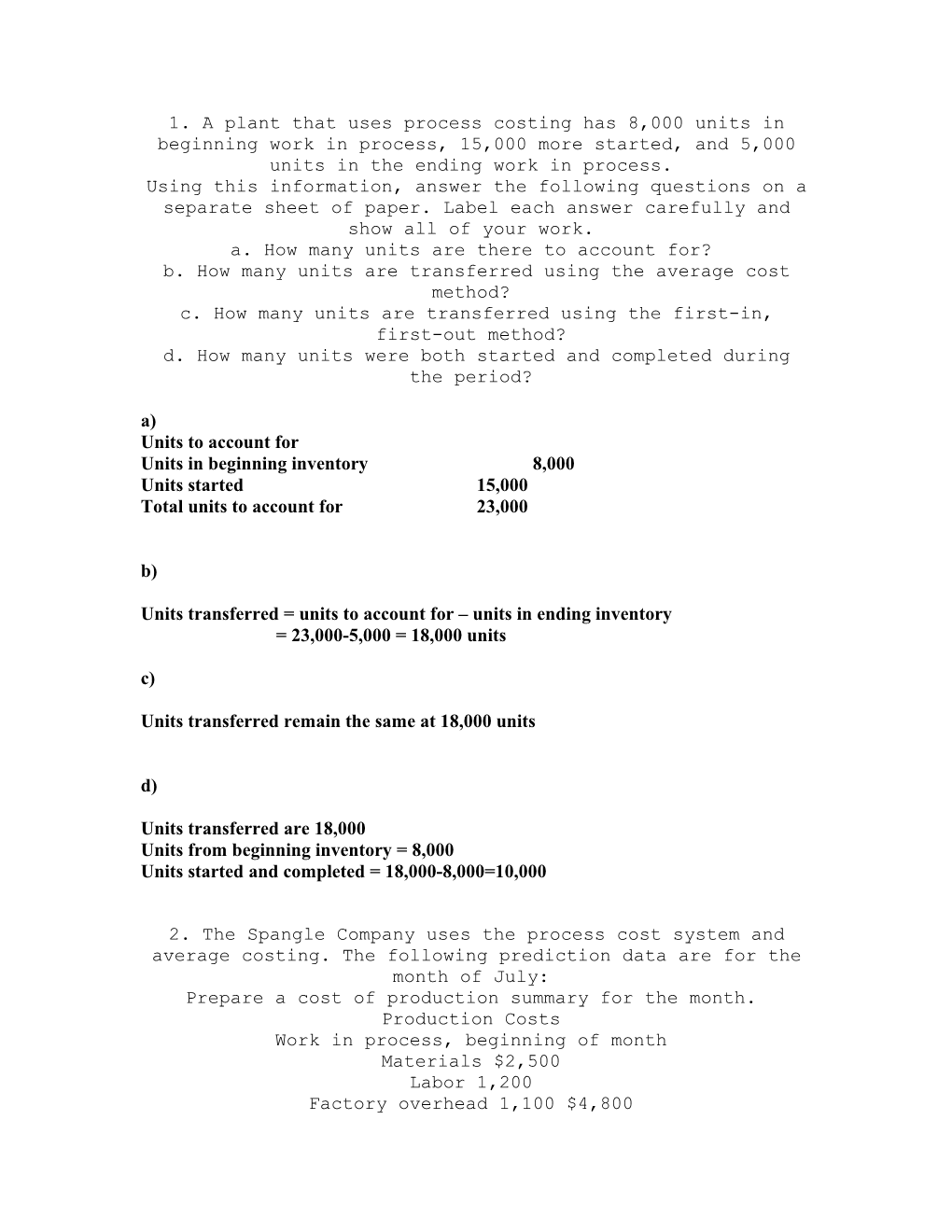

1. A plant that uses process costing has 8,000 units in beginning work in process, 15,000 more started, and 5,000 units in the ending work in process. Using this information, answer the following questions on a separate sheet of paper. Label each answer carefully and show all of your work. a. How many units are there to account for? b. How many units are transferred using the average cost method? c. How many units are transferred using the first-in, first-out method? d. How many units were both started and completed during the period? a) Units to account for Units in beginning inventory 8,000 Units started 15,000 Total units to account for 23,000 b)

Units transferred = units to account for – units in ending inventory = 23,000-5,000 = 18,000 units c)

Units transferred remain the same at 18,000 units d)

Units transferred are 18,000 Units from beginning inventory = 8,000 Units started and completed = 18,000-8,000=10,000

2. The Spangle Company uses the process cost system and average costing. The following prediction data are for the month of July: Prepare a cost of production summary for the month. Production Costs Work in process, beginning of month Materials $2,500 Labor 1,200 Factory overhead 1,100 $4,800 Costs incurred during the month Materials $13,500 Labor 9,200 Factory overhead 8,500 31,200 $36,000 Production Report Units In process, beginning of month 500 Finished and transferred during month 3,800 Work in process, end of month 400 Stage of completion 50%

Production Cost Report – Average Cost Method For the Month of Quantity Schedule Physical Quantities Units Equivalent Units

Material Labor Overhead Units to be accounted for

Work in Process, Beginning 500

Started into Production 3,700

Total Units 4,200 Units Accounted for

Transferred Out 3,800 3,800 3,800 3,800

WIP, Ending 400 200 200 200

Total Units 4,200 4,000 4,000 4,000 Cost per Equivalent Unit

Unit Costs Material Labor Overhead Total

WIP 2,500 1,200 1,100 4,800

Costs in Month 13,500 9,200 8,500 31,200

Total Cost 16,000 10,400 9,600 36,000

Equivalent Units 4,000 4,000 4,000

Unit Costs 4.00 2.60 2.40 9.00 Cost Reconciliation Schedule Costs to be accounted for

WIP, Beginning 4,800

Started into Production 31,200

Total Costs 36,000 Costs Accounted for

Transferred out 34,200 Work in process, Ending

Material 800

Labor 520

Overhead 480

Total WIP 1,800

Total costs 36,000

3. The following data is for a production company: Beginning inventory 1,000 units, three-fourths completed

Finished and transferred 16,000 units Work in process, end of month 2,000 units, one-half completed Assume that materials, labor, and factory overhead are added evenly throughout the process. On a separate sheet of paper, complete the following problems. Label each answer carefully and show all your work. a. Using the average cost method, compute the equivalent production. b. Using the first-in, first-out method, compute the equivalent production. c. During the month, Department B received 10,000 units from Department A with a unit cost of $10; 2,000 of these units were lost during production in Department B. Determine the adjusted cost of these units. d. During the month, Department 2 received 8,000 from Department 1 with a unit cost of $15. Department 2 added materials that increased the number of units by 50%. Determine the adjusted cost of these units. a)

Quantity Schedule Physical Quantities Units Equivalent Units Overhea Material Labor d Units to be accounted for 1,00 Work in Process, Beginning 0 17,00 Started into Production 0 18,00 Total Units 0 Units Accounted for 16,00 16,00 16,00 16,0 Transferred Out 0 0 0 00 2,00 1,00 1,00 1,0 WIP, Ending 0 0 0 00 18,00 17,00 17,00 17,0 Total Units 0 0 0 00 b)

Quantity Schedule Units to be Accounted for 1,00 Beginning Work in Process 0 17,00 Started into Production 0 18,00 Total Units in Production 0 Units Accounted for Material Labor Overhead Transferred Out 1,00 25 25 25 From Beginning WIP 0 0 0 0 15,00 15,0 15,0 15,00 Started and Completed 0 00 00 0 2,00 1,00 1,00 1,00 Ending WIP 0 0 0 0 18,00 16,2 16,2 16,25 Equivalent Units 0 50 50 0 c)

Total cost = 10,000 units X $10 = $100,000 Units available = 10,000-2,000=8,000 Adjusted cost = 100,000/8,000 = $12.5 per unit d)

Cost received = 8,000X15 = $120,000 Units in Department 2 = 8,000 X1.5 = 12,000 Adjusted cost = 120,000/12,000=$10 per unit

4. Cost of production summary, three departments; change in unit cost from prior department; departmental cost work sheet; journal entries; manufacturing statement

Taguchi Manufacturing Co. uses the process cost system. The following information for the month of December was obtained from the company’s books and from the production reports submitted by the department heads:

Production Report Mixing Blending Bott ling Units in process, beginning of period 2 , 500 1,500 3,000 Started in process during month 12,500 - - Received from prior department - 13,000 10,000 Finished and transferred 13,000 10,000 11,000 Finished and on hand &nbs p; - 500 - Units in process, end of period 2,000 4,000 2,000 Stage of completion & nbsp; ¼ 4/5 ½

Production Costs Work in progress, beginning of period: Cost in Mixing…………………………………. $3,075 $6,150 Materials………………………………… $1,470 Labor………………………………………. 650 Factory Overhead…………………… 565 Cost in Blending……………………………….. $3,6 60 Materials…………………………………. 240 Labor……………………………………….. 905 Factory Overhead…………………….. 750 Cost in Bottling…………………………………. Materials………………………………….. 900 Labor………………………………………… 3, 100 Factory Overhead…………………….. 3,080 Costs incurred during month: Materials………………………………….. &nb sp; 15,000 2,500 1,500 Labor………………………………………… 4,750 & nbsp; 8,000 6,500 Factory Overhead…………………….. 5,240 6,100 7,000 Total…………………………………… $27,675 $21,570 $31,890

Required: 1. Prepare cost of production summaries for the Mixing, Blending and Bottling Departments. 2. Prepare a departmental cost work sheet. 3. Draft the journal entries required to record the month’s operations. 4. Prepare a statement of cost of goods manufactured for December.

1. Taguchi Manufacturing Co. Cost of Production Summary—Mixing For the Month Ended December 31, 20--

Cost of work in process, beginning of month: Materials...... $ 1,470 Labor...... 650 Factory overhead...... 565 $ 2,685 Cost of production for month: Materials...... $ 15,000 Labor...... 4,750 Factory overhead...... 5,240 24,990 Total costs to be accounted for...... $ 27,675

Unit output for month: Finished and transferred to Blending during month...... 13,000 Equivalent units of work in process, end of month (2,000 units, one-fourth completed)...... 500 Total equivalent production...... 13,500

Unit cost for month: Materials ($1,470 + $15,000) 13,500...... $ 1.22 Labor ($650 + $4,750) 13,500...... 40 Factory overhead ($565 + $5,240) 13,500...... 43 Total...... $ 2.05

Inventory costs: Costs of goods finished and transferred to Blending during month (13,000 × $2.05)...... $ 26,650 Cost of work in process, end of month: Materials (2,000 × 1/4 × $1.22)...... $ 610 Labor (2,000 × 1/4 × $0.40)...... 200 Factory overhead (2,000 × 1/4 × $0.43)...... 215 1,025 Total production costs accounted for...... $ 27,675

Taguchi Manufacturing Co. Cost of Production Summary—Blending For the Month Ended December 31, 20--

Cost of work in process, beginning of month: Cost in Mixing...... $ 3,075 Cost in Blending: Materials...... $ 240 Labor...... 905 Factory overhead...... 750 1,895 $ 4,970 Cost of goods received from Mixing during month...... 26,650

Cost of production for month: Materials...... $ 2,500 Labor ...... 8,000 Factory overhead...... 6,100 16,600

Total costs to be accounted for...... $ 48,220

Unit output for month: Finished and transferred to Bottling during month...... 10,000 Finished and on hand...... 500 Equivalent units of work in process, end of month (4,000 units, four-fifths completed)...... 3,200 Total equivalent production...... 13,700

Unit cost for month: Materials ($240 + $2,500) 13,700...... $ 0.20 Labor ($905 + $8,000) 13,700...... 65 Factory overhead ($750 + $6,100) 13,700...... 50

Total...... $ 1.35 Inventory costs: Costs of goods finished and transferred to Bottling during month: Cost in Mixing (10,000 × $2.05)...... $ 20,500 Cost in Blending (10,000 × 1 .35)...... 13,500 (10,000 × $3 .40)...... $ 34,000 Cost of goods finished and on hand: Cost in Mixing (500 × $2.05)...... $ 1,025 Cost in Blending (500 × 1 .35)...... 675 (500 × $3 .40)...... 1,700 Cost of work in process, end of month: Cost in Mixing (4,000 × $2.05)...... $ 8,200 Cost in Blending: Materials (4,000 × 4/5 × $0.20)...... $ 640 Labor (4,000 × 4/5 × $0.65)...... 2,080 Factory overhead (4,000 × 4/5 × $0.50)...... 1,600 4,320 12,520 Total production costs accounted for...... $ 48,220 Taguchi Manufacturing Co. Cost of Production Summary—Bottling For the Month Ended December 31, 20-- Cost of work in process, beginning of month: Cost in Mixing...... $ 6,150 Cost in Blending...... 3,660 $ 9,810 Cost in Bottling: Materials...... $ 900 Labor ...... 3,100 Factory overhead...... 3,080 7,080 $ 16,890 Cost of goods received from Blending...... 34,000 Cost of production for month: Materials...... $ 1,500 Labor ...... 6,500 Factory overhead...... 7,000 15,000 Total costs to be accounted for...... $ 65,890 Unit output for month: Finished and transferred to finished goods...... 11,000 Equivalent units of work in process, end of month (2,000 units, one-half completed)...... 1,000 Total equivalent production...... 12,000

Unit cost for month: Cost from preceding department:* Beginning inventory (3,000)...... $ 9,810 Goods received during month (10,000)...... 34,000 Average unit cost for goods (13,000)...... $ 43,810 $ 3.37

Cost in Bottling: Materials ($900 + $1,500) 12,000...... $ 0.20 Labor ($3,100 + $6,500) 12,000...... 80 Factory overhead ($3,080 + $7,000) 12,000...... 84 Total...... $ 1.84

Inventory costs: Costs of goods finished and transferred: Cost in Mixing and Blending (11,000 × $3.37)...... $ 37,070 Cost in Bottling (11,000 × 1 .84)...... 20,240 (11,000 × $5 .21)...... $ 57,310 Cost in work in process, end of month: Cost in Mixing and Blending (2,000 × $3.37)...... $ 6,740 Cost in Bottling: Materials (2,000 × 1/2 × $0.20)...... $ 200 Labor (2,000 × 1/2 × $0.80)...... 800 Factory overhead (2,000 × 1/2 × $0.84)...... 840 1,840 8,580

Total production costs accounted for...... $ 65,890 *Alternative calculation.

Detailed calculation of the average unit costs from other departments as follows:

Cost from Units Mixing Blending Units in process, beginning of month...... 3,000 $ 6,150 $ 3,660 Units received during month...... 10,000 20,500 13,500 Total...... 13,000 $ 26,650 $ 17,160 Unit cost...... $ 2.05 $ 1.32

2.

Taguchi Manufacturing Co. Departmental Cost Work Sheet For the Month Ended December 31, 20-- Cost Units Units Amount Amount per Unit Received Transf. or Charged Credited Analysis Transf. in Dept. on Hand to Dept. to Dept. Mixing: Opening inventory in process...... 2,500 $ 2,685 Started in process...... 12,500 Costs for month: Materials...... $1.22 15,000 Labor...... 40 4,750 Factory Overhead .43 5,240 Finished and trans- ferred to Blending $2.05 13,000 $ 26,650 Closing work in process...... 2,000 1,025 Total...... 15,000 15,000 $ 27,675 $ 27,675

Blending: Opening inventory in process...... 1,500 $ 4,970 Received during month from 13,000 26,650 Mixing… Costs added during month: Materials...... 0.20 2,500 Labor...... 0.65 8,000 Factory overhead 0.50 6,100 Finished and trans- ferred to Bottling. $3.40 10,000 $ 34,000 Completed and on hand...... 500 1,700 Closing work in process...... 4,000 12,520 Total...... 14,500 14,500 $ 48,220 $ 48,220

Cost Units Units Amount Amount per Unit Received Transf. or Charged Credited Analysis Transf. in Dept. on Hand to Dept. to Dept.

Bottling: Opening inventory in process...... 3,000 $ 16,890 Received during month from Blending 10,000 34,000 Costs added during month: Materials...... 0.20 1,500 Labor...... 0.80 6,500 Factory overhead 0.84 7,000 Finished and trans- ferred to stock...... $ 5.24 11,000 $ 57,310 Closing work in process...... 2,000 8,580 Adjusting due to averaging costs from prior department...... (.03) Total...... $ 5.21 13,000 13,000 $ 65,890 $ 65,890

Summary: Materials: Mixing...... $ 15,000 Blending...... 2,500 Bottling...... 1,500 $ 19,000

Labor: Mixing...... $ 4,750 Blending...... 8,000 Bottling...... 6,500 19,250

Factory overhead: Mixing...... $ 5,240 Blending...... 6,100 Bottling...... 7,000 18,340

Total production costs for December...... $ 56,590 Add work in process, beginning of month: Mixing...... $ 2,685 Blending...... 4,970 Bottling...... 16,890 24,545 Total...... $ 81,135 Deduct work in process, end of month: Mixing ...... $ 1,025 Blending...... 14,220 Bottling...... 8,580 23,825 Cost of production, goods fully manufactured during December...... $ 57,310

3. Work in Process—Mixing...... 15,000 Work in Process—Blending...... 2,500 Work in Process—Bottling...... 1,500 Materials...... 19,000 Work in Process—Mixing...... 4,750 Work in Process—Blending...... 8,000 Work in Process—Bottling...... 6,500 Payroll...... 19,250 Work in Process—Mixing...... 5,240 Work in Process—Blending...... 6,100 Work in Process—Bottling...... 7,000 Factory Overhead...... 18,340 Work in Process—Blending...... 26,650 Work in Process—Mixing...... 26,650

Work in Process—Bottling...... 34,000 Work in Process—Blending...... 34,000 Finished Goods...... 57,310 Work in Process—Bottling...... 57,310

4. Taguchi Manufacturing Co. Statement of Cost of Goods Manufactured For the Month Ended December 31, 20--

Materials...... $ 19,000 Labor...... 19,250 Factory overhead...... 18,340 Total...... $ 56,590 Add work in process inventories, December 1...... 24,545 Total...... $ 81,135 Less work in process inventories, December 31...... 23,825 Cost of goods manufactured during the month...... $ 57,310

5. Average and FIFO cost methods; losses at the beginning and end of processing.

Mt. Orab Manufacturing Co uses a process cost system. Its manufacturing operation is carried on in two departments: Machining and Finishing. The Machining Department uses the average cost method and the Finishing Department uses the FIFO cost method. Materials are added in both departments at the beginning of the operations, but the added materials do not increase the number of units being processed. Units are lost in Machining Department throughout the production process and inspection occurs at the end of the process. The lost units have no scrap value and are considered to be a normal loss. Production statistics for July show the following data:

; Machini ng Finishing

Units in process, July 1 (all material 40% of labor & overhead) …………..…………. 20,000 Units in process, July 1 (all material 80% of labor & overhead) …………..…………. 40,000 Units started in production …………………………………………………………………. 140,000 Units completed & transferred …………………………………………………………… 100,000 Units transferred from Machining ………………………………………………………. 100,000 Units completed & transferred to finished goods ……………………………….. 100,000 Units in process, July 31 (all material 60% of labor & overhead)…………..………… 40,000 Units in process, July 31 (all material 40% of labor & overhead)…………..………… 40,000 Units lost in production ……………………………………………………………………….. 20,000

Production Costs &nb sp; Machining Finishing Work in progress, July 1: Materials ……………………………………………………………………………….. $40,000 $110,000 Labor ……………………………………………………………………………………… 24,000 60,000 Factory overhead …………………………………………………………………… 8,000 40,000 Costs in Machining Department …………………………………………….. 240,000 Costs incurred during month: Materials ……………………………………………………………………………….. 280,000 240,000 Labor ……………………………………………………………………………………… 180,000 160,000 Factory overhead …………………………………………………………………… 60,000 8 0,000

Required: Prepare a cost of production summary for each department. (Round to three decimal places)

Mt. Orab Manufacturing Company Cost of Production Summary—Finishing Department For the Month Ended July 31, 20--

Cost of work in process, beginning of month: Cost in Machining Department...... $240,000 Cost in Finishing Department: Materials...... $ 110,000 Labor...... 60,000 Factory overhead...... 40,000 210,000 $ 450,000 Cost of goods received from Machining during month...... 447,900 Cost of production for month: Materials...... $ 240,000 Labor...... 160,000 Factory overhead...... 80,000 480,000 Total costs to be accounted for...... $ 1,377,900* Unit output for month: Materials: To complete beginning units in process...... – 0– Units started and fully manufactured during month (100,000 - 40,000)...... 60,000 Ending units in process (40,000, all material)...... 40,000 Total equivalent production...... 100,000 Labor and factory overhead: To complete beginning units in process (40,000, 20% to complete)...... 8,000 Units started and fully manufactured during month.... 60,000 Ending units in process (40,000, 40% completed)...... 16,000 Total equivalent production...... 84,000 Unit cost for month: Materials ($240,000 100,000)...... $ 2.400 Labor ($160,000 84,000)...... 1.905 Factory overhead ($80,000 84,000)...... 0.952 Total...... $ 5.257

Inventory costs: Cost of goods finished and transferred to finished goods during month: Beginning units in process: Prior month's cost...... $ 450,000 Current cost to complete: Labor (40,000 × 20% × $1.905)...... 15,240 Overhead (40,000 × 20% × $0.952)...... 7,616 $ 472,856 Units started and finished during month: Cost in prior dept. (60,000 × $4.479)...... $ 268,740 Cost in Finishing Dept. (60,000 × $5.257)...... 315,420 Total cost transferred (60,000 × $9.736)...... 584,160 Cost of work in process, end of month: Cost in prior dept. (40,000 units × $4.479)...... $ 179,160 Materials (40,000 units × $2.400)...... 96,000 Labor (40,000 units × 40% × $1.905)...... 30,480 Factory overhead (40,000 units × 40% × $0.952)...... 15,232 320,872 Total production costs accounted for $1,377,888* *Rounding Difference

6.

Allocation of joint costs Clark Manufacturing Co buys crypton for $0.80 a gallon. At the end of processing in Department 1, crypton splits off into products A, B, and C. Product A is sold at the split- off point with no further processing. Products B and C require further processing before they can be sold. Product B s processed in Department 2, and Product C is processed in Department 3. Following is a summary of costs and other related data for the year ended December 31:

Dept. 1 Dept. 2 Dept. 3 Cost of crypton ………………………………….. $76,000 - - Direct labor ………………………………………… 14,000 $51,000 $65,000 Factory overhead ……………………………….. 10,000 26,500 49,000 Total ……………………………………………………. &n bsp; $100,000 $77,500 $114,000

Product A Product B Product C Gallons sold ……………………………………...... 20,000 30,000 45,500 Gallons on hand at December 31 ………….. 10,000 - 15,000 Sales in dollars ………………………………………. $30,000 $96,000 $141,750

No inventories were on hand at the beginning of the year, and no crypton was on hand at the end of the year. All gallons on hand at the end of the year were complete as to processing. Clark uses the relative sales value method of allocating joint costs. Required: 1. Calculate the allocation of joint costs. 2. Calculate the total cost per unit for each production.

1. Unit Ultimate Less Sales Percent Allocatio Cost n Units Selling Sales After Value at of Sales Of Joint Produc Produced(a Price(b) Value Split-Off Split-Off Value Costs t )

A 30,000 $1.50* $45,000 –0– $ 45,000 32.5% $ 32,500 B 30,000 3.20** 96,000 $ 77,500 18,500 13.4 13,400 C 60,000 3.15*** 189,000 114,000 75,000 54.1 54,100 Total $ $ $ 138,500 100.0% $ 100,000 330,000 191,500

* $30,000/20,000 gals. ** $96,000/30,000 gals. ***$141,750/45,000 gals.

A B C Beginning inventory...... –0– –0– –0– Sold during year...... 20,000 30,000 45,000 On-hand, end-of-year...... 10,000 – 0 – 15,000 Produced during year...... 30,000 30,000 60,000

2. Unit cost of Product A = $32,500 / 30,000 gals. = $1.08 gal. Unit Cost of Product B =$51,000 Direct labor + $26,500 Factory overhead + $13,400 Joint costs = $90,900 / 30,000 gals. = $3.03 / gal.

Unit cost of Product C = $65,000 Direct labor + 49,000 Factory overhead + 54,100 Joint costs = $168,100 / 60,000 gals. = $2.80 / gal.