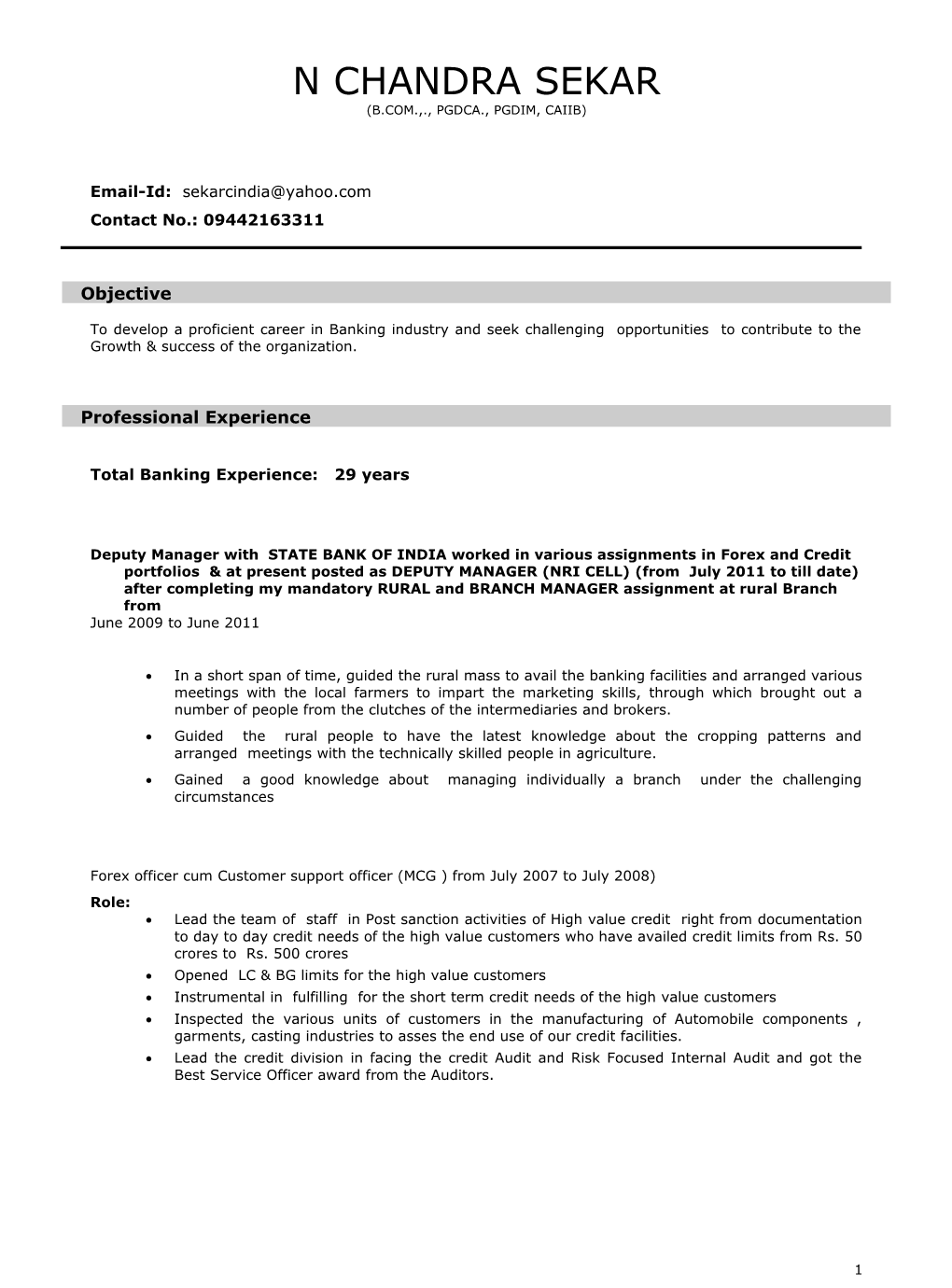

N CHANDRA SEKAR (B.COM.,., PGDCA., PGDIM, CAIIB)

Email-Id: [email protected] Contact No.: 09442163311

Objective

To develop a proficient career in Banking industry and seek challenging opportunities to contribute to the Growth & success of the organization.

Professional Experience

Total Banking Experience: 29 years

Deputy Manager with STATE BANK OF INDIA worked in various assignments in Forex and Credit portfolios & at present posted as DEPUTY MANAGER (NRI CELL) (from July 2011 to till date) after completing my mandatory RURAL and BRANCH MANAGER assignment at rural Branch from June 2009 to June 2011

In a short span of time, guided the rural mass to avail the banking facilities and arranged various meetings with the local farmers to impart the marketing skills, through which brought out a number of people from the clutches of the intermediaries and brokers. Guided the rural people to have the latest knowledge about the cropping patterns and arranged meetings with the technically skilled people in agriculture. Gained a good knowledge about managing individually a branch under the challenging circumstances

Forex officer cum Customer support officer (MCG ) from July 2007 to July 2008) Role: Lead the team of staff in Post sanction activities of High value credit right from documentation to day to day credit needs of the high value customers who have availed credit limits from Rs. 50 crores to Rs. 500 crores Opened LC & BG limits for the high value customers Instrumental in fulfilling for the short term credit needs of the high value customers Inspected the various units of customers in the manufacturing of Automobile components , garments, casting industries to asses the end use of our credit facilities. Lead the credit division in facing the credit Audit and Risk Focused Internal Audit and got the Best Service Officer award from the Auditors.

1 Deputy Manager (Forex) (Officiating) with State Bank of India, Ambattur Industrial Estate Branch ,Chennai (July 2004 – june 2007) Lead the team of staff in FOREIGN INWARD REMITTANCE area, scrutinizing MT 103 and obtaining rates from dealing room and crediting the customers account without delay. Solved the various remittance related problems of the customers and obtained the best customer friendly officer award. Lead the FOREIGN OUTWARD REMITTANCE division and ensured the customer’s funds reached the foreign seller in time. VISHWA YATRA TRAVEL CARDS were sold by me meticulously and got the best seller award from the management. Instrumental in bringing down NOSTRO outstanding entries and balancing the VOSTRO accounts Lead the imports division in issuing and advising the LETTER OF CREDITS and issuing BANK GUARANTEES Lead the team of FORWARD CONTRACTS and booked more number of purchase and sale contracts and assured the best rates to the customers. Lead the Exports division and scrutinized the Export Bills and negotiated the Export Bills Secured a good knowledge in EXIM BILLS software and the MERCUCY FX software

Banking: Core Activity

a. Liability Products Banking: Deposits (Time / Demand) covering Vanilla products like Savings / Current / Recurring Deposit accounts etc., and Hybrid products like unfixed deposits, savings plus deposits, Corporate deposits etc.,

b. Asset Products Banking: Credit Business

Term Lending covering various segments like Retail / Corporate / Agriculture / SME ranging from Short Term, Medium Term, Long Term, Housing, Education, Personal, Pension etc., Working Capital finance Bill Finance (Inland / Foreign) Receivable Finance Non-Fund based business Motor / Transport operator finance Pre-ship / Post Shipment export financing Priority Sector financing and Government Sponsored Schemes Micro Credit for SHGs Agricultural Financing like KCC/KGC, Tractor, Land Development, Horticulture and various types of irrigation project finance High value credit for SSI / SME / Commercial & Institutions

c. General Banking & Miscellaneous Income

1. Remittance Business:

Inland / Foreign remittance both Inward / Outward. Inter branch / Inter bank funds transfer using traditional modes and use of recent facilities like RTGS etc

2. Cash Department:

Cash department procedures, Procedures relating to RBI Cash remittance Currency Chest operation, Small Coin Depot operations Maintenance / control / monitoring functions of currency administration cells Inter branch/bank cash remittance functions etc.,

2 3. Accounts & Miscellaneous business including Government business

Creation/ Maintenance/ Reconciliation of 1. External customer Liability / Asset product accounts 2. Internal / Office accounts 3. Contingency accounts 4. Pensioners accounts 5. Salaried accounts 6. Accounts of HNI’s

d. NPA Management:

Being the area of concern for banks all over the world, this had assumed importance with opening of economy. Here too, I could contribute significantly in recovery of the bad debts of the bank through various tools available in our country.

e.g: Securitisation of Assets (using SARFAESI act), DRT, Civil Suits, Summary Suits, Compromise Settlements, OTS, Lok Adalat, Write off etc.,

Involved in Control, Monitoring of the NPAs.

e. Technology Driven Products (Interfaces / Alternate or Multi-delivery Channels):

Internet Banking, Corporate Internet Banking ATM Debit cum ATM Cards (Domestic / International cards) RTGS/NEFT Cash Management Products & Services for Corporates Internet Kishoks for multiple banking uses for customers. Bunch note acceptors for depositing cash Mobile banking

Clerical Staff with State Bank of India (November 1982 to July 2003) Handled all General Banking areas, branch administration, branch establishment, Cash department, Performance report and other MIS return to the controllers.

Skill Set

Computer : Literacy relevant for banking using technology, Core Banking Solutions, Trade Finance Solution, RTGS, ECS, SWIFT, EDI, Bank Master, ATM, NET banking. Done POST GRADUATE DIPLOMA IN COMPUTER APPLICATIONS and Banking : Project appraisal, Long / Short Term financing, Personal Investment SOFT skills : Being in service industry this is part & parcel of our routine., Value-addition being that I am trained in Behavioral Sciences by State Bank Staff College, Hyderabad.

3 Projects

Name: Pitfalls in Internet Banking & Marketing of Internet Banking facility Client: State Bank of India Brief: Well received by our Circle Management Committee and Suggestions given were used by ITS Department of SBI for up-gradation.

Academic Credentials

Degree/ Certificate University/Board Percentage (%)

P G D M INDIRAGANDHI NATIONAL OPEN “B” Grade UNIVERSITY, NEWDELHI

P G D C A BISHOP HEBER COLLEGE, TIRUCHY FIRST CLASS UNDER BHARATHIDASAN UNIVERSITY, TIRUCHY

B COM., JAMAL MD. COLLEGE, TIRUCHY 56% UNDER MADRAS UNIVERSITY, CHENNAI

Professional Credentials

Certificate Institute Year

Indian Institute of Banking & CAIIB 1991 Finance

POST GRADUATE DIPLOMA IN COMPUTER APPLICATIONS Madurai Kamaraj University 1992

POST GRADUATE DIPLOMA IN MANAGEMENT IGNOU 1994

Personal Details

Date of Birth: 23.07.1958 Languages Known: Tamil, English Father’s Name: T.NATARAJAN Resi. Phone no. 09444981455 044-26600757

4