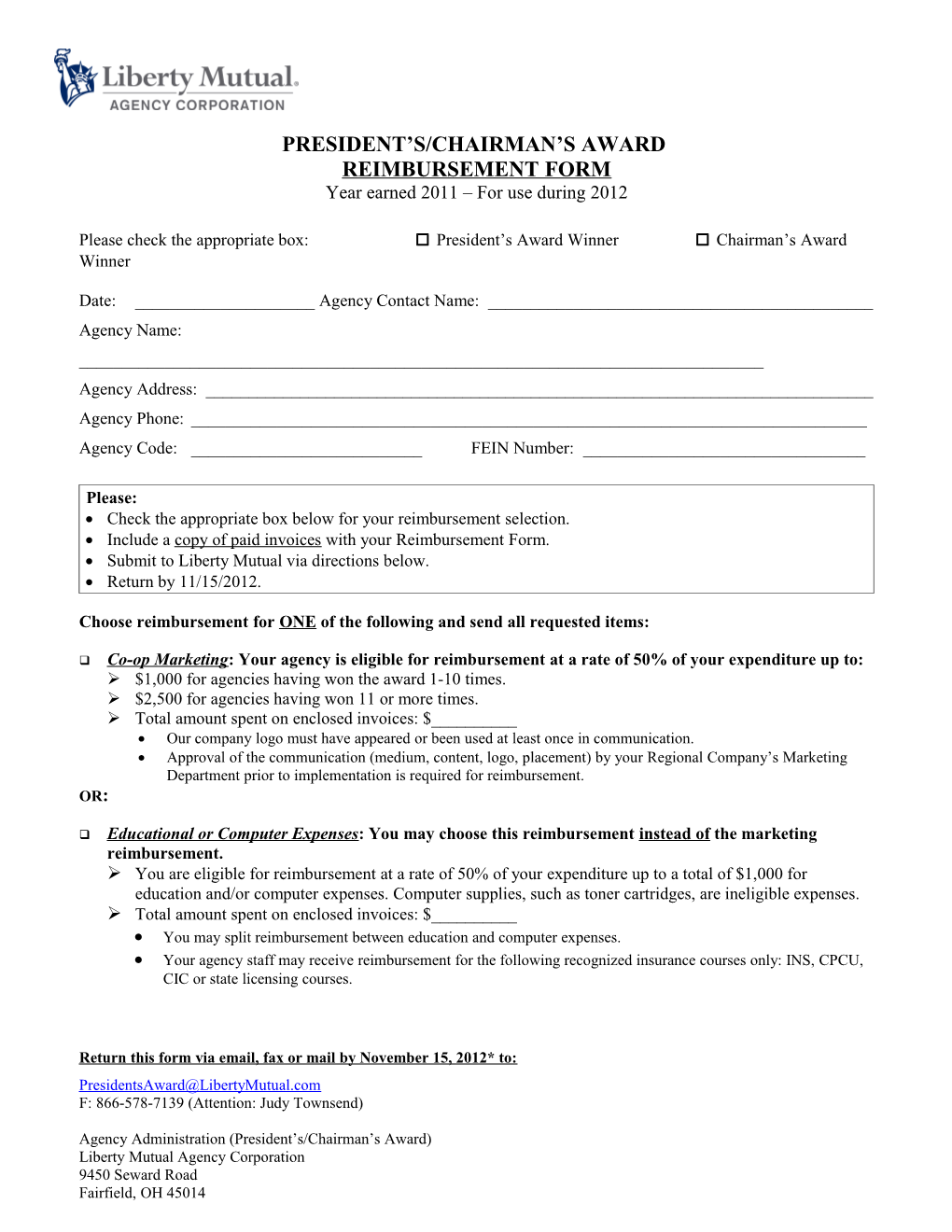

PRESIDENT’S/CHAIRMAN’S AWARD REIMBURSEMENT FORM Year earned 2011 – For use during 2012

Please check the appropriate box: □ President’s Award Winner □ Chairman’s Award Winner

Date: ______Agency Contact Name: ______Agency Name: ______Agency Address: ______Agency Phone: ______Agency Code: ______FEIN Number: ______

Please: Check the appropriate box below for your reimbursement selection. Include a copy of paid invoices with your Reimbursement Form. Submit to Liberty Mutual via directions below. Return by 11/15/2012.

Choose reimbursement for ONE of the following and send all requested items:

Co-op Marketing: Your agency is eligible for reimbursement at a rate of 50% of your expenditure up to: $1,000 for agencies having won the award 1-10 times. $2,500 for agencies having won 11 or more times. Total amount spent on enclosed invoices: $______ Our company logo must have appeared or been used at least once in communication. Approval of the communication (medium, content, logo, placement) by your Regional Company’s Marketing Department prior to implementation is required for reimbursement. OR:

Educational or Computer Expenses: You may choose this reimbursement instead of the marketing reimbursement. You are eligible for reimbursement at a rate of 50% of your expenditure up to a total of $1,000 for education and/or computer expenses. Computer supplies, such as toner cartridges, are ineligible expenses. Total amount spent on enclosed invoices: $______ You may split reimbursement between education and computer expenses. Your agency staff may receive reimbursement for the following recognized insurance courses only: INS, CPCU, CIC or state licensing courses.

Return this form via email, fax or mail by November 15, 2012* to: [email protected] F: 866-578-7139 (Attention: Judy Townsend)

Agency Administration (President’s/Chairman’s Award) Liberty Mutual Agency Corporation 9450 Seward Road Fairfield, OH 45014 * Expense reimbursements submitted after this date cannot be considered as we are unable to insure that the payment will be issued this year, which must be done under our updated tax reporting procedures.