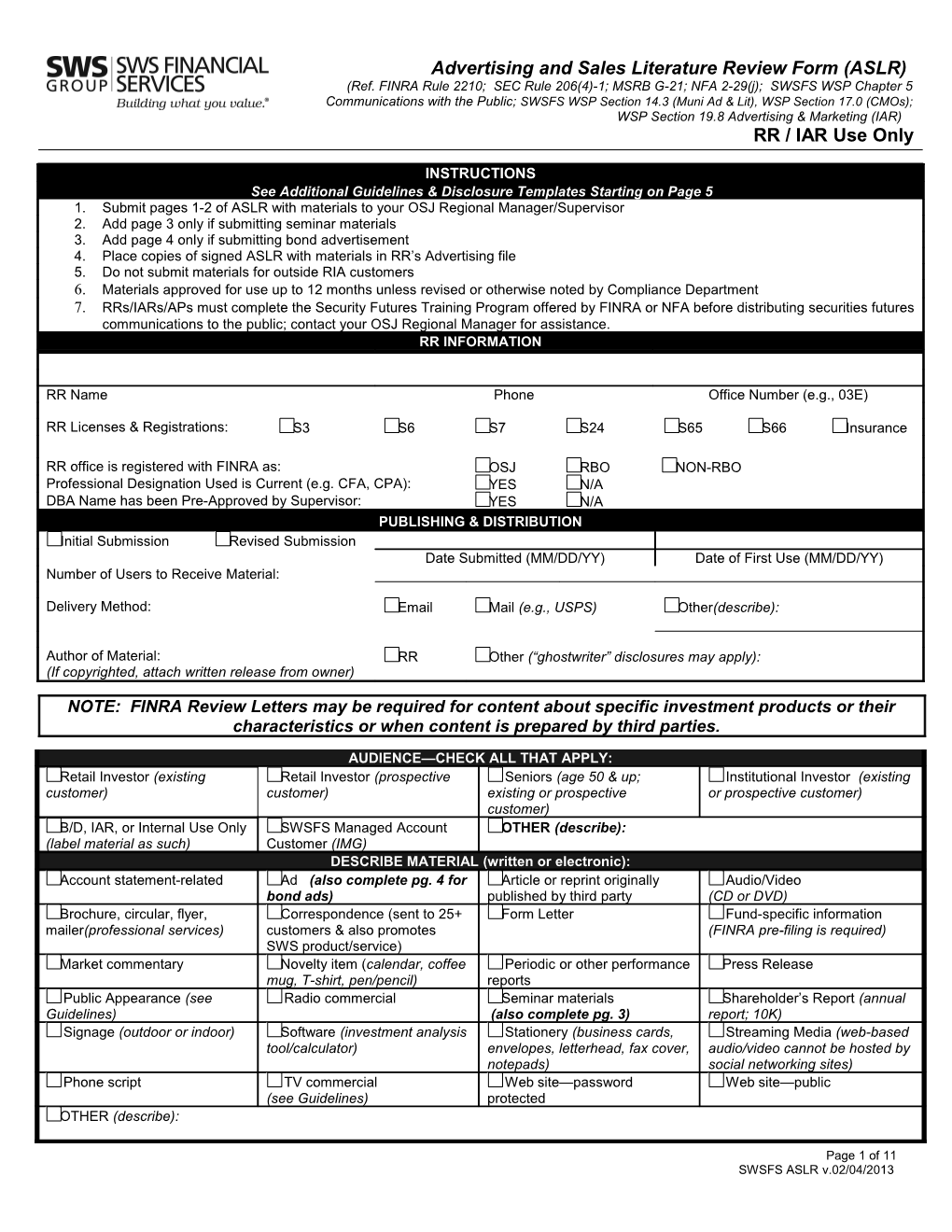

Advertising and Sales Literature Review Form (ASLR) (Ref. FINRA Rule 2210; SEC Rule 206(4)-1; MSRB G-21; NFA 2-29(j); SWSFS WSP Chapter 5 Communications with the Public; SWSFS WSP Section 14.3 (Muni Ad & Lit), WSP Section 17.0 (CMOs); WSP Section 19.8 Advertising & Marketing (IAR) RR / IAR Use Only

INSTRUCTIONS See Additional Guidelines & Disclosure Templates Starting on Page 5 1. Submit pages 1-2 of ASLR with materials to your OSJ Regional Manager/Supervisor 2. Add page 3 only if submitting seminar materials 3. Add page 4 only if submitting bond advertisement 4. Place copies of signed ASLR with materials in RR’s Advertising file 5. Do not submit materials for outside RIA customers 6. Materials approved for use up to 12 months unless revised or otherwise noted by Compliance Department 7. RRs/IARs/APs must complete the Security Futures Training Program offered by FINRA or NFA before distributing securities futures communications to the public; contact your OSJ Regional Manager for assistance. RR INFORMATION

RR Name Phone Office Number (e.g., 03E)

RR Licenses & Registrations: S3 S6 S7 S24 S65 S66 Insurance

RR office is registered with FINRA as: OSJ RBO NON-RBO Professional Designation Used is Current (e.g. CFA, CPA): YES N/A DBA Name has been Pre-Approved by Supervisor: YES N/A PUBLISHING & DISTRIBUTION Initial Submission Revised Submission Date Submitted (MM/DD/YY) Date of First Use (MM/DD/YY) Number of Users to Receive Material:

Delivery Method: Email Mail (e.g., USPS) Other(describe):

Author of Material: RR Other (“ghostwriter” disclosures may apply): (If copyrighted, attach written release from owner)

NOTE: FINRA Review Letters may be required for content about specific investment products or their characteristics or when content is prepared by third parties.

AUDIENCE—CHECK ALL THAT APPLY: Retail Investor (existing Retail Investor (prospective Seniors (age 50 & up; Institutional Investor (existing customer) customer) existing or prospective or prospective customer) customer) B/D, IAR, or Internal Use Only SWSFS Managed Account OTHER (describe): (label material as such) Customer (IMG) DESCRIBE MATERIAL (written or electronic): Account statement-related Ad (also complete pg. 4 for Article or reprint originally Audio/Video bond ads) published by third party (CD or DVD) Brochure, circular, flyer, Correspondence (sent to 25+ Form Letter Fund-specific information mailer(professional services) customers & also promotes (FINRA pre-filing is required) SWS product/service) Market commentary Novelty item (calendar, coffee Periodic or other performance Press Release mug, T-shirt, pen/pencil) reports Public Appearance (see Radio commercial Seminar materials Shareholder’s Report (annual Guidelines) (also complete pg. 3) report; 10K) Signage (outdoor or indoor) Software (investment analysis Stationery (business cards, Streaming Media (web-based tool/calculator) envelopes, letterhead, fax cover, audio/video cannot be hosted by notepads) social networking sites) Phone script TV commercial Web site—password Web site—public (see Guidelines) protected OTHER (describe):

Page 1 of 11 SWSFS ASLR v.02/04/2013 Advertising and Sales Literature Review Form (ASLR) (Ref. FINRA Rule 2210; SEC Rule 206(4)-1; MSRB G-21; NFA 2-29(j); SWSFS WSP Chapter 5 Communications with the Public; SWSFS WSP Section 14.3 (Muni Ad & Lit), WSP Section 17.0 (CMOs); WSP Section 19.8 Advertising & Marketing (IAR) RR / IAR Use Only

CONTENT STANDARDS FOR ALL ADVERTISING & SALES LITERATURE RR CHECKLIST YES N/A Firm’s name and logo appear prominently Firm’s member disclosures are included (see Guidelines) Prominently discloses the RR’s name; Group Marketing name, if applicable; RR’s approved title, branch office or OSJ address and phone number (should match same data reported on RR’s Form U4) Material is prominently marked for Broker, Advisor, Institutional, or Internal Use Only, if applicable Font size used in disclosures should be as prominent as body text Does not state/imply that firm, product/service, or RR has been endorsed/approved by SEC/SROs Copyright/written release for commercial use is attached from original third-party owner/publisher Material facts are disclosed and can be verified through documentation held in RR’s files Market/statistical data and illustrations are dated and sourced to original provider(s) Illustrations/graphics are sourced to original provider(s) Opinions are based on fact and clearly identified (e.g., “…in my opinion”; “I believe...”) Presentation is fair and balanced (benefits and risks of investment product/strategy are presented equally) Sound basis is presented for customers to evaluate facts of product/service offered Excludes or otherwise does not imply stock or sector recommendations (e.g., buy, hold, sell) Excludes false, exaggerated, promissory, unwarranted or misleading statements, claims or illustrations Excludes language too complex/technical for intended audience (“know your customer” rules) Excludes predictions/projections of performance or implications of recurring performance Excludes legends/footnotes that would prohibit an investor’s understanding of the communication Excludes promissory images such as a pot-of-gold; vault; money growing on tree; pile of currency Excludes language intended to provoke emotion or unnecessary/unwarranted action

SUPERVISORY STAFF & COMPLIANCE DEPARTMENT APPROVALS

OSJ Regional Manager/Supervisor Phone Number Review Date(M/D/YY) See noted changes

ADDITIONAL COMMENTS:

COMPLIANCE DEPARTMENT USE

Appears to meet applicable Declined—revisions Declined—requires FINRA Declined—conflicts with Firm standards necessary to meet applicable filing or FINRA Review Letter policies/procedures with noted changes standards see notes in send final version to materials Compliance Dept.

ADDITIONAL COMMENTS:

COMPLIANCE DEPARTMENT: CLH = Chris Holmes 214-859-6758 Compliance Department Review Date(M/D/YY) DP= Damon Phillips 214-859-1509 TCC = Teresa Cybulska-Cland 214-859-1541

Page 2 of 11 SWSFS ASLR v.02/04/2013 Advertising and Sales Literature Review Form (ASLR) (Ref. FINRA Rule 2210; SEC Rule 206(4)-1; MSRB G-21; NFA 2-29(j); SWSFS WSP Chapter 5 Communications with the Public; SWSFS WSP Section 14.3 (Muni Ad & Lit), WSP Section 17.0 (CMOs); WSP Section 19.8 Advertising & Marketing (IAR) RR / IAR Use Only

SEMINAR PLAN

(Ref.: “Protecting Senior Investors: Report of Examinations of Securities Firms Providing "Free Lunch" Sales Seminars”; (Joint Report by SEC, NASAA & FINRA) available at www.finra.org/reports. Includes regulators' findings at B/Ds & IARs that offer "free lunch" sales seminars targeting investors at or nearing retirement age.) (Also see SWSFS WSP Section 5.18 Free-Lunch Seminars, Section 2.5 Gifts/Gratuities; FINRA Regulatory Notice 07-43 “Seniors”)

INSTRUCTIONS 1. Attach to pages 1-2 of ASLR 2. Attach FINRA Review Letters for seminar materials created by third parties 3. Attach copies of visual aids and handouts for supervisory review 4. Provide SWSFS Form ADV to existing/prospective managed account customers who attend the seminar. 5. Maintain list of seminar attendees in the RR’s Advertising file.

EVENT DETAILS

Date(s) of Seminar (M/D/YY) Total Attendees Expected

Location (include city, state) Describe “Giveaway” to Attendees (e.g., free meal)

Speaker(s) (e.g., SWSFS RR, guest, etc.) Product Sponsor(s) Name, if applicable $ Approx. Compensation/Reimbursement from Product Compensation/Reimbursement Items (e.g., meeting room, mailings, Sponsor(s), if applicable food/beverage, etc.)

RR REQUIRED CONTENT FOR SEMINAR INVITATIONS CHECKLIST YES N/A 1. RR’s name & firm-approved title 2. RR’s branch office address & phone number (should match same data on RR’s Form U4) 3. RR disclosures 4. Firm name, logo & member disclosures 5. RR’s DBA name & related disclosures (DBA must be registered with FINRA WEB CRD & local authorities) 6. Name, address, phone of guest speaker(s) or sponsors/co-sponsors 7. General description of topics to be presented 8. Location, date & time of seminar 9. “Giveaway” is disclosed with delivery time (e.g., “Dinner will be served following our presentation.”) 10. Product disclosures

SUPERVISORY STAFF & COMPLIANCE DEPARTMENT APPROVALS

OSJ Regional Manager/Supervisor Date (M/D/YY) Comments

Compliance Department Date (M/D/YY) Comments

Page 3 of 11 SWSFS ASLR v.02/04/2013 Advertising and Sales Literature Review Form (ASLR) (Ref. FINRA Rule 2210; SEC Rule 206(4)-1; MSRB G-21; NFA 2-29(j); SWSFS WSP Chapter 5 Communications with the Public; SWSFS WSP Section 14.3 (Muni Ad & Lit), WSP Section 17.0 (CMOs); WSP Section 19.8 Advertising & Marketing (IAR) RR / IAR Use Only

BOND ADVERTISEMENTS

INSTRUCTIONS 1. Complete and attach to pages 1-2 of ASLR with copy of ad 2. Attach evidence of Firm’s inventory of bond(s) to be advertised

CONTENT STANDARDS FOR BOND ADS RR CHECKLIST (Also see page 2 “Content Standards for All Advertising & Sales Literature”) YES N/A Does not claim SWSFS is a “Member of MSRB” Does not claim “tax-exempt” if “tax-deferred” Identifies relevant investment characteristics (e.g., credit quality/ratings) Presentation is fair, balanced, not misleading (benefits and risks presented equally) Bond Disclosure Statements (see attached Guidelines) Limitations on offer are disclosed Percentage rate labeled as coupon rate or yield (indicate discount (before/after-tax); par; or premium) Yield disclosures Minimum investment amount

BOND DESCRIPTION

ISSUE/ISSUER CUSIP

ISSUE/ISSUER CUSIP

Moody Rating S&P Rating Fitch Rating Insurer(s)

Interest Rate (Coupon) Maturity Date Yield to Maturity (YTM) Lowest Yield (Worst Case Subject to AMT (M/D/YY) Yield/WCY) (Alternative Min. Tax)

Callable/Redemption Date(s) Callable Price Yield to Call Minimum Investment

PUBLICATION INFORMATION

Name of Publication (Include City, State) Run Date(s)

Name of Publication (Include City, State) Run Date(s)

SUPERVISORY STAFF & COMPLIANCE DEPARTMENT REVIEW

OSJ Regional Manager/Supervisor Date (M/D/YY) Comments

Compliance Department Date (M/D/YY) Comments

Page 4 of 11 SWSFS ASLR v.02/04/2013 Advertising and Sales Literature Review Form (ASLR) (Ref. FINRA Rule 2210; SEC Rule 206(4)-1; MSRB G-21; NFA 2-29(j); SWSFS WSP Chapter 5 Communications with the Public; SWSFS WSP Section 14.3 (Muni Ad & Lit), WSP Section 17.0 (CMOs); WSP Section 19.8 Advertising & Marketing (IAR) RR / IAR Use Only

GUIDELINES & DISCLOSURE TEMPLATES

Advertising = Little/No Control Over Audience Sales Literature = Some Control Over Audience

These guidelines are (1) not all-inclusive, and (2) focus on materials or events commonly reviewed by the Firm’s supervisory staff. More information is available in the Firm’s WSPs noted above, or contact your OSJ Regional Manager/Supervisor, or the Compliance Department for additional assistance. Generally, advertising and sales literature includes any written or electronic material that is designed for distribution to the public. For IARs who manage accounts through the Firm’s advisory platforms, advertising materials would include (1) materials distributed to more than 1 person, and (2) materials designed to solicit new or maintain existing customers (excluding most account-related documents/reports).

OUTSIDE RIA BUSINESS: Do not submit materials for use with your outside RIA customers.

I. Advertising & Sales Literature—Examples Article reprints of third-party publications Recruiting material Business cards & stationery Sales presentations; seminar presentations; handouts Email messages sent to multiple recipients Signs or banners Investment Analysis Tools & related output Sponsorships Marketing materials from sponsor companies Streaming Media (web-based audio/video cannot be hosted Mass mailing campaigns by social networking sites) Press releases & interviews Telemarketing scripts Prospecting, target market & form letters Television, radio or other broadcast advertising Web sites (public or password-protected) II. Not Advertising or Sales Literature—Examples Correspondence sent to fewer than 25 prospective Regular account statements, reports, or correspondence retail brokerage customers within a 30-calendar day sent to existing customers (but not to solicit new period business from existing or prospective customer) Reply to unsolicited request by an existing or Telephone, in-person, or other verbal conversation prospective customer III. FINRA Pre-filing Exemptions—Examples Correspondence (as defined by FINRA) Independently prepared reprints Municipal securities (except some 529 plans; funds) Prospectuses Material previously filed by another entity, which Material simply listing products/services offered by SWSFS received a “clean” FINRA letter (opinion) Previously filed material left unchanged Market commentary IV. FINRA Pre-filing Required (allow 4-6 weeks to process)—Examples Investment company literature or rankings Seminar presentations/handouts created by third parties Previously filed material that has been altered beyond TV commercial the provisions of the original FINRA opinion Securities Futures Products communications sent to retail investors V. Public Appearances Any public speaking event (e.g., conducting seminars) Radio or TV interview Webcasts Live or scripted VI. Misrepresenting Expertise Material created by a third party must disclose that it was either created by a third party or prepared for use by the RR (see “ghostwriter” disclosure) Misuse of a title or designation in a manner that exaggerates the RR’s expertise or implies expertise where none exists may violate state and federal securities laws as well as regulatory guidelines established by SROs and Firm policies Page 5 of 11 SWSFS ASLR v.02/04/2013 Advertising and Sales Literature Review Form (ASLR) (Ref. FINRA Rule 2210; SEC Rule 206(4)-1; MSRB G-21; NFA 2-29(j); SWSFS WSP Chapter 5 Communications with the Public; SWSFS WSP Section 14.3 (Muni Ad & Lit), WSP Section 17.0 (CMOs); WSP Section 19.8 Advertising & Marketing (IAR) RR / IAR Use Only

VII. LICENSING, REGISTRATION, DESIGNATIONS Designations used by RRs in all communications with the public must be (1) pre-approved by the Firm; (2) current, and (3) if applicable, reported to the Registration Department and Form U4 before use (CFP; ChFC; PFS; CFA; CIC) RRs with insurance licenses or other designations are responsible for ensuring advertising.sales literature, or other communications meet standards set by their state insurance authorities and issuers of their professional designations VIII. IAR SWSFS WSP Section 19.8 contains detailed advertising and marketing policies specific to the Firm’s IARs, which are not duplicated in these guidelines and should be referenced as needed. Among the IAR advertising/marketing topics covered by WSPs:

Performance Advertising Charts, Formulas, Graphs, Models, and Other Devices Performance Information Actual Results Only One-on-One Presentations Partial Client Lists Back-up of Performance Required Article Reprints Current Performance Data Requirement Superlative Statements Global Investment Performance Standards Substantiation of Claims Past Performance Information Use of "RIA" or "Investment Counsel" Restrictions on Linking Performance Data of Managed Claims of Free Service Accounts and Brokerage Accounts Related Accounts or Composites Responding to Questionnaires, Surveys, and Other Communications Uses of Indexes Providing Information to Third-Party Databases Use of Performance Returns Generated While at Investment Analysis Tools Another Firm Past Recommendations Third-party Investment Programs IX. Security Futures Products (SFP) RRs/IARs/APs must complete the Security Futures Training Program from NFA or FINRA before distributing securities futures communications to the public; contact your Branch Manager for assistance if you have not completed this training (allow approx. 2 hours to complete online modules). SFP communications are subject to pre-filing with FINRA’S Advertising Regulation Department or the NFA’s Advertising Regulatory Team no less than 10 business days before first use. SWS WSP Section 5.22 contains detailed policies specific to communnications about SFPs, which are not duplicated in these guidelines and should be referenced as needed.

X. DISCLOSURES

Disclosure templates are for your use, though these may be modified during the review process. General guidance:

1. Font size used in disclosures should be as prominent as body text 2. Disclosures can be written into the body text or “story line”, or placed in the footer of a page 3. Disclosures specific to illustrations (e.g., a DJIA graph/chart) should be adjacent to or below the illustration, or otherwise in close proximity to the illustration. 4. To prevent detachment, disclosures should not appear “alone” on a single page at the end of a document 5. Benefits and risks of an investment product or strategy must be equally disclosed/discussed 6. Material facts/figures cannot be “hidden” in disclosures or footnotes 7. Discussion of branded products, or specific securities or their characteristics, will likely require product-specific disclosures

Page 6 of 11 SWSFS ASLR v.02/04/2013 Advertising and Sales Literature Review Form (ASLR) (Ref. FINRA Rule 2210; SEC Rule 206(4)-1; MSRB G-21; NFA 2-29(j); SWSFS WSP Chapter 5 Communications with the Public; SWSFS WSP Section 14.3 (Muni Ad & Lit), WSP Section 17.0 (CMOs); WSP Section 19.8 Advertising & Marketing (IAR) RR / IAR Use Only

A. Standard Firm and RR Disclosures (templates)

1. Member (commonly used formats): A. SWS Financial Services, Inc., is a member of FINRA and SIPC B. Member: FINRA / SIPC C. Member of FINRA and SIPC D. SWS Financial Services, Inc., is a registered broker-dealer and registered investment adviser that does not provide tax or legal advice. The firm is a wholly owned subsidiary of SWS Group, Inc. (NYSE: SWS) and a member of FINRA and SIPC. SWS Financial Services, Inc., is located at 1201 Elm Street, Suite 3500, Dallas, Texas 75270, (214) 859-1800.

2. RR *RR NAME* is a registered representative of SWS Financial Services, Inc., a registered broker-dealer and registered investment adviser that does not provide tax or legal advice. Material presented herein is for informational use only by agents of existing and prospective customers of the presenting representative and does not reflect the views of SWS Financial Services, Inc., management. This information may not be duplicated or redistributed without prior consent of SWS Financial Services, Inc., and distribution or publication of this material does not represent a solicitation to complete a financial transaction with the firm. Though information was prepared from sources believed reliable, SWS Financial Services, Inc., does not guarantee its accuracy or completeness. Securities offered by SWS Financial Services, Inc. (1) are not insured by the FDIC (Federal Deposit Insurance Corporation) or by any other federal government agency; (2) are not bank deposits; (3) are not guaranteed by any bank or bank affiliate; and (4) may lose value. SWS Financial Services, Inc., is a wholly owned subsidiary of SWS Group, Inc. (NYSE:SWS) and a member of FINRA and SIPC. SWS Financial Services, Inc., is located at 1201 Elm Street, Suite 3500, Dallas, Texas 75270, (214) 859-1800. Past performance is no guarantee of future results.

3. Dual-Registered Representatives (RR & IAR) *RR/IAR NAME* is a registered representative and registered investment adviser representative of SWS Financial Services, Inc., a registered broker-dealer and registered investment adviser that does not provide tax or legal advice. Material presented herein is for informational use only by agents of existing and prospective customers of the presenting representative and does not reflect the views of SWS Financial Services, Inc., management. This information may not be duplicated or redistributed without prior consent of SWS Financial Services, Inc., and distribution or publication of this material does not represent a solicitation to complete a financial transaction with the firm. Though information was prepared from sources believed reliable, SWS Financial Services, Inc., does not guarantee its accuracy or completeness. Securities offered by SWS Financial Services, Inc. (1) are not insured by the FDIC (Federal Deposit Insurance Corporation) or by any other federal government agency; (2) are not bank deposits; (3) are not guaranteed by any bank or bank affiliate; and (4) may lose value. SWS Financial Services, Inc., is a wholly owned subsidiary of SWS Group, Inc. (NYSE:SWS) and a member of FINRA and SIPC. SWS Financial Services, Inc., is located at 1201 Elm Street, Suite 3500, Dallas, Texas 75270, (214) 859-1800. Past performance is no guarantee of future results.

4. Ghostwriter (materials written/prepared by third party for use by RR/IAR) This material was written and prepared by (*INSERT NAME, ADDRESS & PHONE FOR GHOSTWRITER*). (Insert Standard Disclosure #2 or #3)

5. Investor Education (retail or institutional investor) Suitability on products mentioned herein must be determined on an individual basis. Not all products are suitable for all investors. Additional investor education is available through: FINRA (Financial Industry Regulatory Authority) at www.finra.org; Securities Industry and Financial Markets Association (SIFMA) at www.sifma.org; and Municipal Securities Rulemaking Board (MSRB) at www.msrb.org, EMMA (Electronic Municipal Market Access) System at www.emma.msrb.org, or DPC Data’s MuniFilings® at www.munifilings.com.

Page 7 of 11 SWSFS ASLR v.02/04/2013 Advertising and Sales Literature Review Form (ASLR) (Ref. FINRA Rule 2210; SEC Rule 206(4)-1; MSRB G-21; NFA 2-29(j); SWSFS WSP Chapter 5 Communications with the Public; SWSFS WSP Section 14.3 (Muni Ad & Lit), WSP Section 17.0 (CMOs); WSP Section 19.8 Advertising & Marketing (IAR) RR / IAR Use Only

6. RR Using DBA Name Offering general securities through SWS Financial Services, Inc. (Insert Standard Disclosure #2 or #3)

B. Comparisons Between Investments or Services—(guidance)

Disclose material differences between compared investments or services, such as:

Investment objectives Costs and expenses Liquidity Safety Guarantees or insurance Fluctuation of principal or return Tax features

C. Market Commentary/Letter —(guidance)

Date publication Source and date all market data (e.g., stock/index prices) “Buy”, “Sell”, “Hold” or implications of these/similar recommendations are prohibited “Blanket” recommendations of investment products/services unsuitable for mass distribution (customer suitability) Predictions or projections are prohibited Limit performance information to publicly available data that can be verified by readers Include standard disclosures for Firm, RR and product disclosures (when applicable)

D. Testimonials—(guidance for RRs only; IARs are prohibited from using testimonials)

If the testimonial concerns a technical aspect of investing, the person making the testimonial must have the knowledge and experience to provide the testimony Disclose that testimonial may not be representative of the experience of other customers Explain that testimonial is not a guarantee of future performance or success Disclose whether or not it is a paid testimonial

E. Annuities (templates)

1. Fixed Annuities The guarantees of fixed annuity contracts are contingent on the claims-paying ability of the issuing insurance company. Most annuities have surrender charges assessed during the early years of the contract if the contract owner surrenders the annuity. In addition, if the contract is surrendered before age 59-1/2, the annuity owner may be subject to a 10% federal income tax penalty. Annuity withdrawals are taxed as ordinary income.

Page 8 of 11 SWSFS ASLR v.02/04/2013 Advertising and Sales Literature Review Form (ASLR) (Ref. FINRA Rule 2210; SEC Rule 206(4)-1; MSRB G-21; NFA 2-29(j); SWSFS WSP Chapter 5 Communications with the Public; SWSFS WSP Section 14.3 (Muni Ad & Lit), WSP Section 17.0 (CMOs); WSP Section 19.8 Advertising & Marketing (IAR) RR / IAR Use Only

2. Variable Annuities [NOTE: SEC Rule 482(b)(1) disclosure statements must be presented in a type size at least as large as, and of a style different from, but at least as prominent as that used in the major portion of the material (illustrated below). It also must be offset from, and cannot be combined with, non-Rule 482 disclosures or other disclosure statements in the material. For assistance, contact the Compliance Department or your OSJ Regional Manager].

Rule 482 Disclosures: Variable annuities are sold only by prospectus. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from the investment company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

Non-Rule 482 Disclosures: Investing in a variable annuity may be unsuitable for retirement savings, such as an IRA due to the deferred tax treatment of a variable annuity contract or the higher tax rate paid later. Guaranteed principal is contingent upon the death of the owner before the end of the contract and payment of an additional annual expense known as a “mortality cost.” While variable annuities give investors the opportunity to get higher rates of return as stock markets rise, lower returns are likely when markets fall. Federal income tax and a 10% tax penalty may apply to early distributions.

F. ETFs and/or Mutual Funds (template) [NOTE: SEC Rule 482(b)(1) disclosure statements must be presented in a type size at least as large as, and of a style different from, but at least as prominent as that used in the major portion of the material (illustrated below). It also must be offset from, and cannot be combined with, non-Rule 482 disclosures or other disclosure statements in the material. For assistance, contact the Compliance Department or your OSJ Regional Manager].

Rule 482 Disclosures: [INSERT *ETFs* or *Mutual Funds* or both] are sold only by prospectus. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from the investment company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

G. Securities Futures Products (guidance)

Disclosures must include:

a warning to the effect that “securities futures are not suitable for all investors”; a statement that indicates supporting documentation for any claims (including any claims made on behalf of security futures programs or the security futures expertise of sales persons), comparisons, recommendations, statistics or other technical data, is available upon request.

H. Index (templates)

1. Non-specific Indexes are constructed without management fees, trading costs, or other expenses subtracted from the returns, and are shown on a total return basis that assumes reinvestment of dividends and interest income unless otherwise noted. Please note that investors cannot invest directly in an index. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

2. Dow Jones Industrial Average

Page 9 of 11 SWSFS ASLR v.02/04/2013 Advertising and Sales Literature Review Form (ASLR) (Ref. FINRA Rule 2210; SEC Rule 206(4)-1; MSRB G-21; NFA 2-29(j); SWSFS WSP Chapter 5 Communications with the Public; SWSFS WSP Section 14.3 (Muni Ad & Lit), WSP Section 17.0 (CMOs); WSP Section 19.8 Advertising & Marketing (IAR) RR / IAR Use Only

The Dow Jones Industrial Average is an unmanaged, price-weighted index of 30 large capitalization stocks with dividends reinvested. Please note that investors cannot invest directly in an index. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

3. NASDAQ Composite The NASDAQ Composite is an unmanaged, market capitalization weighted index of stocks listed on the Nasdaq Stock Exchange, reported as price return without reinvestment of dividends. Please note that investors cannot invest directly in an index. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

4. S&P 500 The Standard & Poor’s 500 Index (“S&P 500”) is an unmanaged, market capitalization weighted index of 500 widely held stocks, with dividends reinvested, and is often used as a benchmark for the U.S. stock market. Please note that investors cannot invest directly in an index. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

H. Fixed Income Products (templates)

1. Non-specific Bonds offered are subject to availability, prior sale, and change in price; a minimum investment may also apply. In general, the bond market is volatile—bond prices rise when interest rates fall and vice versa, an effect usually pronounced for longer-term securities. Any fixed income security sold or redeemed before maturity may be subject to a substantial gain or loss. Some bonds have call features that may affect income. Investors who decide to sell any fixed income security, including CDs, before a call or maturity date may not receive the full amount of their invested principal. SWS Financial Services, Inc. may act as principal on any fixed income transaction, public offering or any other securities transaction. Markups may be included in the price for corporate bonds, municipal bonds, government bonds and CDs. SWS Financial Services, Inc., is a registered broker-dealer and registered investment adviser that does not provide tax or legal advice. The firm is a wholly owned subsidiary of SWS Group, Inc. (NYSE: SWS) and a member of FINRA and SIPC. SWS Financial Services, Inc., is located at 1201 Elm Street, Suite 3500, Dallas, Texas 75270, (214) 859-1800.

For complete information about a specific issue, including expenses and charges, risks and other important information, investors should read the issuer’s official statement and other disclosure materials made available by the issuer through a financial professional or the Municipal Securities Rulemaking Board’s EMMA (Electronic Municipal Market Access) System at http://emma.msrb.org/, or DPC Data’s http://www.munifilings.com/munifilings/IndexAction.do. Please read these carefully before investing or sending money.

Page 10 of 11 SWSFS ASLR v.02/04/2013 Advertising and Sales Literature Review Form (ASLR) (Ref. FINRA Rule 2210; SEC Rule 206(4)-1; MSRB G-21; NFA 2-29(j); SWSFS WSP Chapter 5 Communications with the Public; SWSFS WSP Section 14.3 (Muni Ad & Lit), WSP Section 17.0 (CMOs); WSP Section 19.8 Advertising & Marketing (IAR) RR / IAR Use Only

2. Municipal Bonds (non-specific) Municipal Bonds are subject to availability, prior sale and change in price; a minimum investment may apply. Prices and yields represented may not represent market yields and prices at the time an investor contacts a dealer or financial professional. Unless designated as “taxable” or “AMT” (alternative minimum tax), interest on municipal bonds generally is free from federal income tax, but may be subject to tax for residents of certain municipalities and states. Gains on sales or redemptions of all municipal bonds may be taxed as capital gains. Investors should contact their tax professional regarding their individual tax situation. Markups may be included in the price of a municipal bond. If designated, the insurer of a municipal bond issue ensures timely repayment of principal and interest by the issuer; however, the insurer does not guarantee a bond’s market value or protect it during fluctuating market conditions; such guarantees are backed by the paying ability of the insurer. SWS Financial Services, Inc., is a registered broker-dealer and registered investment adviser that does not provide tax or legal advice. The firm is a wholly owned subsidiary of SWS Group, Inc. (NYSE: SWS) and a member of FINRA and SIPC. SWS Financial Services, Inc., is located at 1201 Elm Street, Suite 3500, Dallas, Texas 75270, (214) 859-1800.

For complete information about a specific issue, including expenses and charges, risks and other important information, investors should read the issuer’s official statement and other disclosure materials made available by the issuer through a financial professional or the Municipal Securities Rulemaking Board’s EMMA (Electronic Municipal Market Access) System at http://emma.msrb.org, or DPC Data’s http://www.munifilings.com/munifilings/IndexAction.do. Please read these carefully before investing or sending money.

Page 11 of 11 SWSFS ASLR v.02/04/2013