1

CORPORATIONS Professor Bradford

December 6, 2005 9:00 a.m.

3 Hours and 20 Minutes

INSTRUCTIONS

General Instructions

1. This is a closed-book exam. You may not consult any sources other than the statutes and regulations furnished with the exam, and you may not consult with or communicate with any other person during this exam. If you have any books, notes, briefcases, book bags, or other items, you must bring them to the front of the room now. You may not take any of these items to another designated exam room.

2. This exam has eight (8) pages, including the instructions. The page numbers appear on the top right-hand corner of each page. Please check to be sure that this copy has all the pages.

3. You have three hours and twenty minutes (3:20) to complete the exam. You must turn in your answers in the designated room, even if you are taking the exam somewhere else. If you finish more than five minutes early, you may turn in your answers in the Dean’s Office.

4. The exam consists of five (5) questions. The recommended time for each question is as follows:

Question 1………………..35 Minutes Question 2………………..35 Minutes Question 3………………..25 Minutes Question 4…………….….35 Minutes Question 5………………..70 Minutes

5. Do not spend all of your time writing. Think about the issues and organize your answers before writing. Be concise. Be organized. Long, disorganized, rambling answers will be penalized.

6. For each question, assume, unless the facts of the question indicate otherwise, that the Revised Uniform Partnership Act, the Revised Uniform Limited Partnership Act, the Uniform Limited Liability Company Act, and the Revised Model Business Corporation Act apply. 2

7. If one of the statutes we have studied applies, cite the relevant sections and subsections and explain how those provisions apply to the facts of the problem.

8. If you believe that additional facts are needed to answer a question, state exactly what those facts are and how they would affect your answer. If you believe that a question is ambiguous or unclear, note the ambiguity or lack of clarity and indicate how it affects your answer.

9. You may take the exam in this room, in another designated room, or in the computer lab if you are not using your own computer.

10. The Honor Code is in effect.

11. Good luck and have a pleasant holiday.

Instructions Concerning Taking the Exam on a Computer

12. You must take the exam on a computer that has the latest version of the Exam 4 software installed. If you have not previously installed the Exam 4 software, please notify the exam administrator immediately.

13. Be sure to enter your exam number in the Exam ID field. (Do not use your NU Card ID number or your social security number. You will be required to enter your exam number twice. Select the course name from the drop-down box. Be sure you find the folder for this course, because that is where your exam will be stored. Verify that the information is correct just before you select “Begin Exam” on screen 6.

14. Do not worry about headers, footers, page numbers, or double spacing your exam; the software does all that for you when the exam is printed.

15. When you are finished, please submit your exam electronically. A pop-up box will show the status of your exam. It should show a black bar with 100% in it and a message that says, “Your file has been successfully stored.” If you do not get this message, please see Vicki in the Registrar’s office immediately.

16. If you have any technical problems during the exam, please report them immediately to the Dean’s Office; we will assume you had no technical problems until when you reported them. Be prepared to finish your exam by writing it. (Regular notebook paper is O.K.)

DO NOT TURN THIS PAGE UNTIL YOU ARE GIVEN THE SIGNAL TO BEGIN. 3

Question One (35 Minutes)

Compare and contrast the standard that would be used by the Delaware courts in reviewing the following two decisions. If the standard of review differs in the two situations, discuss whether that difference makes sense.

Decision 1: Board Approval of Contract. Numero, Inc., a Delaware corporation, has five directors—Uno, Dos, Tres, Quatro, and Cinco. By a 5-0 vote, the board of directors of Numero approves a major contract between Numero and a partnership formed by Uno, Dos, and Tres. Prior to the vote, Uno, Dos, and Tres fully disclose their conflict of interest and all material information concerning the transaction. Quatro and Cinco have no personal interest in the contract and are independent of Uno, Dos, and Tres.

Decision 2: Committee Recommendation of Dismissal. After the contract is approved, a shareholder brings a derivative action against the Numero directors claiming that their approval of the contract breached their fiduciary duties to Numero. Demand is excused because a majority of the Numero directors are interested. After the action is filed, the board appoints Quatro and Cinco to a special litigation committee to examine the claim. After a full investigation, Quatro and Cinco determine it is in the best interests of Numero that the action be dismissed. The corporation files the special committee report with the court and moves to dismiss the derivative action. As before, Quatro and Cinco have no personal interest in the contract and are independent of Uno, Dos, and Tres. 4

Question Two (35 Minutes)

Cher Chien owns 50 common shares of Sansgout Corporation, a Delaware corporation. Sansgout has one million outstanding common shares; they are traded on the American Stock Exchange. The current trading price is $50 a share.

Sansgout has a number of different businesses, all related to food. One of its divisions sells food additives—dyes, flavors, and preservatives that are added to packaged foods. The food additive division of Sansgout constitutes 2% of its total assets. Last year, the food additive division was responsible for 4.5% of Sansgout’s gross sales and 6% of its net earnings.

Before being added to foods intended for human consumption, additives must be tested for safety. Sansgout tests its additives on dogs and cats. This testing sometimes results in the death of the animals. No other divisions of Sansgout do any animal testing.

Chien, in addition to being a Sansgout shareholder, is the president of No-Harm!, a national animal rights advocacy group. Two years ago, Chien submitted a proposal relating to animal rights for inclusion in Sansgout’s proxy statement. The proposal, which recommended that Sansgout’s board study alternatives to animal testing of food additives, only received 2% of the shareholder vote. Nevertheless, Sansgout did study the possibility of non-animal testing and concluded that it was not feasible.

This year, Chien submitted another proxy proposal. This proposal recommends the Sansgout board study whether less cruel methods are available to test food additives.

Assume Chien’s request was timely. Discuss whether Sansgout must include Chien’s proposal in its proxy statement. 5

Question Three (25 Minutes)

Hunchback, LLC., is a manager-managed limited liability company organized in a state that has adopted the Uniform Limited Liability Company Act. Its manager, Victor, owns a 40% interest in the company. The other three members, Quasimodo, Esmerelda, and Phoebus, each own a 20% interest.

Hunchback is in the business of selling recorded DVDs and CDs to rental stores. Two months ago, Quasimodo and Esmerelda formed a competing DVD/CD business and began selling to BlockBust, one of Hunchback’s existing customers.

Hunchback’s operating agreement contains the following provisions:

“4. Voting Rights of Members.

4.1 Actions requiring unanimous approval. The following actions shall require the unanimous approval of all Members:

[A list follows that has no application here.]

4.2 Actions requiring majority approval. The following actions shall require the approval of a majority of the Members:

[A list follows that has no application here.]

5. Powers of Manager. Except as provided in ¶ 4, the Manager shall have all authority to make decisions and act on behalf of Hunchback, and other Members shall have no right to interfere with the Manager’s decisions.

6. Duties of Members. In exercising their rights under this Operating Agreement, Members shall act with due care and in the best interests of Hunchback, LLC.”

Nothing else in Hunchback’s operating agreement is relevant to this question.

Discuss whether Quasimodo and Esmerelda are liable to Hunchback and the other members of the LLC. 6

Question Four (35 Minutes)

Bert and Ernie are close friends. Bert is the owner of Bert’s Construction, a sole proprietorship.

On December 1, Ernie stopped by to visit Bert at one of Bert’s job sites. During their conversation, Ernie got cold, so Bert loaned Ernie one of the Bert’s Construction uniform jackets that all of his workers are required to wear.

“How are things going, Bert?,” Ernie asked.

“Not great right now,” Bert replied. “I had to send my forklift to the shop for repairs and it’s taking too long. We’re bogged down waiting. I wish I had another forklift. If I wasn’t stuck here at the job site, I would go rent one.”

“No problem, Bert,” Ernie responded. “I’ll go rent one for you.”

Bert said nothing as Ernie walked away, still wearing the uniform jacket.

Ernie went to the nearest equipment rental store. “I need to rent a forklift for one day for Bert’s Construction,” Ernie told the person at the counter. The rental store employee saw Ernie’s jacket and assumed Ernie was an employee of Bert’s. Bert’s had sent employees to the store before to rent equipment.

Ernie agreed to a rental fee of $500 a day, payable on return of the forklift, and signed a rental contract as follows:

“Lessee: Bert’s Construction By: Ernie.”

When the rental company delivered the forklift to the work site, Bert’s forklift had already been repaired, so Bert refused to accept the rental. Bert has refused to pay the forklift company the contractual minimum of $500.

Discuss whether Bert is liable on the rental contract. (Do not discuss Ernie’s liability, if any.) 7

Question Five (70 Minutes)

Cleaver Corporation is incorporated in a state that has adopted the latest version of the Revised Model Business Corporation Act. Cleaver has two classes of stock. Class A stock is non-voting, with a $50/share, non-participating dividend preference and a $200/share, non-participating liquidation preference. Class B shareholders have voting rights, but no preferences. One hundred shares of each class are outstanding.

Cleaver has four shareholders. Eddie owns 90 of the Class A shares and 40 of the Class B shares. June owns the other 10 Class A shares and 30 of the Class B shares. June’s two children, Theodore and Wally, each own 15 of the Class B shares. The directors of the corporation are June, Theodore, and Wally. June, Theodore, and Wally also work as employees. Eddie is neither a director nor an employee.

Cleaver was incorporated five years ago. After some initial difficulties similar to those experienced by most start-up businesses, Cleaver’s business has been booming. Its net income in 2004 was $120,000 and its net income for the 2005 fiscal year, which just ended on December 1, was $150,000. It pays out a substantial amount of its cash income as dividends. It paid a total dividend of $100,000 in 2004 and in November 2005 paid a total dividend of $120,000. Its balance sheet as of December 6 appears on the following page.

In late November, June was injured in an auto accident. She told Theodore and Wally that, if she did not get some additional cash, she would have to sell her house, move to her retirement condo in Florida, and quit working for Cleaver. Not wanting her to quit, Theodore and Wally agreed to have Cleaver repurchase 15 shares of June’s Class B stock for $30,000 cash. This price is $500 a share less than someone recently offered the three to purchase all of their shares. The board met and approved this transaction on December 6.

Eddie insisted that Cleaver also buy back all of his shares for the same $2,000/share price, but Cleaver refused.

Discuss all possible challenges to the repurchase of June’s shares. (Do not discuss the possibility of involuntary dissolution.) 8

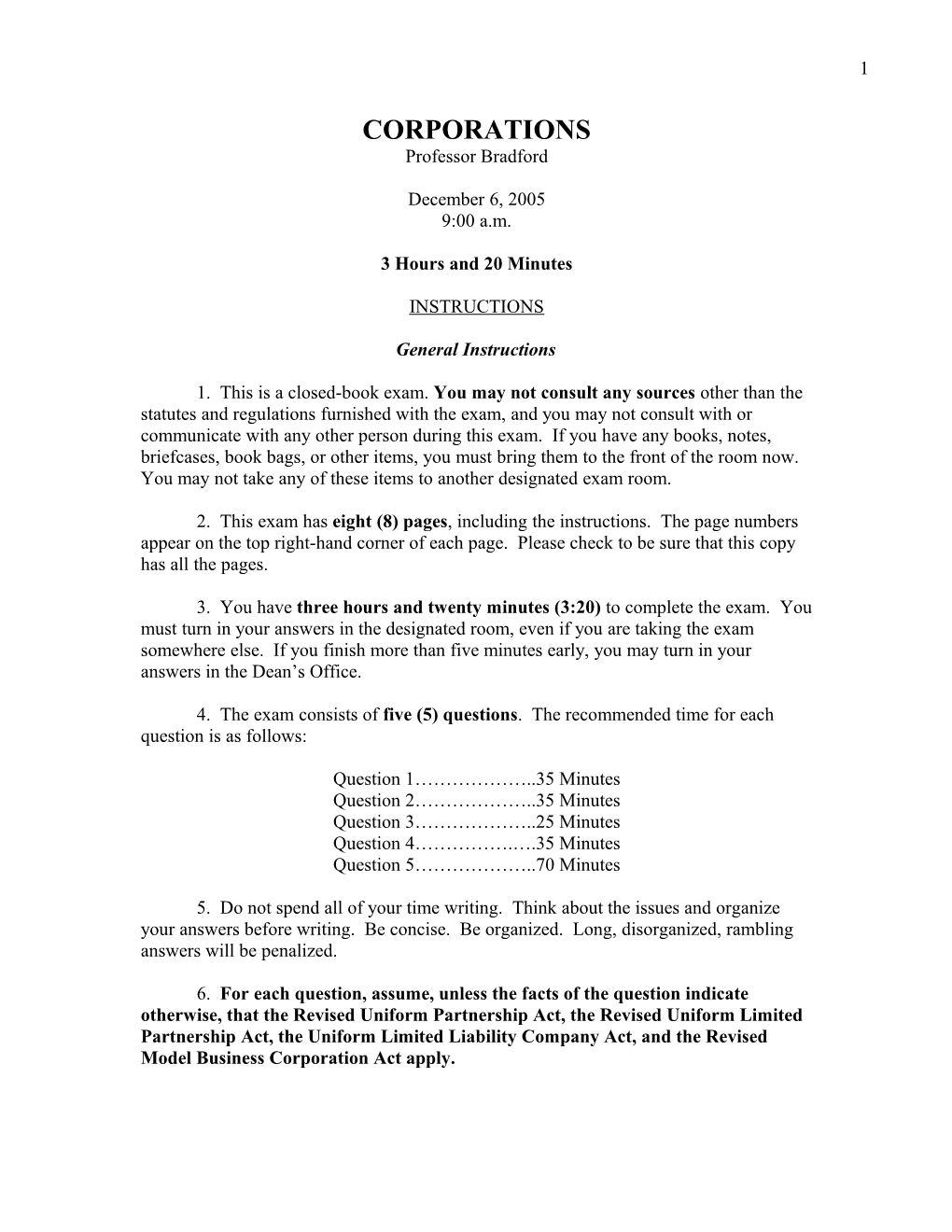

Cleaver Corporation Balance Sheet As of December 6, 2005

Assets Liabilities and Shareholders' Equity Cash $31,000 Liabilities Accounts Receivable $4,000 Accounts Payable $3,500 Inventory $21,000 Income Taxes Payable $7,500 Total Liabilities $11,000

Shareholders' Equity Class A Stock $1,000 Class B Stock $1,000 Additional Paid-In Capital $20,000 Retained Earnings $23,000 Total Shareholders' Equity $45,000

Total Liabilities and Total Assets $56,000 Shareholders' Equity $56,000 9