Price Forecast Accuracy of Trading Agents in Electricity Markets

Total Page:16

File Type:pdf, Size:1020Kb

Price forecast accuracy of trading agents in electricity markets: The role of market informedness, risk aversion, and trading behaviour

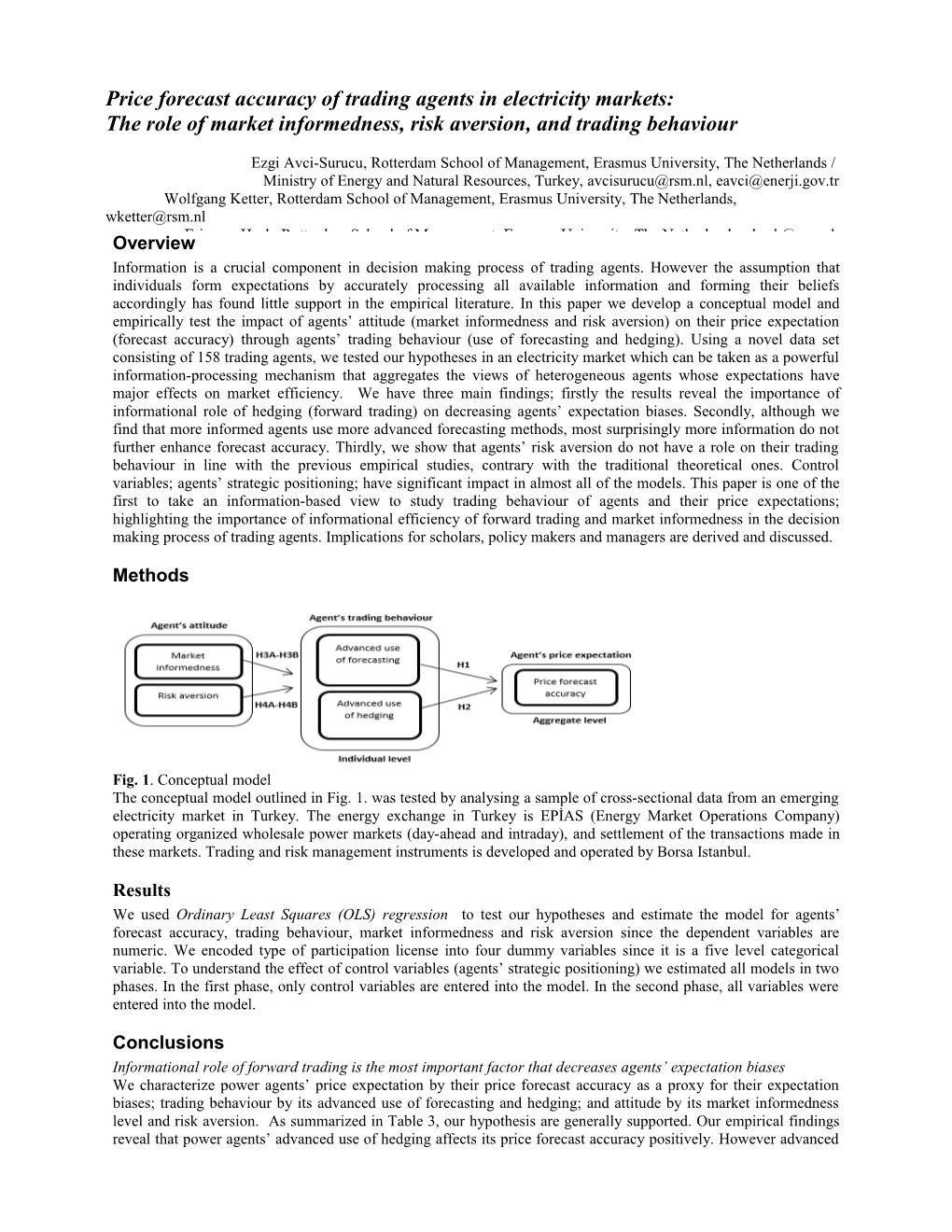

Ezgi Avci-Surucu, Rotterdam School of Management, Erasmus University, The Netherlands / Ministry of Energy and Natural Resources, Turkey, [email protected], [email protected] Wolfgang Ketter, Rotterdam School of Management, Erasmus University, The Netherlands, [email protected] OverviewEric van Heck, Rotterdam School of Management, Erasmus University, The Netherlands, [email protected] Information is a crucial component in decision making process of trading agents. However the assumption that individuals form expectations by accurately processing all available information and forming their beliefs accordingly has found little support in the empirical literature. In this paper we develop a conceptual model and empirically test the impact of agents’ attitude (market informedness and risk aversion) on their price expectation (forecast accuracy) through agents’ trading behaviour (use of forecasting and hedging). Using a novel data set consisting of 158 trading agents, we tested our hypotheses in an electricity market which can be taken as a powerful information-processing mechanism that aggregates the views of heterogeneous agents whose expectations have major effects on market efficiency. We have three main findings; firstly the results reveal the importance of informational role of hedging (forward trading) on decreasing agents’ expectation biases. Secondly, although we find that more informed agents use more advanced forecasting methods, most surprisingly more information do not further enhance forecast accuracy. Thirdly, we show that agents’ risk aversion do not have a role on their trading behaviour in line with the previous empirical studies, contrary with the traditional theoretical ones. Control variables; agents’ strategic positioning; have significant impact in almost all of the models. This paper is one of the first to take an information-based view to study trading behaviour of agents and their price expectations; highlighting the importance of informational efficiency of forward trading and market informedness in the decision making process of trading agents. Implications for scholars, policy makers and managers are derived and discussed.

Methods

Fig. 1. Conceptual model The conceptual model outlined in Fig. 1. was tested by analysing a sample of cross-sectional data from an emerging electricity market in Turkey. The energy exchange in Turkey is EPİAS (Energy Market Operations Company) operating organized wholesale power markets (day-ahead and intraday), and settlement of the transactions made in these markets. Trading and risk management instruments is developed and operated by Borsa Istanbul.

Results We used Ordinary Least Squares (OLS) regression to test our hypotheses and estimate the model for agents’ forecast accuracy, trading behaviour, market informedness and risk aversion since the dependent variables are numeric. We encoded type of participation license into four dummy variables since it is a five level categorical variable. To understand the effect of control variables (agents’ strategic positioning) we estimated all models in two phases. In the first phase, only control variables are entered into the model. In the second phase, all variables were entered into the model.

Conclusions Informational role of forward trading is the most important factor that decreases agents’ expectation biases We characterize power agents’ price expectation by their price forecast accuracy as a proxy for their expectation biases; trading behaviour by its advanced use of forecasting and hedging; and attitude by its market informedness level and risk aversion. As summarized in Table 3, our hypothesis are generally supported. Our empirical findings reveal that power agents’ advanced use of hedging affects its price forecast accuracy positively. However advanced use of forecasting techniques does not further enhance the accuracy. These findings indicate the importance of the informational role of forward trading on decreasing trading agents’ expectation biases. More information do not always lead to more rational(less biased) expectations. More informed agents use more advanced forecasting techniques however most interestingly, market informedness level does not further enhance forecast accuracy. This suggest that more information does not always lead to better electricity price forecasts in line with the study of von der Fehr.(2009) which states that ensuring rational economic behaviour and an efficient and competitive market outcome does not always require general access to information at a very detailed level. Risk aversion do not play a major role in trading decisions of power agents Power agents’ risk aversion levels do not impact neither their forecasting nor hedging behaviour in line with the previous empirical studies. This suggests that risk aversion do not play a major role in trading decisions of power agents. On the other hand our study suggests that trading agents are risk averse supporting the findings of Kalayci and Basdas (2010) and Olsen (1997) on prospect theory. Control variables; agents’ strategic positioning in the market; have significant impact in almost all of the models. This suggests that to ensure an efficient and competitive market outcome, incentives and other market mechanisms should be designed considering these variables.

References Kalayci E. and Basdas U. (2010). Does the prospect theory also hold for power traders? Empirical evidence from a Swiss energy company. Financial Economics, 19, 38-45. Kambil, A., and Van Heck, E. (2002). Making markets: How firms can design and profit from online auctions and exchanges. Harvard Business Press. Ketter, W. (2014). Envisioning and Enabling Sustainable Smart Markets (No. EIA-2014-057-LIS). Ketter, W., Collins, J. and Reddy, P.(2010). Power TAC: A Competitive Economic Simulation of the Smart Grid. Energy Economics, 39:262–270, 2013. Keynes, J. M. (1930). A Treatise on Money: In 2 Volumes. Macmillan & Company,. Lien, D. (2001). A note on loss aversion and futures hedging. Journal of Futures Markets, 21(7), 681-692. Lucas Jr, R. E. (1972). Expectations and the Neutrality of Money. Journal of Economic Theory, 4(2), 103-124. Lucas Jr, R. E. (1978). Asset prices in an exchange economy. Econometrica: Journal of the Econometric Society, 1429-1445. Mahenc, P., and Salanié, F. (2004). Softening competition through forward trading. Journal of Economic Theory, 116(2), 282-293. Makridakis, S. G. and Wheelwright, S. C. (1978). Interactive Forecasting: Univariate and Multivariate Methods. Holden-Day. Malone, T. W., Yates, J., and Benjamin, R. I. (1987). Electronic markets and electronic hierarchies. Communications of the ACM, 30(6), 484-497. Mankiw, N. G., Reis, R., and Wolfers, J. (2004). Disagreement about inflation expectations. In NBER Macroeconomics Annual 2003, Volume 18 (pp. 209-270). The MIT Press. Manski, C. F. (2004). Measuring expectations. Econometrica, 72(5), 1329-1376. Mattos, F., Garcia, P., and Pennings, J. M. (2006). Probability Distortion and Loss Aversion in Futures Hedging. In 2006 Conference, April 17-18, 2006, St. Louis, Missouri (No. 18992). NCR-134 Conference on Applied Commodity Price Analysis, Forecasting, and Market Risk Management. McCabe, K., Rassenti, S. J., and Smith, V. L. (1991). Smart computer-assisted markets. Science(Washington), 254(5031), 534-538. Meir, S. (2005). Normal investors, then and now. Financial Analysts Journal, Vol. 61 No. 3, pp. 31-7. Mentzer, J. T., and Cox, J. E. (1984). A model of the determinants of achieved forecast accuracy. Journal of Business Logistics, 5(2), 143-155. Mentzer, J. T., and Cox, J. E. (1984). Familiarity, application, and performance of sales forecasting techniques. Journal of Forecasting, 3(1), 27-36. Moosa, I. (2003). The sensitivity of the optimal hedge ratio to model specification. Finance Letters, 1(1), 15-20. Muth, J. F. (1961). Rational expectations and the theory of price movements. Econometrica: Journal of the Econometric Society, 315-335. Nance D. R., Smith C. W. and Smithson Jr. C. W. (1993). On The Determinants of Corporate Hedging. The Journal of Finance, 48(1), 267-284. Newberry, D., and Stiglitz, J. (1981). The theory of commodity price stabilization. New York, Clarendon. Olsen R. A., (1997a). Desirability Bias among Professional Investment Managers: Some Evidence from Experts. Journal of Behavioral Decision Making, 10, 65-72. Olsen R. A. (1997b). Prospect Theory as an Explanation of Risky Choice by Professional Investors: Some Evidence. Review of Financial Economics, 6, 225-232. (contd)