Trust Board

27 September 2011

Integrated Corporate Performance Report

For the period ending 31 August 2011

1. Executive Summary

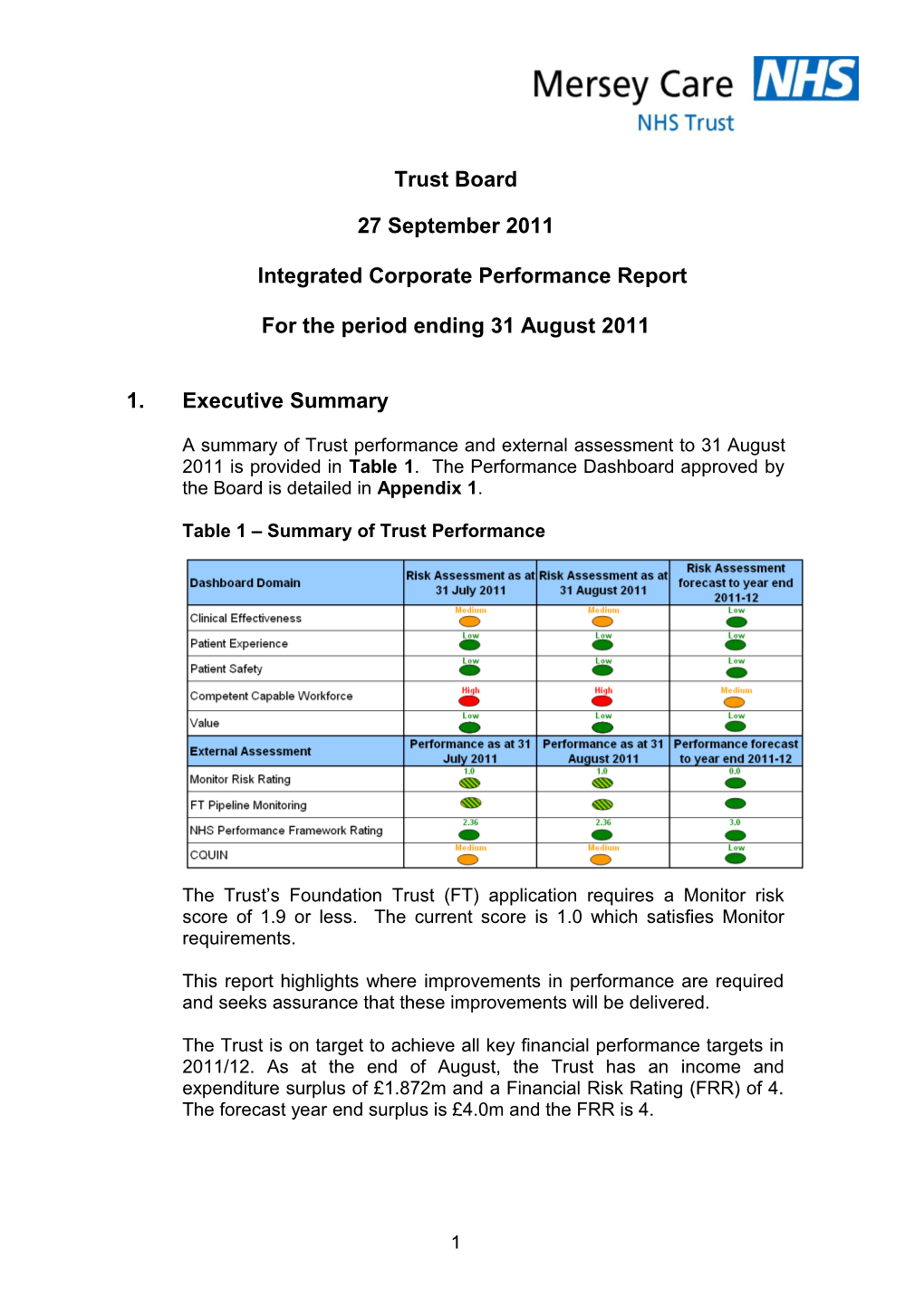

A summary of Trust performance and external assessment to 31 August 2011 is provided in Table 1. The Performance Dashboard approved by the Board is detailed in Appendix 1.

Table 1 – Summary of Trust Performance

The Trust’s Foundation Trust (FT) application requires a Monitor risk score of 1.9 or less. The current score is 1.0 which satisfies Monitor requirements.

This report highlights where improvements in performance are required and seeks assurance that these improvements will be delivered.

The Trust is on target to achieve all key financial performance targets in 2011/12. As at the end of August, the Trust has an income and expenditure surplus of £1.872m and a Financial Risk Rating (FRR) of 4. The forecast year end surplus is £4.0m and the FRR is 4.

1 2. External Assessment

NHS Trusts are required to assess their performance against the NHS Performance Framework. As Mersey Care will be applying for FT status the Trust must also assess performance against the Monitor Compliance Framework and report upon this as part of the FT pipeline monitoring by the Strategic Health Authority (SHA).

2.1 FT Pipeline Monitoring

A Tripartite Agreement is being prepared between the Trust, The Strategic Health Authority (SHA) and the Department of Health (DH) and proposes that the Trust can apply for FT status in April 2013. The SHA will continue to monitor the Trust based upon an Accountability Agreement which contains Monitor, DH and SHA performance metrics. As at the end of August, Trust performance is rated as amber/green.

2.2 Monitor Service Performance Compliance Framework 2011/12

To support the FT application the Trust needs to ensure a performance score of 1.9 or less against the Monitor Compliance Framework and have action plans in place to achieve all targets within a reasonable timeframe. As at the end of August 2011 the Trust has a score of 1.0. Improvements are required in the following areas:

Service users on CPA should be reviewed within the last 12 months. (If the Trust does not achieve this indicator by the end of September 2011, this will mean that the Trust does not achieve one of the key milestones within the FT pipeline and could delay the Trust’s FT application) Recording of HoNOS assessment - Work is on-going to improve performance and current trajectories indicate achievement by the end of the financial year.

2.3 NHS Performance Framework

As the Trust is not yet a FT, it will continue to be monitored by the SHA against the NHS Performance Framework. The framework is similar to Monitor. The Trust is required to achieve a performance score of greater than 2.0 to be rated as a well performing organisation. As at the end of August 2011 the Trust has a score of 2.36. Improvements are required in the following areas:

Service users (10% of adults) on a CPA should be in employment Service users on CPA should be reviewed within the last 12 months Recording of HoNOS assessment.

2 2.4 CQUIN

In 2011/12, the Trust is receiving non-recurrent funding of £2.6m from Commissioners as part of the CQUIN payment framework. The targets have been agreed with Commissioners and detailed action plans developed for their delivery. As at Quarter 1 2011/12 performance against key areas is summarised in Table 2.

Table 2 – Summary of CQUIN Performance

Service Performance Rating

Local Services Amber

Low & Medium Secure Services Amber

High Secure Services Green

As the funding is dependent upon the successful achievement / delivery of these targets, any under achievement of the targets may require the repayment of funding to Commissioners.

3 3. Quality

The Trust is achieving a number of key performance targets in 2011/12 and has many examples of improving performance. However, it is the key areas of underperformance which are the focus of the following sections. A summary of the areas of underperformance as at 31 August 2011 is provided in Table 3.

Trajectories have been developed by services for the majority of areas of underperformance, highlighting key milestones for delivering targets throughout the financial year. Details are provided in Appendix 2. Trajectories will be developed for the remaining areas of underperformance.

Table 3 – Summary of Areas of Underperformance Movement Risk Assessment Performance Performance Target From Last Current July 2011 August 2011 Outturn Month Month Quality - Clinical Effectiveness Data Completeness: Indentifiers - Marital Status 97.00% 87.61% 86.52% Service users in employment # 10.00% 3.14% 3.49% Recording of HoNOS assessment * # 90.00% 34.96% 36.36% NICE Clinical Guidelines Compliance Not Compliant Not Compliant Recording of disability status 85.00% 59.89% 65.42% Recording of religion status 85.00% 73.59% 76.04% Recording of sexual orientation 85.00% 35.74% 43.45% Information Goverance Toolkit (Level 2) Compliance Not Compliant Not Compliant Quality - Patient Experience

2 out of 3 2 out of 3 Achieve trajectories Delivery of FT membership targets constituencies constituencies for all constituencies Amber rated Amber rated Performance Performance Service user survey (measured annually) Performing Under Review Under Review Outpatient waiting times (breaches) 0 38 33 Psychological services waiting times (service 0 8 16 users waiting over target as at month end) Quality - Patient Safety Number of absconds from escorted leave in Med 0 1 1 Secure (over 12 hours) Patients on CPA reviewed in last 12 months * 95.00% 93.29% 91.83% Quality - Competent Capable Workforce Staff attendance 94.90% 94.20% 93.96% Corporate Essential Mandatory Learning 95.00% Not available Not available Personal Development Plans 80.00% Not available Not available Better than Worse than Worse than Staff Survey (measured annually) average/Improve average / average / ment Improvement Improvement Value

100% by end of Payment by Results - service users clustered 33.00% 53.00% Dec 2011

# Performance figures are calculated by the Trust from the Mental Health Minimum Data Set information sent to the Department of Health (DoH). Actual performance is published by the DoH three months after the end of each Quarter. There may be slight variations in reported performance. *The performance areas indicated by an asterisk are elements within the Monitor Compliance Framework for Mental Health Trusts.

Note: The NHS Performance Framework target for the recording of HoNOS assessment is 90% and the Monitor target is 50%.

4 3.1 Quality – Clinical Effectiveness

Key areas of underperformance are outlined below.

3.1.1 Data Completeness: Identifiers – Marital Status

As at 31 August 2011, 86.52% of service users had a valid marital status recorded against a target of 97%. Trajectories have been received indicating that this target will be met by 31 March 2012.

3.1.2 Service Users in Employment

In August 2011, the proportion of service users (adults) on a CPA in employment was 3.49% against a target of 10%. Trajectories have been received that indicate that the services aim to achieve this target by 31 March 2012. The Board is asked to note that this may prove difficult due to the high unemployment rates within the general population served by the Trust.

3.1.3 Recording HoNOS assessments

In August 2011, 36.36% of service users on a CPA had their HoNOS assessment recorded. Trajectories have been received that indicate that this target will be met by 31 December 2011 in Liverpool CBU and Positive Care Partnerships CBU and by 31 March 2012 in Rebuild CBU and SaFE CBU.

3.1.4 NICE Clinical Guidelines

As at the end of August 2011, four Clinical Business Units (CBUs) were not fully compliant with all relevant NICE clinical guidelines. Trajectories have been received indicating that performance may remain below target for three guidelines at the year end in Liverpool, PCP and Safe CBUs.

3.1.5 Equality, Diversity and Human Rights (Charts, showing a trend analysis, are provided in Appendix 3).

Recording of Disability Status

In August 2011, 65.42% of service users within Local Services had their disability status recorded against a target of 85%. Trajectories have been received that indicate that this target will be met by Local Services by 31 March 2012. Information flows are currently being developed within High Secure CBU in order to begin reporting from Month 7, October 2011.

Recording of Religion Status

In August 2011, 76.04% of service users had their religion status recorded against a target of 85%. Trajectories have been received that indicate that this target will be met by 31 March 2012.

5 Recording of Sexual Orientation

In August 2011, 43.45% of service users had their sexual orientation status recorded against a target of 85%. Trajectories have been received that indicate that this target will be met by 31 March 2012.

3.1.6 Information Governance Toolkit (Level 2)

Performance against this indicator is measured annually and achievement of Level 2 is required for the Trust to become a Foundation Trust. The Trust was not achieving Level 2 as at the annual submission in March 2011. Trajectories have been received indicating that the Trust will achieve Level 2 for all Information Governance Toolkit standards by 31 March 2012.

ACTIONS: The Executive Director of Service Development and Delivery and Medical Director to ensure the delivery of performance trajectories and report by exception to the Trust Board if agreed trajectories are not achieved.

The Medical Director and the Executive Director of Service Development and Delivery to develop action plans with CBUs to ensure compliance with NICE Clinical Guidelines by the end of the year.

6 3.2 Quality - Patient Experience

Key areas of underperformance are outlined below.

3.2.1 Delivery of FT membership targets

Performance against this indicator is measured quarterly. As at the end of June 2011, the targets for the service user / carer and public constituencies are not being achieved. Trajectories have been received that indicate that the targets for all membership constituencies will be achieved by 31 March 2012.

3.2.2 Service User Survey

The NHS Performance Framework uses the results of the annual Service User Survey to assess patient experience in four domains. To be classed as “Performing” the Trust has to achieve results consistent with the national average in all four domains.

The most recent survey for which results in these domains has been published was the 2010 survey. The Trust’s 2010/11 results are below:

Access and waiting – Consistent with national average Safe, high quality, coordinated care – Consistent with national average Better information, more choice – Worse than national average Building relationships – Consistent with national average

The overall result for the Trust in 2010/11 for patient experience was “Performance Under Review”.

The results for the 2011 survey are expected to be published in December 2011. Initial analysis of the Trust’s 2011 survey results show that performance has improved in the “Better information, more choice” domain (example questions include: “Do you think your views were taken into account in deciding which medicines to take?” and “Does your care plan set out your goals?”). However, the Trust will need to await publication of the results nationally to see if performance is consistent with the national average.

3.2.3 Waiting times

Outpatient Waiting Times

From April 2011 to August 2011, 33 service users had been waiting for 6 weeks or more for their first outpatient appointment. Trajectories have been received that indicate that there will be no further breaches of this target by 30 September 2011.

7 Psychology Waiting Times

At the end of August 2011, 16 service users had been waiting for 6 weeks or more for their first psychology appointment. With the exception of Safe CBU, trajectories have been received that indicate that this target will be met by 31 March 2012.

ACTIONS: The Executive Director of Service Development and Delivery is developing trajectories highlighting key milestones for delivering the psychology waiting times target in Safe CBU.

The Executive Director of Service Development and Delivery and Director of Communications to ensure the delivery of performance trajectories and report by exception to the Trust Board if agreed trajectories are not achieved.

8 3.3 Quality - Patient Safety

Key areas of underperformance are outlined below.

3.3.1 Incidents

The North West Specialised Commissioning Team require there to be no absconds from escorted leave from Medium Secure services (over 12 hours)

From April to August 2011, there has been one abscond (over 12 hours) from escorted leave from Medium Secure services. This occurred in June 2011.

3.3.2 Service users on CPA recorded as being reviewed in at least the last 12 months

As at 31 August 2011, 91.83% of service users on a CPA have had a review within the previous 12 months against a target of 95%. Trajectories have been received that indicate that this target will be met by 30 September 2011. It is important that performance is delivered against this target. The Trust has not achieved the target of 95% for three quarters. Failure to achieve this by the end of September 2011 may delay the FT application.

ACTIONS: The Executive Director of Service Development and Delivery to ensure the delivery of performance trajectories and report by exception to the Trust Board if agreed trajectories are not achieved.

9 3.4 Quality – Competent Capable Workforce

Key areas of underperformance are outlined below.

3.4.1 Staff Attendance

For April to August 2011, staff attendance was 93.96% against a target of 94.90%. Trajectories have been received that indicate that this target will be met by 31 December 2011 in Liverpool CBU and PCP CBU and by 31 March 2012 in Rebuild CBU and SaFE CBU. High Secure CBU has supplied a trajectory indicating that an attendance level of 93% will be achieved by 31 March 2012.

Current performance to the end of August by CBU is summarised in the chart below:

3.4.2 Corporate Essential Mandatory Learning

Performance against this indicator is measured quarterly. Work is underway to ensure data completeness within the Trusts HR/Payroll system.

3.4.3 Personal Development Plans (PDP)

Performance against this indicator is measured quarterly. Work is underway to ensure data completeness within the Trusts HR/Payroll system.

3.4.4 Staff Survey

Performance against this indicator is measured annually. A comparison of the 2010/11 staff survey results against 2009/10 shows that performance has improved or remained consistent across all key scores. Comparison with other Mental Health Trusts shows worse than average performance. A performance trajectory has been prepared by the

10 Director of Workforce and presented to the Integrated Governance Committee.

ACTIONS: The Director of Workforce to work with CBU and SMS Leaders to: Ensure the completeness of ESR data in respect of corporate essential mandatory learning Ensure the completeness of ESR data in respect of the number of staff with a completed PDP Share the trajectories to ensure that the staff survey results in a better than average score next year

The Director of Workforce to ensure the delivery of the staff attendance performance trajectories and report by exception to the Trust Board if agreed trajectories are not achieved.

11 4. Value

4.1 Statutory Financial Duties

The Trust is required to achieve all key financial performance targets including: Breakeven Duty Capital Resource Limit (CRL) Capital Cost Absorption External Financing Limit (EFL)

4.1.1 Breakeven Duty - Income and Expenditure Position

At the end of August, 2011 the Trust has an income and expenditure surplus of £1.872m and is forecasting a surplus of £4m at the end of the year. This is the reported position before impairments which are forecast to total £2.4m in 2011/12. A summary of the financial position is shown in Table 4 and detailed in Appendix 4.

Table 4 - Trust Summary Financial Position Summary Full Year to Year to Income & Expenditure Account Year Date Year to Date Budget Budget Date Actual Variance £'000 £'000 £'000 £'000 Contract Income 188,134 78,228 78,228 0 Operational Income 2,445 1,304 1,728 425 Costs -175,364 -72,993 -73,418 -425 EBITDA (Earnings before Interest, Tax, Depreciation and Amortisation) 15,215 6,538 6,539 0 EBITDA Margin % 7.98% 8.22% 8.18% Capital Charges -10,392 -4,316 -4,316 0 Provisions Unwinding of Discount -470 -193 -193 0 Interest Payable -444 -182 -182 0 Interest Receivable 91 24 24 0 I&E Surplus (before Exceptional Items) 4,000 1,872 1,872 0 I&E Surplus Margin % 2.10% 2.35% 2.34% Capital Impairment 0 0 -1,572 -1,572 Net I&E Surplus / (Deficit) 4,000 1,872 300 -1,572

* EBITDA is an indicator of financial performance and allows direct comparison from one organisation to another by removing the impact of an organisations asset costs.

The main areas to note are: 2011/12 Local Authority funding for 2011/12 has been confirmed and is reflected in the Rebuild CBU position. All CBUs are forecasting underspend or breakeven positions.

12 4.1.2 Capital Resource Limit (CRL)

The Trust has a CRL of £9.7m. This includes an investment from Trust surpluses of £4.5m for the TIME project and the Step Down Unit. Trust expenditure to 31 August is £2.4m.

4.1.3 Capital Programme

The Trust Board approved a Capital Programme at the start of the financial year. There are amendments to the costs of five existing schemes. The proposed amendments to the capital programme are as follows: HSS OER Modernisation £12,000 HSS Segregation from HMP Kennet £3,000 PCP CMHT Improvements to Hesketh Centre -£73,000 Liverpool Mossley Hill Ward 8 £2,000 Retentions for 2010/11 schemes £30,000 Total Decrease in Costs -£26,000

The Trust Board is asked to approve the changes to the 2011/12 Capital Programme.

4.1.4 Capital Cost Absorption

The Trust is required to absorb the cost of capital at a rate of 3.5% of average net relevant assets. The Trust is on target to achieve this financial duty.

4.1.5 External Financing Limit (EFL)

The Trust has a target of -£0.6m in 2011/12, which means that the cash position at the end of the year cannot be less than £9.4m. The Trust is on target to achieve this financial duty.

4.2 Other Financial Duties/Targets

4.2.1 Financial Risk Rating (FRR)

The Trust is achieving a FRR of 4 and forecasts a FRR of 4 for the year end. A minimum FRR of 3 is acceptable to Monitor in an application for FT status. This is detailed in Appendix 5.

4.2.2 Cost Improvement Plans (CIPs)

The Trust has a CIP target of £8.031m in 2011/12. As at the end of August, £3.234m of schemes have been delivered as planned. This is shown in Table 5. The remaining plans are on target to be achieved by the end of the year.

13 Table 5 – 2011/12 CIP Plans Achieved to date

Total Plans (£'000) Achieved to Date CBU/SMS Red Amber Green Total £'000 Addiction (inc phasing) 259 259 108 Liverpool 352 741 1,093 455 PCP 110 874 984 410 Rebuild 545 545 227 HSS (inc phasing) 2,213 2,213 921 Safe 512 512 213 SMS 1,045 1,045 425 Strategic (inc phasing) 472 908 1,380 474 Total 0 934 7,097 8,031 3,234

The changes to 2011/12 CIP plans will be presented to Trust Board for approval in September in a separate paper.

4.2.3 Cash

The Trust has a cash balance of £18.3m at the end of August 2011 and is forecasting a cash balance of £9.4m by 31 March 2012. The cash flow for 2011/12 is shown in Appendix 6.

4.2.4 Balance Sheet

A copy of the Balance Sheet is included in Appendix 7.

4.2.5 Better Payments Practice Code (BPPC)

This target measures the speed with which the Trust pays its creditors. It is vital during tough economic times that the Trust supports local businesses and makes payments promptly. Performance as at 31 August 2011 against the BPPC is detailed in Table 6.

Table 6 – Performance Against BPPC Targets

Target Performance Non NHS Invoices paid within 30 days 95.00% 98.68% Small/Med Enterprises Invoices paid within 10 100.00% 100.00% days Payments to Service User/Carers within 10 days 100.00% 100.00%

4.2.6 Workforce

The Trust has been successful in reducing expenditure on overtime and agency costs, which are at a financial premium. Expenditure on bank is forecast at £7.4m for 2011/12. These costs are not at a financial premium.

Bank, agency and overtime costs are provided in Table 7.

14 Table 7 – Bank, Agency and Overtime Costs 2008/09 to 2011/12

Year to 2011/12 2010/11 Date Aug Forecast Actual 2011 Outturn Outturn Additional Staffing £000 £000 £000 Agency - Medical Locums 800 1,921 2,135 Agency - Social Workers 209 500 684 Agency - Other 606 1,456 1,774 Overtime 78 188 470 Plain 63 148 118 Bank 3,086 7,409 7,221 Total 4,842 11,622 12,402

4.2.7 Payment by Results (PbR)

The Department of Health (DoH) plans to introduce a system of Payment by Results (PbR) for Mental Health Trusts by 2013/14. Under this system the Trust will be paid for the activity that it undertakes. The national currencies for mental health are being developed based on clinical need, patient outcomes and quality, and use of resources. The national project is developing currencies for Adult and Older Peoples services. Forensic, LD, and CAMHS currencies are being developed but are outside of the national project at present. To date, 21 clusters have been identified ranging from non-psychotic to psychotic to organic.

The Trust is required to cluster all service users within the scope of PbR by 31 December 2011. The DoH plan is for Mental Health Trusts and local Commissioners to use Care Clusters as part of 2012/13 contract monitoring.

A chart showing clustering by CBU is provided below.

15 Service users grouped using Mental Health Clusters

As at 31 August 2011, 53% of service users have been clustered against a target of 100% by 31 December 2011. Trajectories have been received that indicate that this target will be met by 31 December 2011.

16 5. Conclusions/Recommendations.

The Trust Board is asked to:

Note the Trust is achieving the majority of key performance targets in 2011/12 and is working hard to achieve targets in under performing areas. The key areas of underperformance are: Service users (10% of adults) on a CPA should be in employment Recording of HONOS assessment NICE Clinical Guidelines Service users on CPA should be reviewed within the last 12 months Payment by Results (PbR) clustering Note the Trust is on target to achieve all key financial targets and duties in 2011/12. The forecast year end surplus is £4.0m and the FRR is 4. Approve the changes to the 2011/12 Capital Programme.

NEIL SMITH Executive Director of Finance and Performance

17 Appendix 1

Approved Corporate Dashboard 2011/12 August 2011

Responsible Current Forecast Outturn Responsible Current Forecast Outturn Ref Page Progress Ref Page Progress Director Performance Performance Director Performance Performance

Quality-Clinical Effectiveness Quality-Patient Safety Access to CRHT (gatekeeping) KC CPA follow up KC External assessment-Annual Prison Service Audit Access to healthcare for people with LD KC RW (High Secure) External assessment-Compliance with Social Care 3.1.1 5 Data Completeness: identifiers KC RW Standards (High Secure) Delayed admissions (High Secure) RW 3.3.1 9 Incidents KC Delayed transfers of care / Delayed Discharges KC / RW Infection control RW Service users on CPA reviewed in at least the last 12 3.1.2 5 Employment status KC 3.3.2 9 KC months 3.1.3 5 HONOS DF Under 16 and Under 18 admissions KC 3.1.4 5 NICE guidance implementation DF Quality - Competent Capable Workforce 3.1.5 5 Equality, Diversity and Human Rights KC / KD / RW 3.4.1 10 Attendance All External assessment-Care Quality Commission DF 3.4.2 10 Corporate Essential Mandatory Learning All Registration Requirements External assessment-Compliance with Information 3.1.6 6 DF 3.4.3 10 Personal Development Plans All Governance Toolkit (Level 2) 2.4 3 External assessment-CQUIN 2011/12 High Secure RW Revalidation DF 2.4 3 External assessment-CQUIN 2011/12 Local Services KC 3.4.4 10 Staff Survey (measured annually) KD External assessment-CQUIN 2011/12 Low and 2.4 3 KC Value Medium Secure Services 2.1 2 External Assessment - FT Pipeline Monitoring KC / DF / NS Carbon Reduction Strategy KC External Assessment-Monitor Compliance Framework 2.2 2 KC / DF 4.1.1 12 Financial Position - Breakeven NS 2011/12 External assessment-NHS Litigation Authority Level 1 DF / RW 4.1.2 13 Capital Resource Limit NS 2.3 2 External assessment-NHS Performance Framework KC 4.1.4 13 Capital Cost Absorption NS Settled Accommodation status KC 4.1.5 13 External Financing Limit NS Specialist Teams-Early Intervention Services New KC 4.2.1 13 Financial Risk Rating NS Cases Quality-Patient Experience 4.2.2 13 Cost Improvement Plans NS Complaints KC 4.2.3 14 Cash NS Delivering Single Sex Accommodation KC 4.2.4 14 Balance Sheet - Debtors NS 3.2.1 7 Delivery of FT membership targets CH 4.2.5 14 Better Payments Practice Code NS PEAT assessment KC / RW 4.2.7 15 Payment by Results DF Recording of service user ethnicity KC Reference Costs NS 3.2.2 7 Service User Survey (measured annually) KC 3.2.3 7 Waiting times KC KC Kim Crowe Improvement Plan not achieved KD Kath Davies No change Plan almost achieved DF David Fearnley Deterioration Monitor Assessment - Amber / Green CH Christine Hughes Monitor Assessment - Amber / Red NS Neil Smith Plan achieved or overachieved RW Ray Walker No information flow or quality measure construction to be determined Quarterly/Bi-Annual/Annual/Biennial - Not yet due to be reported

18 Appendix 2 Performance Trajectories

Key Performance Indicator Target CBU Trajectory Trajectory Trajectory September 2011 December 2011 March 2012

Quality – Clinical Effectiveness Data completeness: identifiers 97% Liverpool 90% 99% 99% – marital status (MHMDS) Positive Care Partnerships 90% 99% 99% SaFE Partnerships 85% 90% 97% Service users in employment 10% Liverpool 5% 7% 10% (CPA) Positive Care Partnerships 5% 7% 10% SaFE Partnerships 0% 0% 0% Recording HoNOS 90% Liverpool 35% 100% 100% assessments Positive Care Partnerships 50% 100% 100% Rebuild 70% 80% 90% SaFE Partnerships 70% 80% 90% Recording of disability status 85% Addictions 40% 65% 85% Liverpool 50% 70% 85% Positive Care Partnerships 75% 80% 85% Rebuild 52.46% 75% 85% SaFE Partnerships 85% 85% 85% Recording of religion status 85% Addictions 70% 75% 85% Liverpool 75% 80% 85% Positive Care Partnerships 75% 80% 85% Rebuild 52.07% 75% 85% SaFE Partnerships 85% 85% 85% Recording of sexual orientation 85% Addictions 20% 50% 85% Liverpool 60% 75% 85% Positive Care Partnerships 50% 65% 85% Rebuild 20.55% 75% 85% SaFE Partnerships 60% 70% 85% Information Governance Toolkit Compliant Trust Wide 62% 66% 70% 19 Key Performance Indicator Target CBU Trajectory Trajectory Trajectory September 2011 December 2011 March 2012

(Level 2) (70%) Quality – Patient Experience Delivery of FT membership Achieve for all Trust Wide – Liverpool 100% 100% 100% targets Constituencies Public (Public, Trust Wide – Sefton Public 80% 90% 100% Service Users Trust Wide – Knowsley 70% 85% 100% and Carers, Public Staff) Trust Wide – Service Users 65% 85% 100% Trust Wide – Carers 55% 75% 100% Outpatient waiting times 0 Addictions No further No further No further (maximum wait 6 weeks) breaches breaches breaches Liverpool 26 26 26 Positive Care Partnerships 15 15 15 Psychology waiting times 0 Liverpool 10 4 0 (maximum wait 6 weeks) Quality – Patient Safety Service users on CPA recorded 95% Liverpool 95% 95% 95% as being reviewed in at least Positive Care Partnerships 95% 95% 95% the last 12 months Rebuild 95% 95% 95% SaFE Partnerships 95% 95% 95% Competent Capable Workforce Staff attendance 94.9% Liverpool 94.7% 94.9% 94.9% High Secure 92.4% 92.8% 93% Positive Care Partnerships 94.9% 94.9% 94.9% Rebuild 93.98% 94% 94.9% SaFE Partnerships 93% 94% 94.9% Value Payment by Results - 100% Liverpool 60% 100% 100% Clustering Positive Care Partnerships 70% 100% 100% Rebuild 94% 100% 100%

20 21 Appendix 3

Clinical Effectiveness Charts

22 Appendix 4

Summary Financial Position – 31 August 2011

Year to Date Forecast Annual Variance Under/-Over Risk Budget Budget Actual Under/-Over Spend Assess- Trust Summary Financial Position £000 £000 £000 £000 £000 ment Total Contract Income 188,134 78,228 78,228 0 0

Budget Position Addiction Services CBU -7,293 -2,996 -2,895 101 200 Low High Secure Services CBU -48,278 -20,155 -19,671 484 350 Low Liverpool CBU -27,734 -11,552 -11,480 72 100 Low Positive Care Partnership CBU -27,103 -11,281 -10,230 1,051 1,000 Low Rebuild CBU -15,243 -6,236 -6,194 42 0 Low Safe Partnerships CBU -12,798 -5,276 -5,176 100 78 Low Specialist Management Services -34,903 -13,811 -13,600 211 574 Low Non CBU/SMS Areas -11,955 -4,925 -4,925 0 0 Low Total Budget Position -185,307 -76,232 -74,171 2,061 2,302 Reserves & Strategic Savings CIP Strategic Savings CIP (SS) Target 1,353 0 0 0 0 Earmarked Reserves -180 -124 -2,185 -2,061 -2,302 Total Reserves and SS CIP Target 1,173 -124 -2,185 -2,061 -2,302 I&E Surplus (Excl. Impairments) 4,000 1,872 1,872 0 0 Impairments -1,572 -1,572 0 I&E Surplus (Incl. Impairments) 4,000 1,872 300 -1,572 0

23 Appendix 5

FINANCIAL RISK RATING 2011/12

Financial Risk Rating at FRR score at Forecast Forecast FRR 31/08/11 31/08/11 rating 2011/12 score 2011/12

EBITDA % 100% 5 100% 5 achieved EBITDA margin 8.18% 3 7.98% 3 (%) Return on 6.30% 5 6.00% 4 assets (%) I&E surplus 2.34% 4 2.10% 4 margin (%) Liquidity ratio 44 days 4 38 days 4 (days) Overall 4 4 forecast rating

The FRR is allocated using a scorecard which compares key financial information. A rating of 5 reflects the lowest level of financial risk and a rating of 1 the highest.

24 Appendix 6 2011/12 CASH FLOW

Actual Forecast Full Year Statement of Cash Flows (CF) April May June July August September October November December January February March FOT £000s £000s £000s £000s £000s £000s £000s £000s £000s £000s £000s £000s £000s CASH FLOWS FROM OPERATING ACTIVITIES Net Cash Inflow/(Outflow) from Operating Activities 1,780 5,908 547 1,287 2,892 (945) 745 1,440 1,345 1,104 1,528 (7,512) 10,119 CASH FLOWS FROM INVESTING ACTIVITIES Net Cash Inflow/(Outflow)from Investing Activities (1,037) (575) (640) (577) (449) (953) (3,316) (589) (556) (248) (548) (226) (9,714) NET CASH INFLOW/(OUTFLOW) BEFORE FINANCING 743 5,333 (93) 710 2,443 (1,898) (2,571) 851 789 856 980 (7,738) 405 CASH FLOWS FROM FINANCING ACTIVITIES Net Cash Inflow/(Outflow)from Financing (88) 35 35 (5) (6) (5) (5) (5) (5) (6) (6) (124) (185) Net Increase/(Decrease) in Cash 655 5,368 (58) 705 2,437 (1,903) (2,576) 846 784 850 974 (7,862) 220 Cash at the Beginning of the Period 9,218 9,873 15,241 15,183 15,888 18,325 16,422 13,846 14,692 15,476 16,326 17,300 9,218 Cash at the End of the Financial Year 9,873 15,241 15,183 15,888 18,325 16,422 13,846 14,692 15,476 16,326 17,300 9,438 9,438

25 Appendix 7

BALANCE SHEET AS AT 31 AUGUST 2011

Year Forecast 2010/11 To Date Year End Year End £000 £000 £000

NON-CURRENT ASSETS 144,773 147,836 146,541 CURRENT ASSETS Inventories 371 518 518 Trade Receivables 1,648 1,223 1,007 Other Receivables 2,148 2,214 2,514 Cash and Cash Equivalents 18,325 9,438 9,218 TOTAL CURRENT ASSETS 22,492 13,393 13,257 CURRENT LIABILITIES Trade and Other Payables (13,974) (7,394) (7,361) Provisions (1,254) (1,362) (1,394) Borrowings (74) (84) (67) TOTAL CURRENT LIABILITIES (15,303) (8,840) (8,822) NET CURRENT ASSETS (LIABILITIES) 7,189 4,553 4,435 TOTAL ASSETS LESS CURRENT LIABILITIES 151,962 152,389 150,976 NON-CURRENT LIABILITIES Provisions (17,498) (16,725) (16,782) Borrowings (5,105) (5,056) (5,141) TOTAL ASSETS EMPLOYED 129,359 130,608 129,053

FINANCED BY: TAXPAYERS' EQUITY Public dividend capital 58,099 57,739 58,099 Retained Earnings (31,838) (28,690) (33,820) Revaluation Reserve 43,191 41,652 44,219 Government Grant Reserve 0 0 640 Donation Reserve 0 0 8 Other reserves 59,907 59,907 59,907 TOTAL TAXPAYERS' EQUITY 129,359 130,608 129,053

26