Name: ______

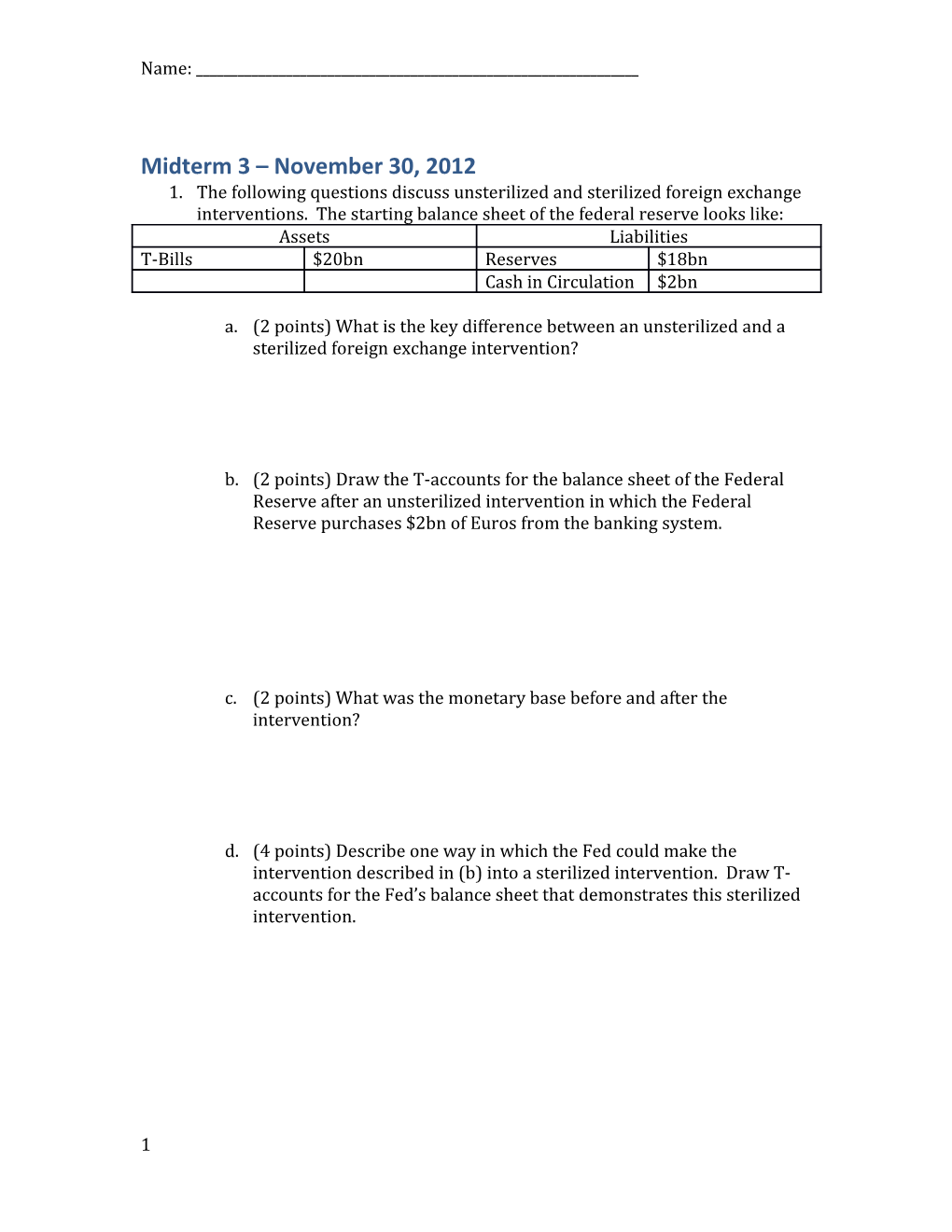

Midterm 3 – November 30, 2012 1. The following questions discuss unsterilized and sterilized foreign exchange interventions. The starting balance sheet of the federal reserve looks like: Assets Liabilities T-Bills $20bn Reserves $18bn Cash in Circulation $2bn

a. (2 points) What is the key difference between an unsterilized and a sterilized foreign exchange intervention?

b. (2 points) Draw the T-accounts for the balance sheet of the Federal Reserve after an unsterilized intervention in which the Federal Reserve purchases $2bn of Euros from the banking system.

c. (2 points) What was the monetary base before and after the intervention?

d. (4 points) Describe one way in which the Fed could make the intervention described in (b) into a sterilized intervention. Draw T- accounts for the Fed’s balance sheet that demonstrates this sterilized intervention.

1 Name: ______

2. Before countries were allowed to join the Euro they had to satisfy several criteria. a. (3 points) Name three criteria that were required to join the Euro.

b. (2 points) Why were these criteria seen as important to the long-term survival of the Euro?

3. The following question has to do with order books for a stock. a. (3 points) The order book for a stock looks like: Bid Quantity Bid Price Offer Price Offer Quantity 2,000 100 102 6,000 6,000 99 103 10,000 A trader places an intermediate-or-cancel limit order to sell 5,000 shares at 100. How many shares will he sell and at what average price? Draw the resulting order book.

2 Name: ______

b. (7 points) For this problem use the following order book. Bid Quantity Bid Price Offer Price Offer Quantity 2,000 100 102 6,000 6,000 99 103 10,000 The following orders are placed sequentially into the order book Trader Order A A market if touched order to sell 2000 shares at 103 B A limit order for 8,000 shares at 102 C A market buy order for 5,000 shares What number of shares does each trader buy or sell and at what average price? What does the resulting order book look like?

3 Name: ______

4. The Hong Kong Dollar (HKD) is currently pegged to the US Dollar (USD) at 7.75 HKD/USD. a. (4 points) Draw supply/demand curves demonstrating the relationship between the exchange rate and the quantity of assets in the small country.

b. (2 points) Assume you have 1000 dollars that you want to save in a bank. If interest rates in Hong Kong were 5% and interest rates in the US were 2% would you prefer to put your savings in Hong Kong or the United States? Would you expect this to cause the HKD to be over- valued or under-valued? Why?

c. (4 points) Currently there is a fear that in order to sort out the federal debt problems in the United States the dollar will become weaker over time. It is expected that if this occurs the peg will have to be revised to reflect a stronger HKD. This creates buying pressure today on the HKD. Describe two ways in which Hong Kong could reduce this buying pressure.

4 Name: ______

5. The Continental Illinois National Bank and Trust Company (CINB) experienced a crisis in May 1984 that culminated with the FDIC effectively nationalizing the bank in September 1984. The following table reflects some key items on the balance sheet of CINB. 1977 1978 1979 1980 1981 1982 Assets Loans 14.4bn 17.5bn 21.9bn 25.7bn 31.1bn 32.2bn Liabilities Deposits 5.6bn 6.0bn 6.3bn 6.2bn 5.8bn 6.4bn Equity 1.1bn 1,2bn 1.4bn 1.5bn 1.8bn 1.8bn Capital

a. (2 points) Given that deposits and equity capital were relatively stable over the period but lending increased significantly name two ways in which CINB might have raised cash in order to finance these loans.

b. (4 points) Explain what is meant by capital adequacy management. Why do banks want neither too much or too little capital. Be specific.

The following table shows loan losses over the same period. 1977 1978 1979 1980 1981 1982 Loan 52m 39m 46m 58m 68m 371m Losses c. (2 points) Why might this be an issue from a capital adequacy management perspective?

d. (2 points) Why might this be an issue from a liability management perspective?

5 Name: ______

6. A bank has the following balance sheet. The reserve requirements are 10%. The bank earns 0.25% interest on any reserves (to compute interest use the formula where t is measured in years). The Commercial loan earns 1% simple interest per month. The bank pays 0.25% simple interest to its deposit holders. Assets Liabilities Reserves $10m Deposits $100m Excess $50m Bank Capital $10m Reserves Commercial $50m Loans

a. (4 points) Draw T-accounts that show the bank’s balance sheet after one month. Include in the balance sheet any interest income and expenses.

b. (2 points) What is the bank’s 1-month return on assets?

c. (2 points) What is the bank’s 1-month return on equity?

6 Name: ______

7 Name: ______

7. The following problem is regarding the following stock information. Assume that the cost of borrowing a stock is computed using the initial value of the stock and the following formula:

Stock Today’s Share Price Commission per Borrow share Rate Microsoft $25.00 $0.50 0.5% Apple $500.00 $0.50 1.0% a. (4 points) You buy 2,000 shares of Apple and sell 40,000 shares of Microsoft at these prices. After 1 year the Apple share price drops to $475 the Microsoft share price drops to $20. You then sell the portfolio. What is the return in dollars of this portfolio? Take account of all costs.

b. (4 points) You buy 2,000 shares of Apple and sell 40,000 shares of Microsoft at these prices. You are planning on holding the position for 1 year. By what percentage does Apple have to outperform Microsoft over that year in order for you to break-even?

8 Name: ______

8. The following question refers to equity markets. a. (2 points) What is a market maker? How does a market maker make money?

b. (2 points) What is a broker? How does a broker make money?

c. (2 points) Explain the difference between a quote driven market and an order driven market?

d. (2 points) What is an ECN?

9