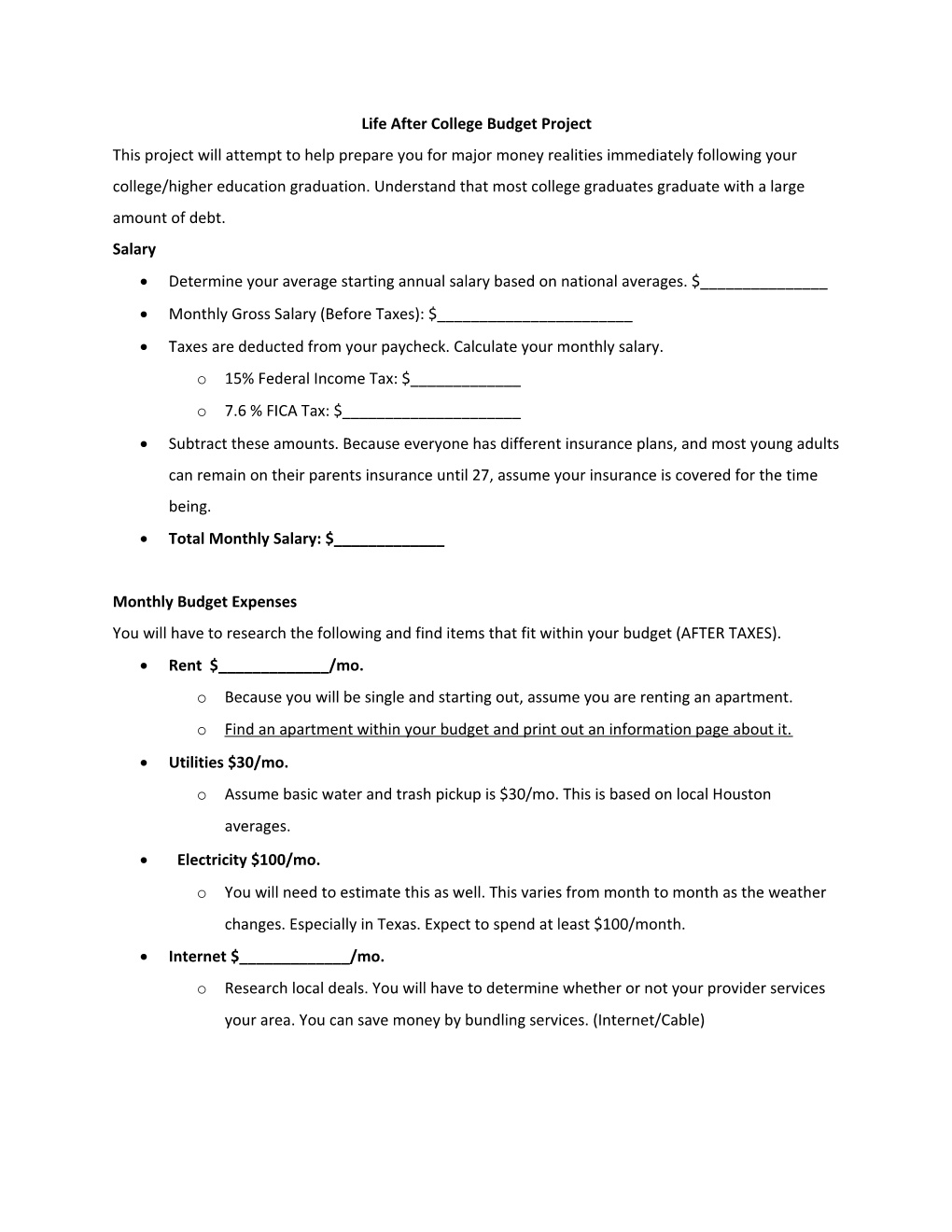

Life After College Budget Project This project will attempt to help prepare you for major money realities immediately following your college/higher education graduation. Understand that most college graduates graduate with a large amount of debt. Salary Determine your average starting annual salary based on national averages. $______ Monthly Gross Salary (Before Taxes): $______ Taxes are deducted from your paycheck. Calculate your monthly salary. o 15% Federal Income Tax: $______o 7.6 % FICA Tax: $______ Subtract these amounts. Because everyone has different insurance plans, and most young adults can remain on their parents insurance until 27, assume your insurance is covered for the time being. Total Monthly Salary: $______

Monthly Budget Expenses You will have to research the following and find items that fit within your budget (AFTER TAXES). Rent $______/mo. o Because you will be single and starting out, assume you are renting an apartment. o Find an apartment within your budget and print out an information page about it. Utilities $30/mo. o Assume basic water and trash pickup is $30/mo. This is based on local Houston averages. Electricity $100/mo. o You will need to estimate this as well. This varies from month to month as the weather changes. Especially in Texas. Expect to spend at least $100/month. Internet $______/mo. o Research local deals. You will have to determine whether or not your provider services your area. You can save money by bundling services. (Internet/Cable) Cable/Satellite $______/mo. o Research local deals. Pay attention to introductory offers. These do not last. See above. You can save money by going with Netflix/Hulu, but you will HAVE to have internet service. You may choose to research the cost of Netflix/Hulu instead. Phone $______/mo. o Determine the cost of a monthly cell phone bill. You may choose to stay on your family plan, but you must determine how much you pay your parents a month if you do. Car Insurance $______/mo. o If you already have car insurance, you may use the current amount you already pay. o If you are on your parent’s plan, you will need to get your own insurance. Car $______/mo. How long will you be paying this off? ______o You have received $2000 in graduation gift money. You may choose to use this towards a down payment on a car. o Part 1: You must purchase a car even in you have one or if someone is giving you a car. Also, now that you have a job, you need reliable transportation - your car must cost at least $7,500. o Print the information page that includes the cost of the car and any fun features. o Part 2 : Compute monthly payments for your car loan and include into your budget. o Use the following information for your calculations: . Loan Amount = cost of the car you want to purchase minus what you are using as a down payment (minimum is $7,500) . Interest Rate = 9.0% . Tax rate =9 % . Use the following website to determine your monthly payments: http://carpaymentcalculator.net/

Gas Price $______/mo.

o You cannot drive your car without it. Determine your commute to work, determine roughly how many gallons of gas you will need per month and multiply by the current average gas price per gallon. Groceries $______/mo. o Man cannot live on ramen alone. Determine a realistic grocery budget. Understand that “groceries” will include paper towels, toilet paper, dish detergent, shampoo, deodorant, toothpaste, etc. Not just food. You should make a grocery list, then “shop” online to find an average cost of items on that list.

Student Loan Debt: $______/mo. How long will you be paying this off? ______o 2 year degree/certificate (or less): $10,000 student loan debt o 4 year degree/certificate: $20, 000 student loan debt . Assume an interest rate of 6% . Assume a minimum payment amount of $50/month. . Use the following website to determine your monthly student loan payments http://www.finaid.org/calculators/loanpayments.phtml Credit Card Debt: $______/mo. How long will you be paying this off? ______o 2 year degree/certificate (or less): $1500 credit card debt o 4 year degree/certificate: $3000 credit card debt . Assume an interest rate of 10% . Assume a minimum payment amount of $25/month. . Use the following website to determine your monthly credit card payments http://www.mycalculators.com/ca/ccalm.html Savings $______/mo. o Plan on putting at least 8% (recommended is 10%) of each paycheck into savings for emergencies. Entertainment $______/mo. o This includes going out to eat, shopping, movies, bowling… almost anything where you will spend excess money. Plan according. You cannot afford to spend outside this limit. Item Monthly Cost Annual Cost Rent Utilities (Water/Trash) Electricity Internet Cable/Satellite Phone Insurance (Car/Renters) Car Payment Gas Groceries Student Loans Credit Card Savings Entertainment Total Money left AFTER bills

Project Rubric

Requirements Point Scale Points Earned A cover page including your job title & monthly wages 10 An excel sheet/chart of all monthly/annual expenses 45 A print out of your apartment information 5 A printout of your car information 5 Your grocery list with costs of each individual item and a total 15 amount at bottom (“receipt”) This COMPLETED worksheet packet 10 A half-page reflection discussing what you learned from this 10 project Total: 100