Gas Operational Forum – Thursday 23rd November 2017

Gas Operational Forum - Minutes

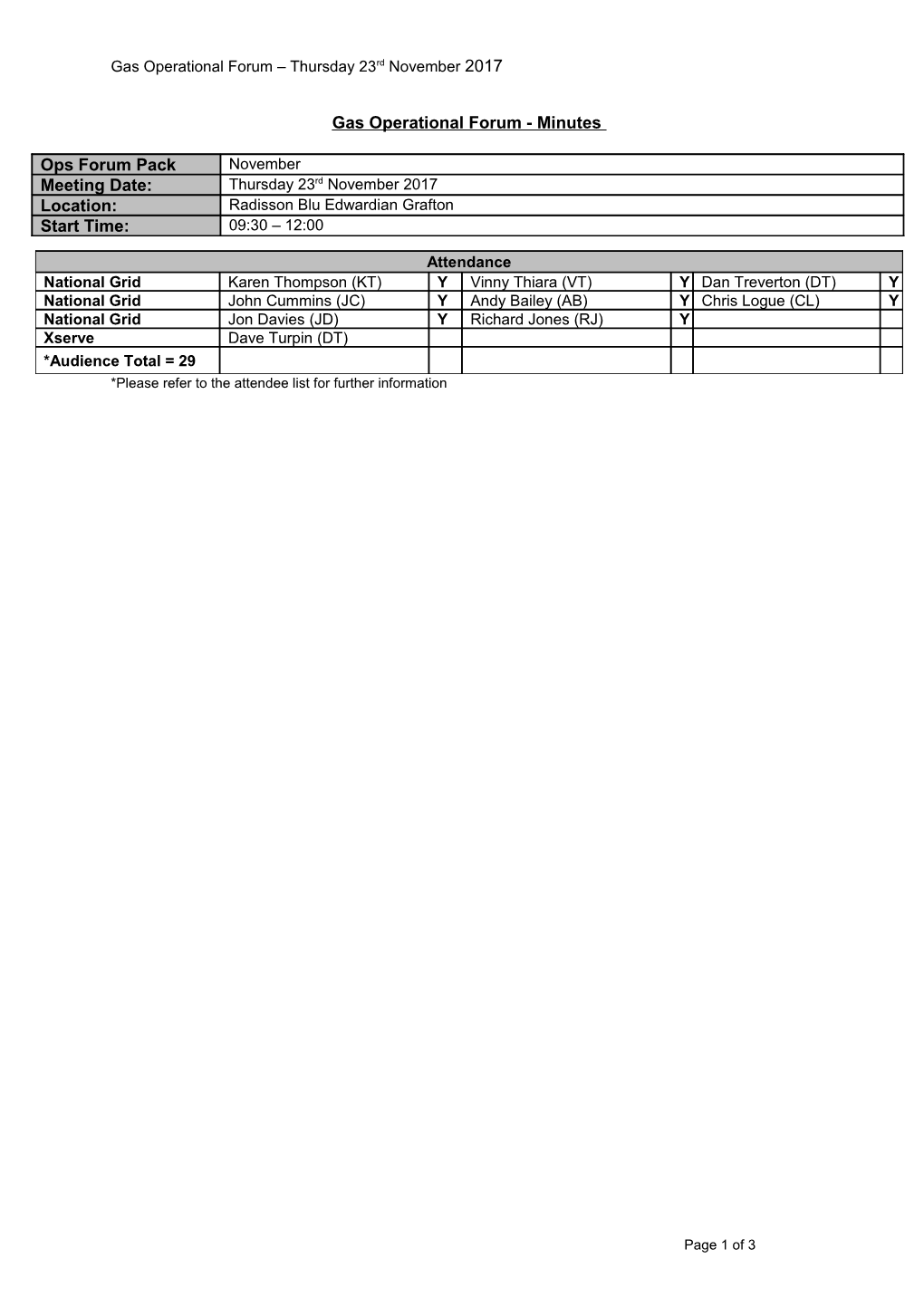

Ops Forum Pack November Meeting Date: Thursday 23rd November 2017 Location: Radisson Blu Edwardian Grafton Start Time: 09:30 – 12:00

Attendance National Grid Karen Thompson (KT) Y Vinny Thiara (VT) Y Dan Treverton (DT) Y National Grid John Cummins (JC) Y Andy Bailey (AB) Y Chris Logue (CL) Y National Grid Jon Davies (JD) Y Richard Jones (RJ) Y Xserve Dave Turpin (DT) *Audience Total = 29 *Please refer to the attendee list for further information

Page 1 of 3 Agenda Action Minutes Item Ref

- KT addressed the actionsrd following last forum such as: Gas Operational- ForumConfirmed – Thursday operational 23 November overview 2017now contains volumes for supply information and NG will look to provide volumes for demand data in future forums. 1 - Confirmed that interesting days request had been communicated and NG will be going through some specific interesting days during the balancing regime agenda. - Tuesday 24th October – RIIO T2 event invitations were sent out - KT confirmed that quality checks on all webinars were performed – from which some Actions from Previous will be re-recorded before the next ops forum. Forums 2 - KT also confirmed the following in relation to line pack data: - Week commencing Monday 27th November – NG will begin to log/publish historic line pack data. - Week commencing Monday 4th December – Where applicable, NG will provide 3 historic data since October 2nd 2017. - KT also confirmed as a minimal on quarterly basis Xoserve service desk updates will feature on ops forum agendas. - KT informed the audience that National Grid will provide a high level walkthrough of TSO > TSO the TSO to TSO Nomination Matching process in the event of Gemini being Nominations unavailable, communications unavailable, Adjacent TSO system is unavailable. Matching - The walkthrough will be via webex hosted by John McNamara on Tuesday 28th & 29th Contingency November, simply email [email protected] to register your Process place. Alternatively NG will plan to record a webinar and include it as part of the 4 winter webinars - ACTION - KT delivered the Operational Overview slides, which included for both supply and demand breakdowns. - Supply – very similar to previous month, with IUK being on export mode. - LNG average flow still remain low which relates to increased competition in the LNG market and therefore a reduction in cargos seen to the UK which drove lower flows. - Power demand has been down this year compared to last year, this reduction is believed to be due to an increase of renewable generation sources (Solar/Wind) which has reduced the generation load from conventional gas power plants. - IUK Exports during the period Oct 2017 are larger than the same period last year (average 20 mcm/d vs 14mcm/d). This is due to Rough storage facility being unavailable meaning supply volumes have been diverted to IUK exports. Operational Overview - Although supplies have remained similar to the previous year, the split of demand has changed. LDZ Demand has reduced due to slightly milder weather, higher Storage Injection has been offset by lower Power Station Demand believed to be driven by an increase in renewable generation. - As per Remit notifications, Centrica Storage expects almost 1bcm of gas to be withdrawn from their facility from October onwards throughout the winter months which is beginning to show on the storage stocks graphs from which will be more evident in future months. - KT also demonstrated a new innovative way of articulating interesting days in which the audience preferred compared to graphs as this helped to explain an operational view in more interactive manner. ACTION Where possible to provide an interesting 5 day in an interactive format. - KT provided a high level summary of how NG now produces a daily linepack difference between NTS supply and demand notification which is intended to help give an indication of what the linepack may be at the lowest point in the day. - The report is based on hourly physical supply and demand flow notifications received from NTS connected sites and latest linepack of the Gas Day. - KT confirmed the report will be published at three key points within the gas day Calculated Linepack (06:00, 12:30 and 18:30) based on the latest information. Data - KT also confirmed where this information can be found on NG.com

- KT also explained how reliance of line pack flexibility has increased and where market operation is using up more of the available line pack flexibility, consequently the system is becoming less resilient to asset failures. This is evident when comparing data over the past 15 years. - KT explained how NG have recently been collating industry feedback through various channels such as 2 interactive sessions as ops forums, Xserve ‘Ticket Closure’ Surveys which are emailed to individuals when their issue has been resolved, satisfaction surveys and through the Mystery shopper where Xserve have recently undertook a trial with a shipper, and as a result have now included an internal Mystery Shopper stage for all newly trained Service Desk operatives. - Current themes include: language barriers, lack of industry/Gemini knowledge, Xserve Service Desk frequency of updates & unhappy with resolution when not fully resolved. - KT confirmed that Xserve Service Desk will continue to regularlyPage feature 2 of at 3 ops forums. Work on going to look at alternative service desk offerings to better meet customer expectations and Wider RIIO T2 project to review service provided by Xoserve and National Grid

- KT also clarified the key points of contact within Xserve & National Grid where the Gas Operational Forum – Thursday 23rd November 2017

Action Discussion Who is Closed/ Action Due Date Ref Item Responsible Open

Supply & Demand slides are good indications but Operational 1 can NG introduce some indication on actual NG Jan Forum Open Overview volumes in the slides for Demand

Winter NG to re-record the some of winter webinars that 2 NG Jan Forum Open Webinars failed the quality check.

Week commencing Monday 4th December – Calculated 9th 3 Where applicable, NG will provide historic data NG Open Linepack Data December since October 2nd 2017. TSO > TSO Nominations Following the live Webex, NG to record a webinar 4 Matching NG Jan Forum Open Contingency in which will be uploaded onto NG.com Process Interactive Where possible to provide an interesting day in an 5 NG Ongoing Open slides interactive format.

Constraint It was agreed that to revisit the Constraint 6 Management NG Q1 2018 Open Scenario Management Scenario session in future forums Balancing Energy Balancing Team to review Regime & comments/questions following the voice of 7 NG Q1 2018 Open System customer session and provide feedback at future Operator Role forum National Grid to review comments/questions Future of 8 following the voice of customer session and NG Q1 2018 Open Gemini provide feedback at future forum

Page 3 of 3