch. I8—Losses and Bad Debts 9,25,30,43,44,48,52,54,55,59

16 Ch. I9—Employee Expenses and 1,4,28,30,42,53,54,62,64,67 Deferred Compensation

23 Ch. I5-Property Transactions: Capital 2,4,6,15,35,37,40,44,49,57,59 Gains and Losses

30 Ch. I14-Special Tax Computation 1,11,20,24,45,46,50,51,59 Methods, Tax Credits and Payments

Dec. 7 Reading Day

14 FINAL EXAM (7:00 - 10:00)

Note that this schedule is tentative and subject to change at the discretion of professor.