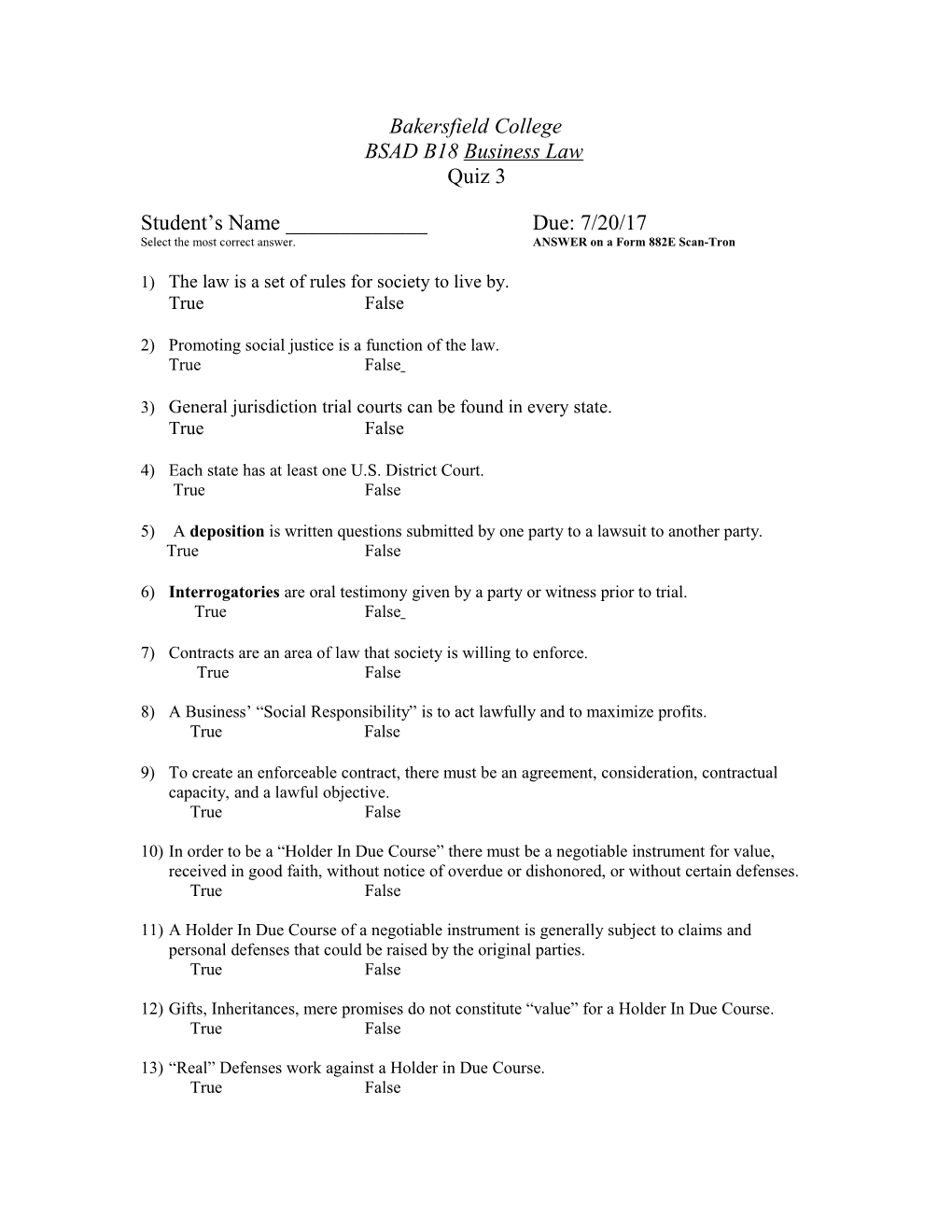

Bakersfield College BSAD B18 Business Law Quiz 3

Student’s Name ______Due: 7/20/17 Select the most correct answer. ANSWER on a Form 882E Scan-Tron

1) The law is a set of rules for society to live by. True False

2) Promoting social justice is a function of the law. True False

3) General jurisdiction trial courts can be found in every state. True False

4) Each state has at least one U.S. District Court. True False

5) A deposition is written questions submitted by one party to a lawsuit to another party. True False

6) Interrogatories are oral testimony given by a party or witness prior to trial. True False

7) Contracts are an area of law that society is willing to enforce. True False

8) A Business’ “Social Responsibility” is to act lawfully and to maximize profits. True False

9) To create an enforceable contract, there must be an agreement, consideration, contractual capacity, and a lawful objective. True False

10) In order to be a “Holder In Due Course” there must be a negotiable instrument for value, received in good faith, without notice of overdue or dishonored, or without certain defenses. True False

11) A Holder In Due Course of a negotiable instrument is generally subject to claims and personal defenses that could be raised by the original parties. True False

12) Gifts, Inheritances, mere promises do not constitute “value” for a Holder In Due Course. True False

13) “Real” Defenses work against a Holder in Due Course. True False 14) “Real” Defenses include: a) Fraud b) Forgery c) Infancy d) Material Alteration e) All of the above

15) “Personal” Defenses work against Holders in Due Course. True False

16) “Personal” Defenses include: a) Lack of Consideration b) Nonperformance c) Undue Influence d) Non-delivery e) All of the above.

17) A deposit into a bank creates a contract relationship between the customer and the bank. True False

18) When someone deposits money into a bank account (i.e. checking account), the bank becomes the customer’s debtor. True False

19) A bank customer has a duty to review their statement. True False

20) According to the U.C.C., customers are not required to maintain sufficient funds in a checking account to cover the checks the customer expects to write. True False

21) Commercial Paper is an unconditional written demand or order to pay money. True False

22) A negotiable instrument must be: a) in writing and signed by the drawer. b) State a fixed amount of money, payable “to order” or “bearer”. c) Not require any undertaking (other than to pay money). d) Be payable upon demand or at a time certain. e) All of the above.

23) A Certificate of Deposit is a form of Commercial Paper. True False

24) A “Draft” is a tow-party instrument. True False

25) A Check is a distinct form of a Draft drawn on a financial institution and payable on demand. True False 26) Promissory Notes are a three-party negotiable instrument. True False

27) Specialized types of Commercial Paper include: a) Certified Checks b) Teller’s Check c) Cashier’s Check d) Money Orders e) All of the above.

28) Negotiable Instruments serve as a substitute for money. True False

29) Negotiable Instruments serve as a substitute for a credit device. True False

30) A nonnegotiable instrument is useless and has no legal value. True False

31) Bankruptcy is a legal procedure for settling debts of legal entities that are unable to pay their debts as they become due. True False

32) The founders of the United States thought the plight of debtors was so important that they included a provision in the U.S. Constitution. True False

33) Bankruptcy cases are heard in federal courts. True False

34) One of the goals of federal bankruptcy law is to give debtors a chance at a fresh start financially. True False

35) The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, makes it easier for debtors to escape from their debts under federal bankruptcy law. True False

36) In addition to federal bankruptcy laws, there are individual state bankruptcy laws as well. True False

37) Under the 2005 Act, a debtor may be given only a partial fresh start as s/he may have to pay more of their pre-petition debts out of post-petition earnings. True False

38) The U.S. Trustee may perform many of the tasks that the bankruptcy judge had previously performed. True False

39) An involuntary petition for bankruptcy is filed by creditors and places the debtor into bankruptcy. True False 40) Attorneys may be fined for factual discrepancies under the 2005 Act. True False

41) The effect of an automatic stay is to suspend certain legal actions by creditors against the debtor or debtor’s property. True False

42) Bankruptcy laws vary from state to state. True False

43) The Bankruptcy Code provides for which type of “discharge”? a) Chapter 7 – Liquidation b) Chapter 11 - Business Reorganization c) Chapter 13 – Adjustment of an Individual’s Debt d) All of the above e) None of the above

44) Homestead exemptions are state laws and therefore vary from state to state. True False

45) Numerous federal consumer protections laws apply to debtor/creditor relationship. True False

46) All debts are dischargeable in Bankruptcy. True False

THIS QUIZ IS TO BE SUBMITTED at the end of class THURSDAY, July 20,, 2017

Keep Reading the Text!