Federal Income Taxation of Individuals

Tax is about 5 questions: o What is income? o What kind of income is it? o What is deductible? o When is it taxed? o Who is it taxed to?

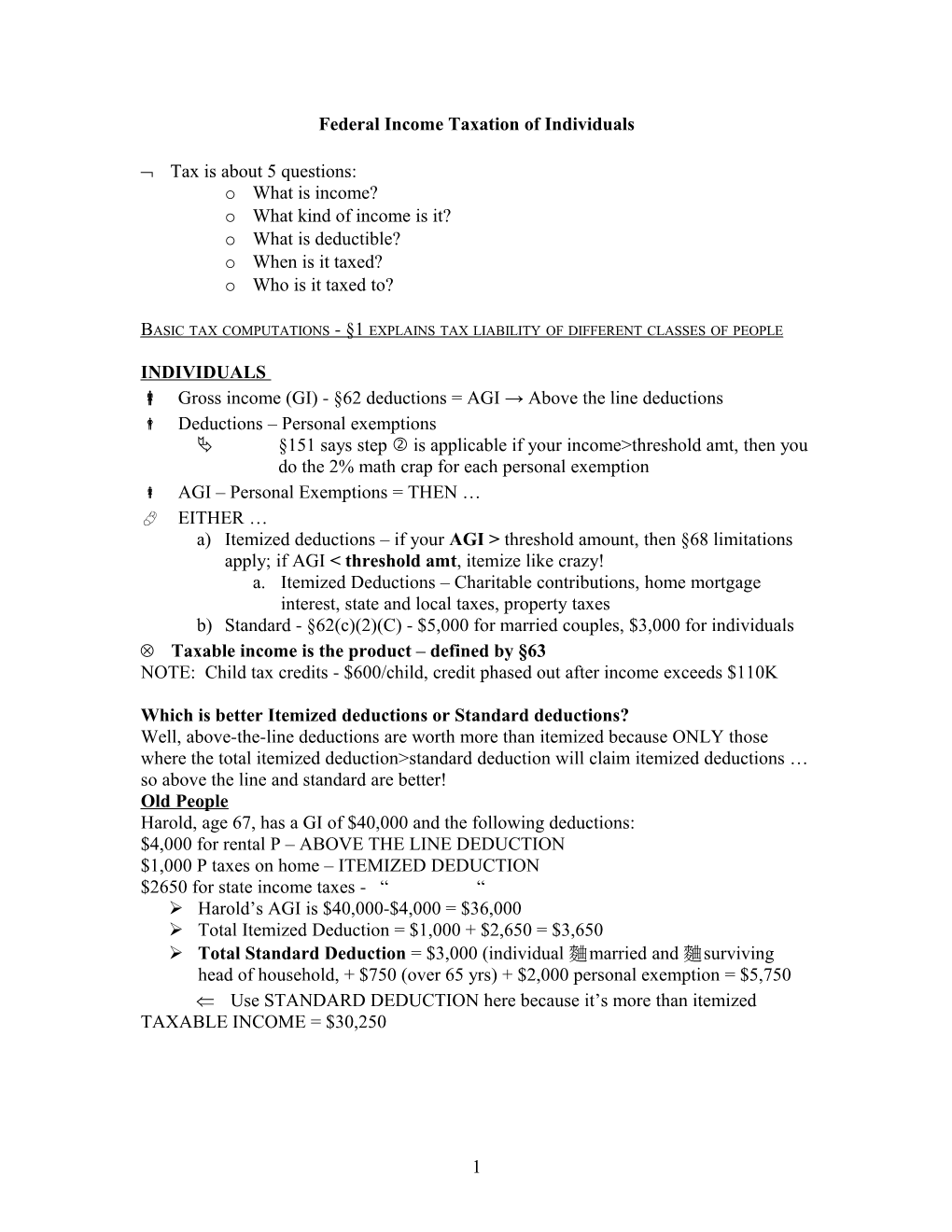

BASIC TAX COMPUTATIONS - §1 EXPLAINS TAX LIABILITY OF DIFFERENT CLASSES OF PEOPLE

INDIVIDUALS Gross income (GI) - §62 deductions = AGI → Above the line deductions Deductions – Personal exemptions §151 says step is applicable if your income>threshold amt, then you do the 2% math crap for each personal exemption AGI – Personal Exemptions = THEN … EITHER … a) Itemized deductions – if your AGI > threshold amount, then §68 limitations apply; if AGI < threshold amt, itemize like crazy! a. Itemized Deductions – Charitable contributions, home mortgage interest, state and local taxes, property taxes b) Standard - §62(c)(2)(C) - $5,000 for married couples, $3,000 for individuals Taxable income is the product – defined by §63 NOTE: Child tax credits - $600/child, credit phased out after income exceeds $110K

Which is better Itemized deductions or Standard deductions? Well, above-the-line deductions are worth more than itemized because ONLY those where the total itemized deduction>standard deduction will claim itemized deductions … so above the line and standard are better! Old People Harold, age 67, has a GI of $40,000 and the following deductions: $4,000 for rental P – ABOVE THE LINE DEDUCTION $1,000 P taxes on home – ITEMIZED DEDUCTION $2650 for state income taxes - “ “ Harold’s AGI is $40,000-$4,000 = $36,000 Total Itemized Deduction = $1,000 + $2,650 = $3,650 Total Standard Deduction = $3,000 (individual married and surviving head of household, + $750 (over 65 yrs) + $2,000 personal exemption = $5,750 Use STANDARD DEDUCTION here because it’s more than itemized TAXABLE INCOME = $30,250

1 Two Hypos of how Progressive Taxes Work #1 – Jeff earns $100,000 of taxable income The tax rate schedule works like this: income over $53,500, but not over $115,000 is taxed at $11,493, plus 30% of the excess over $53,500. - $11,493 is automatic - $100,000-$53,500=$46,500x30%=$13,950+$11,493=$25,443 tax liability - Marginal tax rate = 30%; Average tax rate is 25.43% (100,000/25,443) #2 – Aubrey earns $50,000/year/ten years. Annie earns nothing in years 1, 3, 5, 7, and 9, but $100,000 in years 2, 4, 6, 8, and 10. The tax rate schedule works like this: 0% on the first $25,000, plus 10% of amount which taxpayer income exceeds $25,000. - Aubs: $50,000-$25,000=$25,000x10%=$2,500x10years=$25,000 - Annie: No tax in odd years; Even years: $100,000-$25,000=$75,000x10%=$7,500x10years=$37,500/10yr FAMILIES So, how’s a normal family taxed? Married couple with 2 dependents with $60,000 GI and the following deductions a. $2,000 loss on sale of business P b. $8,000 mortgage interest on principal residence c. $1,000 charitable contribution d. $4,000 state and local income taxes e. $2,000 P taxes on principle residence (a) is the only above the line deduction - so AGI = $58,000 (b) – (e) are itemized deductions totaling $15,000 – $58,000 = $45,000 Couple gets $2,000 personal deduction per person ($8,000) = $37,000 o Taxable Income = $37,000 . Rate - $1,200 + 15% of excess over $12,000 TAX LIABILITY = $4,950 – Child care expenses and child tax credit = TAX = $2,490 WEALTHY Poor, poor little rich girl … wealthy people fight 2 complications added in the ‘90’s to raise revenues, but will be phased out by 2006 … just in time! ;) A) Phase-outs §151(d) Phases out the personal exemptions by 2% for each $2,5000 of AGI for taxpayers whose AGI’s exceed “threshold amount.” Threshold Amounts: $150K for joint returns or surviving spouse $100K for individual married or surviving spouse $75K for married filing separately HYPO Married couple filing jointly has AGI = $250K, AGI exceeds threshold by $100K. Therefore, personal exemption appropriately reduced. B) Reduction of Itemized Deduction

2 §68 limits itemized deductions for married taxpayers whose AGI>$100K, excluding itemized deductions for medical expenses, casualty losses, investment interest, and wagering losses This affect those who take standard deductions instead of itemized GLENSHAW GLASS Income is derived by any source whatsoever - §61(a)(1) §61(a)(1) –Unless otherwise stated in the code, GI = income from ANY source derived §1001(a) – What is GAIN GAIN Taxpayer’s gain on disposition of P is excess of amt realized – adj basis Amt realized is price the taxpayer sells the P for §1.61-.14 – Miscellaneous items of gross income: Punitive damages, employer paying employee taxes, illegal gains, treasure trove §1012 – What is BASIS - Basis is cost §1011 – What is adjusted basis ADJUSTED BASIS - Basis of property, usually the cost of the property, UNLESS Adjusted for expenditures, receipts, losses, or other charges properly charged to the capitol account. Adjusted for depreciation, amortization and depletion

EXAMPLES: A. Find $20 on street … income NOW! B. Employer paying employee’s income taxes – still income to employee! (Old Colony) – In employment context, the “gift” argument will not work C. Discharge of my debt to Mom is income to me D. Find coin worth $100.00 then have income of $100 E. Buy coin for $50 and it appreciates to $100 over time, don’t have income until you REALIZE that income by selling the coin F. Find $ in piano you bought – even if you didn’t find the $ for years – it’s income when you find it. G. Teacher receives book to adopt – If teacher donates it to library and takes a deduction, value of books are taxable because the teacher asserted complete control over them (before the books were sent without any request – see diff?) H. Natural gas under your yard – Not taxable until you extract it I. Barter clubs – must pay income on what barter club decides value of service is J. If you pay less than a car is actually worth due to bargaining, you don’t have to pay income on the amount of money you saved K. Note from GM that you won 10 millionth of a car, PRIZE IS INCOME L. I owe Mom $1,000; I give Mom something worth $1,000 that I only paid $400 for. My gain is ______. Mom’s gain is ______. M. I build a building on leased land. I default on a lease payment. When the owner of the land regains possession, then he realizes income = to the value of the building.

3 WORKIN’ FOR GOODWILL There is no income if you work directly for Goodwill - §1.61-2(c) However if I mow your lawn and instead of paying me you pay the Church, then the $ you paid the church is my taxable income – but I do get a deduction

LOSS DEDUCTION → If you sell stock for less than the purchase price then the GI = $0 because there is no such thing as a NEGATIVE GI. → If you have what would be a negative GI then you are allowed a loss deduction in calculating taxable income.

REALIZATION v. RECOGNITION → Realized gain is includable in GI only if it is also recognized → The only time realization is not recognized is provided in §1031 → §1031 – Exchange of business or investment property for other business or investment property of like kind is NOT recognized

Gross Income from Sales – Tax system usually does not tax appreciation or allow for a deduction from losses until the taxpayer disposes of the P because it is difficult to make annual appraisals to ascertain how much appreciation has occurred. HYPOS: L buys land for $100,000 – one year later oil is struck next door – land now worth $500,000 – Oil never found, but doesn’t have to pay taxes on increased value of land until she sells it 40 years later. T buys stock for $1,000 on June 15, by the end of the year it’s worth $1,500 – not taxable until T sells it Even if T sells that stock next year for $1,700 the sale requires T to recognize that gain. The profit on the transaction is only $700 from the original $1,000 If the same taxpayer has sold the stock for $900, the gross income is 0 and there is no negative gross income! The lost $100 will be figured in when T gets a $100 deduction in calculating taxable income.

Fun Definitions §1001(a) Computation of a T’s gain on the disposition of P is (excess amount gain or loss realized/adjusted basis) §1001(b) Amount realized Amount realized from the sale or other disposition of P is ($ received + FMV of P) §1001(c) Recognition of Gain or loss realized on sale/exchange of an asset is gain or loss taxed §1012 Basis of P – Basis of P is it’s cost COST

4 §1011(a) Adjusted basis for Adjusted basis for figuring out the gain or loss of sale of determining gain P is the basis, adjusted for expenditures, receipts, or loss losses or other items properly chargeable to the capitol account and adjusted for depreciation, amortization, and depletion

NOW LET’S DO SOME HYPOS: Aubrey finds and keeps an old Oscar worth $10,000. If she sell the statue in a few years for $12,000, how much gain will she realize on the sale – DUH - $2,000! BUT she has to pay tax on the original $10,000 when she sells the statue! Cait bought a statue from an antique dealer for $4,000, but the real value is $14,000 – WHOA, what a shopper – She sold it for $16,000 later. What’s her gain? $12,000 – her basis was $4,000. Tim asks Aubrey to prepare his will. Tim gave me a hunting dog for preparing the will and says she’s worth about $400. Then Aubrey realizes $400 worth of income. If Aubrey sells the dog to Sterling for $500, then Aubrey has a gain of $100, and is taxed only on that gain! (As long as she paid the tax on the original $400 before!) Jon renders services to a widow and never charges her. Jon meets the widow for dinner and she gives him $300; Jon will argue it is a gift, but IRS will say it is income Thom receives a $500 federal income tax refund – NOT includable in gross income! House is for sale for $75,000, but appraised at $100,000 – NOT income to the buyer Attny gives Client $10,000 after bad legal advice which cost her $10,000 – INT income to Client because she is just being returned to her original position – Tax Free Recovery of Capitol. M owes $1M in damages to person he hit; Ins pays M’s obligation; No income to M

LoBUE §61 says that P transferred for services rendered is INCOME Π had an option to buy stock – the receipt of an option a taxable event – however, when Π exercises the option and buys stock, then taxable event, income for services. NOTE: Π has income when he uses his option to buy stock IF, and only if, there are no restrictions on the option! §83 says if there ARE restrictions on the option, then there is only income AFTER the restrictions go away or are satisfied, even if you owned stock for several years. SO if you pay the tax (ELECTION: when EMR gives EME stock option, he has 30 days to choose to include it in his income that year) then forfeit the option b/c you didn’t meet the restriction, too bad, so sad. Example restrictions: can’t exercise for x yrs, can’t transfer option, EMR must achieve x earnings, must stay employed for x yrs. If Π elects to include the bargain element of the transaction in the stock immediately, then substantial vesting rules apply and no further amt will be included when the P becomes vested. Any subsequent appreciation in value of stock is taxable as compensation but as a Capitol Gain.

5 CALLED Non-Qualified Stock Option – Stock given to EME for bargain price and subject to restrictions: nontransferable and subject to forfeiture; so when restrictions are lifted, EME includes in ordinary income the value of the stock at the time the restrictions are lifted, not the value at the time of the transfer. BASIS OF OPTION = $ spent to exercise + amt on which is taxed GENERAL RULE: If you buy stock or P from EMR for less than it’s worth, you still have income to the “extent of the spread” or FMV-price paid. EXAMPLE – I get a car worth $10,000 for $5,000 from my EMR. My basis would be what I paid plus income on the spread. ($5,000 + $5,000 = Basis of $10,000) My EMR could deduct the spread. §305 - Shareholder/EME – EVERYONE GOT ONE – If EME receives a stock dividend, and all EME receive same dividend, then NO taxation. There is no taxation there because it’s not a dividend, but more stock! §421-422 – Incentive Stock Options - (which are 10 or less year plans and say you cannot sell within certain restrictions) – These are different from §83 stock options because holders of ISO have no income when they are granted, no tax when exercised, and company gets no deduction, EVER. Only pay tax when you SELL the stock: 2 Restrictions … Only grant ISO’s pursuant to a plan the s/h agrees to Must hold stock for 2 years from the date option is granted and 1 year from when option is exercised. HYPO: EME receives ISO allowing purchase of EMR stock for $50/share and exercises option when stock has value of $80/share. HERE, EME has no income, even if EME’s ownership rights are vested Generally, these stocks taxable until they’re transferred and are substantially vested …. P is substantially nonvested when it is subject to substantial risk of forfeiture and nontransferable – so it’s vested when it’s transferable and not subject to forfeiture (rights of EME to enjoy P are conditioned upon future performance of services of EME.)

6 HYPO On 11/1/78, Lexmark sells Jon 100 shares of stock at $10/share, when FMV was $100/share. Restrictions: Nontransferable and substantial risk of forfeiture until 11/1/88. Jon’s stock is substantially non-vested; so he include any amt in GI in ‘78 On 11/1/88 FMV is $250/share and stock is substantially vested, so Jon must include stock in income in ’88 – 100 shares x $250 FMV - $10/share Lexmark originally paid = $24,000

On 8/15/00, EME as compensation receives EMR stock, which must be returned to EMR if EME quits before 6/5/03. Stock is restricted, but EME may transfer by gift or sale. Stock worth $50K on 8/15/00 and $80K on 6/5/03. EME works through 6/5/03 and sells stock in ’04 for $100K - EME must pay $80K of tax when it vests on 6/5/03 - EMR may make a deduction when stock vests on 6/5/03 for $80K - EME must then pay $20K tax when he sells it

EME makes election of $50K when he receives it. - After sale, gain on subsequent sale of P at $100K, EME taxed at $50K gain as a Capitol gain! (SO much better than ordinary income!)

EME makes election, but then quits before vesting - BAD MOVE – you still paid election tax, but don’t get any income! - EMR must reverse any compensation deduction it previously took

Carson does some work for Thom and receives a $30,000 car as compensation. §83(a) requires Carson to include the car in his gross income – Equivalent to Carson being paid cash and buying the car for himself.

Carson sells the car to Kyan for $30,000. - Carson amount realized is $30,000!

7 DEFERRED COMPENSATION – Save your pennies! The key to deferred compensation is §83: Delay taxes without delaying gains! You pay tax on deferred compensation when it is constructively received – When is that? As long as the $ is available to EMR’s creditors and EME, then not constructively received. ROTH IRAS – No tax or deductions on $ you put in, no tax as it grows, and if taxpayer only takes qualified distributions the earnings are never taxed TRADITIONAL – Withdrawals from the traditional IRA can be made w/out losing tax benefits for wider variety of purposes (medical expenses, edu costs, etc.) – deduct amt of contributions and taxed when you take it out Traditional IRA’s deferral of taxes on both initial contributions and annual earnings on contributions yield same benefits as Roth’s forgiveness of taxes on the earnings, with no benefit on the initial contributions. HYPO No tax - Thomas saved $2K of his salary, invested it for 20 yrs at 10% interest and would yield $13,455 Tax - $2,000 would be taxed immediately at 30% so would invest $1,400 and annual return of 10% is also taxed at 30%, which would leave the annual tax at 7% yielding only $5,418 Deferment – Put in the $1,400 (still taxed), but then no other tax and at 10% interest would yield $9,418 in 20 yrs.

SO, what we are doing here is encouraging savings, C has enacted 2 benefits: Earnings of a savings plan are not taxed $ in plan taxed when earned, but the original investment and all accumulated savings are taxed when they are withdrawn.

Is there any way to get around pension and profit sharing to avoid higher taxation? Qualified Deferred EMR gets deduction even if EME receive any income compensation Nonqualified deferred EMR only gets deduction if EME includes amount in income. compensation Draw to this used to be b/c every $1.00 past $250,000 was taxed at a higher income. Not quite as big of an incentive now because we don’t have as high of taxes

8 Illegal Gains So, here’s the thing, embezzled money is income. When a taxpayer acquires earnings without the consensual recognition of an obligation to repay, he has income. You must willfully evade taxes – specific intent is required. LOAN: o Taking a loan is different due to the consensual obligation to repay! o Loans are not income

HYPO T is the trustee for a family trust not subject to judicial supervision. T, in breach of the trust sells himself an asset for $4K that is worth $10K. What result? This is NOT a bargain purchase or a windfall due to T’s deliberate actions. T has $6K of gain that he MUST pay taxes on and the basis is now $10K!

9 4. RECOVERY OF A CAPITOL ASSET A. SALES a. The importance of basis in the case of a sale or exchange is that it determines the amount of gain: §1012: Basis, §1001: Gain is amt realized b. In the case of a sale, the taxpayer’s recover of capital takes place at the state of calculating the gross income → most simple form of cap. recovery HYPO EME buys corporate stock for $3,000 and sells it for $3,700. EME’s GI is $700. His cost basis is $3,000, which is NOT taxable, because it is recovery of capitol. B. Dividends, Interest and Rent a. Income received from these is taxable when you receive it. Period. HYPO T buys farm land for $100K, which he leases for $8K/yr. $8K rent is includable in T’s gross income each year. The $100K investment-the basis-does not enter the calculation of GI from the P or taxable income until he sells the land. T buys corporate stock for $100K. He use any of the stock’s $100K to offset the receipt of cash dividends; as the previous hypo indicates, the use of basis must await the disposition of the stock.

C. Depreciation a. Largest amount of deduction next to salary – Permits taxpayer to recover the cost of P that is exhausted in the process of generating business income. b. General rule: Assets used in business, trade or generation of income become less valuable as time goes by; thus P may be depreciation if the taxpayers investment will be consumed, in part or whole, by the effects of exhaustion, wear and tear, or obsolescence. The taxpayer deducts annually an arbitrary % of the cost of the asset. NOTE: If the asset is an intangible asset, such as a copyright, the deduction is known as amortization. Real estate is not depreciable; nor are things that appreciate with time such as art or antiques; musicians have depreciated rare instruments Every time you depreciate, your basis decreases c. Two Factors used in Depreciation: Useful life and Salvage Value

10 d. Two Methods of Depreciation: Straight Line Method: Depreciate at a constant rate ($10/yr for 10 yrs on a $100 asset) Declining Balance Method: 10% of the balance every year e. Hampton Pontiac – Can deduct the life of a franchise owner … b/c it will affect the future viability of the business … Like Ron Shaver. f. Professional sports owner can depreciate his players K’s (Does owner get double benefit b/c he gets a depreciation deduction and a deduction for his player’s salaries?!)

HYPO Richard buys a truck for $10K, takes a straight line depreciation of $4K, and sells the truck for $7K. What is T’s gain: After he depreciated, his basis was $6K so his gain is $1K If Al pays $50K for asset used to produce income for 5 yrs and then is worthless, Al must at some point deduct $50K from receipts if only gain is to be taxed. Al will deduct 1/5 ($10K) of the asset’s cost each year for 5 yrs. Unlike sale of P, the $ Al paid for the asset doesn’t affect determination of GI

D. ANNUITIES – Pg. 20 of Jeff’s outline a. K providing for regular payments from an ins co to the annuitant, with an interest element, which begins at retirement or other fixed date and continue for a term of years for the life of one or more individuals. b. If you die before you get your money paid back, too bad, but your estate gets a deduction for unrecovered capital…if you live beyond the time, all the money you get is interest, so completely taxable. d. Here’s the deal, the ins co could go bankrupt on any one claims so they are willing to bet that the make more on your premiums than they will have to pay you back in interest. What you are getting paid back depends upon what interest rate the co is willing to assume. What you are getting paid back is not just the interest, but part of the principle + the interest. SO §72 says how much you are taxed so you don’t get taxed on your capitol: Exclusion ratio: Investment in K Expected Return

4. CANCELLATION OF INDEBTEDNESS General Rule – Before you get out of debt you have to get in debt by borrowing. Usually, borrowing does not give rise to income to the borrower and repaying the debt does not give rise to a deduction. As for the lender, he does not have a deduction when making the loan, and does not have income in repayment. §108(a)(1): Gross income does not include any amount …by reason of discharge of indebtedness of the taxpayer if: o Discharge occurs in a bankruptcy case o Discharge occurs when the taxpayer is insolvent Kirby Lumber

11 → Cancellation of indebtedness is income to the borrower and the amount reduced or cancelled is treated as income – see §61(a)(12) – but the debt forgiven is only taxed to the extent that the taxpayer is solvent after the cancellation

HYPO Thomas owns $100K in debts and has two assets, each worth $75K. One of the assets would otherwise be exempt from taxes and other would not. HERE, there is no such thing as tax exempt assets and the whole shebang is in with him having $150K worth of assets. Before cancellation of indebtedness, Thomas has $1000 of assets and $1600 debts. Thomas is insolvent. $900 of the debt is cancelled upon the payment of $100. Ordinarily this would result in $800 of debt cancellation income; however, T is insolvent to the tune of $600, therefore $600 of that debt cancellation income is not taxed. Therefore, Thomas has only $200 of debt cancellation income. Thomas has to go down the list of §108(b) until he finds tax attributes sufficient to absorb the entire amount of untaxed income.

Rail-Joint Principle: Cancellation of a debt gives rise to income only if incurring the debt gave the taxpayer money, property or services. o §108(e)(5) seems to favor rail-joint principle

NOTE: A reduction of the purchase price is not income…only a reduction (which doesn’t occur in insolvency or bankruptcy cases) Hirsch v. Commissioner Π bought P for $29K and paid $10K down with $19K mortgage debt. Several years later the value of the P fell $8K. The mortgagee agreed to take $8K in full satisfaction. HELD: $8K that was cancelled was a reduction in purchase price, income. HYPO I buy a car from Starko. I paid $10,000, but found that there were a few things wrong with the car. Starko said he’d give me the car for $7,000 … only an adj in purchase price, not income

Qualified Real Property Business Indebtedness An exclusion created under §108(a)(1)(D) for taxpayers ( C Corp’s) and applies only to the extent that the amount of the debt before cancellation exceeds the value of the P which secures the debt. HYPO T incurs a debt of $200K buying a building used in trade. Value of building falls $180K. A cancellation of $30K of the debt will only bring in $20K of income because §108(a)(1)(D) only applies to the amount of debt that exceeds the value, here $20K. SO the basis of the P must be reduced by the amount of debt cancellation income that is included – again, $20K.

12 Loan-forgiveness programs … SCHOOL LOANS Many schools have adopted programs designed to encourage their grads to take low-paying public interest jobs, by forgiving loans from school as grad works. o Under §108(f)(3) the exclusion apply to loan-forgiveness on account of services performed for the educational organization itself.

Here’s the deal … if it doesn’t fit in the §108 exclusion, then it’s income!

5. Damages and Social Welfare Payments IN GENERAL …§104-If $ does not arise out of physical injury, use “in lieu of test” Damage compensation for sickness and injury are excludable o A pi or damages for lost wages on account of pi … excludable Attorney’s Fees … $ spent for production of taxable income is deductible Property – Damages for destruction of P or business P are not taxable unless the damage exceeds the value of the P HYPO Vacation home has a basis of $20K and is destroyed in hurricane … owner receives $30K in damages from tortfeasor or insurance payments. T has $10K of income. PAYMENTS: o Periodic payments and interest associated with them are excludable under §104 – Better for Π to take periodic payments than lump sum o If you invest a lump sum payment, such as in an annuity, then the lump sum is excludable, but the interest portion of the annuity payment is included under §72 HYPO $300K settlement NOW or $360K spread over time? If took $300K now and put it in an annuity, then part of it would be taxable, but if you took the spread then none of it would be taxable

SO if it’s not a physical injury … how do you test for the damages taxability? IN LIEU OF TEST …in lieu of what were the damages awarded? Sager Glove – basic K claim → Look at each category and how Π was damaged and where $ would fit: Exclusion Goodwill – Not taxable Return of capital lost or injured – To the extent that it doesn’t exceed the basis of the capitol, it is return of capitol and not taxable Capital gain Ordinary income – compensation for lost profit – taxable! → Attorney’s fees for Business … see table

13 Taxable Nontaxable Damages for Age and Sex Discrimination Attorneys fees used to re-compensate for lost taxable income is deductible Loss of Profits Compensation for injury to good will Punitive damages are taxable Incur physical injury and receive damages for lost wages are excluded Damages for libel and slander All medical payments, even if not related to physical injury Pre-judgment interest is taxable Worker’s compensation Social welfare payment that is Damages for physical injury: Damages indiscriminate (everyone gets it) then (other than punitives) received (whether by included as income and taxed suit or agreement, lump sums or periodic payments) on account of personal physical injuries or physical sickness are nontaxable Awards from injuries that are “self- Real social welfare payment, not taxable inflicted” are taxable: (must be based on need and have to qualify - X jumps off bridge b/c of libel to receive it) - Headaches because of anxiety Awards for Mental/Psychological Injuries are NOT taxable unless they are a result of an otherwise PHYSICAL INJURY Damages for emotional distress are NOT includable, but recoveries for medical expenses for emotional distress are includable Damages for destruction of personal or business P is excludable to the extent that the damage award does not exceed basis, but above basis, that award is taxable Attorney’s fees: Can’t deduct expenses you incur to get excludable income, but can deduct fees used to get damages that are NOT excludable … i.e. if you have damages represent lost income, you can get a deduction for attorney’s fees (§212). Compensation for lost profit is taxable

HYPOS: M’s child almost hit by car, now has headaches … no physical injury to child. If car hit Son, causing physical injury (bruises), and M recovers, this is excludable because the event that gave rise to the damage award was a physical injury

14 M is accused of sexual harassment by S. S sues M and wins. S’s award is taxable because there was no physical injury.

NOTE: If you are in a case where you ask for $1M actual damages and $10K punitives, then settle for $1M; the IRS will try to tax $10K of the $1M saying that was the punitive part!

IMPUTED INCOME Benefits created when a taxpayer performs services for himself of his family. If you paint your own house, then no income is created for you not having a painter; but if William paints our house and I do the Scott’s will, then there is income to the extent of the will’s cost.

Williams v. Commissioner Π paid 30% commission on each lot he sold. Π bought 10 lots and got a for 10% of the value. HELD: for 10% was income; (Idiots SHOULD have reduced purchase price of lots by amt of commission).

CHAPTER 3: EXCLUSIONS, DEDUCTIONS, and CREDITS

A. Interest on State and Local Obligations §103 exempts interest on state and local bonds from income tax

B. Gifts §102 – Gross Income include value of P acquired by gift, bequest, devise, or inheritance. §102(c) – In general gifts from EMR to EME is income, with exception for de minimus gift; even gifts to EME for long, loyal service = income; exception for related parties. (Jeff P.26) If you give income from P as a gift then it’s taxable to the donee (and donor) Donors deduction for gift and donees have no income - HYPO A earns salary or collects interest on a bond then gives some $ to B; then, A has income on that salary or interest as per §61, but B does not as per §102

What’s a gift? I’m thinking of a word, it starts with I, it ends with T, it has five letters … I’ll wait. o The most important consideration is the transferor’s intent, not what donee thought!

15 o In the statutory sense it proceeds from a detached sense of disinterested generosity o Duberstein: In a business setting the concept of income is pretty broad and gratuitous transfers are slim! (see Pg. 25 of Jeff’s outline)

HYPO Dad gives me $10K … income? … probably not – probably gift as this is not compensation for services. As per Duberstein, look into Dad’s head, did he intend gift? Dad thinks Priest is underpaid and gives him $50. Dad augmented Priest’s income. The more Priest thinks this is related to his services in the clergy and the more he expects it – the more clearly it becomes income Difference between two hypos is the relationship between the parties … Dad and I are family and Dad and Priest are not!

How do you figure basis for a gift? Donee takes Donor’s basis HYPO Dan gives Annie stock as a present in ‘03. Then Annie gives it to Wally in ‘07. Dan’s basis in stock - $10,000 FMV ‘03 - $15,000 Annie’s basis - $10,000 FMV ’07 - $20,000 Wally’s basis - $10,000 … when Wally sells it his $10K gain will be taxed Exception: IF FMV is less than basis at time of gift, for purposes of determining loss, basis shall be FMV Dan’s basis - $10,000 FMV - $8,000 Annie sells it for $9,000 … no gain or loss Annie sells it for $11,000 … $1,000 gain Annie sells it for $7,000… $1,000 loss

C. Bequests

16 General rule is that you take a stepped up basis – the person acquiring the P takes as their basis the FMV of the P on D-day … could produce a stepped down basis if P depreciated while D held it. HYPO Aubrey has $250,000 P and takes $200,000 in deprecation deductions, so her basis is now $50,000. The P is willed to Mary. When Aubrey dies the FMV of the P is $450,000. Mary’s basis is $450,000. Old man Swygert buys a Lake Michigan house for $28,000 in 1938. Today it’s worth $1.2M. Old man says he’s going to give it to Mike Swygert and Mike says don’t leave it to me in the will, but give as a gift so my basis will remain $28,000!

D. Prizes Prizes and Awards are taxable under §74(a); EXCEPT Charitable Transfer – Prize taxable received for scientific, educational, or similar achievements and recipient orders that it be transferred to a charity taxable. EME Achievement Award – Award to EME for length of service or safety achievement is taxable unless worth more than $400. HYPO The Fridge receives a car from SI after named MVP of Super Bowl. TAXABLE accession to wealth under Glenshaw – not gift or noteworthy service.

E. Life Insurance Proceeds – P. 27-30 in Jeff’s outline Proceeds from life insurance policies are taxable; however, proceeds paid under an ins K, by reason of death of the insured are excluded from gross income. No deduction shall be allowed for premiums on any life ins policy, or annuity K if taxpayer is directly or indirectly a B under the policy or K

F. Charitable Contributions and Tax-Exempt Organizations IN GENERAL: Be paid to or for the use of a qualified recipient Constitute a gift or contribution rather than a payment for a good or service Consist of cash or qualified P Not exceed specified % of taxpayer’s AGI in year of payment Meet certain other §170(c) standards TAXPAYER MUST ITEMIZE THE DEDUCTION Charitable contributions may be deducted in computing taxable income. Must be to organizations that: “Contribution or gift to or for use of the gov’t, any entity organized and operated primarily for charitable, religious, scientific, literary or educational purpose.

17 charitable org just b/c entity is tax exempt and gifts to needy individuals deductible even if charitable org plays a role in delivering the gift NOTE: If you are going to donate P that has appreciated since you have owned it, it is better to give the entity the P because then the entity will pay the taxes on it than to sell it and donate the proceeds because then you pay the tax! Haverly v. United States Π received sample textbooks that he donated to the lib then took a deduction ... Court said that donation of unsolicited samples requires donor to include value of books in income to receive deductions ANYTHING we receive in mail (toothpaste, books) are accession to wealth under Glenshaw Glass, but we don’t have to report them because it would be a pain in the ass. HYPO Eddie donated $2,000 to ND Athletic Fund (to get better FB tix!) – 100% is deductible. 100K basis in stock, FMV is 80K. Should you donate the stock or sell then donate the proceeds? Sell then donate the proceeds … you can take a loss that way! Nancy owns stock that cost her $2K, but now worth $10K, if she donates whole stock then she can deduct the full $10K with the $8K going untaxed! (Note caveats on P. 32 on J’s outline)

G. State, Local and Foreign Taxes §164(a): Except as otherwise provided the following taxes are deductible: State, local, and foreign real property taxes State and local personal property taxes State, local and foreign income, war profits and excess profits taxed WTF

H. Personal Exemption and Filing Status 1. Personal Exemption a. §151 allows a $2000 deduction (fixed for inflation) for each taxpayer below certain income level to be deducted from AGI, therefore is a below the line deduction b. Dependants don’t get one, but married couples get two 2. Dependency Exemption a. Also below the line deduction … for person defined by §152 (basically anyone who gets more than ½ support from taxpayer – must be related or share same home) b. There are exceptions for children of divorced parents, see Jeff’s @ Pg. 33 – If have multiple support make out agmt who gets deduction each year 3. Filing Status a. Married Couples i. May file separately or jointly – if one makes substantially more than other, usually file together – makes both spouses liable for tax b. Single People

18 i. Must calculate tax under §1(c) unless they are SS or HoH c. Surviving Spouse (SS) i. Although single, gets the benefit of filing jointly – Must be unmarried whose spouse died during either of 2 yrs immediately preceding taxable year who furnishes over half the cost of a household (where SS lives) that constitutes home for dep. Child d. Head of Household (HoH) i. HoH taxed more lightly than single, but as lightly as SS ii. Must be unmarried ( SS) who furnishes over ½ cost of household for a dependent

I. Alimony §71 – Alimony is taxable to the recipient and deductible for the payer May be a single payment, have to be monthly payments Alimony must meet strict requirements under §71(b) differentiating it from child support of § 71 (c) (CAN opt out of §71(b) … see Jeff’s outline at 35 Spouse who gets P in breakup gets carry over basis and that P is alimony Qualified Domestic Relations Order (QDRO) – When dealing with qualified pension benefits (including IRA’s), it is necessary to draft and obtain court approval of QDRO, which is nec. to permit the plan trustee to make distributions to former spouse and shift income tax liability to them.

J. Personal Tax Credits §21 allows credit for amounts paid for childcare and household services if the taxpayer has at least one child under the age of 13 or an incapacitated dependent; and the amounts are paid in order to enable the taxpayer to be gainfully employed. More information on Pg. 36 if necessary Employment related expenses §21(b)(2)(a) – The following expenses qualify: o Expenses for ordinary and usual household services o Expenses for care of qualifying individual Calculation of the credit – Pg. 37 of Jeff’s outline Earned-Income Credit - §32 provides a refundable credit to taxpayers with relatively small amount of earned income (the credit is phased out as the taxpayer’s income increases). The primary purpose of this credit was to provide tax relief to the low income individuals with children and improve incentives to work.

19 Qualifying children – The % of earned income credit varies according to # of qualifying children in taxpayers household. a. 0 qualifying children: 7.65% b. 1 qualifying children: 34% c. 2 or more qualifying children: 40%

CHAPTER 4: BUSINESS AND INVESTMENT EXPENSES Jammin Number 1 - Depreciation – (§167) – Depreciation refers to the deduction allowing a taxpayer to recover the costs of assts used in his business or investment activities over time.

A. Must ask: a. What is the item’s basis? b. What’s the applicable recovery period? (3 to 39 years) c. What method are you going to use: i. 200% or 150% declining balance method (P in 3, 5, 7 & 10 yr) ii. Straight line method – Most real P d. Applicable convention – determining when P was in service i. Personal P usually depreciated by using ½ yr convention … treats all personal P placed in service during a yr as having been placed in service in the middle of the year. B. Depreciation Methods a. Accelerated depreciation – Permits larger depreciation in early years tapering out to later years; because of the time value of $ taxpayers will prefer this method because they want to reduce taxes sooner than later! b. Straight line depreciation: Total value - Salvage value = X/# yrs of asset’s useful life i. Salvage Value – Est value of asset at end of useful life ii. Useful Life – Service life of asset for purpose acquired ( nec. physical life of asset) HYPO Thomas bought a $10K business asset with a salvage value of $2K after an estimated useful life of 5 years – Annual Depreciation Deduction: 10K-2K=8K/5=$1,600 C. NOTES a. Depreciation of intangibles - Amortization – Goodwill, licenses, patents, permits, workforce, business book and records … deductible over 15 years b. Can deduct Organizational Expenditures (articles of incorporation, fees for bylaws, minute preparation) over 5 years (§248) c. Election to expense certain depreciable business assets (§179) – If satisfy criteria, instead of depreciating, may dispense it right now up to $25K/year – do this purely for economic stimulus d. Depreciation of improvements - §168 says that depreciation on improvements on or additions to P should be taken as if the Δ were in place at the time of the depreciation. Crane v. Commissioner

20 Mr. C transferred to Mrs. C P w/ FMV of $262K and subject to $262 mortgage. Mrs. C operated P for 7 yrs collecting rent and taking depreciation deductions of $25,5000 and now sells P subject to nonrecourse mortgage for $2500 cash: BASIS: 262,000-25500 = 236,500 Basis decreases by proportional amount of depreciation taken. T receives only $2,500, but relieved of mortgage, which adds to her gain .. 2500 + 25500 = $264,000 is amount realized GAIN: 264,000-236,500 = 28,000 LESSON: Milk your deprecation, sell the P, then start over!

2 – Capitol Expenditures Megan’s definition: Assets other than inventory Jeff’s definition: Expenditures made for assets with a useful life of more than one year; the cost of keeping P in an ordinary efficient operating condition may be be deducted as an expense, capitalized! o Some business or investment costs “called capitol expenditures” are deductible immediately; instead they are included in the basis of an asset (i.e. CAPITOLIZED) and are recovered either through depreciation or by reducing gain when the taxpayer disposes of the asset . Some capitol expenditures be recovered through depreciation. EX: Cost of land purchased for business use, MUST be capitalized. Plainfield-Union Test: o The cost of keeping P in ordinary operating condition may be deducted as an expense. A capital expenditure is more permanent increment in the longevity, utility or worth of the P, and creates more income over the future. Every possible acquisition const, even if put of for a long time, must be capitalized.

CAPITOLIZED: ADDED TO BASIS AND DEPRECIATED

§§162 and 262(a) are friends. They tell us: How do you figure out which business expenses you can deduct this year and which ones you must capitalize?

21 §162 – Current Year Deductions allowed §262(a) – No deductions allowed for for expenditures that are: Ordinary, and Expenditures for development of mines or deposits Necessary – if business decides it needs it, Research and experimental expenditures then courts usually go along with it – and Trade or business expenses Soil and water conservation expenditures (Basically repairs that we think of as pretty Expenditures by farmers for fertilizer basic are currently deductible) TEST: Does expenditure materially enhance the value, use, life expectancy, strength or capacity as compared with the status of the asset prior to the condition necessitating expenditure?

FACTS DEDUCTIBLE OR CAPITOLIZE? Oil seepage in meat packing plant – T lined Deductible because repairs did not increase walls and floors with concrete to restore to useful life or value when compared to pre- normal operating procedures. seepage period. Same as above, but T provided for seepage Capitalize in construction Floor of 3rd story of T’s building sagged. Held: Expenditure was restoring P to Steel columns and crossbeams installed to former condition therefore DEDUCT permanently cure the problem Morrisson: Life expectancy was extended so should have capitalized Sawed off rotten parts and replaced with Deductible expenditure cement Construction of new drive-in caused rain Cost of drainage system is Capitalized b.c water to drain into neighborhood, T need for drain should have been forseen constructs drainage system when theater was built – KEY: FORESEEABILITY An expenditure which would be a repair if will be a capital expenditure if the repair it had been the only expenditure for the is made as a general plan of rehabilitation. year in question… Cost of a new roof cannot be treated as repairs on the theory that the replacement of one shingle is a repair, so replacement of roof is NOT many repairs

22 Building has asbestos Removal will likely be capitalized D corp hires a law firm and pays them a After year expires and no merger activity, retainer to do nothing retainer is deductible D corp hires a law firm and the firm In the year that the merger goes through, actually does something retainer is capitalized - a successful merger produces increased benefits, synergies, etc … thus a retainer fee is allocable to some time in the future, not just this year New company selling software, gets Even though you would likely see the advertising co to promote it income to be produced over a number of years, not just one year, Commissioner says you can DEDUCT it! T owns laundry and dry-cleaning bidnes Capitalize that cost – truck is depreciable and (a) buys a second-hand delivery truck over time (b) repaint interior of building every three Currently deductible – develop a history years and therefore deduct it the period you actually use it! WAGES paid in carrying on of trade or Qualify as a deduction from gross income, business but when wages are paid in acquisition of capital asset , must be capitalized and are entitled to be amortized over life of the capital asset so acquired If you replaced the roof on your HOUSE HOUSE: Capital expenditure to be added and OFFICE …. What arguments would to the basis, resulting in less of a taxable you make for each? gain when you sell it OFFICE: Repair of ordinary business expense … Morrisson says you will lose though! Repair v. Replacement: AT what point No bright line test .. 1-5 shingles = repair, does it turn from a repair (deductible) to a 15-25 shingles = replacement? NO! replacement (capitalized)? Recurring v. Nonrecurring: Most ordinary Most capital expenditures are expenses (per §162) are recurring and extraordinary in sense of nonrecurring noncapitol in nature

Idaho Power If you use your own trucks to build a capital asset, you will take the amount you would have depreciated the trucks and add it onto the basis of a new capitalized asset and depreciate it over the life of the asset, not the truck

INDOPCO If you spend $$ to make business more efficient, then (a) capitalize the amount as an intangible, and

23 (b) depreciate for the period set out for intangibles

3 - INVENTORY Goods purchased or made by a firm and held for sale as part of the firm’s ordinary business operations. Cost of units sold are offset against selling price of units to = net income Two common inventory accounting methods: First-in, first-out (FIFO) Last in, first out (LIFO) When prices are rising, LIFO shows higher costs than FIFO making LIFO more attractive for tax purposes For non-tax purposes, taxpayers prefer FIFO since it results in higher profits on financial statements shown to creditors and shareholders.

4 – Business, Investment, and Personal Expenditures

Most non-capital costs of earning a profit can be deducted. a. If an activity is a trade or business, depreciation on assets used in the activity can be deducted under §167 and other expenses are deducted are deductible under §162(a). b. Expenses of managing, conserving, and maintaining the P are deductible under §212(2). c. Costs incurred for production of collection of income are deductible because §212(1)

§162 – Trade or Business Expense Deduction (above-the-line) available for ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business Trade or business: Activity w/ continuity and regularity and primary purpose must be for income/profit. Hobby, sporadic or amusement qualify. o HERE dog gambling did qualify as trade or business o EME business expenses can be deducted: Union dues and subscription to professional journals

§212 – Expenses for Production of Income – INDIVIDUALS (below the line) For individuals, deductions for all ordinary and necessary expenses paid during the taxable year:

24 For the production or collection of income For mgmt, conservation, or maintenance of P held for production of income In connection with determination of taxes (tax returns, planning, etc)

§262 – Personal, Living, and Family Expenses Unless otherwise indicated, no deductions allowed for personal, living, or family expenses – like life ins premiums, home ins, expenses for maintaining home Expenses for traveling deductible unless under §§162, 212 Costs to keep yourself continuing to work are personal and thus nondeductible

§263 – Capitol Expenditures No deduction for any amt paid for new buildings or permanent improvements made to increase the value of any P

Yeager v. Commissioner If you are an investor for yourself, you can deduct your expenses under §212, but if you are a trader doing this as a job for other people, you get a §162 deduction §163 – Investment interest for individuals can be deducted only to the limit that you have investment earnings.

Kenseth v. Commissioner Π gets $$$ for his discrimination suit then wants the contingency fee to be taken out of the part that would count towards his income --- he gets to deduct the fee under §212, not §162. You can’t assign your income to people so that no one gets taxed – Dad gives 15% to me, 25% to Jeff, 30% to Mom and keeps the rest – SORRY CHARLIE! Dut says …. Dario is my sex slave

4 – Connecting Expenses to Activities Gilmore This bozo owns several dealerships and his wife is divorcing him – he claims attny fees as deductible b/c he’s protecting his bidnez - HOLDING: NOT deductable as per §262 and cannot capitalize his costs in the basis of the stock Here he really was protecting his assets, but the origin of his COA was personal LESSON: Look at the ORIGIN of the claim, NOT THE RESULT o GILMORE II – allowed bozo to include legal fees in basis of P he kept his wife from getting

If your litigation arises out of a capital asset (like your personal home), then you can capitalize the legal fees and add to the basis of the asset, but you cannot deduct the fees like you would for a business asset.

25 Wild Legal fees that arise from trying to collect income (like alimony) CAN be deductible under §212. The key is to link the fees with obtaining the income

Pevsner If clothes are bought for work and they are suitable for general wear and personal usage, then they cannot be deducted. If you are a police man and you buy a uniform, that is deductible. BUT if you work at Ann Taylor and are a biker chick in real life, you can’t deduct the clothes - our problem you aren’t a classy bitch. o OBJECTIVE APPROACH o EXAMPLE: . Professional Musician – Tuxedo – Deductible . Painter – Bibs – NOT deductible . Steel Worker – Steel toes and goggles – Deductible WHAT IS ORDINARY AND NECESSARY? §162 Welch v. Helvering Π paid off creditors to strengthen his reputation as a businessman. Court said what he did was NECESSARY, but not ordinary. Not ordinary because people don’t do this all the time – Doesn’t’ have to be habitual, but must be ordinary in the business world. Most people don’t repay debts after they have been discharged. That is EXTRAORDINARY NOTE: IT may be ordinary if it only happens ONCE in the life of the bidnez REASONABLE ALLOCATION FOR SALARY The amount of compensation reasonable and must be purely for service o Bonuses count when made in good faith and as additional compensation for services actually rendered as long as they are reasonable HIGH salaries: o Highest paid executives are not subject to reasonable test – salaries >$1M, §102(m)(c) can get around this and allow corporation to deduct this o Excessive salary really only comes up when it is apparent that a s/h is trying to get earnings without corporation declaring a dividend

Elliots If Co is going to deduct payments to EME’s as salary, then it must be reasonable. Cannot hide dividends in salaries! Doesn’t matter if you have “extreme personal dedication and devotion to work,” just matters if its reasonable to pay you X amt o Salaries are compensation for services, not just giving out profits made! o LESSON Is the salary reasonable? Was the payment purely for services?

NOTE: SALARIES are deductible, DIVIDENDS are not – so closely held corporations have every reason to pay high salaries and low dividends!

26 TRAVEL AND ENTERTAINMENT Traveling btwn diff work spaces → You can deduct costs, if you reimbursed. Traveling from your house to work is NOT deductible (Danville → Lex) o Home → Principle Place of Business → only deduct when away fm PPB EXCEPTIONS: o When additional expenses are incurred for transporting job required tools o Taxpayer on duty while commuting (police) o Commuting to a distant, temp job If you work at home and you go to visit clients … deductible! It’s also deductible to go to another work area. What is TEMPORARILY AWAY FROM HOME? o If you go away overnight, you may deduct travel, lodging, and meals – HOME = PPB o If you away for less than 1 yr, then can deduct – if you can reasonably anticipate time more than 1yr, then move b/c get to deduct more expenses → If you reup for a 2nd term, then you can deduct up to the time of the decision to make it last great than a year. o §247 says you can only deduct 50% of the cost of the meals and can deduct taking clients out . If you are a traveling salesman and don’t have a home (Planes Trains and Automobiles) then you can’t deduct lodging and meals!

Moss → Cannot deduct daily lunches! → If meals are furnished for convenience of EMR and on premises of EMR, then that is NOT income to EME and cost of food is deductible to EMR. → If Moss had been an EME, rather than a self-employed taxpayer, the issue would have been whether the cost of the meals was includable in GI → If you are the EME/eater of the lunch decide if lunch is excludable under §119 or as a de minimus fringe benefit; if you are the EMR/buyer then deduct meal as business expense under §162 NOTE: Home, Work A, Work B, Home = Deductible; Home, Meet Client = Dedu.

Hantzis → Law stud at BU works in NYC for summer – tries to deduct travel expenses, apt, and meals under §162 – NO DICE – NYC was home for summer as it was PPB – PPB is usually home, not residence

The Carry-on Requirement

27 o Start up/ pre-opening (travel, market research, moving and expansion) costs can be deducted over 5 years, if they are not capital expenses. Pre- opening expenses are NOT capital expenses. (§195) o SEEKING NEW EMPLOYMENT: §217 provides deduction of moving expenses (above the line), mileage, but not meals → May deduct even if you don’t have a new job before you move! BUT must be employed at former job for at least 39 weeks to get deduction. o EXAMPLES: . If business is expanding, costs may be deducted in yr incurred. . If looking for new job in same field as in now, costs are deductible . If seeking job in new field, not deducible

CHAPTER 5 – INTEREST INCOME AND DEDUCTIONS A. FORMS OF INTEREST – Interst is includable in the lender’s income under §61(a)(4) unless §103 applies (interest on state and local bonds). Borrower can deduct interest under §163, but limited – cannot deduct interest for personal loans. B. Types of interest a. POINTS – Banks charge loan processing fees or points to borrowers… POINTS are interest unless they are paid for services like paper work i. MOST points deducted when paid, but must be written off over term of loan under §146(g) ii. If points really are interest and fee, then deduct all point interest b. CARRYING CHARGES - §163(b) c. IMPUTED INTEREST - §§438 and 1274

C. Personal Interest – Personal interest deductions ltd to 4 types: a. Interest arising out of trade or business (T is sole proprietor and borrows $ to buy new assets) b. Investment interest – Only to the extent that is income c. Interest taken into account under §469 in computing income or loss from passive activity of taxpayer – borrow $ to invest in apt that T actively manage d. Acquire or renovate personal residence – Home mortgage interest i. ALSO educational loans interest is deductible UNLESS T finds one of those “safe harbors,” then the interest will not be deductible: Examples – Consumer interest, credit card interest, interest on car loan, etc.

CHAPTER 7 – WHO IS THE TAXPAYER? A. Two principles here: Lucas

28 → Income is taxed to the person who earns it – gratuitous asmt of income is not effective ---- this is kind of obsolete now because of joint returns → Assignments of the fruit are ineffective if T still retains the tree (Horst) Here’s what Lucas wanted – Made $24,000/year …. Without the Split Split $4,000 x 6% = $240 $12,000 assigned to W and $12,000 to H $20,000 x 12% = + $2,400 $4,000 x 6% = $240 $2,640 $12,000x 12% = +$960 TAX $1,200 x 2 = $2,400 H earned the $ and a gratuitous assignment effective, regardless of K’s validation. Income tax cannot be escaped by anticipatory arrangements and K’s, however skillfully devised to prevent salary when paid from vesting in the one who earned it.

Poe → H&W can file joint returns – May split the income in have because it is community P – CONTROL doesn’t matter over the P, it’s the ownership. HYPO Jai and Kyan have a partnership. Profits are $300K. $250K is attributable to Jai’s hard work. $50K to Kyan’s occasional work (done on the golf course) – you cannot assign the income – this inequity should be addressed by the partnership Vandercoy works in the clinic and is sometimes entitled to $ for services, which is turned over to skoo. Income to Vandercoy? NO – Vandercoy is acting as an agent of the organization. ( likely VUSL will get taxed on $ b/c it’s a tax-free institution. W is executor of H’s will and is entitled to a fee – W waives fee in order to avoid income – NOT taxable! Roush says to BOD, I don’t want any more salary so they give it to start up new Centre law skoo – Roush not taxed b/c he had nothing to do with where that $ went. If he SUGGESTED they start the Centre law skoo … then may be taxed! B. Income from P Blair → T assigned income received from a trust to his kids – it’s income to the kids b/c whoever receives income owns title to it and therefore pays taxes on it. → Here, the Dad’s life interest in the trust is the TREE (underlying P); Dad has chopped down some of the fruit and some tree and gave some fruit and some tree to kids. Effective shift in liability. If you only give away fruit, then that will not shift the tax liability!

Helvering – CARVED OUT INTEREST → T kept bond and gave away coupon – he still had income on an interest he wasn’t receiving. He ahs carved out an interest here and not given away the WHOLE interest. If he gave away the whole bond, then the receiver gets taxed on the interest income.

29 → TEST: Identify the tree/the property that is held – does the donee still have rights to the tree? Or has he parted with the tree? HERE, through the gift, the coupons became the absolute P of the donee, free from the donors control and in no way depended upon ownership of the bonds.

Eubank → If you assign future earnings for services not yet performed, Lucas says you get taxed!

Taxation of Minor Children: o Family Partnership and giving away interest to children: . Apt Bldg – Dad owns and gives away interest in capital partnership to 2 kids, each getting a 10% chunk of income . Accountant – This will NOT work b/c it’s shifting income (fruit) and not the tree … Lucas . Lawyer – Bldg Dad’s business is in has depreciated down to $0 – Dad gives that to kid and pays $100K rent to kid creating a §162 expense and a deduction . IRS – If kids don’t do anything to earn the $,t hen allocate salary to reasonable partner, like the Dad

CHAPTER 8 – INCOME FROM DEALINGS IN P HYPO Purchase stock for $40 – end of yr it’s worth $100 – wealth has >$60, but T include increment in income b/c stock has been disposed of … i.e. not realized!

A. Analysis of Property Transaction Ask whether the sale, exchange, or other taxable event has (realizing event) has occurred → If Yes, then … Determine amt of gain or loss realized, by comparing amt realized with adjusted basis of P disposed. If there is a gain, is it recognized? If loss, is it deductible? (See §§1001(a) gain or loss, (b) amount realized, 1011 adjusted basis) If there is a gain or loss is it ordinary or capital?

30 o §165 generally allows deductions for recognized losses sustained during the year; but §165(c) prohibits noncorporate taxpayers from deducting losses other than: . Those incurred in a trade or business . Those incurred in a transaction entered into for profit Losses from sale of securities and or investments Gambling losses (but only to extent of gam. gains) Casualty losses with respect to personal use P B. The Taxable Event A gift of P is nontaxable, bequests are nontaxable, exchanges of similar P are nontaxable. HYPO Andy gets a $15 haircut at Larry’s. He pays w/ stock w/ FMV of $15, but basis of $5. RESULT: Andy has $10 of gain because there was a realizing event! It’s the same as if he would have cased the stock in and received $15, and gave that to Larry. Larry has $15 of income and basis of $15.

International Freighting → Corporation gives stock to EME as bonus → Corp can’t figure out what to deduct --- ME NEITHER --- FMV at gift was $24K, but corp paid $16K for stock. → Corp deducted FMV and Commissioner says that if you deduct FMV then you must realize and recognize the gain on the stock FIRST, which would be a capital gain of $8,000. → Corp must realize the gain on the transaction; then they can deduct the $24K because EME pays taxes on the $24K as income under §83

HYPO T, a cash-method accounter, owes EME $10K for services rendered. T satisfies the obligation by giving EME P w/ adj basis of $4K and FMV of $10K. RESULT: T has $6K of capital gain and $10K of deduction per §162; EME has $10K gain and basis

C. Computation of a realized gain or loss Megan says …. o The basis of P acquired by purchase, taxable exchange, or exercising an option will be amount paid for the option + price going to pay for the real estate. o If the P appreciates over the option period, then it doesn’t matter, he’s not buying the P for that amount. o The guy that gets thte

HYPO Basis of Property acquired by exercising an opton

31 T pays A $10K for option to buy business RE for $100K, w/in next 2 yrs. (No income here) –Currently P is worth $95K → In 2001, T exercises an option when P is worth $115 – RESULT: T recognizes no gain, and obtains basis of $110K ($10K option + $100K purchase price) … A now has income of $110K. → If option expired with no deal going through A would just have $10K ordinary income

Allocation of Basis Otis buys $25K of P that is a used car lot worth $10K and gas station $15K. 5 yrs later Otis sells the gas station for $20Kwhen he has depreciated $2K of that P. SO Otis’ gain on that P is $7K because the gas station’s basis was reduced to $13K with the deprecation. → BASICALLY if you split P and sell it, the basis of the sold portion must be allocated between the parts sold and retained in proportion to the relative values of those portions at the time the P was purchased.

Inaja Π paid $61K for recreational P in LA, LA pollutes river and pays Π $41K for easement to keep polluting. NO GAIN TO Π – Just reduce basis by the amount Π was reimbursed for by the city. So basis is now longer $61K-$41K = $21K. → If the city would have paid Π more than he had paid for the P, then Basis would be 0 and he would have capital gain for amt over what he paid!

D. Transactions involving mortgaged P Parker Paying down mortgage principle does NOT Δ basis If take depreciation, then give bank P back because you pay the mortgage, have to pay that depreciation back minus the amount that you have paid on the principle. Also works out to be the (Mortgage Balance) – (Adjusted Basis)

Payment of the debt doesn’t impact basis at all (does affect amount realized) Fluxuation in value impact the basis (does affect amt realized when you sell)

Crane Basis is the amount of your down payment + mortgage Treat amount of debt as amount of part realized Amount of nonrecourse debt liability is included in amt realized in sale MORTGAGE DEBT IS INCLUDED IN BASIS

Woodsam --- Jeff’s outline p. 56 Subsequent equity loan P does not change your basis in the P

32 When you turn the P over you just realize the amount of the indebtedness It’s just like the bank paid you the amount of the indebtedness for your P so the difference between that and the basis is your gain.

Tufts

HYPO In the following hypos focus on whether there is a disposition of P and realization of gain (from basis) from the debt being forgiven. Just b/c cash is not being given does not mean that T can’t realize the income/gain:

Debtor transfers P with basis of $5K, FMV of $6K, to a creditor in full satisfaction of a $7,500 debt, which was secured by the P. RESULT: If debtor was personally liable on the indebtedness he realizes $1000 gain on the disposition and $1500 of discharge of indebtedness income. If not personally liable, Turfts treats the full amt of indebtedness as an amt realized on the transfer of the P to the lender, here $2,500.

Same facts, but debtor persuades the lender to accept $5K cash in full discharge of $7500 indebtedness. Since the encumbered P is disposed of, there is no occasion to compute any amt realized. RESULT: $2500 of income via discharge-of-indebtedness

Debtor pays lender $5000 cash in full discharge of a $7500 of qualified real P business indebtedness (See §108(a)(1)(D)) The real P had a FMV of $6K and basis of $5K. RESULT: Of the $2500 discharged, the borrower may elect to exclude $1500 from income and apply that amount against the basis of the P, thus reducing the basis to $3500 (See §108(c)) T buys P for $50K, properly deducting $30K of depreciation thereon, and then borrows $40K from the bank on a non-recourse note, using P as security. RESULT: Even though the loan proceeds exceed the P’s basis, no gain is recognized, and thus the basis of the P is increased.

D. Basis of P Acquired by Gift In general, the recipient of a gift can exclude the gift from income under §102(a) and takes donor’s basis in the P. A donor, who transfers the P by gift, usually recognizes no gain or loss on the transfer. o BUT if at the time of the gift, the value of the P is LESS than the donor’s basis, the donee must use the FMV in computing the amount of loss realized on the disposition of the P.

33 §1015(b) – If gift transfer requires a gift tax, the basis of the P that the donee takes will be increased by the amount of gift tax paid. Marriage and Divorce transfers o §1041 – Gain or loss is not recognized upon the transfer of the P to the taxpayer’s spouse or ex-spouse . If one spouse sells other P and there is a loss, it is not like §1015 (lower of basis FMV rule) … they keep the basis of the transferor spouse. . §1041 applies to all transfers between spouses, even at just an arm’s length … so if H sells P to W, its treated like a P settlement transfer.

Farid o Π gave her marital rights in consideration for the stock – there was no gift so she gets the basis of the FMV of the stock – transaction treated as a sale, not gift.

Basis of P acquired by bequest of inheritance Recipient of inherited P takes a basis of FMV of P on D-day – any appreciation of P that occurred during D’s life is exempt from tax. Cannot transfer P to future decedent within one year of D-day just to have them transfer the P back to you to get the stepped up basis. If you get stock as a beneficiary, it is always long term gain

HYPOS Basis in stock is $100, FMV is $10K. T’s brother-in-law is ill so T gives him the stock. (WTF? To make him feel better?!) Brother-in-law takes $100 basis then bequests stock back to T, who will get the stepped up basis. RESULT: §1040(e) prevents bush-league tatics $100 basis in stock that now has FMV of $1M. HUGE GAIN, how do you avoid? Go to bank and borrow $990,000 with stock as security – You get this $ as tax-free borrowed money. If T dies in an accident, heirs get the $1M stepped-up basis and deduction for $990,000 loan, based upon Fed Estate Tax

CHAPTER 10 – CAPITOL GAINS AND LOSSES A. The Significance of Characterization Whenever a gain is recognized or loss allowed, it must be characterized as ordinary or capital Capitals gains must be fully included in gross income LTCG are generally taxed at a lower rate than ordinary gain

34 BUT capital losses are WORSE than ordinary losses – ordinary losses are fully deductible against ordinary income on a dollar-for-dollar basis, o BUTT … only $3,000 of ordinary income can be offset by a capitol loss each year If have gain you want it to be capital, if you have a loss you want it to be ordinary

Capitol gains/losses: §1222 defines capital gains and losses as gains and losses from (a) Sale or exchange of (b) Capital assets (must have both) i. Capital Asset – P held by the taxpayer (regardless if connected with a trade or business), other than excluded by §§1221(a): inventory, depreciable or real P used in trade or business, certain copyrights and artistic compositions, accounts or notes receivable from inventory or in the ordinary course of business or trade. Capital Assets Noncapital Assets Stocks, bonds, securities held by taxpayer P held mainly for sale to customers or P in his personal account who is NOT a that will physically become part of the professional dealer in stocks/securities merchandise that is for sale for customers Undeveloped land held as investment Supplies regularly used in the ordinary course of business Paintings or other artifacts – gold, silver, If it’s a transaction where I’m making stamps, coins, gems, etc. provided they are money off an asset or my livelihood and not held for sale by dealer I’m making income off of it … NOT a capital asset T’s home (If home was sold at loss, deduction for the loss would be allowed, thus the Q of a capital loss treatment would not arise – any gain on sale of home is a cap gain) Household furnishings

Car used for pleasure or commuting Investment P

Long term/short term – Depends upon T’s holding period. - Holding period is significant b/c only LTG get benefit of CG - A gain or loss is long term if the asset was held for more than 1 year before being sold or exchanged: §§ 1222(3)(4)

35 Mechanics of gain/loss: If T has both capital gains and losses, then the gains are NOT netted against the losses in computing gross income; instead the losses are just deducted in computing the AGI. - NCG is subjected to favorable capital gains tax rates - NCG is computed by taking the NLTCG - NSTCL

If LTCG > LTCL (LTCG-LTCL = NLTCG), one next nets all the short term transactions. Any excess of STCL>STCG (STCG – STCL = NSTCG) is subtracted from NLTCG to arrive at NCG. o NLTCG – NSTCG = NCG

HYPO STCG = $5,000 STCL = $7,000 LTCG = $14,000 LTCL = $4,000 NSTCL = $2,000 NLTCG = $10,000 NCG = $8,000 … THIS is what is taxed favorably! Any excess of the NSTCG>NLTCL is taxed at ordinary income rates

LTCG = $10,000 LTCL = $5,000 STCG = $12,000 NLTCG: $5,000 NSTCL: $2,000 NCG: $3,000 If NSTCL was $10,000, it would wipe out all of the NLTCG ($5,000) and still leave NLTCL of $5,000; thus $3,000 would be deductible and $2,000 carried forward as STCL to offset cap gains of later years

From taxpayer’s point of view … 1st prize is to get net capitol gain for the year. The consolidation prize is a capital loss that can be used to offset up to $3,000 of ordinary income. The $3,000 offset only occurs if there is a deductible capitol loss left over after offsetting capital gains.

NLTG is taxed at capital gain rates and NSTL is taxed at ordinary income rates If you have a loss after figuring it all out … then you can deduct $3,000 that year and carryover all the rest to the following year.

36 o Do this every year until loss is recovered. The $3,000 offset only occurs if there is a deductible capitol loss left over after offsetting capital gains. When taking a loss you allocate the loss to the highest taxable bracket of capital gains first – this lessens the amount of high tax capital gain for a taxpayer – GOOD FOR US! RECAPTURE: If have a capital asset then you depreciate, when you sell that P, the amount you depreciated, you will have to pay 25% of the tax rate – the rest is taxed at the capital gain rate NOTE: §1250 If you buy some P for $100K and depreciate it down to $40K, but sell it at $80K, then it’s not §1250 recaptured … now the gain is taxed at 25% - only to previously deducted real estate. On business real estate, if there is a gain, it is a capital gain. If there is a loss, then it is an ordinary loss - §1231

This is the worst class ever – Cheers, Philip!

Nahey – If there is a GAIN there must be a sale of a capitol asset.

37