2014/2015

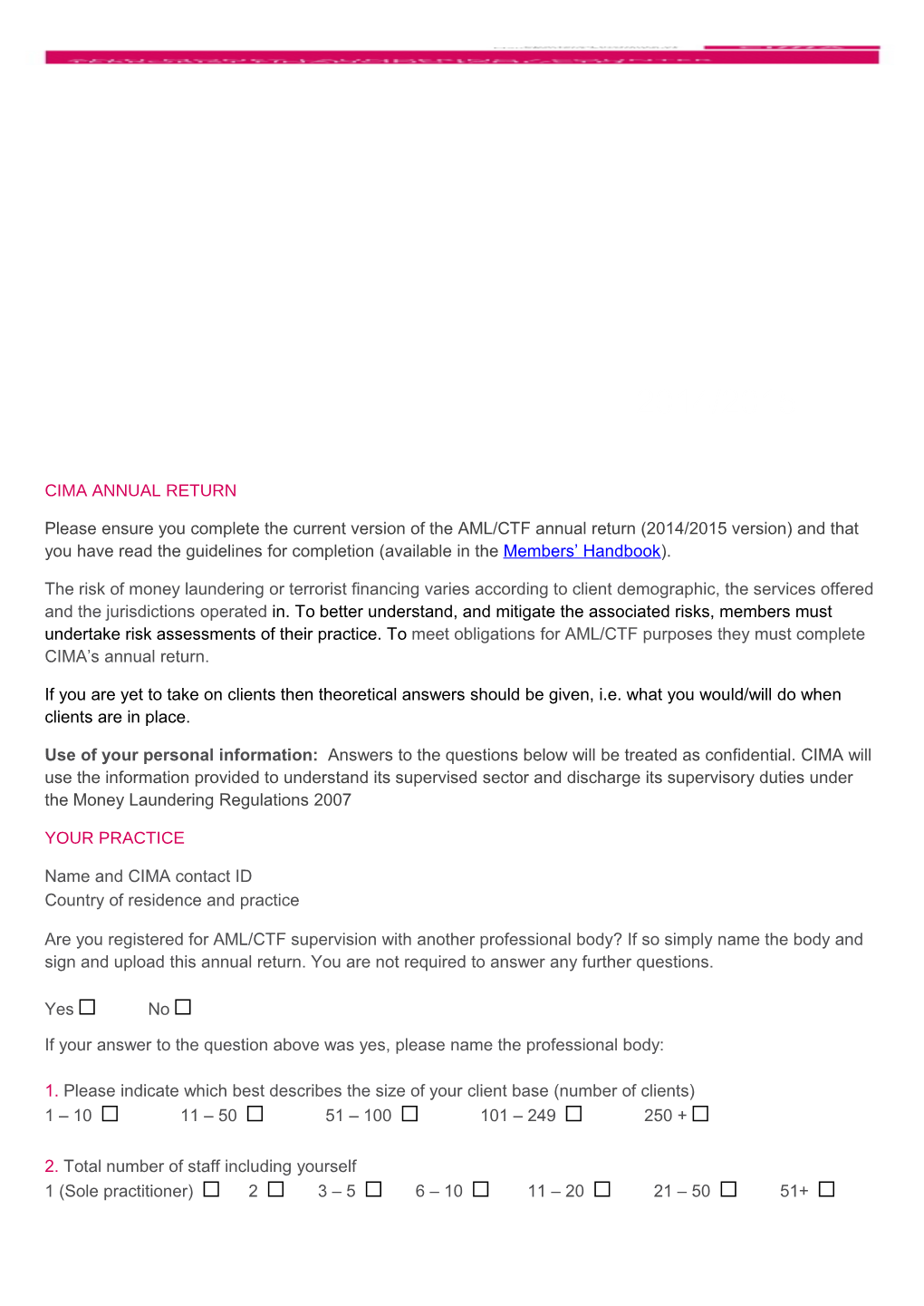

CIMA ANNUAL RETURN

Please ensure you complete the current version of the AML/CTF annual return (2014/2015 version) and that you have read the guidelines for completion (available in the Members’ Handbook).

The risk of money laundering or terrorist financing varies according to client demographic, the services offered and the jurisdictions operated in. To better understand, and mitigate the associated risks, members must undertake risk assessments of their practice. To meet obligations for AML/CTF purposes they must complete CIMA’s annual return.

If you are yet to take on clients then theoretical answers should be given, i.e. what you would/will do when clients are in place.

Use of your personal information: Answers to the questions below will be treated as confidential. CIMA will use the information provided to understand its supervised sector and discharge its supervisory duties under the Money Laundering Regulations 2007

YOUR PRACTICE

Name and CIMA contact ID Country of residence and practice

Are you registered for AML/CTF supervision with another professional body? If so simply name the body and sign and upload this annual return. You are not required to answer any further questions.

Yes No

If your answer to the question above was yes, please name the professional body:

1. Please indicate which best describes the size of your client base (number of clients) 1 – 10 11 – 50 51 – 100 101 – 249 250 +

2. Total number of staff including yourself 1 (Sole practitioner) 2 3 – 5 6 – 10 11 – 20 21 – 50 51+ 3. Please indicate your business type Sole practitioner

Partnership

Limited Company

Limited Liability Partnership

Other, including non UK jurisdiction (please specify) .

4. Does your practice operate from a single office location or from multiple business units? Single Multiple If multiple how many locations and in what country/ies

5. How do you maintain awareness of AML/CTF threats to your practice?

6. What do you consider to be the main AML/CTF threats to your practice? Why? How do you mitigate them?

7. Do you complete a documented AML/CTF risk assessment on your practice as is legally required by AML/CTF regulation? Yes No

7a. Please describe your risk assessment process and documentation.

OTHERS HOLDING A MANAGEMENT INTEREST IN YOUR PRACTICE

If you are a sole practitioner you are not required to complete this section, please continue to 9.

8. Please list any other Directors / partners within your practice

Name Position held Name of professional body of which they are a member* Who is their supervisor for AML/CTF compliance?

Name Position held Name of professional body of which they are a member Who is their supervisor for AML/CTF compliance?

Name Position held Name of professional body of which they are a member Who is their supervisor for AML/CTF compliance?

*if they do not hold membership of a professional body please leave blank

YOUR CLIENTS

Risk assessments and customer due diligence checks on all clients should be made at the point of engagement and continued periodically.

9. How do you assess client risk? 10. What level of risk from money laundering / terrorist financing would you associate with your client base? Low risk higher risk

11. Please explain on what basis you have allocated the above risk level

12. Is the larger proportion of your client base composed of clients who are: New Longstanding Friends/family Recommended from person known to you

13. Do you have any particular client sector/client type that you consider higher risk? Yes No

If yes, which and why?

14. Do you offer any particular service/product that you consider to be higher risk? Yes No

If yes, which and why?

15. Businesses with a large cash income (e.g restaurant owners, shopkeepers, taxi drivers, car dealers etc) can be seen as a higher risk. Do you deal with cash based businesses? Yes No

If yes, what percentage of your client base are cash based businesses? %

16. Do you have any Politically Exposed Persons (PEP’s) as clients? Yes No

17. Do you have any family or close associates of PEP’s as clients? Yes No

18. Do you work with agents or representatives of an individual as clients? Yes No

If yes, what checks are undertaken to establish the beneficial owner of the business?

19. Do you have clients that you (or your staff) have not met face to face? Yes No

If yes, please describe the enhanced due diligence checks you undertake

20. Do you have any clients where the ownership of the business is obscured? Yes No

If yes, please describe the enhanced due diligence checks you undertake

21. How many, if any, clients have you turned away due to them being unable to comply with CDD requirements Did you take any further action on those turned away, if so, please explain

22. The Financial Action Task Force (FATF) publish a list of high risk and non-cooperative jurisdictions with regards to their AML/CTF regimes and require Enhanced Due Diligence (EDD) to be applied in response to these. Do you operate or have clients based in any of the published FATF jurisdictions? Yes No

If yes, please indicate where and in what capacity.

23. What Customer Due Diligence (CDD) documents or materials do you require new clients to provide you with?

24. Please confirm that you keep secure records of you CDD in respect of each client and retain them for at least 5 years. Yes No 25. How do you make clients aware of your obligations to meet AML/CTF regulatory requirements? YOUR SERVICES

26. Do you offer any accounting or financial services other than those defined in CIMA’s Member in Practice Rules (point 2)? Yes

No

If yes please specify.

27. What services does your practice offer predominately? (maximum of three) 1. 2. 3.

28. What sectors does your practice serve predominately? (maximum of three) 1. 2. 3. *e.g. commercial, manufacturing, retail

39. Do you offer the provision of registered office, business address, correspondence or administration address? Yes No

30. Do you act or arrange for a person to act as a partner of a partnership? Yes No

31. Do you arrange for another person to act as a Director or Secretary of a company? Yes No

32. Do you offer services forming companies or other bodies corporate? Yes No

33. Do you offer services for the buying and selling of business entities? Yes No

34. Do you offer off shore company registration? Yes No

35. Do you offer services for the buying and selling of real estate? Yes No

36. If you offer tax services, tick which of the following apply Tax compliance Tax planning

37. Do you hold a tax qualification*? Yes No

If yes, with which awarding body? *Please note, CIMA is not a tax qualification

38. Do you hold client money, securities or other assets? Yes No

If yes please give details and to what amount

39. Do you manage bank, savings or security accounts? Yes No TRAINING AND GUIDANCE

40. What training have you undertaken in AML/CTF matters as required by AML legislation? (Where relevant please give dates and the name of the training provider)

41. What arrangements do you make for AML/CTF training for your staff?

42. CIMA provides a free online course for its UK members in practice on anti-money laundering / counter terrorist financing (AML/CTF) covering:

• Money laundering regulations, obligations and penalties for non-compliance • Assessing the risks to the business • Customer due diligence (CDD) • How to identify and report suspicious activity • Record keeping

Have you completed CIMA’s AML/CTF course? Yes No

If no, please indicate why

43. Have you attended any of CIMA’s AML/CTF events? Yes No

If yes, please indicate which event and date attended.

INTERNAL AML/CTF PROCEDURES OF YOUR PRACTICE

Internal systems and controls should reflect the degree of associated risk to the business. It is the Money Laundering Reporting Officer’s (MLRO’s) duty to maintain AML/CTF processes and procedures robustly and to identify any weaknesses and mitigate them.

44. Are you the MLRO? Yes No

If not, please supply the name of your nominated officer.

45. How do you review the effectiveness of your procedures?

REPORTING SUSPICIOUS ACTIVITY

All businesses regulated under money laundering regulations must report any suspicious activity to the Financial Intelligence Unit specific to their country (members in the UK are required to submit Suspicious Activity Reports (SAR’s) to the National Crime Agency (NCA).)

46. Have you made any SAR’s or global equivalent during the past year? Yes No

47. If so, how many?

Signature Date (typed signatures are accepted)