19) ______says to calculate the incremental after-tax cash flows connected with working capital decisions. A. The Signaling Principle B. The Principle of Incremental Benefits C. The Principle of Time Value of Money D. The Options Principle

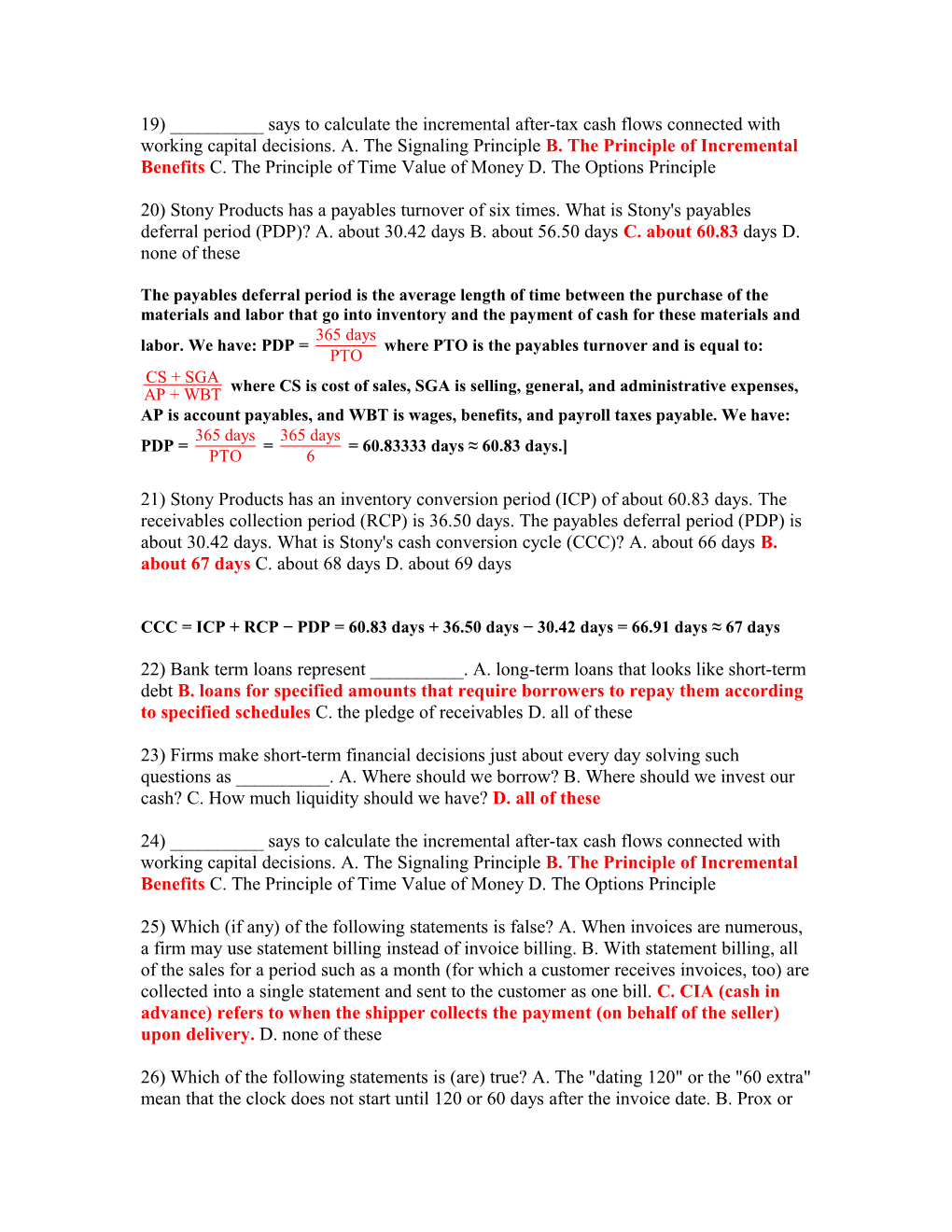

20) Stony Products has a payables turnover of six times. What is Stony's payables deferral period (PDP)? A. about 30.42 days B. about 56.50 days C. about 60.83 days D. none of these

The payables deferral period is the average length of time between the purchase of the materials and labor that go into inventory and the payment of cash for these materials and 365 days labor. We have: PDP = where PTO is the payables turnover and is equal to: PTO CS + SGA where CS is cost of sales, SGA is selling, general, and administrative expenses, AP + WBT AP is account payables, and WBT is wages, benefits, and payroll taxes payable. We have: 365 days 365 days PDP = = = 60.83333 days ≈ 60.83 days.] PTO 6

21) Stony Products has an inventory conversion period (ICP) of about 60.83 days. The receivables collection period (RCP) is 36.50 days. The payables deferral period (PDP) is about 30.42 days. What is Stony's cash conversion cycle (CCC)? A. about 66 days B. about 67 days C. about 68 days D. about 69 days

CCC = ICP + RCP − PDP = 60.83 days + 36.50 days − 30.42 days = 66.91 days ≈ 67 days

22) Bank term loans represent ______. A. long-term loans that looks like short-term debt B. loans for specified amounts that require borrowers to repay them according to specified schedules C. the pledge of receivables D. all of these

23) Firms make short-term financial decisions just about every day solving such questions as ______. A. Where should we borrow? B. Where should we invest our cash? C. How much liquidity should we have? D. all of these

24) ______says to calculate the incremental after-tax cash flows connected with working capital decisions. A. The Signaling Principle B. The Principle of Incremental Benefits C. The Principle of Time Value of Money D. The Options Principle

25) Which (if any) of the following statements is false? A. When invoices are numerous, a firm may use statement billing instead of invoice billing. B. With statement billing, all of the sales for a period such as a month (for which a customer receives invoices, too) are collected into a single statement and sent to the customer as one bill. C. CIA (cash in advance) refers to when the shipper collects the payment (on behalf of the seller) upon delivery. D. none of these

26) Which of the following statements is (are) true? A. The "dating 120" or the "60 extra" mean that the clock does not start until 120 or 60 days after the invoice date. B. Prox or proximate refers to the next month. C. Invoices with "10th prox" must be paid by the 10th of the next month. D. all of these

27) Credit-policy decisions involve all aspects of receivables management. The decision does NOT include which of the following? A. setting evaluation methods and credit standards B. the choice of credit terms C. monitoring receivables and avoiding actions for slow payment D. controlling and administering the firm's credit functions