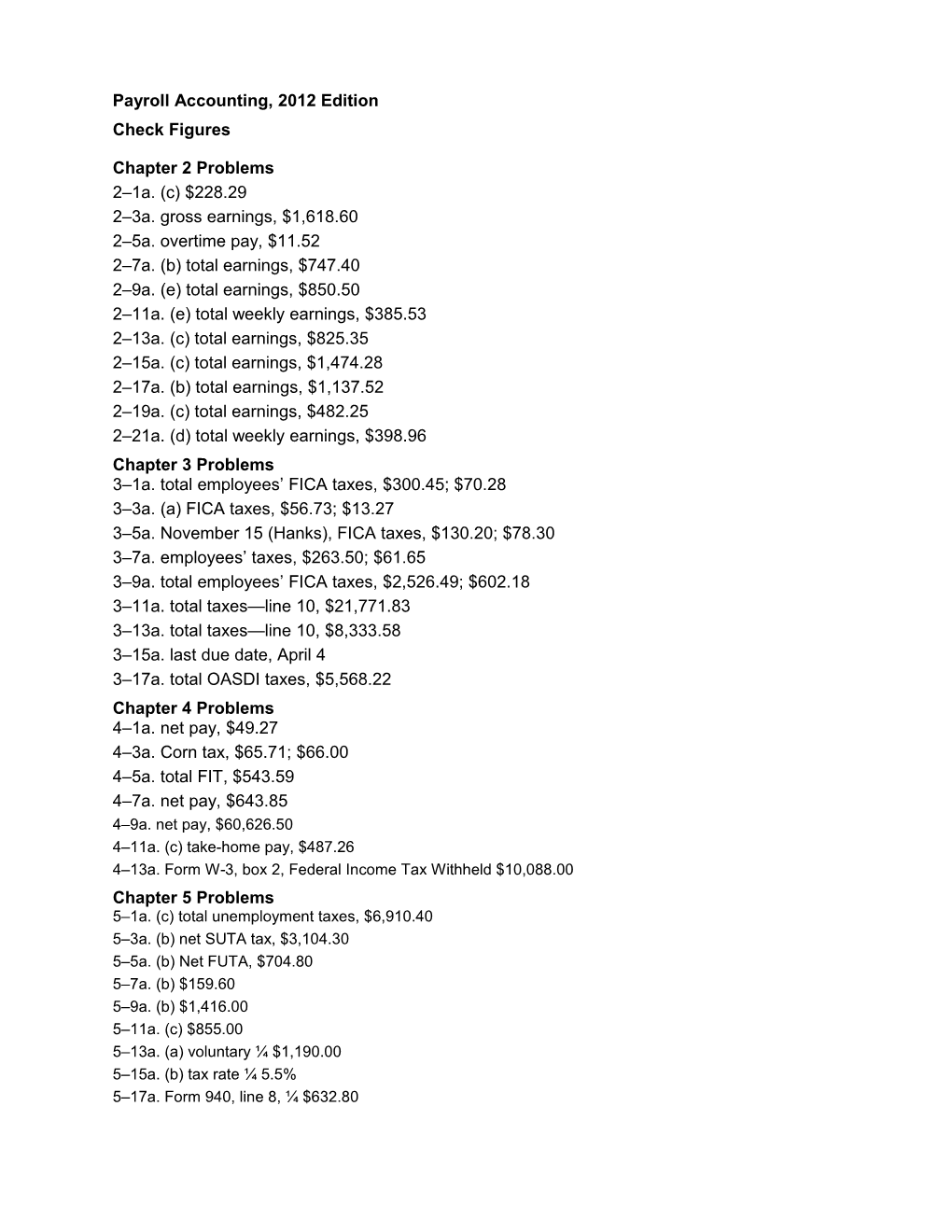

Payroll Accounting, 2012 Edition Check Figures

Chapter 2 Problems 2–1a. (c) $228.29 2–3a. gross earnings, $1,618.60 2–5a. overtime pay, $11.52 2–7a. (b) total earnings, $747.40 2–9a. (e) total earnings, $850.50 2–11a. (e) total weekly earnings, $385.53 2–13a. (c) total earnings, $825.35 2–15a. (c) total earnings, $1,474.28 2–17a. (b) total earnings, $1,137.52 2–19a. (c) total earnings, $482.25 2–21a. (d) total weekly earnings, $398.96 Chapter 3 Problems 3–1a. total employees’ FICA taxes, $300.45; $70.28 3–3a. (a) FICA taxes, $56.73; $13.27 3–5a. November 15 (Hanks), FICA taxes, $130.20; $78.30 3–7a. employees’ taxes, $263.50; $61.65 3–9a. total employees’ FICA taxes, $2,526.49; $602.18 3–11a. total taxes—line 10, $21,771.83 3–13a. total taxes—line 10, $8,333.58 3–15a. last due date, April 4 3–17a. total OASDI taxes, $5,568.22 Chapter 4 Problems 4–1a. net pay, $49.27 4–3a. Corn tax, $65.71; $66.00 4–5a. total FIT, $543.59 4–7a. net pay, $643.85 4–9a. net pay, $60,626.50 4–11a. (c) take-home pay, $487.26 4–13a. Form W-3, box 2, Federal Income Tax Withheld $10,088.00 Chapter 5 Problems 5–1a. (c) total unemployment taxes, $6,910.40 5–3a. (b) net SUTA tax, $3,104.30 5–5a. (b) Net FUTA, $704.80 5–7a. (b) $159.60 5–9a. (b) $1,416.00 5–11a. (c) $855.00 5–13a. (a) voluntary ¼ $1,190.00 5–15a. (b) tax rate ¼ 5.5% 5–17a. Form 940, line 8, ¼ $632.80 Chapter 6 Problems 6–1a. federal tax levy, $583.46 6–3a. (a) payroll tax debit, $650.25 6–5a. (a) cash credit, $50,748.80 6–7a. cash credit, $862.21 6–9a. cash credit, $13,441.03 6–11a. wages debit, $13,060.00 6–13a. (a) July w/h, $286.16 6–15a. (2) total payroll taxes, $274.28 Chapter 7 Problems Net pay, October 23, $11,131.63 Net pay, November 6, $10,897.23