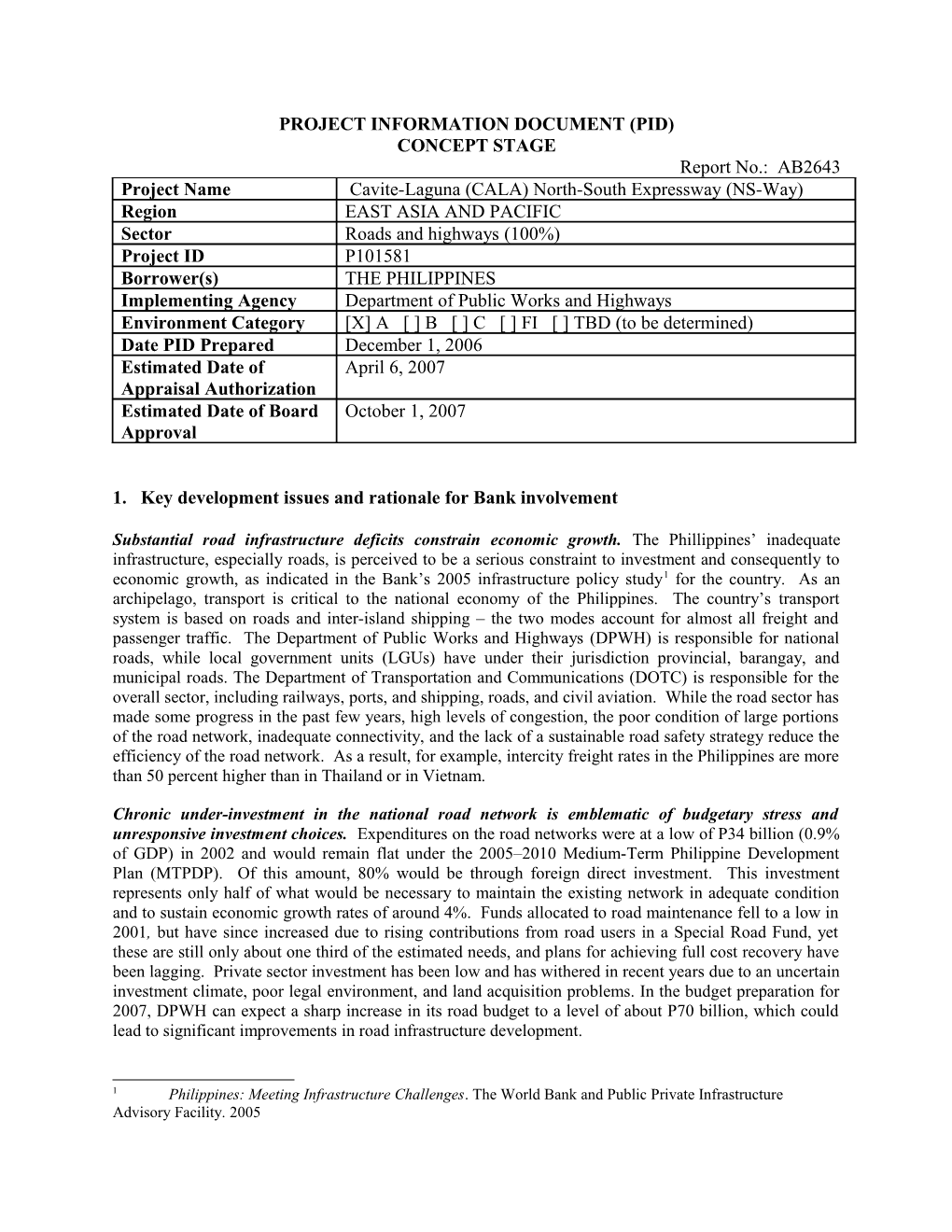

PROJECT INFORMATION DOCUMENT (PID) CONCEPT STAGE Report No.: AB2643 Project Name Cavite-Laguna (CALA) North-South Expressway (NS-Way) Region EAST ASIA AND PACIFIC Sector Roads and highways (100%) Project ID P101581 Borrower(s) THE PHILIPPINES Implementing Agency Department of Public Works and Highways Environment Category [X] A [ ] B [ ] C [ ] FI [ ] TBD (to be determined) Date PID Prepared December 1, 2006 Estimated Date of April 6, 2007 Appraisal Authorization Estimated Date of Board October 1, 2007 Approval

1. Key development issues and rationale for Bank involvement

Substantial road infrastructure deficits constrain economic growth. The Phillippines’ inadequate infrastructure, especially roads, is perceived to be a serious constraint to investment and consequently to economic growth, as indicated in the Bank’s 2005 infrastructure policy study1 for the country. As an archipelago, transport is critical to the national economy of the Philippines. The country’s transport system is based on roads and inter-island shipping – the two modes account for almost all freight and passenger traffic. The Department of Public Works and Highways (DPWH) is responsible for national roads, while local government units (LGUs) have under their jurisdiction provincial, barangay, and municipal roads. The Department of Transportation and Communications (DOTC) is responsible for the overall sector, including railways, ports, and shipping, roads, and civil aviation. While the road sector has made some progress in the past few years, high levels of congestion, the poor condition of large portions of the road network, inadequate connectivity, and the lack of a sustainable road safety strategy reduce the efficiency of the road network. As a result, for example, intercity freight rates in the Philippines are more than 50 percent higher than in Thailand or in Vietnam.

Chronic under-investment in the national road network is emblematic of budgetary stress and unresponsive investment choices. Expenditures on the road networks were at a low of P34 billion (0.9% of GDP) in 2002 and would remain flat under the 2005–2010 Medium-Term Philippine Development Plan (MTPDP). Of this amount, 80% would be through foreign direct investment. This investment represents only half of what would be necessary to maintain the existing network in adequate condition and to sustain economic growth rates of around 4%. Funds allocated to road maintenance fell to a low in 2001, but have since increased due to rising contributions from road users in a Special Road Fund, yet these are still only about one third of the estimated needs, and plans for achieving full cost recovery have been lagging. Private sector investment has been low and has withered in recent years due to an uncertain investment climate, poor legal environment, and land acquisition problems. In the budget preparation for 2007, DPWH can expect a sharp increase in its road budget to a level of about P70 billion, which could lead to significant improvements in road infrastructure development.

1 Philippines: Meeting Infrastructure Challenges. The World Bank and Public Private Infrastructure Advisory Facility. 2005 Inefficiency is being addressed through organizational and sector reform. The inefficiency in resource utilization is attributed to inadequate policy, institutional, and governance frameworks, and to poor capacity. A major thrust for road sector reform was initiated in 1997 and was articulated in the Better Roads Philippines 2000 study (1999). The reform strategy focused on sustainable financing through road user cost recovery, and commercialization of road sector operations through the establishment of a road management authority and increased private sector participation. Some progress has been made in implementing road sector reforms but implementation has been slow. Much of the progress has been at an organizational level in improving the internal business processes in DPWH. At the institutional level, the Special Road Fund (SRF) and Road Board were established in 2001, but the release of funds was delayed until 2003, the Board Secretariat was only appointed in mid-2004, and some funds were allocated for politically-motivated programs, thereby reducing the Fund’s effectiveness in improving the overall road maintenance program. Also, little progress has been made in further separating the roles of the client and service provider in DPWH through the establishment of a commercially oriented performance-based Authority, despite substantial consultations and evaluation of options.

Critical issues are being addressed under the Bank-supported National Roads Improvement and Management Program (NRIMP). NRIMP, the Phase 1 of which has been substantially successful, focuses on the sustainable development and operation of the National Roads System (NRS) through effective management systems, and financial, environmental, and social sustainability. The development objectives for NRIMP Phase 2, currently under preparation, include (a) improving road management organization for the National Road System countrywide, with responsibilities, assets and staffing appropriately realigned to national and local roles, (b) funding road preservation needs by revenues from road users, with appropriate allocation to national and local levels, and (c) improving physical condition of the primary arterial roads.

Rationale for the proposed operation. Given the high remaining financial needs in the national road system, beyond the support provided by NRIMP and other donors, particularly in the congested corridors south of Manila, and the need to undertake a pilot demonstration project to enhance local capacity in implementing public-private partnership (PPP) projects in the road sector, it is considered crucial that the Bank continues to provide strong support to Government efforts in the sector. Through the impetus and scope of the proposed NS-Way project, Bank support would be applied to build on and catalyze local efforts to improve efficiency in road transportation in the country’s premiere industrial belt, under an approach that could be replicated elsewhere in the country. The Philippines CAS, inter alia, seeks to provide programmatic support to well articulated plans for strengthening agency effectiveness and service delivery, and lists the DPWH as a possible and strong candidate. The demonstration effect of the PPP approach is expected to contribute significantly to achieve this CAS objective. It also furthers the CAS strategy of designing interventions that are conducive to enabling “islands of excellence” to survive and thrive.

High priority infrastructure projects have been identified. The line agencies are focusing their efforts on a few high priority projects and the main stakeholders, within the administration, plan to join forces to ensure high quality preparation of those projects. NEDA as the planning agency of the Government is completing the process of identifying the 10 high-impact, well prepared and implementation-ready projects. An executive order to expedite implementation of these projects is expected to be issued shortly. In addition to identifying these ready to go projects, line agencies under the aegis of the Infrastructure Committee and Investment Coordination Committee are finalizing guidelines for preparation and appraisal of projects based on improved methodologies for assessing project feasibility and costing parameters.

Public-private partnerships (PPP) in infrastructure are being strengthened at the policy and transaction levels. While the Philippines was a pioneer in infrastructure PPPs, flaws in design, bidding and financing caused these to languish and have added to the government’s contingent liabilities. The government is now aiming for a paradigm shift. Over 50 percent of projects in the pipeline are slated to have a private finance and private participation component compared to only 4 percent of committed or ongoing projects. Further, NEDA aims to secure at least 27 percent of the total financing from private financiers. Under the aegis of the PDF the government is working with the private sector and development partners in modifying BOT laws to clarify the concessions, public guarantee and public subsidy policy framework with regard to the infrastructure sector. These reforms are aimed at assuaging concerns of private operators and financiers about policy risks and the ability of the government to deliver on its commitments while simultaneously keeping contingent liabilities at manageable levels.

The government has implemented measures aimed at strengthening the PPP framework. The Implementing Rules and Regulations of the BOT Law have been revised. One substantial change in the BOT IRR is that before, the project had to undergo two approval stages: (i) First pass - project approval - depending on the amount, approval will be sought from ICC or NEDA Board and (ii) Second pass - draft contract approval - depending on the amount, approval will be sought from ICC or NEDA Board. Now, there's only a single pass to expedite project approval - project and draft contract reviewed in parallel by ICC or NEDA Board, depending on the amount. Also, in the new BOT IRR, the "contract re- opener" clause was removed thus eliminating a major source of delays in project implementation. Over the medium-term the government is also developing a clear policy framework procedures and institutional jurisdiction relating to the use of GOP credit enhancements/financial participation in public-private infrastructure projects. Government support in the form of subsidies or guarantees would only be made available to competitively bid projects.

Investment including private participation in the Transport Sector is being increased. Inadequate transport infrastructure, especially roads, is perceived as being a serious constraint to investment and consequently to growth. Roads and inter-island shipping account for almost all freight and passenger traffic. High levels of congestion, the poor condition of the road network, inadequate connectivity, and the lack of a sustainable road safety strategy reduce the efficiency of the road network. As a result, for example, intercity freight rates in the Philippines are more than 50% higher than in Thailand or in Vietnam. The transport sector, therefore, accounts for about 52% of total planned investment during 2006-2010. This decision will compensate for past chronic under-investment --- expenditures on the road networks fell to a low in 2001 and were half the amount needed to maintain the existing network in adequate condition and to sustain economic growth rates of around 4%. The government has since increased funds allocated to road maintenance due to rising contributions from road users in a Special Road Fund. But these are still only about one third of the estimated needs, and plans for achieving full cost recovery have been lagging. Private sector investment has been low and has declined in recent years due to an uncertain investment climate, poor legal environment, and many land acquisition problems. The government is taking measures to make the road sector more hospitable for private investment.

2. Proposed project development objectives

The objectives of the proposed Bank-supported Cavite-Laguna North-South Expressway (NS-Way) project would be: (a) to improve road access to the country’s premiere industrial belt by reducing traffic congestion through construction of the NS Way; and (b) to assist in creating an enabling environment for private sector participation through a public-private partnership (PPP) scheme. The project would include a comprehensive assistance package that would combine investment lending for the construction of NS Way with credit enhancement and technical assistance to create an enabling environment for private sector participation in road infrastructure. The NS Way was identified as a potential candidate for Bank support due to its impact on improving road access to the country’s premiere industrial belt by reducing traffic congestion along Aguinaldo Highway and Coastal Road, and for providing an alternative north-south artery to the CALA region. The NS Way project includes the construction of a six-lane 27.2 km expressway connecting Bacoor and Dasmarinas, and linking the Manila-Cavite Coastal Road (R-1 Expressway), in the north, to the proposed East-West Cavite-Laguna Expressway, in the south.

The assessment of the achievement of the project development objectives will be carried out through the measurement of outcome indicators, including reduction in average freight rates, travel times, vehicle operating costs, and accident rates along the corridor to be constructed, as well as enhanced knowledge and application of updated public-private partnership approaches in the provision of road infrastructure.

3. Preliminary project description

The CALA Expressway has been divided in five sections, NS-1 to NS-5, from north to south. The preliminary findings of the feasibility study indicate that sections NS-1 to NS-3 (12.8 km) would be financially feasible to attract private finance through a build-operate-transfer (BOT) scheme, while the financial viability of sections NS-4 and NS-5 (14.4 km) is still being assessed. Consequently, it is proposed to carry out the construction of NS 1-3 through a BOT concession, while NS 4-5 may be financed through public funding, supported by a WB loan.

The estimated cost of the entire corridor is US$ 278 million. The discussions between the Bank team and DPWH have suggested two options for project implementation and financing.

The first option entails the construction of NS 1 to NS 3 with private finance under a PPP scheme, with NS 4 and NS 5 built separately with public funds. Upon construction completion, NS4 and NS5 could be operated by a private concessionaire under an operation and maintenance contract. A Bank loan is proposed to fund right of way acquisition for NS 1-3, and also provide a Bank partial risk guarantee to facilitate private sector participation. A Bank loan would also be proposed to provide funding for NS 4 and NS 5.

The second option involves the entire NS-Way corridor being offered to a private concessionaire selected through an international competitive bidding process. Project funding would be secured under a blended financing scheme involving public and private finance. The level of Government financial contribution is determined against funds needed to ensure the project’s financial viability. Under this approach, it is proposed that the Bank will provide a loan to cover right of way acquisition along with the required public financial contribution to the project. The Bank may also offer a partial risk guarantee for the concessionaire to obtain favorable financing terms from commercial lenders.

Under both options, an institutional strengthening program with an estimated cost of US$1 million would be offered of which US$0.8 million would be financed by the Bank Loan. The program shall provide capacity enhancement at DPWH and line agencies to improve their project identification, selection, and approval procedures with a view towards attracting private sector participation. Annex 1 gives more detail on the project background, status of preparation, and preliminary institutional arrangements for implementation.

The DPWH through grant based TA from JICA has commissioned a Feasibility Study and Implementation Support on the CALA East-West National Road Project conducted jointly by ALMEC Corp. and Nippon Koei Co., Ltd. (the “Consultants”). The key findings of the consultants based on their relevance to the NS-Way project are as follows: Estimated project cost of NS1-5 is P 13.8 bn delineated by project stage: As per the consultants assessment of costs relating to construction, engineering service, land acquisition, and project administration for the project the total project cost is P 13.9 bn (US$ 278 million) of which NS 1-3 accounts for US$ 104 million and NS 4-5 for US$ 174 million.

Current toll rates – The existing toll rates in Manila and adjacent regions are as follows:

Table 1: Current toll rates of expressways in Manila (Peso/km) Toll Road Class 1 Class 2 Class 3 Car/Jeepney Truck/Bus Truck/Trailer SLEX at Grade 2.49 6.23 7.47 NLEX at Grade 2.49 6.23 7.47 Coastal at Grade 2.73 5.45 8.18 Road Skyway at Grade 4.29 8.57 12.86 Elevated 12.14 24.59 36.43

Source: ALMEC; Nippon Koie; Feasibility Study and Implementation Support on the CALA East-West National Road Project – Sept. 2006

Willingness to pay - The JICA consultants conducted a willingness to pay study to arrive at a range of toll rates to use for their feasibility assessment. The study was based on an interview of 1,200 road users and conducted against reduction in travel time benefits. It was found that for a 15 to 20 minute travel time reduction consumers are willing to pay 20 pesos for a car owner (P 1.31/km benefit), 16 pesos for a jeepney driver (P 1.04/km benefit), and 27 pesos for a truck driver (P 1.65/km benefit).

Revenue Maximization – The JICA consultants also conducted a revenue maximization analysis for NS 1 and 2, and NS 3 against progressively higher toll rates with corresponding reduction in traffic flows. The revenue curves showed a straight line increase upto 12 pesos following which the gradient continued to rise at a lower rate upto 20 pesos and leveled off thereafter. Based on the above willingness to pay study, prevailing toll rates in Manila, demand analysis, traffic forecasts, and the revenue maximization analysis, the consultants recommended that a flat rate of 18 pesos for Class 1 vehicles which corresponds to a rate of 2.4 – 2.8 pesos per km based on road length, and which conforms to the lower end of existing toll rates charged at SLEX, NLEX, and the Coastal Road. At this rate, estimated traffic volumes vary from 140,000 to 180,000 passenger car units (PCUs) per segment per day in 2015 to between 210,000 to 300,000 PCUs per segment per day by 2030. Forecasts for NS 1-3 with ramp up from phased completion dates are also available.

Economic and financial evaluation – The consultants also conducted a demand forecast on the basis of the above proposed flat toll level of P 18 (for cars) and willingness to pay indicators. A base case that assumes NS 1-3 being operational by 2011 and NS 4 and 5 in 2013 was used to conduct a detailed financial and economic feasibility analysis for the project. The NS-Way project was found to be financially and economically viable with NS 1, NS 2, and NS 3 jointly yielding an ERR of 38 percent while the entire corridor of NS 1-5 has an ERR of 23 percent (see Table 3 below). In addition, all sub-projects showed healthy financial returns with NS 1, 2, and 3 yielding a real FRR of 19.2 percent while the entire corridor has an FRR of 15.5 percent thereby exceeding the 12 percent threshold assuming that NS 4 and 5 will also be tolled. The FRR was also found to be resilient against changes in revenue and cost with FRR elasticity against costs being in the range of 0.7 and 1.0 and against revenues, in the range of 0.9 and 1.3. The project also has a positive net present value of PHP 4.5 billion (US$ 89 million). Thus the project demonstrates strong financial and economic fundamentals when compared with remaining road projects being considered in the CALA region.

Table 3: Evaluation of NS Corridor Evaluation Unit NS 1&2 NS-3 NS 1,2&3 NS 1-5 Indicator ERR % 80.1 38.6 38.0 22.9 FRR (real) % 21.9 17.9 19.2 15.5 NPV P million 14,895.6 4,835.6 10,541.8 4,485.9 Benefit/Cost - 10.9 3.0 4.2 1.6

Source: ALMEC; Nippon Koie; Feasibility Study and Implementation Support on the CALA East-West National Road Project – Sept. 2006

5. Lessons learned from existing BOT projects

While the country’s legal and regulatory framework (Republic Act No. 7718) is viewed as being supportive of PPP in infrastructure, the experience in the transport sector has been less than favorable. Of the seven transport projects that were awarded concessions, only one was initiated through a competitive bid process while the remaining were the result of unsolicited proposals that underwent significant post award issues and challenges. Their contractual structures were based on the need of the hour thereby leading to long drawn out negotiations post award. The projects were inadequately prepared prior to award and failed to produce a sound business case for implementation. The sponsors had a weak financial base and faced numerous challenges in attaining financial close especially following the East Asian economic crisis. A compilation of the varied issues and challenges faced by each project is covered in the Feasibility Study and Implementation Support on the CALA East-West National Road Project produced by the JICA Consultants. The key lessons that emerge from past experience are therefore (a) to reject unsolicited proposals and instead introduce an open tender process for developer/investor selection based on predetermined and transparent selection criteria; (b) to require evidence of financial strength during the early part of the tender process (weed out those entities that have failed to financially close road projects of similar magnitude and scale in the recent past); (c) to replace selection based on lowest toll with a formula-based approach that takes into consideration multiple criteria including the level of Government financial incentives needed for securing PSP; and (d) clearly identify conditions under which the Government can exercise its step-in rights – avoid open-ended awards for subsequent phases of project development.

6. Potential risks and mitigation

DPWH has made substantial progress in implementing Phase 1 of NRIMP and their staff has maintained excellent cooperation in preparing Phase 2 of NRIMP and in the initial stages of preparing the proposed NS-Way project. DPWH and other agencies have shown a keen interest in developing the country’s high- grade highway network using the PPP approach, and already have considerable experience in managing concessions to the private sector in the road sector. This experience will help reduce the preparation and implementation risks of the project. The following table shows the various risks associated with the project. 2. Safeguard policies that might apply

Environmental and Social Considerations – As part of JICA’s “Implementation Support” a complete EIA was conducted for all the CALA road projects including NS-Way. The EIA followed the official EIS procedure of the Philippine Government and JICA’s “Guidelines on Environmental and Social Considerations.” The activities included an initial environmental examination and scoping; a study on current environmental conditions; environmental impact forecasts and estimates, evaluation of environmental impact on optimal route alignments, examination of environmental mitigation measures and social consideration, preparation of an Environmental Management and Monitoring Plan (EMMP), preparation of draft Environmental Impact Statement, and preparation of Preliminary Resettlement Action Plan (Pre-RAP). In addition, a consensus building exercise was pursued in close coordination with DPWH, Dept. of Environment and Natural Resources (DENR), LGUs, and related NGOs, POs, and residents. The results were documented through eight stakeholder meetings, and numerous consultations with LGUs and focus group discussions. Each LGU through its provincial, city, and municipal councils issued a resolution endorsing the proposed project and reserved the rights of way needed for the project. A record of all EIA activities can be accessed through the weblink (www.cala-ew.info). As of now, no serious problems have been encountered regarding this aspect of the project.

3. Tentative financing Source: ($m.) BORROWER 40 INTERNATIONAL BANK FOR RECONSTRUCTION AND 140 DEVELOPMENT Total 180

4. Contact point Contact: Benedictus Eijbergen Title: Senior Infrastructure Specialist Tel: 63-2-917-3038 Fax: Email: [email protected] Location: Manila, Philippines (IBRD) wb156224 D:\Docs\2018-04-16\05754a08416bb61c1a24e0f48c3936c4.doc